Company Summary

| Aspect | Information |

| Company Name | GWTrade |

| Registered Country/Area | Cyprus |

| Founded Year | 2016 |

| Regulation | CYSEC |

| Minimum Deposit | €100 |

| Maximum Leverage | 1:200 |

| Spreads | Start from 0.3 pips |

| Trading Platforms | MetaTrader 5 |

| Tradable Assets | Stocks, forex, commodities, indices, future and cryptocurrencies |

| Account Types | Standard, Silver, Gold, VIP and Professional |

| Demo Account | Available |

| Customer Support | Email, phone and social media |

| Deposit & Withdrawal | Skrill, Przelewy24, Trustly, Neteller, wire transfers with Bank of Cyprus or Eurobank, Nuvei, and Sofort |

| Educational Resources | Introduction courses, In-depth courses, Ebooks, FX Glossary and Economic Calendar Tutorial |

Overview of GWTrade

GWTrade is a Cyprus Investment Firm that offers a range of financial services tailored to meet the needs of both novice and experienced investors since 2016. The firm provides access to a variety of market instruments, including stocks, forex, commodities, and indices, etc. GWTrade prides itself on its user-friendly trading platforms and various educational resources designed to empower traders with the knowledge and tools necessary to make informed decisions.

The broker is committed to ensuring the safety and security of client funds through strict regulatory compliance and robust risk management practices. GWTrade also offers several account types, flexible leverage options, and competitive trading fees. Despite its numerous advantages, some areas such as customer service hours and detailed information on fees could be improved to enhance the overall client experience.

Regulatory Status

GWTrade is authorized and regulated by the Securities and Exchange Commission (CYSEC) in Cyprus, with registration number 291/16.

Pros and Cons

GWTrade offers several advantages for traders. It's a licensed and regulated broker, ensuring a level of security. They provide a diverse range of tradable instruments and utilize the popular MetaTrader 5 platform, familiar to many traders. Additionally, GWTrade offers a variety of account types to suit different needs and experience levels, and their educational resources can be valuable for beginners.

However, there are also some drawbacks to consider. GWTrade charges an inactivity fee, which can eat into profits for less frequent traders. Additionally, they don't offer swap-free accounts, which can be a dealbreaker for some Sharia-compliant traders.

| Pros | Cons |

| Licensed and regulated by CYSEC | Inactivity fee applied |

| Diverse Market Instruments | No swap-free account |

| Use of popular MetaTrader 5 | |

| Various account types | |

| Diverse educational resources |

Market Instruments

GWTrade offers a diverse range of market instruments, enabling clients to engage in various trading strategies and diversify their investment portfolios. The primary categories of instruments available include:

- Stocks: Clients can trade a wide selection of stocks from major global exchanges. Stock trading allows investors to buy and sell shares of publicly traded companies, providing opportunities for capital growth and dividend income. GWTrade provides access to blue-chip stocks, mid-cap, and small-cap companies, ensuring a broad spectrum of investment opportunities.

- Forex: The forex market is a significant component of GWTrade's offerings, allowing clients to trade major, minor, and exotic currency pairs. Forex trading involves buying and selling currencies in pairs, with the aim of profiting from fluctuations in exchange rates. GWTrade's platform supports high liquidity and tight spreads, making it a popular choice for forex traders.

- Commodities: GWTrade also facilitates trading in various commodities, including precious metals like gold and silver, energy products such as oil and natural gas, and agricultural commodities. Commodity trading can serve as a hedge against inflation and economic uncertainty, providing a stable investment alternative.

- Indices: Clients can trade global indices, which represent the performance of a group of stocks from a specific country or sector. Indices trading allows investors to gain exposure to broader market movements without having to trade individual stocks. Popular indices available on GWTrade include the S&P 500, NASDAQ 100, and FTSE 100.

- Cryptocurrencies: GWTrade offers trading in popular cryptocurrencies, including Bitcoin, Ethereum, and Ripple. Cryptocurrency trading provides opportunities for high returns, albeit with higher volatility compared to traditional assets. The broker's platform supports transactions and real-time price tracking for digital assets.

- Future: GWTrade caters to futures trading, where contracts lock in a price to buy or sell an asset at a specific future date. These contracts expire, requiring positions to be closed or automatically rolled over to the next contract.

Account Types

GWTrade offers five live trading account types and a demo account:

Standard Account: This account type has a minimum deposit of €100 (or equivalent currency). It offers spreads from 0.7 pips and has a maximum leverage of 1:30. This account type is suitable for new traders who are just starting out.

Silver Account: The Silver Account requires a minimum deposit of €1,000 (or equivalent currency). It offers tighter spreads from 0.6 pips and has the same maximum leverage of 1:30 as the Standard Account. This account type may be suitable for traders who are looking for slightly tighter spreads than the Standard Account.

Gold Account: The Gold Account has a minimum deposit requirement of €5,000 (or equivalent currency). It offers even tighter spreads from 0.5 pips and maintains the same maximum leverage of 1:30. This account type may be attractive to traders who demand narrower spreads.

VIP Account: The VIP Account requires a minimum deposit of €20,000 (or equivalent currency). It offers spreads from 0.6 pips and the same maximum leverage of 1:30. This account type may be suitable for experienced traders who are comfortable with taking on more risk.

Professional Account: The Professional Account has the highest minimum deposit requirement of €50,000 (or equivalent currency). It offers the tightest spreads from 0.3 pips and also increases the maximum leverage to 1:200. This account type is likely targeted at professional traders who have significant capital and experience.

| Feature | Standard | Silver | Gold | VIP | Professional |

| Minimal Deposit | €100 | €1,000 | €5,000 | €20,000 | €50,000 |

| Spread | from 0.7 | from 0.6 | from 0.5 | from 0.4 | from 0.3 |

| Stop Out Level | 50% | 50% | 50% | 50% | 13% |

| Margin Call level | 100% | 100% | 100% | 100% | 80% |

| Margin Hedge | 50% | 50% | 25% | 25% | Not Applicable |

| Platform | MT5 Desktop, Mobile, Web Terminal | MT5 Desktop, Mobile, Web Terminal | MT5 Desktop, Mobile, Web Terminal | MT5 Desktop, Mobile, Web Terminal | MT5 Desktop, Mobile, Web Terminal |

| Min Size | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

| Forex commissions | 0 € / $ | 0 € / $ | 0 € / $ | 0 € / $ | 4 € / $ |

| Metals commissions | 0 € / $ | 0 € / $ | 0 € / $ | 0 € / $ | 4 € / $ |

| Crypto commissions | Not Available | 0 € / $ | 0 € / $ | 0 € / $ | 0 € / $ |

| Energies commissions | Not Available | 0 € / $ | 0 € / $ | 0 € / $ | 3 € / $ |

| Indices commissions | Not Available | 0 € / $ | 0 € / $ | 0 € / $ | 2 € / $ |

| Stocks commissions | Not Available | 0 € / $ | 0 € / $ | 0 € / $ | 3 € / $ |

| Futures commissions | Not Available | 0 € / $ | 0 € / $ | 0 € / $ | 2 € / $ |

| Max Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:200 |

Account Opening Process

Opening an account with GWTrade is a streamlined and user-friendly process. Prospective clients can start by visiting the firm's website and selecting the “Open Account” option. The account opening process involves the following steps:

- Registration: Clients need to provide basic personal information, including their name, email address, phone number, and country of residence.

- Verification: To comply with regulatory requirements, clients must verify their identity by submitting copies of a government-issued ID and proof of address (such as a utility bill or bank statement). This step ensures the security and integrity of the account.

- Funding: Once the account is verified, clients can fund their accounts using various payment methods, including bank transfers, credit/debit cards, and electronic wallets. The minimum deposit requirement varies depending on the account type chosen.

- Trading: After funding the account, clients can start trading by accessing the trading platform and selecting their preferred market instruments.

Leverage

GWTrade's leverage options cater to different risk appetites. Standard, Silver, Gold, and VIP accounts offer a conservative maximum leverage of 1:30, suitable for beginners. For experienced traders comfortable with higher risk, Professional accounts raise the maximum leverage to 1:200, allowing for amplified returns (and losses).

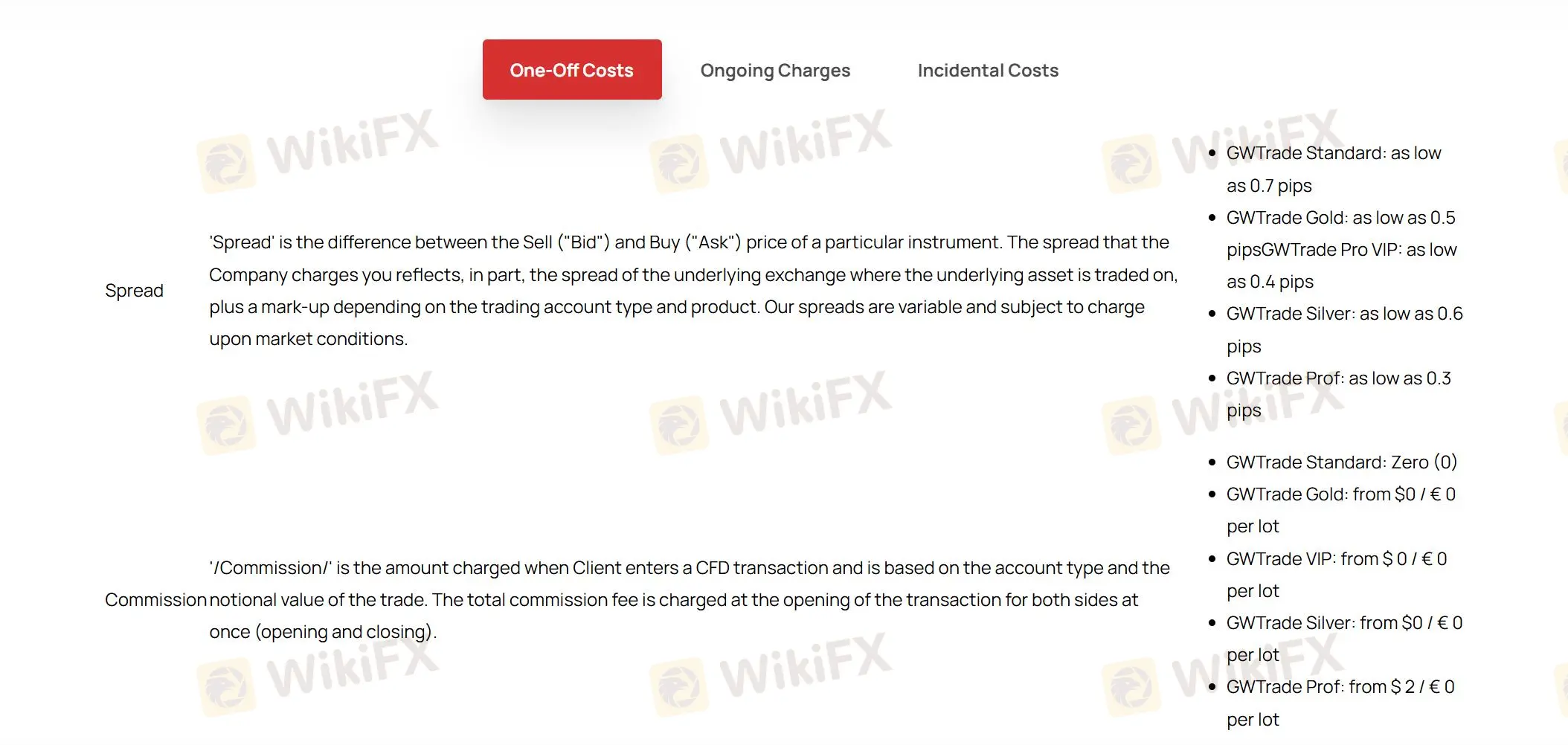

Trading Fees

GWTrade offers a variety of account types, each with different spreads and commissions to cater to traders with various needs and trading volumes.

GWTrade offers Standard and Silver accounts with 0.7 & 0.6 pip spreads respectively, starting at €100 and €1,000 minimum deposits, with no commissions on any trades. Higher tiers (Gold, VIP) require larger deposits but offer tighter spreads (0.5 & 0.4 pips) and maintain zero commissions across all asset classes.

The Professional account, demanding a minimum deposit of €50,000, offers the tightest spreads starting from 0.3 pips. Unlike other account types, this account incurs commissions: €4 for forex and metals, €3 for energies, €2 for indices and futures, and €3 for stocks.

GWTrade also charges an inactivity fee of €/$ 25applies only to accounts that remain inactive for a period of 3 months (90 calendar days).

Trading Platforms and Tools

GWTrade offers the popular MetaTrader 5 (MT5), the most advanced trading platform by MetaQuotes. It offers a diverse suite of analytical tools accessible via desktop, app, and web terminal. These built-in features empower users to dissect market conditions, pinpoint price movements, and identify entry points. Compared to its predecessor, MT4, MT5 boasts more order types, a wider range of graphical objects, diverse timeframes, and an integrated economic calendar and email system.

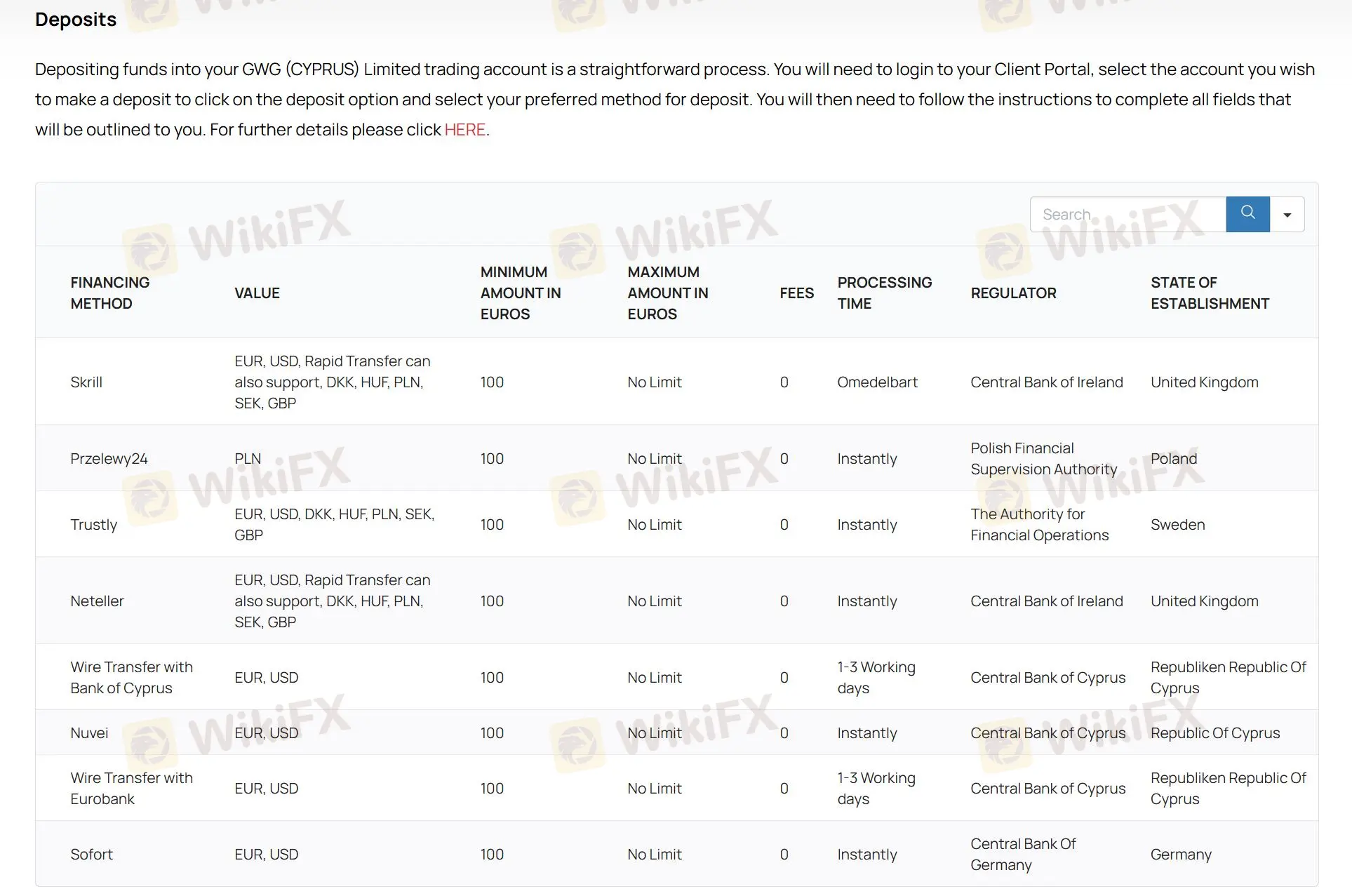

Deposit and Withdrawal

GWTrade supports a variety of deposit methods, including Skrill, Przelewy24, Trustly, Neteller, wire transfers with Bank of Cyprus or Eurobank, Nuvei, and Sofort. The minimum deposit amount for all methods is €100, with no maximum limit. Most methods, such as Skrill, Przelewy24, Trustly, Neteller, Nuvei, and Sofort, offer instant processing with no fees, ensuring that funds are available for trading without delay. However, wire transfers may take 1-3 business days to process.

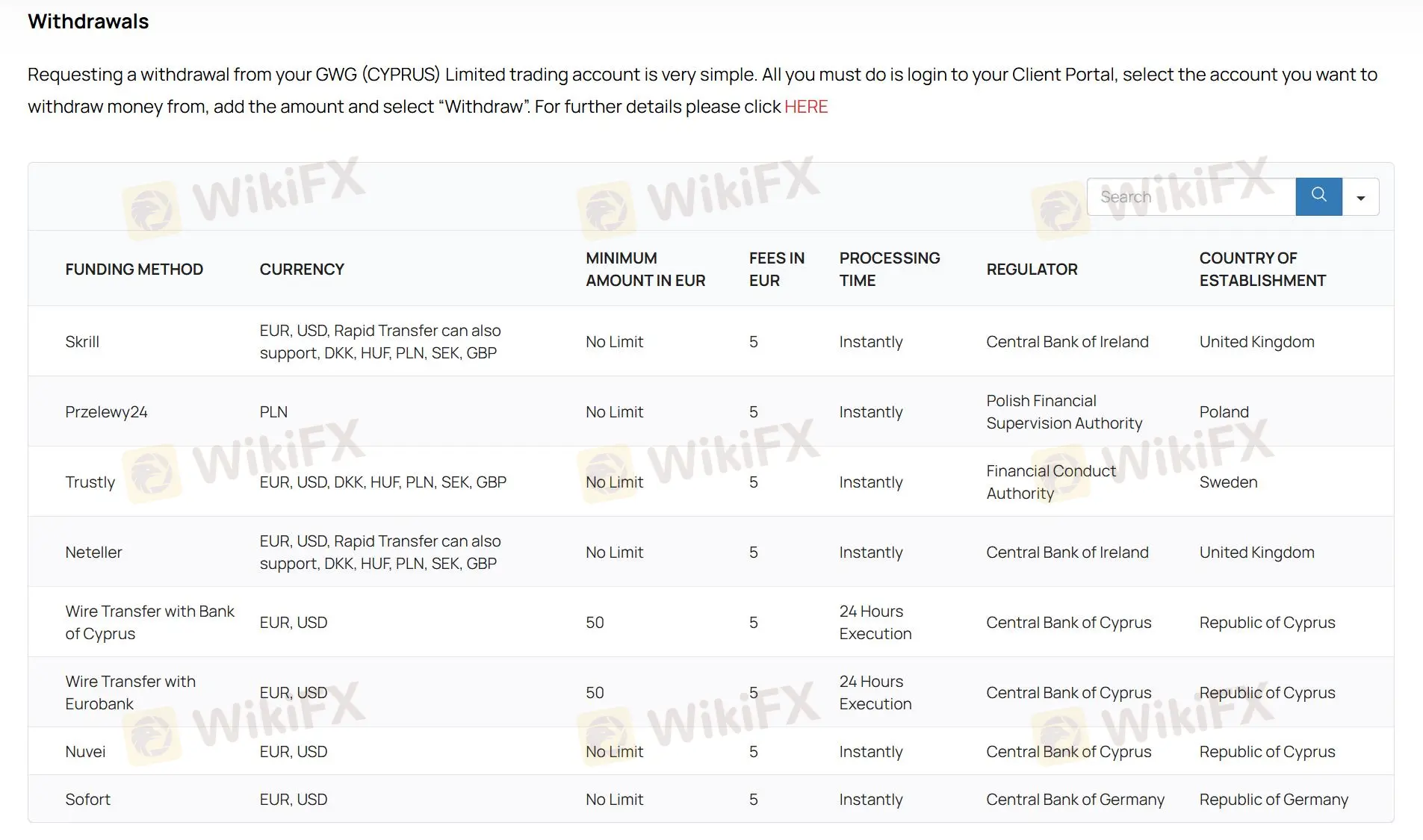

The withdrawal methods mirror the deposit options, ensuring consistency and convenience. All withdrawal requests are processed instantly except for wire transfers, which take up to 24 hours for execution. There is a standard fee of €5 for withdrawals across all methods, and for wire transfers, the minimum withdrawal amount is €50. Additionally, withdrawals are processed back to the original deposit source, ensuring security and compliance with anti-money laundering regulations.

Customer Support Options

GWTrade offers multiple ways to connect with their support team for any questions you might have. Whether it's a quick email tosupport@GWTrade.eu, a phone call (+357 22 008 100), or reaching out through their social media channels (Facebook, Youtube, etc). The brokers support team is responsive and knowledgeable, assisting clients with any issues they may encounter. This high level of customer support ensures that clients can resolve their problems efficiently and continue trading with minimal disruptions.

Educational Resources

GWTrade is committed to providing clients with extensive educational resources to enhance their trading knowledge and skills. The firm's educational offerings include: Introduction courses, In-depth courses, Ebooks, FX Glossary and Economic Calendar Tutorial. These resources are available to guide clients through the features and functionalities of GWTrade's trading platforms. These step-by-step courses and tools are useful for both beginners and experienced traders looking to maximize their use of the platforms.

Conclusion

GWTrade offers a robust trading experience backed by a wide range of market instruments, user-friendly platforms, and extensive educational resources. Its regulatory compliance ensures client fund safety and security. The broker provides flexible account types and competitive trading fees, making it suitable for various trader profiles. While GWTrade charges an inactivity fee and lacks swap-free accounts, its overall offerings provide significant advantages, particularly for those looking to leverage the sophisticated MetaTrader 5 platform and a diverse set of trading tools.

FAQs

What types of market instruments can I trade with GWTrade?GWTrade offers a wide range of market instruments including stocks, forex, commodities, indices, cryptocurrencies, and futures.

How do I open an account with GWTrade?To open an account, visit the GWTrade website, select “Open Account,” complete the registration process by providing personal information, verify your identity, and fund your account using various payment methods.

What is the minimum deposit required to start trading with GWTrade?The minimum deposit varies by account type, starting at €100 for the Standard Account.

Are there any fees associated with deposits and withdrawals?Deposits are generally free of charge, while withdrawals incur a fee of €5 for most methods. Wire transfers may take 1-3 business days to process.

What educational resources does GWTrade offer?GWTrade provides a variety of educational resources, including introductory and in-depth courses, eBooks, an FX glossary, and an economic calendar tutorial to help traders enhance their knowledge and skills

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.