Company Summary

| Aspect | Information |

| Company Name | Maunto |

| Registered Country/Region | Saint Lucia |

| Founded | 2023 |

| Regulation | No license |

| Tradable Assets | Indices, Forex, Cryptocurrency, Stocks, Commodities, Metals |

| Account Types | CLASSIC, SILVER, GOLD, PLATINUM, VIP |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 for FX |

| 1:200 for Silver & Gold, Indices, and Commodities | |

| 1:5 for Stocks/Equities | |

| EUR/USD Spread | 0.9 - 2.5 pips |

| Trading Platform | Maunto WebTrader |

| Deposit & Withdrawal | Credit/Debit Cards, Wire Transfer, APMs. Minimum withdrawal amounts vary by method |

| Customer Support | Monday - Friday: 12:00 till 21:00 GMT |

| Live chat, contact form | |

| Phone: +44 203 150 2 347 | |

| Email: support@maunto.com | |

| Regional Restrictions | Euorpean Union |

Overview of Maunto

Maunto, registered in Saint Lucia in 2023, offers a wide array of tradable assets including indices, forex, cryptocurrencies, stocks, commodities, and metals. The broker introduces a range of account types - CLASSIC, SILVER, GOLD, PLATINUM, VIP - with a minimum deposit requirement of $250. It offers maximum leverage up to 1:400 for FX and varying levels for other assets. The Maunto WebTrader platform is their primary trading interface.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

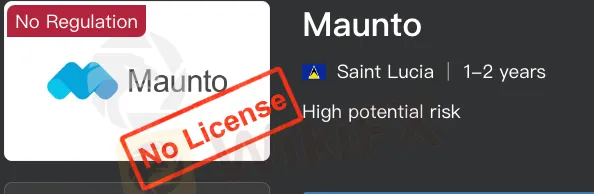

Is Maunto Legit?

No, it is unregulated by any famous regulatory authorities, like ASIC, or FSA.

Market Instruments

Maunto delivers an extensive array of trading instruments via CFDs, encompassing indices, forex, cryptocurrencies, stocks, commodities, and metals. Indices offer insights into broader market trends, Forex trading presents a rich selection of currency pairs highlighting the market's depth, and cryptocurrencies introduce a dynamic investment avenue. Additionally, stock trading capitalizes on company-specific movements, commodities provide a hedge against geopolitical shifts, and metals trading offers a traditional safeguard against economic fluctuations.

Account Types

This broker provides 5 distinct trading accounts: CLASSIC, SILVER, GOLD, PLATINUM, and VIP. The initial deposit requirement for all accounts is $250. The Classic account does not offer a swap discount, which is a disadvantage when compared to other account types where this benefit is available.

Leverage

This broker offers the maximum trading leverage is up to 1:400 for forex trading, with adjusted levels for other assets such as up to 1:200 for Silver & Gold, Indices, Commodities, and up to 1:5 for Stocks/Equities.

| Asset Class | Leverage |

| FX | 1:400 |

| Silver & Gold/Indices/Commodities | 1:200 |

| Stocks/Equities | 1:5 |

Spreads & Commissions

The Classic and Silver accounts offer EUR/USD and GBP/USD spreads starting from 2.5 and 2.8 pips, respectively, aligning with the standard for retail forex trading. For more experienced traders, the Gold, Platinum, and VIP accounts provide progressively tighter spreads, with the VIP account offering the most competitive rates, such as a 0.9 pip spread on EUR/USD. Interestingly, Maunto extends its competitive edge with flexible spreads as low as 0.03 pips for Platinum and VIP accounts, and crude oil trading offers dollar-based spreads.

Maunto also charges zero deposit commissions across all account types.

| Spread | CLASSIC | SILVER | GOLD | PLATINUM | VIP |

| EUR/USD | 2.5 | 2.5 | 1.8 | 1.4 | 0.9 |

| GBP/USD | 2.8 | 2.8 | 2.3 | 2 | 1.4 |

| USD/JPY | 2.8 | 2.8 | 2.3 | 2 | 1.4 |

| Crude Oil | $0.14 | $0.14 | $0.13 | $0.12 | $0.10 |

Other Fees

Maunto applies various non-trading fees, including withdrawal fees, inactivity fees, maintenance fees, and swap fees.

The first withdrawal is free if the account is fully verified and has conducted at least one trade; otherwise, a $10 fee is applied. Subsequent withdrawals incur charges, such as 3.5% for card transactions and $30 for wire transfers.

Inactivity fees scale with the period of inactivity, starting from 100 EUR after one month, increasing to 500 EUR beyond six months.

A monthly maintenance fee of $10 is charged regardless of account activity.

Swap fees are incurred for positions held overnight, calculated daily and tripled on Wednesdays to cover the weekend. These fees vary by asset class, including Forex, Cryptocurrencies, Commodities, Indices, and Stocks.

Trading Platform

Maunto's WebTrader platform delivers an accessible and intuitive trading environment, enabling users to connect from any device. It features a straightforward interface for customizing alerts and analyzing trading performance, supporting strategic decision-making. Additionally, Maunto places a strong emphasis on security, incorporating high-level technological measures and encryption to ensure the safety of users' trading operations.

Deposit & Withdrawal

Maunto offers several methods for depositing and withdrawing funds, including Credit/Debit Cards, Wire Transfer, and APMs. Withdrawal minimums are set at 10 USD/1500 JPY for Credit Cards and 100 USD/15000 JPY for Wire Transfers, with e-wallets offering more flexibility on amounts, subject to fees. Withdrawals are processed within 8 to 10 business days, but timelines differ according to local bank procedures.

Education

Maunto says to offer comprehensive educational resources, from beginner basics to advanced strategies, including market insights, interactive courses, and real-world knowledge. However, the education center is locked, and if you want to access education materials, you have to sign up or log in.

Customer Support

24/5 Live Chat

Phone: +44 203 150 2 347

Email: support@maunto.com

Social media: Facebook, Instagram, Twitter, LinkedIn, YouTube

Conclusion

Operating since 2023 with offshore regulation, Maunto offers wide range of assets, competitive spreads, and no deposit fees are attractive. However, the platform's user-friendly features are marred by the costs through inactivity and maintenance fees, along with a slow withdrawal process.

Q&A

What types of assets can be traded on Maunto?

Maunto offers trading in indices, forex, cryptocurrencies, stocks, commodities, and metals.

What account types does Maunto provide?

CLASSIC, SILVER, GOLD, PLATINUM, VIP, each with a minimum deposit requirement of $250.

What is the maximum leverage available on Maunto?

The maximum leverage is up to 1:400 for forex and varies for other asset types.

Are there fees for deposits and withdrawals at Maunto?

There are no deposit commissions, and the first withdrawal is fee-free. Subsequent withdrawals will incur fees, and there are also inactivity and maintenance fees.

Are there any regional restrictions?

Yes. Maunto does not provide its services to residents of the Euorpean Union or any other jurisdiction where such distribution would be contrary to local news and regulations.

FX1395681821

South Korea

The broker recommended an investment and I followed their instructions to execute the transaction. However, all of my investment funds disappeared in an instant and they have not taken any measures to compensate for the loss. It was a scam from the beginning, so let's not be deceived by the broker's words. The broker is still demanding investments while explaining the market situation.

Exposure

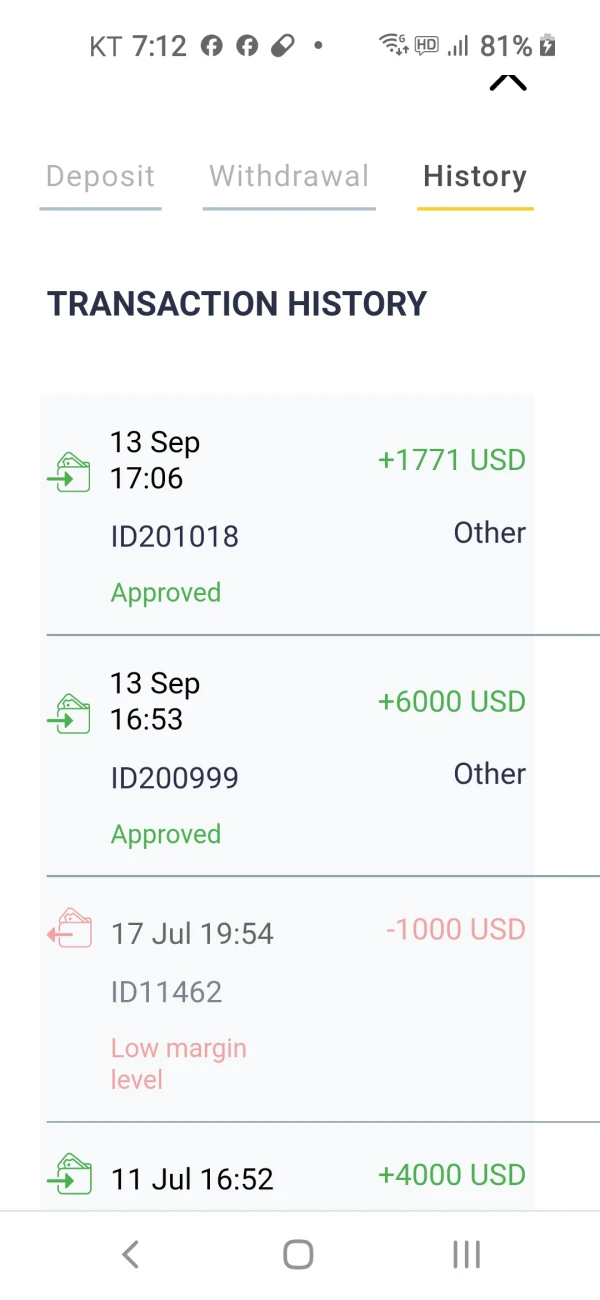

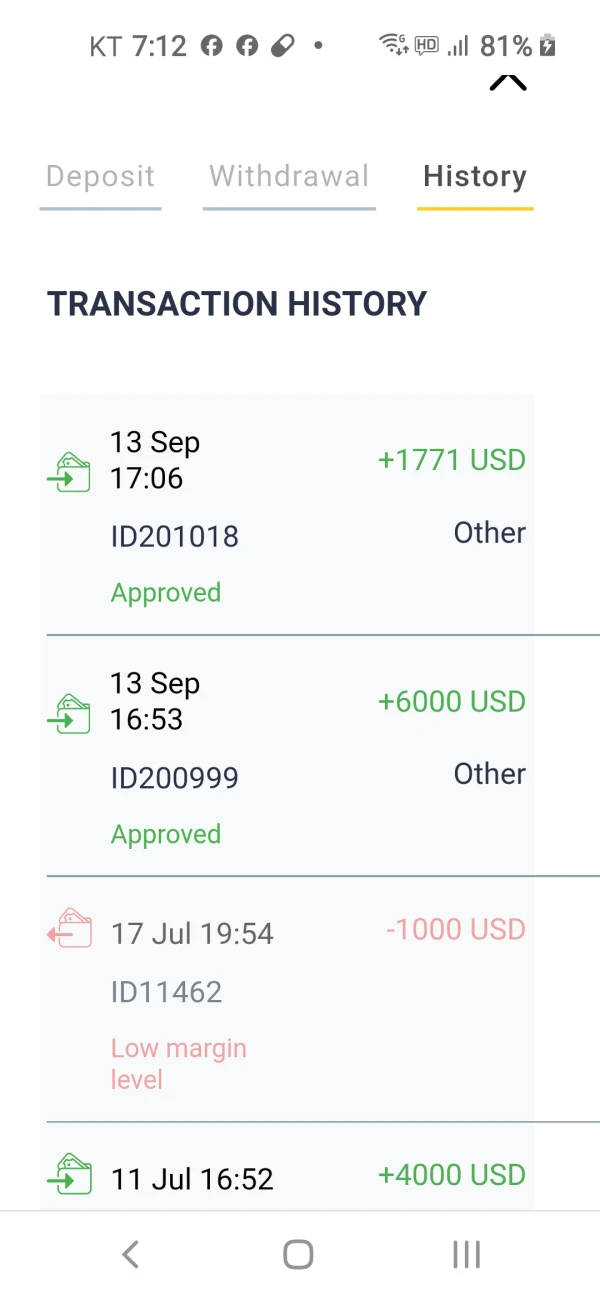

カナンの母

Japan

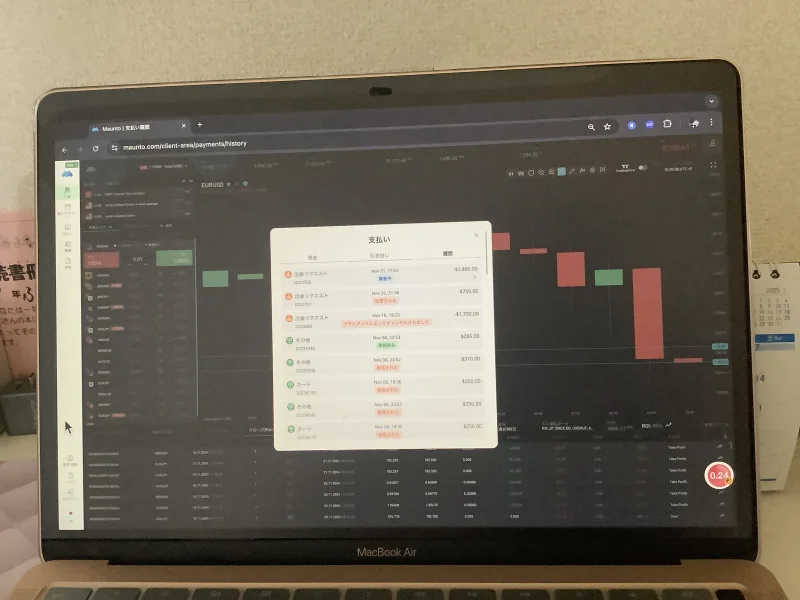

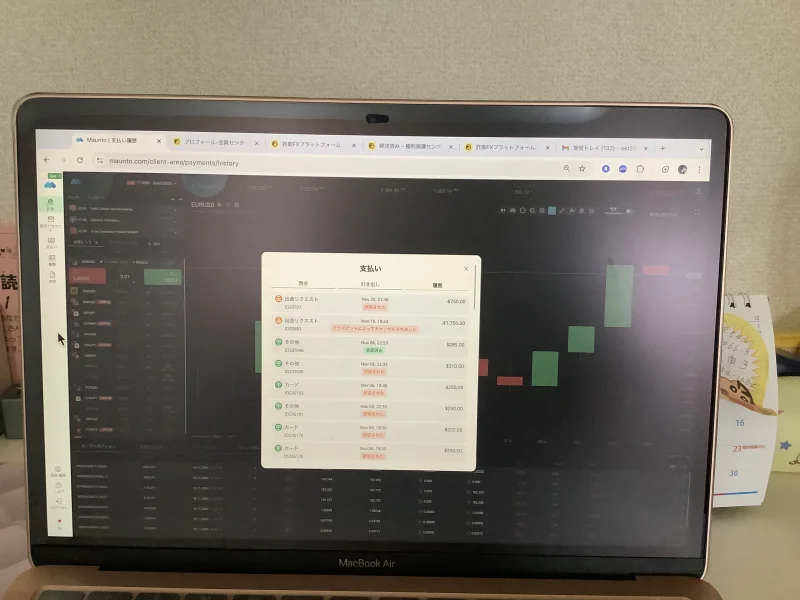

Many times, but still 4300 dollars have not been withdrawn. Maybe it's because of that. It is intentionally set to negative. There is definitely 4300 dollars. The remaining balance of 9000 to 10100 dollars is displayed as negative to make it impossible to withdraw. The strange payment fee remains unchanged.

Exposure

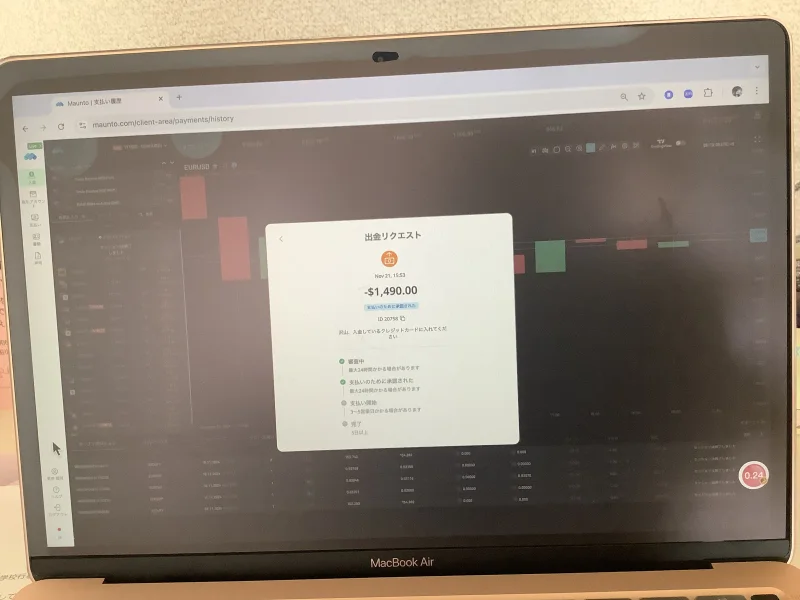

カナンの母

Japan

It's strange, I've been waiting for a withdrawal request since November 23rd last month. Not only was it arbitrarily reduced, but my $4300 withdrawal request was also rejected. Strange fees have also been charged. It's a complete scam. Since they stopped answering the phone, there should be $4300 + $9000 in the negative. When you look at the representation of Bitcoin, it's clear that it's a complete scam. I requested a withdrawal because I want to cancel, but they're doing this. I hope I can recover everything. $4300 + $9000. For now, there is information about the amount even in the photos. It can be submitted. I have taken enough photos to explain the scam and the strange negative aspects on their side. I want to get my money back quickly.

Exposure

FX1395681821

South Korea

The account manager requested investors to deposit more funds, claiming that they could recover losses. Trusting the account manager's words, the investor made additional deposits. However, after the investor made the additional deposits and followed the account manager's advice to execute trades, the initially profitable trades suddenly started to incur continuous losses, contrary to the expected profits. As a result, the investor suffered significant losses. The entire account balance disappeared in an instant, and the current account balance is $0. The account manager requested investors to deposit more funds, claiming that they could recover losses. Trusting the account manager's words, the investor made additional deposits. However, after the investor made the additional deposits and followed the account manager's advice to execute trades, the initially profitable trades suddenly started to incur continuous losses, contrary to the expected profits. As a result, the investor suffered significant losses. The entire account balance disappeared in an instant, and the current account balance is $0.

Exposure

カナンの母

Japan

Since November 26th of last month, I have been requesting a withdrawal to withdraw the amount that I have been depositing with credit card and cash. There is absolutely no sign of movement. What's more, my balance is currently showing a negative value. It would be helpful if I could deposit into my account and still have some evidence left. I am unable to withdraw.

Exposure

FX3148611005

Japan

This is a highly fraudulent site. Even if you are asked to make a deposit or offered very good conditions, please do not deposit. The person in charge will pretend to be making a profit, propose favorable conditions, and use mind control to make you feel like you will lose if you don't deposit. I regretted trusting the other party and making a deposit, and now I am burdened with a large amount of debt. It is the biggest regret of my life, and no matter what I do, I want the money to be returned. However, since the other party is a professional scammer, I have reported it to the police, but it seems that there will be no refund unless the culprit is caught. Even if there is a profit in this, you can only withdraw a very small amount of money. The other party only uses this to gain trust. I am fortunate if even one person is saved by reading my review. If you are being forced to make a deposit, and they mention 5000 credits, VIP, or elite, please firmly refuse and focus on withdrawing your money. I pray that you can recover even a little. If you ignore their calls, they will change your password without permission, and everything they do is fraudulent.

Exposure

FX1395681821

South Korea

The account manager asked the investor about the part on the trading site where the "profit is always displayed as a negative (-) amount" during the trading process, as it was not understood. The account manager replied that there is no need to worry because there are foreign exchange and stocks that have been purchased, and that they will gradually see profits without incurring losses through investment. However, suddenly everything disappeared. The current balance is $0, but the total amount deposited for investment so far, as advised by the broker, is $23,021 ($33,663,703 KRW). It was later discovered that the broker and intermediaries were involved in a scam, and I would like to know the solution.

Exposure

カナンの母

Japan

How much did I deposit? How much is it now? I started in July of this year. The entrance is from SmartNews. I started when I was interested in overseas investment. The first professional I met was Benjamin. The first deposit was made with a credit card, 250 dollars and 501 dollars. At first, I was making decent profits. But at some point, the withdrawals started to be decided by the other party. Also, I made cash transfers using BitFlyer, depositing 5000 dollars and 2001 dollars along the way. I have photos of all transactions, so I can prove it. I also left my phone number just in case. I also know the email address. Also, on November 9th, I deposited 281 dollars by credit card, 250 dollars times 7, which is 1750 dollars, and cash transfer. Now, the current balance should be 12,260 dollars and 60 cents. But for some reason, it's negative. I want to quickly recover the money I put in here. The current professional I'm dealing with is a person named Avi. I also have the ZOOM codes for both of them, so I can provide them. I'm afraid that if things continue like this, my balance will definitely be reduced to zero.

Exposure

FX1395681821

South Korea

The broker manager recommended trading AUDUSD (trade date 4th), US500 (trade date 18th), US30 (trade date 21st), NZDUSD (trade date 22nd), XAGUSD (trade date 23rd), AUDUSD (trade date 23rd), BRENT (trade date 29th), US500 (trade date 30th), XAUUSD (trade date 30th), USTEC (trade date 30th) and I followed the recommendation. However, I believed the manager's words that the market would rise after the US presidential election day (November 5th), so I did not close the positions and continued to wait. On October 30th, my balance was $13,035 with a credit of $10,000, but on October 31st, I was stopped out all at once. Currently, my balance is $0. During this time, I have deposited a total of $23,021 (₩33,663,703) based on the recommendations of the Mounto (broker) manager. I hope you can help me recover from the losses at least a little bit.

Exposure

FX1395681821

South Korea

The positions that were executed based on the broker's recommendation continued to incur losses, and the margin level kept decreasing. Despite this situation, the broker claimed that the market would rise starting from November 5th, the day the US presidential election ended, and advised me to hold on without liquidating. However, during this period, the executed positions only increased slightly when the market went up, but when the stop out point was reached, they plummeted rapidly. I cannot understand the reason for this sudden drop, and I find it hard to believe. The broker, despite the positions being contrary to the market trend, did not liquidate them and left them as they were, resulting in significant losses that wiped out my account balance. However, the broker insists that all the losses were due to the investor's mistakes.

Exposure

FX1395681821

South Korea

The total amount of investment deposits made so far, as recommended by the Mounto (broker) administrator, is $23,021 (₩33,663,703). However, the broker administrator failed to keep the promise of depositing $3,000 in order to prevent stop out, resulting in the investor's entire investment amount disappearing on October 31st due to stop out.

Exposure

FX1395681821

South Korea

The trading settlement items recommended by the broker manager are AUDUSD (trading day 4, profit -3102), US500 (trading day 18, profit -853), US30 (trading day 21, profit -1768), NZDUSD (trading day 22, profit -719), XAGUSD (trading day 23, profit -2479), AUDUSD (trading day 23, profit -767), BRENT (trading day 29, profit -972), US500 (trading day 30, profit -415), XAUUSD (trading day 30, profit -2233), USTEC (trading day 30, profit -3261) were traded as recommended by the broker manager. The trading settlement items for investors are USTEC (trading day 30, profit -1653), USTEC (trading day 30, profit -1640), USTEC (trading day 30, profit -1612), USTEC (trading day 30, profit -1552), which were directly traded by the investors. The balance on October 30th was $13,035, with a credit of $10,000. However, on October 31st, it was suddenly stop out and the current balance is $0. During this time, the total amount of investment deposits made by the Mounto (broker) manager recommendation is $23,021 (33,663,703 won), but it all disappeared.

Exposure

FX1395681821

South Korea

The broker is calling to deposit investment funds again after cheating and trying to cheat again~~~

Exposure

FX1395681821

South Korea

At first, the margin level was increased to make it seem profitable and induce investors to deposit more funds. At the same time, the broker executed trades on recommended stocks. However, shortly after, strangely, the margin level suddenly decreased, resulting in significant losses contrary to the expected profits from the recommended trades. This caused the entire account balance to be lost in an instant. It was falsely claimed that depositing more funds in the Silver account would prevent stop out when using AI3 level in the Gold account, but that was not the case. It was a lie to encourage more deposits. The broker, who is supposed to minimize investor losses and maximize profits, did not fulfill their duty. They requested additional deposits by mentioning the decrease in margin level but did not provide any explanation about the potential risks of losses to the investors. The trading account balance on September 19th was $36,296, but as of September 26th, the current account balance is $0, and the Total Profit is -$52,319.

Exposure

FX1395681821

South Korea

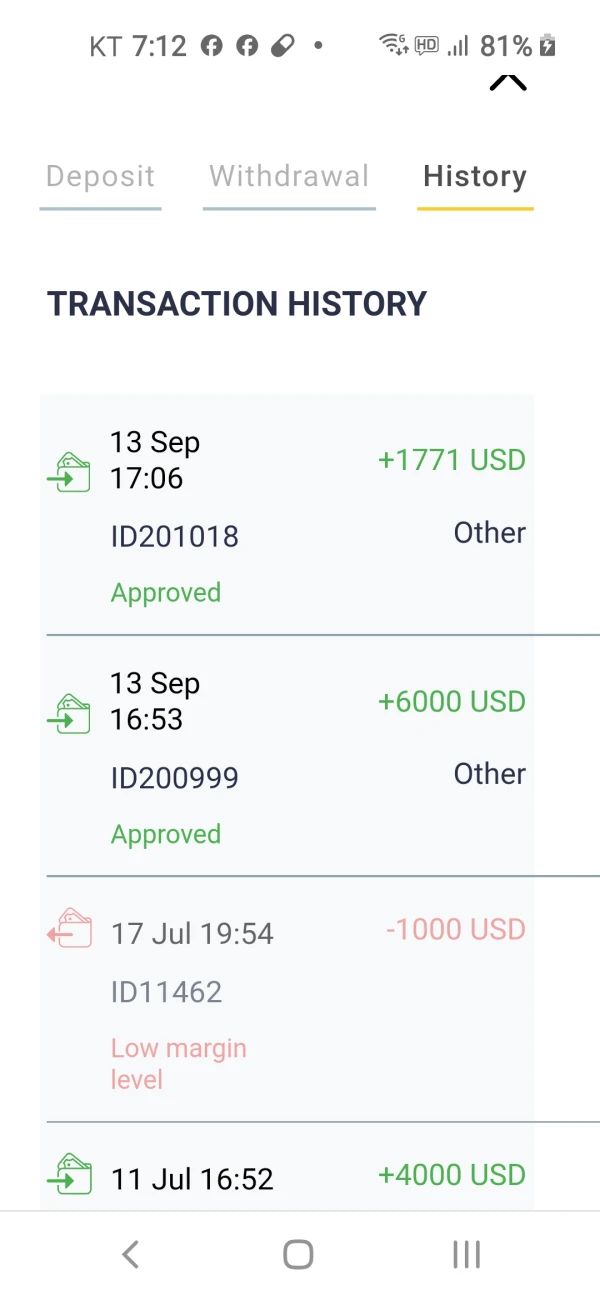

On September 13th, after depositing an additional $7,771 as investment capital, the profit gradually increased. However, on September 19th, the trading account balance dropped from $36,296 to the broker-recommended positions that were traded as "sell" on September 19th and 20th. After the trade execution, the margin level started to rapidly decrease. The broker-recommended positions resulted in significant losses, contrary to the expected profits. To prevent further losses, on September 23rd, the margin level continued to decline to 138%. The investor urgently requested whether all trading positions should be liquidated. In response, the broker stated, "It would be good to allocate a bit more funds that can withstand the situation. Increase the margin level because the market won't stay like this for long. It will return to the planned state, so it's just a matter of time. If you deposit more investment capital to increase the margin level, it seems that you can sustain it for a longer period." However, the broker only mentioned that if additional funds were not deposited, it would be inevitable to incur losses due to insufficient funds. The investor requested assistance from the broker again to prevent losses, but there was no response. When the investor requested liquidation from the broker on September 23rd, if at least the positions were liquidated, it could have reduced significant losses. However, following the broker's advice to not liquidate the positions and to observe further, the investor suffered substantial losses and lost all investment capital. The broker, who is supposed to minimize the investor's losses while maximizing profits, did not fulfill their responsibility. In a blink of an eye, on September 26th, all investment capital disappeared. The trading account balance, which was $36,296 on September 19th, is now $0, and the Total Profit is -$52,319. These brokers are highly optimized scammers.

Exposure

FX1395681821

South Korea

Investors lost all the investment funds they deposited on the Mounto Investment Platform, totaling $23,021 (equivalent to 33,663,703 KRW), in an instant on September 26th. The broker requested that investors deposit more funds, stating that if they invest more than their current trading account balance in the Silver account, they can upgrade to the Gold account and recover their losses. They also mentioned that using AI Level 3 can prevent stop-outs. In response to this request, on September 13th, the investor deposited an additional $7,771 as investment funds. The profits were gradually increasing until September 19th when the trading account balance was $36,296. However, after executing the broker-recommended positions as "sell" on September 19th and 20th, the margin level started to rapidly decline. As a result, the trades recommended by the broker resulted in significant losses instead of the expected profits, causing the investor to lose all their investment funds in an instant on September 26th. The current account balance as of September 26th is $0, down from $36,296 on September 19th, and the Total Profit is -$52,319.

Exposure

FX3438353907

Turkey

I got scammed so many times I was nervous working with Maunto too but account manager was so good so I just trust on him activated the account. Now I am happy that I made a right choice this time because I am getting profit frequently

Positive

FX2163275548

Turkey

! week ago i was just going through a link then I just clicked so someone called me. I was not really planning to invest but when they suggested me to at least try once then I did activate my account with them without knowing if its real or fake but yes I started getting the profit from the very next day and even i withdraw that profit without any hassle, What I think that there are still some real platform like maunto

Positive

FX2641354923

South Korea

After joining Mounto with a minimum amount of $250, I checked and found that there were many scam comments, so I decided to cancel my membership one hour after joining by sending an email. However, I only received feedback that it is still under review, and until now, after three days, they have not refunded the deposit amount... On their website, it clearly states that withdrawals will be processed within 24 hours, but they have not sent any processing results... This is a scam account, so please never join!!!! I wasted $250 here!!! However!! I am determined to continue asking for my money back... It's frustrating... Please, please do not join... Even if you make a profit and try to withdraw, it's obvious that it will be a headache...

Exposure

FX2121063711

Turkey

Its been 6 months now working with maunto company. So far everything is good. My senior account manager is very good whenever I call him he response me promptly. good company

Positive

FX3981886987

Turkey

I opened my account with this company last week invested minimum and as they told that I can withdraw whenever I want so just to give it a try after depositing I tried to withdraw and yes it was so quick and easy. I will recommend Maunto to everyone

Positive

Manjo Grg

Turkey

Started with 22400 INR/ I was skeptic in the beginning before investing due to some different names of the currency conversion people that they asked me to add the funds but i did and I could see my balance instantly. i am getting minimum 1200 INR daily but I am jobless so i am withdrawing it daily not collecting it

Positive

Avinash Mathore

Turkey

MY friend suggested me to open the account with Maunto so invested with them without doing any research but yes its a good platform as I am getting good return of my investment. Its been 6 months now working with Maunto so no bad experience. Good investment company

Positive