Company Summary

| UE Capital Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Lucia |

| Regulation | No Regulation |

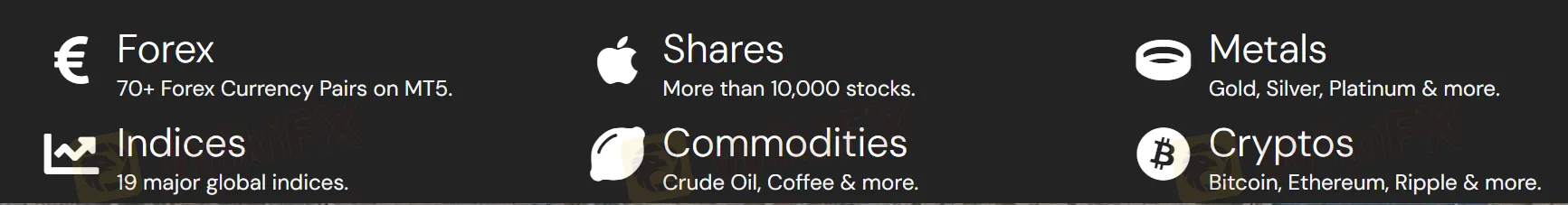

| Market Instruments | Forex, Indices, Shares, Commodities, Metals, Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0 pips (Classic account) |

| Trading Platform | MT5 |

| Minimum Deposit | $50 |

| Customer Support | 24/7 support, contact form |

| Email: support@ue.capital | |

| Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. | |

| LinkedIn, Facebook, Instagram, YouTube, WhatsApp, Telegram | |

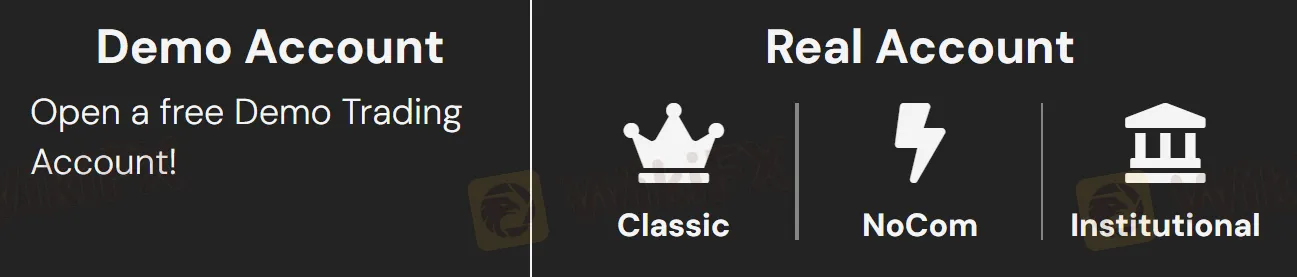

UE Capital is an unregulated financial firm established in 2023 and registered in Saint Lucia. It offers diverse products: Forex, commodities (metals), indices, cryptocurrencies, and shares. The firm provides a demo account and Real Accounts (Classic, NoCom, Institutional) with a minimum deposit requirement of just $50 and high leverage up to 1:500. What's more, UE Capital supports the MetaTrader 5 (MT5) platform.

Pros and Cons

| Pros | Cons |

| Demo accounts available | No regulation |

| A wide range of trading products | Limited payment options |

| Diverse account types | |

| 24/7 customer support | |

| Low minimum deposit | |

| MT5 platform |

Is UE Capital Legit?

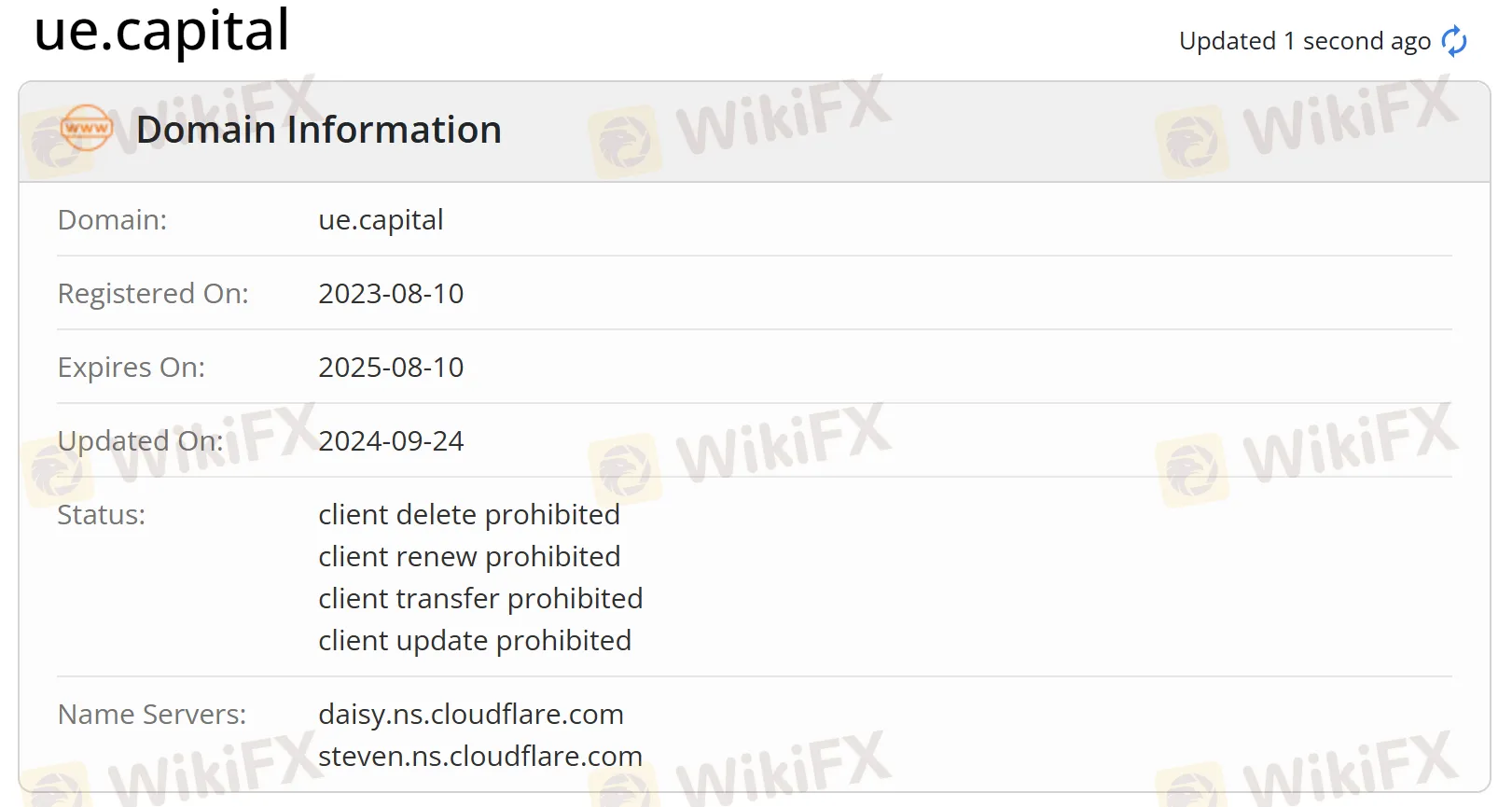

At present, UE Capital lacks valid regulation. Its domain was registered on Aug 10, 2023, and the current status is “client delete prohibited, client renew prohibited, client transfer prohibited, client update prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

What Can I Trade on UE Capital?

On UE Capital, you can trade with Forex, Indices, Shares, Commodities, Metals, and Cryptos.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

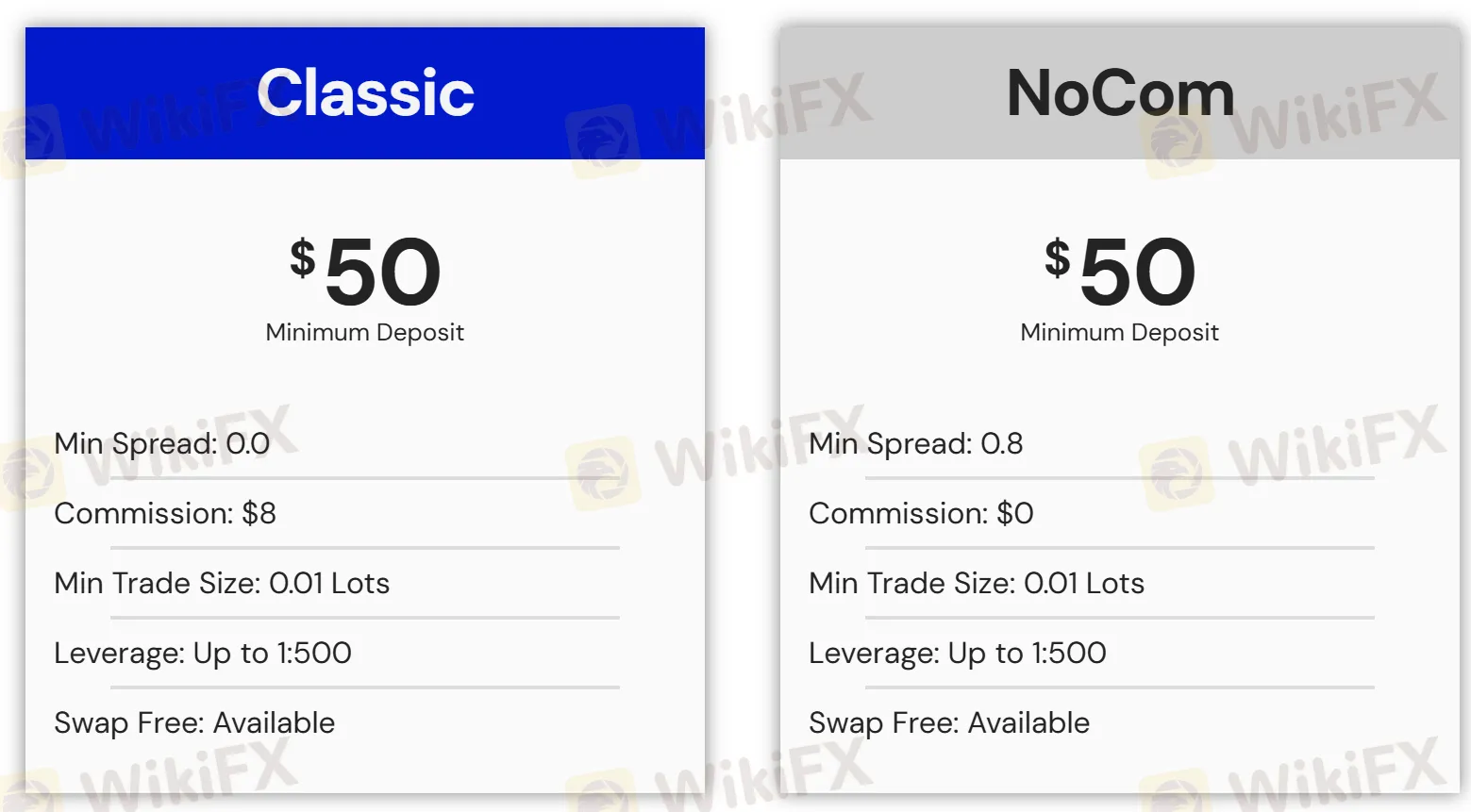

Account Type

UE Capital provides a Demo Account and Real Accounts (Classic, NoCom, Institutional). The minimum deposit requirement is $50.

Leverage

The maximum leverage is up to 1:500. However, note that high leverage can amplify both profits and losses.

Spreads and Commissions

| Account Type | Minimum Spread | Commission |

| Classic | 0 | $8 |

| NoCom | 0.8 | $0 |

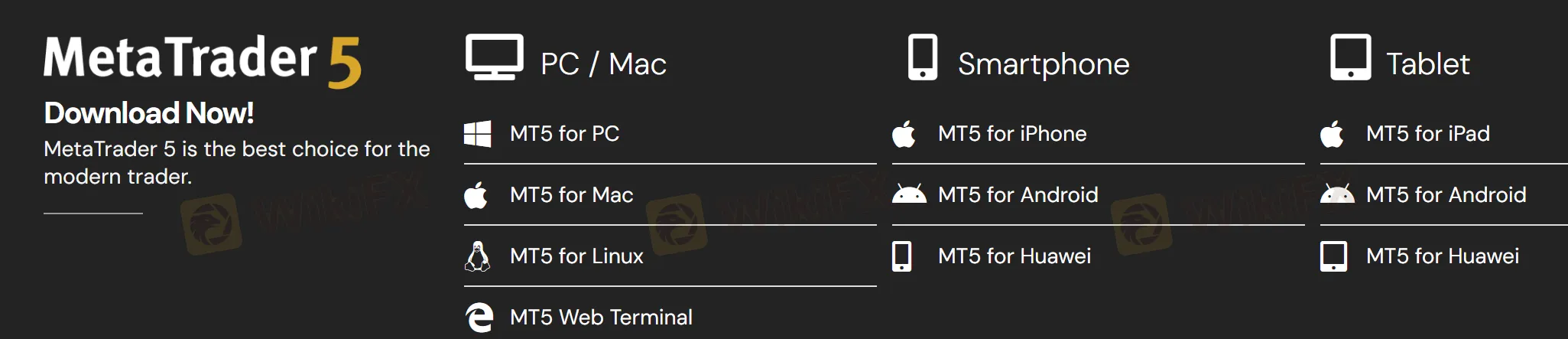

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, Mac, Linux, Web Terminal, iPhone/iPad, Android, Huawei | Experienced traders |

| MT4 | ❌ | / | Beginners |

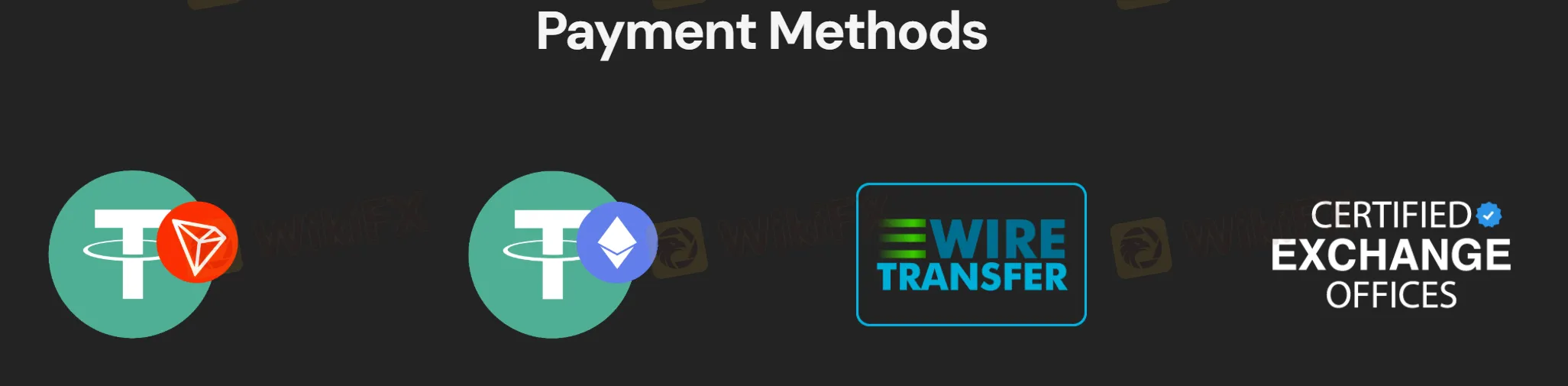

Deposit and Withdrawal

UE Capital supports payments through Tether (TRON), Tether (Ethereum), Wire Transfer, and Certified Exchange Offices. However, specific info like deposit and withdrawal processing time and associated fees is not revealed.

Nguyễn Văn Min

Vietnam

Regular market updates are provided. The quality of the analysis is adequate.

Positive

GDHEW

Cyprus

Account creation was very easy, you are guided through the process by the hand. Then my first touch with the platform (station) and after a day of training I got hooked; it is like a computer game, so entertaining. I know, it is a gambling, at least I am aware of ;-) About the service - great experience as well. Prompt help using built-in chat. I have tested also other brokers, so far UE Capital experience was the best

Positive

Fadel Abbas

Italy

I've been trading with EU Capital for a while now, and I must say, they've consistently exceeded my expectations! The platform is user-friendly, making it easy for both beginners and seasoned traders to navigate and make the most out of their investments. One of the standout features for me has definitely been the withdrawal process – it's lightning fast! I've made several withdrawals, and each time, the funds were in my account quicker than I anticipated, without any hassle or unnecessary delays. This efficiency is a huge plus, especially in the trading world where timing and trust are everything. The customer service at EU Capital is also top-notch. They are always available, friendly, and incredibly helpful, ensuring that any queries or issues are addressed promptly and effectively. It's clear they prioritize their clients, making sure we're supported every step of the way. For anyone looking for a reliable and efficient trading partner, I wholeheartedly recommend EU Capital. Their commitment to excellence and client satisfaction makes them a standout in the financial services industry. Give them a try – you won't be disappointed!

Positive

Haohwj

Ukraine

The app is good otherwise but i give it 2 star because of the lack of % view of stocks as well as portfolio performance which is very important for customers to make decisions on buying more or selling. Can i please request the team to add this feature on desktop & app platforms at the earliest.

Neutral