Company Summary

| ADMIS Review Summary | |

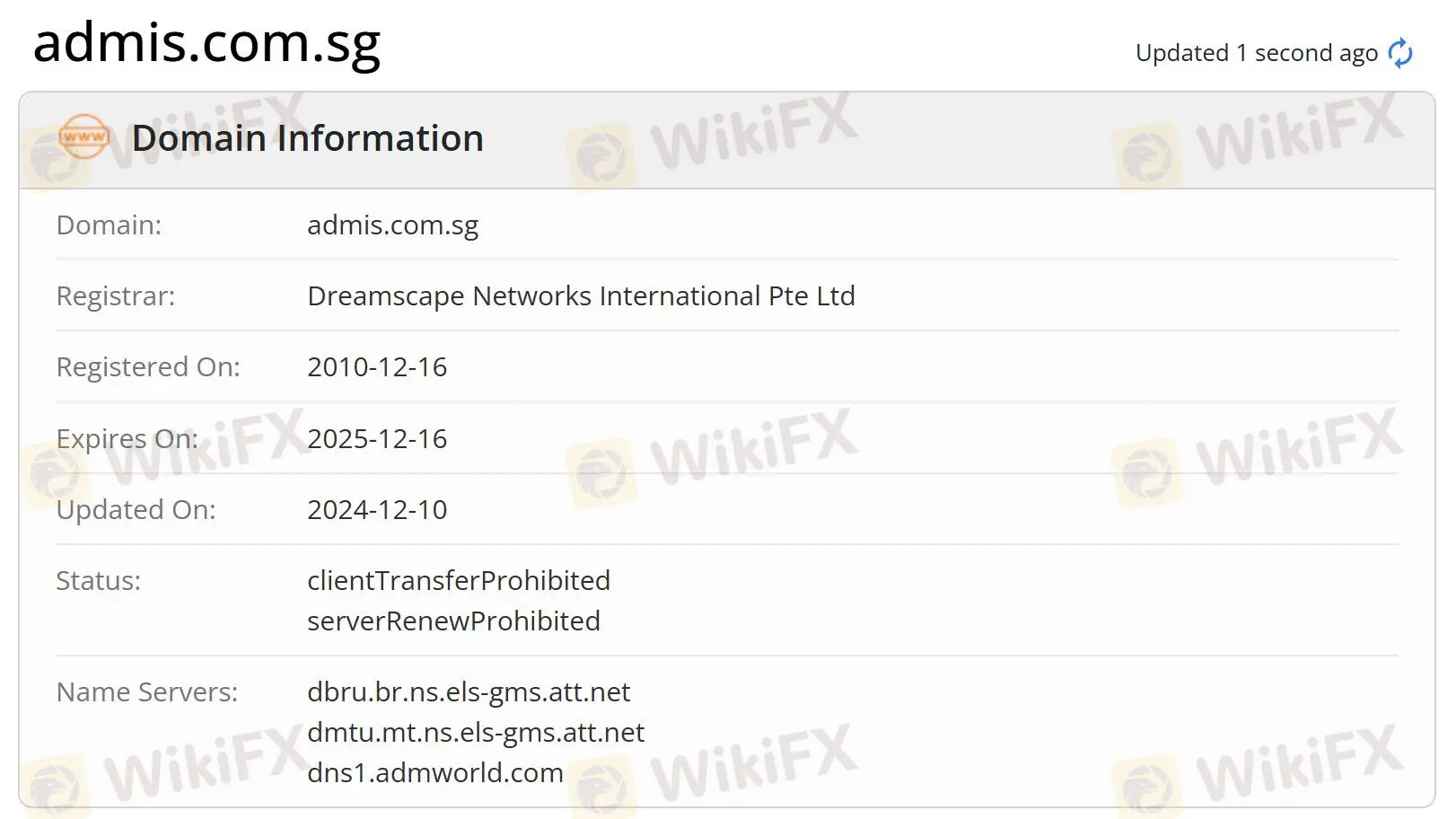

| Founded | 2010 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Futures on grains, metals, softs, and forex |

| Demo Account | / |

| Leverage | / |

| Trading Platform | CQG, TT |

| Min Deposit | / |

| Customer Support | Tel: +65-6632-3000 |

| Email: sales@admis.com.sg | |

| Address: 230 Victoria Street Bugis Junction Towers #11-06 Singapore 188024 | |

ADMIS was registered in 2010 in Hong Kong, which is a broker specializing in futures trading. It uses CQG and TT as its trading platforms, and it is regulated by SFC. However, it does not reveal much information about account and trading details.

Pros and Cons

| Pros | Cons |

| Long operation time | No physical office |

| Unclear fee structure | |

| No MT4 or MT5 | |

| Unknown payment options |

Is ADMIS Legit?

Yes, ADMIS is regulated by Securities and Futures Commission of Hong Kong (SFC).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | ADMIS Hong Kong Limited | Dealing in futures contracts | ACP509 |

WikiFX Field Survey

WikiFX field survey team visited ADMIS's regulatory address in Hong Kong, but we did not find its physical office.

What Can I Trade on ADMIS?

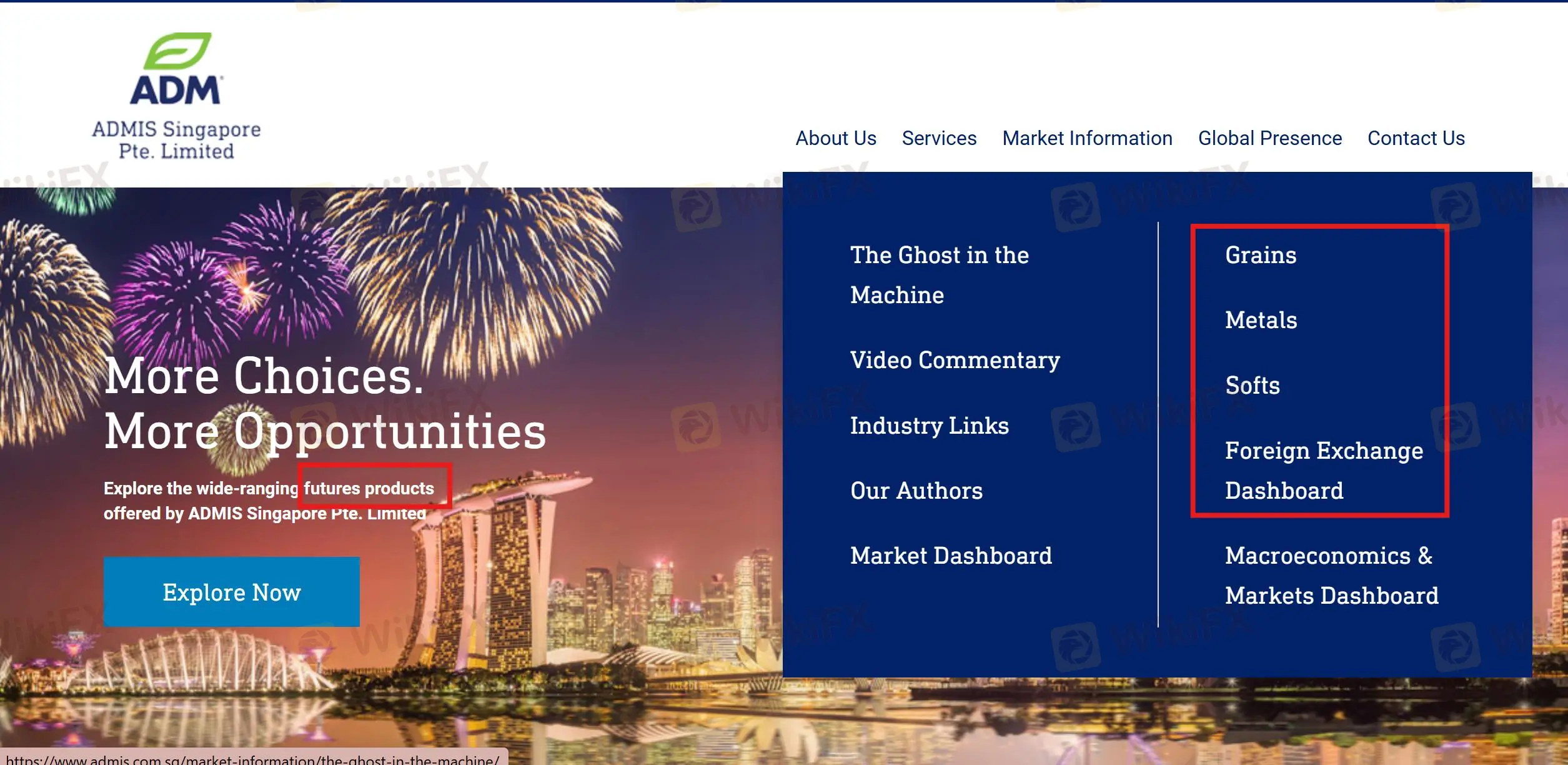

ADMIS provides a wide range of futures products. Besides, it offers market information related to grains, metals, softs, and forex.

Trading Platform

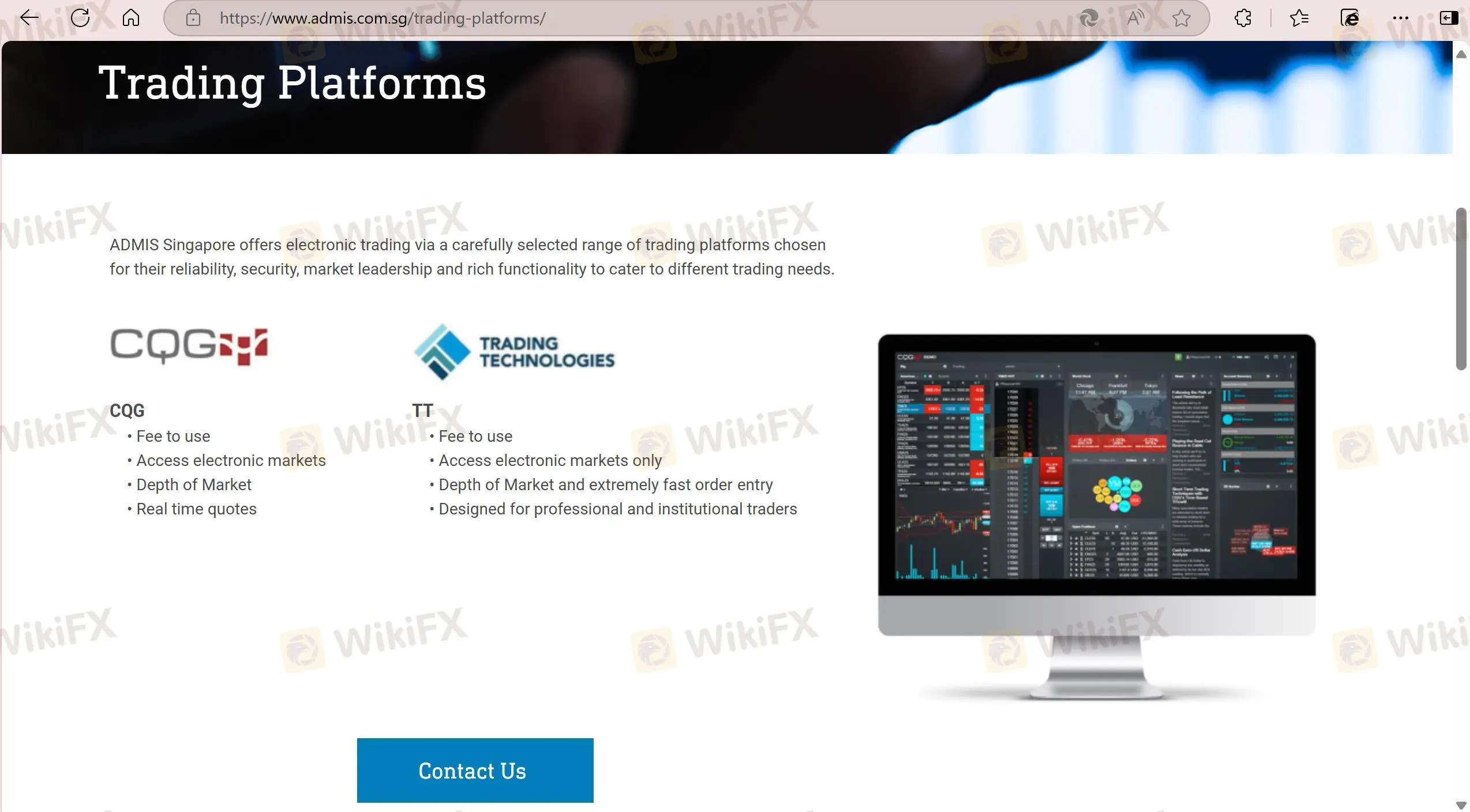

ADMIS uses CQG and Trading Technologies (TT) as its trading platforms, and it does not suppot MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| CQG | ✔ | PC, web | / |

| Trading Technologies | ✔ | PC, web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

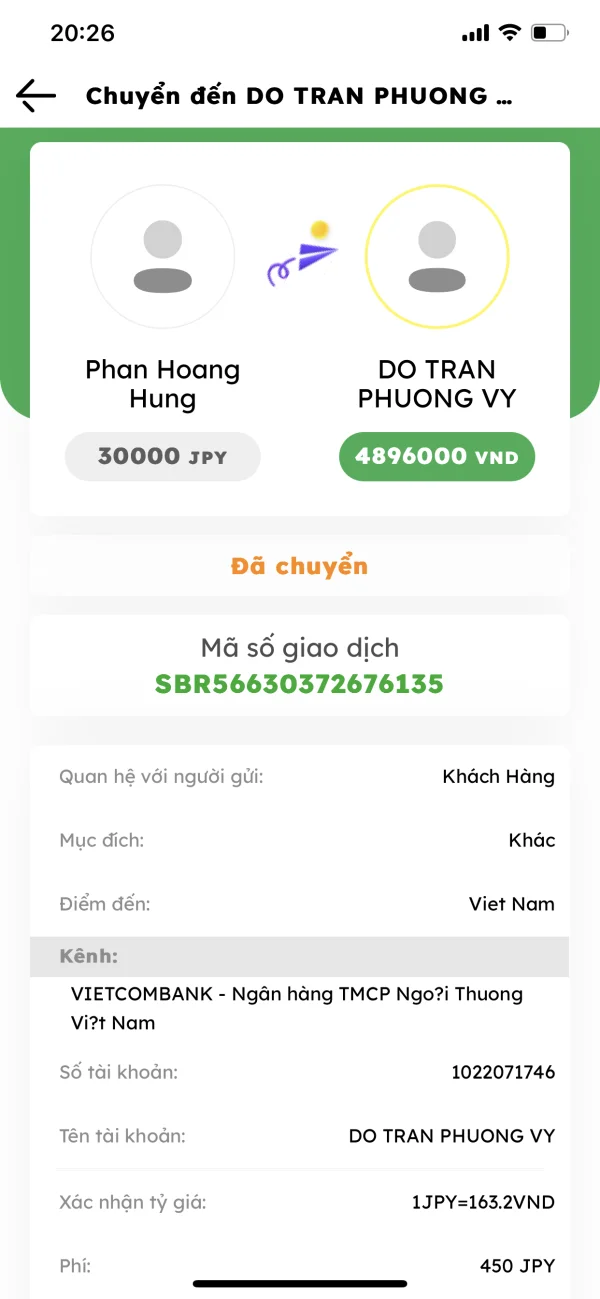

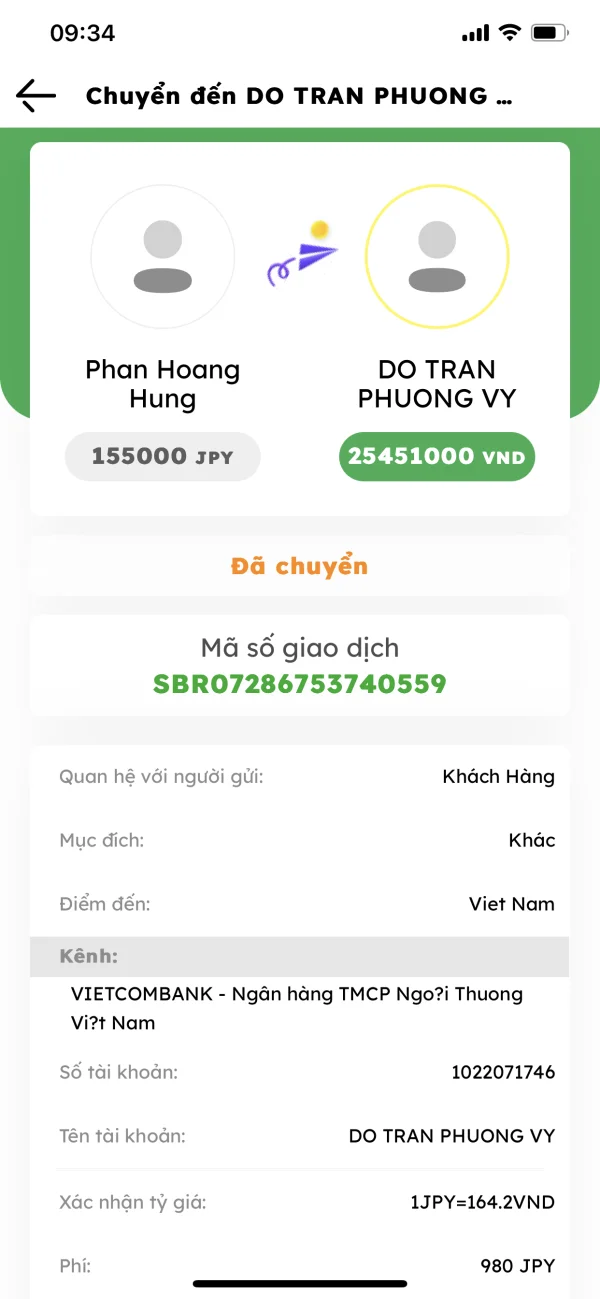

hung816

Japan

Dear customer, I have to respond to the progress of the business order of Vietnam Debt Trading Company Limited - Ministry of Finance guaranteed by the Government of Vietnam. Your treasury business order has an unusual status due to money transfer (amount too large, suspected money laundering) Vietnam Debt Trading Company Limited - Ministry of Finance guaranteed by the Government of Vietnam is to ensure the safety of funds for business and the cause of hidden danger. Currently, this business order has been frozen. In order for your business money to be transferred effectively and safely to your bank account. Vietnam Debt Trading Company Limited - Ministry of Finance guaranteed by the Government of Vietnam requests you. Note number: 20230825.6192061 Mr. PHAN HOANG HUNG 1: Phone number: 08075008346 2: Gmail address: hungphan3051999@gmail.com 3: NumberWithdrawal amount: 205.643$ = 4.935.432.000 VND 4: Bank name: Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) 5: Bank account number: 050111039736 6: Account holder name: TRAN THI KIM NGOC The amount 205.643$ = 4.935.432.000 VND has been sealed. You need to pay the currency exchange fee, then Vietnam Debt Trading Company Limited - Ministry of Finance guaranteed by the Government of Vietnam will make a withdrawal order for you - The currency exchange fee is applied at 2%. Conversion 205.643$ = 4.935.432.000 VND x 0.02 = 98.708.640 VND Explain that after the payment is completed, the amount will be automatically converted into the business order money transfer and transferred to the State Bank of Vietnam. - Request from 08/25/2023 to 09/05/2023 you must pay the amount 98.708.640 VND After you pay the full amount 98.708.640 VND, Vietnam Debt Trading Company Limited - Ministry of Finance guaranteed by the Government of Vietnam will refund the amount of 98.708.640 VND after 30 days from the date you pay the full amount of 98.708.640 VND. If you do not pay the full amount of 98.708.640 VND after September 5, 2023, the file will be sent to the Department of Planning and Finance - Ministry of Public Security for processing and settlement. Thank you

Exposure

FX1519754694

Hong Kong

The customer service at ADMIS proved to be top-notch. It had a sense of responsibility you don't find just about anywhere. Responses were quick and solutions provided were adequate. It felt like having a reliable ally in my trading journey. What also impressed me was the speed of their withdrawal process. Receiving funds from ADMIS was like getting an express delivery, quick and without any unnecessary delay.

Positive

FX7287257892

United Kingdom

so amazing , i won 100,000$ , the exchange helped me to withdraw and deposit smoothly . thank you !

Positive

FX1993775032

Vietnam

In my personal experience, the customer service is enthusiastic and provides 24/7 support. The deposit and withdrawal process is handled quickly. The trading platform operates well with no errors during transactions.

Positive

时尚阳光

Ecuador

Personally, I think this ADMISI is not bad, but I saw bad information on the wikifx website and it scares me a little. This field investigation shows that it does not have an office in the UK. Does that mean it's a scammer? Should I stop the loss in time?

Positive

FX1023300450

United Kingdom

This broker’s customer support is not that professional and professional, and they don’t support online chat. I remembered I sent an inquiry to them, and no one answers me, which is quite weird. I found out some problems: lack of fee details, no clear information about the minimum deposit… Who can tell me how this platform performs?

Neutral