Company Summary

| Tracom Review Summary | |

| Founded | 2008 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Products & Services | Capital Market, Demat, Mutual Fund, PMS Distribution, IPO Application, Investment in NCDs / Bonds, Corporate Fixed Deposits, RBI Bonds, Capital Gains Tax Savings Bonds |

| Demo Account | ❌ |

| Trading Platform | Mobile APP |

| Customer Support | Tel: 079 - 29666001 |

| Email: info@tracom.co.in | |

| Social media: Facebook, X, Instagram, Telegram | |

| Address: A 705 The First, Behind Keshavbaug Party Plot, Near ITC Narmada, Vastrapur, Ahmedabad 380015. Gujarat | |

Tracom Information

Tracom is an unregulated service provider of premier brokerage and financial services in the Indian Stock Exchange. Tracom offers products and services on Capital Market, Demat, Mutual Fund, PMS Distribution, IPO Application, Investment in NCDs / Bonds, Corporate Fixed Deposits, RBI Bonds, Capital Gains Tax Savings Bonds.

Pros and Cons

| Pros | Cons |

| Various products & services | Lack of regulation |

| Various contact channels | No demo accounts |

| Long operation time |

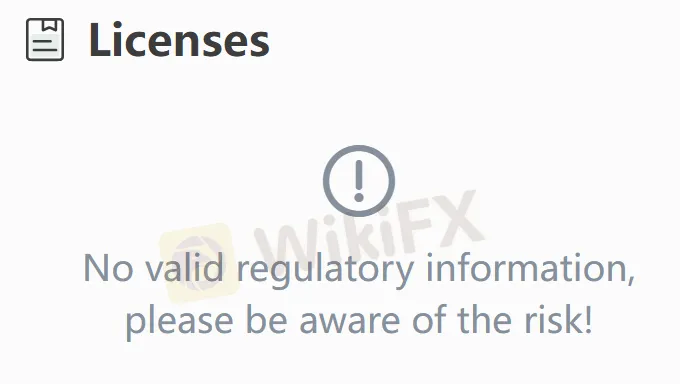

Is Tracom Legit?

No. Tracom currently has no valid regulations. Please be aware of the risk!

Products and Services

| Products & Services | Supported |

| Capital Market | ✔ |

| Demat | ✔ |

| Mutual Fund | ✔ |

| PMS Distribution | ✔ |

| IPO Application | ✔ |

| Investment in NCDs | ✔ |

| Bonds | ✔ |

| Corporate Fixed Deposits | ✔ |

| RBI Bonds | ✔ |

| Capital Gains Tax Savings Bonds | ✔ |

Trading Platform

The broker has its own application as the trading platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile APP | ✔ | Mobile | / |