Founded in 2010, ETO Markets is a forex and CFD forex broker based in Sydney, Australia, providing online solutions for retail and institutional investors in over 100 countries. It is regulated by the AISC and offshore regulated by the FSA. Besides, it offers many live accounts with acceptable minimum deposit requirements and flexible leverage up to 1:500, through MT4, MT5, and CRM APP. However, many residents from some countries and regions have no access to trade with them.

Pros and Cons

Is ETO Markets Legit?

ETO Markets isregulated by the Australian Securities and Investments Commission (ASIC) and offshore regulated by the Seychelles Financial Services Authority (FSA).

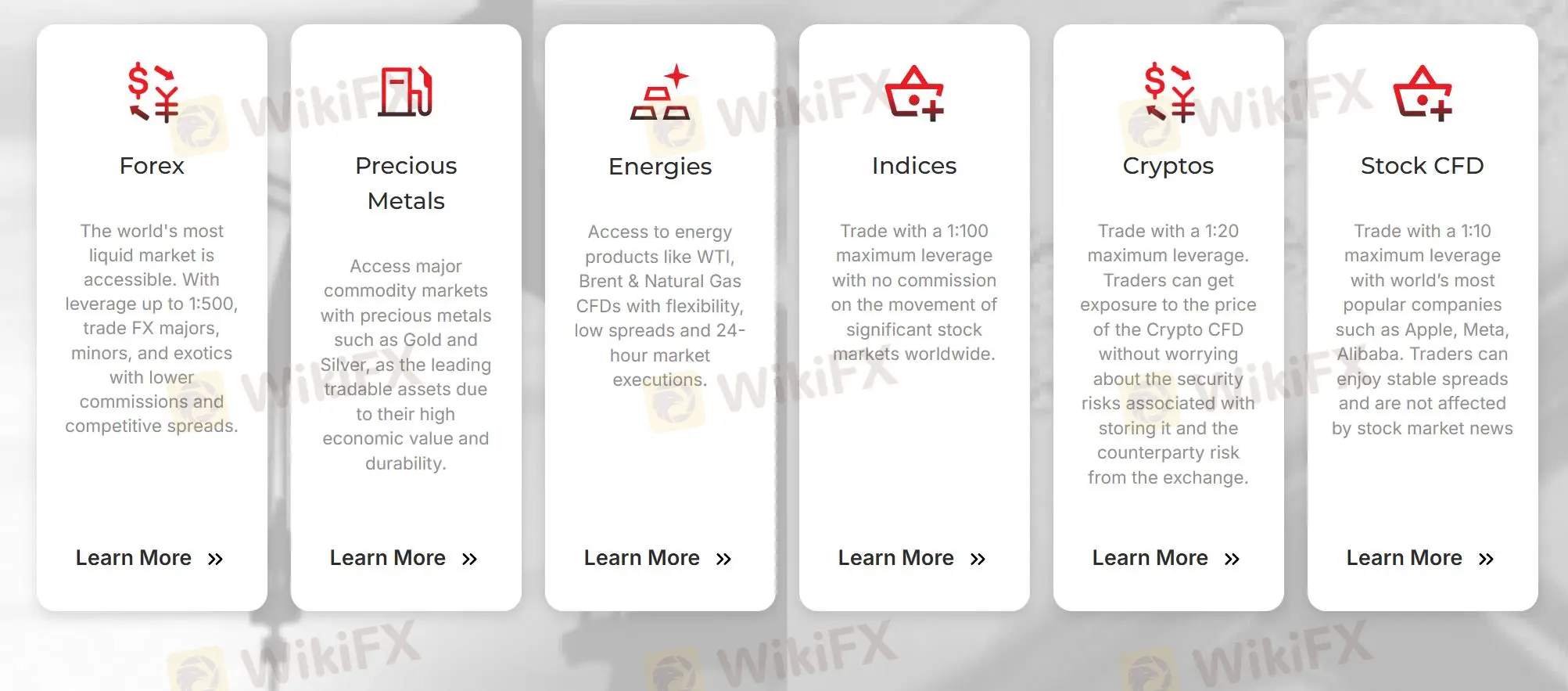

What Can I Trade on ETO Markets?

ETO Markets offers 50+ forex, energies, commodities, precious metals, indices, cryptos and stock CFDs.

Account Type

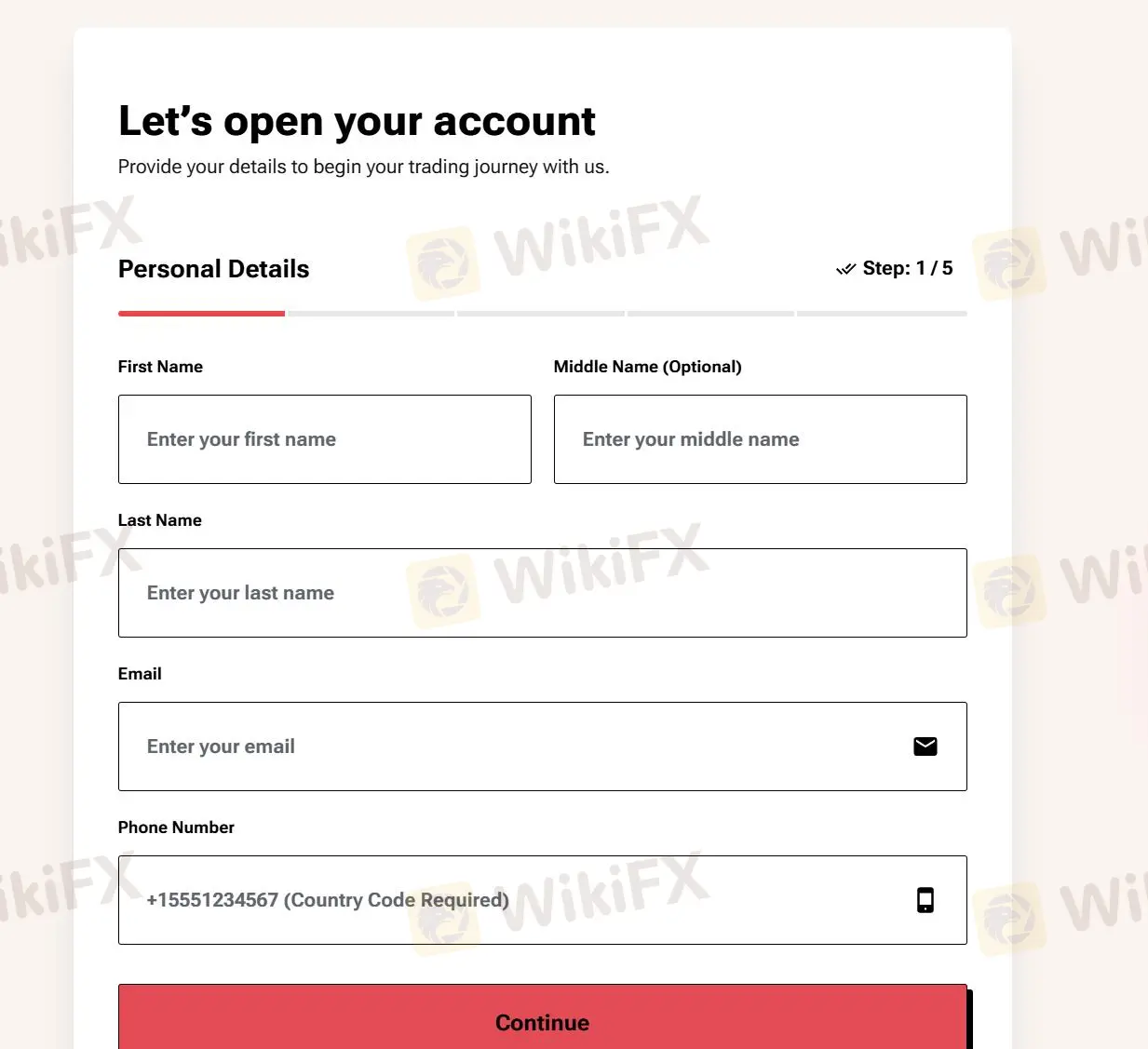

Opening an account with ETO Markets involves five steps, during which you can provide your personal information.

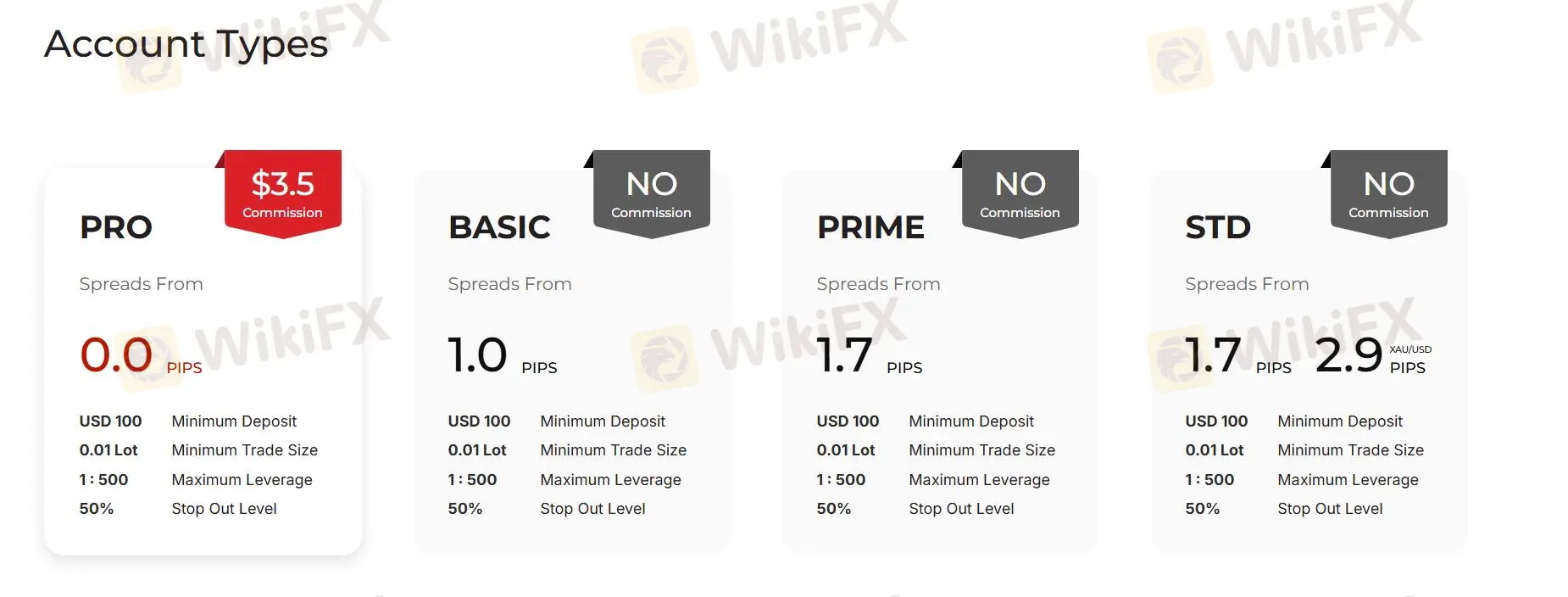

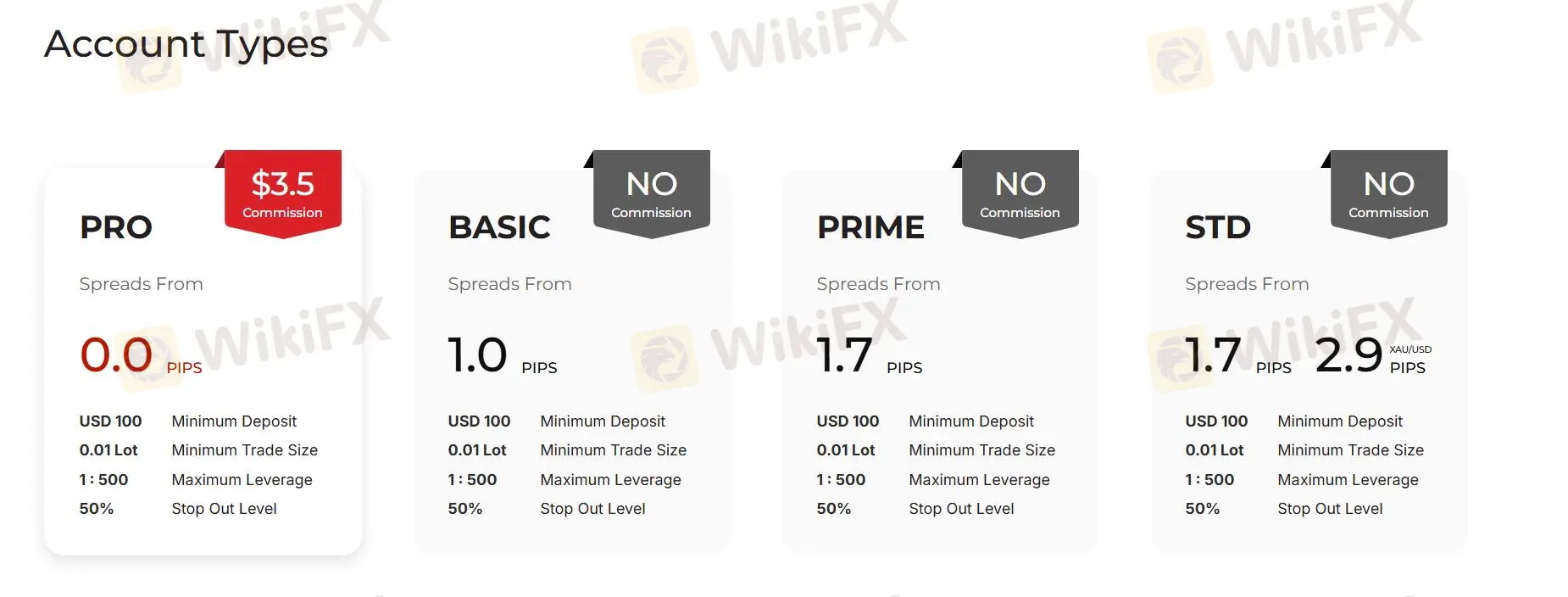

ETO Markets offers four kinds of live accounts: the Pro, Basic, Prime and STD accounts with the minimum deposits of $100.

Leverage

ETO Markets charge the maximum leverage of 1:500 for each account. Besides, it also provides flexible leverage ratios for various trading products:

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ETO Markets Fees

Trading Platform

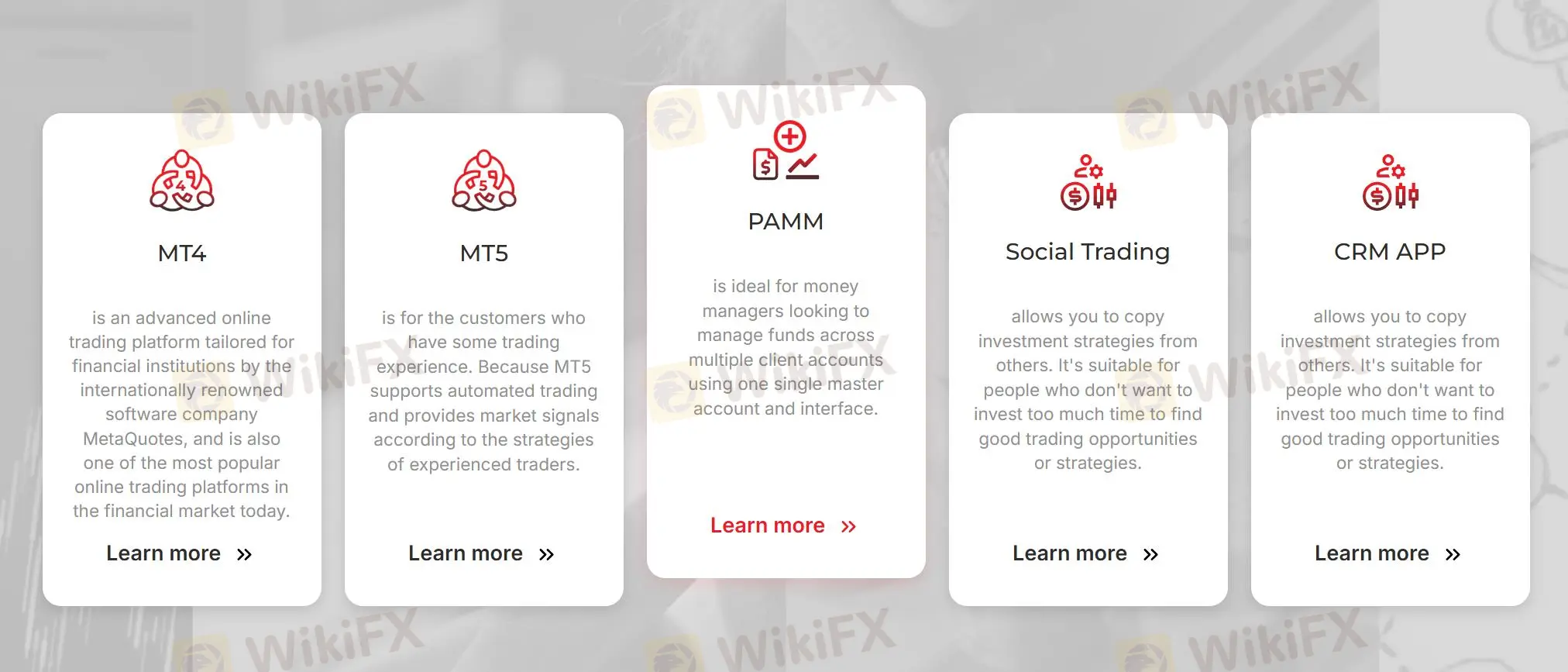

ETO Markets offers a range of trading platforms for their traders including MT4, MT5, and CRM APP.

瑞创

South Korea

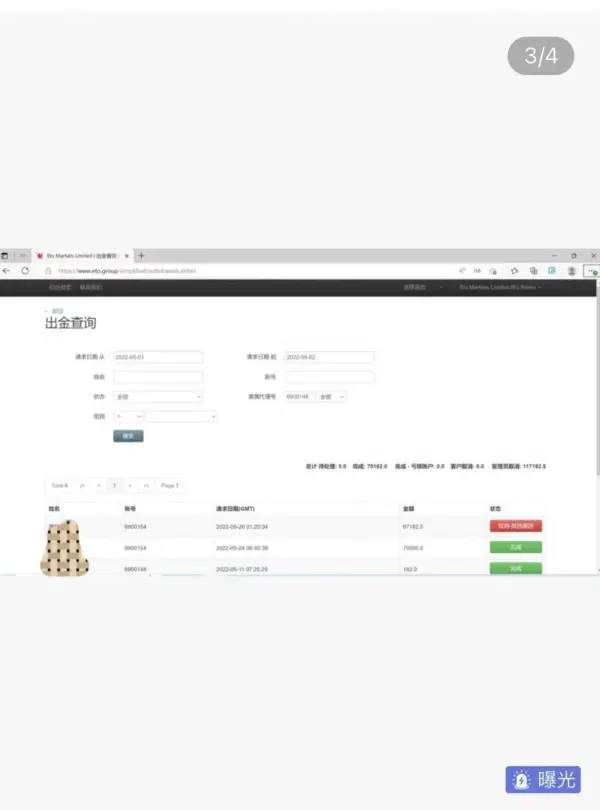

This platform has been a scam platform since its foundation, using various methods to induce customers to trade and then, after about half a year, various malicious slippages and malicious refusal to withdraw funds were occured. They always find various excuses.

Exposure

FX1062393618

United States

ETO is a fraudulent platform that won't let withdrawals, account is disabled, can't trade, says it is counterfeited and is a fraudulent platform.

Exposure

FX2508073351

United States

Nov 16, 2023 i traded on eto platform, the quote that mt4 doesn't have but eto platform does, black platform. The black platform liquidated my account and do not give me compensation. Don't use the black platform. I've suffered all this.

Exposure

แอดแอ่ดแอ้ด

Thailand

Smooth, no stuttering. Sometimes withdrawals are fast, sometimes slow, but overall, it's okay for me.

Neutral

Starye

United States

I traded forex on ETO Markets and it went super smoothly! The deposit and withdrawal methods are totally reasonable, and the speed is lightning fast!

Positive

FX3239945048

Malaysia

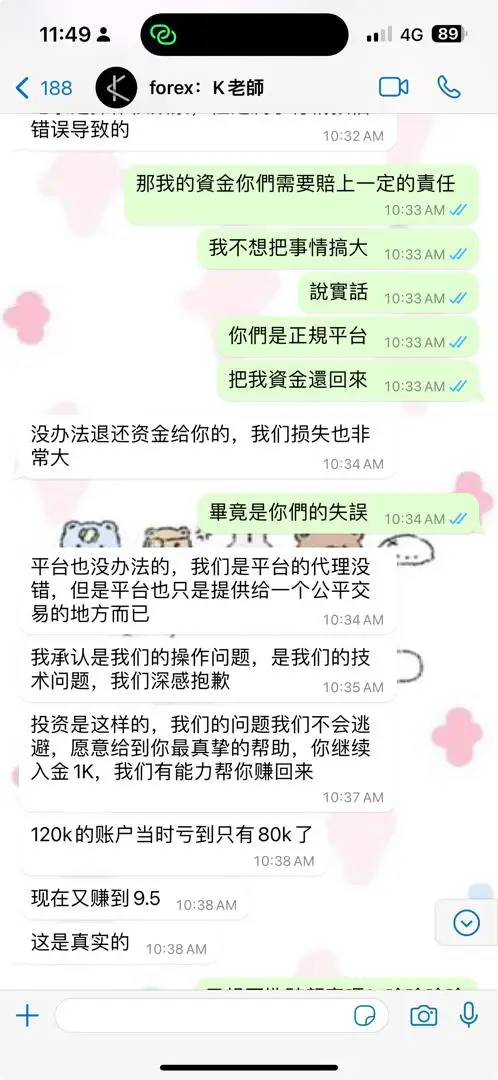

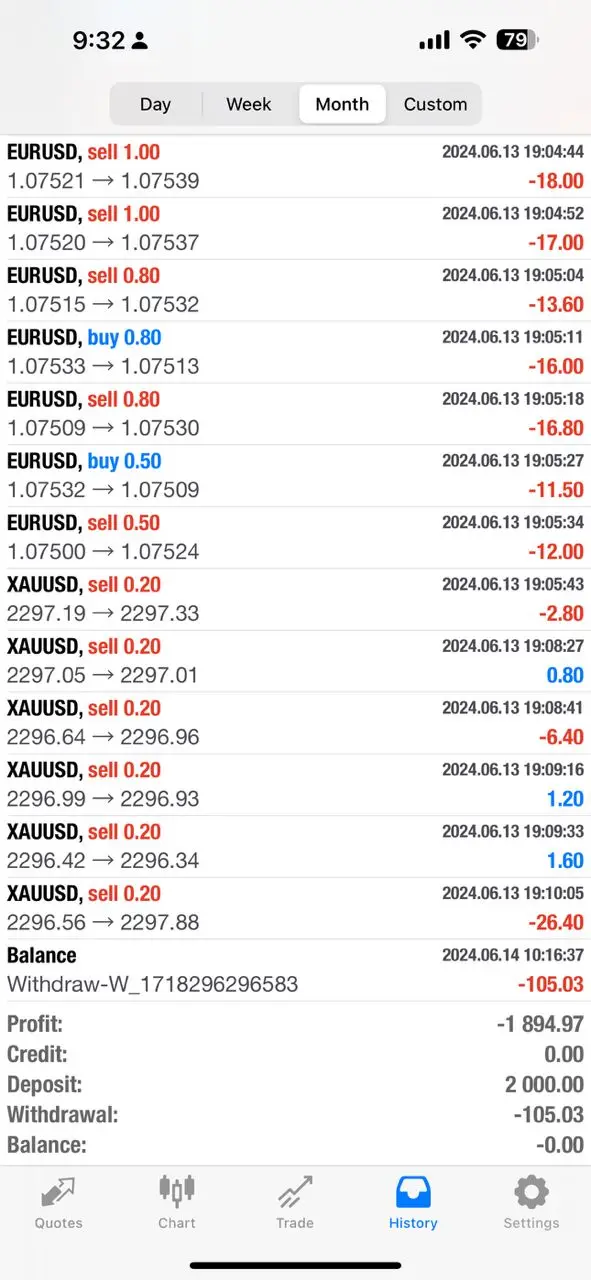

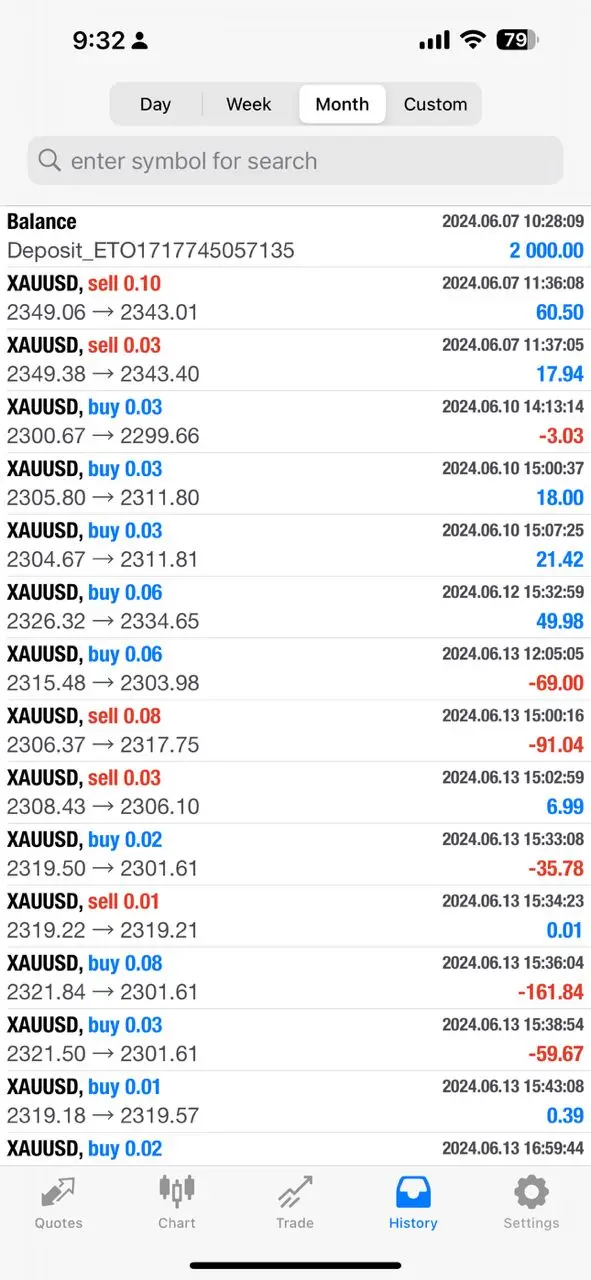

Everyone must be alert for this issue which I had voice out my problem to this platform company regarding my money why suddenly cant log in and my money inside all gone within no more than 10 minutes. I try call the manager who ask me to use this platform and put in money 2k USD. Everyone must be alert and becareful for this so called K teacher (+85268271986) he is the manager ask me using this platform.They not even settle my problem and ask me put in money again to this platform and help me trade and win back the money . Everyone must becareful to avoid same thing happen to you guys.

Exposure

Kikoyo

New Zealand

I was intrigued by ETO Markets due to its variety of trading options and easy-to-use platforms. Starting with just $100 and the assurance of ASIC regulation felt reassuring.

Positive

Huikn

Argentina

They offer cTrader and a great selection of Forex trading pairs. It is one of my favorite brokers to date. The only issue I have is with their German entity. According to local laws they debit 26% of profits in withholding tax after each winning transaction but do NOT refund that amount when you have losing transactions. That results in way too much money being deducted at the end of each month. The only way to get those funds back is by filing a tax return.

Neutral

sjiajaks

Malaysia

An unscrupulous platform tries to induce consumers to continue depositing money.

Exposure

FX2508073351

United States

They maliciously liquidated my account and refused to compensate me. This is a black platform. The quotation that mt4 does not have, their platform manually pulled the K line to liquidate my account, and they did not compensate me.

Exposure

Yogesh9711

India

I have been trading on this platform since 3 months and it gives me satisfaction in return and I want to continue trade with this platform.

Positive

Hugo Victor Garcia Andrade

Mexico

I hope so too, so let's see what happens, greetings from Mexico

Positive

A039900

Peru

I have been trading with this company for 5 months now and I am satisfied so far and will continue to trade at least. I can trade the financial instruments I like! I like its leverage, up to 1:400, which allows me to trade more positions. Also, the various educational resources they provided helped me a lot as well.

Positive