Company Summary

Note: ZERO MARKETS' official website: https://www.zeromarkets.com/ is currently inaccessible normally.

| ZERO MARKETS Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Regulated by FMA |

| Market Instruments | Forex, share CFDs, indices, commodities, metals, cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | Average 1.3 pips (Standard account) |

| Trading Platform | MT4, MT5 |

| Social Trading | ✅ |

| Min Deposit | $100 AUD |

| Customer Support | Live chat |

| Tel: +61 (0)2 7908 3133 / +44 800 917 4388 | |

| Email: support@zeromarkets.com | |

| Twitter, Facebook, Instagram, Linkedin | |

| Address: First St Vincent Bank Ltd Building, James Street, Kingstown, Saint Vincents and the Grenadines | |

| Regional Restrictions | The United States, Japan or New Zealand |

Zero Markets is a broker offering access to global markets. It is a group of companies which include Zero Financial Pty Ltd and Zero Markets LLC. Zero Financial Pty Ltd (ZERO Markets, ABN 72 623 051 641) is an Authorized Representative (No. 001273819) of First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFSL 286354). Zero Markets LLC is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020.

Pros and Cons

| Pros | Cons |

| Regulated by FMA | Unavailable website |

| Diverse range of tradable assets | ASIC (Exceeded) |

| Demo accounts | Commissions charged |

| Multiple account types | Withdrawal fee charged |

| MT4 and MT5 available | Regional restrictions |

| Acceptable minimum requirement | |

| Multiple payment options | |

| No deposit fees | |

| Social media presence |

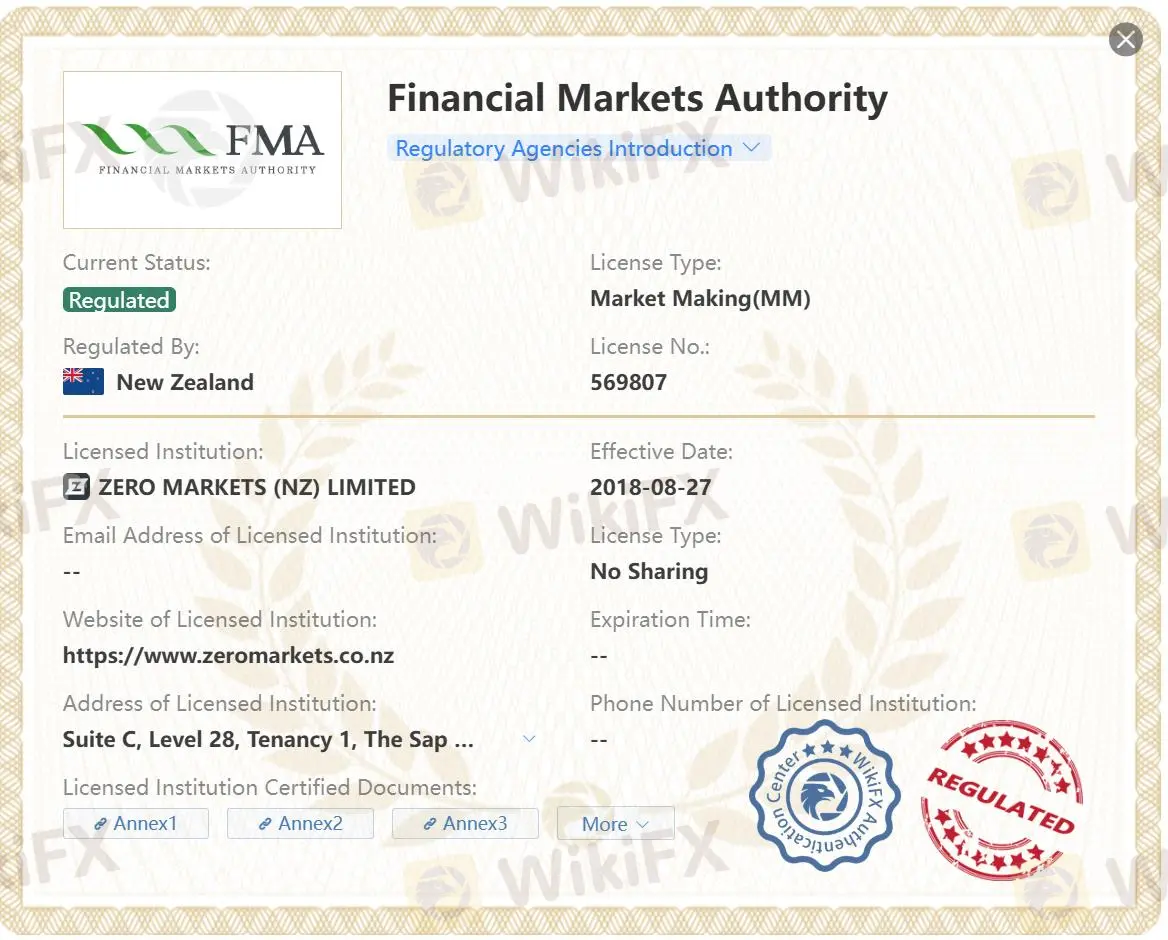

Is ZERO MARKETS Legit?

Yes, ZERO MARKETS is regulated by the Financial markets Authority (FMA), holding Market Making (MM) license with No. 569807.

| Regulatory Status | Regulated |

| Regulated by | Financial Markets Authority (FMA) |

| Licensed Institution | ZERO MARKETS (NZ) LIMITED |

| Licensed Type | Market Making (MM) |

| Licensed Number | 569807 |

What Can I Trade on ZERO MARKETS?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Share CFDs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

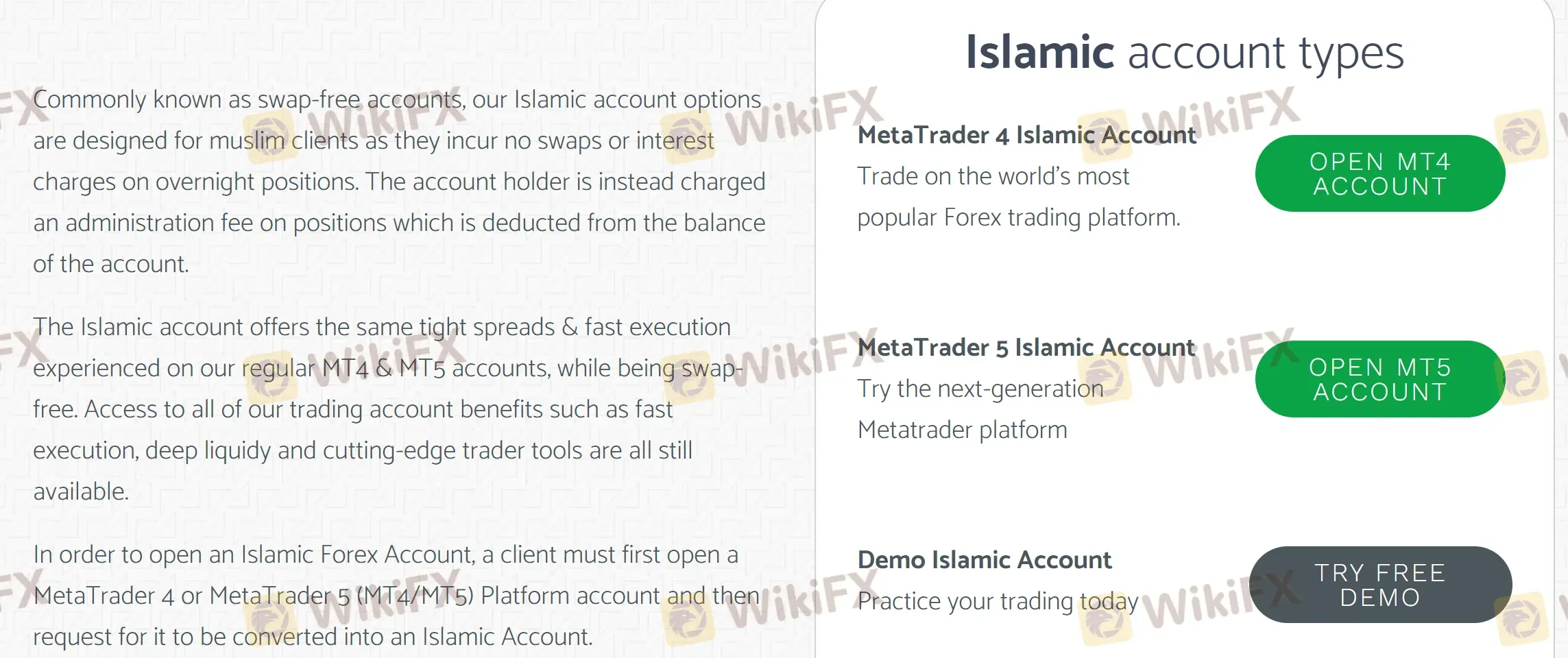

Account Type

ZERO MARKETS offers Islamic raw account, Islamic standard account, Standard account and Super Zero account with the minimum deposit of $100 AUD.

Leverage

ZERO MARKETS offers the maximum leverage of 1:500 for Islamic raw account and Islamic standard account. This high leverage setup allows traders to trade larger positions with smaller capital, leading to high returns. However, high leverage also entails high risk.

ZERO MARKETS Fees

ZERO MARKETS offers a range of spread and commission options to accommodate different trading preferences. The Standard account provides a commission-free trading environment, where traders can execute trades without incurring additional fees. The spreads for this account start from 1.0 pips.

For traders seeking even tighter spreads, ZERO MARKETS offers the Super Zero account, which features spreads as low as 0 pips. However, it's important to note that the Super Zero account carries a commission charge starting from $2.50 per side. This commission fee is applied to cover the cost of trade execution.

| Account Type | Spread | Commission |

| Standard | From 1.0 pips | ❌ |

| Islamic Standard | From 1.0 pips | ❌ |

| Super Zero | From 0.0 pips | $2.5 per side |

| Islamic Raw | From 0.0 pips | $2.5 per 100,000 Volume |

Trading Platform

ZERO MARKETS provides traders with a versatile and comprehensive trading platform. Traders have the option to choose between two popular platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are available for Windows, iOS, macOS, Android, and also have a web-based version.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, iOS, macOS, Android, Web | Beginners |

| MT5 | ✔ | Windows, iOS, macOS, Android, Web | Experienced traders |

Deposit and Withdrawal

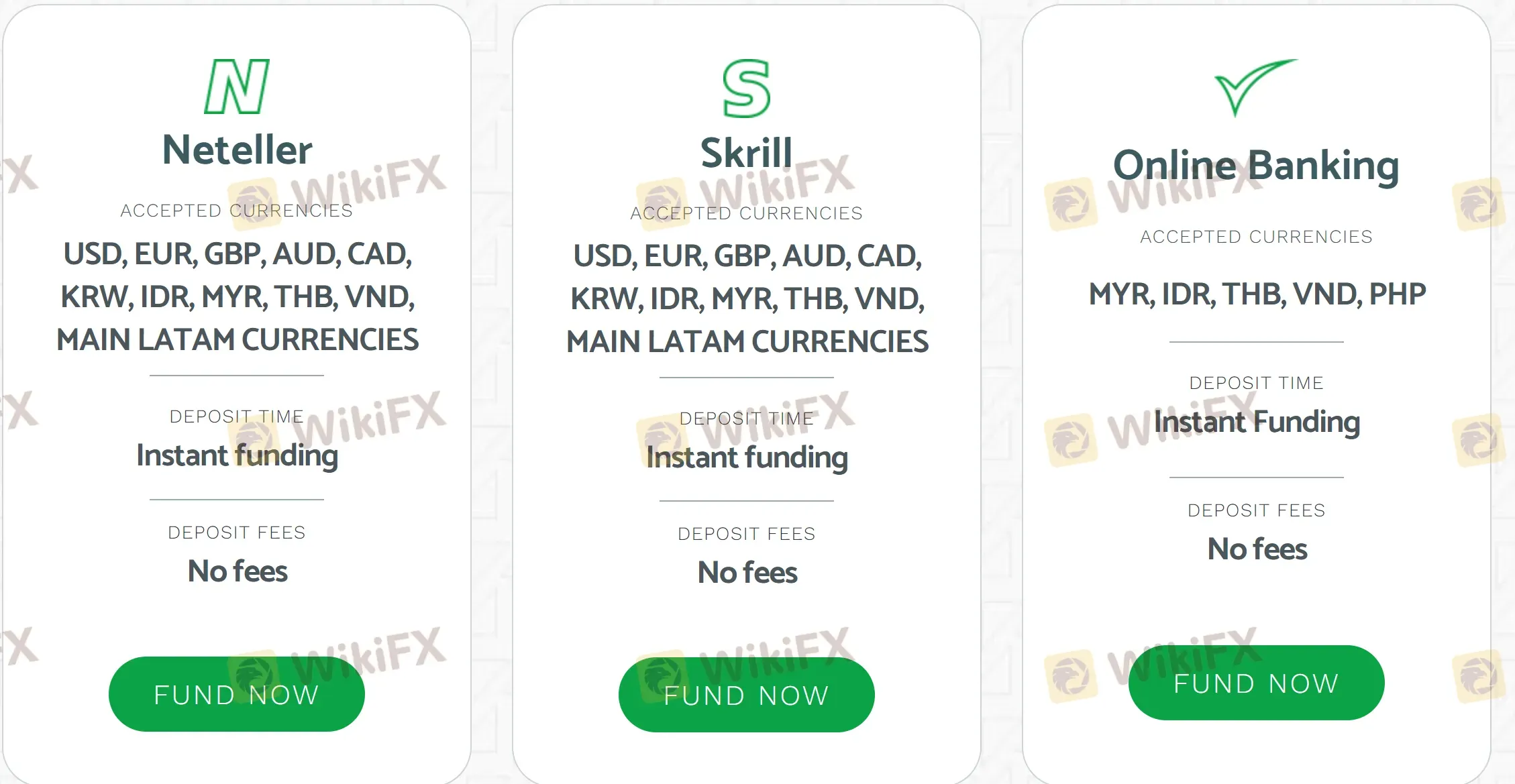

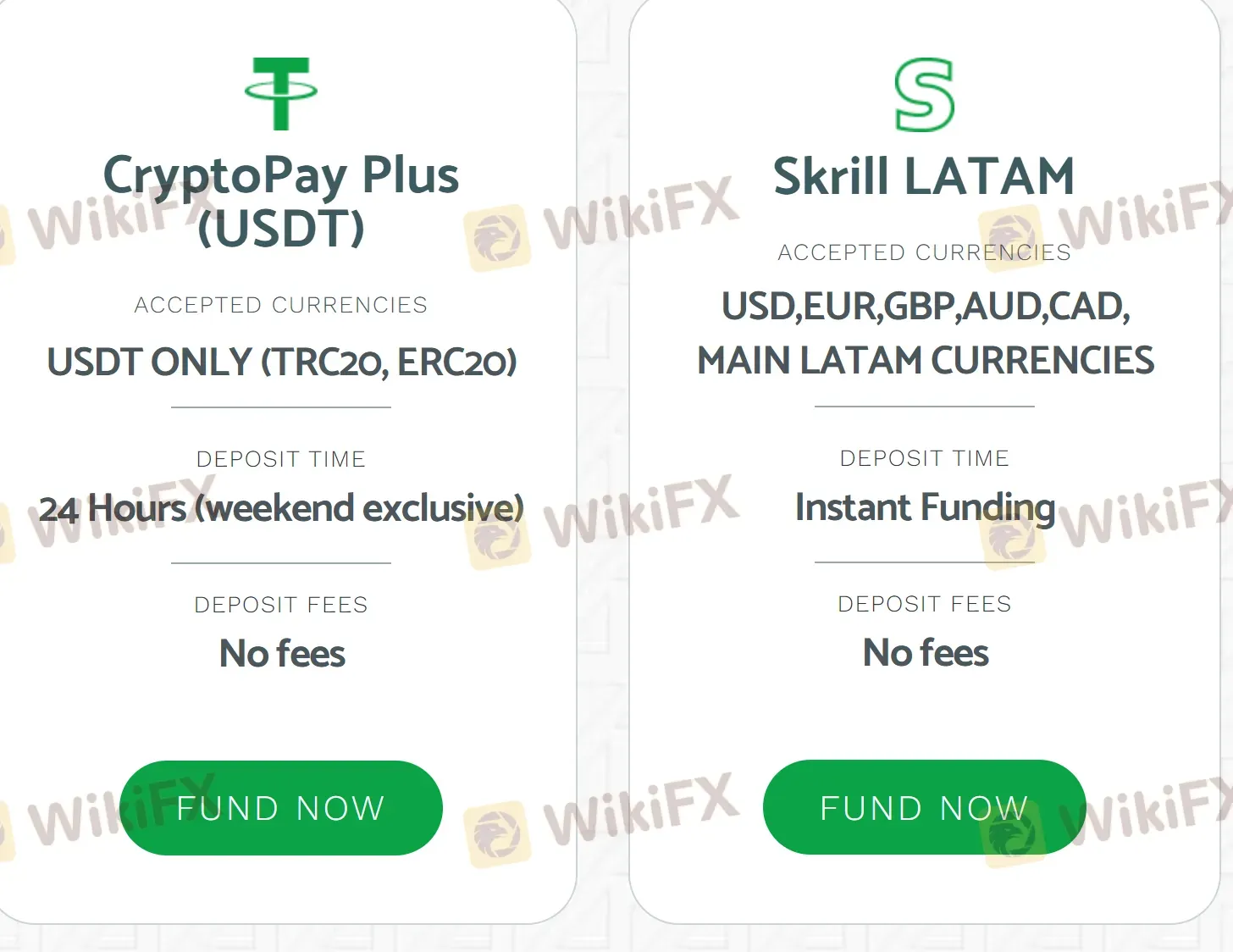

Deposit Options

| Deposit Option | Accepted Currencies | Deposit Fee | Deposit Time |

| Neteller | USD, EUR, GBP, AUD, CAD, KRW, IDR, MYR, THB, VND, Main LATAM currencies | ❌ | Instant |

| Skrill | ❌ | Instant | |

| Online Banking | MYR, IDR, thb, vnd, php | ❌ | Instant |

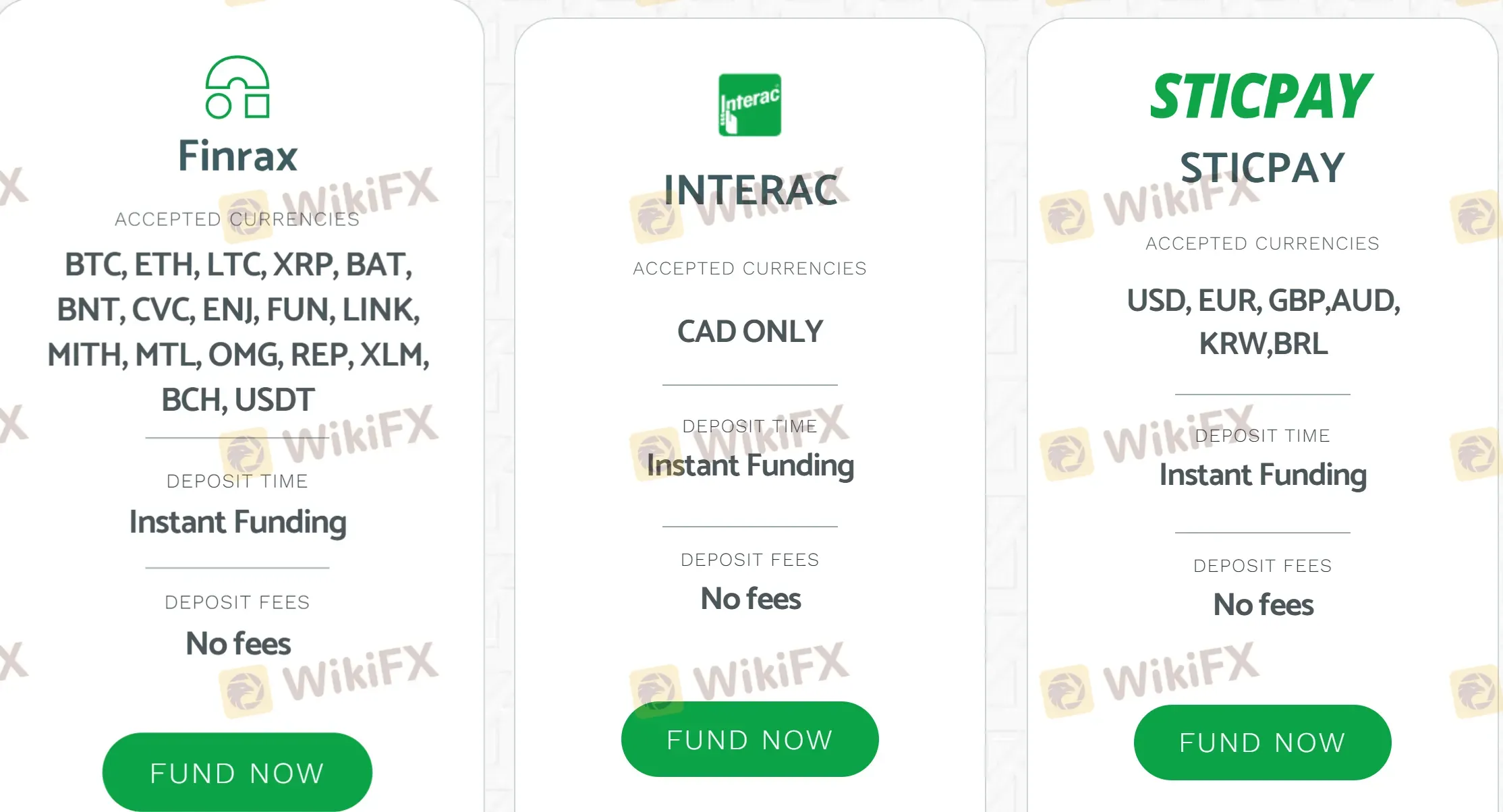

| Finrax | BTC, ETH, LTC, XRP, BAT, BNT, CVC, ENJ, FUN, LINK, MITH, MTL, OMG, REP, XXLM, BCH, USDT | ❌ | Instant |

| Interac | CAD | ❌ | Instant |

| Sticpay | USD, EUR, GBP, AUD, KRW, BRL | ❌ | Instant |

| CryptoPay Plus (USDT) | USDT (TRC 20, ERC 20) | ❌ | 24 hours (weekend exclusive) |

| Skrill LATAM | USD, EUR, GBP, AUD, CAD, Main LATAM currencies | ❌ | Instant |

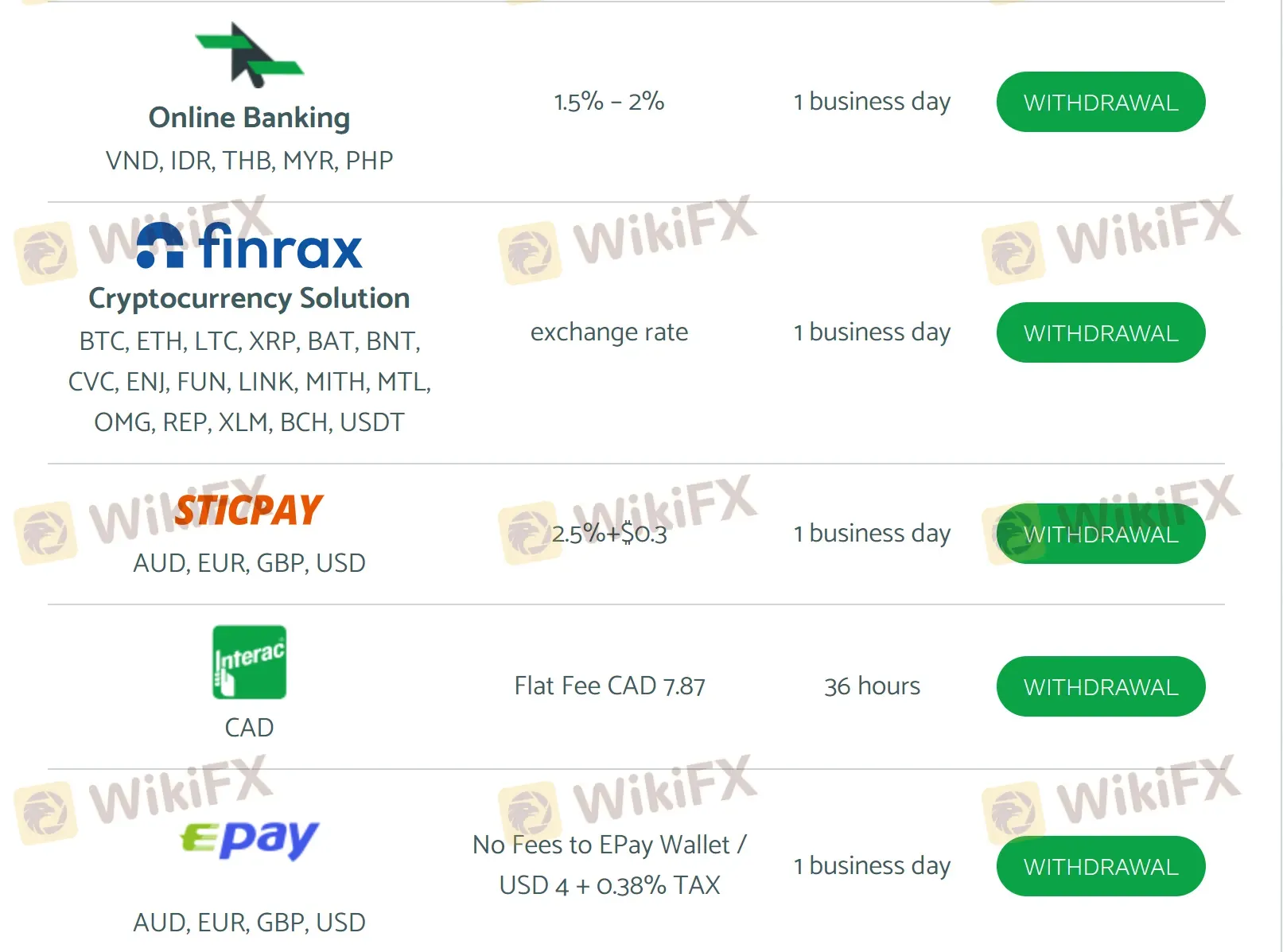

Withdrawal Options

| Withdrawal Option | Accepted Currencies | Withdrawal Fee | Withdrawal Time |

| Neteller | AUD, EUR, GBP, USD | 1% (min USD) + 1% country fee | 1 business day |

| Skrill | 1% + 1% country fee (if applicable) | 1 business day | |

| EBUY | USD | Fee may apply | 1 business day |

| Online Banking | VND, IDR, THB, MYR, PHP | 1.5%-2% | 1 business day |

| finrax | BTC, ETH, LTC, XRP, BAT, BNT, CVC, ENJ, FUN, LINK, MITH, MTL, OMG, REP, XXLM, BCH, USDT | exchange rate | 1 business day |

| Sticpay | AUD, EUR, GBP, USD | 2.5% + $0.3 | 1 business day |

| Interac | CAD | Flat fee CAD 7.87 | 36 hours |

| EPay | AUD, EUR, GBP, USD | No fees to EPay wallet/USD 4+ 0.38% TAX | 1 business day |

| Tether | AUD, EUR, GBP, USD | Flat fee USDT | 1 business day |

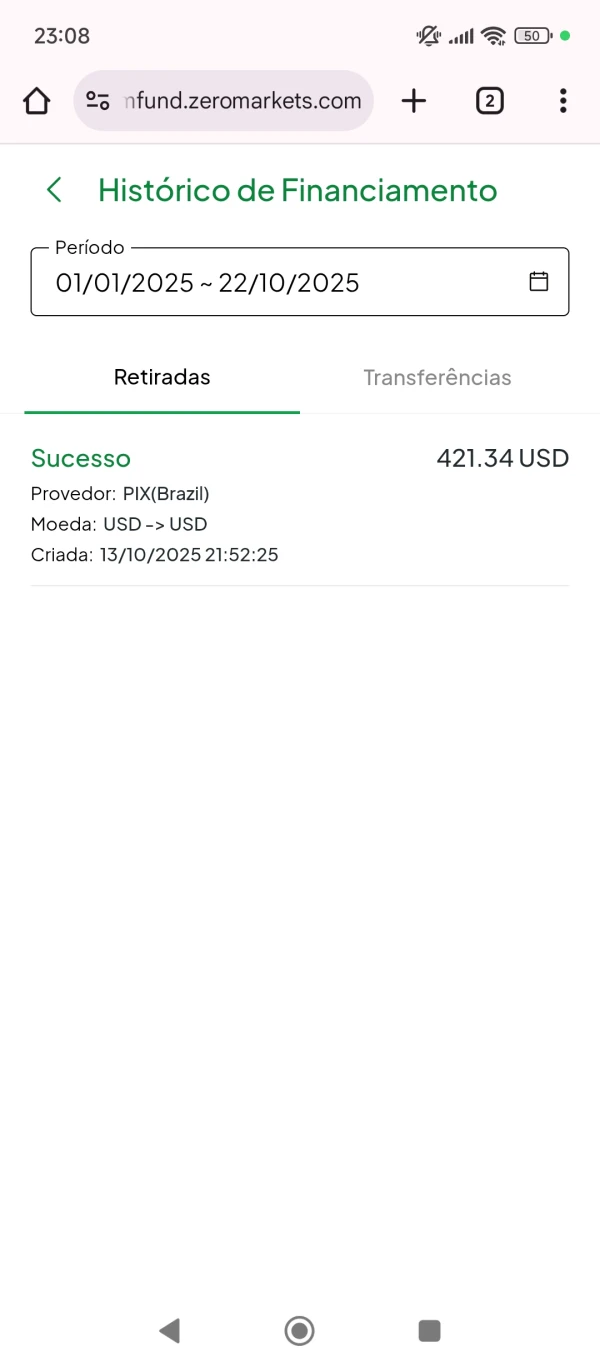

| pix | BRL | 2.38% (2% WDL + 0.38% VAT fee) + BRL 3 | 1 business day |

FX3301061491

South Korea

$116,111 Do not use under any circumstances. Zero Market will make all sorts of excuses to prevent withdrawals if you win big.

Exposure

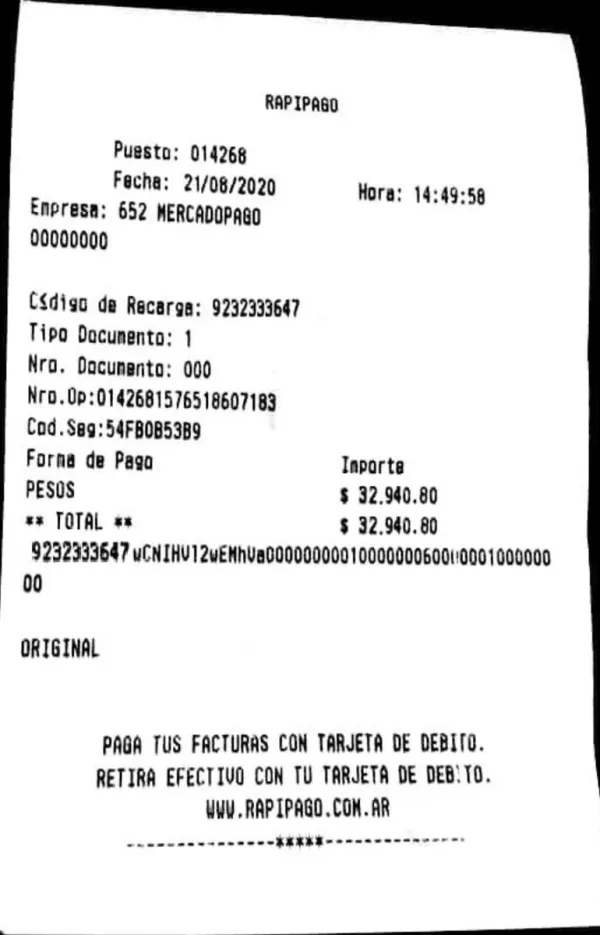

FX1068423177

Venezuela

I invested 32,940 Colombian pesos and everything went well. Later, I wanna withdraw funds cuz I needed money BUT I can't

Exposure

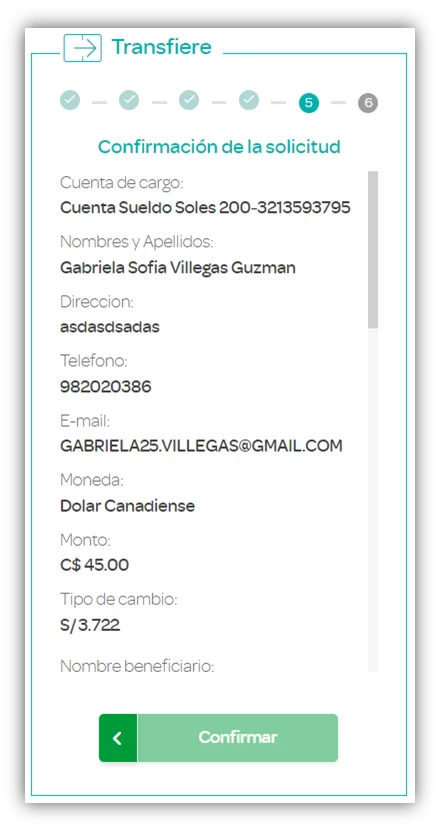

FX3699186977

Mexico

I saw this broker’s ad on Facebook, saying that investing in the stock market will make a lot of money. They asked me to deposit my initial $45 successfully, and then they added me to a Telegram group to receive notifications. But all the signals of the platform were lost, and the money was declining. It was a scam.

Exposure

oscarjuniorfx

Brazil

Great broker, I have no slippage. The only point I don't like is the withdrawal fee, but the rest has proven to be very good. I've been using it for 3 weeks and have already withdrawn once.

Neutral

FX1875436440

South Korea

The user interface is clean and the usage guide is explained in detail, and various events are held. I mainly use it because the trading environment is good.

Positive

Prunella Willoughby

Argentina

ZERO MARKETS got me feeling uneasy. Yeah, they offer crazy high leverage and a bunch of stuff to trade, but here's the deal – no regulation. That's like playing with fire in the trading game. And when you need help, good luck getting it 24/7 because their customer support ain't there all the time. Plus, I heard they hit you with withdrawal fees, which is just adding insult to injury. Gotta think twice before diving in with these guys, you know?

Neutral

Cornelius Sinclair

Pakistan

ZERO MARKETS provides traders with a set of advantages, including high leverage of up to 1:500 and a diverse range of tradable assets, spanning forex, commodities, indices, cryptocurrencies, shares, and ETFs. The availability of Islamic accounts caters to clients following Sharia principles. The user-friendly MT4 & MT5 trading platform, multiple payment options, educational resources, and demo accounts contribute to a comprehensive trading experience. However, potential concerns arise as the broker lacks regulation and offers no 24/7 customer support.

Neutral

momo74136

Pakistan

I liked this platform: it's clear to understand and with responsive support. Tip: start with smaller amounts and practice on a demo account first to get a feel for how they work.

Positive

FX6010210692

Colombia

I deposited $280,600 and they promised to be millionaire. I made the withdrawal but did not receive it. The operation disappeared.

Exposure

FX2983974756

Colombia

I deposited 62500 pesos and gained a lot. But they rejected my withdrawal.

Exposure

FX3740271812

Mexico

A friend took $300 from me and changed my transaction. It was a scam.

Exposure

FX2663775816

Colombia

They make you lose all your investment, in my case it was 60,000 pesos, everything is manipulated to make you lose

Exposure

FX2596895593

Chile

My account never received the withdrawal. They were scammers and cheated me of 89.000 pesos.

Exposure