Company Summary

| MC Prime Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Mauritius |

| Regulation | SFC and CySEC |

| Market Instruments | Currencies, Commodities, Cryptos, and Indices |

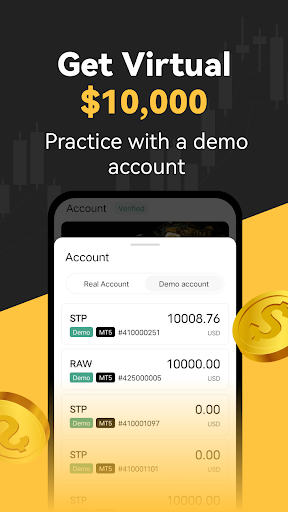

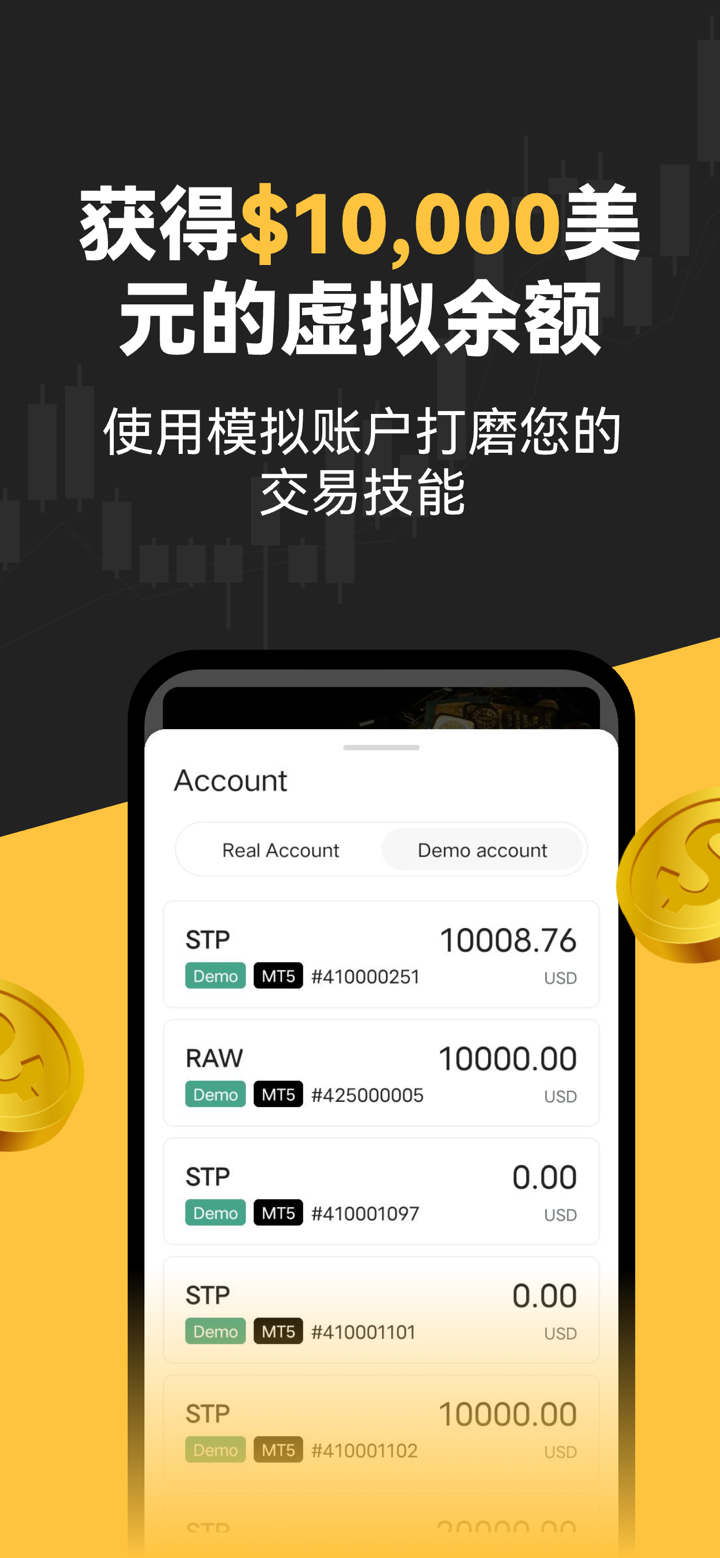

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platform | MC Prime App, MT4, MT5 |

| Minimum Deposit | $50 |

| Copy Trading | ✅ |

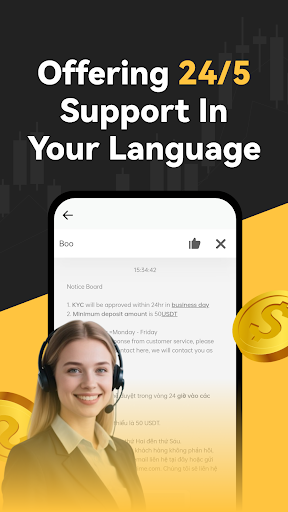

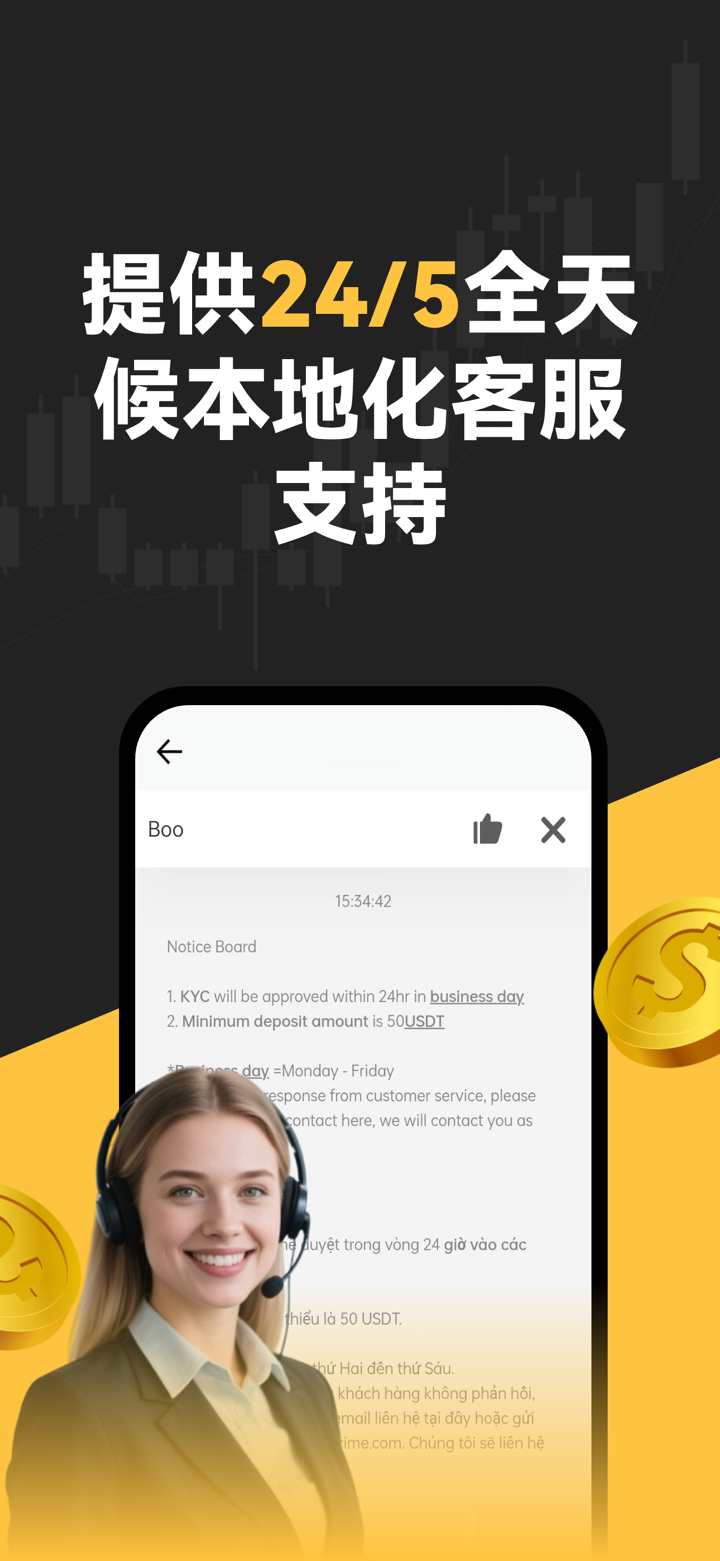

| Customer Support | Contact form |

| Social Media: Instagram, Telegram, Facebook, X | |

| Regional Restrictions | Canada, Cuba, Iran, Iraq, Myanmar, North Korea, Sudan, Syria, Turkey, Chimera, and the United States |

MC Prime Information

MC Prime is a broker that offers trading services on Currencies, Cryptos, Commodities, and Indices. It provides high leverage up to 1:500 and spreads from 0 pips on its MC Prime App or MT4/MT5 platforms. It is regulated by the SFC in Hong Kong and CySEC in Cyprus.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Unverified CySEC and FSA licenses |

| Various trading instruments | Limited customer support methods |

| MT4 & MT5 supported | Regional restriction |

| Four account types | |

| Copy trading offered | |

| Popular payment options | |

| Deposit bonus offered |

Is MC Prime Legit?

MC Prime is regulated by the Securities and Futures Commission (SFC) in Hong Kong for dealing in futures contracts and leveraged foreign exchange trading. It also has license of Cyprus Securities and Exchange Commission (CySEC).

| Regulated Authority | Current Status | Regulated Country | License Type | Licensed Entity | License No. |

| The Securities and Futures Commission (SFC) | Regulated | China (Hong Kong) | Dealing in futures contracts & Leveraged foreign exchange trading | Magic Compass Securities Limited | AXT242 |

| The Cyprus Securities and Exchange Commission (CySEC) | Regulated | Cyprus | Market Maker (MM) | MAGIC COMPASS LTD | 299/16 |

What Can I Trade on MC Prime?

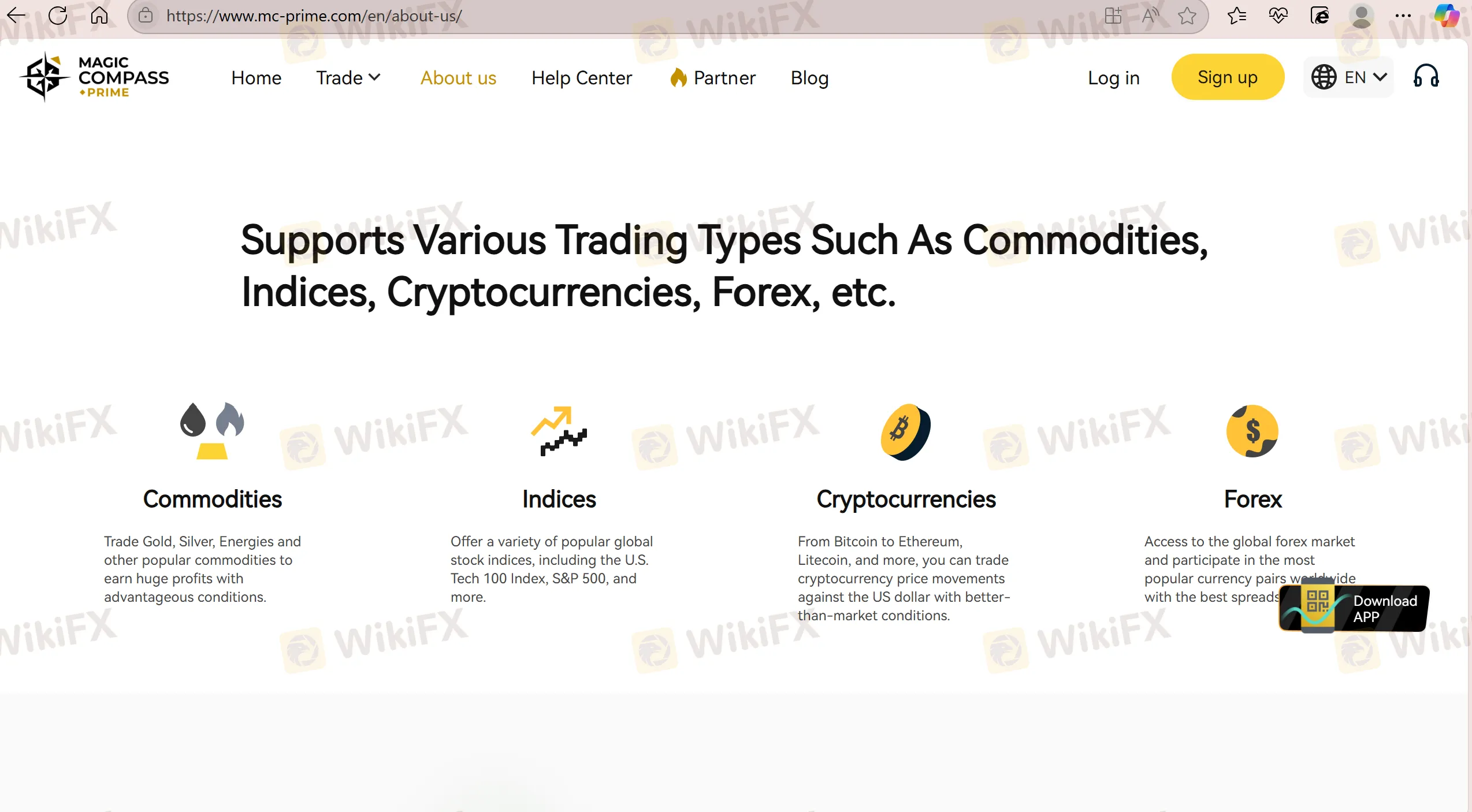

MC Prime offers trading in Currencies, Cryptocurrencies, Commodities (Gold, Silver, Energies), and popular global stock Indices (U.S. Tech 100, S&P 500).

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

| Shares | ❌ |

| Options | ❌ |

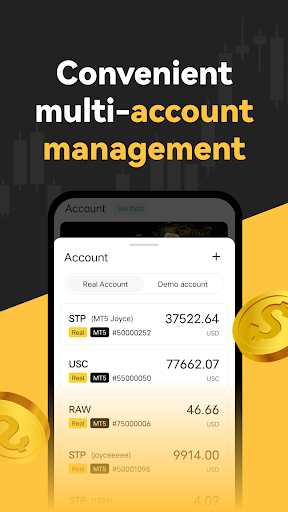

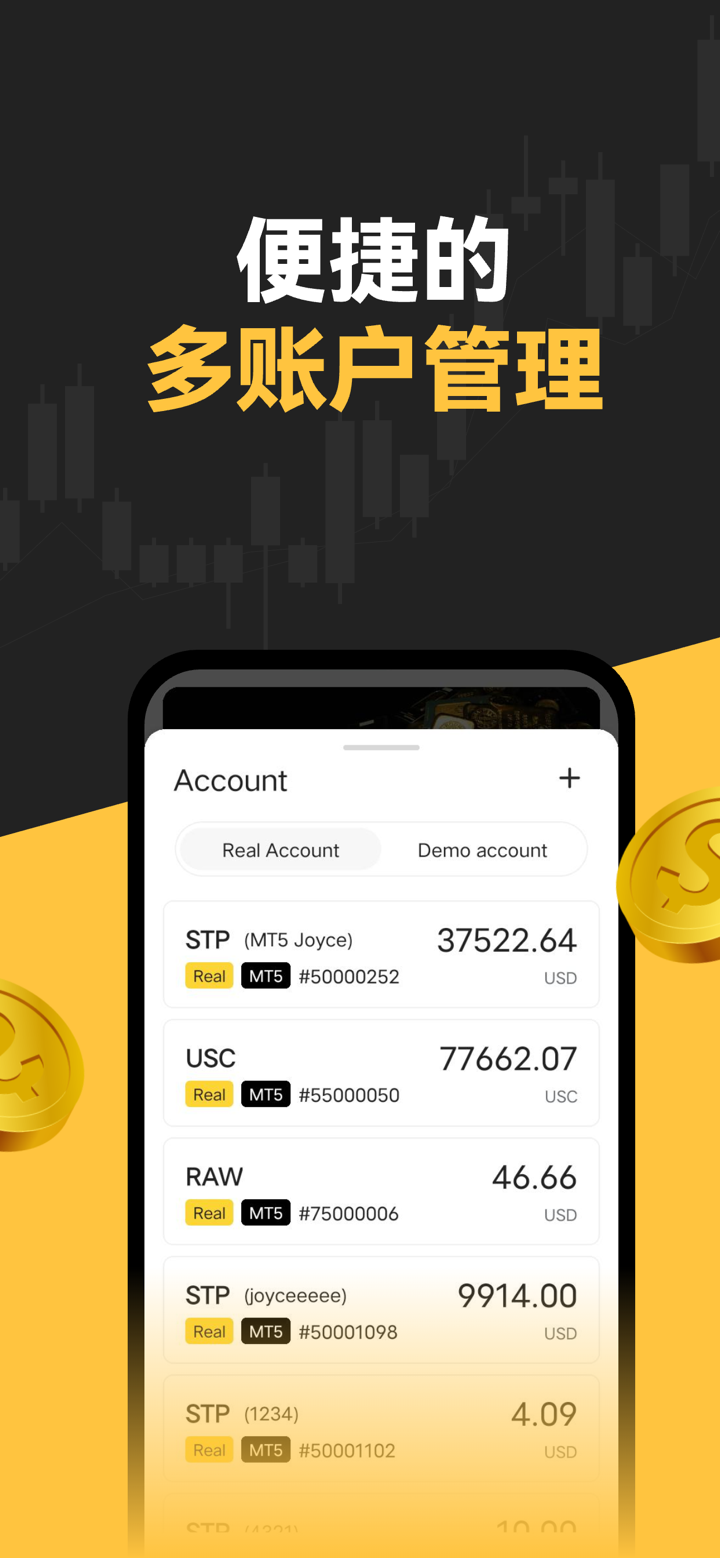

Account Type

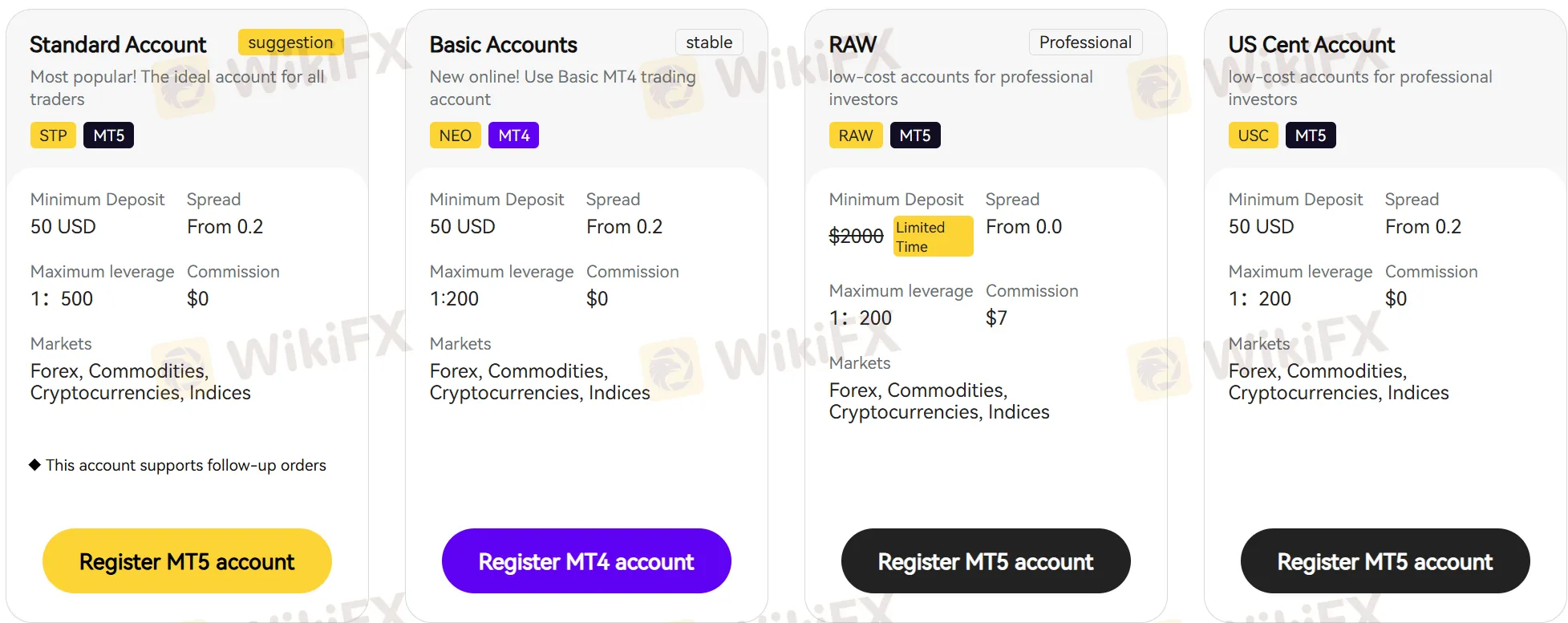

MC Prime offers four account types:

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission |

| Standard Account | 50 USD | 1:500 | From 0.2 pips | $0 |

| Basic Accounts | 50 USD | 1:200 | From 0.2 pips | $0 |

| RAW | Limited Time | 1:200 | From 0.0 pip | $7 |

| US Cent Account | 50 USD | 1:200 | From 0.2 pips | $0 |

Leverage

MC Prime offers a high leverage of up to 1:500. Customers need to consider carefully before investing, since high leverage is likely to bring high potential risks.

MC Prime Fees

MC Prime offers accounts with spreads starting from 0.0 pip to 0.2 pips. The commissions range from $0 to $7.

| Account Type | Spread | Commission |

| Standard Account | From 0.2 pips | $0 |

| Basic Accounts | From 0.2 pips | $0 |

| RAW | From 0.0 pip | $7 |

| US Cent Account | From 0.2 pips | $0 |

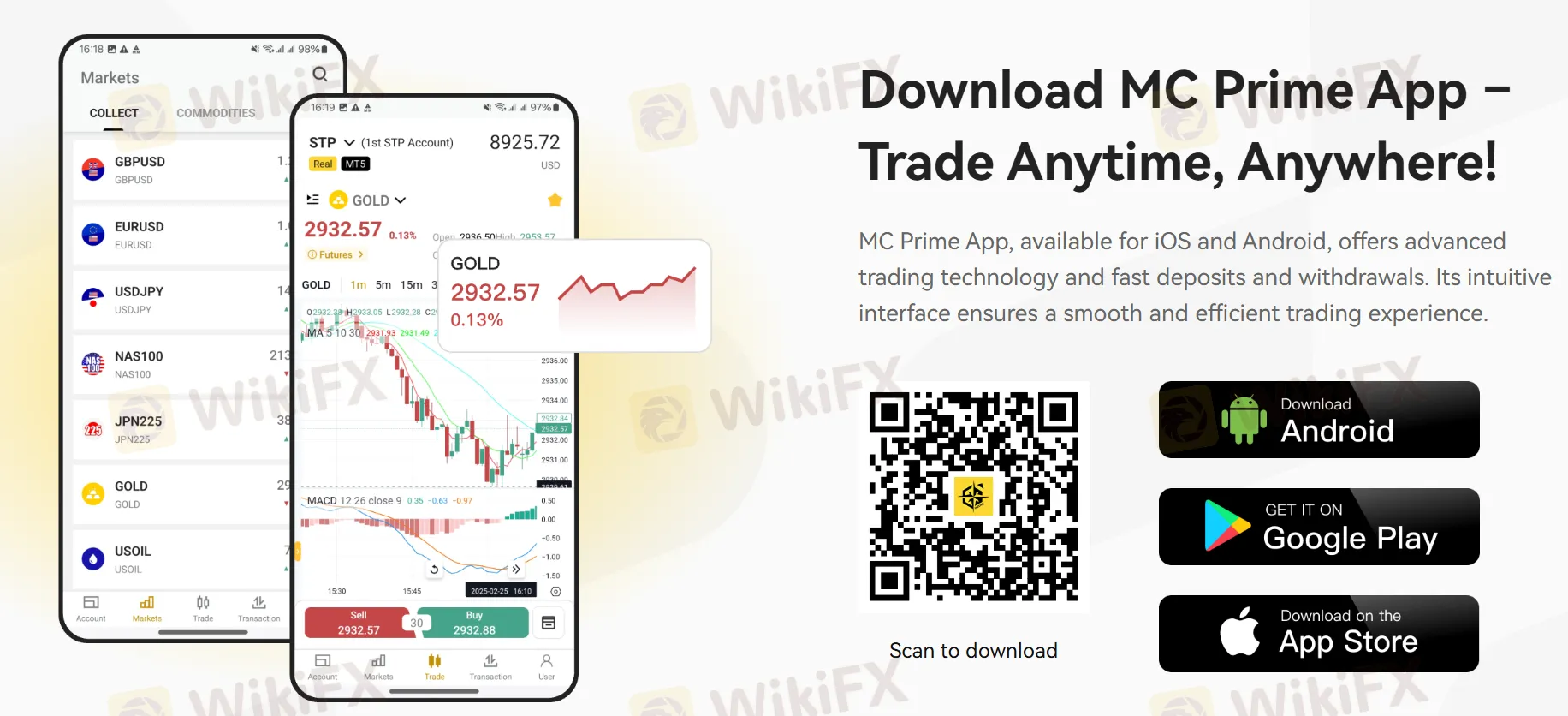

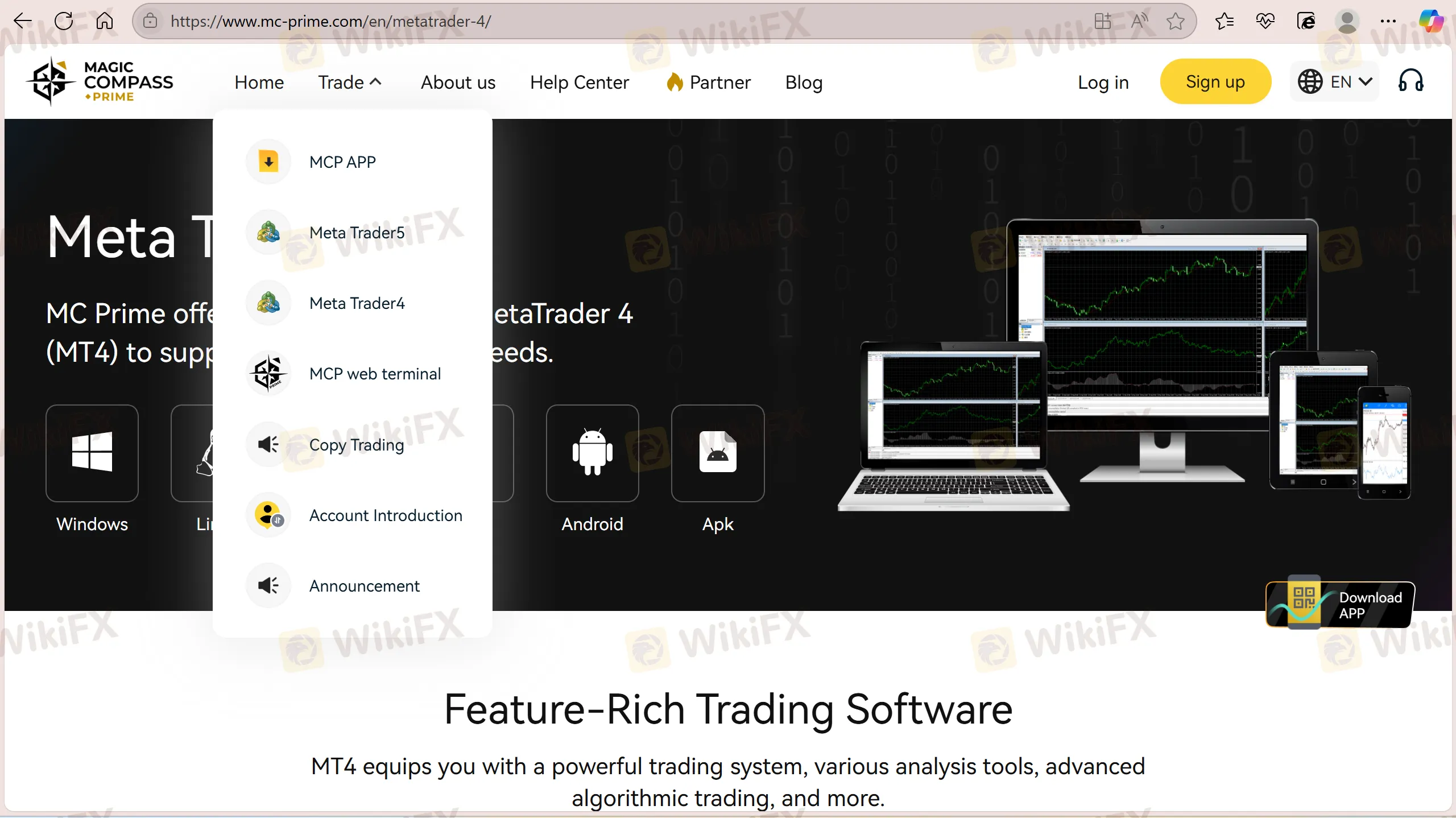

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MC Prime App | ✔ | IOS and Android | / |

| MT4 | ✔ | PC and Mobile | Beginners |

| MT5 | ✔ | PC and Mobile | Experienced traders |

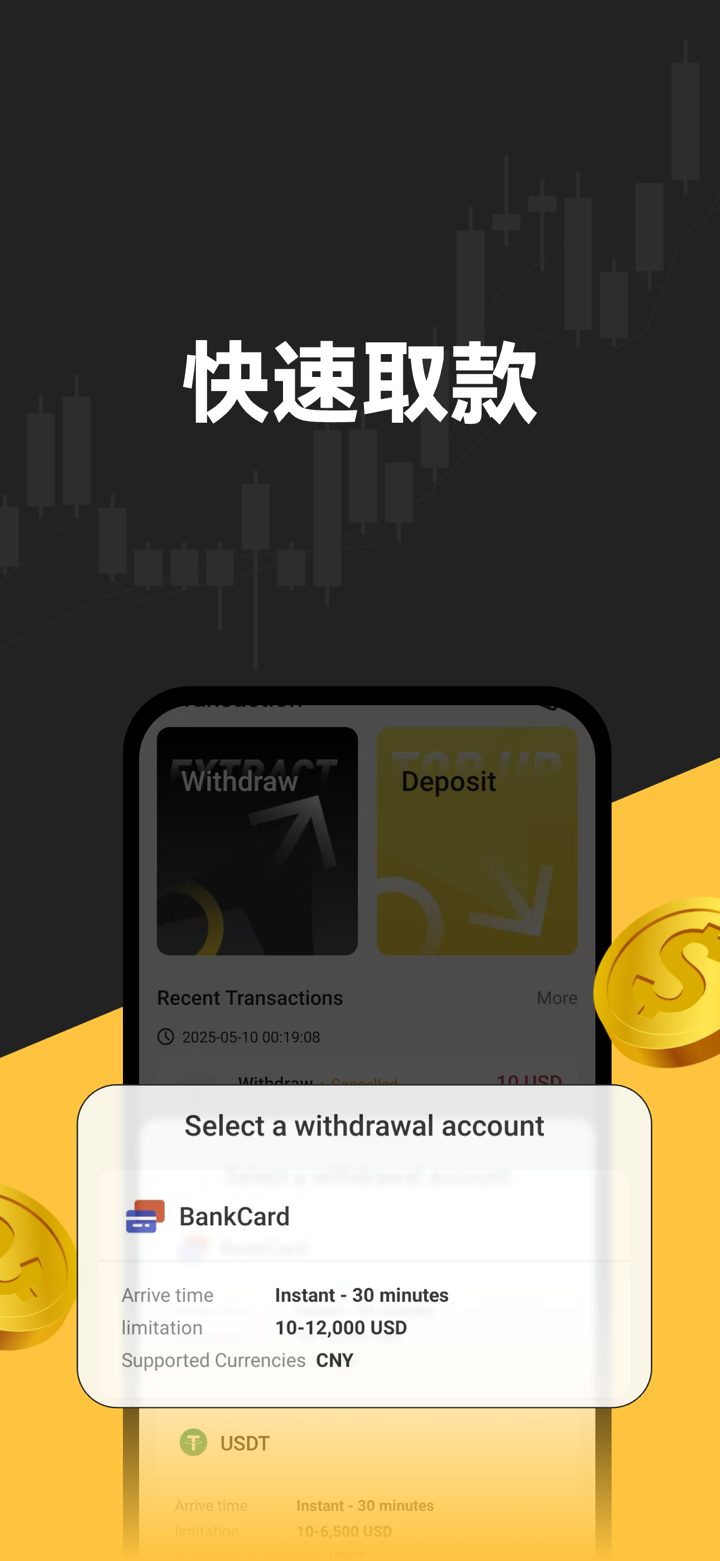

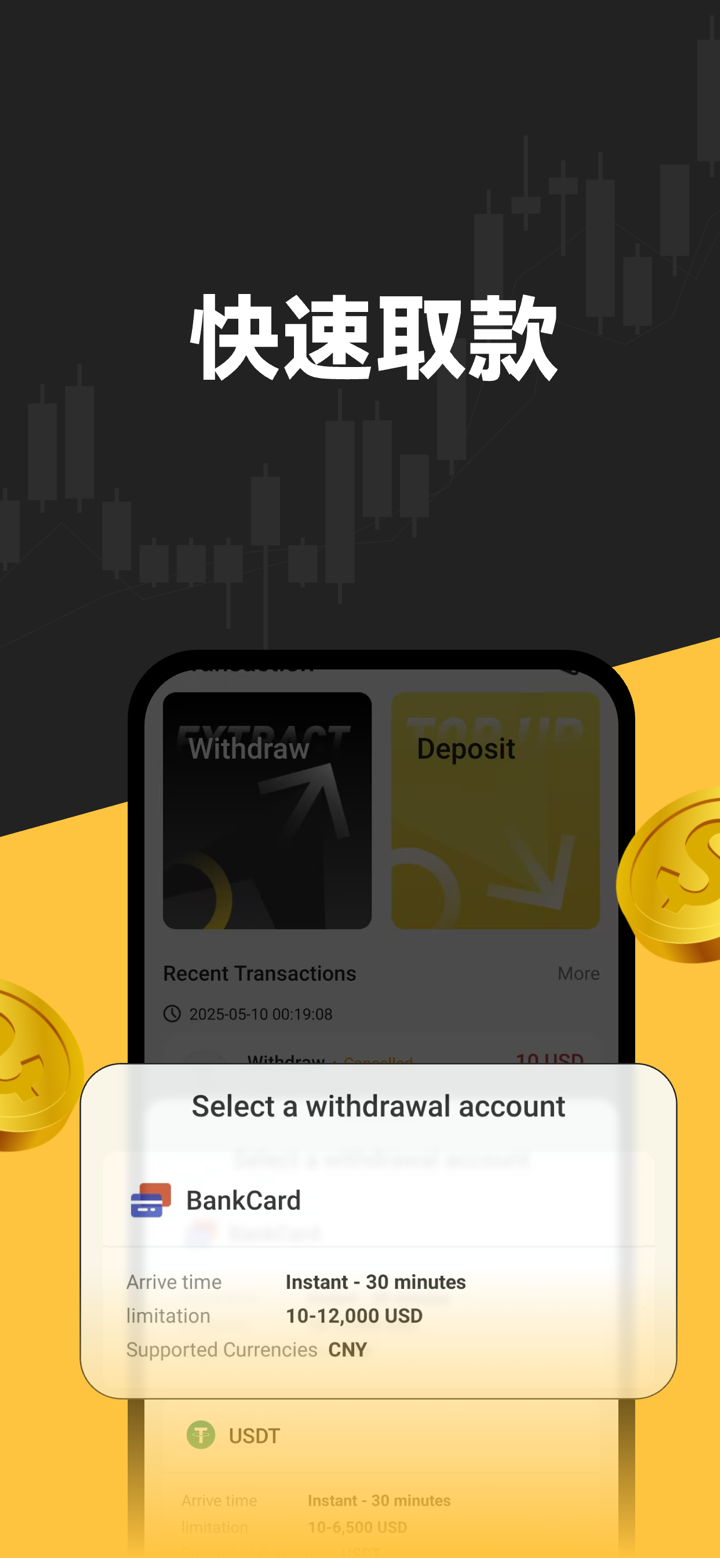

Deposit and Withdrawal

MC Prime requires a minimum deposit of $50. MC Prime supports a variety of deposit options, including major credit/debit cards (Visa, Mastercard), e-wallets (Skrill, Neteller, Klarna), and local payment methods such as Przelewy24, Blik, MB Way, and ePay.bg.