Company Summary

| Swiss KMS Review Summary | |

| Founded | 2009 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, commodities, indices, shares, stocks and cryptocurrencies |

| Demo Account | Unavailable |

| Leverage | 1:30-1:300 |

| EUR/ USD Spread | N/A |

| Trading Platforms | Swiss KMS Webtrader |

| Minimum Deposit | €250 |

| Customer Support | 24/5 GMT 09:00 AM – 7:00 PM ( Monday to Friday) Phone, email, online messaging |

What is Swiss KMS?

Swiss KMS is an online trading platform that was founded in 2009 and is registered in the United Kingdom. It operates in the financial market as an unregulated platform. Swiss KMS allows its clients to trade a wide range of market instruments, including forex currency pairs, commodities, indices, shares, stocks, and cryptocurrencies. The leverage offered on the platform ranges from 1:30 to 1:300, giving clients the potential to amplify their trading positions.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

Pros of Swiss KMS:

- A range of trading instruments: Swiss KMS offers a 350+ selection of trading instruments, including forex currency pairs, commodities, indices, shares, stocks, and cryptocurrencies. This allows clients to access various markets and potentially capitalize on different opportunities.

- Flexible leverage: Swiss KMS provides flexible leverage options ranging from 1:30 to 1:300. This allows traders to potentially amplify their positions and make larger trades with a smaller amount of capital.

- Multiple account types: Swiss KMS offers multiple account types, which can cater to different trading needs and preferences. This allows clients to choose an account type that aligns with their trading style and objectives.

Cons of Swiss KMS:

- High minimum deposit: One of the downsides of Swiss KMS is the high minimum deposit requirement. The platform requires a minimum deposit of €250, which could pose a barrier for those who want to start trading with smaller amounts.

- Operates without valid regulation: Swiss KMS operates as an unregulated trading platform. This means that it does not fall under the oversight and regulations of any reputable financial authority. The lack of regulation can raise concerns about the platform's credibility and client protection.

- No 24/7 customer support: Swiss KMS offers customer support during specific hours on weekdays only, from 09:00 AM to 7:00 PM GMT. This limited availability may not be convenient for clients who require round-the-clock support, especially when trading in global markets where different time zones are involved.

Is Swiss KMS Safe or Scam?

Swiss KMS operates without valid regulation, indicating that its activities lack oversight from government or financial authorities. This absence of regulation introduces inherent risk to investing with them. Before deciding to invest with Swiss KMS,research the company and carefully assess the potential risks in comparison to the possible rewards. In all, it is advisable to opt for well-regulated brokers to safeguard and protect your funds.

Trading Instruments

Swiss KMS offers a wide range of trading instruments across various markets. The trading instruments available on the platform include:

Forex Currency Pairs: Traders can engage in forex trading by accessing a vast selection of currency pairs. These pairs include major, minor, and exotic currencies, allowing traders to speculate on the exchange rate fluctuations between different currencies.

Commodities: Swiss KMS provides access to popular commodities such as metals, energies, and agricultural products. Traders can trade instruments like gold, silver, platinum, crude oil, natural gas, wheat, corn, soybeans, coffee, and more. These commodities can be traded in spot or futures markets, providing opportunities to profit from price movements.

Popular Stocks: The platform allows traders to invest in popular stocks from domestic and international markets. Traders can trade shares of well-known companies and potentially benefit from stock price movements, dividends, and corporate actions.

Indices: Swiss KMS offers trading instruments based on stock indices, allowing traders to speculate on the overall performance of specific markets or sectors. Traders can trade indices like the S&P 500, Dow Jones Industrial Average, FTSE 100, DAX, and more.

Cryptocurrencies: The platform supports trading in a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, and more. Traders can speculate on the price movements of these digital currencies, taking advantage of the volatility and potential opportunities in the crypto market.

Shares: Apart from popular stocks, Swiss KMS also provides access to shares of companies listed on various exchanges. This allows traders to trade shares of both large and small companies and potentially benefit from their performance.

Account Types

Swiss KMS offers different types of trading accounts to cater to the varying needs and preferences of traders.

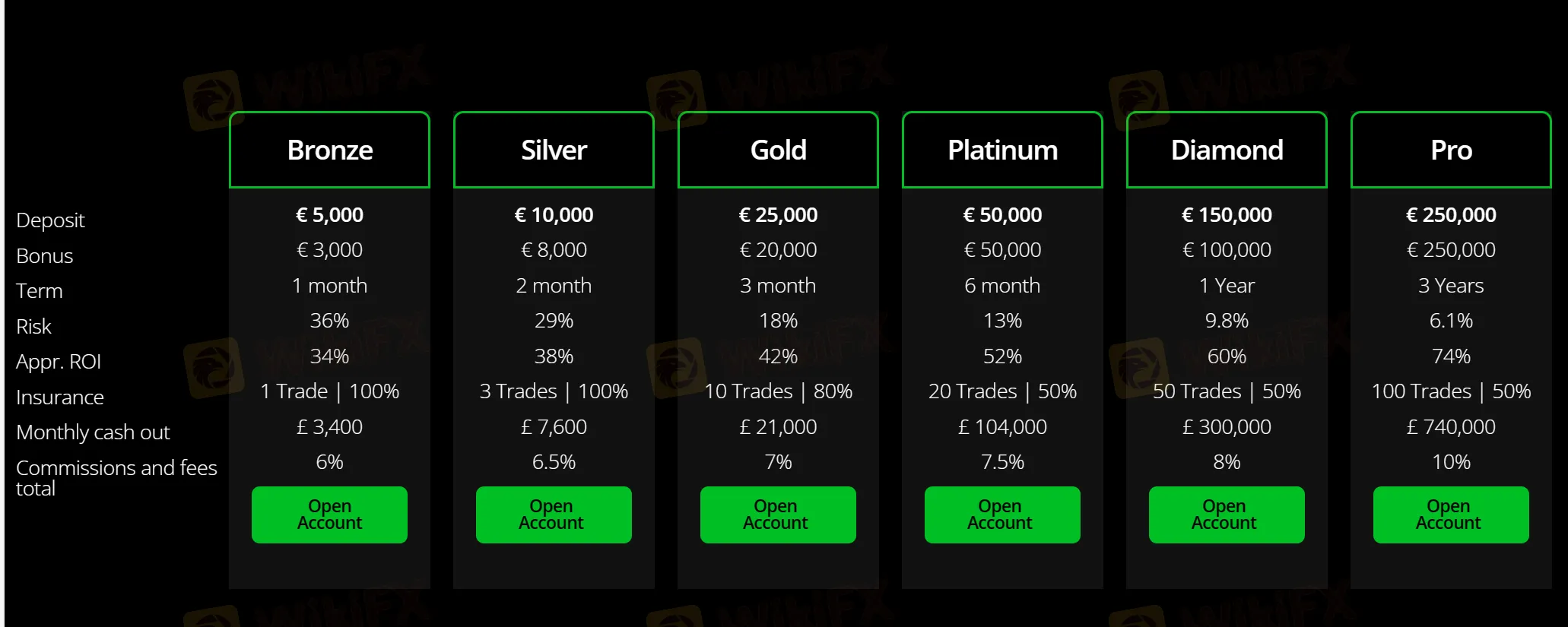

Bronze Account (Minimum deposit: €5,000):

The Bronze account is the basic account option available on Swiss KMS. It has a relatively lower minimum deposit requirement compared to other account types. Traders with this account can access a range of trading instruments and enjoy basic trading features and services offered by the platform.

Silver Account (Minimum deposit: €10,000):

The Silver account is a step up from the Bronze account. With a slightly higher minimum deposit requirement, traders with Silver accounts gain additional benefits such as enhanced trading features, access to exclusive resources, and potentially better trading conditions.

Gold Account (Minimum deposit: €25,000):

The Gold account is designed for traders who wish to have access to more advanced features and services. With a higher minimum deposit, Gold account holders typically enjoy benefits like lower trading costs, priority customer support, and personalized account management services.

Platinum Account (Minimum deposit: €50,000):

The Platinum account is a higher-tier account option that offers even greater advantages for traders. Account holders with Platinum accounts may benefit from features like tighter spreads, faster trade execution, advanced trading tools, exclusive research and analysis, and dedicated support from experienced account managers.

Diamond Account (Minimum deposit: €150,000):

The Diamond account is a premium account option designed for high-net-worth individuals or professional traders. With a significantly higher minimum deposit requirement, Diamond account holders receive top-of-the-line trading services and exclusive perks, such as personalized trading strategies, VIP support, and invitations to exclusive events or seminars.

Pro Account (Minimum deposit: €250,000):

The Pro account is the highest level of account offered by Swiss KMS. It is specifically tailored for institutional clients or highly advanced and experienced traders. Pro account holders enjoy the highest level of personalized services, including dedicated account managers, customized trading conditions, specialized research and analysis, and direct access to liquidity providers.

| Account Type | Minimum Deposit (€) |

| Bronze | 5,000 |

| Silver | 10,000 |

| Gold | 25,000 |

| Platinum | 50,000 |

| Diamond | 150,000 |

| Pro | 250,000 |

How to Open an Account?

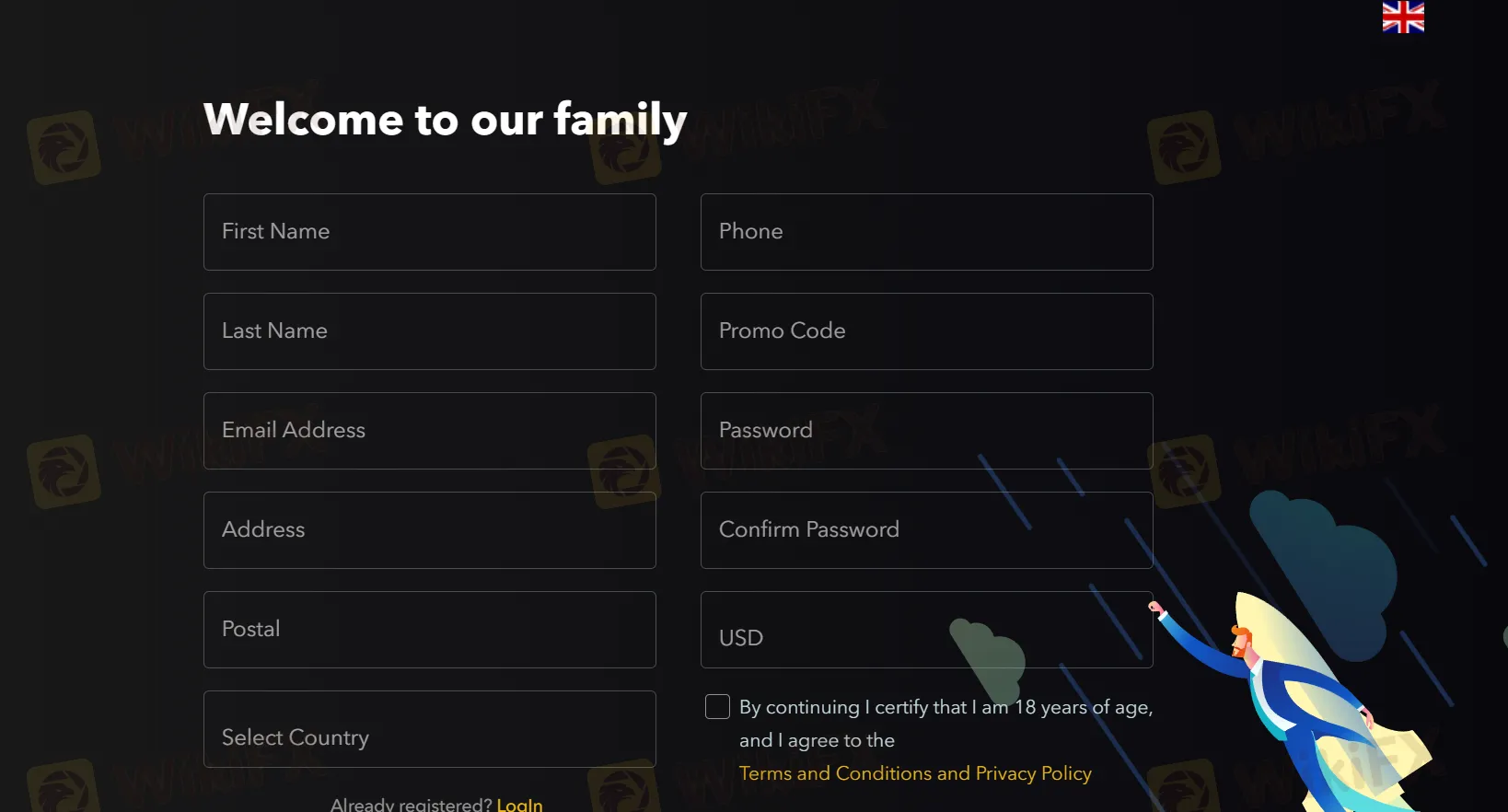

| Step 1 | Visit the Swiss KMS website or directly click: https://client.swisskms.com/en-US/Account/Register |

| Step 2 | Click on the“Open Your Account” button |

| Step 3 | Enter your First Name |

| Step 4 | Enter your Last Name |

| Step 5 | Enter your Email Address |

| Step 6 | Enter your Address |

| Step 7 | Enter your Postal Code |

| Step 8 | Select your Country |

| Step 9 | Enter your Phone number |

| Step 10 | Enter any applicable Promo Code |

| Step 11 | Create a Password |

| Step 12 | Confirm your Password |

| Step 13 | Select your Preferred Currency (e.g., USD) |

| Step 14 | Click on “Sign Up” to complete the registration process |

Leverage

Swiss KMS offers a range of leverage options for its clients, with maximum leverage ranging from 1:30 to 1:300. Leverage refers to the ability to control a larger position in the market with a smaller amount of capital. For example, with a leverage of 1:100, a trader can control a position worth 100 times their initial deposit.

Having higher leverage, such as 1:300, can potentially lead to significant returns on investment. It allows traders to take advantage of small market movements and amplify their potential profits. However, it's important to remember that higher leverage also carries higher risks.

Spreads & Commissions

Swiss KMS charges commissions based on the account type and the minimum deposit amount. The commission rates range from 6% for the Bronze account to 10% for the Pro account, calculated on the total commissions and fees.

For example, if you have a Bronze account with a minimum deposit of €6,000, the commission rate would be 6% of the total commissions and fees. This means that if your total commissions and fees amount to €1,000, you would be charged €60 as a commission.

Similarly, for other account types like Silver, Gold, Platinum, and Diamond, the commission rates are 6.5%, 7%, 7.5%, and 8% respectively. The higher the account type, the higher the commission rate.

Unfortunately, the official website of Swiss KMS does not mention the specific spreads offered by the platform. Spreads typically refer to the difference between the buying and selling prices of an asset. They represent the cost of trading and can vary depending on the market conditions and the financial instrument being traded.

To get detailed information about spreads, you can contact Swiss KMS directly or refer to their customer support. They will be able to provide you with accurate and up-to-date information regarding their spreads and any associated costs.

Trading Platforms

Swiss KMS Webtrader is a robust and user-friendly trading platform offered by Swiss KMS, designed specifically for beginner traders. It utilizes advanced trading algorithms to provide traders with a powerful and reliable trading experience. One of its major advantages is that it is entirely web-based, eliminating the need for time-consuming downloads and installations.

The platform's versatility lies in its compatibility with any kind of operating system and devices, making it accessible to a wide range of traders. Whether you prefer using a Windows PC, Mac, or mobile devices like smartphones and tablets, Swiss KMS Webtrader ensures a seamless trading experience across all devices.

Deposits & Withdrawals

Swiss KMS facilitates the deposit and withdrawal of funds through several convenient methods, including VISA, Mastercard, Maestro, and wire transfer. Clients looking to deposit funds using a debit or credit card can do so by accessing their Swiss KMS account, navigating to the deposit section, and selecting the card payment option. Upon entering the necessary card details such as the card number, expiry date, and CVV code, the client can specify the desired deposit amount and finalize the transaction. Subsequently, the deposited funds will become available in their trading account.

For those preferring to initiate deposits or withdrawals via wire transfer, they can obtain the essential banking information by reaching out to the Swiss KMS customer support team or accessing the platform's banking details section. Subsequently, they can initiate the wire transfer through their bank's online banking platform or in person. The processing time for wire transfers may vary based on the client's bank and its location.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

24/5 GMT 09:00 AM – 7:00 PM ( Monday to Friday)

Telephone: UK Branch: +44 7389646908

Germany Branch: +44 7389646908

Email: support@swisskms.com

Swiss KMS offers online messaging as part of their trading platform. This allows you to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In summary, Swiss KMS is an online trading platform that offers various trading assets. It provides a trading platform called Swiss KMS Webtrader. The absence of regulation introduces significant risk when investing with Swiss KMS. The company‘s unregulated status raises concerns about the safety of clients’ funds and the level of transparency and accountability maintained by the platform. Additionally, the high minimum deposit requirement and potential salty commissions may deter potential traders.

Frequently Asked Questions (FAQs)

| Q 1: | Is Swiss KMS regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at Swiss KMS? |

| A 2: | You can contact via telephone: UK Branch: +44 7389646908, Germany Branch: +44 7389646908, email: support@swisskms.com and online messaging. |

| Q 3: | Does Swiss KMS offer demo accounts? |

| A 3: | No. |

| Q 4: | What platform does Swiss KMS offer? |

| A 4: | It offers Swiss KMS Trader. |

| Q 5: | What is the minimum deposit for Swiss KMS? |

| A 5: | The minimum initial deposit to open an account is €250. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.