Company Summary

| Aspect | Information |

| Company Name | FXTime |

| Registered Country/Area | Cyprus |

| Founded year | 2022 |

| Regulation | CySEC, FCA, FSCA |

| Market Instruments | Forex, Commodities, Shares, Indices, Digital Coins |

| Account Types | Basic, Standard, Premium |

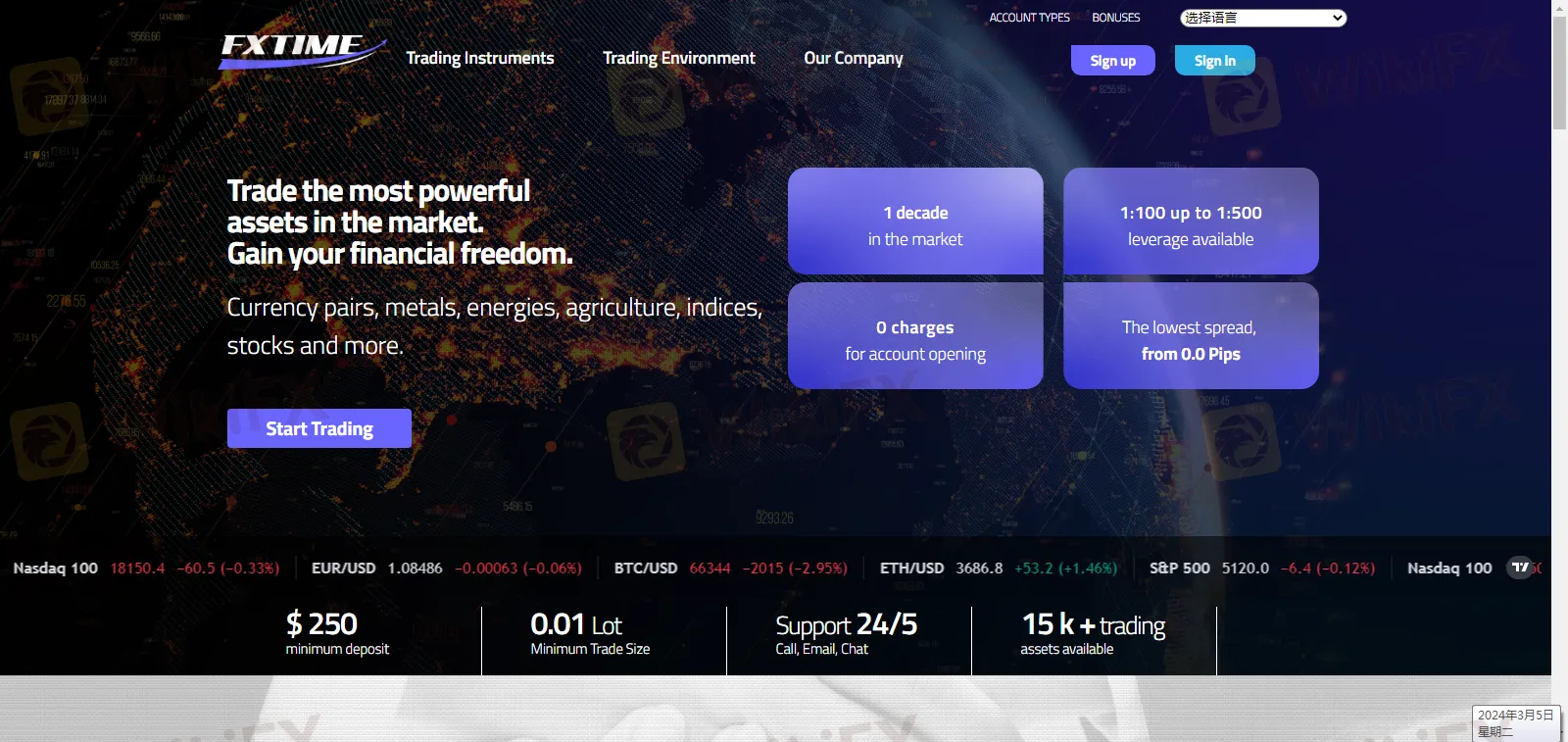

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Trading Platforms | Fx Time Webtrader |

| Demo Account | Available |

| Customer Support | 24/5 support via phone, email, and live chat |

| Deposit & Withdrawal | Various payment methods, minimal fees |

| Educational Resources | Articles, tutorials, demo accounts |

Overview of FXTIME

FXTime is a trading platform offering a diverse array of financial instruments satisfying various investment interests. Despite regulatory concerns, it is regulated by prominent authorities like CySEC, FCA, and FSCA. Offering multiple account types with varying minimum deposits, it provides traders access to a wide range of assets including forex, commodities, shares, indices, and digital coins. The platform's Fx Time Webtrader facilitates trading with advanced features and technical analysis tools. FXTime emphasizes customer support, offering assistance 24/5 via phone, email, and live chat. Educational resources are also provided, including articles, tutorials, and demo accounts, aimed at empowering traders of all levels.

Pros and Cons

| Pros | Cons |

| Diverse range of financial instruments | Regulatory concerns |

| Access to multiple account types | Minimum deposit requirements |

| Advanced trading platform | Potential withdrawal fees |

| Competitive spreads and commissions |

Pros:

Diverse range of financial instruments: FXTime offers a wide variety of trading products, including forex, commodities, shares, indices, and digital coins. This diversity allows traders to explore different markets and diversify their investment portfolios.

Access to multiple account types: FXTime provides various account types tailored to suit different trading preferences and experience levels. This flexibility enables traders to choose an account type that aligns with their specific needs and objectives.

Advanced trading platform: The Fx Time Webtrader platform offers advanced features and technical analysis tools, providing traders with a sophisticated trading experience. It is available for both desktop and mobile devices, allowing for trading on the go.

Competitive spreads and commissions: FXTime offers competitive spreads and commissions, helping to minimize trading costs for its users. Tight spreads and transparent commission structures contribute to a cost-effective trading environment.

Cons:

Regulatory concerns: FXTime has raised regulatory concerns, with its status labeled as “Suspicious Clone” by regulatory authorities. This raises questions about the platform's legitimacy and regulatory compliance.

Minimum deposit requirements: While FXTime offers a range of account types, some traders find the minimum deposit requirements prohibitive. Higher-tier accounts require substantial initial deposits, limiting accessibility for traders with smaller budgets.

Potential withdrawal fees: While FXTime imposes minimal charges associated with deposits, traders should be aware that withdrawal fees apply. Depending on the withdrawal method selected, traders incur additional fees, impacting their overall trading costs.

Regulatory Status

FXTime is regulated by several prominent financial regulatory authorities, which ensures adherence to stringent standards and safeguards the interests of traders. The company holds licenses from the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the United Kingdom, and the Financial Sector Conduct Authority (FSCA) in South Africa.

Under the jurisdiction of CySEC, FXTime operates with the license number 185/12. However, its current status is labeled as “Suspicious Clone,” indicating potential concerns about its legitimacy. The license type granted by CySEC is Market Making (MM), signifying the company's involvement in providing liquidity to the market.

In the United Kingdom, FXTime is regulated by the Financial Conduct Authority (FCA), holding two separate licenses. The first license type is Straight Through Processing (STP), providing assurance of transparent and direct trade execution. The second license type, known as European Authorized Representative (EEA), enables FXTime to conduct regulated activities within the European Economic Area (EEA). However, similar to CySEC, its status is classified as “Suspicious Clone.”

Furthermore, FXTime is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, operating under the license type of Financial Service Corporate. This license authorizes the company to offer financial services within the jurisdiction of South Africa, ensuring compliance with local regulations.

While FXTime maintains regulatory oversight from these reputable authorities, the designation of “Suspicious Clone” raises questions regarding its legitimacy.

Market Instruments

FXTime offers a comprehensive array of trading products designed to diverse investment interests.

For Forex enthusiasts, the platform provides access to over 50 currency pairs, allowing users to engage in the dynamic and highly liquid foreign exchange market with ease. With competitive starting rates as low as 0.1 pips, traders can capitalize on even the smallest market movements.

Those interested in commodities can leverage FXTime's extensive offerings, which include gold, silver, crude oil, and agricultural products like corn, coffee, and rice. Whether through betting commodity trading or CFD commodity trading, investors have the flexibility to pursue their strategies effectively.

Moreover, the platform facilitates shares trading, providing access to publicly traded companies, allowing investors to gauge and capitalize on a company's valuation. For those interested in broader market trends, FXTime offers indices trading, enabling users to tap into a diverse range of global opportunities.

Additionally, the platform satisfies the growing popularity of digital money trading, offering a experience without the need for external wallets or exchanges. With its user-friendly interface and diverse range of offerings, FXTime empowers traders to explore various markets and seize lucrative opportunities, making trading accessible and rewarding.

Account Types

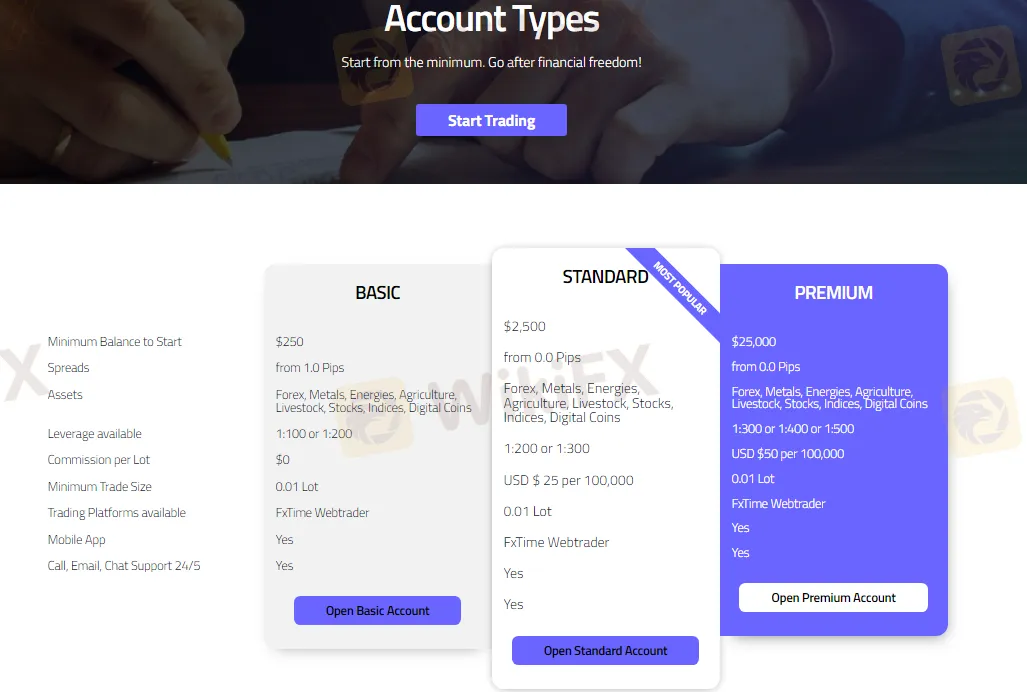

FXTime offers a range of account types tailored to suit varying trading preferences and experience levels, each designed to accommodate different financial thresholds and objectives.

The BASIC account provides a straightforward entry point into trading with a minimum balance of $250. With spreads starting from 1.0 pips, traders have access to a diverse selection of assets including Forex, Metals, Energies, Agriculture, Livestock, Stocks, Indices, and Digital Coins. Leverage options of 1:100 or 1:200 enhance trading capabilities, while commission-free trading and a minimum trade size of 0.01 Lot offer flexibility. The account is supported by the FxTime Webtrader platform, accessible via desktop or mobile app, with round-the-clock customer support via call, email, or chat.

For those seeking enhanced features and trading conditions,

The STANDARD account requires a minimum balance of $2,500. Offering tighter spreads starting from 0.0 pips, traders can access the same array of assets with leverage options of 1:200 or 1:300. While commission charges of USD $25 per 100,000 traded apply, the minimum trade size remains at 0.01 Lot. Like the BASIC account, the STANDARD account is supported by the FxTime Webtrader platform and offers 24/5 customer support.

The PREMIUM account, deemed the most popular choice, satisfies seasoned traders and requires a minimum balance of $25,000. With spreads also starting from 0.0 pips, traders benefit from increased leverage options of 1:300, 1:400, or 1:500. While a higher commission of USD $50 per 100,000 traded applies, the account maintains the same minimum trade size of 0.01 Lot. As with the other account types, the PREMIUM account leverages the FxTime Webtrader platform and provides access to round-the-clock customer support.

How to Open an Account?

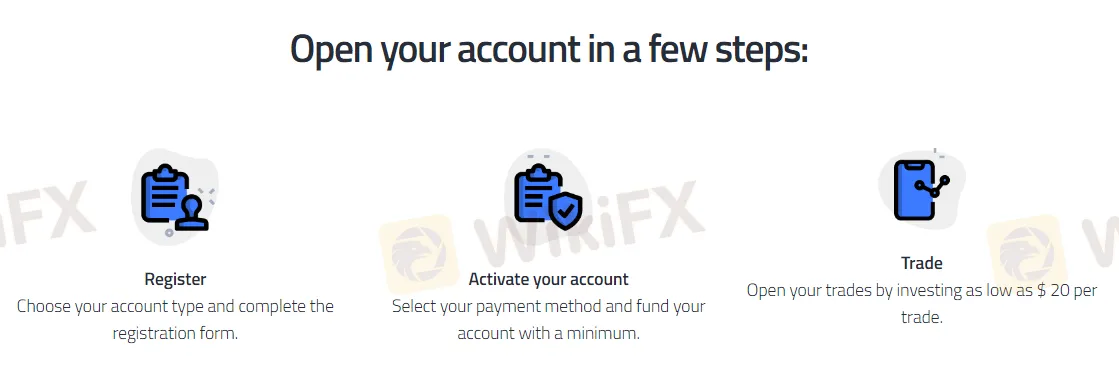

To open an account with FXTime, it only needs three steps:

Register: Begin by selecting your desired account type and completing the registration form with your personal details.

Activate your account: Choose your preferred payment method and fund your account with the minimum required amount to activate it.

Trade: Start trading by opening positions with as little as $20 per trade, utilizing the funds in your FXTime account.

Spreads & Commissions

FXTime offers competitive spreads and commissions to ensure transparent and cost-effective trading experiences for its users.

Spreads refer to the difference between the buying and selling prices of a financial instrument, and FXTime offers tight spreads across its various asset classes, starting from as low as 0.0 pips depending on the account type and market conditions.

Commissions are charged on certain account types and vary accordingly, typically ranging from zero commissions on basic accounts to a fixed amount per 100,000 traded on higher-tier accounts. These spreads and commissions are designed to provide traders with clear pricing structures and minimize trading costs, enabling them to optimize their trading strategies and potentially maximize their profits.

| Account Type | Spreads | Commission per 100,000 traded |

| BASIC | From 1.0 pips | $0 |

| STANDARD | From 0.0 pips | $25 |

| PREMIUM | From 0.0 pips | $50 |

Leverage

FXTime offers maximum leverage options that vary depending on the account type chosen by the trader.

The maximum leverage available ranges from 1:100 to 1:500, with different tiers of leverage offered across the BASIC, STANDARD, and PREMIUM account types. For example, the BASIC account typically provides leverage options of 1:100 or 1:200, while the PREMIUM account offers higher leverage options of 1:300, 1:400, or 1:500. Leverage allows traders to control larger positions with a relatively small amount of capital, amplifying both potential profits and losses.

However, it's crucial for traders to understand and manage the risks associated with leverage effectively. FXTime provides varying levels of leverage to accommodate different trading styles and risk appetites, empowering traders to choose the level of leverage that aligns with their strategies and objectives.

| Account Type | Maximum Leverage |

| BASIC | 1:100 or 1:200 |

| STANDARD | 1:200 or 1:300 |

| PREMIUM | 1:300, 1:400, or 1:500 |

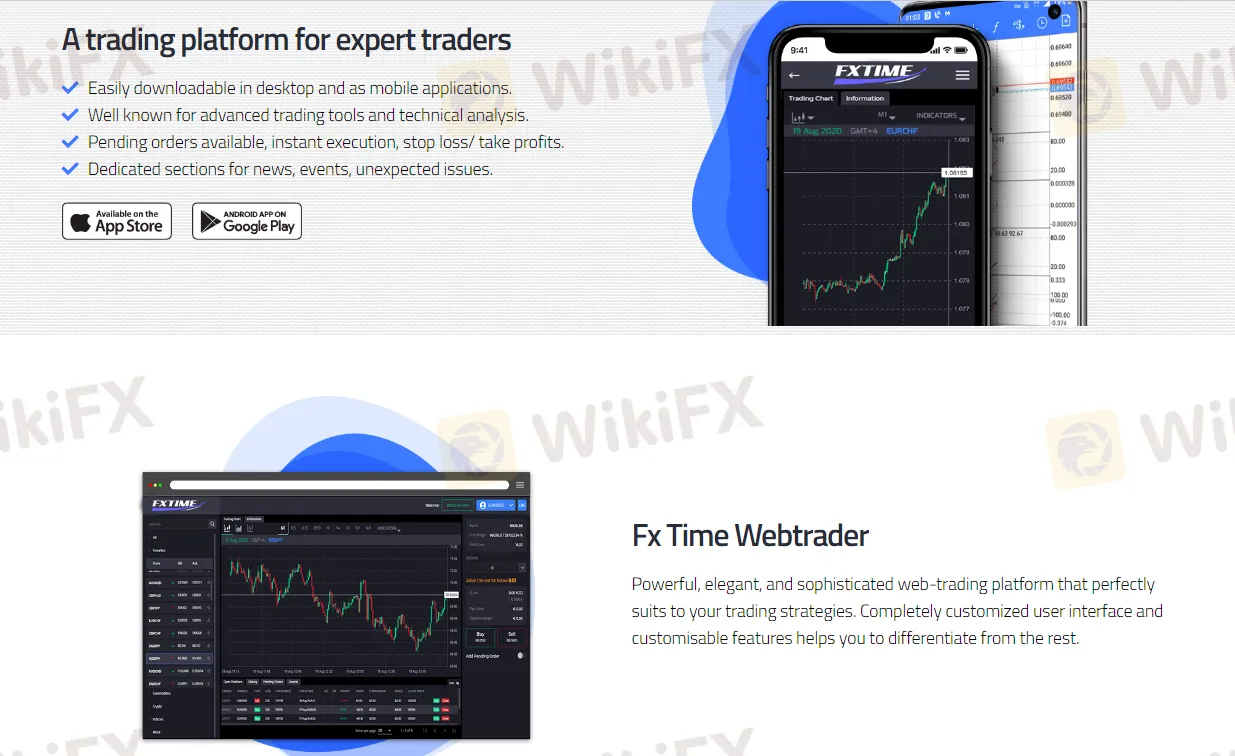

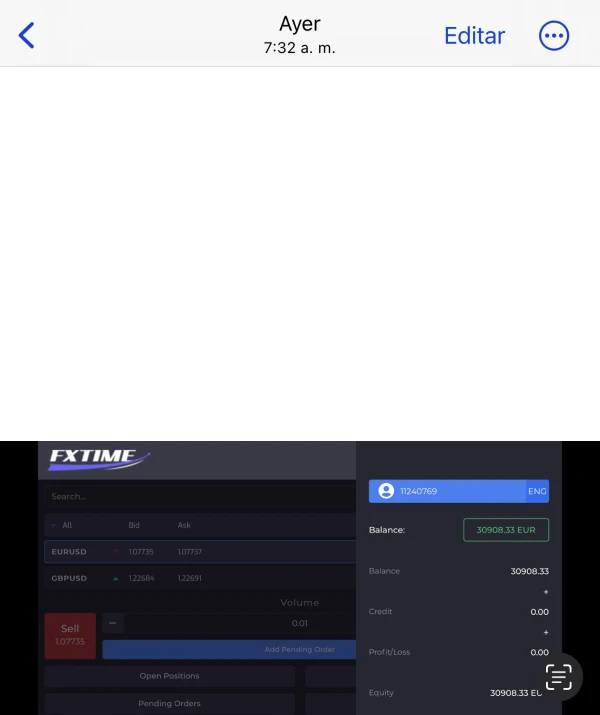

Trading Platform

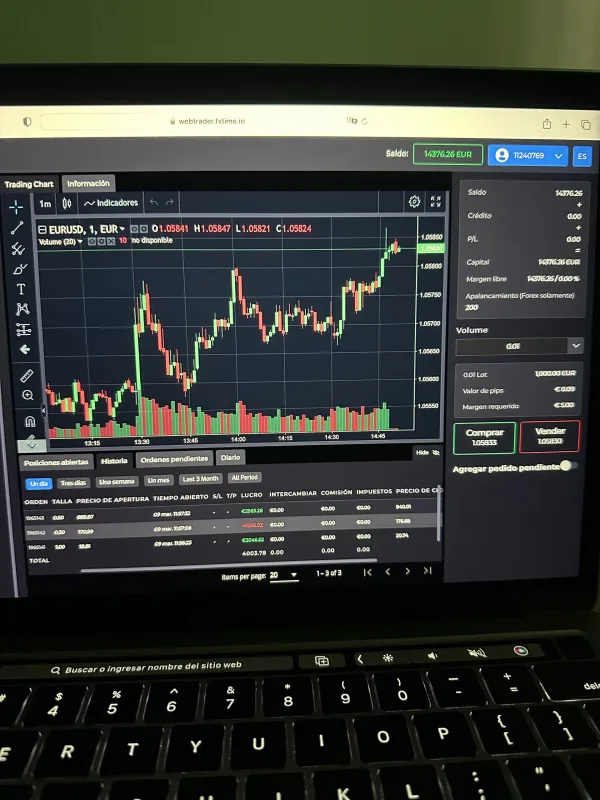

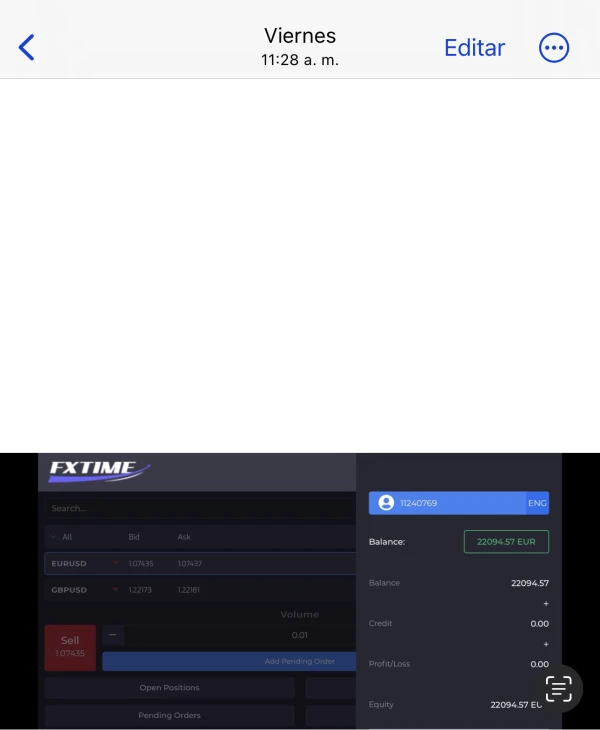

FXTime's trading platform, known as the Fx Time Webtrader, is tailored for expert traders seeking advanced features and technical analysis tools.

Available for both desktop and mobile devices, it offers accessibility, allowing traders to stay connected and execute trades on the go. The platform is renowned for its comprehensive set of trading tools and advanced charting capabilities, empowering users to conduct in-depth technical analysis and make informed trading decisions. With features such as pending orders, instant execution, and options for setting stop loss and taking profit levels, traders have full control over their positions and risk management strategies.

Additionally, the platform includes dedicated sections for news, events, and unexpected market developments, ensuring traders stay informed and react swiftly to market changes. The Fx Time Webtrader's powerful and elegant interface, coupled with its customizable features, provides traders with a sophisticated trading experience tailored to their individual strategies and preferences.

Deposit & Withdrawal

FXTime offers a range of convenient payment methods to facilitate deposits and withdrawals for its traders. Traders can fund their accounts using various payment options such as bank transfers, credit/debit cards, and popular e-wallets like PayPal or Skrill. These payment methods provide flexibility and convenience, allowing traders to choose the option that best suits their preferences and requirements.

In terms of fees, FXTime imposes minimal charges associated with deposits and withdrawals. Typically, deposits are free of charge, meaning traders can fund their accounts without incurring any additional fees. However, it's essential to note that fees are levied by the payment service provider, such as banks or e-wallets, depending on the chosen method.

For withdrawals, the specific withdrawal fees vary depending on the withdrawal method selected by the trader. Bank transfers, for instance, incur a fixed fee or a percentage-based fee, while withdrawals through e-wallets could have different fee structures.

Furthermore, the minimum deposit required to start trading with FXTime is $250, providing accessibility for traders with varying budget sizes.

Customer Support

FXTime prioritizes the provision of comprehensive and accessible customer support services, ensuring traders receive assistance whenever needed.

With support available 24/5, traders can rely on FXTime's dedicated team to address inquiries and resolve issues promptly. The support channels offered include direct phone assistance, where traders can reach out to the support team by calling +41445514229. Additionally, traders can also contact the support team via email at support@fxtime.io, providing an alternative communication avenue for queries and concerns. Furthermore, FXTime offers live chat support, enabling traders to engage in real-time conversations with knowledgeable representatives for immediate assistance.

With multiple support channels available and a commitment to responsiveness, FXTime endeavors to deliver a supportive trading experience for its users.

Educational Resources

FXTime provides a robust array of educational resources designed to empower traders with the knowledge and skills needed to succeed in the financial markets. These resources satisfy traders of all experience levels, from beginners to seasoned professionals. The educational materials cover a wide range of topics, including basic concepts of trading, technical and fundamental analysis, risk management strategies, and advanced trading techniques.

One of the key educational offerings is comprehensive articles and tutorials accessible through the FXTime website and trading platform. These resources delve into various aspects of trading, providing valuable insights and practical guidance to help traders navigate the complexities of the markets effectively.

Moreover, FXTime offers demo accounts, allowing traders to practice trading strategies in a risk-free environment using virtual funds. This hands-on approach enables traders to gain practical experience and confidence before transitioning to live trading.

Overall, FXTime's educational resources aim to equip traders with the knowledge, skills, and confidence needed to make informed trading decisions and achieve their financial goals. By providing a comprehensive and accessible learning environment, FXTime demonstrates its commitment to supporting the growth and success of its traders.

Conclusion

In conclusion, FXTime offers a diverse range of financial instruments and account types tailored to accommodate various trading preferences. Despite regulatory concerns labeled as “Suspicious Clone” by authorities like CySEC and FCA, FXTime provides competitive spreads, advanced trading platforms, and comprehensive customer support. However, minimum deposit requirements and potential withdrawal fees pose challenges for some traders. Nevertheless, with its emphasis on education and accessibility, FXTime aims to empower traders with the knowledge and resources needed to navigate the financial markets effectively.

FAQs

Q: What types of financial instruments can I trade on FXTime?

A: FXTime offers a wide variety of trading products, including currencies, commodities, stocks, indices, and digital assets.

Q: Is FXTime regulated by any financial authorities?

A: Yes, FXTime is regulated by prominent regulatory bodies such as CySEC, FCA, and FSCA, ensuring compliance with stringent standards and safeguards for traders.

Q: What account types does FXTime offer?

A: FXTime provides multiple account options tailored to suit different trading preferences and experience levels, each with varying minimum deposit requirements and features.

Q: How can I contact customer support at FXTime?

A: You can reach FXTime's customer support team 24/5 via phone, email, or live chat, providing assistance with inquiries and issue resolution.

Q: Does FXTime offer educational resources for traders?

A: Yes, FXTime provides a range of educational materials, including articles, tutorials, and demo accounts, designed to empower traders with the knowledge and skills needed for successful trading.

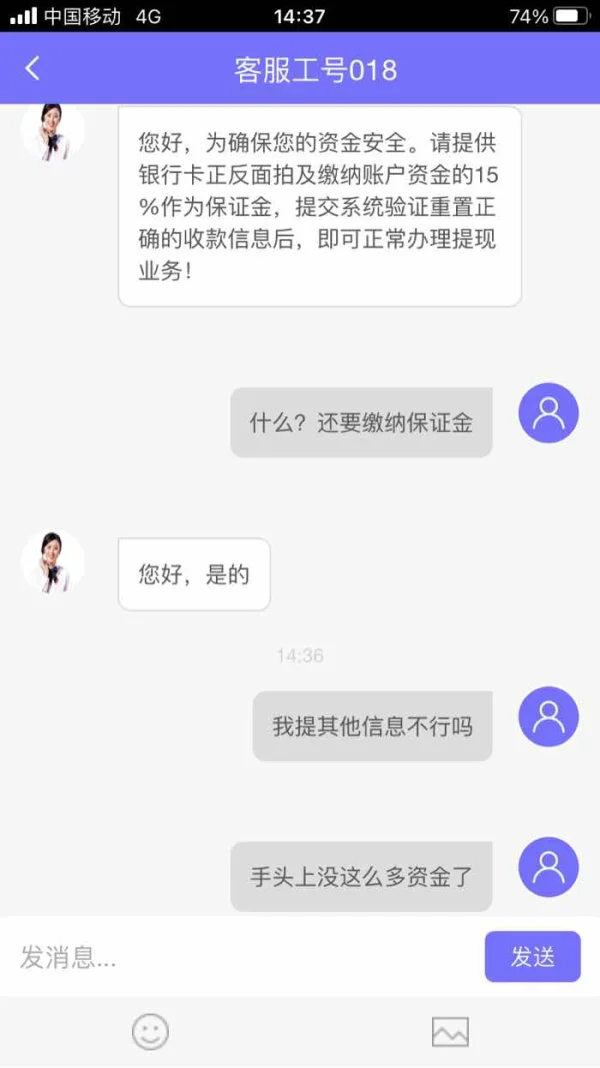

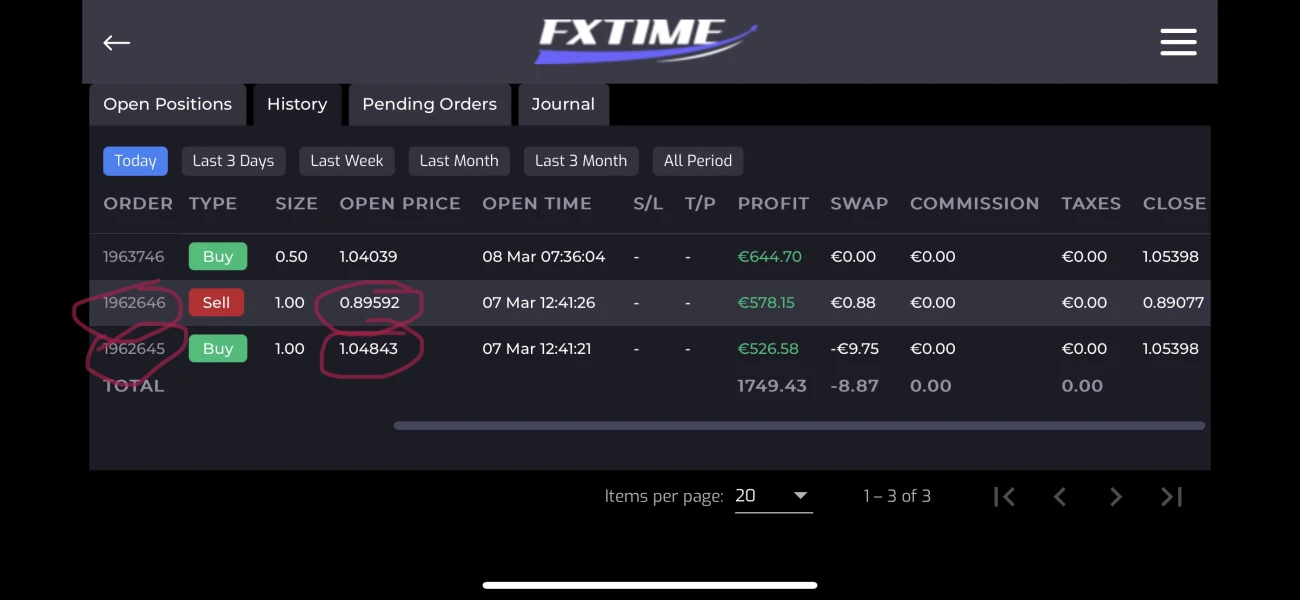

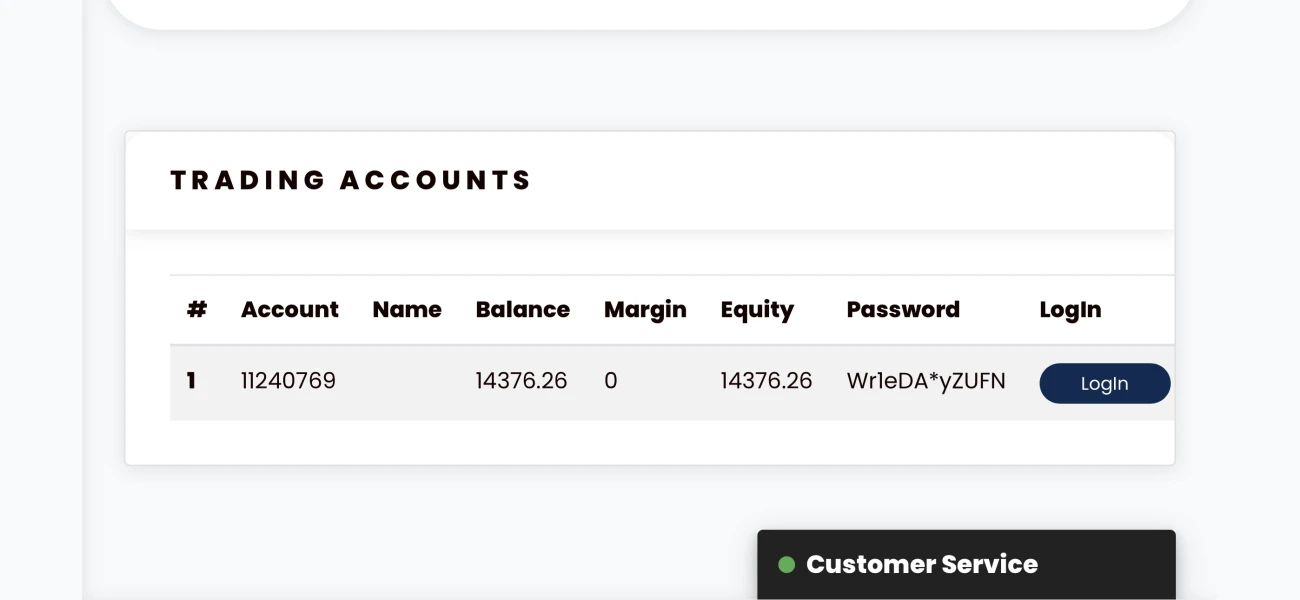

小沫

Hong Kong

15% margin is required for wrong opening bank. But I am afraid if I pay the money, some other problems will occur. I’ve deposited 114,000

Exposure

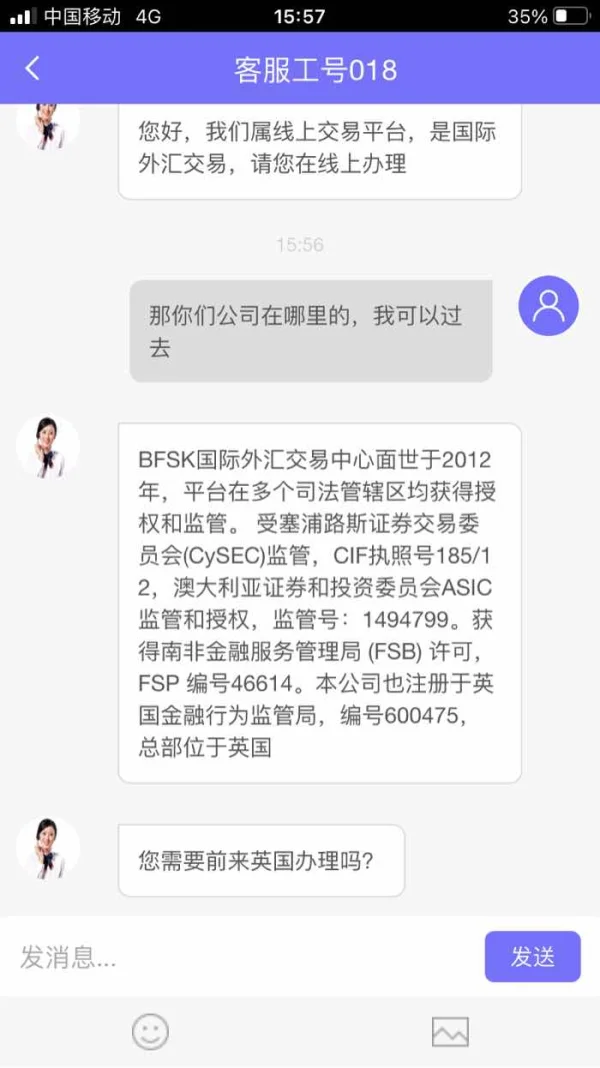

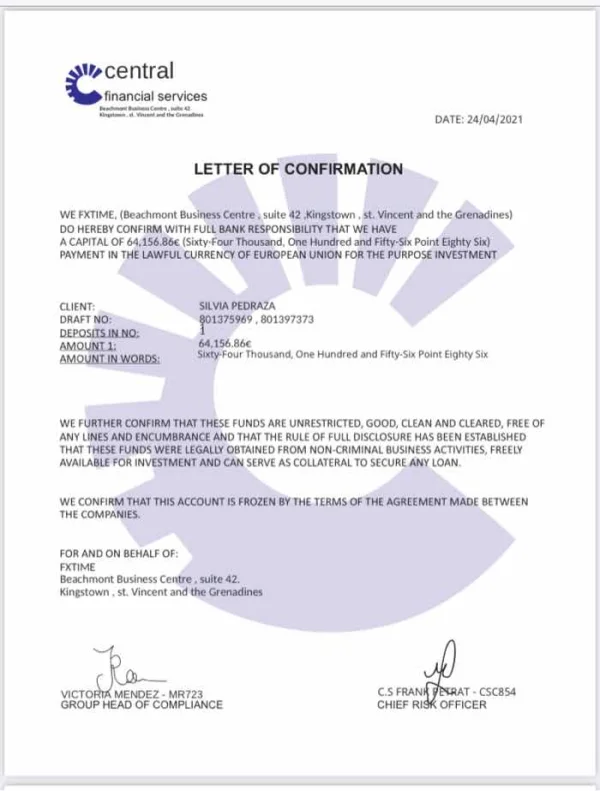

FX3252560841

United Kingdom

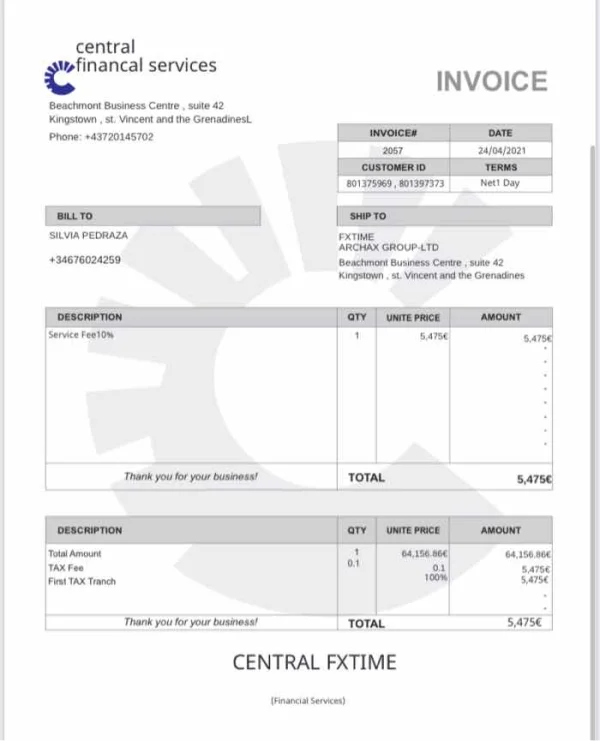

Apparently, a person from this company called me and told me that they are changing the company from UK to Austria and they have to liquidate all the account. We have to pay 10% fee to unfreeze our account. They sent us the following letter that I attach here. I only have 615€ but my friend has 64000€ and she has to pay more than 5000€ in advance to withdraw her money. According to the letter they are called ANTRAX GROUP, but instead of London, they are based in Saint Vicent and Granadinas. SCAM

Exposure

D329

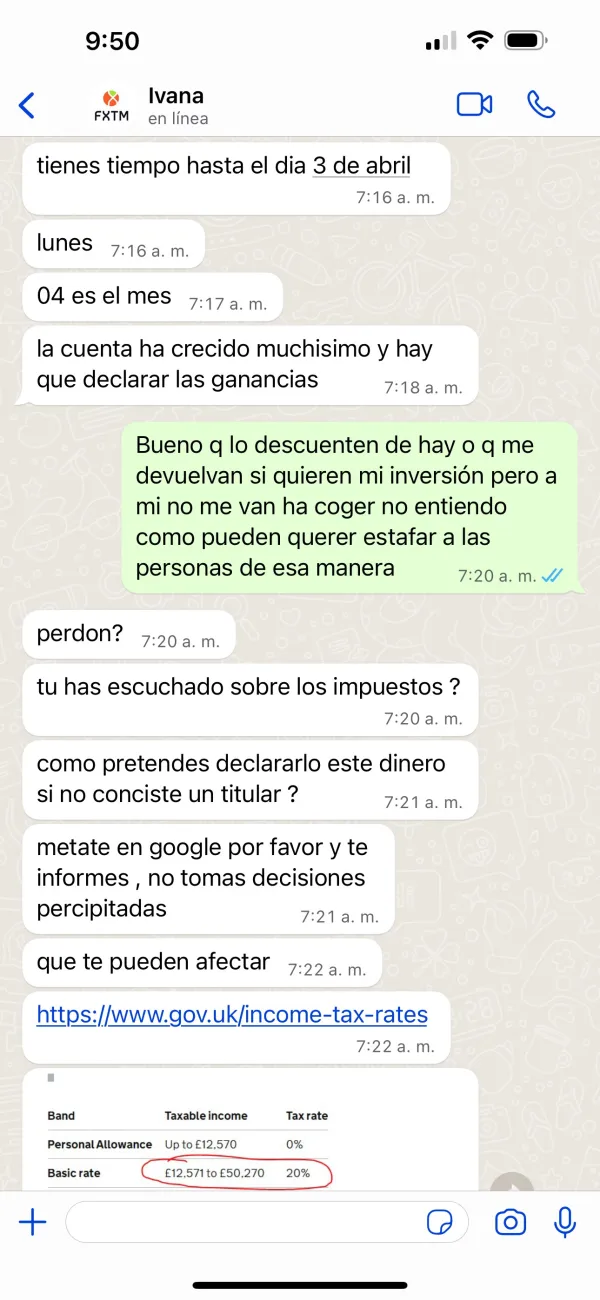

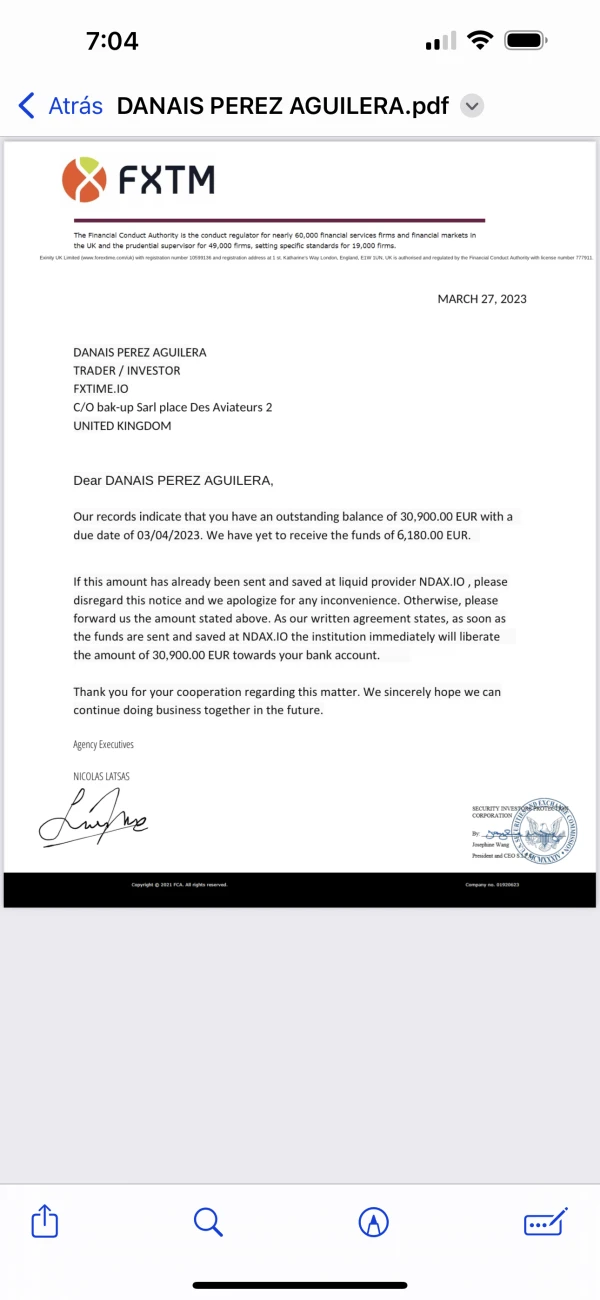

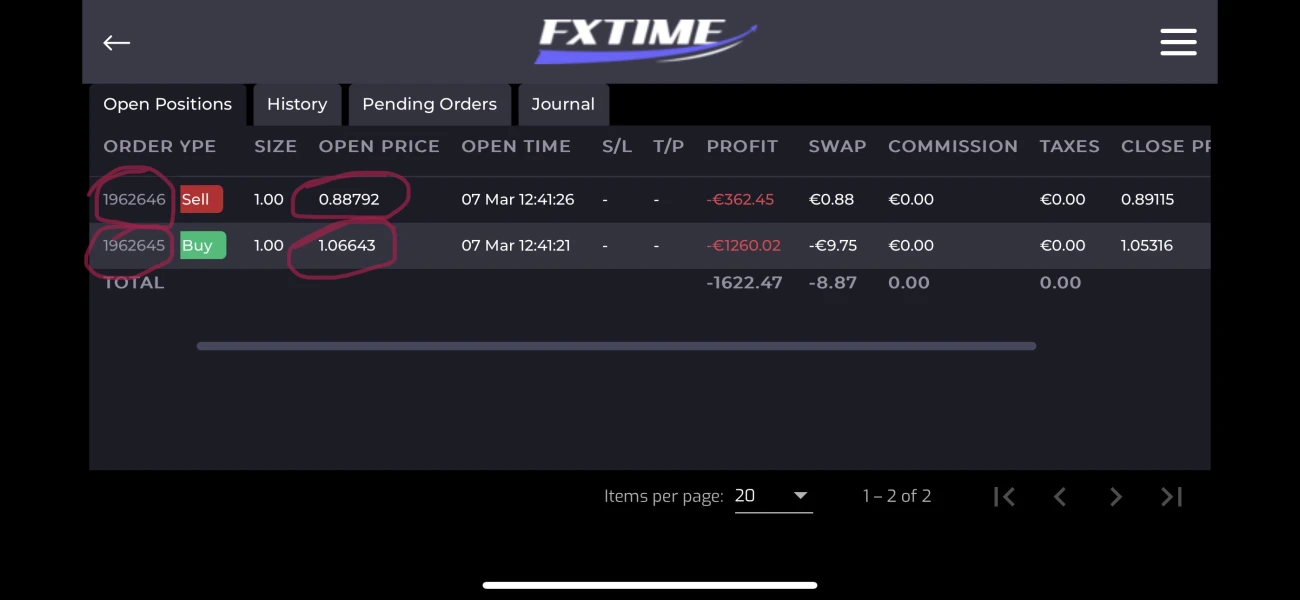

Canada

when they contacted me they told me that i could start with 430 canadians and that i had a trial week so that later if i saw good profits i would continue investing and likewise it was a week there were half by half profits and i reinvested 2500 canadians and the profits continued and the broker called ivana and this is her phone number told me that she had a good project and that i had to invest 10,000 euros but i didn't have them. the only thing i could get from a bank card was 5,000 canadian and we deposited it, i told her. that for that money i had to pay a monthly interest of 600 canadian dollars and he told me that we could take it out that it was not a problem but later i found out about this page and i realized that this company FXTIME it is not regulated and the brokers showed me the data of this other company called fxtm to which i wrote and they told me that they had nothing to do with FXTIME so i paid more attention to the operations that the brokers were doing and i realized that they were moving the graph in profit since i was getting very good profits. to close the account and withdraw all the money and i told her that it was fine that she was going to withdraw everything and close the account but she sent me a document that says that i have to deposit 6180 euros of taxes before april 4, 2023 and if i don't deposit them i lose all my money that there are already 30,900 euros but i know that if i deposit they will scam me and i'm afraid since i have 7,930 canadian invested and i owe money to the bank and i don't even have enough to pay the interest for please, i am writing to you to see if you can help me to recover the money and so that people are careful when they are going to invest, that they inform themselves first so that this does not happen to them.

Exposure

黄玫

Venezuela

This company does not provide online chat service, only contact by email or phone, which gives me the feeling that it is relatively inefficient.

Neutral

Liz

Venezuela

Awful, this company claims to have multiple regulatory licences, but wikifx info shows that none of them are valid... mostly cloned licences. Other language content on the page is provided by Google Translate, and some parts don't make any sense.

Neutral