Company Summary

| Swift Trader Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Comoros |

| Regulation | MISA (Offshore regulated), ASIC |

| Market Instruments | Forex, Commodities, Metals, Indices, Cryptocurrencies |

| Demo Account | ✅ |

| Spread | From 2 pips (Standard account) |

| Leverage | Up to 2000x |

| Trading Platform | MT5 |

| Minimum Deposit | USD 10 |

| Customer Support | Contact ticket, live chat, FAQ |

| Email: info@swifttrader.com; Support: support@swifttrader.com | |

| Registered address: Bonovo Road – Fomboni Island of Mohéli – Comoros Union | |

| Restricted Regions | Afghanistan, Australia, Belarus, Bosnia and Herzegovina, Burma (Myanmar), Central African Republic, Democratic Republic of Congo, Eritrea, Iran, Iraq, Lebanon, Libya, North Korea, Somalia, South Sudan, Sudan, Syria, Yemen, Zimbabwe, St. Vincent & the Grenadines, USA. |

Swift Trader Information

Swift Trader was registered in Comoros Union and claims to have more than 50 years industry experience in finance. Nowadays, it mainly focuses on trading services in forex, commodities, indices, cryptocurrencies. It offers the industry-leading MetaTrader 5 platforms to enhance customer trading experience.

A demo account is available for practicing, with tight spread from 0 pips for live accounts. And the broker implements fund segregation to separate client funds from their operational accounts.

In addition, educational resources are also provided to equip investors with necessary knowledge and skills for successful trading.

The good thing is that the company is regulated by MISA and ASIC, which means its financial activities are strictly watched by these authorities, to some extent guarantees a certain level of customer protection. However, you should be cautious because the MISA regulation is offshore only.

Pros and Cons

| Pros | Cons |

| ASIC regulated | Offshore MISA regulation |

| MT5 platform | |

| Demo accounts | |

| Fund segregation | |

| No deposit fees | |

| Rich educational resources | |

| Affordable minimum deposit |

Is Swift Trader Legit?

Swift Trader is currently being well regulated by MISA (Mwali International Services Authority), Australia Securities & Investment Commission (ASIC), with license no. T2023364 and 001313975 respectively.

However, one fact that you should not neglect is that the MISA regulation is offshore only, which indicates less grasp by the authority.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| MISA | Regulated | Swift Trader Ltd | Retail Forex License | T2023364 |

| ASIC | Offshore Regulated | SWIFTTRADERAU PTY LTD | Appointed Representative (AR) | 001313975 |

| Trading Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

To familiarize yourself before commiting actual trading, you can start with a demo account to practice your trading strategies.

While being confident enough to open a live account, you can go with four tiered accounts, with different trading conditions to suit for the needs of different client groups:

| Account Type | Minimum Deposit | Spread | Commission | Suitable for |

| Standard | USD 10 | From 2 pips | ❌ | Beginners |

| Pro | From 0.6 pips | ❌ | Professional traders | |

| ECN | From 0 pips | $2.5 for forex; $7 for metals; 0.05% for cryptos | Scalping traders | |

| Velocity | From 1.2 pips | ❌ | Traders want higher leverage | |

| Bonus-X | / | / | ❌ | Traders want bonus |

For those who want additional margin without tying up their cash balance, the broker offers a unique Bonus-X account. Traders will receive a 150% first deposit bonus, 100% on future deposits, zero commission trading, and up to 1000:1 leverage.

You can enhance your trading power without increasing your financial risks. But bonus funds will act as extra margin, not cash, which means withdrawals remove your bonuses.

Leverage

While Swift Trader offers leverage up to 2000x, different maximum leverage applies for different account types:

| Account Type | Maximum Leverage |

| Standard | 1:1000 |

| Pro | |

| ECN | |

| Velocity | 1:2000 |

| Bonus-X | 1:1000 |

Traders should use leverage cautiously and choose the product that best suits their experience levels to avoid huge losses.

Trading Platform

Swift Trader claims to use the world renowned MetaTrader 5 platforms, which are well-recognized by its advanced charting tools and robust functionalities.

You can reach the platform on web, or download app from Windows, mobiles phones and Mac.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, mobile, Windows, Mac | Experienced traders |

| MT4 | ❌ | / | Beginners |

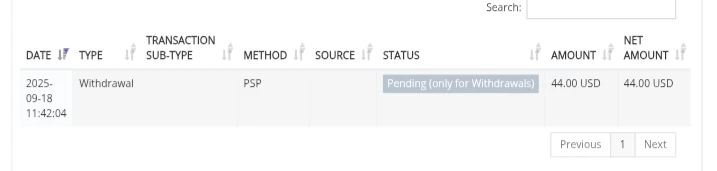

Deposit and Withdrawal

Swift Trader offers deposits and withdrawals in USD, JPY, and USDT via international/domestic bank transfer, Tether, and STICPAY.

Minimum deposits start from just 5 USDT or 50 JPY, with most methods processing in 0–15 minutes.

Withdrawals are freeon Swift Traders side but may incur bank or STICPAY fees.

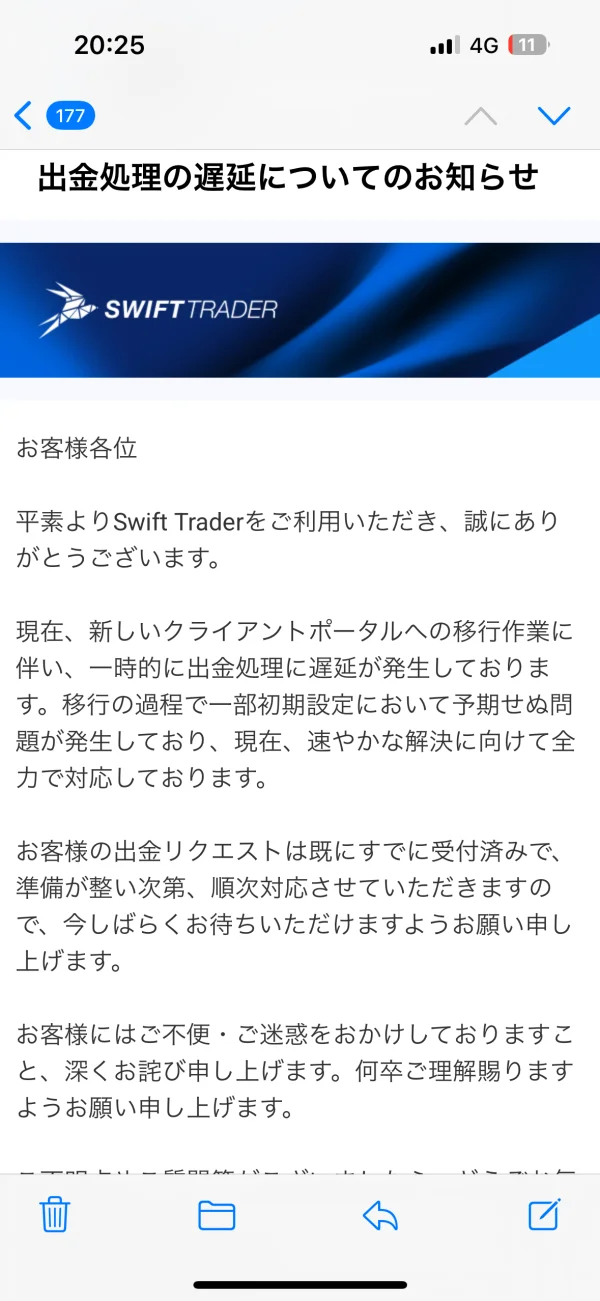

Ruslan Said

Indonesia

Withdrawal scam almost 1 month Not processed customer service also never responds to clients

Exposure

FXdaisuki_boko

Japan

swifttrader52 million yen fraud incident‼️⚠️ Withdrawal refused by SwiftTrader When using the dealer called SwiftTrader, my account was forcibly closed, all profits were deleted, and withdrawals were refused due to a violation of the bonus terms. ■ Details of the situation ・After depositing, I traded as shown in the attached image and requested a withdrawal of 522,398 yen. ・Initially, I received an email confirming the withdrawal, but after 5 days passed without receiving the funds and being unable to access MT5, I contacted support and the withdrawal was suddenly canceled. ・I was unilaterally notified of a "violation of the bonus policy" and my account was frozen. ・As I had not done anything of the sort and had no recollection of any violations, I requested a specific explanation of the violation and evidence, but all requests were denied. ・I was informed unilaterally via LINE that "this is the final decision within the company, so no objections or disclosure of evidence will be entertained." Initially, even after contacting support multiple times, I stopped receiving any responses‼️ Additionally, only the deposit amount has been returned, and I have requested a withdrawal, but the funds have not yet been transferred to my bank account! Everyone, please be cautious! They have no intention of allowing withdrawals here at all, so everyone, please be cautious. I believe they will definitely not process withdrawals for slightly larger amounts.

Exposure

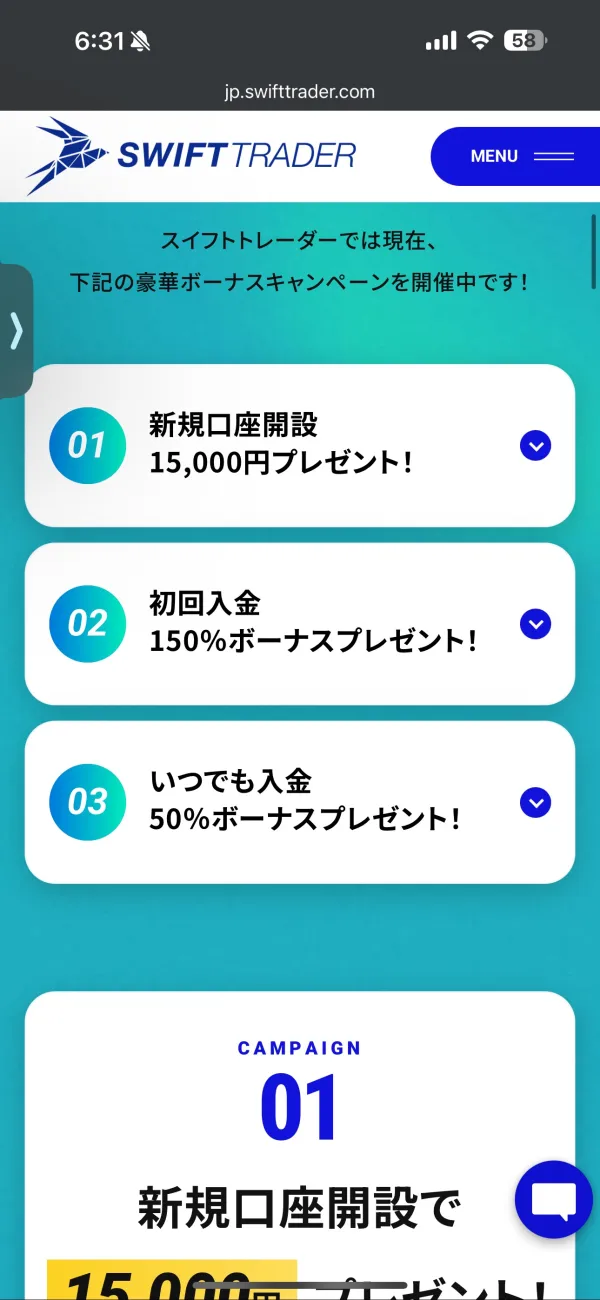

FX3645813234

Japan

The new account opening campaign, the first deposit campaign, and above all, the 50% deposit bonus available anytime are great. I just made a trade the other day and it went well. Withdrawals also arrived at my domestic bank in about a week.

Positive

FX3574251122

Japan

The bonus (new account opening bonus of 15,000 yen + first deposit 150% bonus + regular deposit 50% bonus) is attractive. However, the spreads are somewhat wide, support responses can be slow, and bank transfer withdrawals require submission of transaction statements. My impression is that I wouldn't use it as my main platform.

Neutral

FX8823628920

Japan

I genuinely received the 150% first deposit bonus! It was great to be able to start with a decent amount of funds even with a small deposit!

Positive

Matt Starkey

Australia

Great service from KW and AB on client side with fast withdrawal and smooth processing every time 😃

Positive

Alessandro Mancini

Italy

MT5 platform's functionality and user experience, good, so far. The API for automated strategies is quite stable and user-friendly. Overall, they are ok.

Positive

Yuri2

Nigeria

A clear easy to use platform with transparent ideas of what direction other clients are trading.

Positive