Company Summary

| KAGAWA Review Summary | |

| Founded | 1944 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, bonds, investment trusts, REITs, ETFs |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Online inquiry |

KAGAWA Information

KAGAWA (香川証券株式会社) is a Japanese brokerage firm that has been around since 1944 and is overseen by the Japan FSA. It offers a wide range of financial products, including domestic and overseas equities, investment trusts, REITs, and ETFs. Its main customers are Japanese regular and institutional investors.

Pros and Cons

| Pros | Cons |

| Long history and strong reputation in Japan | Limited information on trading platforms |

| Comprehensive product range | Complex fee structure |

| Regulated by FSA |

Is KAGAWA Legit?

Yes, KAGAWA (香川証券株式会社) is a fully regulated financial institution that Japan's Financial Services Agency (FSA) has given a Retail Forex License number 四国財務局長(金商)第3号.

What Can I Trade on KAGAWA?

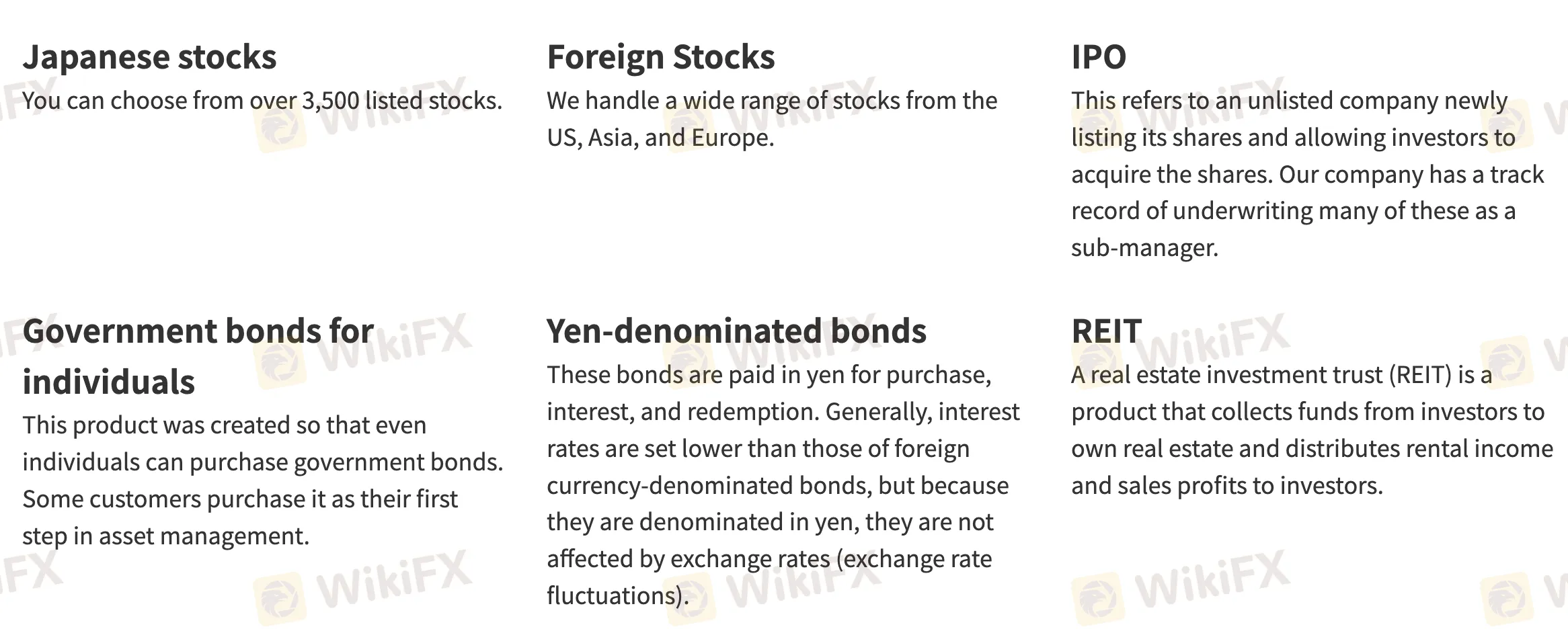

KAGAWA has a lot of different financial products, such as Japanese and foreign stocks, bonds, investment trusts, REITs, and ETFs.

| Trading Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| REITs | ✔ |

| ETFs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Options | ❌ |

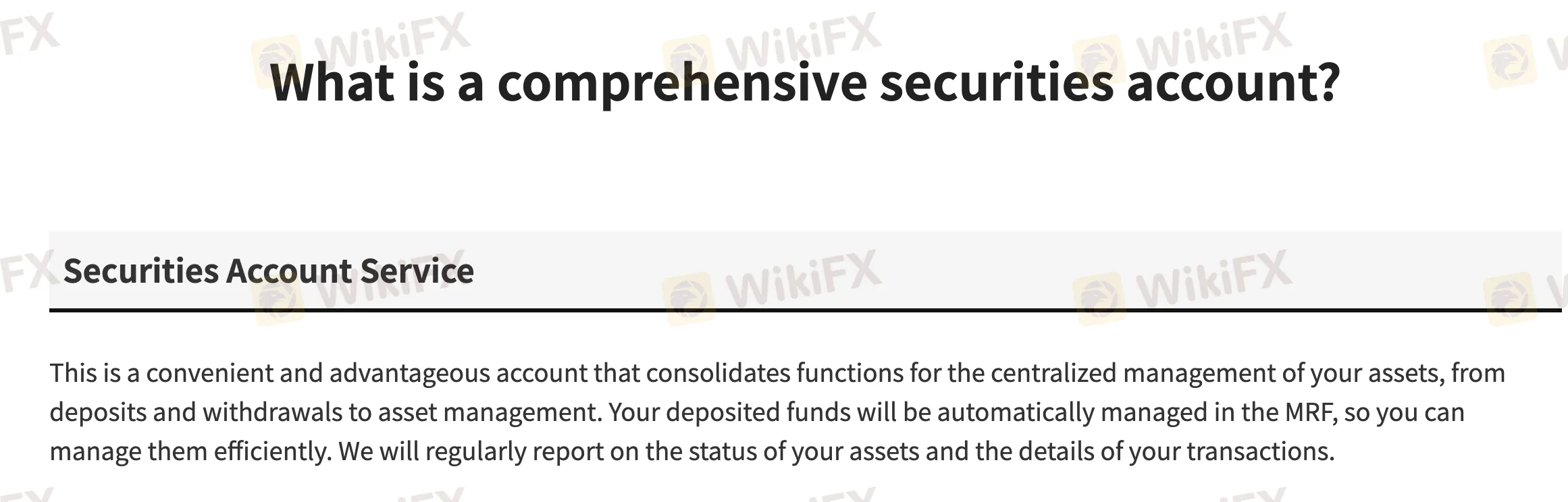

Account Type

KAGAWA has one main live account type: Securities General Account. This account is for individual investors who want to handle all of their deposits, withdrawals, and investments in one place.

KAGAWA Fees

In Japan, KAGAWA's fees are usually about the same as those of other companies in the same field. Some specialist services, such processing foreign securities or margin trading fees, can end up being more expensive than cheap brokers, even when they have fair commission structures and lower prices for bigger transactions.

| Fee Type | Amount |

| Domestic Stock Fees | 1.166% (under ¥1M) → 0.110% + ¥166,100 (over ¥50M); min ¥2,200, max ¥275,000 |

| Convertible Bonds Fees | 1.10% (under ¥1M) → 0.11% + ¥182,050 (over ¥50M); min ¥2,750, max ¥275,000 |

| Foreign Stocks (Domestic Brokerage) | 1.518% (under ¥1M) → 0.363% + ¥216,150 (over ¥50M); max ¥1,100,000 |

| Index Futures/Options Fees | Scaled by contract value; min ¥2,750, max ¥275,000 (options) |

| Government Bond Futures Fees | 0.0165% (under ¥500M) → 0.00275% + ¥220,000 (over ¥5B) |

| Safekeeping Account Fee | ¥2,200/year; waived for comprehensive securities accounts and corporate customers |

| Foreign Securities Trading Account Fee | ¥2,200/year (per account holding foreign stocks) |

| Stock Transfer Fees | Starts ¥1,100 for 1 unit; increases with units, capped at ¥6,600 |

| Margin Trading Management Fee | From ¥110/month (min) up to ¥1,100/month (max) |

| Rights Processing in Margin Trading | ¥55 per unit, no cap |