Company Summary

| Aspect | Information |

| Registered Country/Area | Austria |

| Company Name | Aglo Trade |

| Regulation | Unregulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:100 |

| Spreads | Dynamic, based on market conditions |

| Trading Platforms | Web, Android, iPhone |

| Tradable Assets | Forex, CFD Stocks, Crypto CFDs |

| Account Types | Gold, Silver, Bronze |

| Demo Account | Available |

| Customer Support | Limited online presence, no major social media |

| profiles, limited communication channels | |

| Payment Methods | Visa, Bitcoin, Ethereum |

| Educational Tools | Limited educational resources, basic FAQ |

Overview

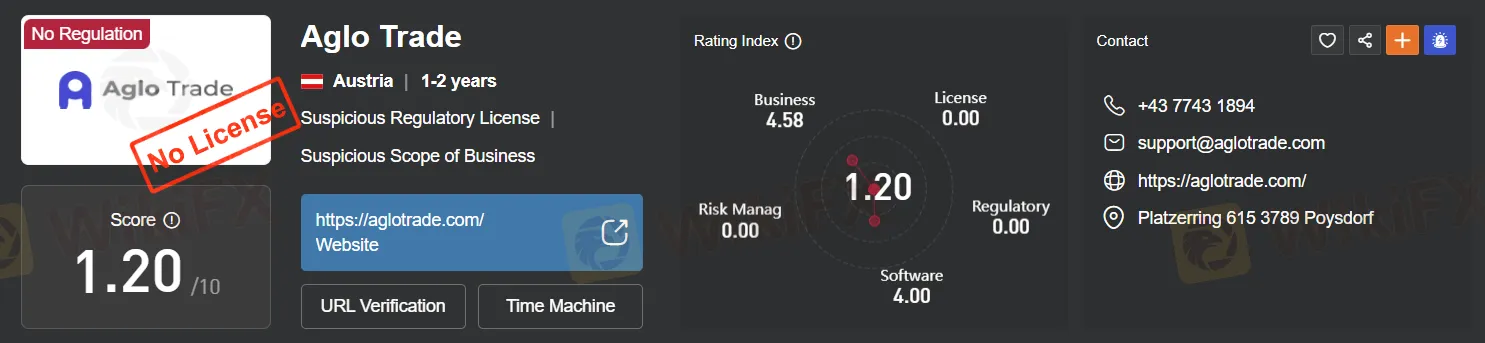

Aglo Trade, an unregulated brokerage based in Austria, has raised significant concerns within the online trading community. With no regulatory oversight, the company operates without adherence to the stringent standards and transparency requirements expected of regulated counterparts, leaving investors exposed to potential risks. The absence of key information, such as the minimum deposit, coupled with high leverage of up to 1:100 and dynamic spreads, raises doubts about the broker's commitment to transparency. While it offers trading platforms accessible via web, Android, and iPhone, the limited online presence, absence from major social media platforms, and constrained communication channels reflect a lack of engagement and support for customers. The educational resources are notably deficient, providing only a basic FAQ section. Furthermore, the current unavailability of its website adds to the overall uncertainty surrounding Aglo Trade. Investors are strongly advised to exercise extreme caution when considering this broker for their financial transactions.

Regulation

Aglo Trade, operating as an unregulated broker, has sparked concerns within the online trading community due to its lack of regulatory oversight. Unregulated brokers like Aglo Trade may not adhere to the strict standards and transparency requirements imposed on their regulated counterparts, potentially exposing investors to risks. These concerns primarily center around issues of accountability, transparency, and investor protection. Traders and investors should approach dealings with unregulated brokers cautiously, conducting thorough research and carefully assessing the associated risks before engaging in any financial transactions. Opting for regulated brokers, subject to oversight by established financial authorities, can offer a higher level of security and protection to those participating in the trading process.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aglo Trade presents a mixed bag of pros and cons. On the positive side, it offers a variety of market instruments and three tiered trading accounts with different benefits, providing flexibility to traders. The availability of high leverage and instant funding options can be advantageous for some. Accessible trading platforms and live video chat support contribute to the user experience. However, the lack of regulatory oversight raises concerns about transparency and investor protection. The absence of key information like the minimum deposit and dynamic spreads may lead to uncertainty in trading costs. Limited online presence, constrained communication channels, and deficient educational resources further challenge the broker's credibility. Traders should weigh these pros and cons carefully before engaging with Aglo Trade.

Market Instruments

Forex (FX):

Forex CFDs are contracts that allow traders to speculate on the price movements of currency pairs without owning the physical currencies. These pairs consist of two currencies, with one being the base currency and the other the quote currency. Traders can profit from both upward (going long) and downward (going short) price movements in these pairs.

Examples: Common forex pairs include EUR/USD (Euro/US Dollar), GBP/JPY (British Pound/Japanese Yen), and USD/JPY (US Dollar/Japanese Yen), among others.

CFD Stocks:

CFDs on stocks enable traders to speculate on the price movements of individual company shares without owning the underlying stocks. This means traders can potentially profit from both rising and falling stock prices.

Examples: CFDs are available for a wide range of individual stocks from various stock exchanges worldwide, including Apple Inc. (AAPL), Google parent company Alphabet Inc. (GOOGL), or Amazon.com Inc. (AMZN).

Crypto CFDs:

Crypto CFDs are contracts that allow traders to speculate on the price movements of cryptocurrencies like Bitcoin, Ethereum, Ripple, and many others without owning the actual digital assets. These CFDs offer a way to trade cryptocurrencies within the framework of traditional financial markets.

Examples: Common cryptocurrency CFDs include BTC/USD (Bitcoin/US Dollar), ETH/USD (Ethereum/US Dollar), and XRP/USD (Ripple/US Dollar), among others.

Account Types

The broker offers three tiered trading accounts: Gold, Silver, and Bronze, each designed to meet the specific needs of traders.

Gold Account:

Benefits: 24/7 live chat support, 1-hour withdrawals, +50% bonus, demo account, Copy Trading tool, Master class sessions, first 3 risk-free trades, personal success manager.

Silver Account:

Benefits: All Gold account features, +100% bonus.

Bronze Account:

Benefits: All Silver account features, +150% bonus, ideal for experienced traders.

Here's a concise table summarizing the key features:

| Account Type | Live Support | Withdrawal Time | Bonus | Demo Account | Copy Trading | Master Class | Risk-Free Trades | Personal Success Manager |

| Gold | 24/7 | 1 hour | 0.5 | Yes | Yes | Yes | First 3 | Yes |

| Silver | 24/7 | 1 hour | 1 | Yes | Yes | Yes | First 3 | Yes |

| Bronze | 24/7 | 1 hour | 1.5 | Yes | Yes | Yes | First 3 | Yes |

These account types offer traders flexibility and varying levels of support to match their trading goals and experience.

Leverage

This broker provides a maximum trading leverage of up to 1:100, allowing traders to control a position size up to 100 times their initial capital. High leverage can magnify both profits and losses, making it essential for traders to use it cautiously and employ effective risk management strategies to safeguard their investments. Understanding the implications of leverage and trading in alignment with one's risk tolerance and experience is crucial when utilizing this level of leverage.

Spreads and Commissions

The company utilizes a flexible pricing structure that involves spreads and commissions, which can vary depending on the specific financial instruments and trading accounts used.

Spreads: Spreads are typically applied as trading costs and are dynamic, taking into account factors like market liquidity and competitiveness. The company reserves the right to adjust spreads, particularly during periods of increased volatility or market illiquidity.

Commissions: Commissions are charged for specific trading scenarios:

For unleveraged Cryptocurrency CFD positions, a commission ranging from 1% to 2.5% may apply.

Leveraged Cryptocurrency CFD positions may incur a commission of up to 5% of the transaction.

Swap Fee: Clients may also be subject to a swap fee for holding positions overnight, currently set at 0.07% of the position's face value. This fee calculation involves a fixed percentage and the Libor rate.

Deposit & Withdrawal

The company offers a range of deposit and withdrawal options, including:

Visa: Clients can use Visa cards to deposit funds instantly into their accounts, providing a seamless way to fund trading activities.

Bitcoin: Cryptocurrency enthusiasts can utilize Bitcoin for both deposits and withdrawals, offering a secure and efficient means of managing their funds.

Ethereum: Ethereum, another popular cryptocurrency, is also available for deposits and withdrawals, providing fast and secure transactions for clients who prefer using Ether.

All Regions Covered: Regardless of their location, clients from around the world can take advantage of these deposit and withdrawal options, ensuring inclusivity.

Instant Funding: Clients benefit from instant funding, allowing them to quickly access their deposited funds and initiate trades or investments promptly.

Up to 1 Hour for Withdrawal: Withdrawals are processed efficiently, with funds typically becoming available within 1 hour, providing clients with timely access to their withdrawn assets.

Trading Platforms

Algo Trade provides a versatile trading platform for Options and CFD trading, accessible in three versions: web, Android, and iPhone. Key features include:

Asset Selection: Traders can choose from a variety of assets via a dropdown menu.

Live Charts: Real-time charts are available for all CFDs, aiding in technical analysis.

Instant Execution: Traders can swiftly execute trades to seize market opportunities.

Trade History: Users can access their entire trade history for review.

Mobile Access: Android and iPhone platforms allow trading on the go.

User-Friendly: The platform is intuitive, suitable for traders of all levels.

Trading Options: It supports regular options and CFD trading.

Funds Management: Traders can withdraw funds conveniently.

Live Video Chat: Live video chat support is available for immediate assistance.

Algo Trade 's platform ensures a seamless trading experience with accessibility, usability, and essential tools for traders.

Customer Support

Aglo Trade's customer support is notably deficient in its communication channels and online presence. The absence of the company on major social media platforms such as Twitter, Facebook, Instagram, and YouTube reflects a lack of transparency and engagement with clients. Additionally, the company's lack of a LinkedIn profile raises questions about its professionalism and credibility within the financial industry. The omission of popular messaging platforms like WhatsApp, QQ, and WeChat further limits accessible means of customer assistance. Overall, the limited communication options, both online and offline, undermine the company's commitment to providing comprehensive and responsive customer support.

Educational Resources

Aglo Trade's educational resources are conspicuously lacking, offering no substantive content to empower traders with the knowledge and information necessary for informed decision-making and skill enhancement. With a mere basic FAQ section and no additional educational materials or resources, clients are left with minimal guidance and support, diminishing the overall value of the platform's offering in terms of trader education. This deficiency in educational resources can hinder traders in understanding market dynamics, risk management, and effective trading strategies, ultimately limiting their ability to make informed and profitable trades.

Summary

Aglo Trade, operating as an unregulated broker, has raised concerns in the online trading community due to its lack of regulatory oversight, potentially putting investors at risk. While it offers a variety of market instruments such as Forex, CFD stocks, and Crypto CFDs, the absence of regulatory supervision raises questions about transparency and investor protection. The broker provides three tiered trading accounts, each with its benefits, and offers high leverage of up to 1:100, which requires cautious use. The pricing structure involves spreads, commissions, and swap fees. In terms of deposit and withdrawal options, it caters to various preferences and geographic locations. The versatile trading platform is accessible on web and mobile devices. However, Aglo Trade's customer support is notably deficient, with limited communication channels and an online presence lacking on major social media platforms. The educational resources provided are minimal, hindering traders' ability to make informed decisions and limiting their potential for success. Overall, investors should exercise caution when considering Aglo Trade as a trading platform.

FAQs

Q1: Is Aglo Trade a regulated broker?

A1: No, Aglo Trade operates as an unregulated broker, raising concerns about the absence of regulatory oversight, transparency, and investor protection.

Q2: What market instruments can I trade on Aglo Trade?

A2: Aglo Trade offers a variety of market instruments, including Forex, CFD stocks, and Crypto CFDs, allowing you to speculate on various financial assets.

Q3: What are the risks associated with Aglo Trade's high leverage?

A3: Aglo Trade provides high leverage of up to 1:100, which can magnify both profits and losses. It's crucial to use it cautiously and employ effective risk management strategies to protect your investments.

Q4: How quickly can I access my funds for trading on Aglo Trade?

A4: Aglo Trade offers instant funding options, allowing you to quickly access your deposited funds. Withdrawals are typically processed within 1 hour, providing timely access to your assets.

Q5: Does Aglo Trade provide comprehensive educational resources?

A5: Unfortunately, Aglo Trade's educational resources are limited, with only a basic FAQ section available. This may leave traders seeking more in-depth knowledge disappointed, potentially hindering their ability to make informed trading decisions.