Company Summary

| CMS Financial Review Summary | |

| Founded | 1999 |

| Registered Country/Region | United States |

| Regulation | Securities and Commodities Authority |

| Market Instruments | Forex, commodities, indices, and stock CFDs |

| Demo Account | Yes |

| Leverage | Up to 1:100 |

| Spread | Starting from 0.0 pips |

| Trading Platform | MT5 |

| Min Deposit | $5,000 |

| Customer Support | support@cmsfinancial.ae |

| +971 (4) 44 74 712 | |

CMS Financial Information

CMS Financial is an online trading platform offering over 200 trading assets including Forex, commodities, indices, and stock CFDs. Regulated by the Securities and Commodities Authority, it offers three account types with no commissions, high leverage up to 1:100, and competitive spreads as low as 0 pips through MT5. However, it requires a high minimum deposit of $5,000.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

|

Is CMS Financial Legit?

CMS Financial has a Retail Forex License regulated by the Securities and Commodities Authority in the United Arab Emirates with a license number of 20200000144.

| Regulatory Status | Regulated |

| Regulated by | Securities and Commodities Authority |

| Licensed Institution | CMS Financial LLC |

| Licensed Type | Retail Forex License |

| Licensed Number | 20200000144 |

What Can I Trade on CMS Financial?

CMS Financial offers 200+ tradable assets including Forex, commodities, indices, and stock CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock | ✔ |

| Indices | ✔ |

| Cryptocurrency | ❌ |

| Shares | ❌ |

| Metals | ❌ |

Account Type

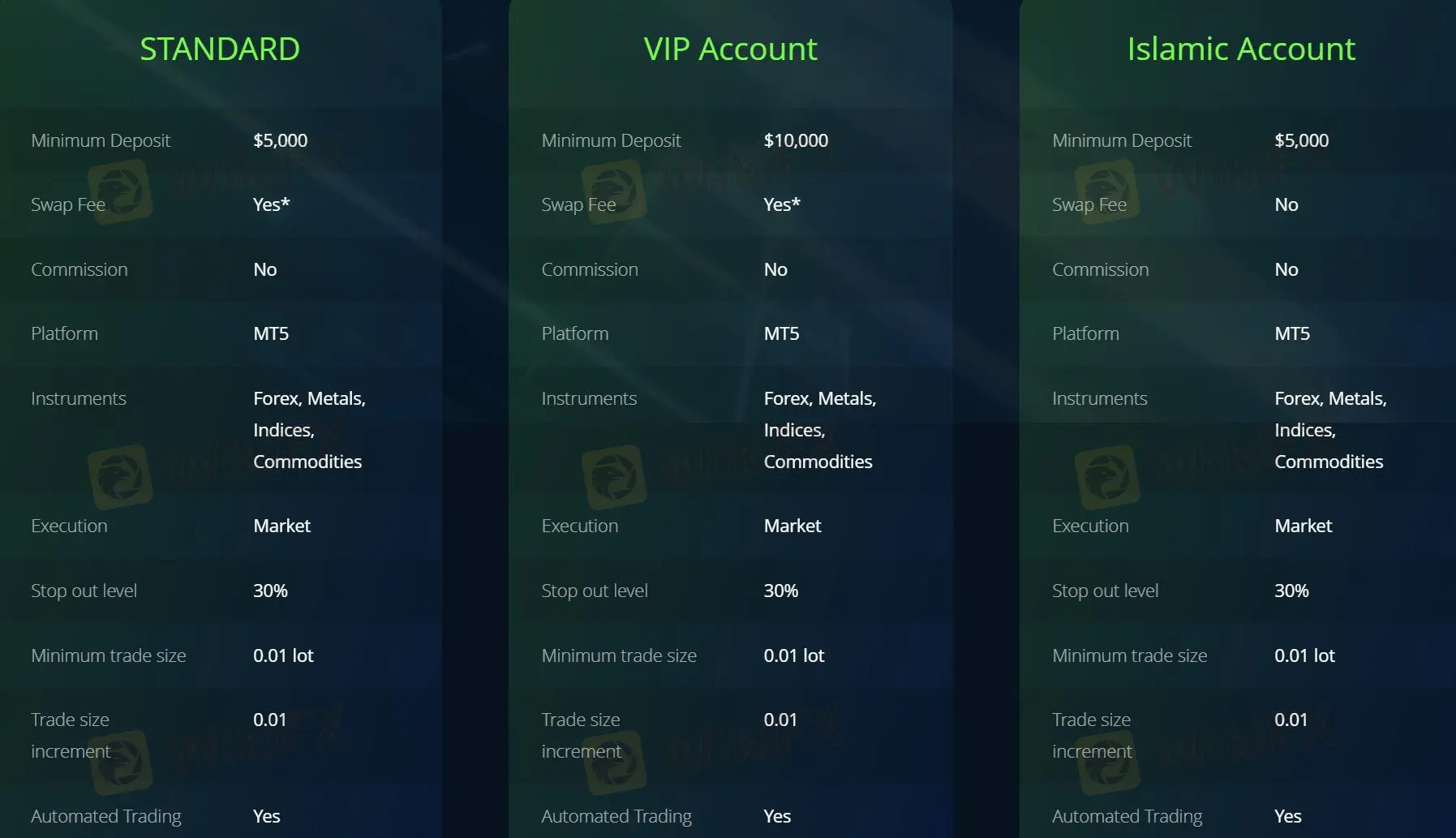

CMS Financial offers three types of accounts: Standard, VIP Account, and Islamic Account. You can refer to the table for details.

| Account Type | Minimum Deposit (USD) | Swap Fee | Commission | Stop Out Level | Minimum Trade Size | Trade Size Increment |

| Standard | 5,000 | Yes* | No | 30% | 0.01 lot | 0.01 |

| VIP Account | 10,000 | Yes* | No | 30% | 0.01 lot | 0.01 |

| Islamic Account | 5,000 | No | No | 30% | 0.01 lot | 0.01 |

CMS Financial Fees

CMS Financial offers spreads starting from 0.0 pips. It charges no commissions for all accounts.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC and Mobile | Investors of all experience levels |

Deposit and Withdrawal

CMS Financial requires a minimum deposit of $5,000 with no commissions.