Company Summary

| Bank of China Limited London Branch Review Summary | |

| Founded | 2001 |

| Registered Country | United Kingdom |

| Regulation | Regulated (FCA) |

| Services | Corporate Loans, Deposits, Trade Services, RMB Services, Treasury & FX |

| Demo Account | ❌ |

| Minimum Deposit | Depends on product |

| Customer Support | Email: jon.sartoris@uk.bankofchina.com |

| Address: 1 Lothbury, London, EC2R 7DB, United Kingdom | |

Bank of China Limited London Branch Information

The Bank of China Limited London Branch is one of the most important branches of the Chinese state-owned banking organization that is located outside of China. It has been doing business in the UK since 2001 and offers a full range of financial services, including trade finance, corporate loan, RMB settlement, and foreign currency solutions for both businesses and individuals.

Pros & Cons

| Pros | Cons |

| FCA regulated since 2001 | No demo account |

| Offers corporate FX and RMB cross-border services | |

| Four types of accounts |

Is Bank of China Limited London Branch Legit?

Yes. Bank of China Limited London Branch is officially regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

| Regulatory Status | Regulated |

| Regulated By | United Kingdom (FCA) |

| License Type | Market Maker (MM) |

| Licensed Institution | Bank of China Limited London Branch |

| License Number | 170910 |

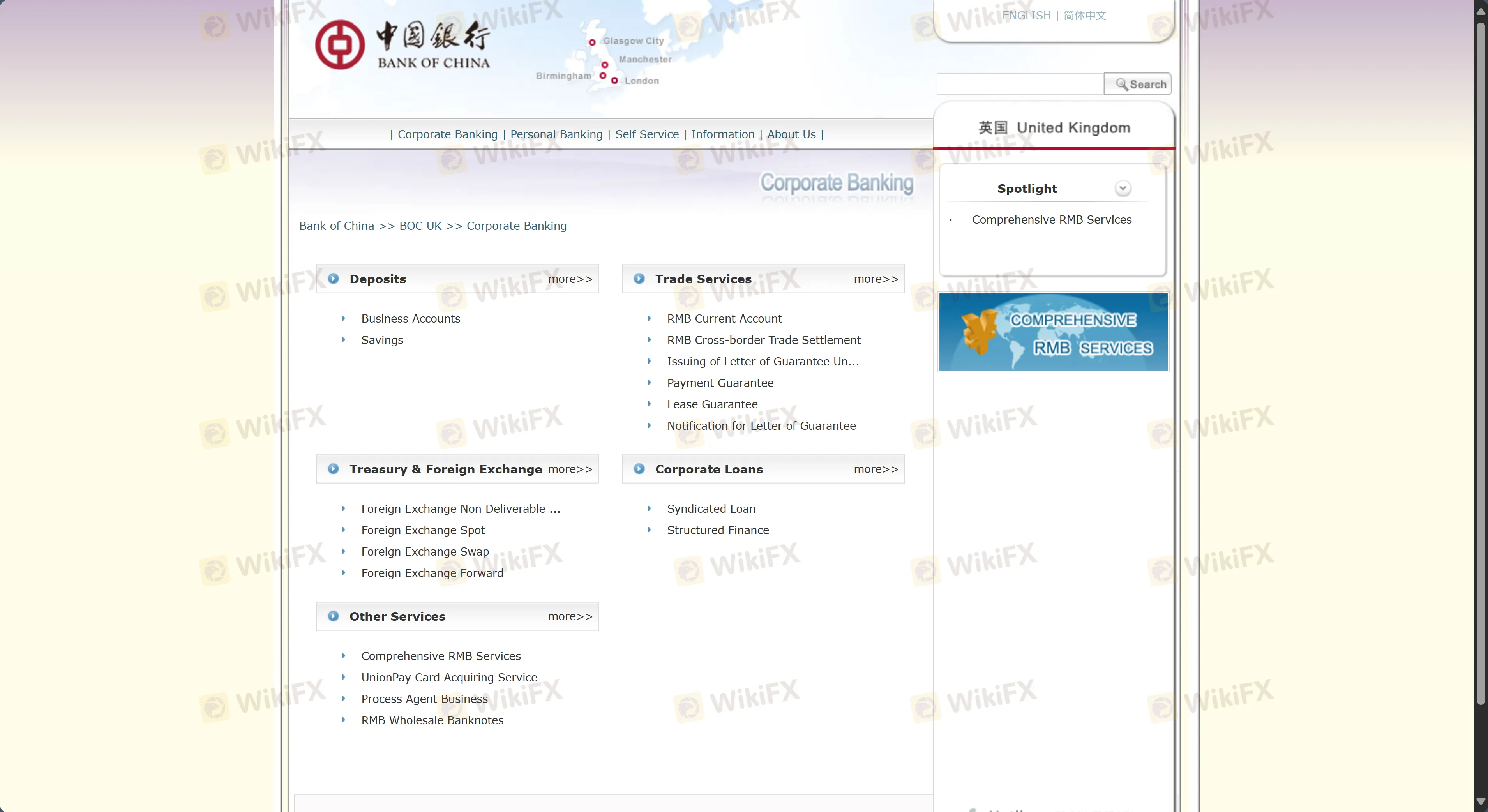

Bank of China London Branch Services

| Service Category | Available |

| Corporate Banking | ✔ |

| Personal Banking | ✔ |

| RMB Services | ✔ |

| Trade Services | ✔ |

| Mortgages | ✔ |

Account Types

| Type | Eligibility | Key Features |

| Business Account | UK & overseas companies | Multi-currency, internet banking, credit card, no cash withdrawal fee |

| RMB Corporate Account | Import/export enterprises | RMB settlement, FX conversion, no interest, for trade-related transactions |

| Personal Account | UK residents (16+, 18+ for debit) | No fees, UK-wide ATM access, online banking, standing orders |

| Student Prime Account | Students with UK university offer | Opened pre-arrival, debit card, no fees, international remittance support |

Fees

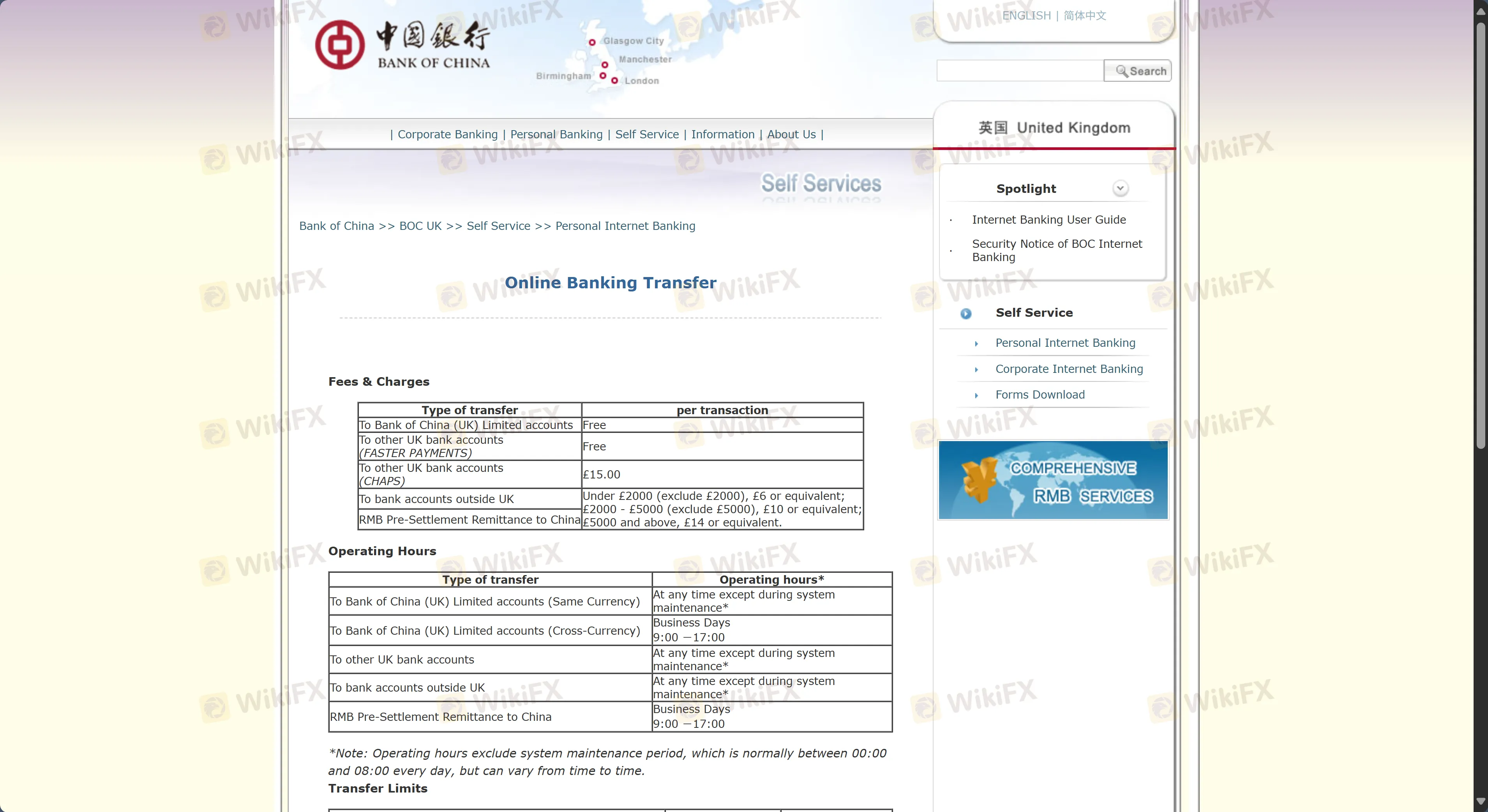

Bank of China (UK) publishes a detailed transaction fee. Trading spreads/commissions are not relevant due to the lack of retail trading.

| Type of Transfer | Fee per Transaction |

| To BOC (UK) accounts | Free |

| To other UK bank accounts (Faster Payments) | Free |

| To other UK bank accounts (CHAPS) | £15 |

| To bank accounts outside the UK | £6 (<£2,000)£10 (£2k–5k)£14 (≥£5,000) |

When you send money across borders, the exchange rate changes all the time. The exchange rate is validated when the final transfer order is given.

Deposit and Withdrawal

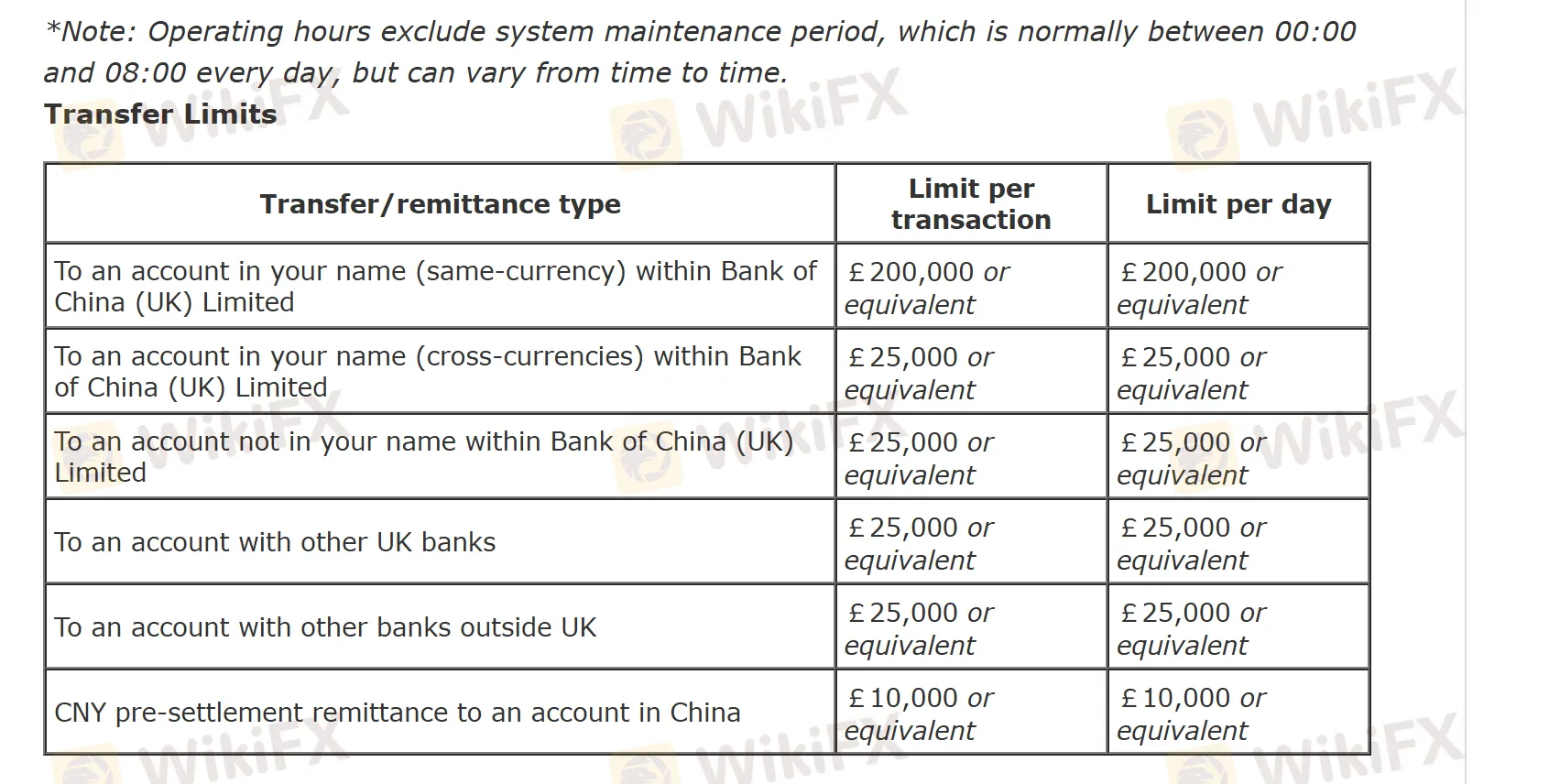

As a traditional bank, deposit/withdrawal options apply to bank accounts, not trading accounts. Here's the transfer limit.

| Transfer Type | Limit per Day |

| Same-currency within BOC (UK) | £200,000 |

| Cross-currency within BOC (UK) | £25,000 |

| To other UK banks | £25,000 |

| To overseas banks | £25,000 |

| RMB Remittance to China | £10,000 |