Company Summary

| Key Information | Details |

| Company Name | CBMH |

| Years of Establishment | 2-5 years |

| Headquarters | China |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Forex, CFDs, Binary options, Stocks, Cryptocurrencies |

| Account Types | Standard, VIP, Islamic |

| Demo Account | Available |

| Minimum Deposit | $250 |

| Leverage | Up to 1:500 |

| Spread | As low as 0.5 pips |

| Deposit/Withdrawal Methods | Bank Transfer, Credit Card, Debit Card |

| Trading Platforms | MetaTrader 4 |

| Customer Support Options | QQ, Phone Number, Email |

Overview of CBMH

CBMH is an unregulated company that has been established for 2-5 years. It operates in the financial sector, offering a platform for trading various assets, including Forex, CFDs, Binary options, Stocks, and Cryptocurrencies. The company provides different types of accounts, such as Standard, VIP, and Islamic, each with varying minimum deposit requirements and leverage ratios.

However, it's important to note that CBMH currently lacks an accessible website for potential clients to gather information or access their services. This means that there is no way to make an account despite having different account types. Traders can access the MetaTrader 4 platform for their transactions. The company's customer support is available through QQ, a phone number, and email. Deposit and withdrawal options include Bank Transfer, Credit Card, and Debit Card.

Regulation

CBMH operates as an unregulated broker, meaning it is not under the oversight or supervision of any regulatory authority. As an unregulated entity, the company is not bound by specific rules or standards that regulators often impose on financial service providers. This lack of regulation entails that there is no external authority monitoring its operations or ensuring compliance with industry guidelines. Without regulatory oversight, there is no guarantee of adherence to best practices, and clients may have limited avenues for seeking redress in case of any potential misconduct or malpractices by the company.

Pros and Cons

CBMH offers a range of tradable assets, including Forex, CFDs, Binary Options, Stocks, and Cryptocurrencies. The availability of multiple asset classes allows traders to diversify their investment portfolios and explore different market opportunities. Additionally, the company provides different types of accounts, such as Standard, VIP, and Islamic, catering to traders with various preferences and risk tolerances. The MetaTrader 4 platform further enhances the trading experience, offering a user-friendly interface and access to advanced trading tools. Traders can also benefit from a demo account to practice their strategies before committing real funds.

One notable drawback of CBMH is the absence of an accessible website, which can undermine the company's credibility and hinder potential clients from gathering information easily. Traders may find it inconvenient not to have an online platform for account registration, as they would have to rely on alternative channels such as phone or email. Moreover, the company's lack of regulation raises concerns about investor protection, as there is no external authority overseeing its operations. This unregulated status may deter some traders who prioritize dealing with companies under regulatory supervision for added assurance.

| Pros | Cons |

| Various tradable assets | Lack of an accessible website |

| Different types of accounts | Inaccessible account registration process |

| MetaTrader 4 platform | Unregulated |

| Demo account |

Inaccessbile Website

CBMH currently lacks an accessible website, which can have significant implications for the company's credibility. A website serves as a vital online presence for any company, allowing potential clients to gather information, understand the services offered, and establish trust in the company's operations. Without an accessible website, CBMH may miss out on opportunities to showcase their offerings and demonstrate transparency to potential traders.

The absence of an accessible website also means that traders cannot create a trading account with the company directly through an online platform. This limitation can be inconvenient for traders who prefer a streamlined and efficient account registration process. Instead, they may have to rely on other channels such as phone or email, which could be less efficient and may lead to a delay in account creation.

Market Instruments

CBMH offers a selection of market instruments that includes Forex, CFDs, Binary options, Stocks, and Cryptocurrencies. Specifics are as follows:Forex: CBMH offers the Forex market instrument, allowing traders to engage in currency trading across various currency pairs. This instrument enables them to speculate on exchange rate movements and potentially profit from currency fluctuations.

CFDs: CBMH provides Contracts for Difference (CFDs) as a market instrument. With CFDs, traders can speculate on the price movements of underlying assets without owning the assets themselves. This instrument offers flexibility and the opportunity to trade a wide range of assets, including indices, commodities, and stocks.

Binary options: CBMH includes Binary options as a market instrument, allowing traders to place bets on whether an asset's price will rise or fall within a specific time frame. This instrument offers a fixed return on investment if the trader's prediction is correct, simplifying the trading process.

Stocks: CBMH allows traders to access the stock market instrument, enabling them to trade shares of publicly listed companies. This instrument provides an opportunity to invest in individual companies and potentially benefit from their performance in the stock market.

Cryptocurrencies: CBMH offers the cryptocurrency market instrument, giving traders access to the digital currency market. This instrument enables them to trade popular cryptocurrencies like Bitcoin, Ethereum, and others, allowing exposure to the rapidly evolving crypto market.

The following is a table that compares CBMH to competing brokerages:

| Broker | Market Instruments |

| CBMH | Forex, CFDs, Binary options, Stocks, Cryptocurrencies |

| FXPro | Forex, CFDs, Stocks, Indices, Futures, Metals, Energies, Cryptocurrencies |

| IC Markets | Forex, CFDs, Stocks, Indices, Commodities, Cryptocurrencies |

| FBS | Forex, CFDs, Stocks, Metals, Energies, Cryptocurrencies |

| Exness | Forex, CFDs, Stocks, Indices, Metals, Energies, Cryptocurrencies |

Account Types

CBMH offers three account types: Standard Account, VIP Account, and Islamic Account. Specifics are as follows:

Standard Account: CBMH's Standard Account is designed for traders looking to start with a minimum deposit of $250. With this account type, traders can access a variable spread, allowing them to participate in Forex, CFDs, Binary options, Stocks, and Cryptocurrencies. Leverage of up to 1:500 is available for trading, providing traders with the potential to amplify their positions in the market. A demo account is offered, allowing users to practice their trading strategies without risking real funds.

VIP Account: CBMH's VIP Account caters to more experienced traders who are willing to deposit a minimum of $5,000. Traders with this account type benefit from fixed spreads, providing greater certainty over trading costs. Additionally, the VIP Account offers higher leverage of up to 1:1000, allowing for larger trading positions. This account type also comes with the advantage of a dedicated account manager, providing personalized support and assistance.

Islamic Account: CBMH's Islamic Account is tailored to traders who adhere to Islamic principles and requires a minimum deposit of $250. This account type provides variable spreads for trading various assets without incurring swap fees, ensuring compliance with Shariah law. Like the Standard Account, it offers a demo account to practice trading strategies without interest-related costs. However, a dedicated account manager is not available for this account type.

| Account Type | Standard Account | VIP Account | Islamic Account |

| Minimum Deposit | $250 | $5,000 | $250 |

| Spread | Variable | Fixed | Variable |

| Leverage | Up to 1:500 | Up to 1:1000 | N/A |

| Dedicated Account Manager | No | Yes | No |

Demo Account

A demo account is a virtual trading platform that allows traders to practice their trading strategies and explore the features of a brokerage without using real money. It provides a risk-free environment for traders to familiarize themselves with the platform's functionalities, test different trading techniques, and gain confidence in their trading abilities. For traders, the benefits of a demo account include honing their skills, identifying strengths and weaknesses, and reducing the risk of potential losses. Additionally, offering a demo account demonstrates the company's commitment to providing a supportive and transparent trading experience, enhancing its reputation as a broker that prioritizes trader education and success.

Minimum Deposit

CBMH offers different minimum deposit rates for its various account types. The Standard and Islamic Accounts require a minimum deposit of $250, providing access to a range of tradable assets with variable spreads. For traders seeking more advanced features, the VIP Account demands a higher minimum deposit of $5,000 and offers fixed spreads along with a higher leverage option. These minimum deposit rates cater to traders with diverse risk tolerances and trading preferences, allowing them to choose an account type that aligns with their individual financial goals and experience levels.

Leverage

Standard Account can access leverage of up to 1:500, providing the potential to amplify their trading positions. For more advanced traders seeking higher leverage, the VIP Account offers up to 1:1000, which allows for greater exposure to the market. However, it's important for traders to exercise caution when using high leverage, as it can also magnify potential losses.

To understand how CBMH's leverage compares to other brokers, here's a table that compares the maximum leverage on previously mentioned market instruments with FXPro, IC Markets, FBS, and Exness:

| Broker | Maximum Leverage |

| CBMH | Up to 1:500 |

| FXPro | Up to 1:500 |

| IC Markets | Up to 1:500 |

| FBS | Up to 1:3000 |

| Exness | Up to 1:2000 |

Spread

CBMH offers two different spread values across the three different account types. The Standard Account provides a spread of 1.5 pips for trading Forex, CFDs, Binary options, Stocks, and Cryptocurrencies. On the other hand, the VIP Account offers a fixed spread of 0.5 pips, while the Islamic Account also provides a spread of 1.5 pips for trading, the same as the Standard Account. The spread represents the difference between the buying and selling price of an asset and plays a crucial role in determining trading expenses.

Deposit & Withdrawal

CBMH offers three deposit and withdrawal methods for its traders. The first method is Bank Transfer, which allows traders to transfer funds directly from their bank accounts to their trading accounts and vice versa. The second method is Credit Card, where traders can use their credit cards to make deposits and withdrawals securely. The third method is Debit Card, enabling traders to use their debit cards for seamless transactions. These methods provide convenient and reliable options for funding and withdrawing funds, ensuring smooth and efficient financial operations for traders.

Trading Platforms

CBMH offers the MetaTrader 4 platform for trading, providing a user-friendly interface and access to a range of advanced trading tools. Traders can benefit from a seamless trading experience and execute their trades efficiently using this popular and widely recognized platform.

The following is a table that compares the trading platforms offered by CBMH to other brokers:

| Broker | Trading Platforms |

| CBMH | MetaTrader 4 |

| FXTM | MetaTrader 4, MetaTrader 5, FXTM Trader |

| Exness | MetaTrader 4, MetaTrader 5, Exness Trader |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader |

| FP Markets | MetaTrader 4, MetaTrader 5, IRESS, WebTrader |

Customer Support

CBMH offers three customer support options: QQ for Chinese customers, Phone Number, and Email. These channels provide various ways for traders to reach the company's support team and seek assistance as needed. Specifics are as follows:

QQ: A popular messaging platform widely used in China, serves as one of the avenues to reach CBMH's customer support team. Traders can communicate their inquiries or concerns directly through the QQ platform by adding the user “4006063399”.

Phone Number: The number for contact is 400-606-3399. This offers traders another channel to contact CBMH's customer support. By dialing this number, traders can connect with the support team and receive assistance over the phone.

Email: The address for contact is help@cbmh.com which, allows traders to send their queries or issues via email to CBMH's support team. This method enables traders to communicate in writing and receive responses to their inquiries.

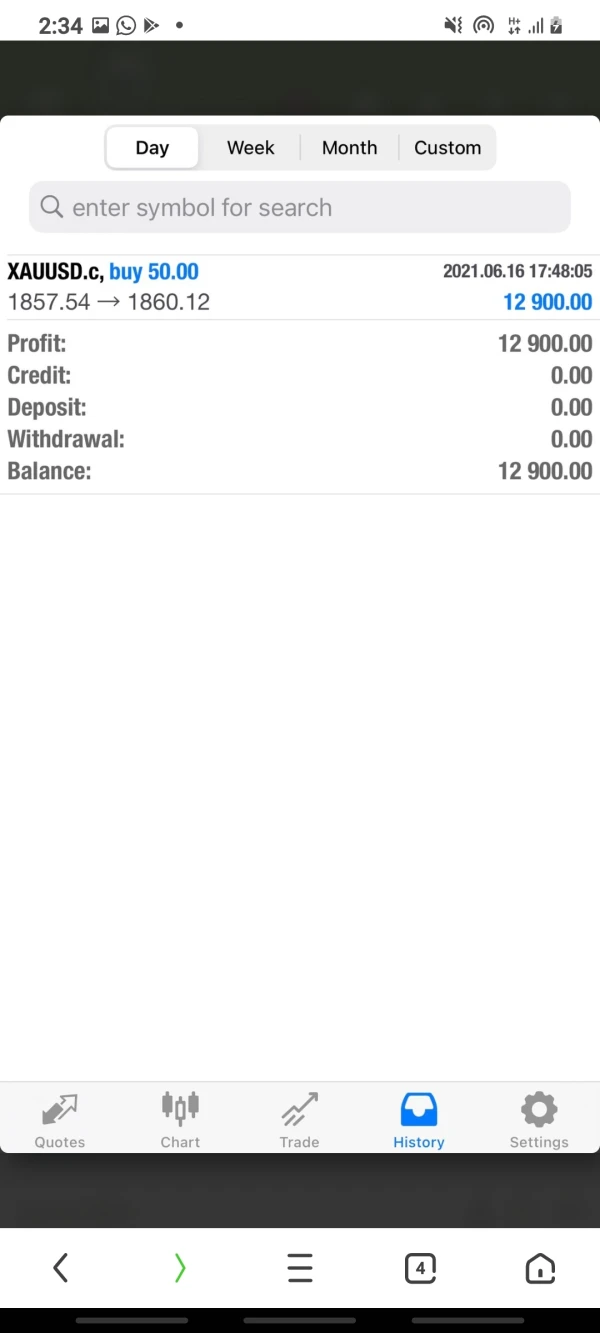

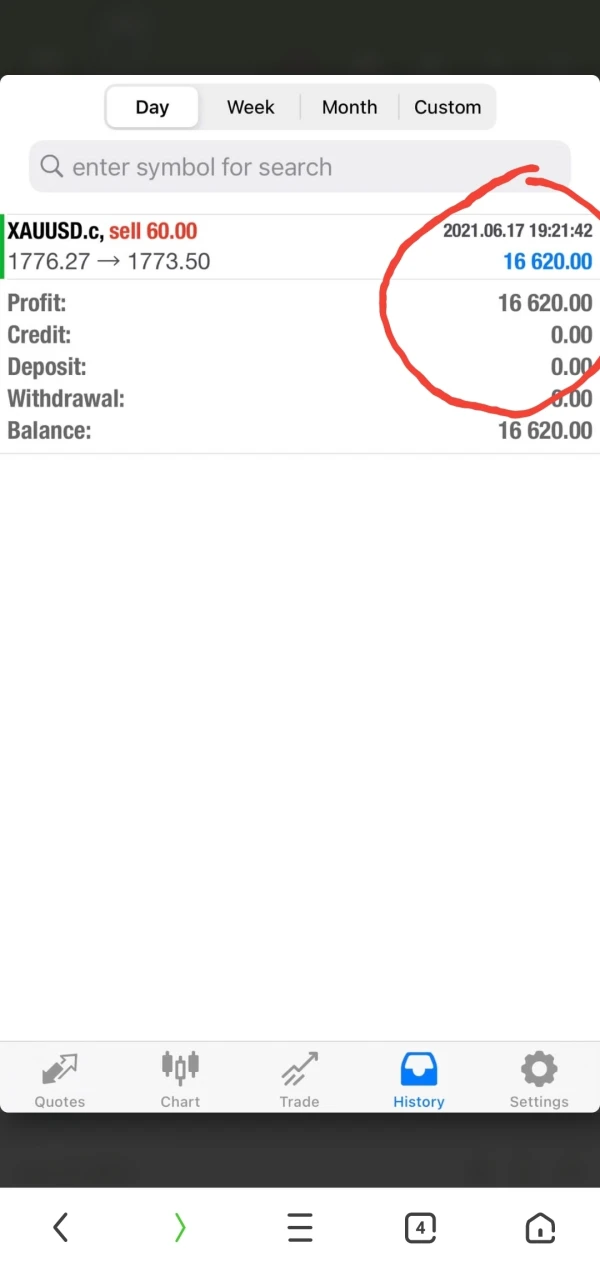

Customer Feedback

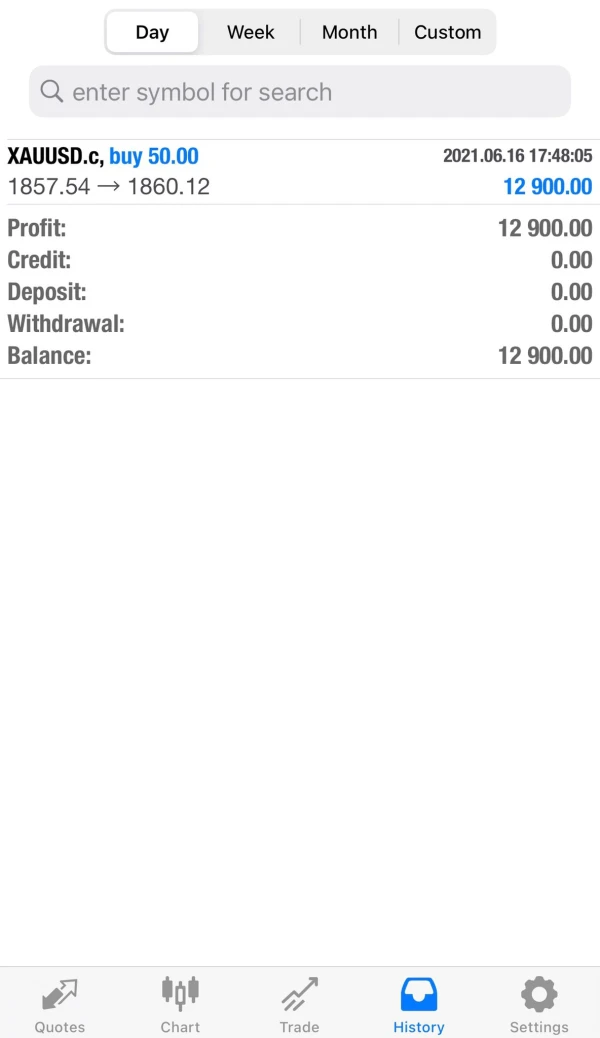

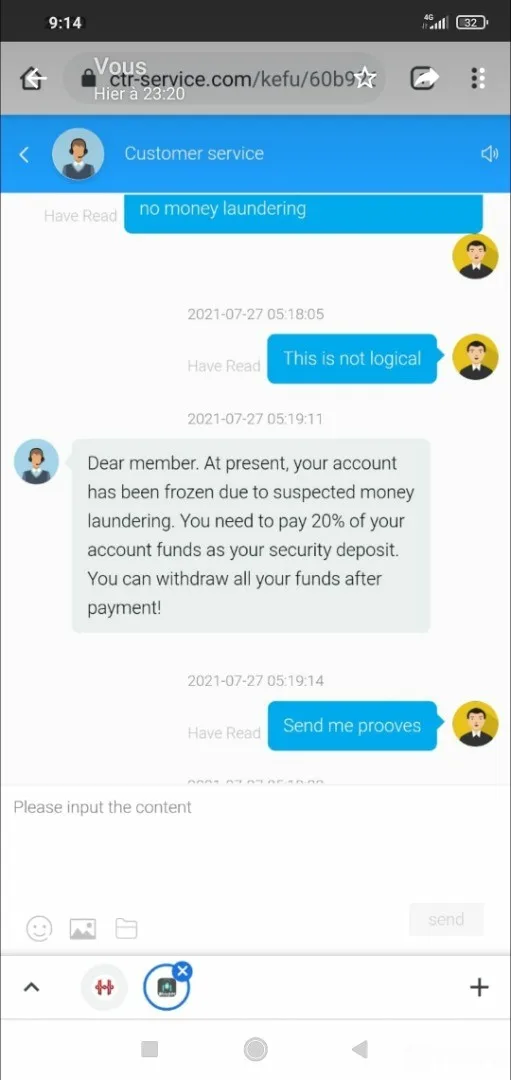

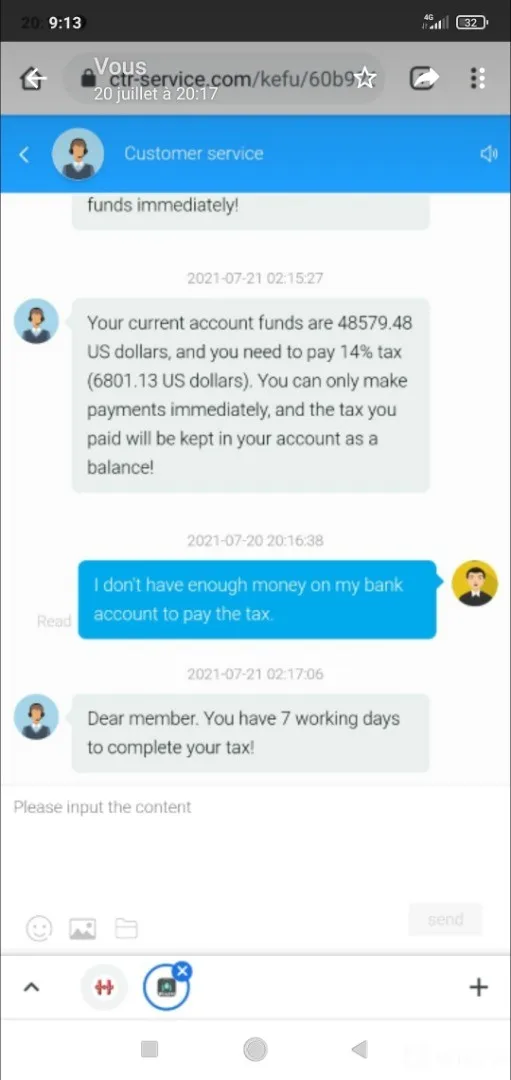

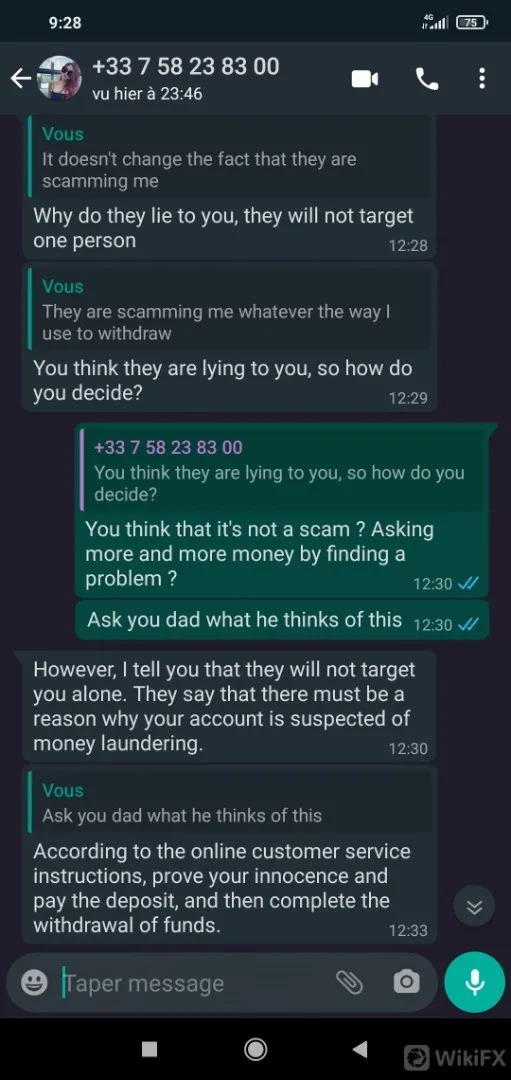

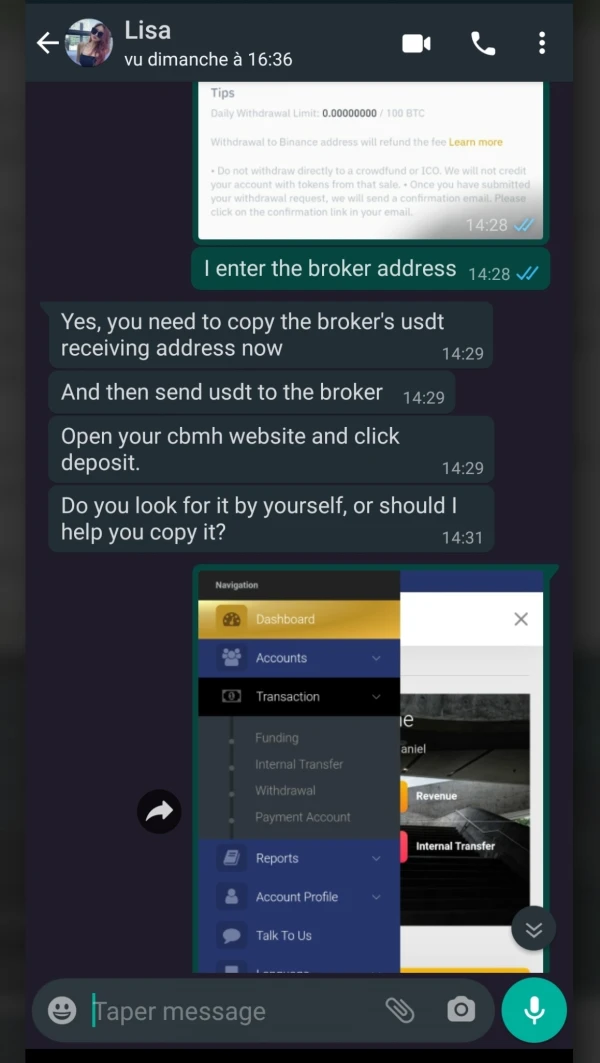

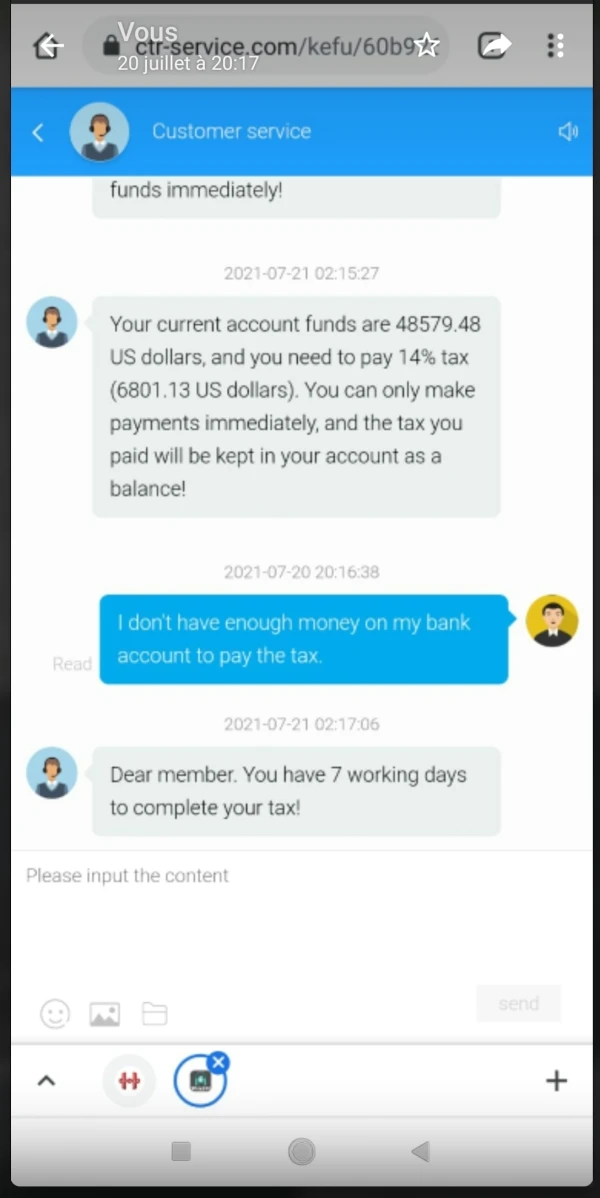

Based on customer feedback, there are several complaints and concerns regarding CBMH's withdrawal process. Traders have expressed frustrations over delays and difficulties in withdrawing their funds. Some reviews mention encountering issues with customer support, with unresponsiveness to inquiries and requests. Additionally, there are allegations of potential scams, where traders were asked to pay taxes or fees before being able to withdraw their funds, leading to suspicions of money laundering. These reviews highlight the importance of conducting thorough research and due diligence before engaging with CBMH or any brokerage, and it's essential for traders to be cautious and vigilant when dealing with unfamiliar platforms.

Conclusion

In conclusion, CBMH is an unregulated financial company offering a range of trading services for Forex, CFDs, Binary options, Stocks, and Cryptocurrencies through the MetaTrader 4 platform. There are three different account types, including Standard, VIP, and Islamic, all offering traders access to varying leverage ratios and spreads as well as a minimum deposit of $250.

However, it's important to note that CBMH currently lacks an accessible website, limiting potential clients from gathering information easily or going through a conventional online account creation process. Instead, traders may have to rely on alternative channels such as phone, QQ, or email to access the platform. Additionally, several concerning customer feedback reviews have been noted, citing difficulties and delays in the withdrawal process, as well as potential scam-related allegations.

FAQs

Q: What types of assets can I trade with CBMH?

A: CBMH offers a range of assets, including Forex, CFDs, Binary options, Stocks, and Cryptocurrencies.

Q: What are the minimum deposit requirements for each account type?

A: The minimum deposit for the Standard and Islamic accounts is $250, while the VIP account requires a minimum deposit of $5,000.

Q: Which trading platform does CBMH provide?

A: CBMH offers the MetaTrader 4 platform for trading.

Q: What are the available leverage ratios for each account type?

A: The Standard account offers leverage of up to 1:500, while the VIP account provides leverage of up to 1:1000.

Q: How can I reach customer support at CBMH?

A: You can contact customer support through QQ, phone, or email channels.

Q: Is CBMH a regulated brokerage?

A: No, CBMH operates as an unregulated brokerage.

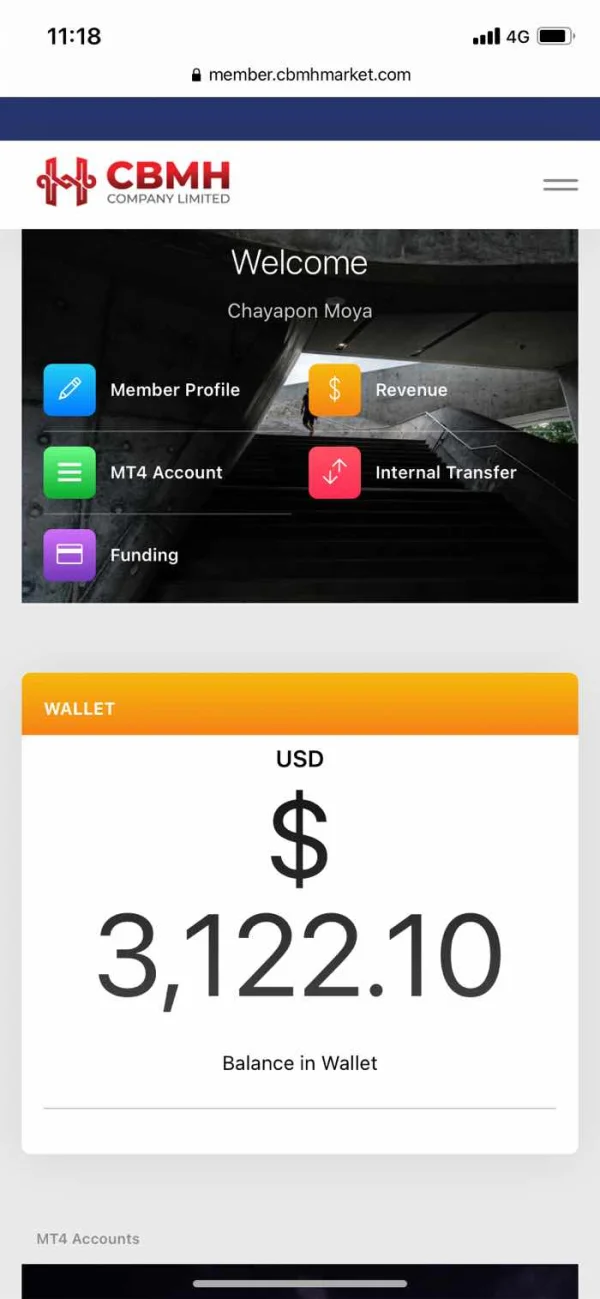

Fujisan Boy Moya

Thailand

The staff didn't answer my questions. Now everyone is waiting for their withdrawals

Exposure

FX4281583189

Malaysia

My account has been closed and a 10% margin has been required. Will the same thing happen again? A scam?

Exposure

FX3754804380

Singapore

Scam people to deposit money, then don't allow to withdraw

Exposure

FX3020294841

Nigeria

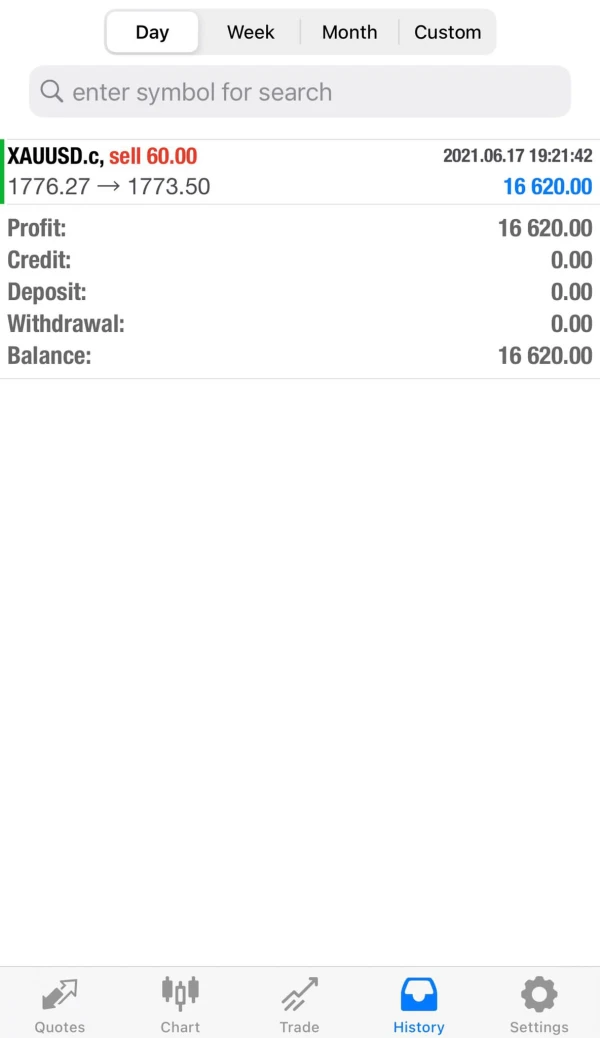

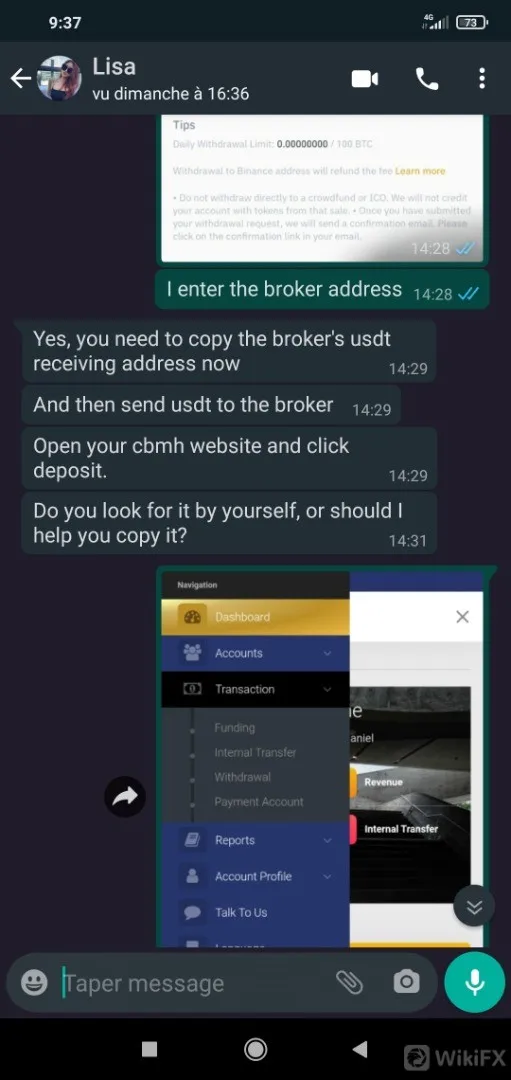

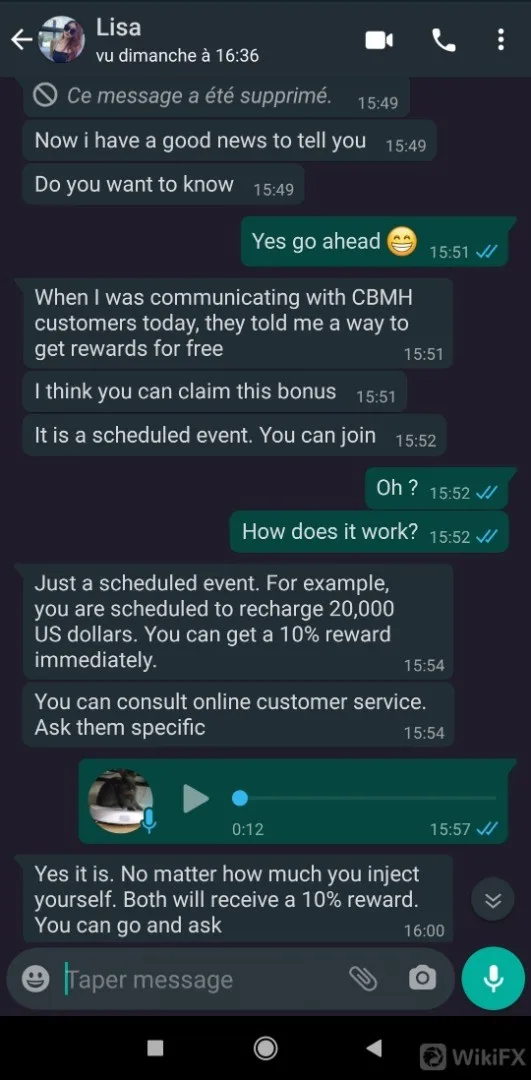

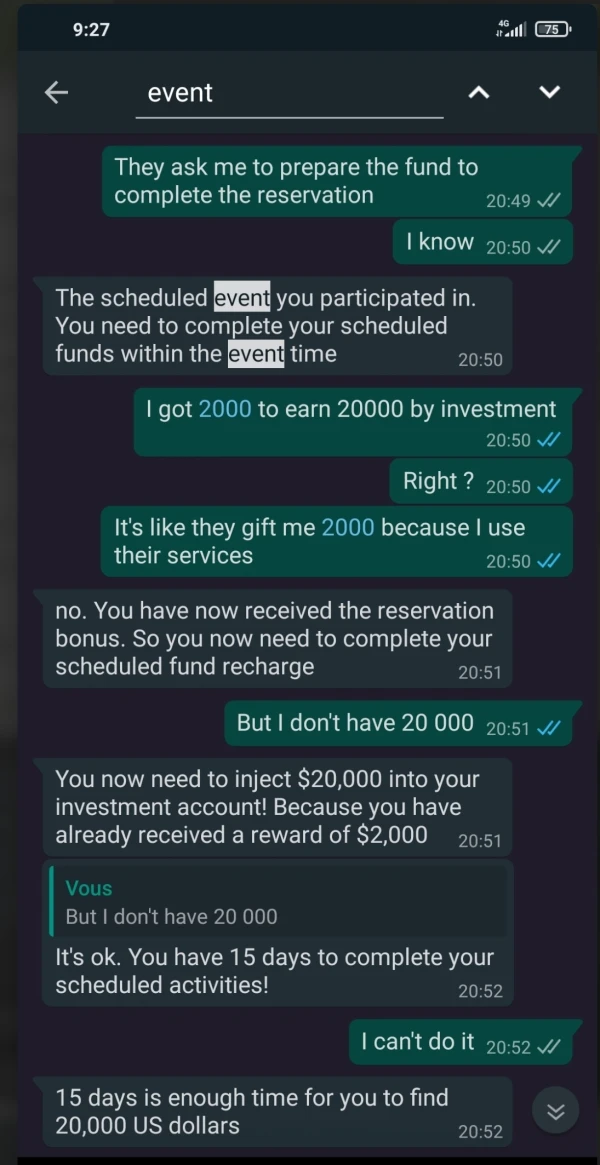

Hello everyone, I knew a girl from app called travel and she asked for my whats app and we started chatting and she said she is from Thailand but she is visiting her Aunt in Chicago atm and the chat was normal untill she explained to me how much she is making a week and she is doing it throught trading leverage in Gold 1:100 and she have never lost a trade,i do have experience in trading and i understand that what she saying is impossible to win all trades,

Exposure

Andy loh

Malaysia

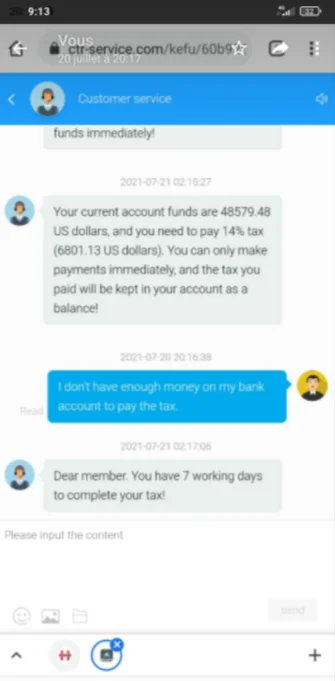

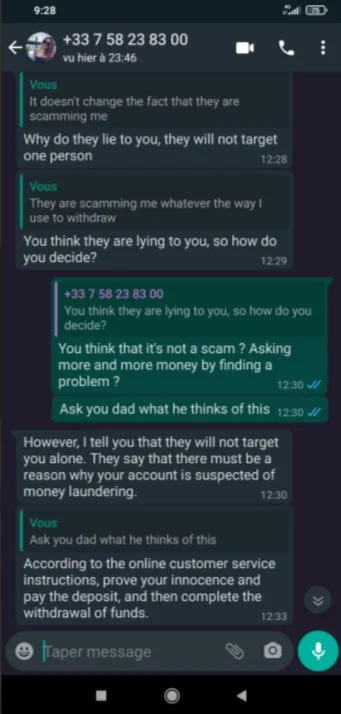

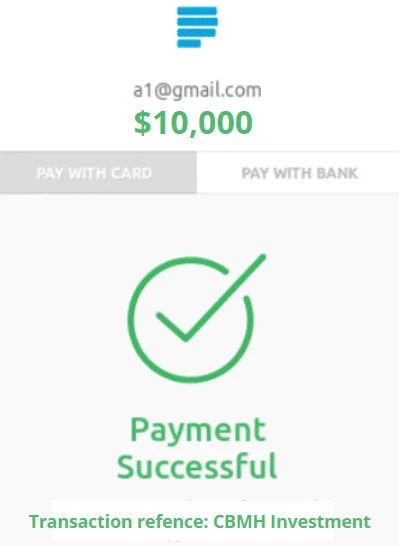

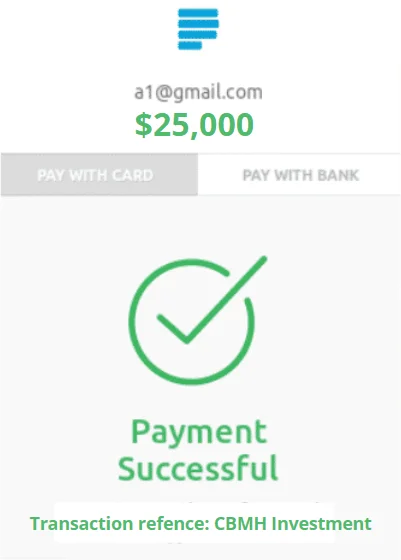

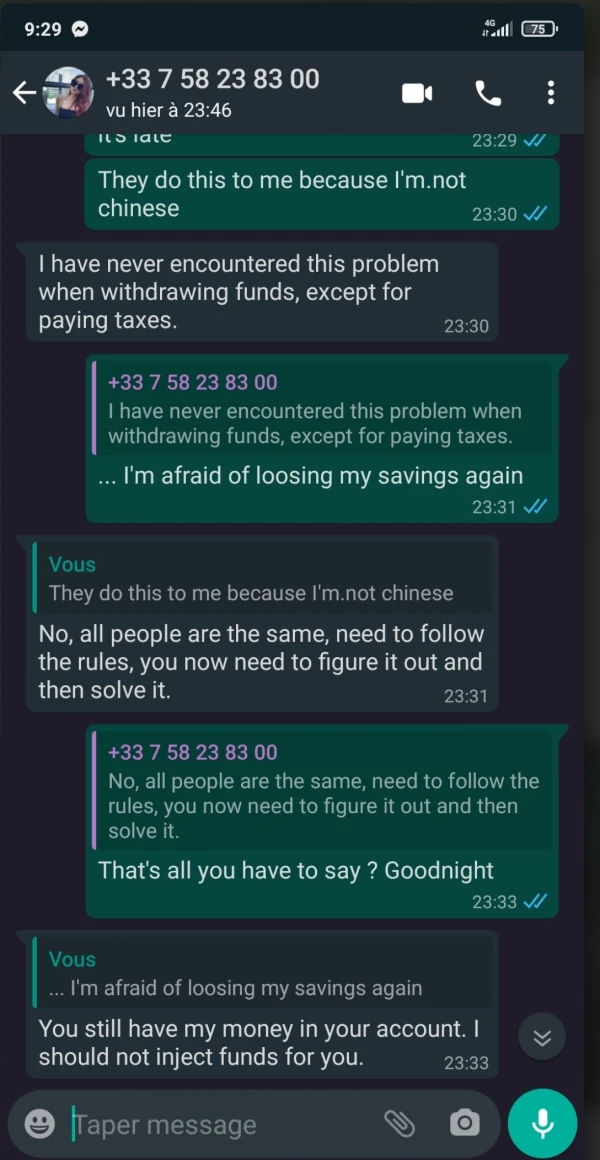

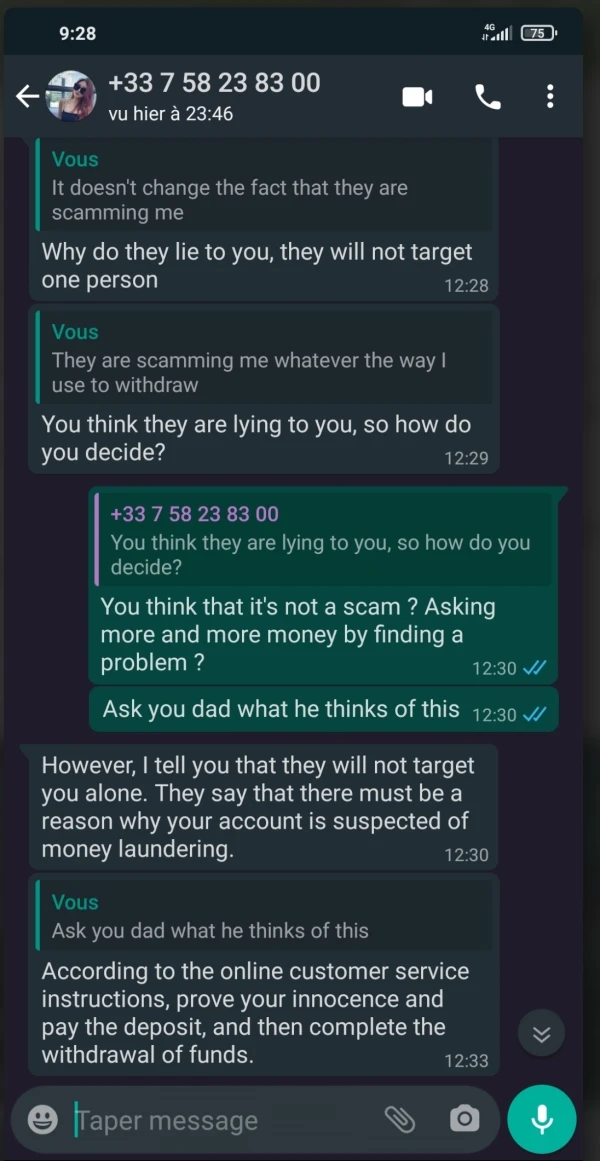

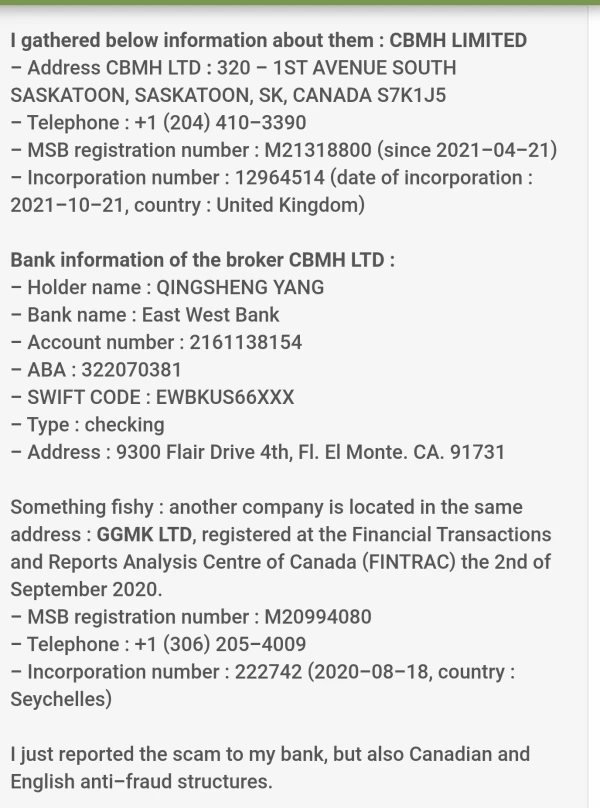

I was introduced to the scam by a Chinese girl named Lisa to invest in gold through the broker CBMH LTD on the MT4 platform.She is based in Paris and wanted to help me earn more money. After a while and some suspicion, I finally injected little by little all my savings, thinking that I could withdraw whenever I want. when i want to withdraw they asked me to pay taxes when I first tried to withdraw, corresponding to 14% of my invested money. They told me I could then withdraw without limit. I paid it with the help of the Chinese girl the 26th of July 2021, but when I tried to withdraw my money to my bank account, they refused it because they suspected that I am doing money laundering.

Exposure

FX7359315392

Bangladesh

A girl named Alina, lured me into investing in this broker. After investment, I found out the girl was a scam, so I withdrew all my funds from the broker through the girl, telling her that I wanted to withdraw to check the credibility of this broker, before investing a further $20k. I got all my money back and never contacted with the girl again. Others stay alert.

Exposure

FX1169078433

Malaysia

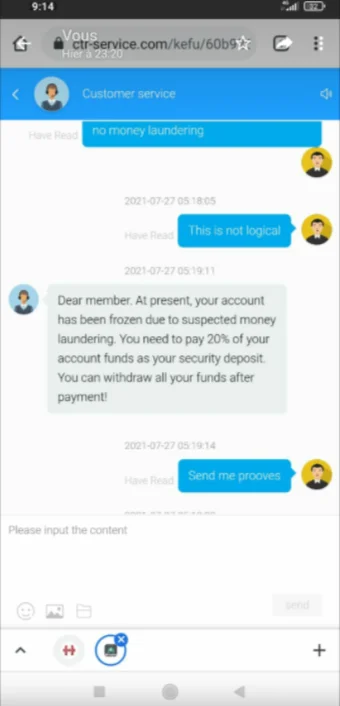

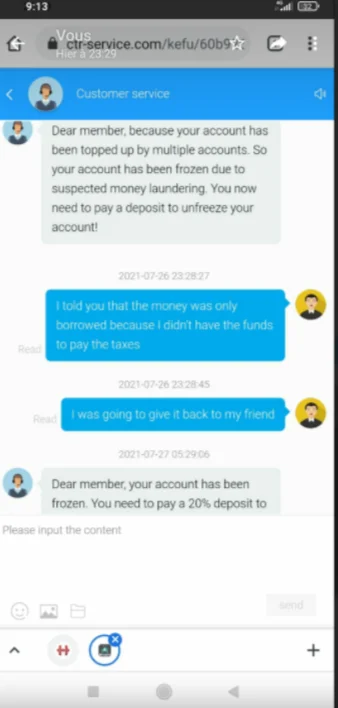

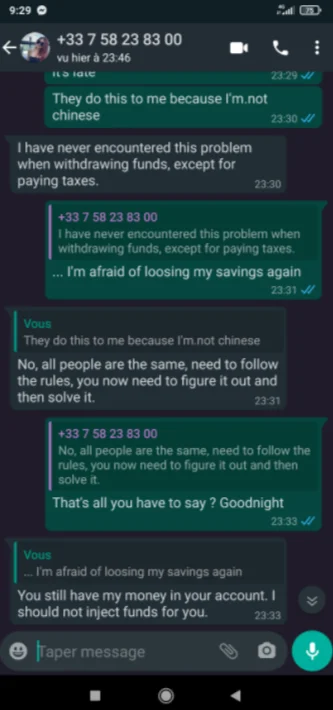

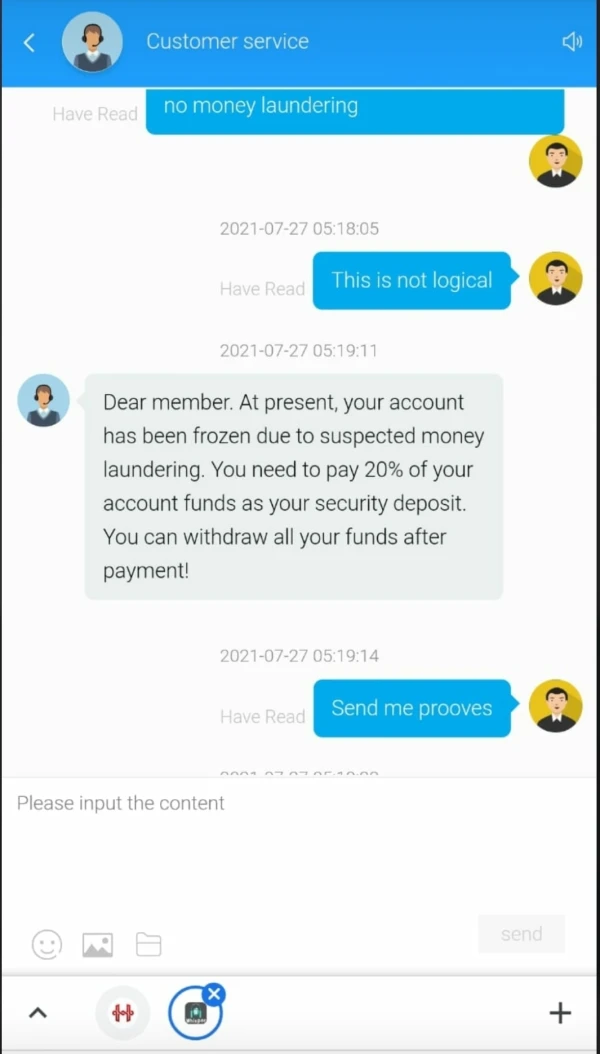

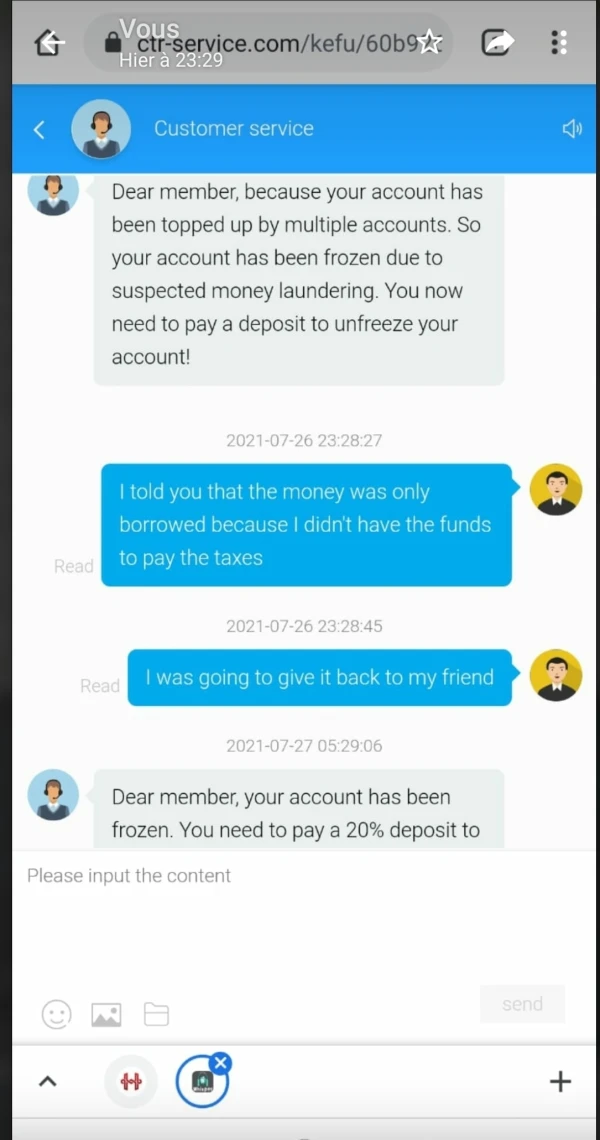

I was scammed by chinese broker through a girl, named Lisa whom i met on Facebook. Lisa persuaded me to invest in Gold through the Broker's platform. She tricked me into accepting an event in which I can earn 10% of the money invested, but she made it sound differently, only telling me that. I took a loan of 15,000 euros to be able to complete the scheduled event before they freeze my account. She taught me how to buy USD cryptocurrency on Binance and then send the money to my MT4 account linked to the Broker's site. I made several payments using Binance, for a total of roughly 25,000 euros. The Broker asked me to pay taxes when I first tried to withdraw, corresponding to 14% of my invested money. They told me I could then withdraw without limit. I paid it with the help of the Chinese girl. But when I tried to withdraw my money to my bank account, they refused it because they suspected that I am doing money laundering. They said my account was topped up by several people, since the girl sent me money through the platform. I explained the situation to them but they don't want to hear anything and ask to fund 20% of my invested money to unfreeze my account. Obviously they will never allow me to withdraw and all of this was planned by the girl as well. I feel so bad to have been so naive, I hope those scammers will get to jail.

Exposure

FX2843103612

Nigeria

Scam broker CBMH LIMITED stole 25000 euros from me Thread starterElyus Start dateJul 28, 2021 Tagscbmh limited cbmh ltd I am French and I mae a post here because I have been scammed by a Chinese broker called CBMH LIMITED through a girl I met on Facebook dating. I was introduced to the scam by a Chinese girl named Lisa to invest in gold through the broker CBMH LTD on the MT4 platform.

Exposure

Mayaz Ahmad

Bangladesh

CBMH LTD asked me to pay taxes when I first tried to withdraw, corresponding to 14% of my invested money. They told me I could then withdraw without limit. I paid it with the help of the Chinese girl the 26th of July 2021, but when I tried to withdraw my money to my bank account, they refused it because they suspected that I am doing money laundering. They justificated it by saying that my account was topped up by several people, since the girl sent me money through the platform.

Exposure

สมพง พระประแดง

Thailand

I was unable to withdraw when making profits. The customer service did not reply. Please help. Beware of it.

Exposure

90Pato

Canada

Tried to withdraw and the same customer asked for money to unlock my own money

Exposure

FX1199423516

Thailand

You can deposit funds but you can't withdraw funds

Exposure