Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Company Name | TNFL FX |

| Regulation | NFA |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:400 |

| Spreads | Limited information provided |

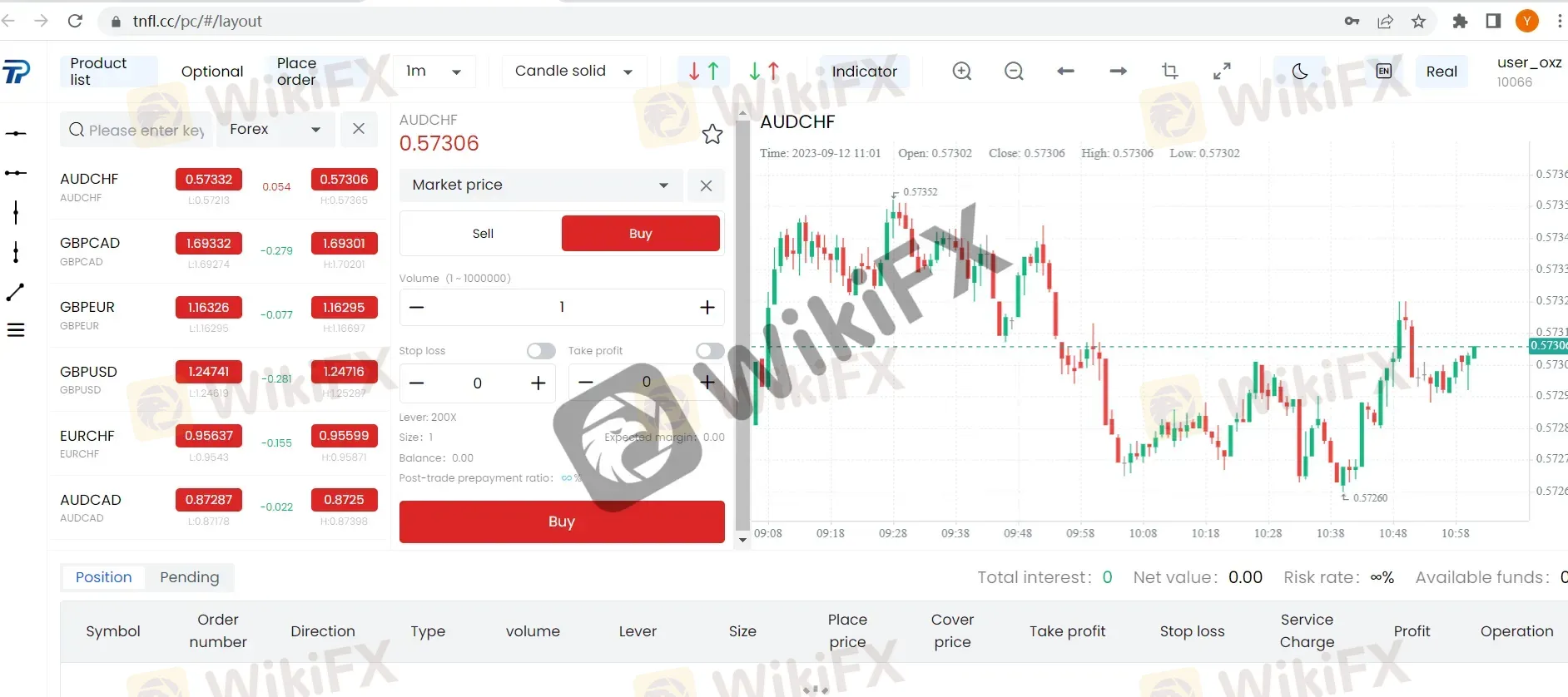

| Trading Platforms | TNFL FX trading platform |

| Tradable Assets | Forex, Precious Metals, Crude Oil, Indices, Cryptocurrencies |

| Account Types | Comprehensive, Finance, Financial STP, Demo Account |

| Demo Account | Available |

| Customer Support | Email-only support |

| Payment Methods | Bank wire transfers, cryptocurrencies |

| Educational Tools | Limited educational resources |

Overview

TNFL FX, based in the United Kingdom, offering access to diverse tradable assets and a maximum leverage of 1:400.

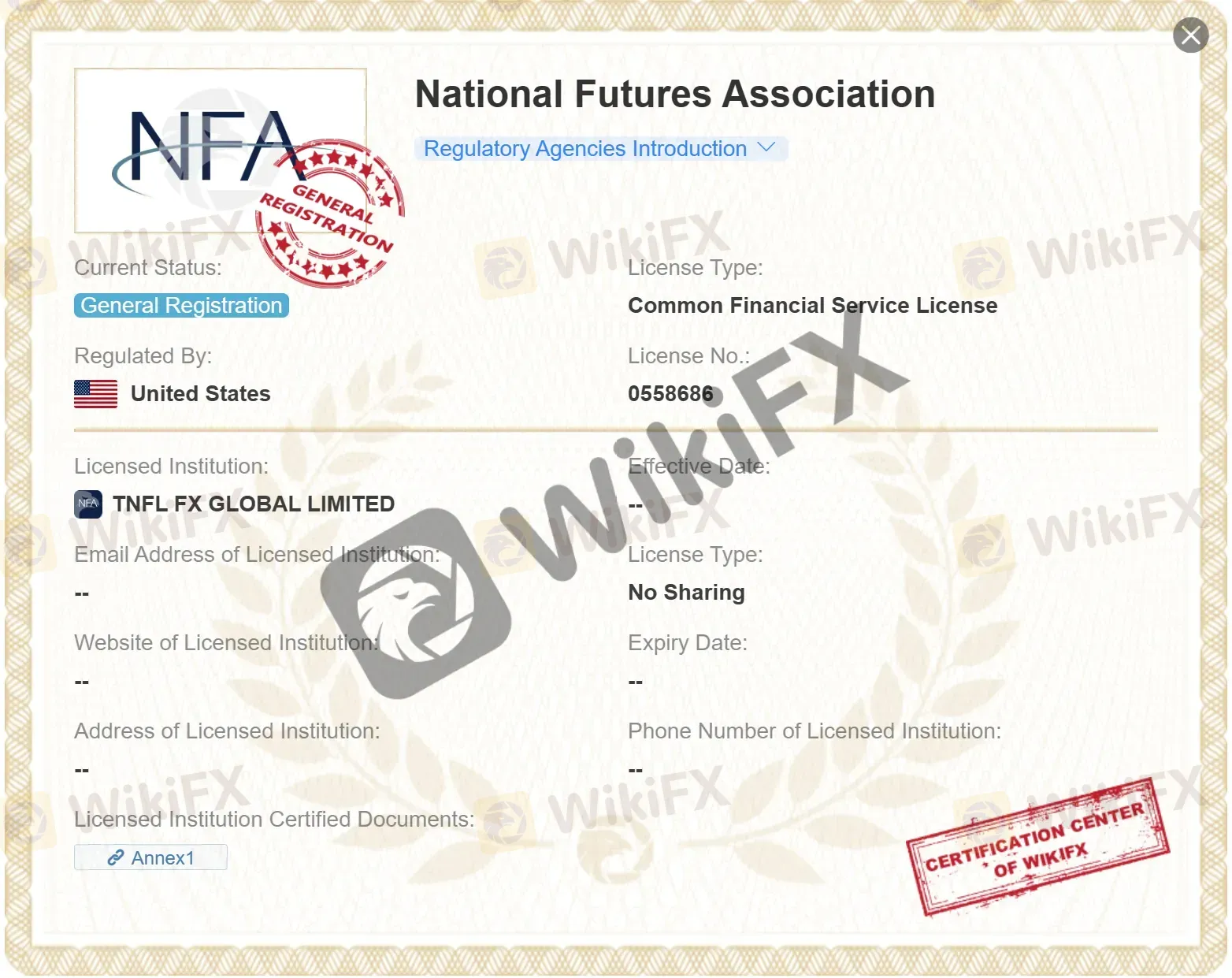

Regulation

Regarding regulation, TNFL FX, is registered with the National Futures Association (NFA) under regulatory license number 0558686.

Pros and Cons

TNFL FX presents a mixed picture for traders. On the positive side, it offers a wide range of market instruments and a powerful trading platform with technical tools. Traders can access a maximum leverage of 1:400 and choose from various account types. The broker also provides cryptocurrency trading options.

However, there are notable drawbacks. Educational resources for traders are limited, potentially hindering skill development. Deposit and withdrawal options are also restricted, and the broker's transparency regarding spreads and commissions is lacking. Customer support is email-only, which may result in slow response times. Traders should carefully consider these pros and cons when evaluating TNFL FX as a potential broker.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

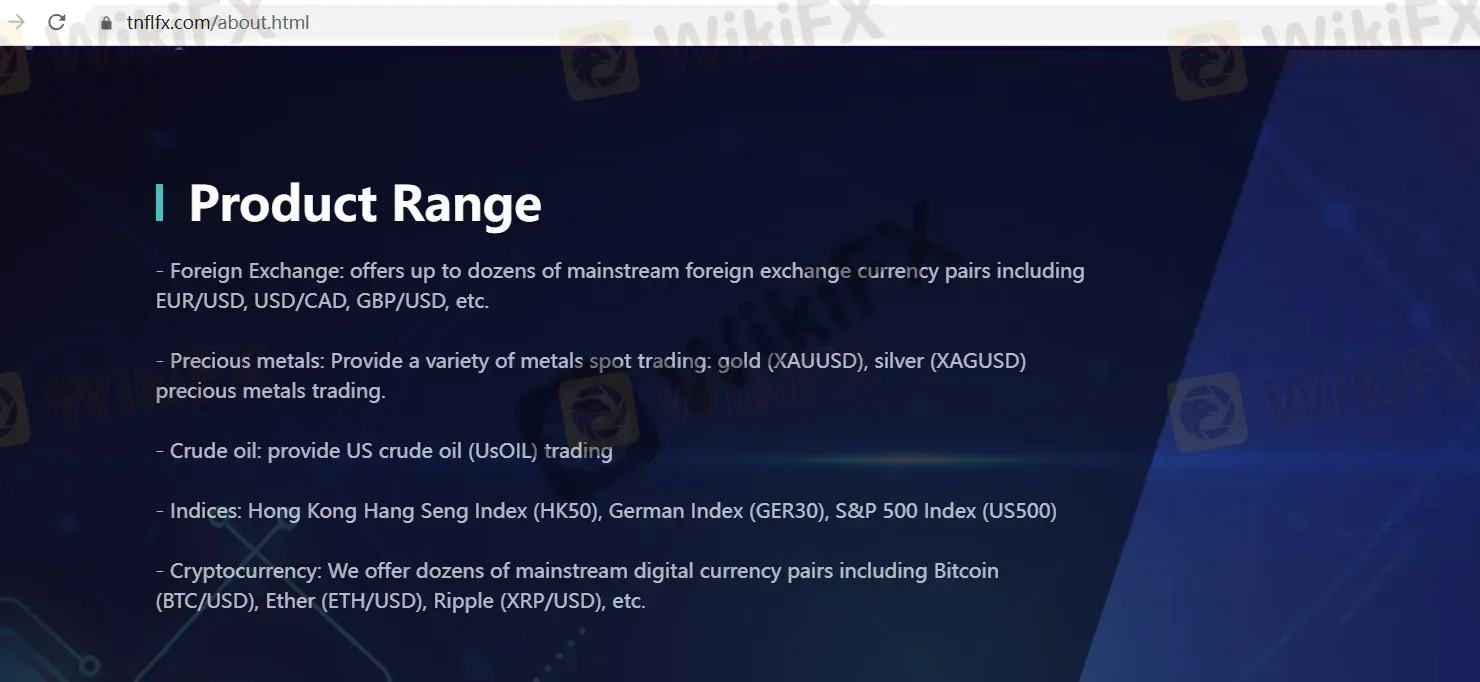

Market Instruments

TNFL FX offers a diverse range of market instruments across various asset classes to cater to the trading preferences of its clients:

Foreign Exchange (Forex): TNFL FX provides access to the foreign exchange market, offering a wide selection of mainstream currency pairs, such as EUR/USD, USD/CAD, GBP/USD, and many others. Forex trading allows investors to speculate on the exchange rates between different global currencies.

Precious Metals: The platform also offers spot trading for precious metals, including gold (XAUUSD) and silver (XAGUSD). Precious metals are often considered safe-haven assets and can serve as a hedge against economic uncertainty.

Crude Oil: TNFL FX facilitates trading in US crude oil (USOIL), allowing traders to speculate on the price movements of this essential commodity. Crude oil is a significant component of global energy markets and can be influenced by various geopolitical and economic factors.

Indices: Traders can access index trading, including well-known indices such as the Hong Kong Hang Seng Index (HK50), German Index (GER30), and the S&P 500 Index (US500). Index trading allows investors to speculate on the performance of a basket of stocks, providing exposure to broader market trends.

Cryptocurrency: TNFL FX offers a diverse range of cryptocurrency pairs, providing access to the volatile and rapidly evolving world of digital assets. This includes pairs like Bitcoin (BTC/USD), Ether (ETH/USD), and Ripple (XRP/USD). Cryptocurrency trading has gained popularity for its potential for high volatility and trading opportunities.

In summary, TNFL FX's market instruments encompass a broad spectrum of assets, from traditional forex and precious metals to commodities like crude oil, stock market indices, and the exciting world of cryptocurrencies. This diverse selection allows traders to diversify their portfolios and take advantage of various market conditions and opportunities. However, it's important for traders to conduct thorough research and risk management when engaging in trading activities across these different asset classes, as each comes with its own unique set of challenges and considerations.

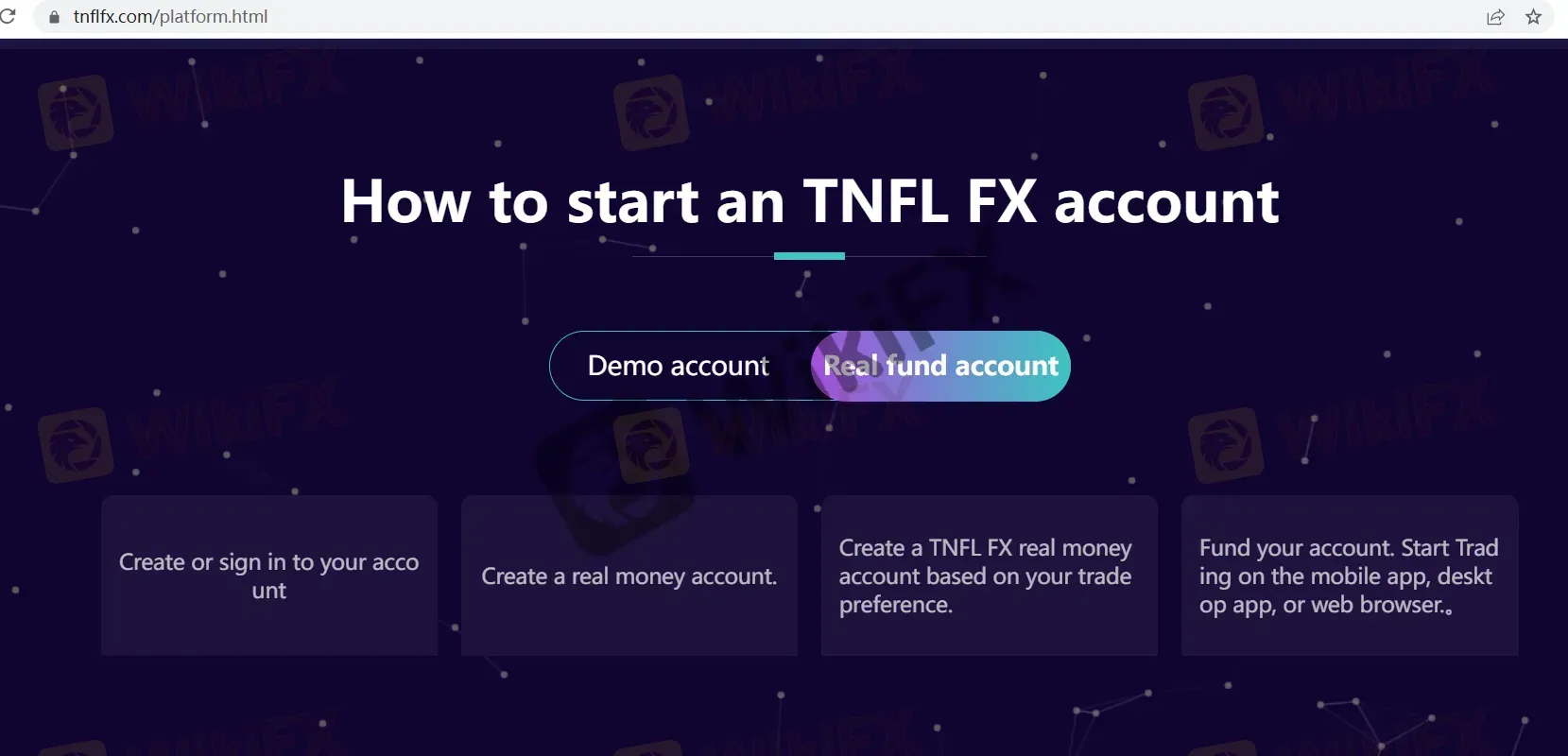

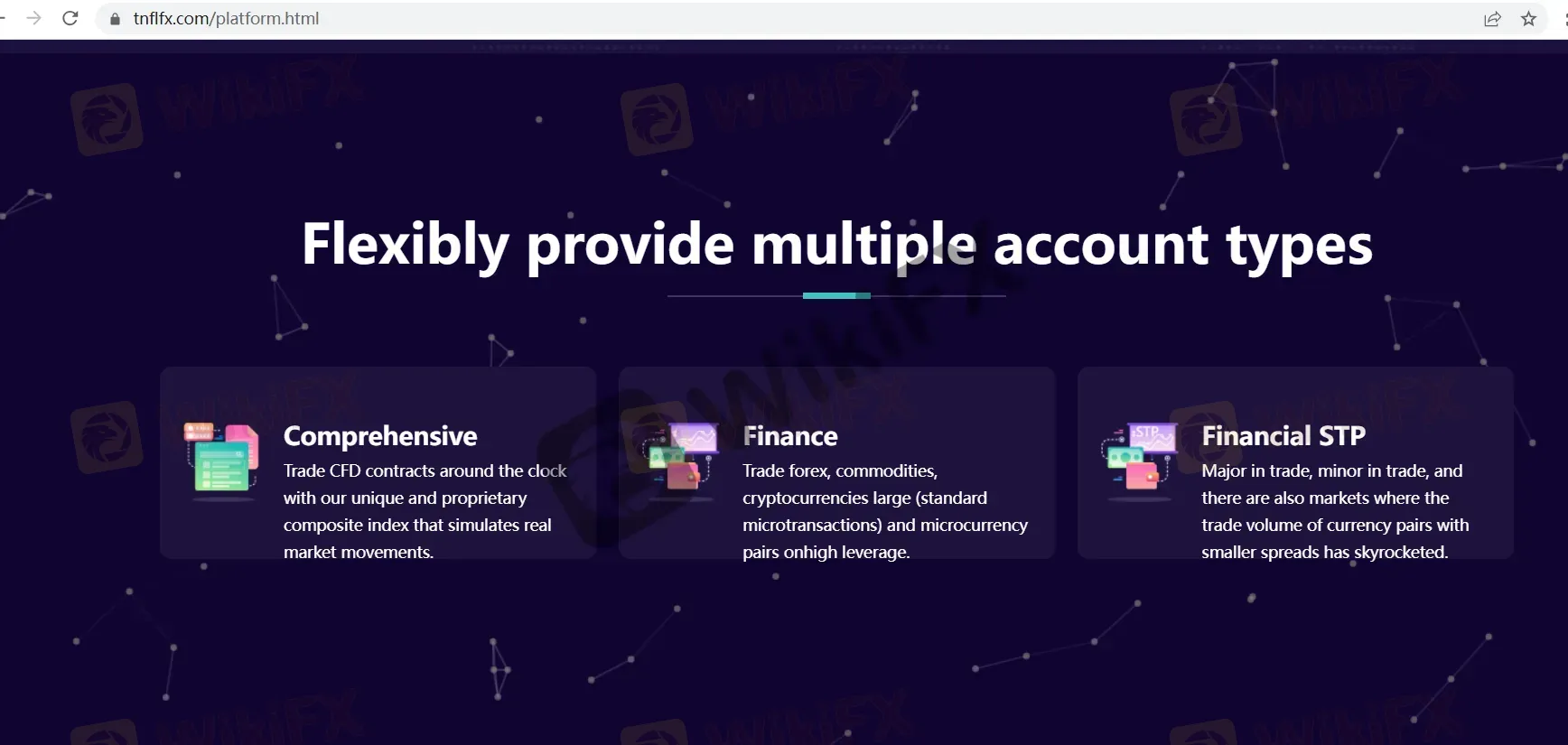

Account Types

TNFL FX provides a comprehensive range of account types to cater to the diverse needs of traders, offering options for both practice and real-money trading. These three tiered trading accounts are designed to accommodate various trading preferences and objectives, each providing unique features and opportunities.

Demo Account:

The journey begins with TNFL FX's free demo account, a perfect starting point for traders seeking to gain experience without any financial risk. By opening a demo account, users can immerse themselves in the world of trading, selecting from a wide array of assets to simulate real market conditions. This account type is accessible through the user-friendly mobile app, desktop application, or web browser, allowing traders to practice their skills and refine their strategies.

Real Fund Accounts:

TNFL FX offers three distinct real fund account options, each tailored to specific trading preferences:

a. Comprehensive Account:

TNFL FX's Comprehensive Account provides traders with the flexibility to trade CFD contracts across the clock. What sets this account apart is its unique and proprietary composite index, which replicates real market movements. This feature allows traders to access a diverse range of trading opportunities and instruments.

b. Finance Account:

For traders interested in the financial markets, TNFL FX's Finance Account offers the ability to trade forex, commodities, and cryptocurrencies. This account supports both standard and microtransactions, empowering traders to choose their position sizes. Furthermore, it offers high leverage, enabling traders to control larger positions with a relatively small capital investment.

c. Financial STP Account:

TNFL FX's Financial STP Account caters to traders who want to engage in currency pair trading. This account type covers major and minor currency pairs and highlights markets where currency pairs with smaller spreads have gained prominence. This can be particularly appealing to traders seeking cost-effective trading opportunities.

Upon creating or signing into a real fund account, traders can customize their experience based on their specific trade preferences. These real fund accounts can be funded with actual capital, and traders can start executing trades using the TNFL FX mobile app, desktop application, or web browser.

To summarize, TNFL FX's tiered account system offers a well-rounded trading experience, encompassing practice accounts for skill development and real fund accounts tailored to traders' specific goals. The three distinct real fund accounts - Comprehensive, Finance, and Financial STP - provide traders with diverse opportunities to explore various markets and trading strategies. It's crucial for traders to carefully assess their objectives and risk tolerance when selecting the most suitable account type for their trading journey.

| Account Type | Description | Key Features | Suitable For |

| Demo Account | Practice trading without financial risk | - Simulate real market conditions | - Novice traders looking to gain experience |

| - Wide range of tradable assets | - Strategy development | ||

| - Accessible via mobile, desktop, and web | |||

| Real Fund Accounts | Transition to live trading with real capital | - Customizable based on trade preferences | - Traders ready to engage with real money |

| Comprehensive | Trade CFD contracts around the clock | - Unique proprietary composite index | - Diverse trading strategies and opportunities |

| - Simulates real market movements | |||

| Finance | Trade forex, commodities, and cryptocurrencies | - Standard and microtransactions available | - Traders interested in financial markets |

| - High leverage for position control | - Various asset classes for portfolio diversification | ||

| Financial STP | Focus on currency pair trading with major and minor pairs | - Markets with smaller spreads highlighted | - Traders seeking cost-effective trading options |

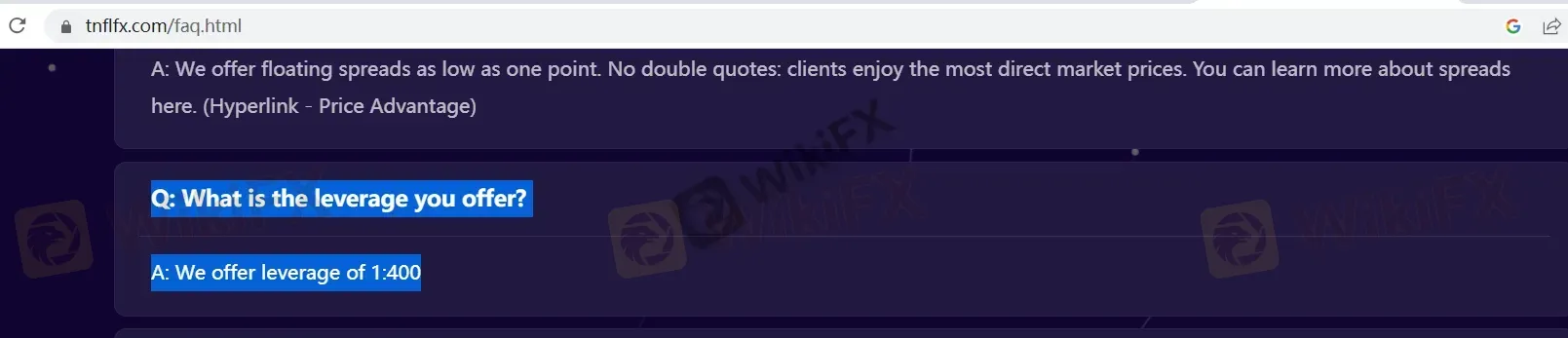

Leverage

TNFL FX offers a maximum trading leverage of 1:400 to its traders. Leverage in trading allows traders to control a larger position size with a relatively smaller amount of capital. A leverage of 1:400 means that for every $1 in the trader's account, they can potentially control a trade worth up to $400. While leverage can amplify potential profits, it also magnifies potential losses, making it essential for traders to use it wisely and consider their risk tolerance carefully. Higher leverage can be appealing to traders seeking to maximize their trading capital, but it's important to be aware of the associated risks and implement appropriate risk management strategies.

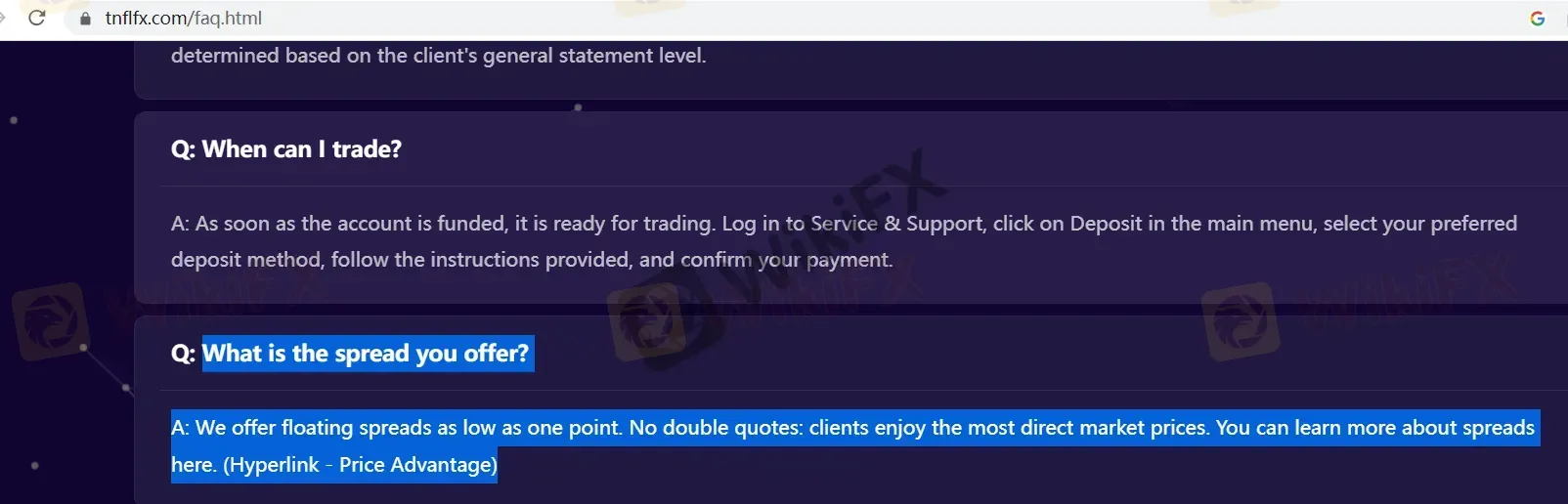

Spreads & Commissions

Unfortunately, TNFL FX provides very limited information about its spreads and commissions. While they mention offering floating spreads as low as one point, they do not provide a comprehensive breakdown of spreads for different trading accounts or instruments. Additionally, the provided hyperlink (“Price Advantage”) appears to be non-functional, leaving traders without access to vital pricing details.

This lack of transparency regarding spreads and commissions can be frustrating for potential traders who need this information to make informed decisions about their trading strategy and the suitability of TNFX as their broker. Without clear and readily accessible information about spreads, traders may have concerns about hidden costs or unfavorable trading conditions.

In summary, TNFX's limited and non-functional information about spreads and commissions can be a significant drawback for traders who require transparency and clarity in their broker's pricing structure.

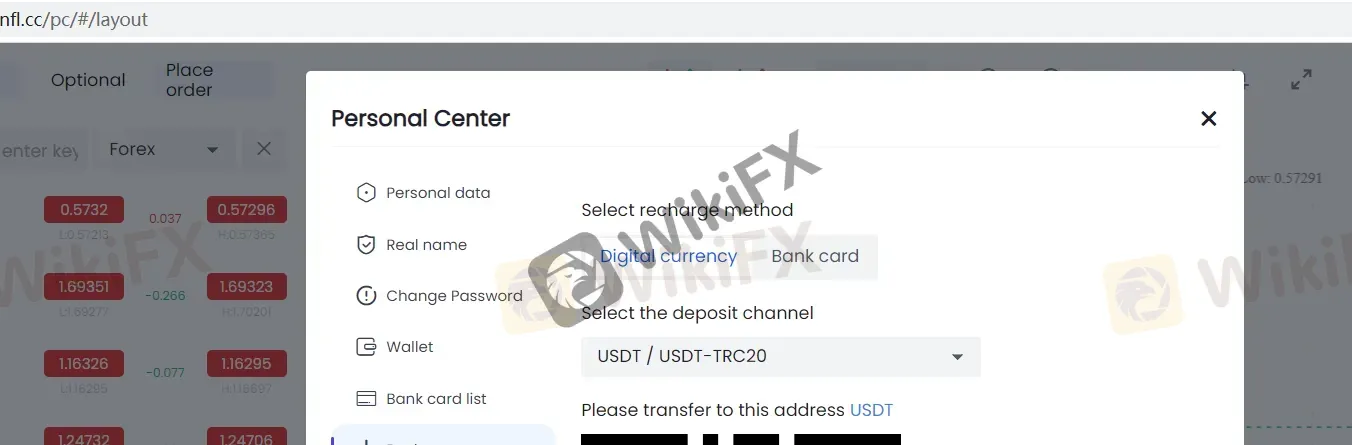

Deposit & Withdrawal

TNFL FX's deposit and withdrawal options are notably limited and have their share of drawbacks.

Bank Wire Transfers: While secure, they can be slow and come with fees.

Cryptocurrency Transactions: These introduce volatility risks due to the unpredictable nature of digital currency values.

These limited and potentially inconvenient choices fail to provide the flexibility and convenience that many traders seek in managing their funds. For those looking for a more user-friendly payment system, TNFX's options may fall short of expectations.

Trading Platforms

TNFL FX offers a widely recognized online trading platform known for its versatility and power. The platform boasts an impressive array of over 50 technical indicators and intraday analysis tools, making it a valuable resource for traders of all levels. It places a strong emphasis on security and reliability, ensuring a safe trading environment. Despite its advanced features, it remains user-friendly, catering to both novice and experienced traders. This platform has earned its place as a standard in the online trading world, offering a comprehensive and dependable trading experience.

Customer Support

TNFL FX's customer support, represented by the email address: support@tnfl.cc, falls short of meeting traders' expectations. Email-only support can result in frustratingly slow response times, particularly during urgent situations. The absence of real-time support channels like live chat or phone assistance suggests a lack of commitment to addressing traders' needs promptly. Additionally, using a generic email address rather than a dedicated support system can lead to disorganization and delayed responses, contributing to an overall unsatisfactory customer support experience.

Educational Resources

TNFL FX appears to provide limited educational resources for traders. The absence of comprehensive educational materials, such as tutorials, webinars, or educational articles, suggests that the broker may not prioritize trader education as a central part of its services.

This lack of educational support can be a drawback for traders, especially for those who are new to the world of online trading and need guidance and resources to develop their trading skills and knowledge. Traders seeking to enhance their understanding of the markets and trading strategies may find the absence of educational resources to be a limitation when considering TNFL FX as their broker.

In summary, TNFL FX's limited educational resources may leave traders looking for more comprehensive learning materials and support elsewhere. Trader education is a crucial aspect of success in online trading, and brokers who offer a range of educational resources can be more attractive to traders seeking to improve their trading skills.

Summary

TNFL FX, as an unregulated forex broker, presents notable concerns for traders. The absence of regulatory oversight raises questions about trader protection and financial security. Limited educational resources further hinder traders, especially those new to online trading, as comprehensive materials are lacking. The platform's deposit and withdrawal options, primarily bank wire transfers and cryptocurrencies, may frustrate traders seeking more convenience. Additionally, the lack of transparency regarding spreads and commissions raises doubts about hidden costs. TNFL FX's customer support, limited to email communication, may result in slow responses and organizational issues. Overall, TNFL FX falls short in several crucial aspects, making it less competitive in the crowded forex broker landscape. Traders should weigh these limitations carefully when considering this broker.

FAQs

Q1: What is TNFL FX's maximum trading leverage?

A1: TNFL FX offers a maximum trading leverage of 1:400, allowing traders to control larger positions with relatively small capital.

Q2: What market instruments can I trade with TNFL FX?

A2: TNFL FX offers a diverse range of instruments, including forex, precious metals, crude oil, indices, and cryptocurrencies.

Q3: Are there educational resources available for traders?

A3: Unfortunately, TNFL FX provides limited educational materials, which may not be sufficient for traders seeking comprehensive learning resources.

Q4: How can I contact TNFL FX's customer support?

A4: TNFL FX's customer support can be reached via email at support@tnfl.cc, but it lacks real-time support options like live chat or phone assistance.

Q5: Is TNFL FX a regulated broker?

A5: No, TNFL FX is an unregulated forex broker, which may raise concerns about trader protection and financial security due to the absence of regulatory oversight.