Company Summary

| RICO Review Summary | |

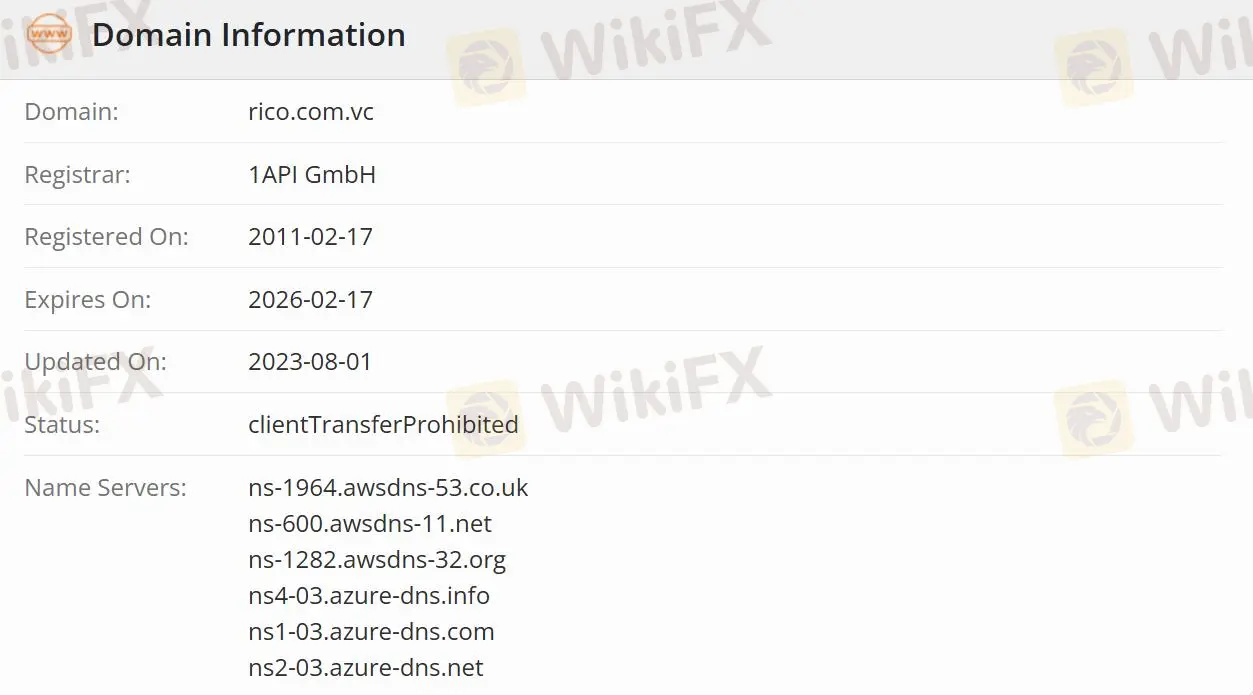

| Founded | 2011-02-17 |

| Registered Country/Region | Brazil |

| Regulation | Unregulated |

| Products | All Investments/Direct Treasury/Tixed Income/Other Investments/The Stock Market and BM&F |

| Demo Account | ✅ |

| Trading Platform | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Customer Support | Phone: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Information

Founded in 2011, RICO is an unregulated investment company registered in Brazil. The company provides various products including all investments and simulators and 5 major platforms with different charges, such as Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro, and Profit. RICO offers investment accounts for investing and digital accounts to handle daily transactions.

Is RICO Legit?

RICO is not regulated, making it less safe than regulated companies.

What products does RICO provide?

The company provides various products including all investments, direct treasury, fixed income, CBD, LC, LCA, LCI, and debentures. RICO also offers other investments, such as investment funds, real estate funds, COE, CRI, CRA, and public offering-lPO. In addition, the stock market and BM&F involved Stock rental, Options, Futures contracts, Mini contracts, Stock futures, and Liquidity Provider-RLP.

Account Type

Rico offers two accounts with different balances. Through the investment account, users can invest in fixed-income and variable-income applications, and use the digital account to handle daily transactions such as paying bills, sending and receiving PIX and TED, and receiving wages.

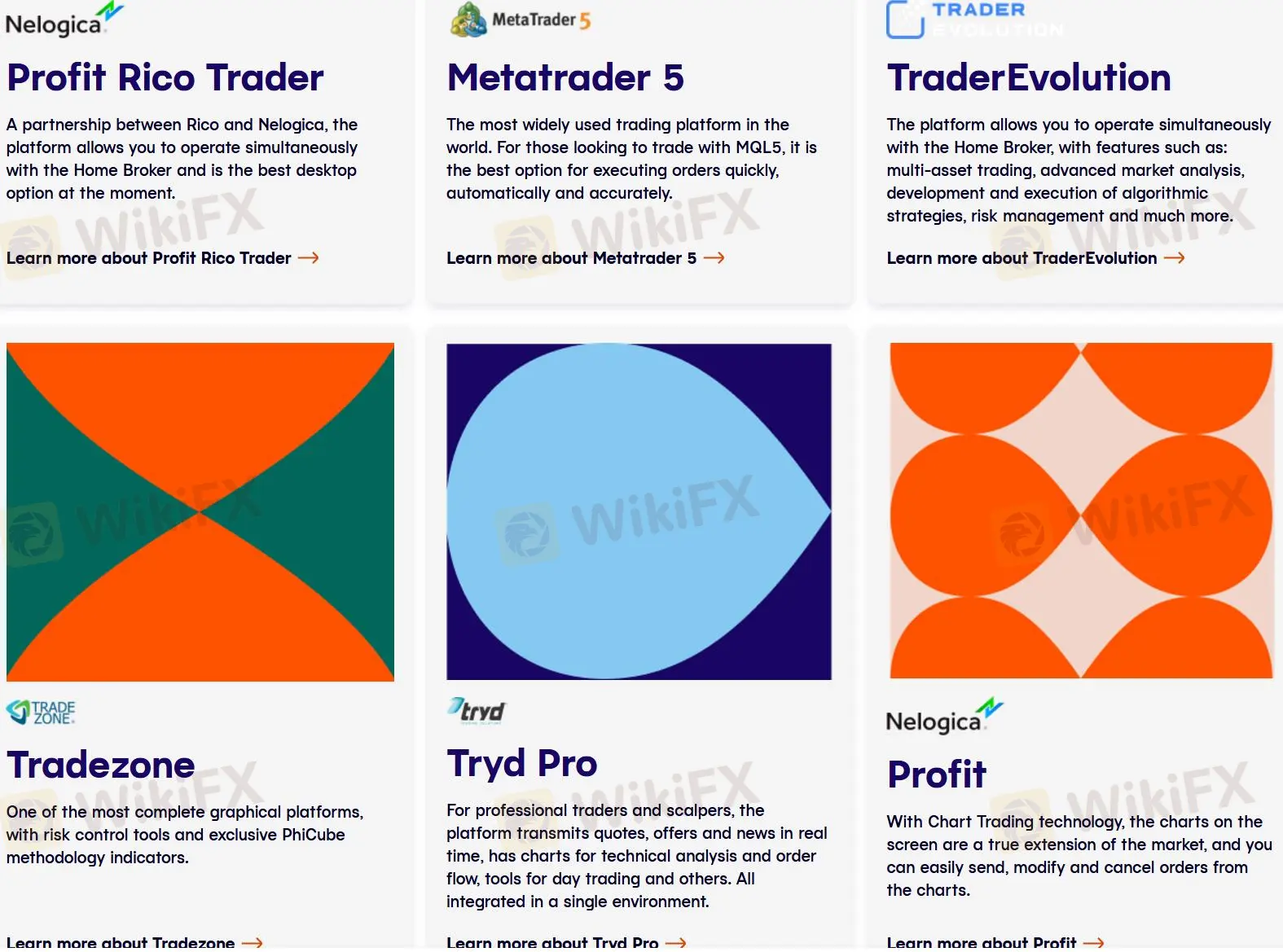

Trading Platform

In RICO, users are free to choose any platform including Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro, and Profit. Apart from Metatrader5 (real and demo account), Tradezone Web (Webchart), and TraderEvolution Web platforms are free. The fees charged by each platform are also different:

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus and

R$ 139.90 – ProfitPro.

However, for paid platforms, there is also an ISS cost of 10.68% of the amount charged.

| Trading Platform | Supported | Available Devices |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Customer Support Options

Traders can follow RICO on YouTube, Instagram,Facebook, and Twitter and keep in touch with the company by calling WhatsApp and phone.

| Contact Options | Details |

| Phone | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Social Media | YouTube, Instagram, Facebook, Twitter |

| Supported Language | Portuguese |

| Website Language | Portuguese |

| Physical Address | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |