Company Summary

| Aspect | Information |

| Registered Country/Area | Vanuatu |

| Founded Year | 2-5 years |

| Company Name | DUBAI FXM LIMITED |

| Regulation | No Regulation (Vanuatu Retail Forex License Revoked) |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:200 |

| Spreads | FIXED SPREADS: Eurodollar - 3 pips (higher than market standard) |

| Trading Platforms | MetaTrader 4 (MT4), Sirix |

| Tradable Assets | Forex currency pairs, Indices, Commodities, Stocks |

| Account Types | Single Standard Account |

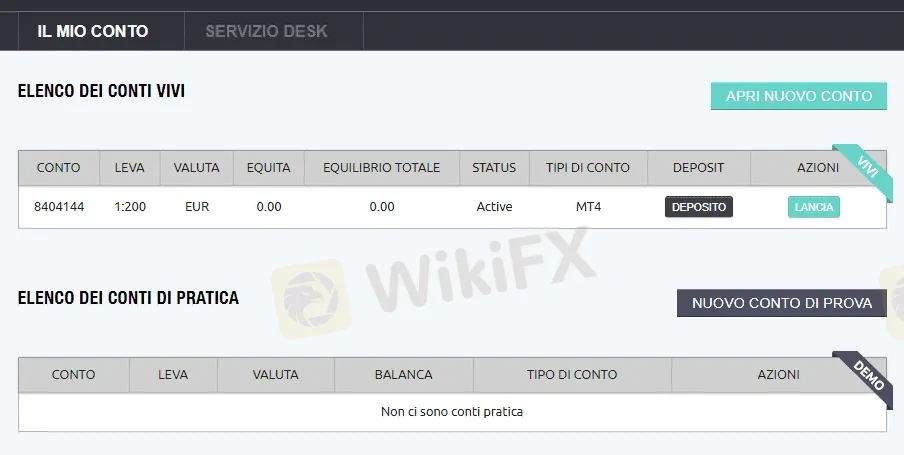

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email, Social Media (Twitter, Facebook), Phone |

| Payment Methods | Wire transfers, Credit/Debit cards, Neteller, Skrill |

Overview of DUBAI FXM

DUBAI FXM is a brokerage firm that operates without regulation, as its license from the Vanuatu Financial Services Commission (VFSC) has been revoked. This lack of regulation raises significant concerns about the legitimacy and trustworthiness of the company. The brokerage offers the popular MetaTrader 4 (MT4) and Sirix trading platforms, providing traders with access to various trading tools and features.

DUBAI FXM offers a single standard account option with a minimum deposit requirement of $200. Traders can utilize a maximum leverage of 1:200, allowing for potentially amplified profits or losses. However, it is crucial to note that the fixed spreads offered by DUBAI FXM are notably higher than the industry average, resulting in increased trading costs for investors.

Customer support is available through email, social media platforms like Twitter and Facebook, as well as phone support. These channels can be utilized to communicate queries or concerns, but it is important to exercise caution due to the company's lack of regulation and suspicious regulatory license.

Overall, DUBAI FXM presents a high potential risk to traders. The absence of regulation and the revoked license raise serious doubts about the safety and reliability of the broker. Traders should exercise caution and consider alternative regulated brokers for their trading activities.

Pros and Cons

DUBAI FXM presents a mixed bag of advantages and disadvantages for potential traders. On one hand, the broker offers a range of market instruments, a single standard account option with a low deposit requirement, and leverage options. They also provide various deposit methods and support through multiple channels. However, there are notable drawbacks as well, such as the lack of valid regulation and a suspicious regulatory status. The broker is associated with a high potential risk, and their fixed spreads are higher than the market standard. Additionally, their bonus scheme comes with significant risks due to the broker's scam reputation. To gain a comprehensive understanding, let's examine the pros and cons in detail:

| Pros | Cons |

| Offers a variety of market instruments | Lacks valid regulation |

| Provides a single standard account with low deposit | Suspicious regulatory status |

| Leverage options for amplifying trading positions | Higher fixed spreads compared to market standard |

| Multiple deposit methods available | Scam reputation and associated bonus risks |

| Offers customer support through various channels | High potential risk associated with trading activities |

Is DUBAI FXM Legit?

Based on the information provided, Dubai FXM Limited, which is licensed by Vanuatu Financial Services Commission (VFSC) with license number 40133/17, had its license revoked. This means that the regulatory status of Dubai FXM is currently abnormal and the official regulatory status is revoked. It is important to note that VanuatuVFSC is an offshore regulatory authority. The warning suggests staying away from this broker and being aware of the associated risks.

Market Instruments

Forex Currency Pairs: Dubai FXM offers a wide range of forex currency pairs, including major, minor, and exotic pairs. Major pairs are the most liquid and traded pairs, while minor pairs are less liquid and traded pairs. Exotic pairs are the least liquid and traded pairs.

Indices: Dubai FXM offers a variety of indices CFDs, including major indices such as the S&P 500, the NASDAQ 100, and the FTSE 100, as well as minor indices such as the Nikkei 225 and the Hang Seng Index.

Commodities: Dubai FXM offers a variety of commodities CFDs, including oil, gold, silver, and copper.

Stocks: Dubai FXM offers a limited number of stock CFDs, including stocks from major companies such as Apple, Google, and Amazon.

Pros and Cons

| Pros | Cons |

| Wide range of forex currency pairs available, including major, minor, and exotic pairs | Forex liquidity may vary for certain currency pairs |

| Variety of indices CFDs offered, including major and minor indices | Limited selection of stock CFDs |

| Availability of commodities CFDs, including oil, gold, silver, and copper | Limited number of stock options from major companies |

Accounts & Leverage

Dubai FXM offers a single standard account option. This account requires a minimum deposit of $200, allowing traders to get started with a relatively small initial investment. The minimum trade size for this account is set at 0.01 lots, enabling traders to make trades of various sizes based on their preferences and strategies. The maximum trading leverage provided by Dubai FXM is 1:200, which allows traders to amplify their trading positions by up to 200 times the amount of their initial investment. This leverage level can be utilized to potentially increase potential profits or losses in trading activities.

Pros and Cons

| Pros | Cons |

| Single standard account option with low minimum deposit requirement | Limited account options beyond the standard account |

| Enables traders to start with a small initial investment | Fixed minimum trade size of 0.01 lots |

| Provides leverage of up to 1:200 for amplified trading positions | Potential for increased losses due to high leverage |

Spreads

FIXED SPREADS: The fixed spread offered by Dubai FXM on the Eurodollar in their standard account is 3 pips. However, it is important to note that this spread is significantly higher than the market standard. High spreads can result in increased trading costs for investors.

Bonus

Dubai FXM provides bonuses to entice potential traders, particularly those who are new to the industry and looking to open an account. However, it is important to note that these bonuses are associated with a significant risk, as Dubai FXM is considered a scam operated by an offshore company. The bonus scheme offered by Dubai FXM is as follows:

Deposit $500 and receive a bonus of up to 50%: Dubai FXM offers a bonus to traders who deposit a minimum of $500 into their account. The bonus amount can reach up to 50% of the deposited funds.

Deposit $1000 and receive a bonus of up to 70%: Traders who deposit $1000 or more can receive a higher bonus from Dubai FXM. The bonus percentage can go up to 70% of the deposited amount.

Deposit $5000 and receive a bonus of up to 100%: For larger deposits of $5000 or more, Dubai FXM offers a bonus of up to 100%. This means that traders can potentially double their deposited funds with the bonus.

Deposit & Withdrawal

Traders using Dubai FXM have access to several deposit methods for funding their investment accounts. These methods include wire transfers, credit/debit cards, and popular e-wallet payment options like Neteller and Skrill. These options offer a range of choices to accommodate different preferences and enable traders to deposit funds.

| Pros | Cons |

| Multiple deposit methods available for funding accounts | Withdrawal process information not provided transparently |

| Accommodates different preferences | Potential delays or complications in withdrawal processes |

| Popular options for depositing funds | Limited information on withdrawal fees or policies |

Trading Platforms

The trading platforms offered by Dubai FXM are MetaTrader 4 and Sirix.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a platform that is well-known among experienced traders. It provides a range of features, including popular trading robots, advanced charting tools, a back-testing environment, and numerous technical analysis indicators. Traders can also add or create new Expert Advisors. MT4 is available for download on both desktop PCs and mobile devices.

Sirix

Sirix, on the other hand, is accessible through web, desktop, and mobile versions. It boasts a user-friendly interface and advanced charting options. Additionally, Sirix offers sophisticated social trading services, allowing traders to automatically observe and replicate the trading activities of other users. This feature enables traders to benefit from the strategies and expertise of successful traders on the platform.

| Pros | Cons |

| MetaTrader 4 (MT4) is a popular platform with advanced features | Lack of information on specific features and functionalities |

| MT4 offers trading robots, advanced charting tools, and technical analysis indicators | Limited information on platform customization options |

| Sirix platform is accessible via web, desktop, and mobile devices | Lack of detailed information on Sirix's social trading features |

| Sirix provides a user-friendly interface and advanced charting options | Limited information on Sirix's compatibility with third-party tools or plugins |

| Sirix's social trading feature allows traders to observe and replicate successful strategies | Limited information on Sirix's order execution and trade management capabilities |

Customer Support

Dubai FXM provides email support for its customers. You can reach their customer support team by sending an email to cs@dubaifxm.com. Email support allows customers to communicate their queries, concerns, or issues in writing and provides a formal and documented way of communication.

SOCIAL MEDIA SUPPORT:

Dubai FXM has a presence on social media platforms such as Twitter and Facebook. You can follow them on Twitter at https://twitter.com/dubaifxm and on Facebook at https://www.facebook.com/dubaifxm/. Social media platforms can serve as additional channels for customers to connect with the company and seek support. Customers can send direct messages or post their queries on these platforms to receive assistance or information.

PHONE SUPPORT:

Dubai FXM offers phone support to its customers. You can contact their customer support team by dialing +44 7405002421. Phone support allows customers to have direct and real-time conversations with support agents, enabling them to address their concerns or inquiries promptly.

Conclusion

In conclusion, Dubai FXM operates without valid regulation, as its license issued by the Vanuatu Financial Services Commission (VFSC) has been revoked. This lack of regulation raises concerns about the legitimacy and trustworthiness of the broker. Dubai FXM offers a single standard account option with a minimum deposit of $200 and maximum leverage of 1:200, providing traders with the ability to trade with relatively small initial investments. However, the fixed spreads offered by Dubai FXM are higher than the market standard, potentially increasing trading costs. The broker also provides bonuses to attract new traders, but it's important to note that Dubai FXM is considered a scam operated by an offshore company. Customer support is available through email, social media platforms (Twitter and Facebook), and phone. However, due to the absence of valid regulation and the associated risks, it is advisable to exercise caution and consider alternative regulated brokers with established reputations.

FAQs

Q: What market instruments does Dubai FXM offer?

A: Dubai FXM offers a wide range of market instruments, including forex currency pairs (major, minor, and exotic pairs), indices (major and minor), commodities (such as oil, gold, silver, and copper), and a limited selection of stock CFDs.

Q: How can I open an account with Dubai FXM?

A: To open an account with Dubai FXM, you can visit their website at https://www.dubaifxm.trade/ and follow the account opening process provided. However, it is important to consider the risks associated with this broker due to the lack of regulation and the revoked license.

Q: What are the spreads offered by Dubai FXM?

A: Dubai FXM offers fixed spreads, and the spread on the Eurodollar in their standard account is 3 pips. It is important to note that this spread is higher than the market standard, which can increase trading costs.

Q: Does Dubai FXM provide bonuses?

A: Yes, Dubai FXM provides bonuses to traders. They offer a bonus scheme based on the deposited amount, ranging from up to 50% for a minimum deposit of $500 to up to 100% for deposits of $5000 or more. However, it is crucial to consider the risks associated with a broker that operates without proper regulation.

Q: What deposit and withdrawal methods are available with Dubai FXM?

A: Dubai FXM offers various deposit methods, including wire transfers, credit/debit cards, and popular e-wallet options like Neteller and Skrill.

Q: Which trading platforms are offered by Dubai FXM?

A: Dubai FXM offers two trading platforms: MetaTrader 4 (MT4) and Sirix. MT4 is a widely recognized platform with advanced features and extensive charting tools, while Sirix offers a user-friendly interface, advanced charts, and social trading capabilities.