Company Summary

| IFIC Bank Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Bangladesh |

| Regulation | No regulation |

| Products | IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), and the foreign currency deposit product NFCD |

| Platform/APP | IFIC Digital Banking App |

| Customer Support | Phone: 09666716250 |

| Fax: 880-2-44850205 | |

| Email: info@ificbankbd.com | |

| Address: IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

IFIC Bank Information

IFIC Bank was founded in 1999 and is based in Bangladesh, offering a variety of savings and income products along with a convenient digital banking app. The bank provides multiple account types and competitive deposit rates, but it is unregulated currently.

Pros and Cons

| Pros | Cons |

| Provides multiple deposit and income-generating products | No regulation |

| Various account types | |

| Convenient digital banking platform available |

Is IFIC Bank Legit?

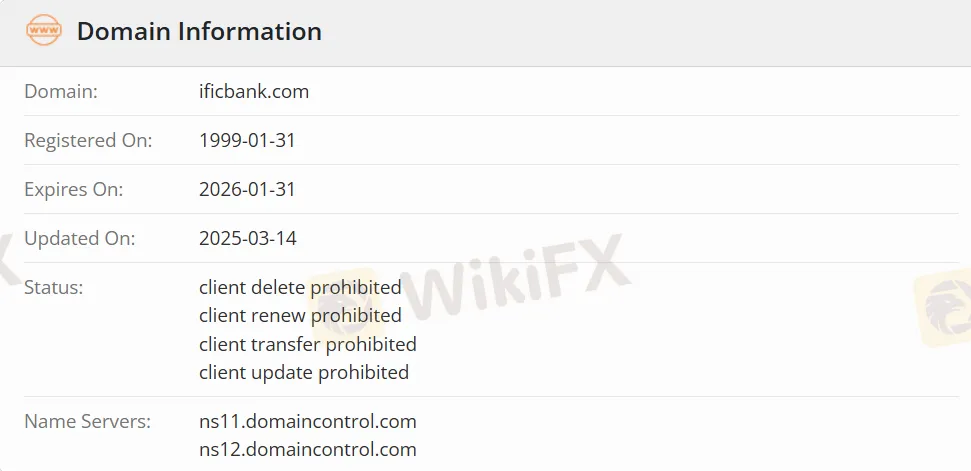

IFIC Bank is unregulated. Its domain name, ificbank.com, was registered on January 31, 1999, and will expire on January 31, 2026.

IFIC Bank Products

IFIC Bank offers a total of seven deposit and income-generating products, namely IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), and the foreign currency deposit product NFCD.

| Products | Supported |

| IFIC Aamar Bhobishawt | ✔ |

| Pension Savings Scheme (PSS) | ✔ |

| PSS-Joma, Special Notice Deposit (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Fixed Deposits | ✔ |

| Monthly Income Scheme (MIS) | ✔ |

| NFCD | ✔ |

Account Type

IFIC Bank offers a total of six types of accounts: IFIC Aamar Account, IFIC Shohoj Account, IFIC Freelancer Account, IFIC Women Banking, General Savings Account (including Student Account), and Current Account.

Trading Platform

IFIC Banks trading platform is the IFIC Digital Banking App, which supports both Android devices (available on Google Play) and Apple iOS devices (available on the App Store).

| Trading Platform | Supported | Available Devices |

| IFIC Digital Banking App | ✔ | Android, iOS |

Deposit and Withdrawal

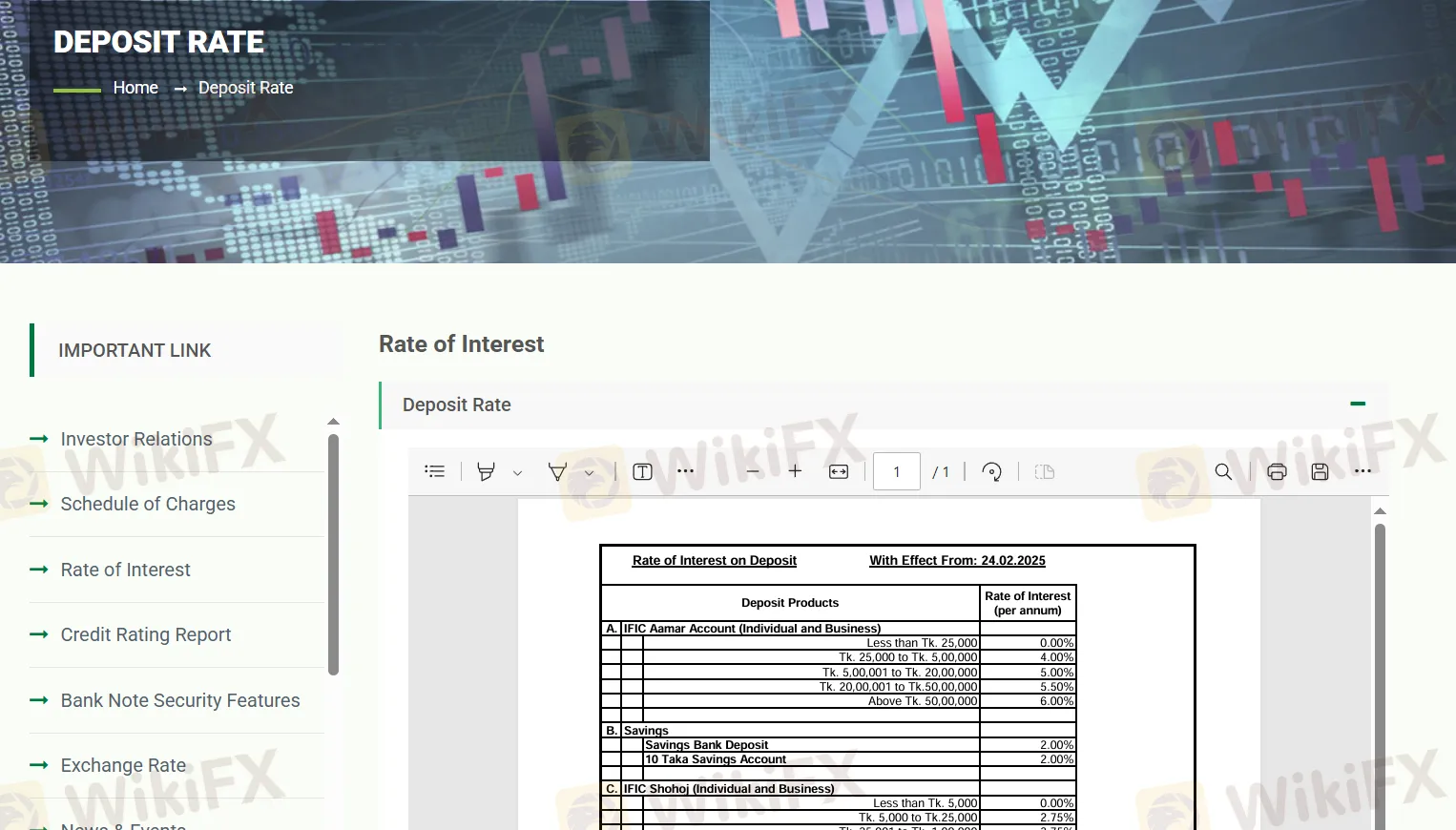

The “IFIC Aamar Bhobishawt” savings scheme offers an annual interest rate of 10% with monthly installments, providing different pre-tax maturity returns for terms ranging from 1 to 10 years; applicable tax rates are 10% and 15%. At the same time, the “Pension Savings Scheme (PSS)” offers an annual interest rate of 7.75%, while the “PSS-Joma” offers 8.00%. The regular savings account has an interest rate of 2%, and the “IFIC Shohoj” account offers tiered rates ranging from 2.75% to 4.25% based on the balance. Special Notice Deposit (SND) and “IFIC Corporate Plus” accounts also provide tiered rates, with a maximum of up to 5%.

For fixed deposits, the 1-month term offers 9.5%, while terms of 3 months or more offer a flat rate of 10.5%. The Monthly Income Scheme (MIS) provides 11%, 11.5%, and 12% interest rates for terms of 1, 2, and 3 years respectively. Separate interest rates apply to foreign currency deposits.