Company Summary

| Aspect | Information |

| Company Name | Flow Trade 24 |

| Registered Country/Area | Netherlands |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Products & Services | Forex,Stocks,Indices Cryptocurrencis,Commodities |

| Account Types | Standard,Silver,Gold,VIP,Pro,Hedgefunds |

| Leverage & Spreads | Leverage:Up to 1:500;Spreads:from 0.2 pips |

| Demo Account | Available |

| Trading Platform | Web Trader 4 |

| Customer Support | Online message system |

| Educational Resources | Trading academy,Charts & Analysis |

Overview of Flow Trade 24

Flow Trade 24, founded in 2023 and based in the Netherlands, is an unregulated financial services provider offering a range of products including Forex, stocks, indices, cryptocurrencies, and commodities.

The company attracts to various types of investors through diverse account options such as Standard, Silver, Gold, VIP, Pro, and Hedgefunds, offering leverage up to 1:500 and competitive spreads starting from 0.2 pips.

Flow Trade 24 provides a Web Trader 4 platform and supports its clients with a demo account, an online messaging system for customer support, and educational resources including a trading academy and charts & analysis tools.

Regulatory Status

Flow Trade 24 is an unregulated financial services provider based in the Netherlands. Despite offering a wide array of trading products and services, it does not hold any regulatory oversight from recognized financial regulatory bodies.

This lack of regulation can pose increased risks for traders and investors who may have fewer protections in place compared to regulated entities.

Pros and Cons

| Pros | Cons |

| Diverse Trading Instruments | Unregulated Status |

| Advanced Trading Platform | Limited Customer Support Options |

| High Leverage Options | Young Company |

| Educational and Analytical Resources | Security Uncertainties |

| Global Accessibility | Potential Conflicts of Interest |

Pros of Flow Trade 24

Diverse Trading Instruments: Offers a wide variety of trading products including Forex, cryptocurrencies, stocks, commodities, and indices, attracting traders with varying interests.

Advanced Trading Platform: Provides the Web Trade 4 platform, which is accessible on all web and mobile platforms, ensuring flexibility and convenience for traders.

High Leverage Options: Allows trading with a high leverage of up to 1:500, which can increase potential returns (though this also increases risk).

Educational and Analytical Resources: Offers a trading academy, advanced technical charts, and in-depth analysis tools to support traders in making informed decisions.

Global Accessibility: Describes itself as the world's fastest-growing cryptocurrency platform, with services available anytime and from anywhere.

Cons of Flow Trade 24

Unregulated Status: The company is unregulated, posing higher risks and fewer protections for traders compared to regulated entities.

Limited Customer Support Options: Only offers an online message system for customer support, which will not suffice for urgent or complex issues.

Young Company: As a company founded in 2023, its relatively short track record will concern traders looking for established credibility.

Security Uncertainties: Although it claims to use secure encryption, the overall effectiveness and robustness of these security measures are unverified due to the lack of regulation.

Potential Conflicts of Interest: As an unregulated entity, there could be less transparency and potential conflicts of interest in its operations, which could affect the trustworthiness and integrity of its trading services.

Products & Services

Flow Trade 24 offers a diverse range of trading products across various asset classes, designed to meet the diverse needs of its clients. Heres a more detailed look at each product category:

Forex: Traders have access to a wide selection of currency pairs, making it possible to engage in the trading of one of the most liquid asset classes in the world. This includes major pairs, minor pairs, and exotics, providing ample opportunities for forex traders to leverage fluctuations in global currencies.

Stocks: Provides the ability to trade shares from a variety of global companies across different industries. This allows traders to participate in the equity markets and benefit from both the dividends and potential price appreciation of company shares.

Indices: Offers trading on major global stock indices such as the Dow Jones, S&P 500, NASDAQ, and others, enabling traders to speculate on the overall movement of specific economies or sectors without having to select individual stocks.

Cryptocurrencies: As part of its offering, Flow Trade 24 provides a platform for trading a variety of digital currencies, asserting itself as a rapidly growing player in the cryptocurrency market. This includes popular options like Bitcoin, Ethereum, and lesser-known altcoins, giving traders the chance to capitalize on the volatility of digital currencies.

Commodities: Traders can engage in the commodity markets, including precious metals like gold and silver, energy commodities like oil and natural gas, and other basic goods. This segment allows diversification of investment portfolios and a way to hedge against inflation.

CFDs (Contract for Difference): Flow Trade 24 offers CFDs, which allow traders to speculate on the price movement of financial assets like stocks, commodities, and indices without the need to own the underlying assets. CFDs provide a flexible way to trade on margin, offering potential for significant gains, but also increased risks.

Account Types

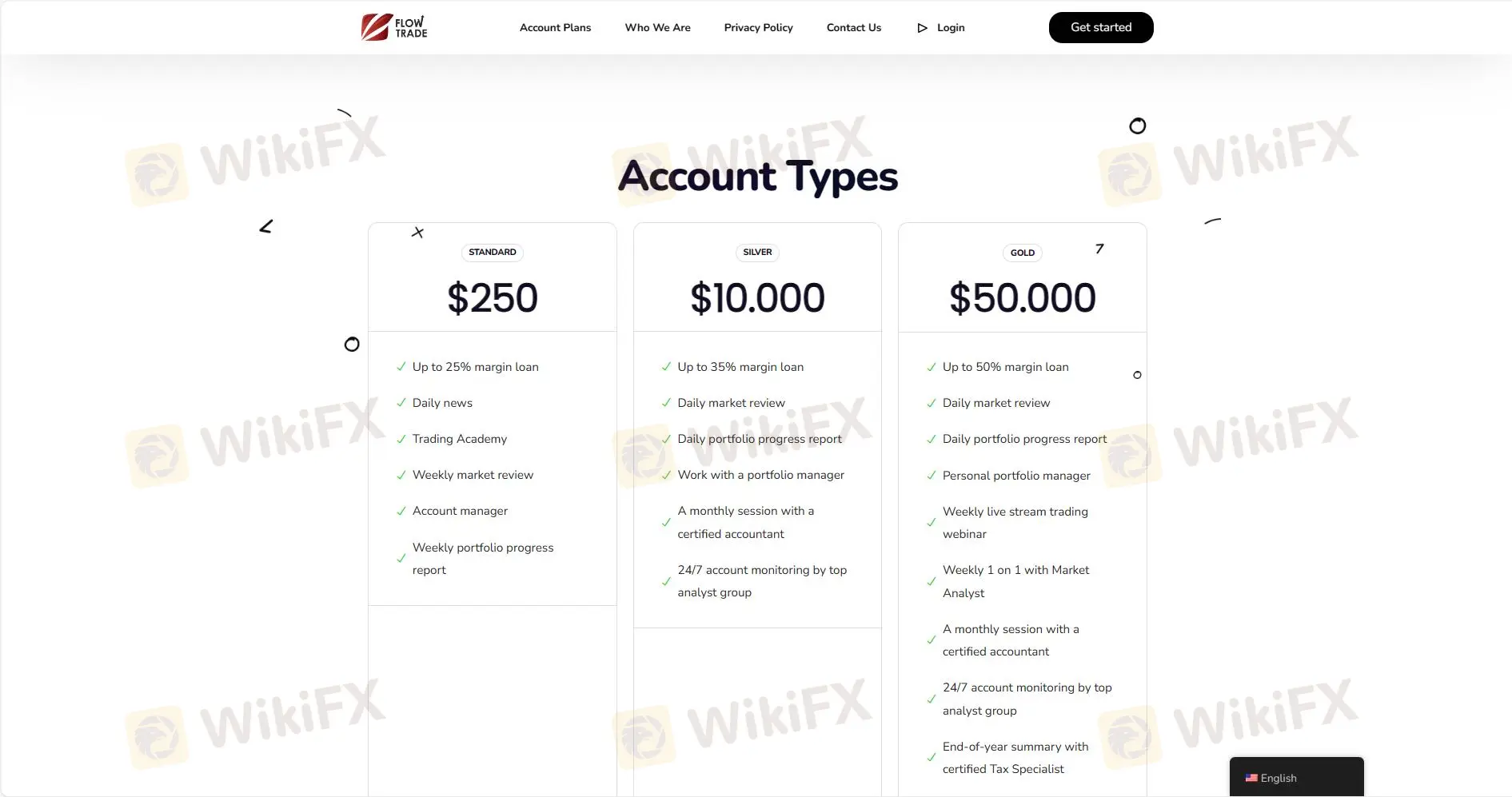

Flow Trade 24 offers six types of accounts designed to attract a wide range of investors, each providing unique features and benefits:

Standard Account: Requires a $250 minimum deposit and provides up to 25% margin loan. It includes daily news, access to the Trading Academy, weekly market reviews, an account manager, and weekly portfolio progress reports.

Silver Account: With a $10,000 minimum deposit, this account offers up to 35% margin loan, daily market reviews, daily portfolio progress reports, the assistance of a portfolio manager, monthly sessions with a certified accountant, and 24/7 monitoring by a top analyst group.

Gold Account: This account demands a $50,000 minimum deposit and includes up to 50% margin loan, daily market and portfolio reviews, a personal portfolio manager, weekly live stream trading webinars, weekly one-on-one sessions with a market analyst, monthly sessions with a certified accountant, 24/7 monitoring by a top analyst group, and an end-of-year summary with a certified tax specialist.

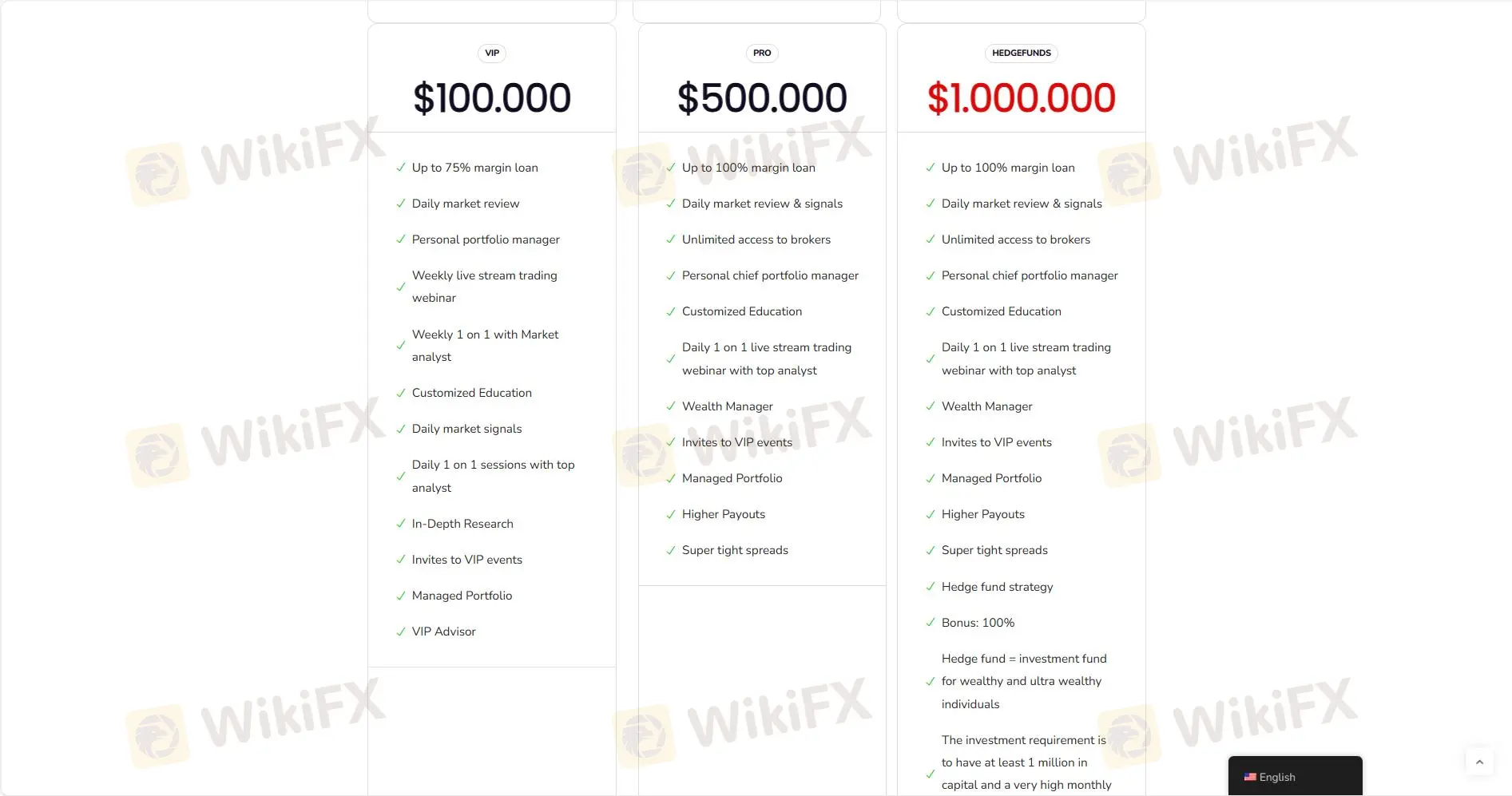

VIP Account: With a $100,000 minimum deposit, the VIP Account offers up to 75% margin loan, daily market reviews, a personal portfolio manager, weekly live stream webinars, daily one-on-one sessions with a top analyst, in-depth research, customized education, invites to VIP events, and a managed portfolio.

Pro Account: Requires a $500,000 deposit and provides up to 100% margin loan, daily market reviews and signals, unlimited access to brokers, a personal chief portfolio manager, daily one-on-one live stream trading webinars with top analysts, a wealth manager, customized education, invites to VIP events, a managed portfolio, higher payouts, and super tight spreads.

Hedge Funds Account: The most exclusive, requiring a $1,000,000 deposit, this account offers up to 100% margin loan, daily market reviews and signals, unlimited access to brokers with a bonus of 100%.

| Account Type | Min. Deposit | Margin Loan | Key Features |

| Standard | $250 | Up to 25% | Trading Academy, Weekly Reviews, Account Manager |

| Silver | $10,000 | Up to 35% | Portfolio Manager, Monthly Accountant Session |

| Gold | $50,000 | Up to 50% | Personal Manager, Weekly Webinars, Tax Specialist |

| VIP | $100,000 | Up to 75% | Daily Signals, VIP Events, Managed Portfolio |

| Pro | $500,000 | Up to 100% | Chief Portfolio Manager, Higher Payouts, Tight Spreads |

| Hedge Funds | $1,000,000 | Up to 100% | Hedge Fund Strategy, Exclusive VIP Invites |

How to Open an Account?

Opening an account with Flow Trade 24 can be a straightforward process. Here are four simple steps to guide you through:

Visit the Website: Start by navigating to the Flow Trade 24 website and click on the “Get Started” or “Open Account” button. This will direct you to the registration page.

Fill Out the Registration Form: Complete the registration form by providing all the required personal information, such as your name, email address, contact information, and any other details necessary for identity verification.

Choose Your Account Type: Select the type of account that best suits your trading needs and financial situation. Each account type, from Standard to Hedge Funds, has different benefits and minimum deposit requirements.

Deposit Funds: Once your account is set up and verified, you will need to deposit funds to meet the minimum deposit requirement for your chosen account type. This can typically be done through various payment methods such as bank transfers, credit cards, or online payment systems.

Leverage & Commissions

Leverage

Flow Trade 24 offers a high maximum leverage of up to 1:500 across all its trading products. This level of leverage allows traders to increase their trading position size significantly with a relatively small amount of invested capital.

High leverage can amplify potential profits on successful trades, but it also increases the risk of higher losses, especially in volatile market conditions. Traders should consider their risk tolerance and trading strategy carefully when deciding to use high leverage.

Spreads

The trading spreads at Flow Trade 24 start from as low as 0.2 pips, providing competitive trading conditions for its clients.

Tight spreads are particularly beneficial for frequent traders such as scalpers and day traders, as they help to minimize transaction costs on trades. Spreads can vary based on the asset class and market conditions, with key factors including market liquidity and volatility influencing the spread at any given time.

Trading Platform

Flow Trade 24 offers its trading services through the “Web Trade 4” platform, which is designed to be highly accessible and user-friendly. This platform is available on both web and mobile interfaces, ensuring traders can manage their investments and respond to market changes promptly, regardless of their location.

The compatibility of Web Trade 4 extends across various operating systems including Mac, Linux, and Windows, making it versatile for different user preferences.

Customer Support

Flow Trade 24 provides customer support primarily through an online messaging system, where traders can submit their queries and issues for assistance.

Additionally, the company offers support at its physical location, with an address at Amstelplein 1, Rembrandt Tower, 11th Floor, 1096 HA Amsterdam, Netherlands.

However, these methods of customer support are somewhat limited. The online messaging system, while convenient, may not offer immediate responses or in-depth support, and the physical address is only practical for those who are local or willing to travel.

Educational Resource

Flow Trade 24 offers a comprehensive suite of educational resources designed to support traders at all levels. The centerpiece is the Trading Academy, where traders can receive guidance and training from professional staff to enhance their trading skills and knowledge.

Additionally, the platform provides access to advanced technical charts and in-depth analysis tools. These resources are crucial for making informed trading decisions, allowing traders to analyze market trends and potential opportunities effectively.

Conclusion

Flow Trade 24 presents a robust trading platform with extensive resources for traders ranging from beginners to advanced levels.

With a comprehensive set of trading products, educational tools, and customer support options, it offers an environment conducive to growth and learning in trading. However, potential users should be aware of its unregulated status, which may pose additional risks.

FAQs

Question: What types of trading accounts does Flow Trade 24 offer?

Answer: Flow Trade 24 offers several account types, including Standard, Silver, Gold, VIP, Pro, and Hedge Funds, each with different features and minimum deposit requirements.

Question: Is there a demo account available at Flow Trade 24?

Answer: Yes, Flow Trade 24 provides a demo account for traders to practice and get acquainted with the platform without risking real money.

Question: What is the minimum deposit required to open an account at Flow Trade 24?

Answer: The minimum deposit to open a Standard Account is $250, but there is no minimum amount required to open a new account in general; however, $250 is needed to access margin and certain other trading privileges.

Question: How can I access customer support at Flow Trade 24?

Answer: Customer support at Flow Trade 24 is available through an online messaging system and at their physical office located at Amstelplein 1, Rembrandt Tower, 11th Floor, 1096 HA Amsterdam, Netherlands.

Question: What trading platforms does Flow Trade 24 provide?

Answer: Flow Trade 24 offers the Web Trade 4 platform, which is accessible on all web and mobile devices, compatible with Mac, Linux, and Windows, ensuring flexible trading across various operating systems.