Company Summary

| Aspect | Information |

| Company Name | CLC Securities Limited |

| Registered Country/Area | Hong Kong |

| Founded Year | 2011 |

| Regulation | Regulated by the Securities and Futures Commission of Hong Kong |

| Spreads | Information not provided |

| Trading Platforms | CLC Global of Mobile, PC, Web version |

| Products and Services | Investment Management, Investment Service, and Corporate Management |

| Customer Support | Global Trading Hotline: (852) 3153 1128, Email: cs@clchk.com |

| Educational Resources | Videos |

Overview of CLC

Established in 2011, CLC is a Hong Kong-based investment firm that manages multiple global investment strategies. They generate attractive investment returns by adhering to a disciplined approach, leveraging unique insights, and conducting thorough research. Their distinct corporate culture has attracted high-caliber individuals who share their vision and are dedicated to their collective growth. This, in turn, allows them to continuously enhance the solutions they offer to their investment partners.

CLC demonstrates their commitment by investing their own capital in every solution, ensuring that their interests are closely aligned with those of their investors. Furthermore, their investments and clients benefit from the extensive financial and operational expertise provided by their Investment Service unit.

The CLC Group of companies operates under the regulatory oversight of the Securities and Futures Commission (SFC), enabling them to offer services in Dealing in and Advising on Securities and Futures Contracts, as well as Asset Management. Their Investment Service unit is focused on delivering cost-effective and efficient execution for both their clients and themselves.

Regulatory Status

CLC is regulated by the Securities and Futures Commission of Hong Kong. Their current regulatory status is “Regulated,” and they hold a license for “Dealing in futures contracts.” The regulatory oversight is provided by the regulatory authority of Hong Kong, and their specific license number is AQF520.

This regulatory information ensures that CLC operates in compliance with the applicable financial regulations in Hong Kong and maintains the necessary authorization to engage in dealing in futures contracts.

Pros and Cons

| Pros | Cons |

| Prospective high-quality investment firm | Limited information on account types, |

| Disciplined approach with deep research | Limited information on deposit and withdrawal methods |

| Unique insights and attractive returns | Lack of educational resource details |

| Diverse strategies and investment options | |

| Client-focused approach | |

| Regulatory oversight by Hong Kong's SFC | |

| Strong customer support channels | |

| Inclusion of Mobile, PC, and Web platforms |

Products and Services

Investment Management

We invest in discretionary macro and systematic strategies for our investment partners and from our own capital. Our people constantly learn and improve our knowledge, understanding and methodologies, with strong curiosity and dedication.

Investment Service

We focus on fostering long-term partnerships with our clients by providing comprehensive and effective financing and investing solutions to help our clients to grow their business and wealth. Our people are experienced industry experts and driven individuals, dedicated to developing extensive knowledge and resources as well as solving complex and challenging tasks.

Corporate Management

Our Corporate Management unit manages corporate affairs and supports the company's growth. The unit consists of Human Capital Management, Legal & Compliance, Accounting & Finance, and Corporate Strategy functions.

We manage in-house and outsourced services, research and deploy corporate strategies, foster corporate culture, and automate and execute routines.

CLC Global trading platform

CLC Securities Limited offers a versatile trading platform available in Mobile, PC, and Web versions. The platform is designed with a user-friendly interface, minimizing the effort required for tasks like logging in, placing orders, accessing market news, and reviewing statements. This design ensures a seamless and efficient trading experience for users, while their customer service team is readily available to address inquiries and support investment needs. The platform is also accessible in a China Mainland Mobile Android version.

How to open an account?

You have two options for opening an account with CLC Securities Limited: online account opening or face-to-face account opening.

5 Steps for Online Account Opening:

Fill in your personal information on the webpage.

Upload your personal identification documents.

Sign the documents that will be sent to your email.

Certify your personal identification card by either mailing a cheque of USD 2,000 (or equivalent) to our company* or by visiting a lawyer, CPA, or a bank branch manager for verification.

Mail the signed documents, your certified IDs, and the USD 2,000 cheque (if applicable) to our company.

5 Steps for Face-to-Face Account Opening:

Fill in your personal information on the webpage.

Upload your personal identification documents.

Schedule an in-person appointment.

Bring your personal information documents to our office.

Our licensed representative will verify your identity and signatures.

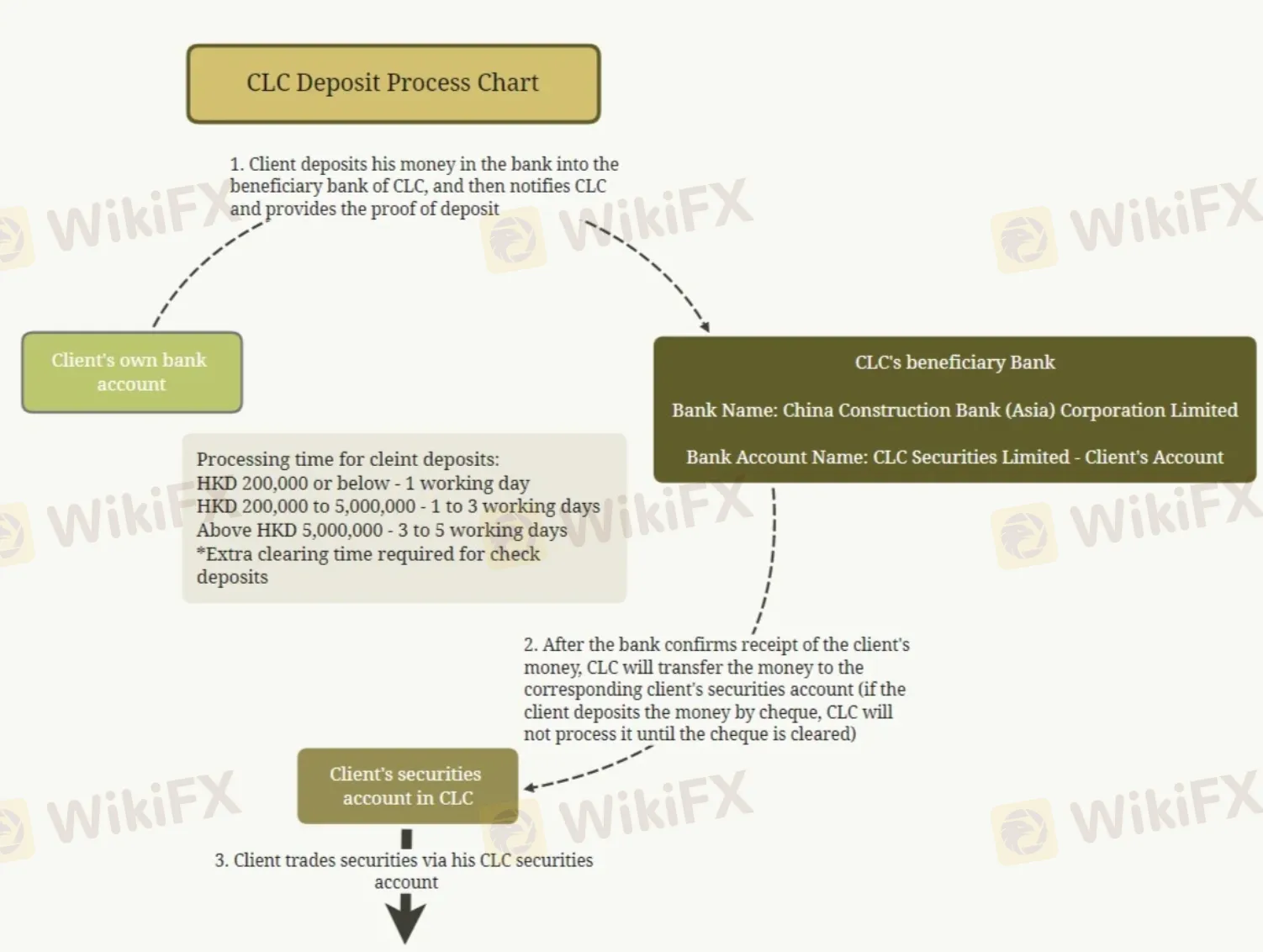

Deposit Process

The client initiates the deposit process by depositing their funds into CLC's beneficiary bank. Following the deposit, the client informs CLC of the deposit and provides supporting proof of the transaction. The beneficiary bank for CLC is China Construction Bank (Asia) Corporation Limited.

- Processing time for client deposits:

- For deposits of HKD 200,000 or below: 1 working day

- For deposits ranging from HKD 200,000 to 5,000,000: 1 to 3 working days

- Deposits exceeding HKD 5,000,000: 3 to 5 working days

- Note: Additional clearing time is necessary for check deposits.

Once the bank confirms the receipt of the client's funds, CLC proceeds to transfer the deposited money to the respective client's securities account. It is important to note that in the case of cheque deposits, CLC will only process the deposit after the cheque has been cleared.

The client is then able to engage in securities trading using their CLC securities account.

Educational Resources

CLC offers quite a few video tutorials, both in Mandarin and Cantonese, on how to open an account, download software, place orders under the trading platform, etc., for novice traders to familiarize themselves with and get started.

Customer Support

CLC Securities Limited offers comprehensive customer support through their Global Trading Hotline. You can reach their customer service team by phone at (852) 3153 1128. Additionally, they provide email support at cs@clchk.com. These contact options enable clients to access assistance, inquire about services, or seek help with any trading-related concerns.

Conclusion

In conclusion, CLC Securities Limited offers the potential for high-quality investment opportunities through its disciplined approach, deep research, and a range of diverse strategies. The company's client-focused approach, regulatory oversight by Hong Kong's SFC, and strong customer support channels are clear advantages.

However, the lack of specific information on essential aspects such as minimum deposits, maximum leverage, spreads, tradable assets, account types, demo accounts, deposit and withdrawal methods, and educational resources could be considered disadvantages, as it may hinder potential clients from making well-informed investment decisions.

FAQs

Q: How to subscribe IPO shares?

A: CLC Securities Limited offers its qualifying clients the ability to participate in Initial Public Offering (“IPO”) via Hong Kong shares offerings (“e-IPO”) and international shares offerings (“Private Placement”).

You can subscribe IPO through your designated Account Executive or visiting our office. The allotted IPO holdings will be directly credited to your trading account on the allotment day. You can trade your shares on the first listing day.

Q: What types of strategies does CLC Securities Limited employ for investments?

A: CLC Securities Limited employs a variety of investment strategies, tailored to different financial goals and risk profiles.

Q: Is there a minimum deposit requirement to start trading with CLC Securities Limited?

A: Minimum deposit requirements may vary depending on the type of account you wish to open.

Q: What level of customer support does CLC Securities Limited provide?

A: CLC Securities Limited offers robust customer support through various channels, including a global trading hotline and email support, to address client inquiries and issues.

Q: What is the regulatory authority overseeing CLC Securities Limited?

A: CLC Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring compliance with financial regulations.

Q: What trading platforms are offered by CLC Securities Limited?

A: CLC Securities Limited provides trading platforms for mobile, PC, and web, giving you flexibility in executing your trades.

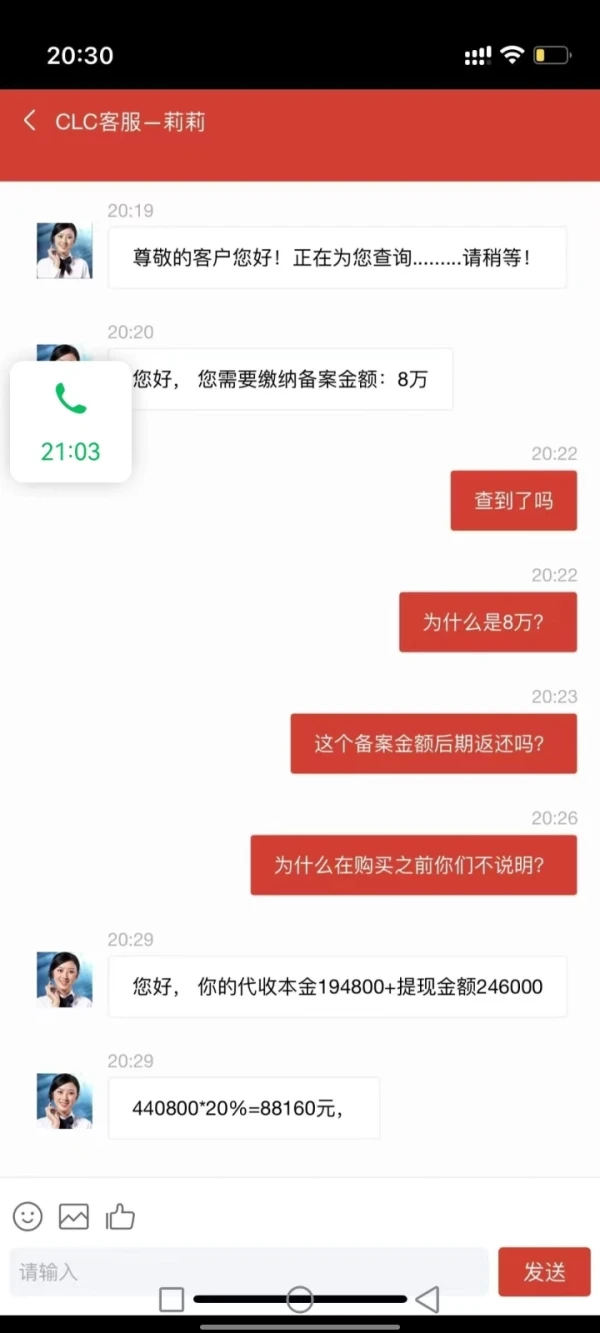

零度寂寞

Hong Kong

Scam platform. They reshuffled again even they absconded. Such shameless people. Now, the app cannot be logged in. Hope the platform can solve it and return my money.

Exposure

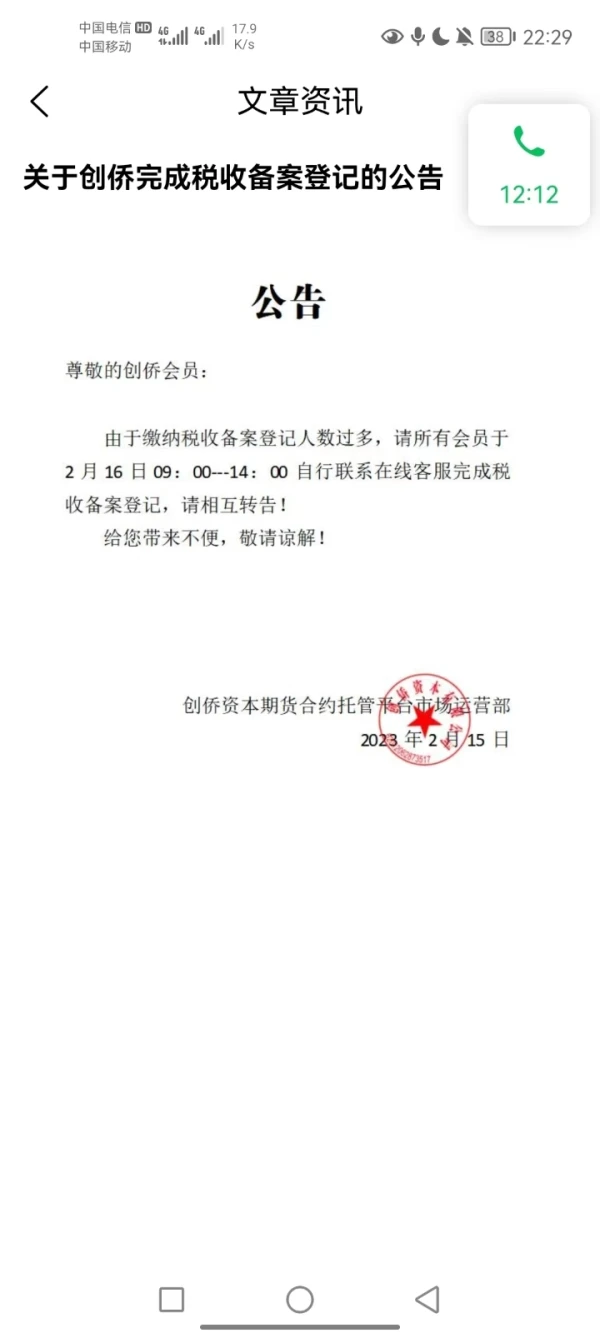

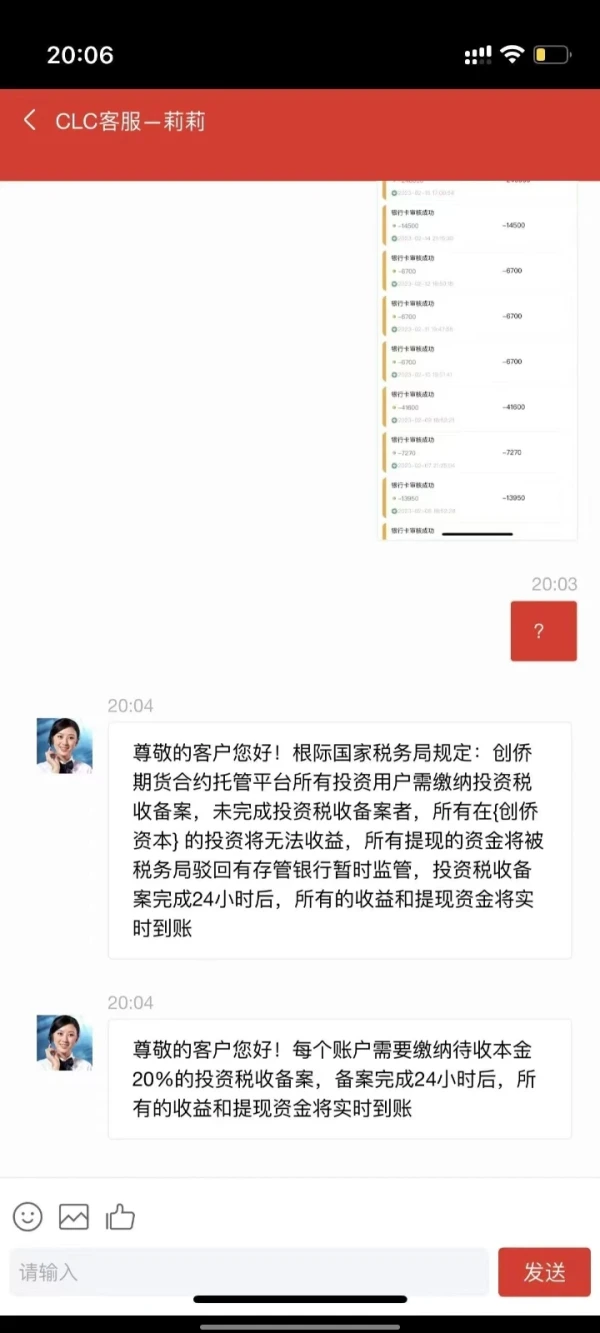

小白2933

Hong Kong

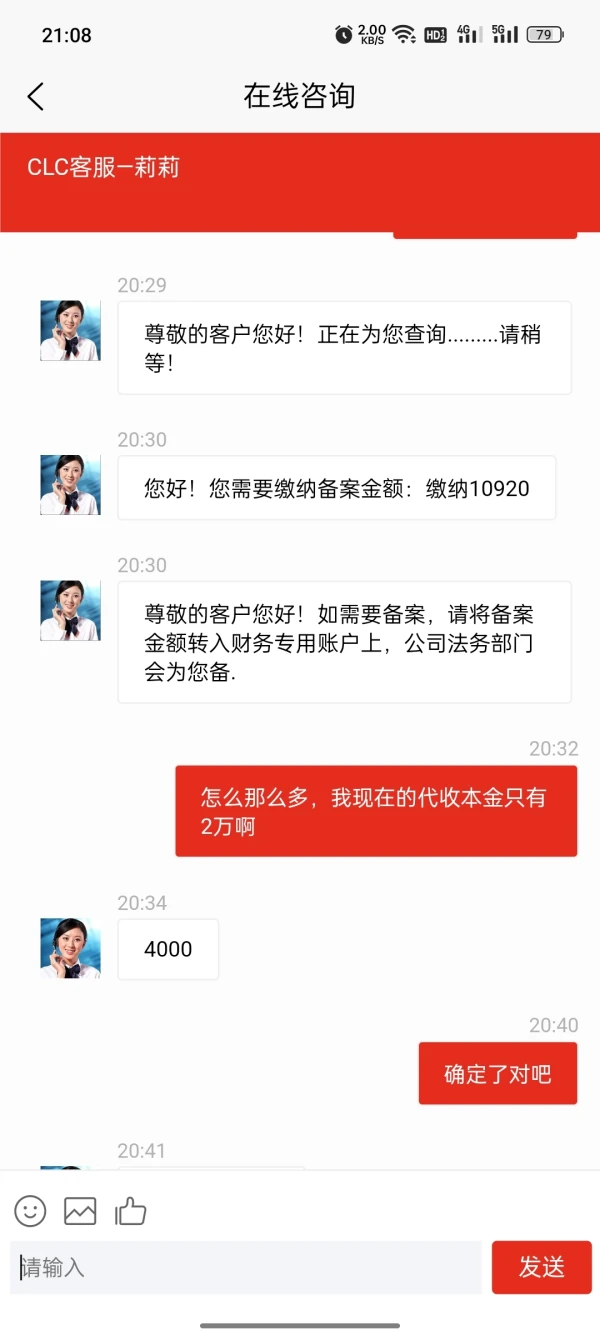

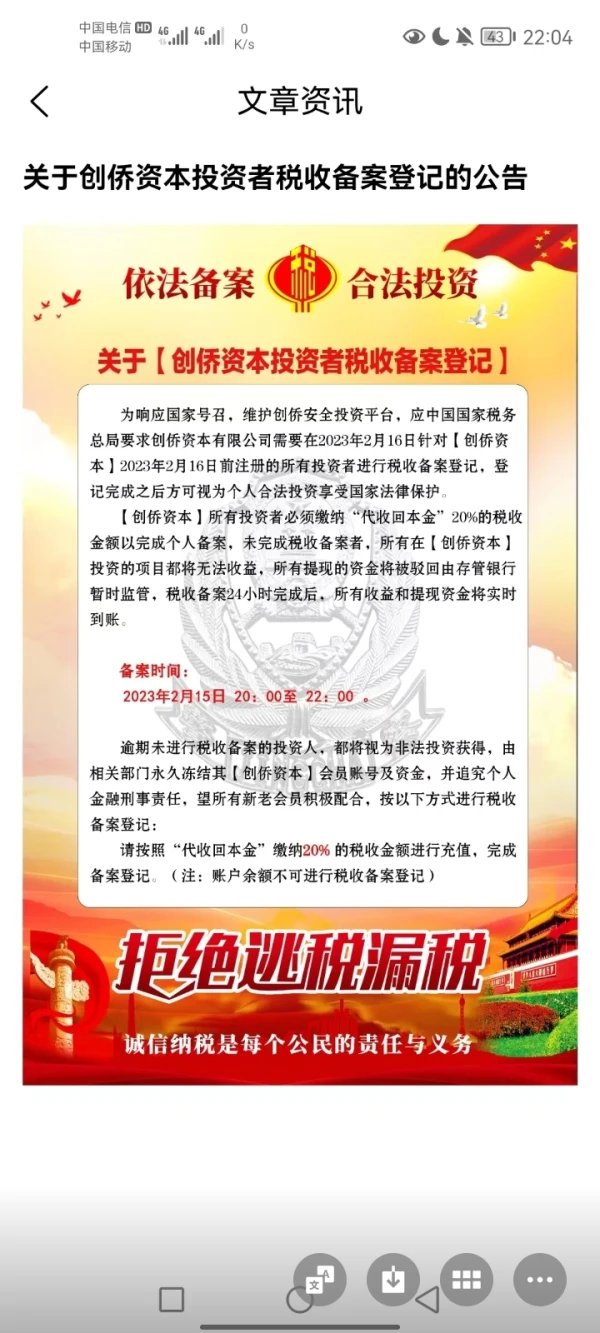

Unable to withdraw and require tax. The police is investigating this. Stop if u see this.

Exposure

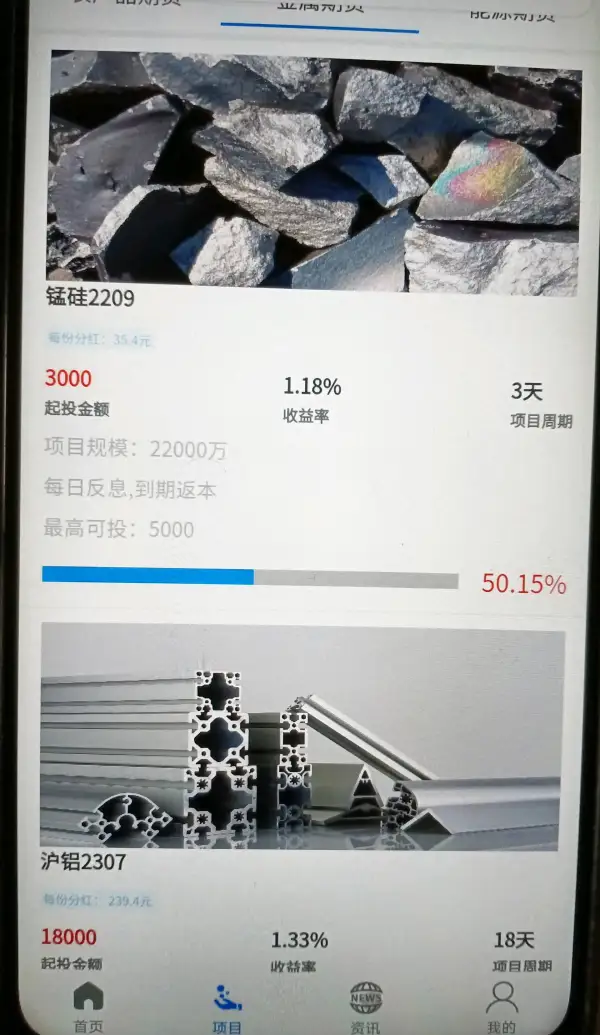

风沙610

Hong Kong

Ponzi scheme. Stay away. If you have lots of money, you can trade at here and give it to scammer.

Exposure

FX1391372709

Hong Kong

CLC is a regulated investment company offering various financial services including securities trading, margin financing, and IPO subscription services. However, recently there are too many negative reviews exposing that they are unable to withdraw. As with any financial institution, it is important to conduct thorough research and due diligence before investing your money or working with them.

Neutral