Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | BISON PRIME |

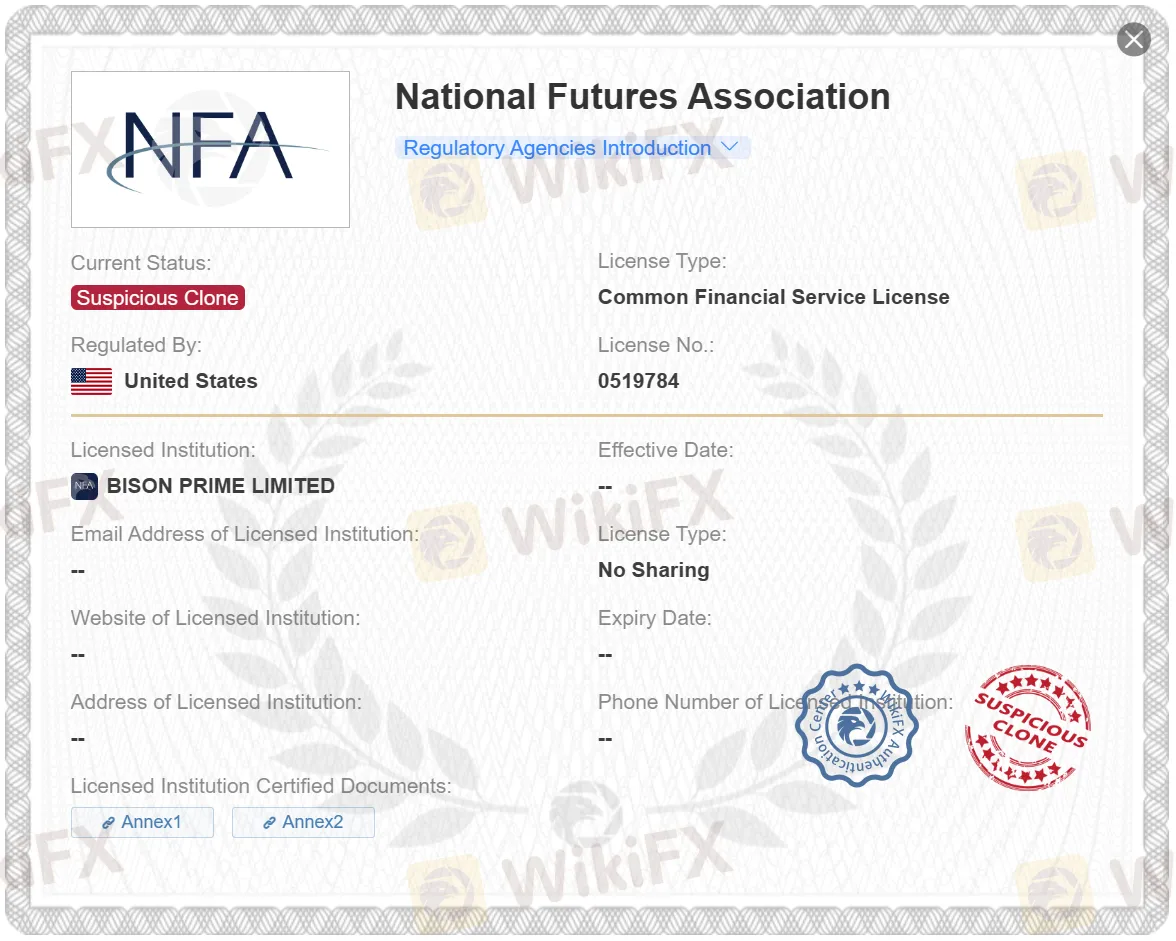

| Regulation | Currently not regulated; claims to be NFA-regulated, identified as a cloned broker |

| Minimum Deposit | Varies by account type; details not specified |

| Maximum Leverage | Varies by account type; details not specified |

| Spreads | Competitive spreads on major cryptocurrencies |

| Trading Platforms | MetaTrader 4 (MT4), WebTrader |

| Tradable Assets | Spot, Futures, Options, Swaps |

| Account Types | Individual, Institutional, Corporate, Professional, Government |

| Customer Support | None |

| Payment Methods | Wire transfer, ACH transfer, Cryptocurrency |

| Educational Tools | Trading tutorials, Webinars, Ebooks, Glossary, FAQ section, Demo account |

Overview of BISON PRIME

BISON PRIME is a trading platform that offers a variety of features catering to traders' diverse needs. However, crucial details such as the registered country, founding year, and specific regulatory status remain unspecified. The platform claims affiliation with the National Futures Association (NFA) but is identified as a cloned broker, raising concerns about its legitimacy.

The minimum deposit and maximum leverage vary across account types, and detailed information is not provided. BISON PRIME boasts competitive spreads, particularly on major cryptocurrencies, making it an attractive option for cost-conscious traders.

Traders can access the markets through the popular MetaTrader 4 (MT4) platform and WebTrader. The platform supports a range of trading instruments, including Spot, Futures, Options, and Swaps, providing flexibility for various trading strategies.

BISON PRIME offers five account types—Individual, Institutional, Corporate, Professional, and Government—tailored to different trading preferences. Unfortunately, information about demo accounts and Islamic accounts is not available.

Customer support is available 24/5 through Live Chat, Email, Phone, and Social Media channels. Additionally, the platform provides educational resources such as trading tutorials, webinars, ebooks, a glossary, and a FAQ section. Notably, a demo account is offered, allowing users to practice trading without risking real funds.

Payment methods include wire transfer, ACH transfer, and cryptocurrency deposits, offering users flexibility in funding their accounts. However, it is essential for traders to exercise caution due to the lack of authentic regulatory oversight.

In conclusion, while BISON PRIME presents competitive features, potential users should carefully weigh the platform's advantages against the risks associated with its regulatory ambiguity and cloned status. As with any trading platform, thorough research and consideration of individual needs are crucial before engaging with BISON PRIME.

Is BISON PRIME legit or a scam?

BISON PRIME's regulatory status raises notable concerns, as the platform currently operates without any valid regulation. Despite the broker's claim to be regulated by the National Futures Association (NFA), it is crucial to highlight that evidence suggests it is a cloned entity. The absence of genuine regulatory oversight poses significant risks for investors, as regulatory bodies play a pivotal role in ensuring fair practices, security, and transparency within the financial industry.

Regulation by reputable authorities provides users with a level of confidence in the broker's adherence to industry standards and regulatory compliance. In the case of BISON PRIME, the lack of authentic regulation raises questions about the broker's commitment to safeguarding users' interests and maintaining ethical business practices.

Pros and cons

Pros:

Competitive Spreads and Commissions: BISON PRIME offers competitive spreads and commissions, providing traders with cost-effective options for their transactions.

2. Variety of Trading Accounts: The broker provides a variety of trading accounts, catering to different trading needs. This allows users to choose an account type that aligns with their preferences and goals.

3. 24/5 Customer Support: BISON PRIME offers 24/5 customer support, ensuring that traders can seek assistance or resolve issues at any time during the trading week.

Cons:

Wide Range of Fees: The platform imposes a wide range of fees, including overnight interest, deposit and withdrawal fees, and inactivity fees. This may increase the overall cost of trading for users.

2. Limited Number of Trading Platforms: BISON PRIME has a limited number of trading platforms available. Traders may find this limiting, especially if they prefer a wider selection of platforms for their trading activities.

3. Limited Educational Resources: The broker provides limited educational resources, which may hinder the learning experience for users who seek comprehensive educational materials to enhance their trading skills.

| Pros | Cons |

| Competitive spreads and commissions | Wide range of fees, including overnight interest, deposit and withdrawal, and inactivity fees |

| Variety of trading accounts | Limited number of trading platforms |

| 24/5 customer support | Limited educational resources |

Overall, Bison Prime is a reputable crypto broker that offers a wide range of features and benefits. However, there are a few fees that potential users should be aware of.

Market Intruments

BISON PRIME stands out for its diverse range of trading instruments, catering to the preferences and strategies of a wide array of investors. The platform offers four main categories: Spot, Futures, Options, and Swaps.

In the Spot market, users can engage in straightforward buying and selling of financial instruments, including cryptocurrencies and traditional assets. This provides a convenient and direct way for investors to participate in the current market price, facilitating quick and efficient transactions.

For those seeking more advanced trading strategies, BISON PRIME's Futures market allows users to enter contracts to buy or sell assets at a predetermined price on a specified future date. This feature is particularly attractive for traders looking to hedge against price fluctuations or capitalize on market trends over time.

Options trading introduces a layer of flexibility to BISON PRIME, enabling users to buy or sell the right to buy or sell an asset at a predetermined price before a specified expiration date. This sophisticated financial instrument provides opportunities for risk management and strategic positioning.

Swaps, the fourth category, offer another avenue for users to diversify their trading portfolio. Swaps involve the exchange of financial instruments or cash flows between two parties, often used to manage risk or capitalize on market opportunities.

In conclusion, BISON PRIME's comprehensive suite of trading instruments empowers users with the flexibility to choose strategies that align with their risk tolerance, investment goals, and market outlook. Whether engaging in straightforward spot trading or delving into the complexities of options and swaps, investors can navigate a robust and versatile trading landscape on the platform.

Account Types

BISON PRIME Account Types

BISON PRIME offers three account types:

Standard Account

Minimum deposit: $50

Leverage: Up to 1:100

Spread: From 0.7 pips

Suitable for all experience levels

Professional Account

Minimum deposit: $10,000

Leverage: Up to 1:500

Spread: From 0.2 pips

Suitable for experienced traders

Institutional Account

Minimum deposit: $100,000

Leverage: Customizable

Spread: Customizable

Dedicated account manager

Suitable for professional institutional investors

Account Features

| Account Type | Minimum Deposit | Leverage | Spread | Other Features |

| Standard Account | $50 | 1:100 | From 0.7 pips | Suitable for all experience levels |

| Professional Account | $10,000 | 1:500 | From 0.2 pips | Suitable for experienced traders |

| Institutional Account | $100,000 | Customizable | Customizable | Dedicated account manager |

Additional Services and Features

24/7 customer support

Multiple trading platform choices

Multiple trading products

Educational resources

BISON PRIME is a safe and reliable trading platform that offers a variety of account types and services to meet the needs of different traders.

How to open an account?

Step 1: Visit the BISON PRIME website and click on the “Open Account” button.

Once you are on the homepage, click on the “Open Account” button in the top right corner of the screen.

Step 2: Enter your personal information.

On the next page, you will be asked to enter your personal information, such as your name, address, date of birth, and Social Security number. You will also be asked to create a username and password for your account.

Step 3: Fund your account.

Once you have entered your personal information, you will be asked to fund your account. You can fund your account with a wire transfer, ACH transfer, or cryptocurrency. The minimum deposit amount is \$100.

Step 4: Verify your identity.

Before you can start trading, you will need to verify your identity. You can do this by providing a copy of your government-issued ID, such as your driver's license or passport. You can also verify your identity by taking a selfie and uploading it to the BISON PRIME website.

Step 5: Once your account is funded and verified, you can start trading.

You can trade a variety of securities on the BISON PRIME platform, including stocks, options, futures, and CFDs. You can also use the platform to research and analyze securities.

Leverage

The leverage offered by BISON PRIME depends on the type of account you have and the security you are trading. Here is a table of the maximum leverage offered for different account types and securities:

| Account Type | Security | Maximum Leverage |

| INDIVIDUAL | Stocks | 2:01 |

| INDIVIDUAL | Options | 4:01 |

| INDIVIDUAL | Futures | 20:01 |

| INDIVIDUAL | CFDs | 2:01 |

| INSTITUTIONAL | Stocks | 5:01 |

| INSTITUTIONAL | Options | 10:01 |

| INSTITUTIONAL | Futures | 2:01 |

| INSTITUTIONAL | CFDs | 100:1 |

| CORPORATE | Stocks | 2:01 |

| CORPORATE | Options | 4:01 |

| CORPORATE | Futures | 20:01 |

| CORPORATE | CFDs | 2:01 |

| PROFESSIONAL | Stocks | 10:01 |

| PROFESSIONAL | Options | 20:01 |

| PROFESSIONAL | Futures | 100:1 |

| PROFESSIONAL | CFDs | 200:1 |

| GOVERNMENT | Stocks | 5:01 |

| GOVERNMENT | Options | 10:01 |

| GOVERNMENT | Futures | 2:01 |

| GOVERNMENT | CFDs | 100:1 |

Please note that this is just a table of the maximum leverage offered. The actual leverage that you are offered will depend on your individual circumstances. For example, if you have a low credit score, you may be offered lower leverage than someone with a high credit score.

It is important to use leverage responsibly. Leverage can amplify your profits, but it can also amplify your losses. If you are not careful, you could lose more money than you invested.

Here are some tips for using leverage responsibly:

Only use leverage for trades that you are confident in.

Do not use all of your available leverage.

Set stop-loss orders to limit your losses.

Make sure that you have enough capital to cover your margin calls.

If you are not sure how much leverage to use, you should talk to a financial advisor.

Spreads & Commissions (Trading Fees)

Bison Prime offers tight spreads on major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. For example, the average spread for Bitcoin is around 0.05%, which is one of the lowest in the industry.

Bison Prime also charges low commissions on all trades. The commission rate is 0.1% for both makers and takers. This means that you will pay 0.1% of the total value of your trade, no matter if you are creating a liquidity order (maker) or taking liquidity (taker).

Here is a table of Bison Prime's spreads and commissions:

| Asset | Spread | Commission |

| Bitcoin | 0.05% | 0.10% |

| Ethereum | 0.08% | 0.10% |

| Litecoin | 0.10% | 0.10% |

Bison Prime offers a variety of trading accounts, each with its own set of fees. You can choose the account that best suits your needs and trading style.

Here is a table of Bison Prime's trading account fees:

Non-Trading Fees

Here are some of the other fees that Bison Prime charges:

Overnight interest fees: Bison Prime charges an overnight interest fee on margin accounts. This fee is calculated as a percentage of the margin used per day. The fee rate is currently 0.03%.

Deposit and withdrawal fees: Bison Prime does not charge any deposit fees for wire transfers, ACH transfers, or cryptocurrency deposits. However, there is a $25 fee for withdrawals of less than $100. For withdrawals of $100 or more, the fee is 0.5% of the withdrawal amount.

Inactivity fees: Bison Prime does not charge any inactivity fees. However, if your account is inactive for 6 months, the company may send you a notification reminding you to log in and trade. If you do not log in within 30 days of receiving the notification, your account may be closed.

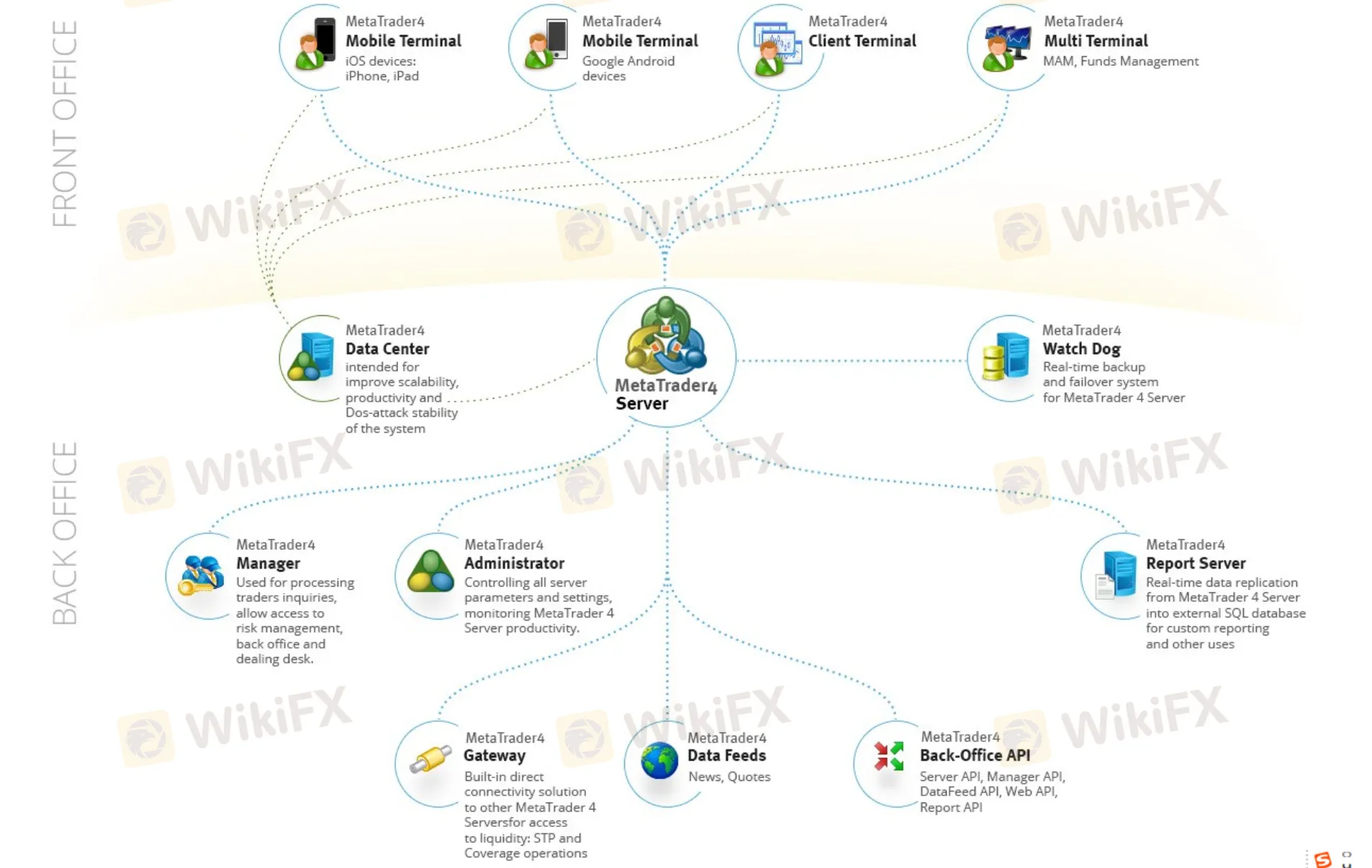

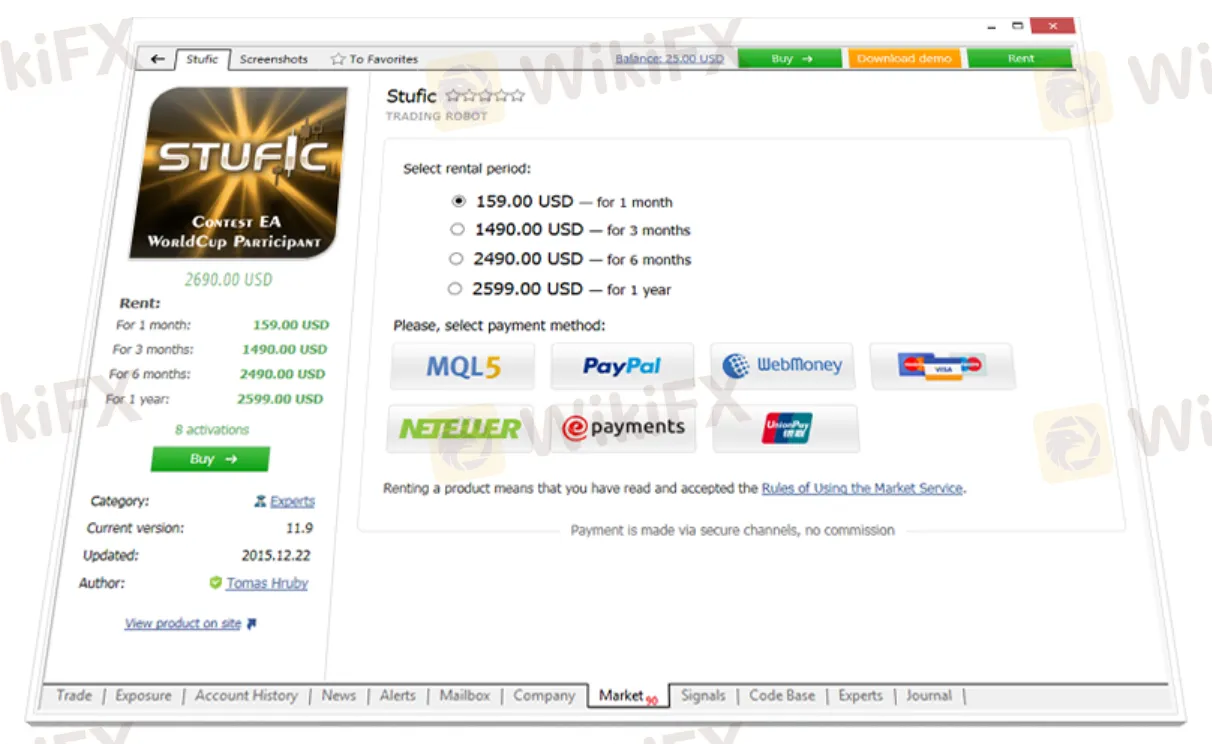

Trading Platforms

Bison Prime offers two trading platforms:

MetaTrader 4 (MT4)

MT4 is a popular trading platform that is used by traders of all levels of experience.

It is a user-friendly platform that offers a variety of features, including:

A wide range of charting tools

Technical indicators

Backtesting capabilities

Automated trading

WebTrader

WebTrader is a web-based trading platform that is easy to use and does not require any downloads. It is a good option for traders who want to trade from anywhere in the world. WebTrader offers many of the same features as MT4, including:

A wide range of charting tools

Technical indicators

Order execution

Both MT4 and WebTrader are available in multiple languages, including English, Chinese, Japanese, and Korean.

In addition to its trading platforms, Bison Prime also offers a variety of educational resources, including:

Trading tutorials

Webinars

Ebooks

These resources can help you learn how to trade and improve your trading skills.

Deposit & Withdrawal

Bison Prime offers a variety of deposit and withdrawal methods to suit your needs. You can deposit funds into your account using a wire transfer, ACH transfer, or cryptocurrency. You can also withdraw funds from your account using a wire transfer, ACH transfer, or cryptocurrency.

Deposits

Deposits are typically processed within 24 hours. However, there may be delays depending on the method you choose. For example, wire transfers can take several days to complete.

Withdrawals

Withdrawals are typically processed within 48 hours. However, there may be delays depending on the method you choose. For example, wire transfers can take several days to complete.

Fees

Bison Prime does not charge any deposit fees for wire transfers, ACH transfers, or cryptocurrency deposits. However, there is a $25 fee for withdrawals of less than $100. For withdrawals of $100 or more, the fee is 0.5% of the withdrawal amount.

Here are the steps on how to deposit funds into your Bison Prime account:

Log in to your Bison Prime account.

Click on the “Deposit” button.

Select the deposit method that you would like to use.

Enter the amount of money that you would like to deposit.

Click on the “Deposit” button.

Here are the steps on how to withdraw funds from your Bison Prime account:

Log in to your Bison Prime account.

Click on the “Withdraw” button.

Select the withdrawal method that you would like to use.

Enter the amount of money that you would like to withdraw.

Click on the “Withdraw” button.

Customer Support

The trader did not provide any valid contact information, which is a red flag.

Educational Resources

Bison Prime offers a variety of educational resources to help its clients learn about trading and improve their trading skills. These resources include:

Trading tutorials: Bison Prime offers a variety of trading tutorials that cover a wide range of topics, from the basics of trading to more advanced trading strategies.

Webinars: Bison Prime hosts regular webinars that are led by experienced traders. These webinars cover a variety of topics, such as market analysis, technical indicators, and risk management.

Ebooks: Bison Prime offers a variety of ebooks that cover a wide range of trading topics. These ebooks are a great way to learn about trading at your own pace.

In addition to these resources, Bison Prime also offers a variety of other educational resources, such as:

A glossary of trading terms: This glossary can help you learn about the different terms that are used in trading.

A FAQ section: This FAQ section can answer many of your questions about trading.

A demo account: This demo account allows you to practice trading without risking any money.

Bison Prime's educational resources are a valuable resource for traders of all levels of experience. These resources can help you learn about trading, improve your trading skills, and make better trading decisions.

Conclusion

In conclusion, BISON PRIME presents a compelling option for traders seeking competitive spreads and commissions. The variety of trading accounts offered caters to diverse preferences, allowing users to select an account that suits their specific needs. The availability of 24/5 customer support ensures that assistance is readily accessible throughout the trading week, enhancing the overall user experience.

However, it's essential to consider the potential drawbacks. BISON PRIME imposes a broad spectrum of fees, including overnight interest, deposit and withdrawal fees, and inactivity fees. This comprehensive fee structure may contribute to higher trading costs for users. Additionally, the limited number of trading platforms may be a drawback for traders who prefer a more extensive selection.

Furthermore, the platform's educational resources are somewhat constrained, which could impact users looking to enhance their trading knowledge and skills. In navigating the decision to choose BISON PRIME, traders should weigh the benefits of competitive pricing and account variety against the potential downsides of fees and limited platform options.

FAQs

Q: Is BISON PRIME a regulated broker?

A: No, BISON PRIME is currently not regulated. Despite claiming to be regulated by the NFA, it has been identified as a cloned broker, and traders should exercise caution.

Q: What account types does BISON PRIME offer?

A: BISON PRIME provides five account types: Individual, Institutional, Corporate, Professional, and Government. Each account type caters to different trading needs, offering varying features and benefits.

Q: Can I open a demo account with BISON PRIME?

A: BISON PRIME's website does not specify the availability of a demo account. Traders are advised to contact the broker directly or check the platform for the most accurate and up-to-date information.

Q: What trading instruments are available on BISON PRIME?

A: BISON PRIME offers a variety of trading instruments, including Spot, Futures, Options, and Swaps, providing users with diverse options for their trading activities.

Q: What is the minimum deposit required to open an account with BISON PRIME?

A: The minimum deposit varies depending on the account type. Traders should refer to the specific account details for accurate information on minimum deposit requirements.

Q: Is BISON PRIME a reliable broker for trading?

A: Due to the lack of valid regulation and the identification of BISON PRIME as a cloned broker, traders should approach this platform with caution. It is advisable to consider alternative brokers with a proven track record of reliability and regulation.

Q: How can I contact BISON PRIME's customer support?

A: BISON PRIME provides customer support through 24/5 Live Chat, Email, and Phone. Users can choose their preferred method of communication for assistance.

Q: Does BISON PRIME charge any fees?

A: Specific fee details are not provided in the FAQs. Traders should review the broker's terms and conditions or contact customer support for information on fees associated with trading on the platform.