Company Summary

| Capitality | Basic Information |

| Registered Country/Area | Switzerland |

| Founded year | 1-2 years ago |

| Company Name | Capitality Markets |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $500 |

| Maximum Leverage | Not specific |

| Spreads | From 1.8 pips on the eur/usd pair |

| Trading Platforms | Not specific |

| Tradable assets | Forex, commodities, cryptos |

| Account Types | Not specific |

| Demo Account | No |

| Islamic Account | Yes |

| Customer Support | Phone, Email |

| Payment Methods | Not specific |

| Educational Tools | None |

Overview of Capitality

Capitality Markets is a forex broker that was founded in Switzerland in the last 1-2 years. The company does not have a clear regulatory status, and it is therefore considered a dubious broker. Capitality Markets offers a minimum deposit of $500, and it does not offer a demo account. The company's maximum leverage is not specified, and its spreads are exorbitant, starting at 1.8 pips on the EUR/USD pair. Capitality Markets offers trading in forex, commodities, and cryptos. The company's trading platforms are not specified, and it does not offer any educational resources. Capitality Markets' customer support is available by phone and email.

It is important to note that Capitality Markets is a disreputable broker, and it is therefore not recommended to trade with this company. There are many other forex brokers that are regulated and have a good reputation. It is always best to do your research before you start trading with any forex broker.

In addition, Capitality Markets does not offer any educational resources. This means that potential clients will have to learn about forex trading on their own, which can be a daunting task.

Is Capitality legit or a scam?

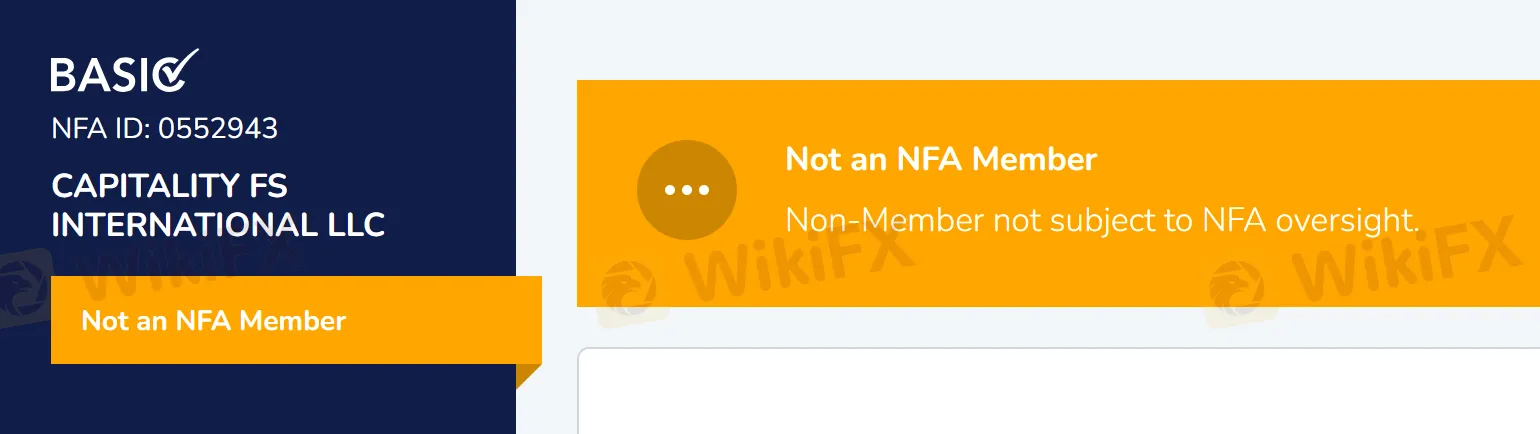

Capitality claims to be regulated by the National Futures Association (NFA), but this claim is misleading. The NFA is a self-regulatory organization (SRO) that is authorized by the Commodity Futures Trading Commission (CFTC) to regulate futures and options markets in the United States. However, the NFA does not regulate forex brokers. The NFA regulatory license number that Capitality lists on its website (0552943) is actually the license number of a different company, Capitality Futures LLC. Capitality Futures LLC is a futures commission merchant (FCM) that is registered with the CFTC, but it is not a forex broker.

The fact that Capitality is not regulated by the NFA is a serious red flag. The NFA is one of the most reputable SROs in the world, and its regulation provides important protections for investors. Without NFA regulation, there is no guarantee that Capitality will protect your funds or that it will operate in a fair and transparent manner.

Pros and Cons

| Pros | Cons |

| Islamic account available | Suspicious regulatory license |

| No demo account | |

| Not specific trading platforms | |

| Not specific payment methods | |

| No educational tools | |

| High minimum deposit of $500 | |

| Limited range of trading assets | |

| Poor customer support |

Market Intruments

Capitality Markets offers a limited range of trading assets, covering forex, commodities, and cryptos. The company does not offer trading in stocks, indices, or other asset classes.

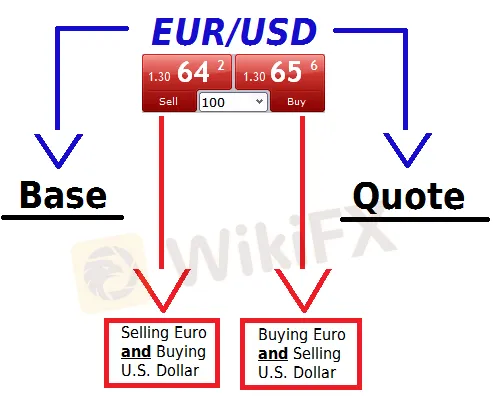

The forex offering at Capitality Markets is relatively basic. The company offers trading in major and minor currency pairs, as well as some exotic pairs. The spreads on forex pairs are not competitive, starting at 1.8 pips on the EUR/USD pair.

The commodities offering at Capitality Markets is also limited. The company offers trading in a few major commodities, such as gold, silver, oil, and natural gas. The spreads on commodities are not competitive, starting at 2.5 pips on the gold/USD pair.

The crypto offering at Capitality Markets is the most extensive of the three asset classes. The company offers trading in a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. The spreads on cryptocurrencies are not competitive, starting at 7 pips on the Bitcoin/USD pair.

Account Types

Capitality Markets does not disclose the types of trading accounts that it offers, which is a red flag. Most reputable forex brokers offer a variety of account types to meet the needs of different traders. For example, some brokers offer standard accounts, which are suitable for most traders, while others offer more specialized accounts, such as Islamic accounts or accounts for high-volume traders.

The lack of transparency around account types at Capitality Markets makes it difficult for potential clients to choose the right account for their needs. Additionally, the minimum deposit requirement of $500 is higher than the minimum deposit requirements of most other forex brokers. This means that Capitality Markets is not a good option for traders who are looking to start trading with a small amount of money.

Finally, Capitality Markets does not offer a demo account. This is a major drawback, as it makes it difficult for potential clients to test out the platform before they deposit money. A demo account allows traders to trade with virtual money, so they can get a feel for the platform and its features without risking any real money.

How to open an account?

Here are the steps on how to open an account with Capitality Markets:

Visit the Capitality Markets website and click on the “Open Account” button.

Complete the online application form. This will require you to provide your personal information, such as your name, address, email address, and phone number. You will also need to provide your trading experience and financial goals.

Make a minimum deposit of $500. You can deposit funds using a variety of methods, such as credit card, debit card, wire transfer, or e-wallet.

Verify your identity. Capitality Markets will require you to verify your identity by uploading a copy of your passport or other government-issued ID.

Download the Capitality Markets trading platform. You can download the platform for Windows, Mac, or Linux.

Start trading. Once you have funded your account and verified your identity, you can start trading forex, commodities, and cryptos.

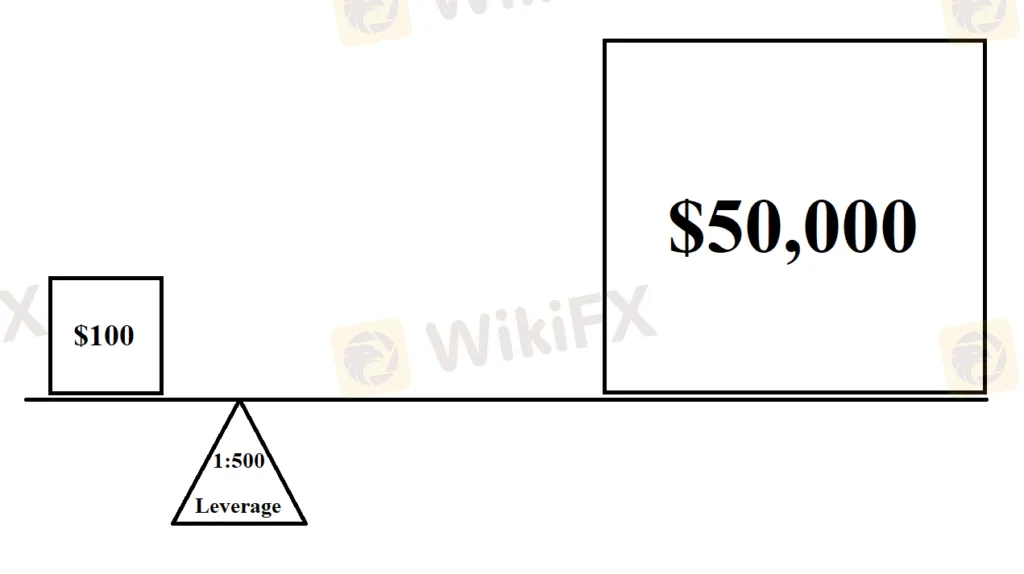

Leverage

Capitality Markets does not disclose its leverage limits, which is a red flag. Most reputable forex brokers offer leverage limits that range from 1:50 to 1:500. However, some brokers offer higher leverage limits, which can be risky for inexperienced traders.

The lack of transparency around leverage limits at Capitality Markets makes it difficult for potential clients to assess the risks involved in trading with the broker. Additionally, the high leverage limits that some brokers offer can lead to excessive risk-taking, which can result in significant losses.

Spreads & Commissions (Trading Fees)

Capitality offers spreads that start at 1.8 pips on the EUR/USD pair. This is higher than the spreads offered by most other forex brokers. For example, some brokers offer spreads that start at 0.5 pips on the EUR/USD pair. The high spreads offered by Capitality Markets can eat into profits, especially for traders who are trading small account sizes. Additionally, the high spreads can make it difficult to trade profitably in volatile markets.

Capitality also charges commissions on some trades. The commissions vary depending on the asset and the trade size. For example, the commission on a EUR/USD trade of $100,000 is $20. The commissions charged by Capitality are not excessive, but they are higher than the commissions charged by some other forex brokers. For example, some brokers do not charge any commissions on forex trades.

Non-Trading Fees

Describe the Non-Trading Fees in paragraphs of Capitality. Please ensure that the language used is formal and eloquent, longer, avoiding excessive use of positive terms.

Capitality charges a number of non-trading fees, including:

Inactivity fee: A fee of $10 per month is charged if the account balance is below $200 for more than 30 days.

Withdrawal fee: A fee of $25 is charged for each withdrawal.

Funding fee: A fee of 2% is charged on all deposits made with credit or debit cards.

Exchange rate margin: A margin of 2% is applied to all currency conversions.

These fees can add up over time, so it is important to be aware of them before you open an account with Capitality Markets.

Trading Platform

Capitality Markets does not disclose the trading platform that it provides, which is a cause for concern. Most reputable forex brokers use well-known and established trading platforms, such as MetaTrader 4 or MetaTrader 5. These platforms are widely used by traders and have a proven track record of reliability and security.

The lack of transparency around the trading platform at Capitality Markets makes it difficult for potential clients to assess the features and functionality of the platform. Additionally, the use of an unknown or untested trading platform can be a risk for traders, as there is no guarantee that the platform will be reliable or secure.

In the absence of any information from Capitality Markets, it is impossible to say for certain what trading platform the company uses. However, the lack of transparency is a red flag, and it is advisable to avoid trading with this broker.

Deposit & Withdrawal

Details regarding the deposit and withdrawal methods at Capitality remain unspecified, leaving traders without clarity about the available options. Transparent and accessible deposit and withdrawal processes are crucial for managing funds effectively. However, the lack of specific details about payment methods with Capitality hinders traders' ability to assess convenience, reliability, and associated costs when depositing and withdrawing funds.

In addition, the minimum deposit requirement at Capitality stands at $500, which is relatively high compared to other brokers in the industry. This minimum deposit amount could potentially present a barrier for traders, especially beginners or those with limited trading capital.

Customer Support

When it comes to customer support, BDG can only be reached through email at info@fxbdg.com. The lack of alternative communication channels such as phone support or live chat options limits the accessibility and responsiveness of customer support. This may lead to potential delays in obtaining assistance or resolving inquiries. Traders should consider the availability and effectiveness of customer support when choosing a broker.

Educational Resources

Although educational resources play a crucial role in empowering traders, especially beginners, Capitality, unfortunately, does not provide any educational resources to assist traders in enhancing their knowledge and skills in the financial markets.

Is Capitality suitable for beginners?

Capitality may not be the optimal broker for beginners due to the following factors:

Firstly, the lack of educational resources provided by brokers can hinder the learning and development process of novice traders. Educational materials are crucial for beginners to understand the basics of trading, learn different strategies, and gain insights into market analysis.

Secondly, the absence of specific account types and detailed information about trading platforms and tools may make it challenging for beginners to navigate the trading environment effectively.

Thirdly, the minimum deposit requirement of $500 may be relatively high for beginners who may want to start with smaller investments to test the waters.

Considering these factors, beginners may find other brokers with comprehensive educational resources, user-friendly platforms, and lower minimum deposit requirements more suitable for their learning and trading needs.

Is Capitalitysuitable for experienced traders?

No, Capitality may not be an ideal option for experienced traders considering several factors. The absence of detailed information regarding trading platforms, maximum leverage, account types, and educational resources raises concerns about the broker's ability to meet the advanced needs of experienced traders. It is advisable for experienced traders to explore alternative brokers that provide a wider range of features, advanced trading tools, and a transparent trading environment.

Conclusion

In conclusion, Capitality raises several red flags that warrant caution for potential traders. The suspicious regulatory license, lack of detailed information on important aspects such as trading platforms and account types, absence of educational resources, and limited customer support options all contribute to a questionable trading environment. Additionally, the broker's minimum deposit requirement and lack of transparency in terms of spreads and leverage further detract from its appeal. Considering these factors, it is advisable for traders to explore alternative brokers that offer more transparency, regulatory oversight, and a comprehensive set of features to ensure a safer and more reliable trading experience.

FAQs

Q: Is Capitality a regulated broker?

A: Capitality holds a suspicious regulatory license, which raises concerns about its credibility and level of oversight.

Q: What is the minimum deposit requirement for opening an account with Capitality?

A: The minimum deposit requirement for Capitality is $500.

Q: What trading instruments are available with Capitality?

A: Capitality offers trading in forex, commodities, and cryptocurrencies.

Q: Does Capitality provide a demo account for practice trading?

A: No, Capitality does not offer a demo account for traders to practice and test their strategies.

Q: What are the available payment methods for deposits and withdrawals with Capitality?

A: Capitality does not provide specific information about the payment methods available for deposits and withdrawals.