Company Summary

| Noor Capital UKReview Summary | |

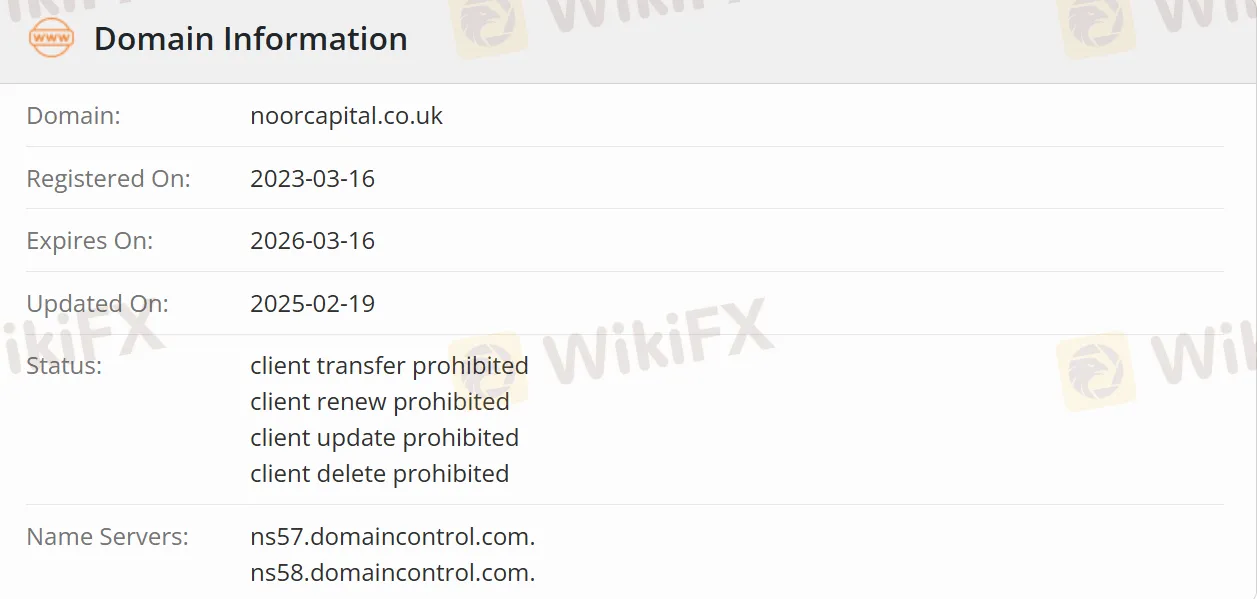

| Registered On | 2023-03-16 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated |

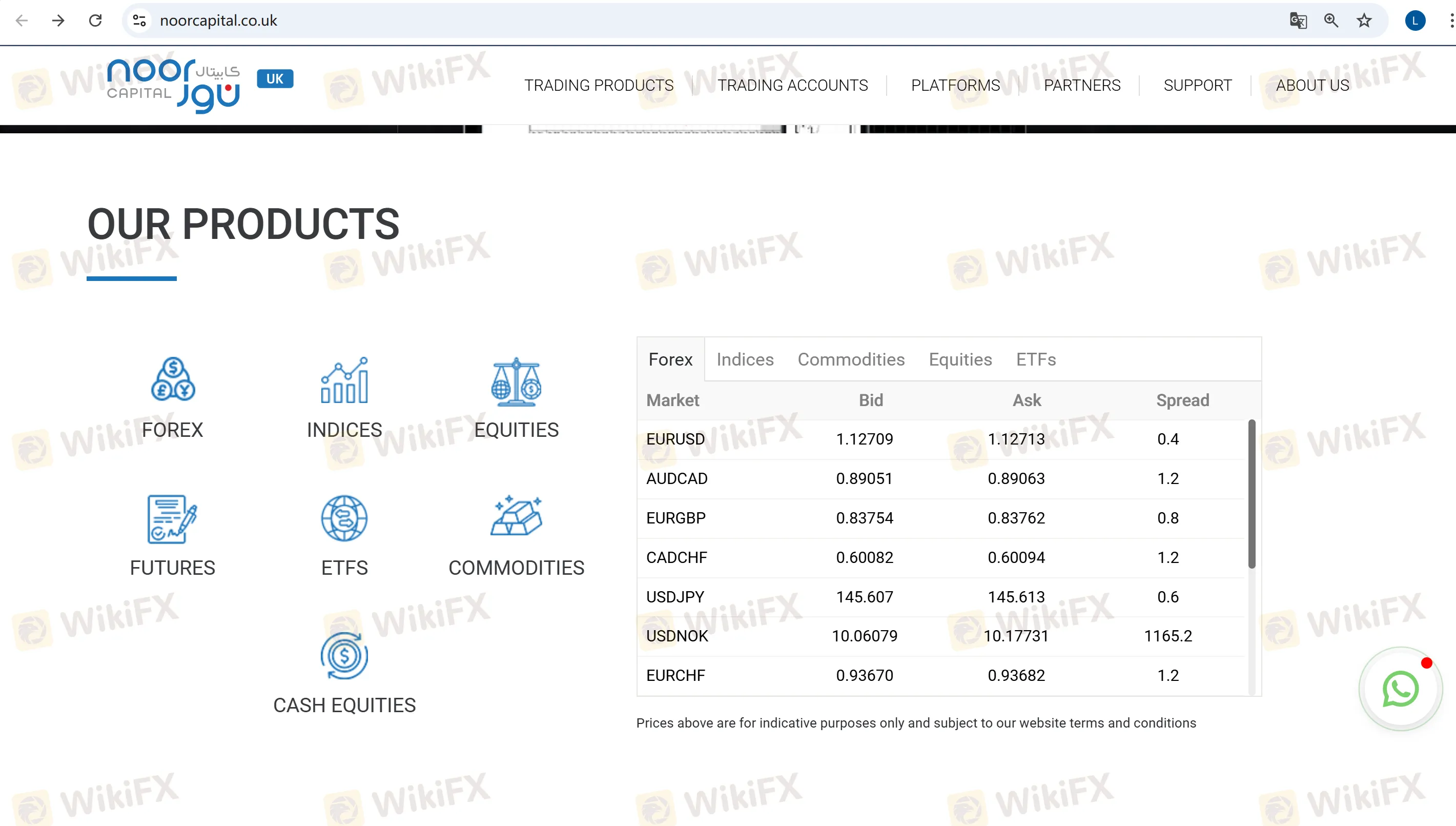

| Market Instruments | Forex, Indices, Commodities, Equities, ETFs, Futures, Cash equities |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | 0.00019 pips (EUR/USD) |

| Trading Platform | MT5 (Windows, WebTrader, iOS, Mac, Android) |

| Min Deposit | / |

| Customer Support | info@noorcapital.co.uk |

| +44 (0) 203-327-7001 | |

| Facdebook, LinkedIn, Twitter, YouTube, WhatsApp | |

| Berkeley Square House, 2nd Floor. Berkeley Square, Mayfair, London W1J 6BD. | |

Noor Capital UK Information

Noor Capital UK Limited is an international financial broker regulated by the UK Financial Conduct Authority (FCA), established in 2014 and specializing in providing online trading services for professional and institutional clients. Through the MetaTrader 5 (MT5) platform, users can trade over 200 financial instruments such as foreign exchange, commodities, indices, and stocks.

Pros and Cons

| Pros | Cons |

| Regulated | Limited deposit and withdrawal information |

| Zero commission (Standard Account) | Restricted service targets (mainly professional and institutional clients) |

| MT5 available | Not 24/7 customer service |

| Swap Free account available | |

| Demo account available |

Is Noor Capital UK Legit?

Noor Capital UK is legitimate and reliable. The company holds a full FCA license (license number: 631382), strictly complies with MiFID II regulations, and segregates client funds from company assets, meeting EU financial regulatory standards.

What Can I Trade on Noor Capital UK?

Noor Capital UK offers over 200 trading instruments, covering Forex, Indices, Commodities, Equities, ETFs, Futures, and Cash equities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

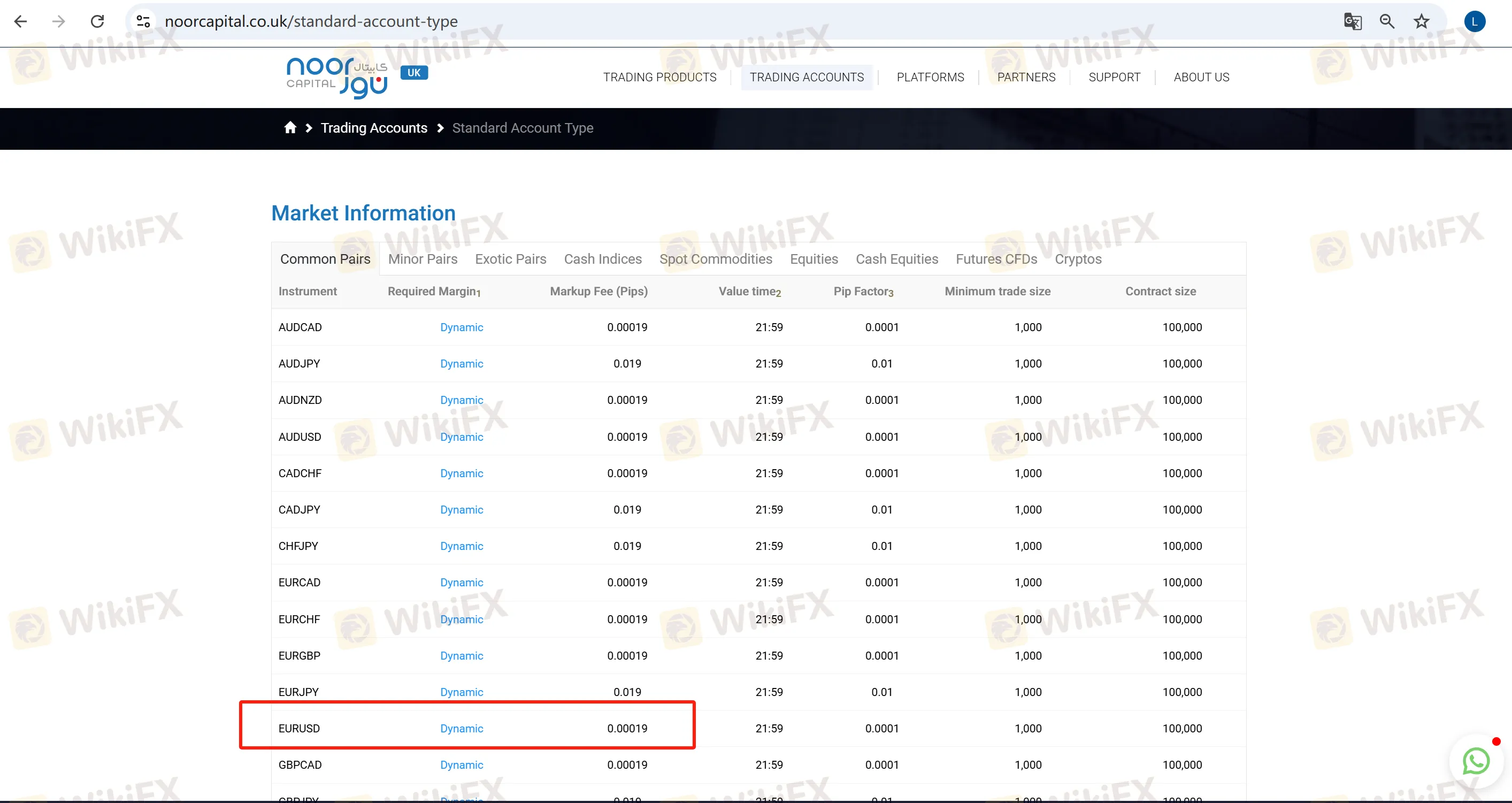

Standard Account

Zero commission, dynamic spread of 0.00019 (EURUSD), supports the MT5 platform, suitable for high-frequency traders.

Trading Account

Noor Capital UK Limited offers three different tiers of accounts: Silver, Gold, and Platinum.

| Account Type | Silver | Gold | Platinum |

| Monthly Trading Volume Range | < 1,000,000 | ≤ 100,000,000 | > 100,000,000 |

| Commission (per $100,000 Traded) | $7 | $6 | $5 |

| Reduction Compared to the Silver Commission | - | 14% | 28% |

Key Account Features

| Available Account Currency Base | EUR/USD/GBP |

| Trading Instruments | More than 60 FX Pairs, Indices, Commodities, and Equities |

| Leverage | Up To 100:1 |

| Spreads | Competitive spreads |

| Min Lot Size | 0.01 |

| Execution Type | ECN |

| Hedging | YES |

| Trading Platform | MT5 |

| Mobile Trading | iOS & Android |

| Expert Advisors | YES |

| One-Click Trading | YES |

| Swap Free Account | YES |

| Fifth Decimal trading | YES |

| Mobile Trading | YES |

Noor Capital UK Fees

The Standard Account offers zero commission; trading accounts charge $5-$7 per $100,000 traded based on trading volume. In terms of spreads, major forex currency pairs have spread as low as 0.00019 pips (e.g., EURUSD).

Leverage

Noor Capital UK offers leverage of up to 1:100.

Trading Platform

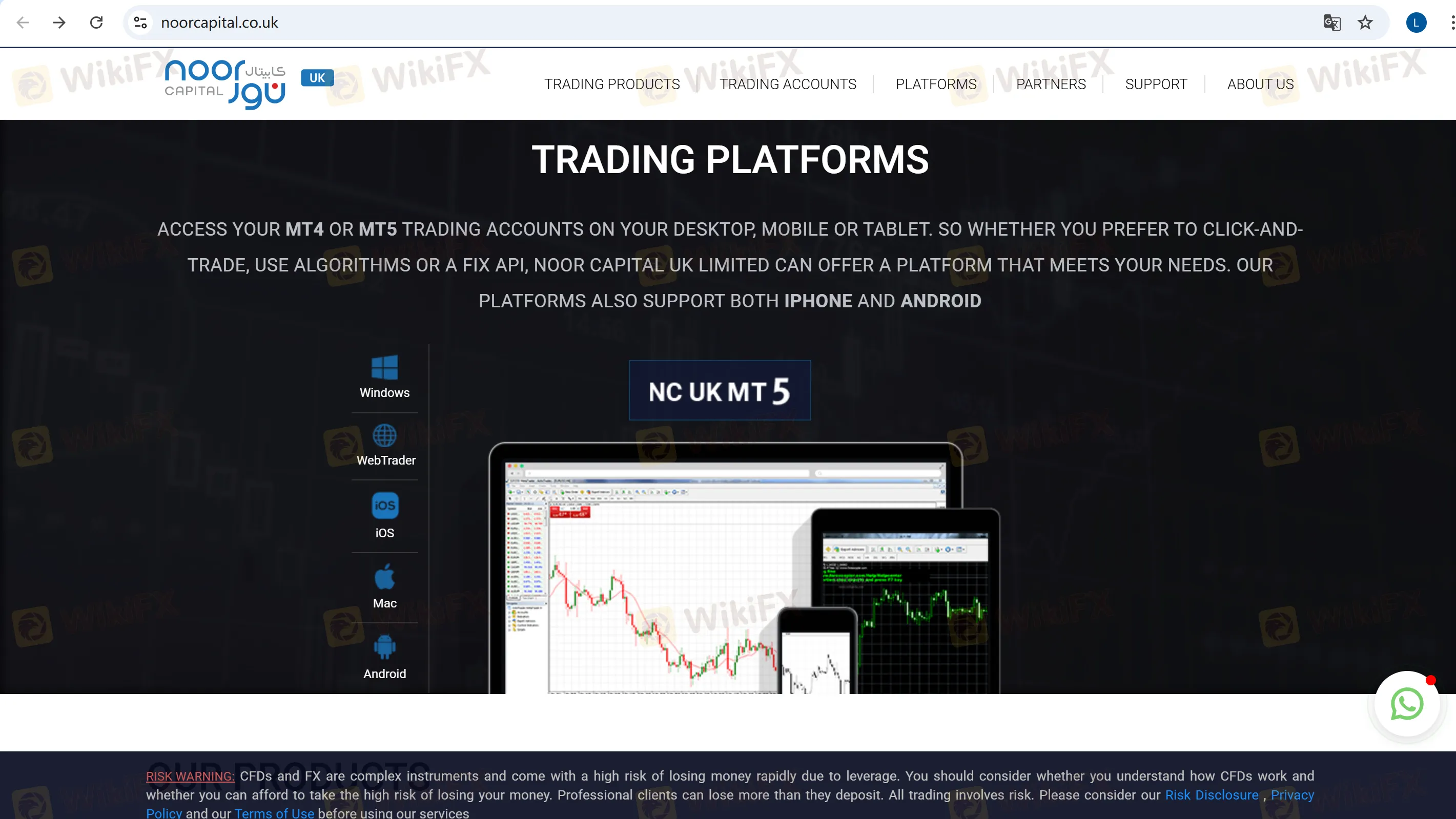

Noor Capital UK provides the mainstream trading platform MT5, which supports multi-device compatibility, including desktop, iOS/Android mobile, and web-based (WebTrader) versions.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, iPhone/iPad, Android, and Mac | Experienced Ttaders |

Deposit and Withdrawal

Deposit

Credit/Debit Card: Funds arrive within 24-48 hours with no fees from Noor Capital (issuing banks may charge fees).

Bank Transfer: Funds arrive within 1-5 working days, subject to an incoming bank fee.

Withdrawal

Fill out the application form and send it to treasury@noorcapital.co.uk. Requests submitted before 11:00 AM (UK time) on working days will be processed within 2 working days.

FX3982179130

Argentina

This Broker promised me that by pressing a button, they would give me some operations so I could just copy and paste and thus earn money, that is the advertisement they give, but when you see it, you get pure news, articles, and lies

Exposure

tanbao

South Africa

Had an issue linking account to MT5 as I lost my email a while ago but sorted in a few mins and back up and running.

Neutral

Trader028

United Arab Emirates

I have traded with Noor Capital for many years, they are regulated in UAE and they were the first broker took the license in UAE, I trust them more than any other broker

Positive

文武34289

United States

The worst broker ever I have seen in all my life I place one position to sell all brokers come under the price but they paused the price to hold my position in negative, they don’t show real price they spread always more than one dollar if you wanna burn ur money work with this broker.

Neutral

南来北往

Indonesia

They only want you to make a big deposit, THAT’S ALL!!! The manager told me that I had to trust them and increase the deposit to access other services, but still, he could explain what were the fundamentals of supporting the suggested buying. Then I lost my money on that trade and everything became clear. STAY AWAY FROM THEM!!!

Positive

繁星空

Malaysia

It is not recommended to do real trading with this broker, after all, they are not subject to any legal regulation. But if you just want to try to use the mt4 platform for trading, you might as well open a demo account to try, but it is only limited to demo trading.

Neutral

FX1061814263

United Kingdom

I've been waiting for my withdrawal since last Friday, and it was processed on Monday, but nothing has happened, and this Friday has already past...

Neutral