Company Summary

| Rayz Liquidity Corp Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | Chernihiv |

| Regulation | Unregulated |

| Market Instruments | Forex, CFDs, Stocks, Metals, Cryptos |

| Demo Account | N/A |

| Leverage | Up to 1:500 |

| Spread | From 0.03 pips |

| Trading Platform | MT5, Mobile platform |

| Min Deposit | $100 |

| Customer Support | Phone: +91 9342963343 |

| Email: support@rayzliquiditycorp.com | |

Rayz Liquidity Corp Information

Rayz Liquidity Corp offers trading opportunities in a variety of market instruments, including Forex with 182 Forex spot pairs and 140 forwards, cryptocurrencies traded via CFDS or exchanges, stocks and CFDS with over 9,000 instruments, as well as tradable commodities such as gold, silver, platinum, copper, crude oil and natural gas. The company offers a variety of account types with leverage up to 1:500, spreads starting at 0.03 points and no commission. The company also offers 24/7 multilingual customer support, providing assistance via email and phone.

Pros and Cons

| Pros | Cons |

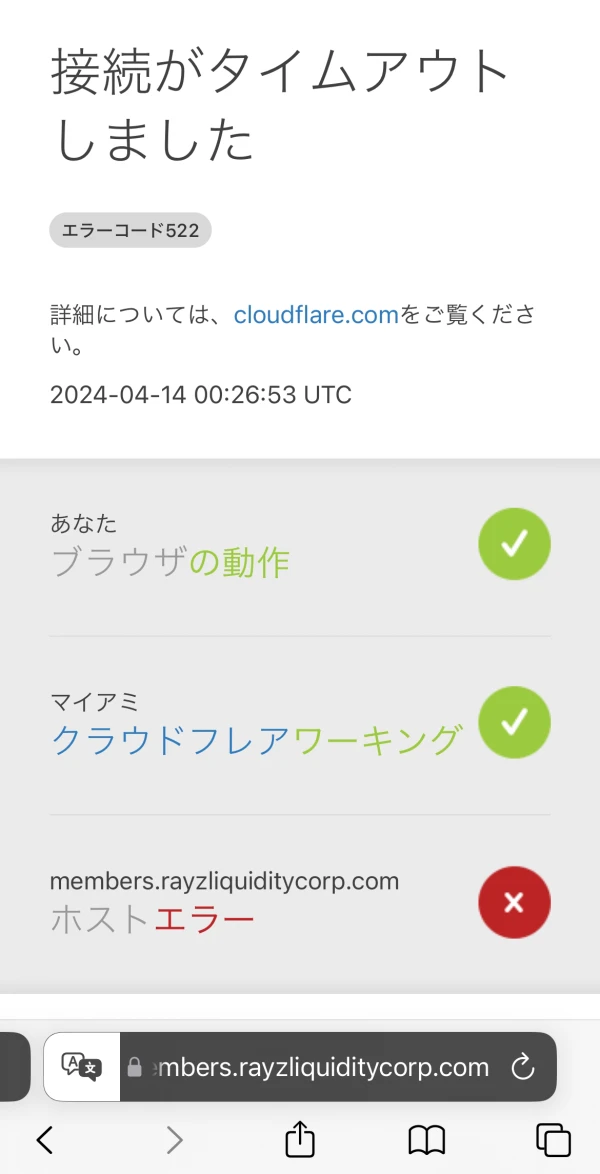

| Low spreads and zero commissions | Unregulated Status |

| Multiple account options | Commission for Premium account |

| Popular MT5 available | Inaccessible official website |

Is Rayz Liquidity Corp Legit?

Rayz Liquidity Corp isn't under effective regulation.

What Can I Trade on Rayz Liquidity Corp?

Clients are able to deal with forex, cryptocurrencies, stock&CFD, and metals on Rayz Liquidity Corp this platform.

182 Forex spot pairs and 140 forwards are provided.

Besides, it allows clients to open long or short positions on more than 9,000 financial instruments with low price spreads and low risk.

As for metals, the platform includes a range of tradable physical commodities such as gold, silver, platinum and copper, as well as energy resources such as crude oil and natural gas.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Crypto currencies | ✔ |

| stock&CFD | ✔ |

| Metals | ✔ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

Account Types

Rayz Liquidity Corp offers three types of accounts:

Standard accounts: use USD, EUR and GBP as the base currency, characterized by a spread starting from 1.6 points, a maximum leverage of 1:500, and a minimum number of trading lots of 0.01.

No commission and availabe swap-free Islamic accounts.

The minimum deposit is $100.

Classic accounts: use the US dollar, Euro and British pound as the benchmark currencies, offering spreads starting from 1.6 points, with a maximum leverage of 1:500 and a minimum number of trading lots of 0.01.

No commission and availabe swap-free Islamic accounts.

The minimum deposit is $250.

Premium account: Premium accounts offer lower spreads, ranging from 0.2 to 0.4 points, and can also use the US dollar, Euro and British pound as benchmark currencies. It offers a maximum leverage of 1:500 and a minimum number of trading lots of 0.01.

Swap-free Islamic available

The minimum deposit requirement is $500.

| Minimum Deposit | Spread | Leverage | Minimum trading lots | Commission | Swap-free Islamic available | |

| Standard account | $100 | start from 1.6 | 1:500 | 0.01 | Free | Yes |

| Classic account | $250 | start from 1.6 | 1:500 | 0.01 | Free | Yes |

| Premium accoun | $500 | 0.2-0.4 | 1:500 | 0.01 | Yes | Yes |

Leverage

Rayz Liquidity Corp offers leverage of up to 1:500.

Rayz Liquidity Corp Fees

Rayz Liquidity Corp offers spreads starting at 0.03 pips with zero commissions.

Trading Platform

MetaTrader 5 (MT5) is the platforms chosen by Rayz Liquidity Corp for clients.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 5 (MT5) | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

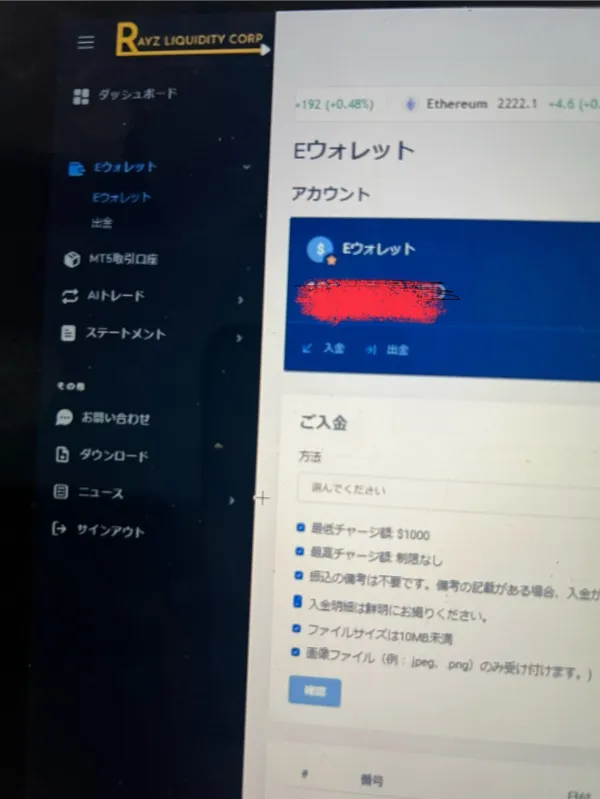

Deposit and Withdrawal

Rayz Liquidity Corp offers a variety of deposit and withdrawal options, including bank transfers, credit/debit cards and e-wallets such as Skrill and Neteller. Withdrawals will be processed within 24 hours.

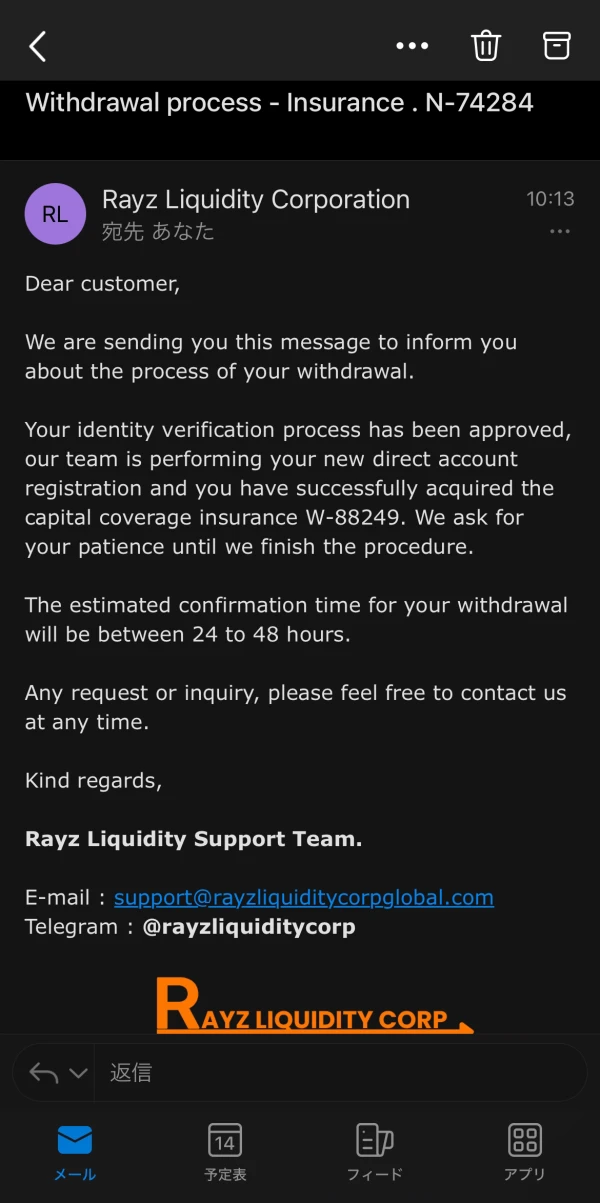

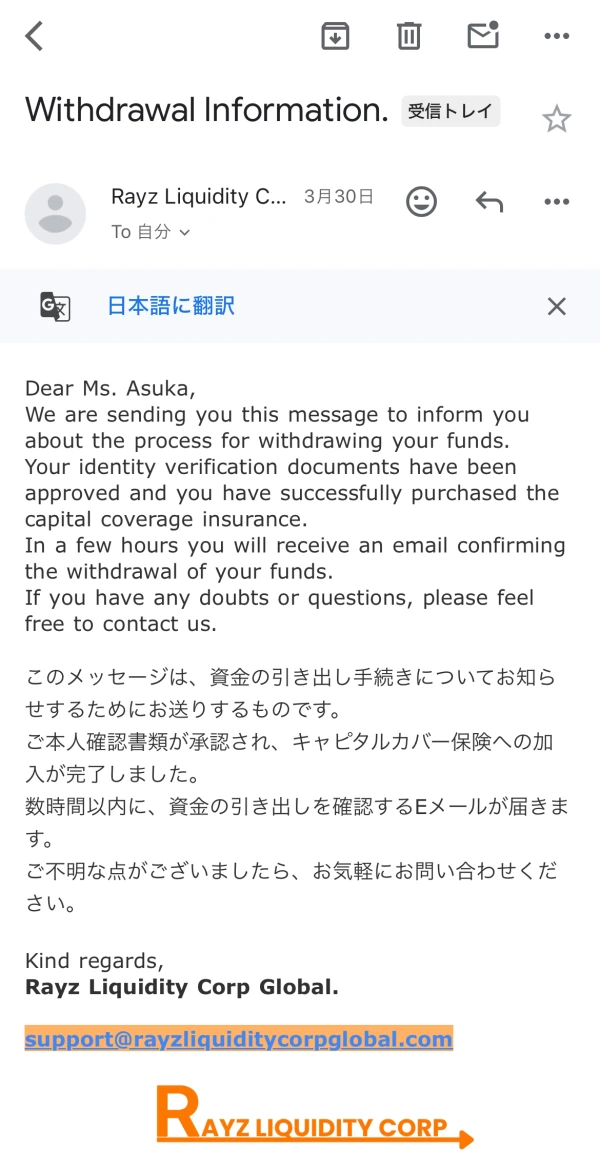

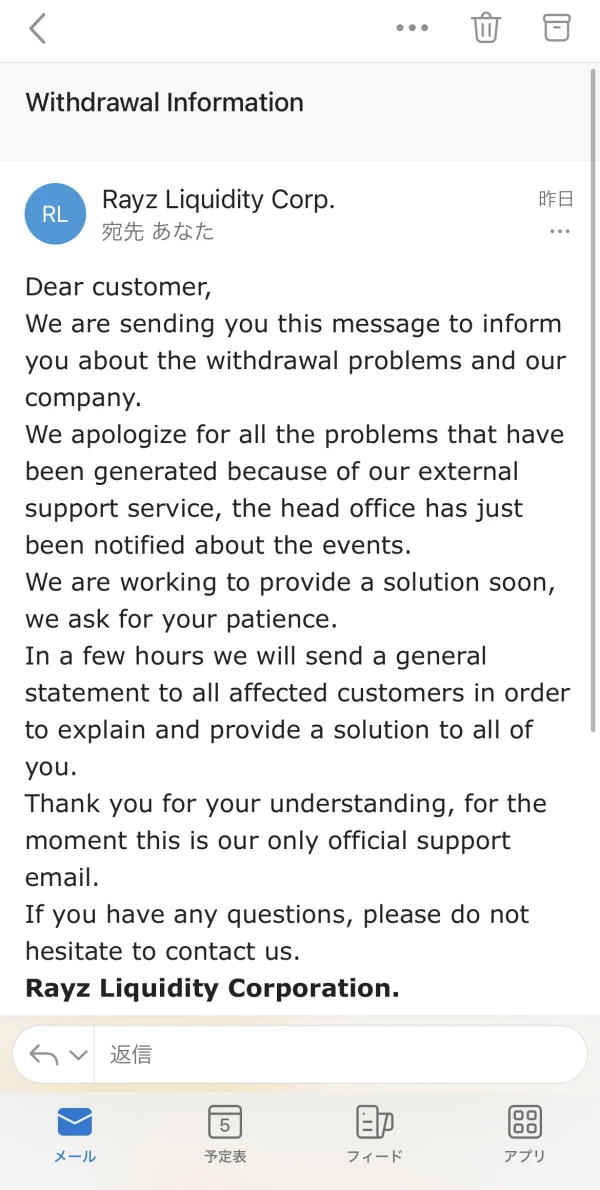

KazumiwuI

Japan

Rayz's general manager spoke up and explained what was happening at the Japanese branch. Our Japanese branch is no longer supported or authorized! Consultant Nakamura had been deceiving me all along. Rayz promised to help and resolve the affected customers of its Japanese branch. I complied with insurance and identification requirements. The support team assured me that I would receive confirmation of my withdrawal within 48 hours at the latest. I am sure of this. If I don't receive the money, I will expose them! -A.

Exposure

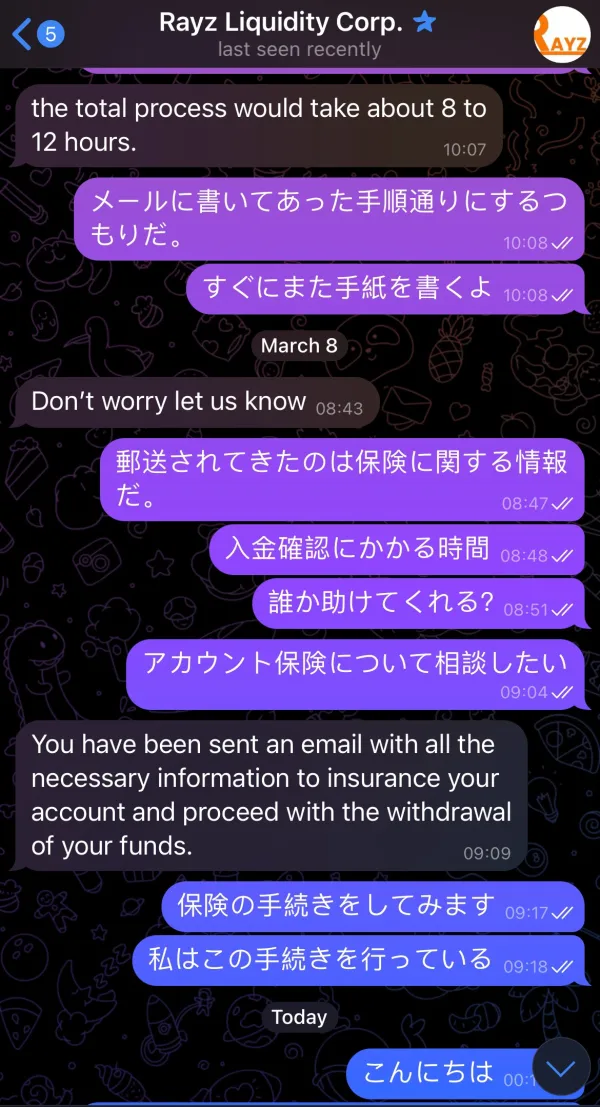

yoshida_76

Japan

I requested a withdrawal from Rayz in Japan over 3 months ago. I was having a lot of issues, but the support team stopped responding and I was unable to access my account. I was contacted by Rayz headquarters on March 14th and they explained what happened at their Japanese branch and suggested a solution to withdraw the money. Rayz required me to meet some conditions and I received confirmation of the withdrawal today. The support team told me that I would receive the money today, so I will not delete the post as a precaution in case I do not receive the money today. I can't deny that the support team at Rayz headquarters was helpful. But I won't be calm until I receive the money. I believe the words of everyone at Rayz.

Exposure

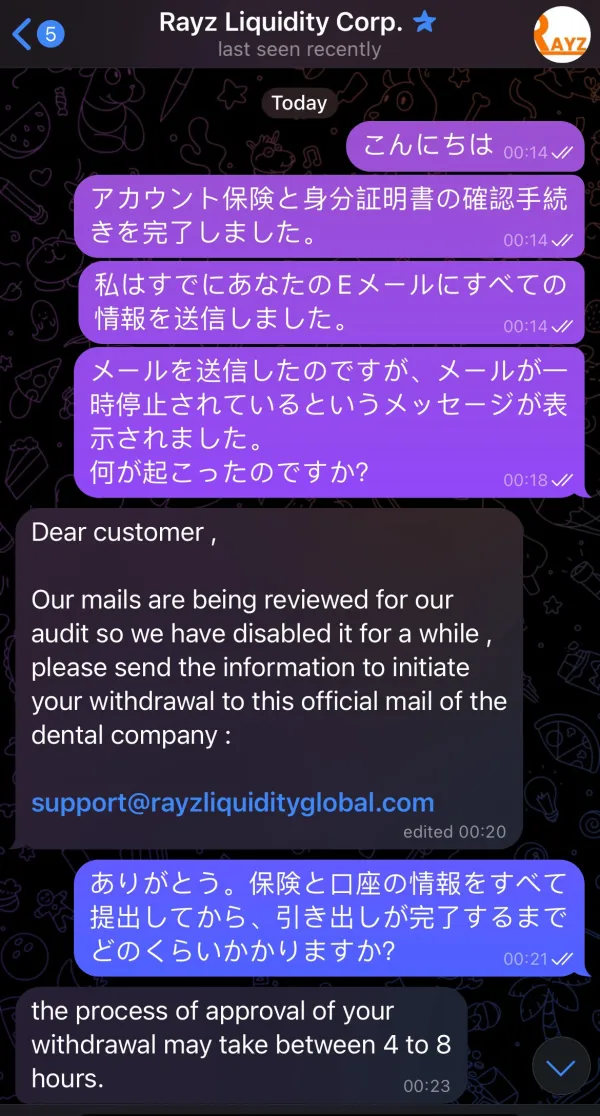

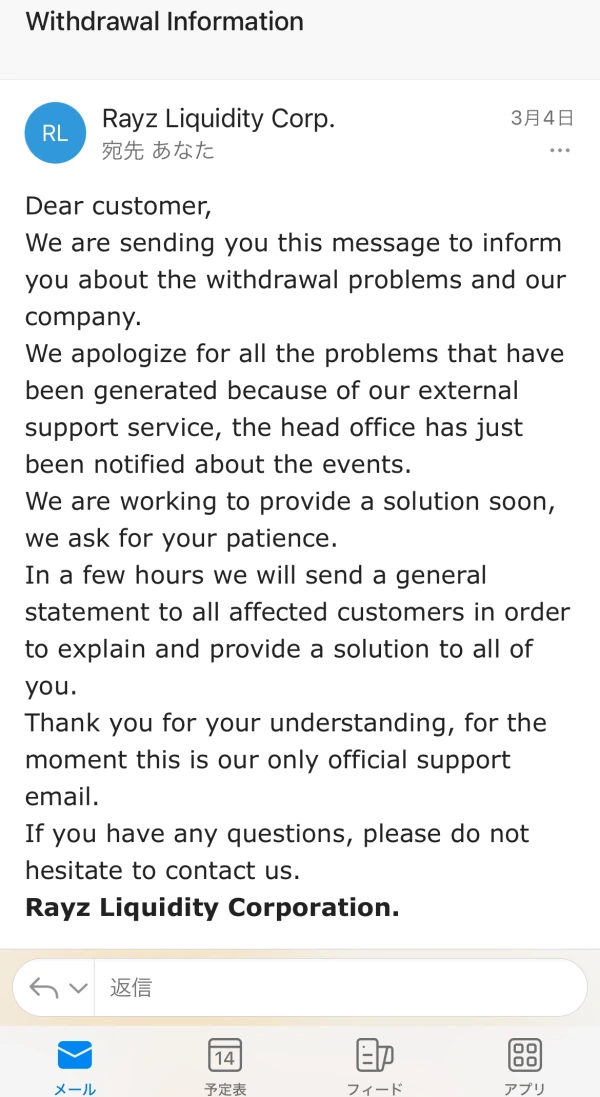

tsgumi-839

Peru

I have been waiting for my money to be withdrawn for over a month. The support team stopped replying for a long time and sent me an email on March 4th explaining everything that happened at the company. When I tried to request a withdrawal, the email was interrupted. I was contacted by the head office on March 8th and they explained how to withdraw money. Today, I fulfilled all the requirements for withdrawal. If I don't receive the money today, I'm going to call the police.

Exposure

Kenrry

Egypt

Rayz Liquidity Corp seems like a good option for traders who want to start small but still want the chance to make big moves. They might have a low minimum deposit that makes it easy to get started, and their high leverage could be a plus for those who know how to handle it.

Neutral

Manuel Rodríguez G

Spain

I heard this broker is not regulated, very sad. 😭😭😭I thought it is the most trusted platform two months ago, professional customer support, mt5 or mobile app without any glitches. Most importantly, no slippages. Feel so sad now!

Neutral

FX1672587862

Belarus

Better than most. No one likes being whip-sawed out of a FTSE trade on a Monday morning though (post Italian referendum.) As a financial markets professional, obviously I intend to ramp up my activity as much as possible. But whilst I have been a customer off and on for almost 10 years I was taken aback by that.

Neutral

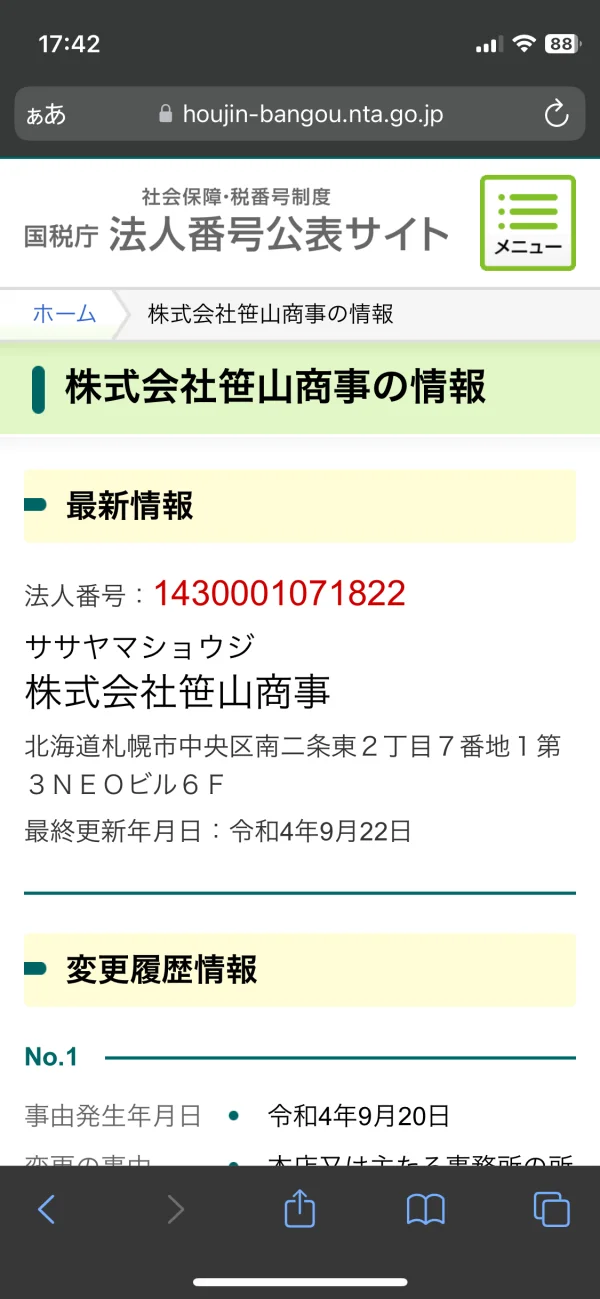

Moko95

Japan

From 23/9, I was introduced to Rayz by Sasayama Financial School, and I made a deposit and started trading. On December 9th, I was suddenly told by Rayz Yamakawa, an assistant at Sasayama Financial School, that I would not be able to withdraw money unless I paid taxes and operating expenses. I was unable to make any withdrawals and suffered a loss of 14 million yen. I would like a refund of the amount I paid. A complete scam.

Exposure

kyoto-sanori676

Japan

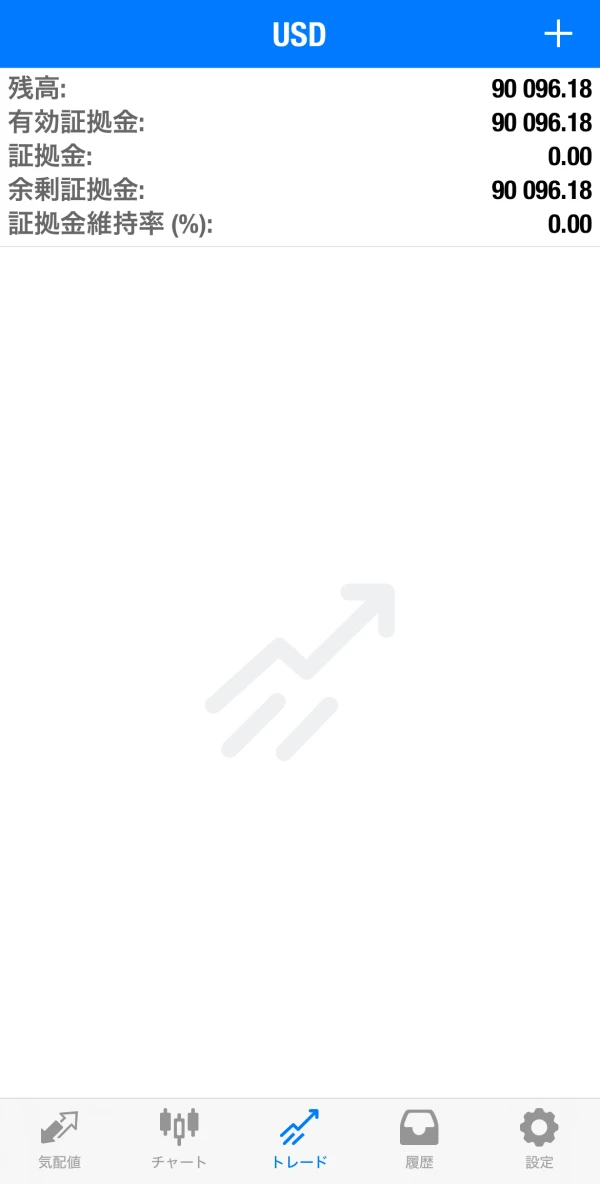

I invested about $75,000 in Rayz and made some profit. Everything was going well until I had a problem with my withdrawal and the support team became unresponsive. Today I received a message from the head office saying they will help me to withdraw my money. I hope they can help me.

Exposure

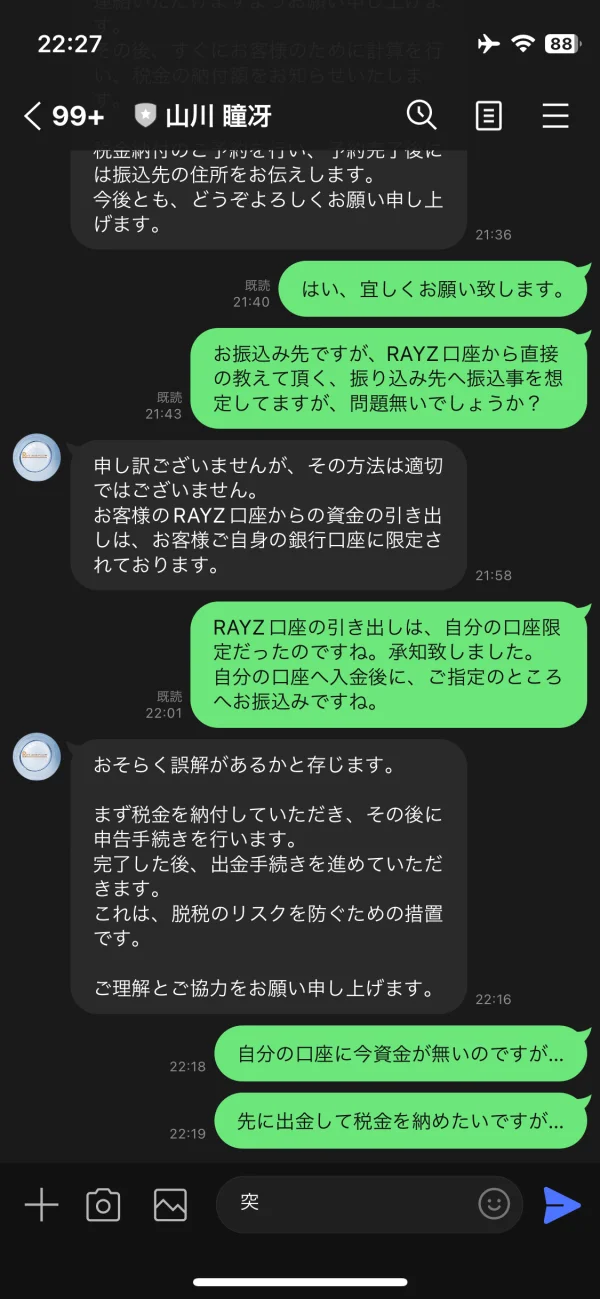

ヨシ315

Japan

I was invited on LINE, and at first he told me to withdraw money, and then asked me to pay for the operating expenses. Even though I said I would pay the operating expenses from the account. But he told me to pay additionally.

Exposure

ヨシ315

Japan

I can no longer log into my account and my balance is gone.

Exposure

TOU7554

Japan

I deposited $67,000 from 2024/9/11 to 2024/12, traded on mt5, and applied for a withdrawal of $150,000 including profit, but it is still pending. 1/24 A warning was issued by the Kanto Local Finance Bureau. Then on February 6th, I suddenly became unable to log in.

Exposure

ヨシ315

Japan

At first I was able to withdraw money, but in the end I was unable to do so for various reasons.

Exposure

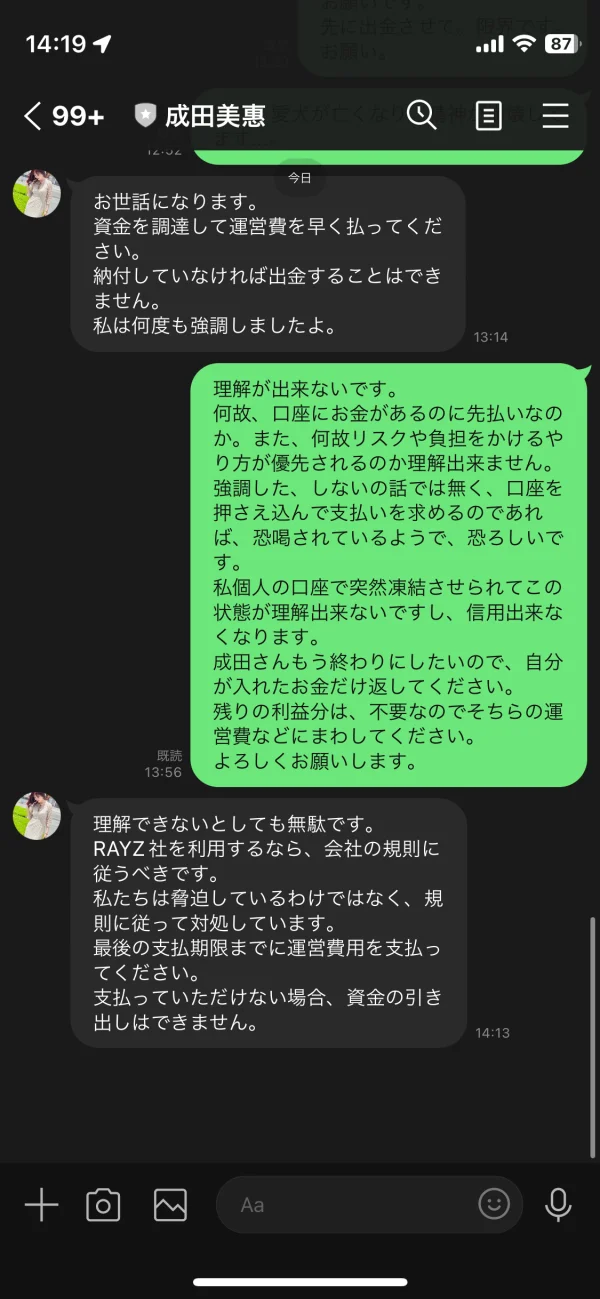

ハッピー

Japan

In mid-September last year, I was directed to Sasayama Financial School of the Line Group through an SMS advertisement, and Rayz Liquidity Corp was designated to open an account. It was my first time trading FX, but I started using MT5 because I was told there was nothing to worry about since it was AI-automated trading. The content of the cram school is that Mr. Sasayama gives lectures on analytical topics such as daily public offering status and moving average lines from candlestick charts. As a beginner in FX, I am very grateful that since I deposited 2 million yen in September, I have been making profits every day using AI automatic trading and MT5, so I took the provocation of my assistant Narita and other group members and made another 100 yen in October. I made an additional deposit of 10,000 yen and confirmed the withdrawal of 350 dollars once, but the money arrived in my account smoothly, and the AI automatic trading continued to generate profits every day. Then, in December, Rayz requested 20% operating expenses of the profit on the investment amount at the end of the year, without any explanation from the time I joined the school, before withdrawing money. I deposited all the surplus amount into AI automatic trading, borrowed over 700,000 yen from people around me and paid them back, paid operating expenses to the designated account, and took the time to withdraw 14,000 dollars. Are you an employee of Rayz Liquidity Corp? This time, they told me that I had to pay taxes to Rayz first, so I couldn't withdraw the money. Since then, I have been threatened several times, but I have put up with it in silence and am considering consulting with the police or a lawyer. However, at the end of December, the Sasayama Finance Juku Group seems to have created a new group, leaving me behind. In that case, I would like to withdraw from the school and receive a refund of $14,000 and the remaining balance.

Exposure

プリン

Japan

I was planning to withdraw $800 to see if I could withdraw money. But I was unable to withdraw $8,500, and when I contacted them, there was no reply.

Exposure

ki455

Japan

This is a scam that used Rayz Liquidity Corp to arrange AI investment at the end of 2023. In my experience, I was able to withdraw money by myself around September, but from the next December onwards, I was no longer able to withdraw money.

Exposure

あ6330

Japan

The amount in my trading account will be made into an e-wallet and then withdrawn to my bank account as a deposit. I made two withdrawals from my trading account. A RAYZ representative told me that the money would be deposited into my account within 2 business days, but since it was the end of the year, when I asked about 2 business days after the new year, there was no response and I have not heard from them yet. The first of the two withdrawal operations has been paid, but the money has not been deposited into the specified bank account. The second withdrawal operation is pending. This is expected to be approved soon, so 10 days will pass. I also wrote an inquiry on the official website, but there was no response. This is a company designated by a common SNS operation group. Similarly, I have not heard from that group or the person in charge since the beginning of the year. I would like to get back at least the amount I deposited, but is there a solution?

Exposure

leileila

Japan

I was told that I could withdraw money as soon as I added funds and the profit reached the target balance. So I deposited money, but I was suddenly told that I couldn't withdraw money unless I paid taxes. And the withdrawal procedure has been pending for a long time. Originally, tax obligations are supposed to be done by filing a final tax return, so you shouldn't have to pay taxes to an overseas Forex company.

Exposure

TOU7554

Japan

I applied for a withdrawal of $150,000 on December 25, 2023, but it is still pending and I cannot withdraw it.

Exposure

KAN64

Japan

I applied for a withdrawal of $2,000 and it says it has been processed, but the money has not been arrived.

Exposure

no_sagi

Japan

He joined Sasayama Financial School's LINE group, with Kotaro Sasayama as his teacher, Emi Narita as his assistant, and the person in charge of his RAYZ account called Oba. The amount deposited using the FXGT app was reflected instantly, so I trusted it, but in reality... Since the account is managed by RAYZ, he cannot withdraw money himself. I get a reminder LINE every day if I can't withdraw money until I pay the management fee for profits. He has deposited about 5 million yen and is at a loss. Mirror account? Well, I was happy when the number increased to 10 million. I would like to collect some of it anyway.

Exposure

Lachlan

Nigeria

Rayz Liquidity Corp – where your trading dreams go to die. Their trading platform performance? More like a snail trying to skateboard. Laggy, clunky, full of glitches. From inconvenient downtimes to unexpected errors - the platform had 'em all. I once tried placing a trade just to watch the system freeze like a distant relative at a family reunion. Lemme tell ya, their customer support was the cream on this rotten cake. You'd think they’d have professional personnel to handle things, right? WRONG. Going through their help desk was like asking my pet parrot for expert advice on quantum physics - loud, messy, and absolutely unhelpful.

Neutral