Company Summary

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Company Name | Eight Plus Capital Ltd (previously Acier FX Ltd) |

| Regulation | CYSEC |

| Minimum Deposit | $200 (USD or EUR) |

| Maximum Leverage | Up to 1:100 (for professional traders) |

| Spreads | Variable, starting from 0.1 pips |

| Trading Platforms | MetaTrader 4 (MT4) for Windows and Mac |

| Tradable Assets | CFDs, Forex, Cash Indices, Spot Metals, Cash Energies, Stocks, Cryptocurrencies |

| Account Types | Various account types available with different features |

| Demo Account | Available |

| Islamic Account | Available upon request |

| Customer Support | 24/5 support via email and phone |

| Payment Methods | Bank Wire, Skrill, Neteller |

| Educational Tools | None |

Overview

Eight Plus Capital Ltd, operating under the name Eightplus.com, is a brokerage firm headquartered in Cyprus and regulated by CYSEC. The company offers a range of trading services, with a minimum deposit requirement of $200 in either USD or EUR. Traders can access a maximum leverage of up to 1:100 for professional trading. The broker provides variable spreads starting from 0.1 pips and utilizes the MetaTrader 4 (MT4) platform for both Windows and Mac users. Eightplus.com offers a diverse selection of tradable assets, including CFDs, Forex, Cash Indices, Spot Metals, Cash Energies, Stocks, and Cryptocurrencies. The brokerage caters to various trader preferences with its range of account types and supports demo and Islamic accounts upon request. Customer support is available 24/5 through email and phone, and the broker accepts payment methods such as Bank Wire, Skrill, and Neteller. However, it's important to note that the company does not provide specific educational tools for traders.

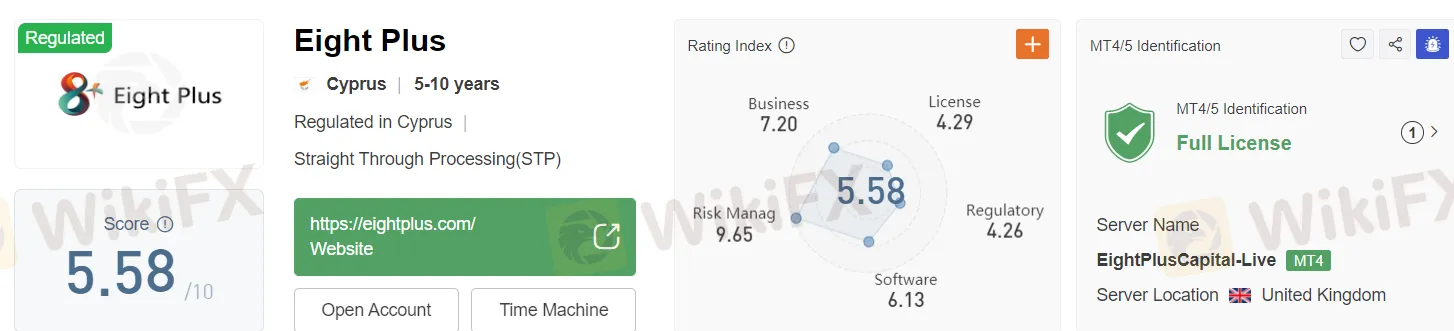

Regulation

Eight Plus is regulated by CYSEC, ensuring that the company complies with established financial industry standards and safeguards for investors. This regulatory oversight provides clients with added confidence and trust in their financial services. CYSEC's supervision helps maintain transparency and accountability within the organization.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Eightplus.com presents several advantages for traders, including regulatory oversight, a wide selection of market instruments, competitive spreads, flexible leverage options, and a user-friendly MetaTrader 4 platform. The availability of 24/5 customer support enhances the trading experience. However, the absence of educational resources and potential withdrawal fees for specific methods are areas where traders should exercise caution and seek external educational materials as needed.

Market Instruments

Contracts for Difference (CFDs):

CFDs are versatile financial derivatives that enable traders to speculate on the price movements of various underlying assets without owning them. This means that traders can potentially profit from both rising and falling markets, making CFDs a valuable tool for portfolio diversification and risk management.

Forex (Foreign Exchange):

Forex trading involves the exchange of currency pairs, allowing traders to profit from fluctuations in exchange rates. It's a highly liquid market that operates 24 hours a day, providing ample opportunities for traders to engage in short-term and long-term trading strategies.

Cash Indices:

Cash indices represent the performance of specific groups of stocks within a particular market. Trading cash indices offers traders exposure to broader market trends without the need to trade individual stocks. This can be particularly beneficial for those looking to gauge the overall health of specific sectors or regions.

Spot Metals:

Spot metals trading includes assets like gold and silver. These precious metals are known for their value and can serve as a hedge against economic uncertainty. Spot metals trading provides traders with an avenue to invest in physical assets without the need for physical ownership.

Cash Energies:

Cash energies encompass commodities like oil and natural gas. These resources are essential to the global economy and can be influenced by various factors, including supply and demand dynamics, geopolitical events, and economic trends.

Stocks:

The broker provides access to a selection of stocks from various global markets. Traders can buy and sell shares of publicly traded companies, potentially benefiting from capital appreciation and dividend income.

Cryptocurrencies:

The emergence of cryptocurrencies has opened up new investment opportunities. The broker offers digital currencies such as Bitcoin, Ethereum, and more. Cryptocurrencies are known for their volatility and are increasingly becoming a part of diversified investment portfolios.

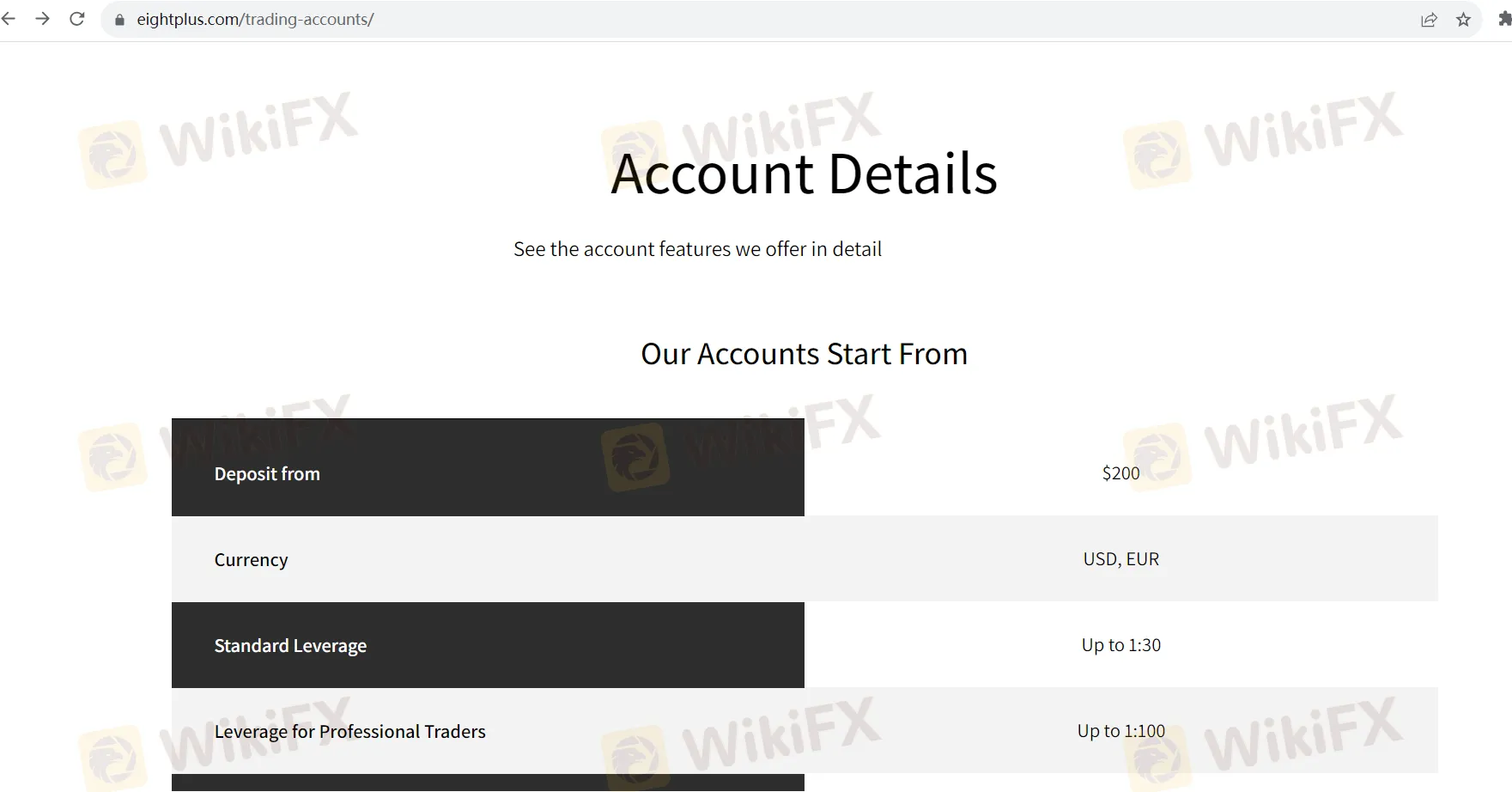

Account Features

Eightplus.com offers a range of account types designed to meet the needs of both retail and institutional traders:

Account Start From: $200 minimum deposit in USD or EUR.

Standard Leverage: Up to 1:30 for standard trading conditions.

Leverage for Professional Traders: Up to 1:100 for experienced traders.

Minimum Transaction Size: Starting from 0.01 lot for flexible trading.

Variable Spreads: Starting from 0.1 pips for competitive pricing.

Execution Type: Fast execution for precision trading.

Commission: No commission fees.

Islamic Account: Available upon request for swap-free trading.

Hedging and Scalping: Supported for various trading strategies.

Expert Advisors: Supported for automated trading.

Dedicated Account Manager: Access to personalized support.

Full Range of Currency Pairs: Extensive options for diversification.

Real-time Online Customer Service: Immediate assistance.

Full IT Support: Technical support for platform reliability.

Technical Analysis Reports: Access to analytical insights.

Investor Education Tools: Resources to enhance trading skills.

Traders can choose the account type that aligns with their trading goals and strategies.

Leverage

This broker offers a maximum trading leverage of up to 1:100 for professional traders. Leverage allows traders to control a larger position size with a relatively smaller amount of capital. However, it's important to note that higher leverage also comes with increased risk, and traders should use it judiciously and be aware of the potential for amplified losses. The choice of leverage should align with a trader's risk tolerance and trading strategy.

Spreads and Commissions

Spreads: The spreads provided by this broker are variable, with starting points as low as 0.1 pips. This variability means that traders can benefit from competitive pricing, as spreads may tighten during periods of high market liquidity. However, it's important to note that spreads can fluctuate based on market conditions and the specific trading instruments being used.

Commissions: The broker offers commission-free trading for certain account types, making it an attractive choice for traders who prefer fee-free trading. However, for traders seeking specialized features or services, commissions may apply. These commissions are typically associated with accounts that offer higher leverage or other specific advantages.

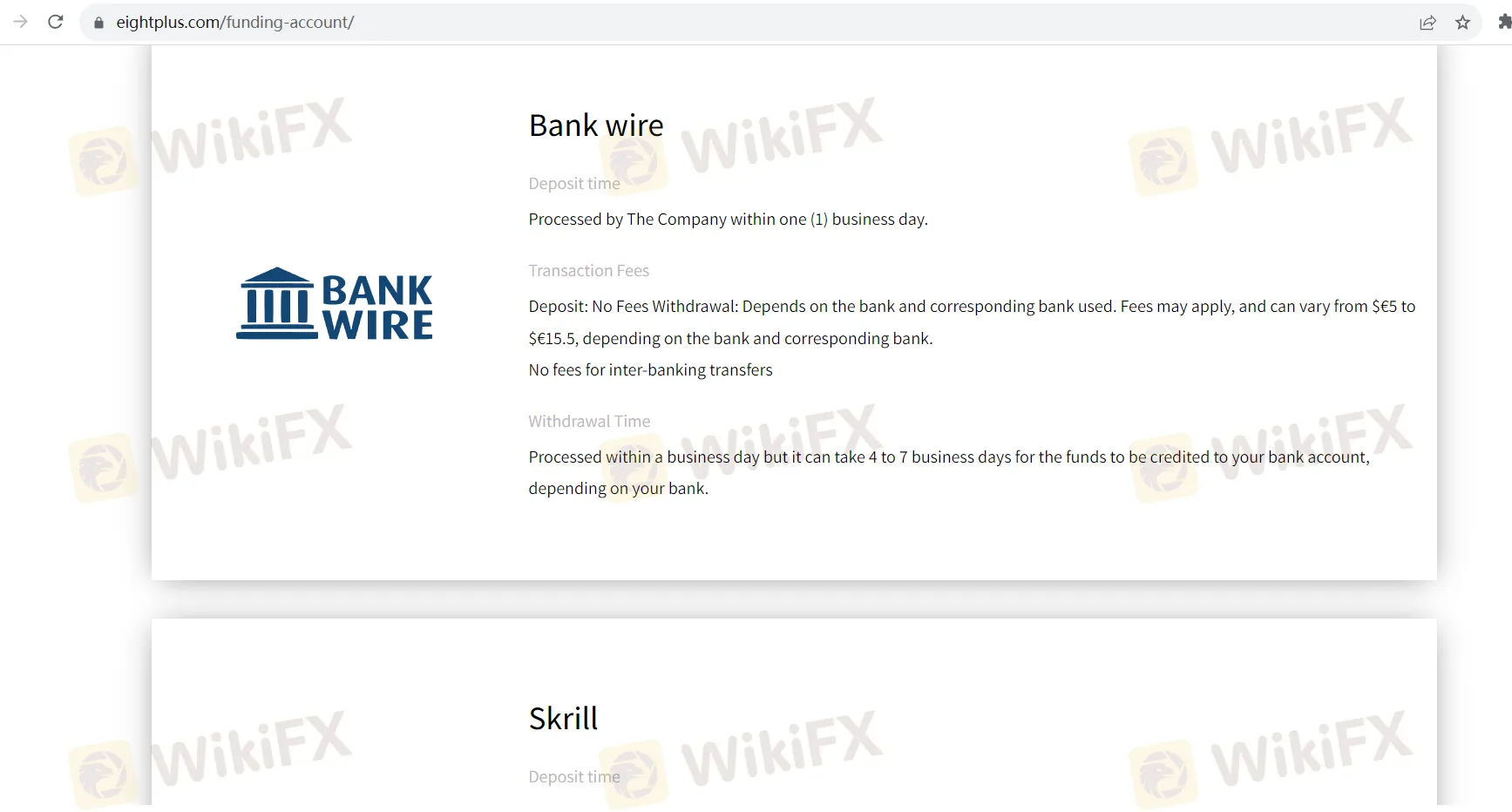

Deposit & Withdrawal

Bank Wire:Bank wire transfers are a traditional and secure method for depositing and withdrawing funds with this broker. Deposits are processed swiftly, typically within one business day. The advantage of bank wire transfers lies in their reliability and widespread acceptance. However, it's important to note that withdrawal times can vary, with funds taking between 4 to 7 business days to be credited to your bank account. Additionally, withdrawal fees may apply, depending on the bank and corresponding bank used, ranging from $€5 to $€15.5. For inter-banking transfers, no fees are charged.

Skrill:Skrill offers a quick and convenient deposit method, with funds typically available for trading within an hour during working hours. One notable benefit is that there are no deposit fees associated with Skrill deposits. When it comes to withdrawals, the broker processes them within one business day, ensuring timely access to your funds. However, there is a withdrawal fee of 1.80% applied to the withdrawal amount after three free withdrawals, making it important for traders to monitor their usage to minimize fees.

Neteller:Similar to Skrill, Neteller provides rapid deposit processing, with funds becoming available for trading within an hour during working hours. Deposits using Neteller do not incur any fees. For withdrawals, the broker processes them online within one business day, ensuring quick access to your funds. However, there is a withdrawal fee of 1.80% applied to the withdrawal amount after three free withdrawals. It's essential to keep in mind the fee structure and utilize the three free withdrawals wisely for cost-effective fund management.

Trading Platforms

Eightplus.com offers the MetaTrader 4 (MT4) platform for both Windows and Mac users, providing a powerful and user-friendly tool for traders. With MT4, traders can access a range of key features including a STP/ECN environment, a wide variety of currency pairs for trading, Expert Advisor (EA) functionality for automated trading strategies, comprehensive technical analysis tools with indicators and charting capabilities, three types of charting options, and the flexibility of hedging and scalping trading strategies. The platform also ensures round-the-clock customer support to assist traders as needed. MT4 for Mac users can enjoy all these features seamlessly, with straightforward installation and usage procedures, making it a versatile and efficient trading platform for traders of all levels.

Customer Support

Eightplus.com places a strong emphasis on providing robust customer support to ensure a seamless and secure trading experience for its clients. Their customer support team is available 24/5, which means they are accessible during most trading hours throughout the week. Whether traders have inquiries, require assistance, or need clarification on any aspect of their trading activities, the dedicated support team is readily available to help. Clients can reach out to the support team via email at support@eightplus.com or by phone at +357 22531111.

Educational Resources

It appears that Eightplus.com does not offer specific educational resources.This means that the broker may not provide educational materials such as trading guides, tutorials, webinars, or other resources to assist traders in improving their knowledge and skills in trading. Traders looking for educational support may need to seek educational materials or resources from external sources to enhance their trading proficiency.

Summary

Eightplus.com is a regulated broker operating under CYSEC oversight, ensuring transparency and accountability in their financial services. They offer a diverse range of market instruments, including CFDs, Forex, Cash Indices, Spot Metals, Cash Energies, Stocks, and Cryptocurrencies. Traders can choose from various account types to suit their preferences, with competitive spreads and flexible leverage options. The platform of choice is MetaTrader 4 (MT4), available for both Windows and Mac users, offering a robust trading experience with technical analysis tools and 24/5 customer support. While educational resources are not prominently featured, the broker provides a comprehensive suite of account features and funding options to support traders in their journey.

FAQs

Q1: What is the minimum deposit required to open an account with Eightplus.com?

A1: The minimum deposit to start trading with Eightplus.com is $200 in either USD or EUR.

Q2: Can I use Expert Advisors (EAs) for automated trading on the MetaTrader 4 platform?

A2: Yes, Eightplus.com supports Expert Advisors (EAs) on the MT4 platform, allowing traders to automate their trading strategies.

Q3: How quickly are deposits processed through Skrill?

A3: Deposits made via Skrill are typically available for trading within one hour during working hours.

Q4: Does Eightplus.com offer Islamic accounts for traders who require swap-free trading?

A4: Yes, Islamic accounts are available upon request, providing swap-free trading options.

Q5: What is the maximum leverage offered by Eightplus.com?

A5: The broker offers a maximum trading leverage of up to 1:100 for professional traders, allowing for increased position size with a smaller capital investment.

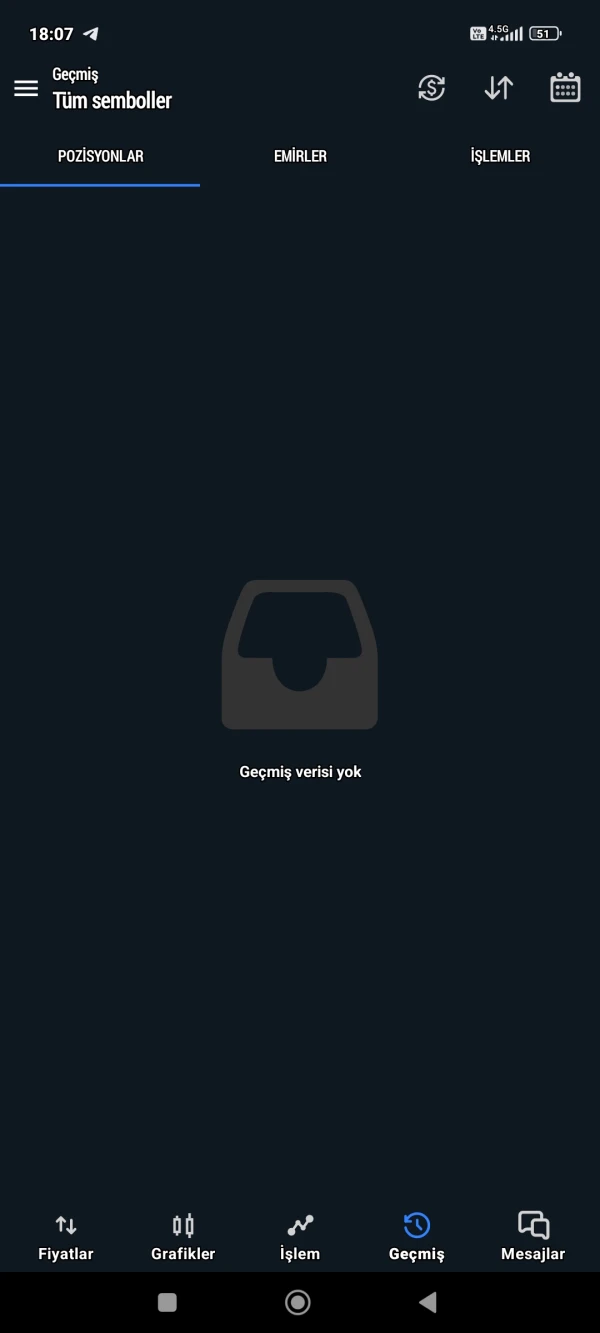

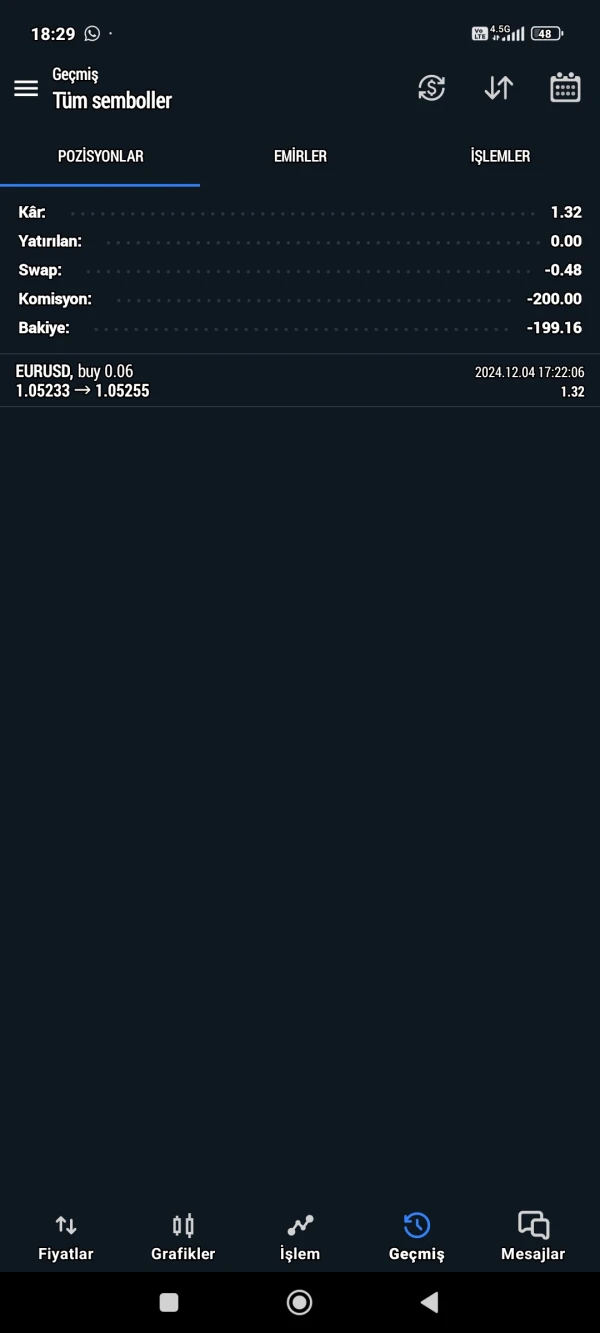

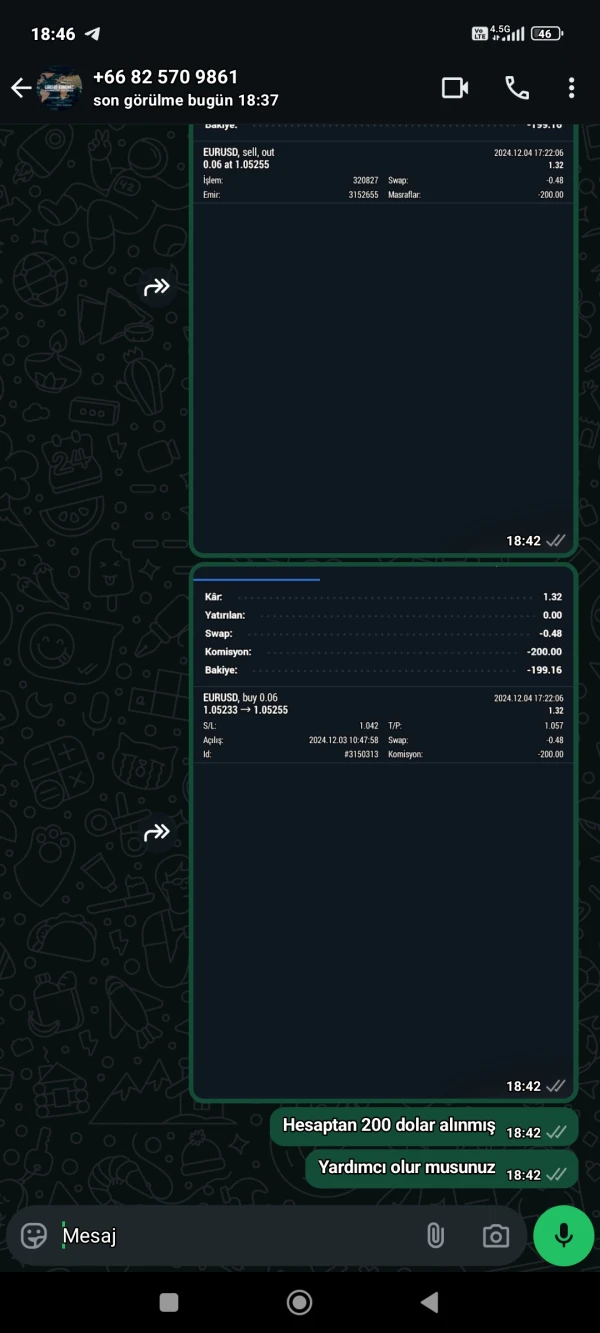

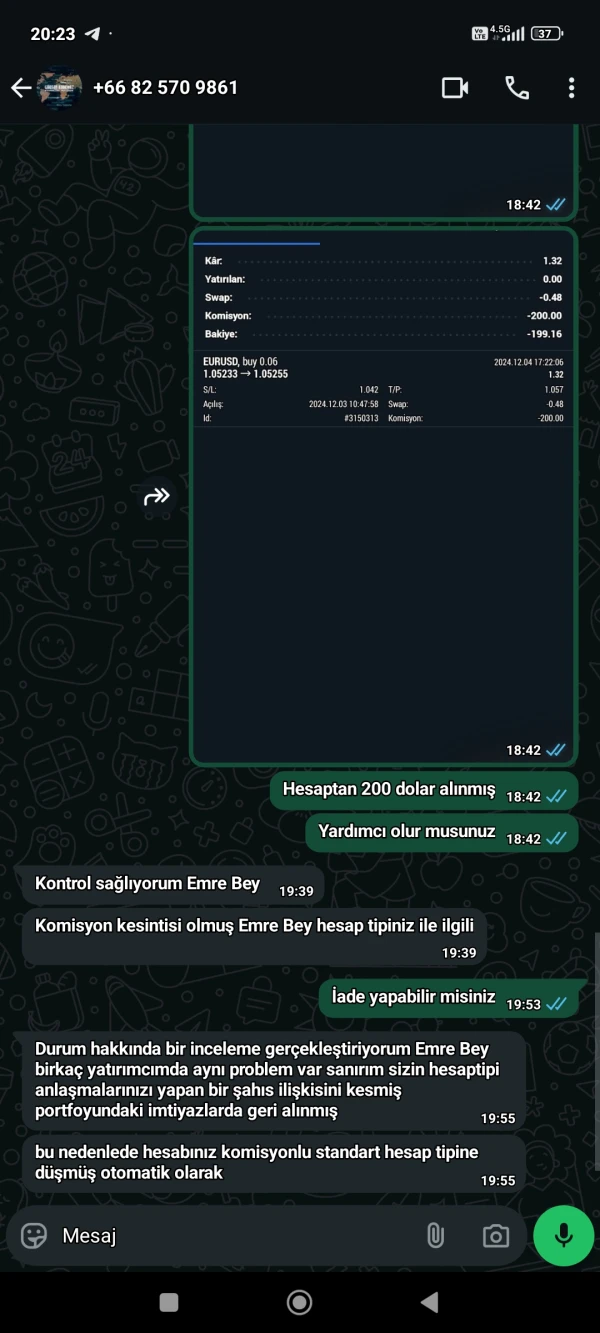

FX1804675303

Turkey

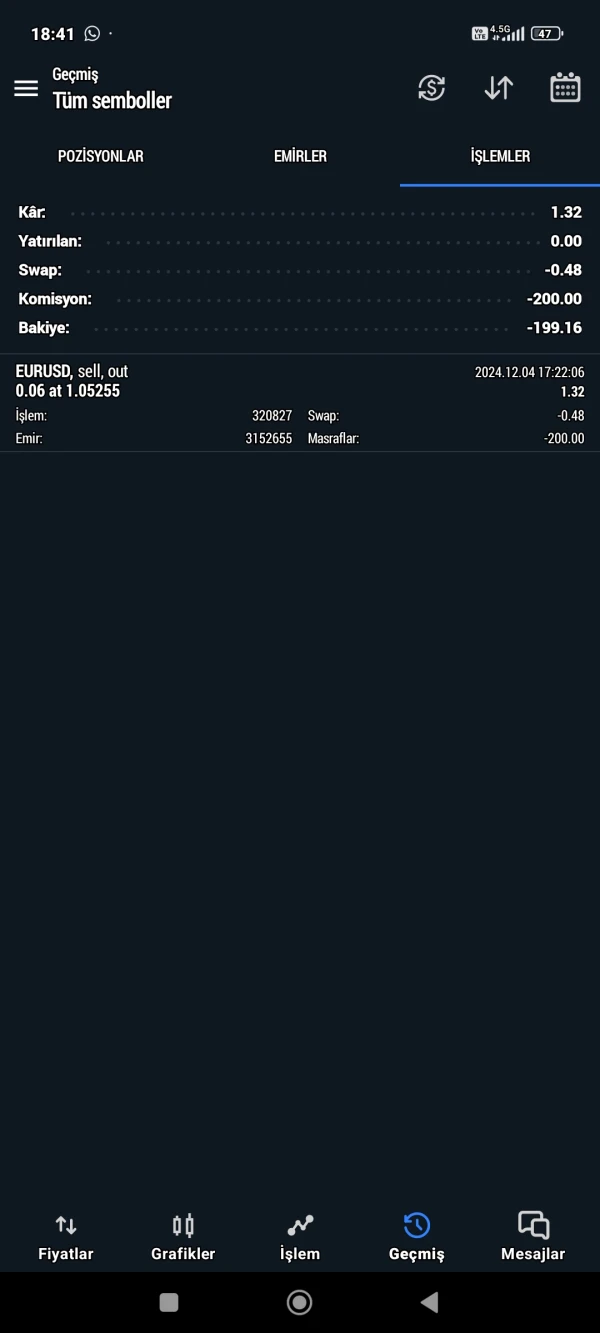

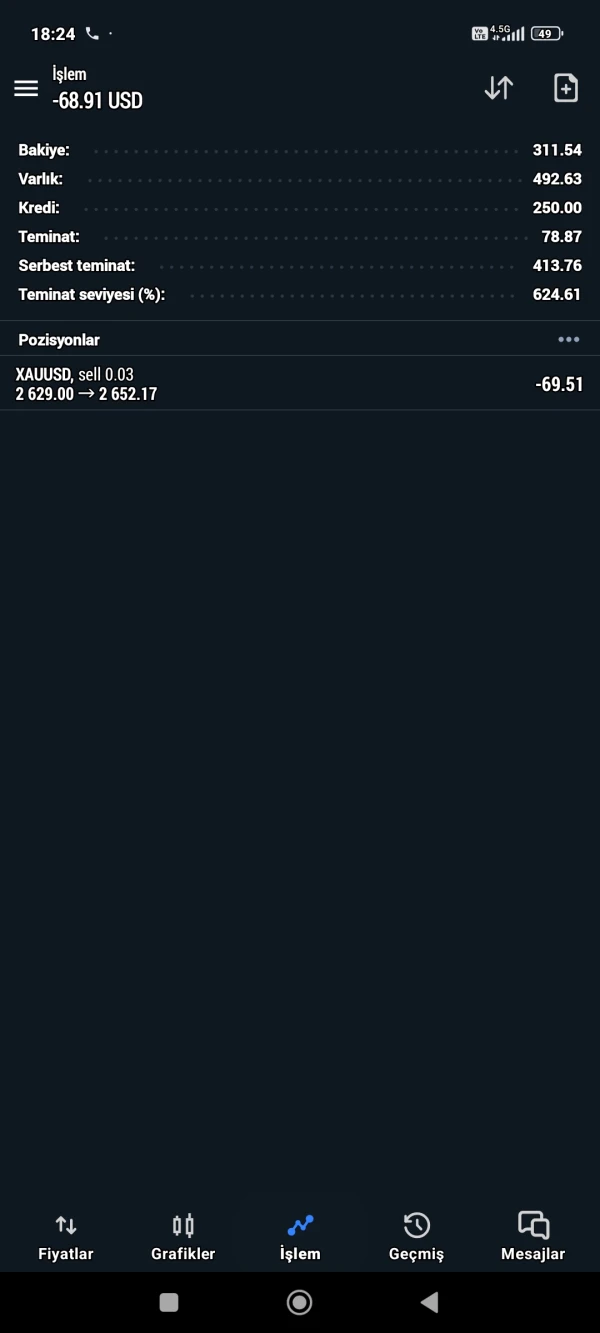

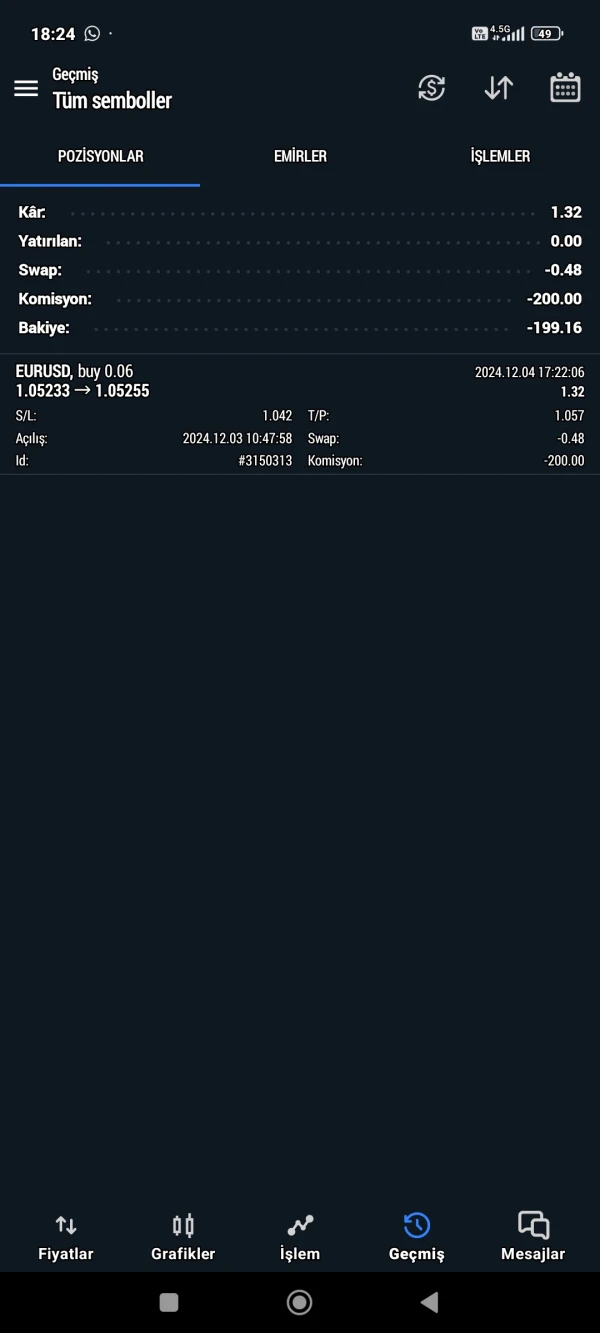

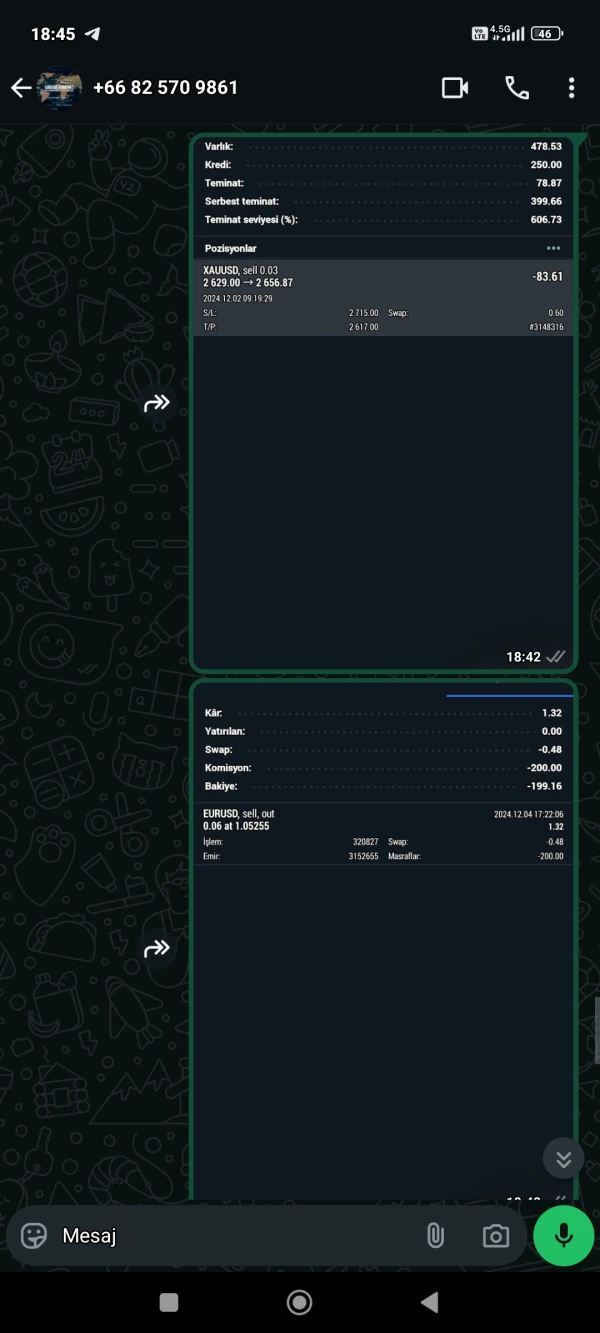

Scammers are resetting your account under the name of commission. I made a profit of 2 dollars, they deducted 200 dollars as commission, and now they are not giving me the remaining amount.

Exposure

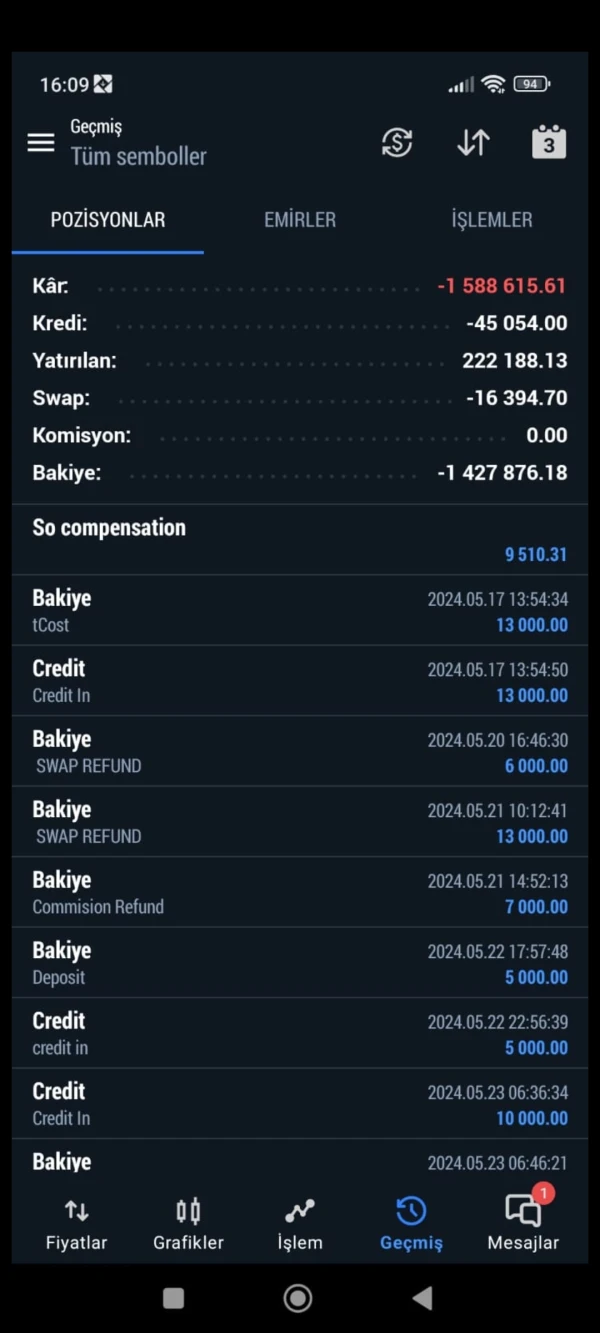

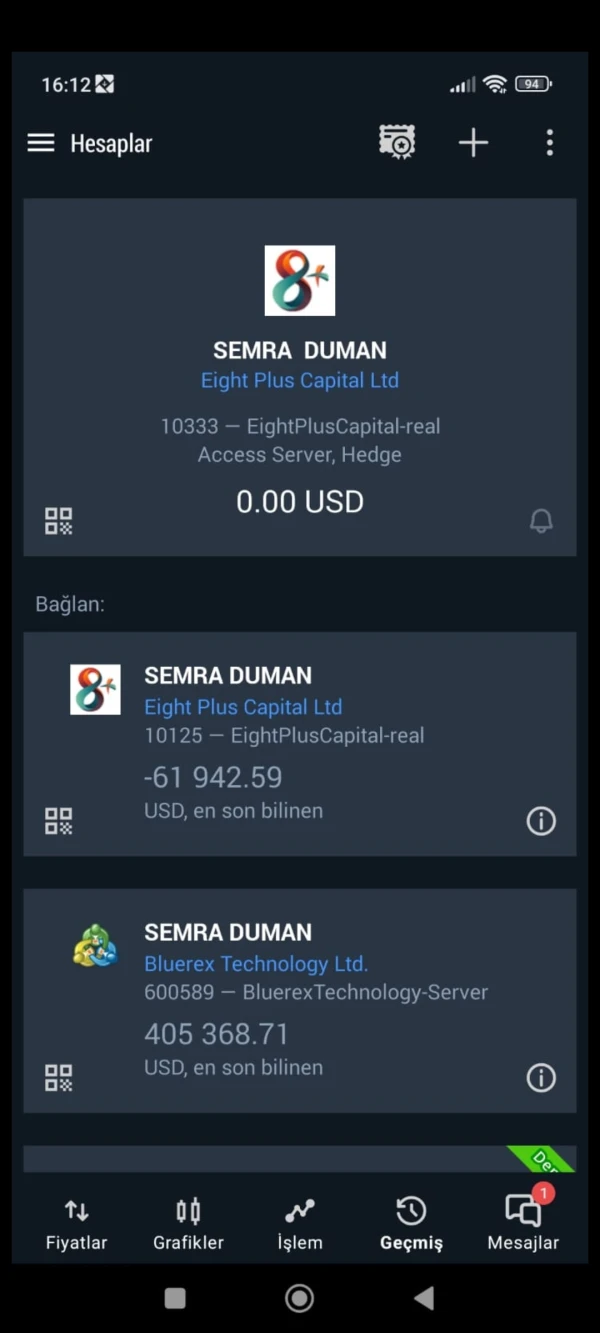

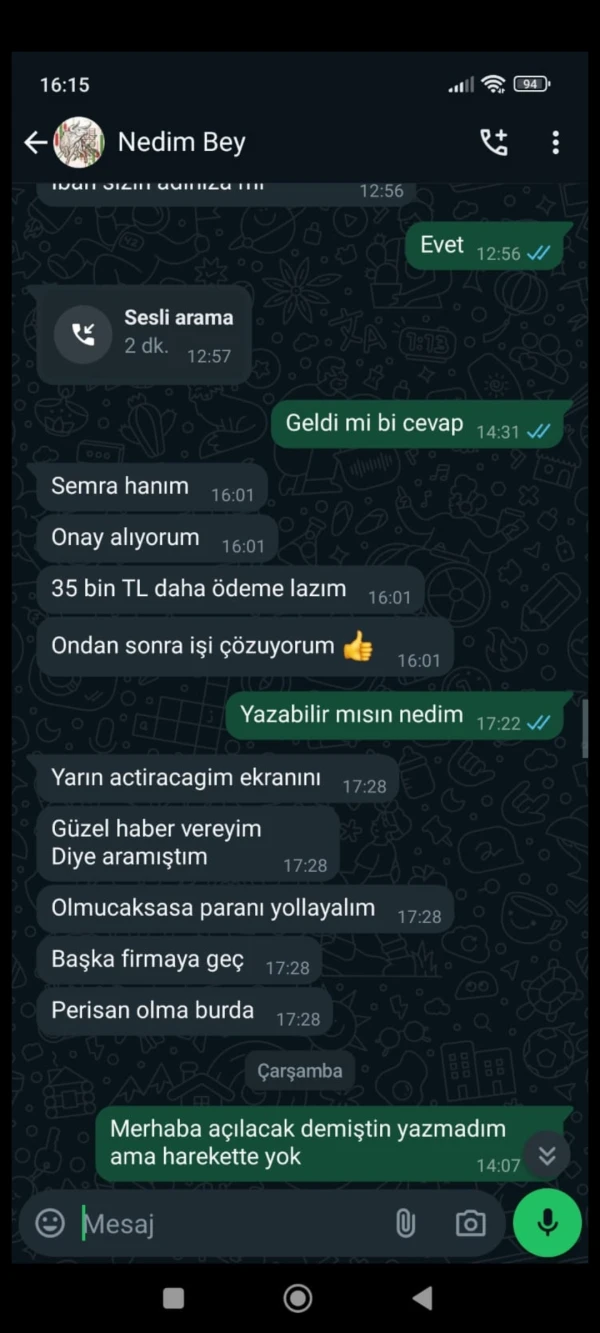

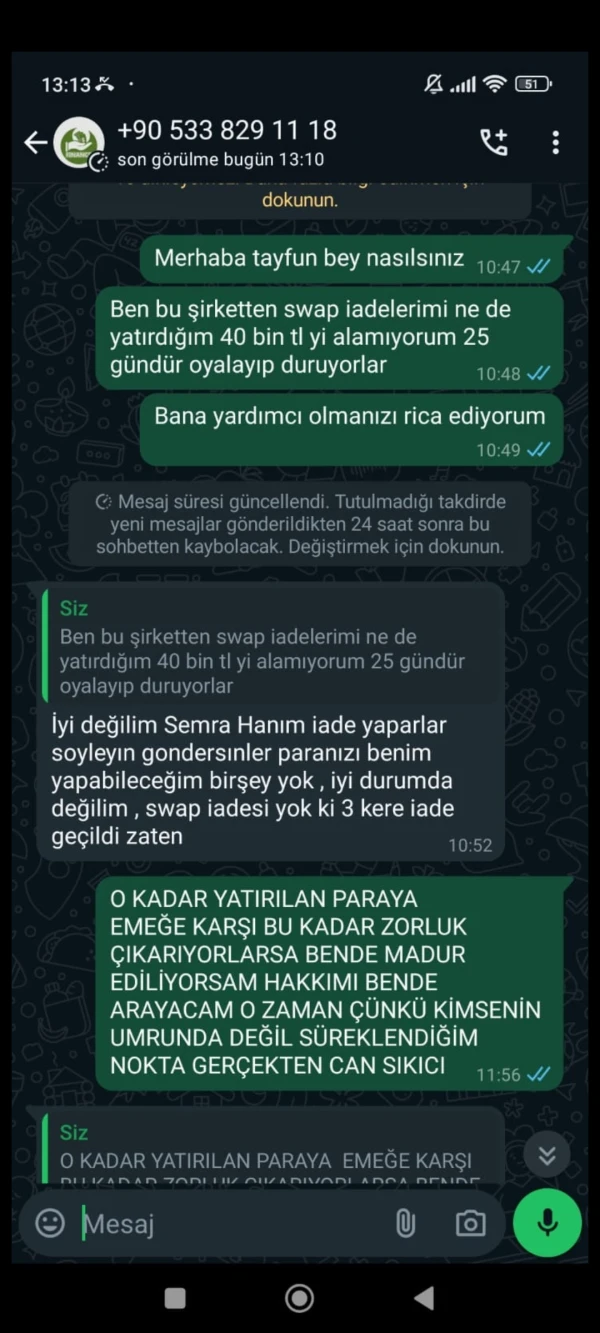

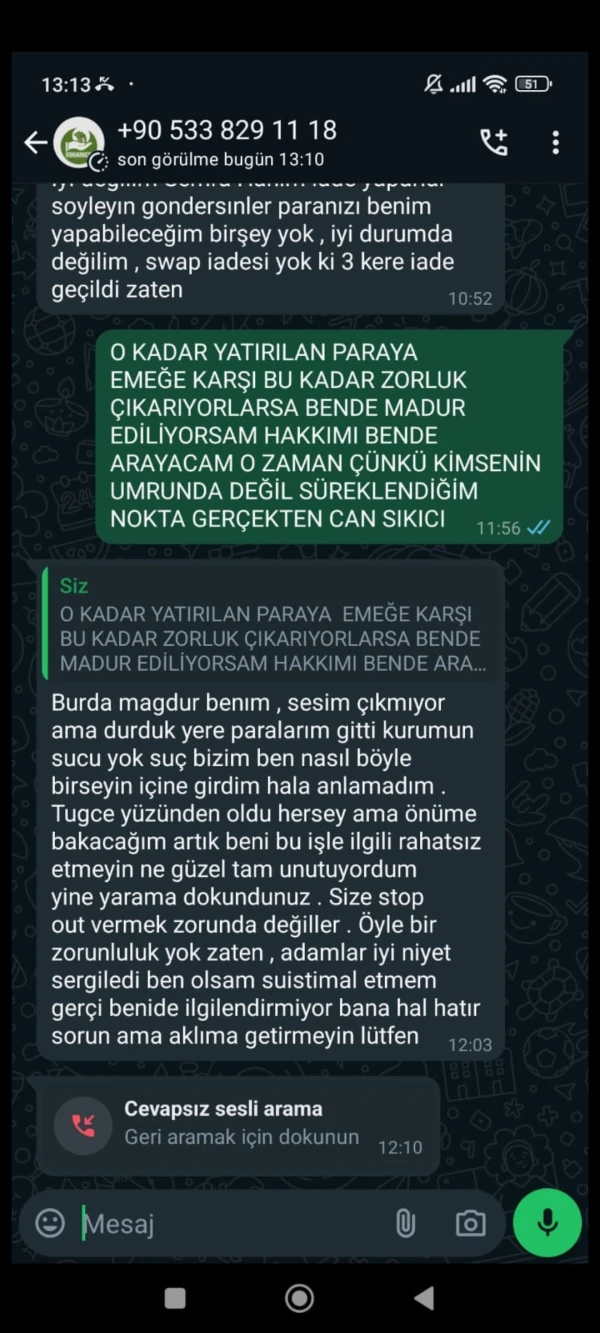

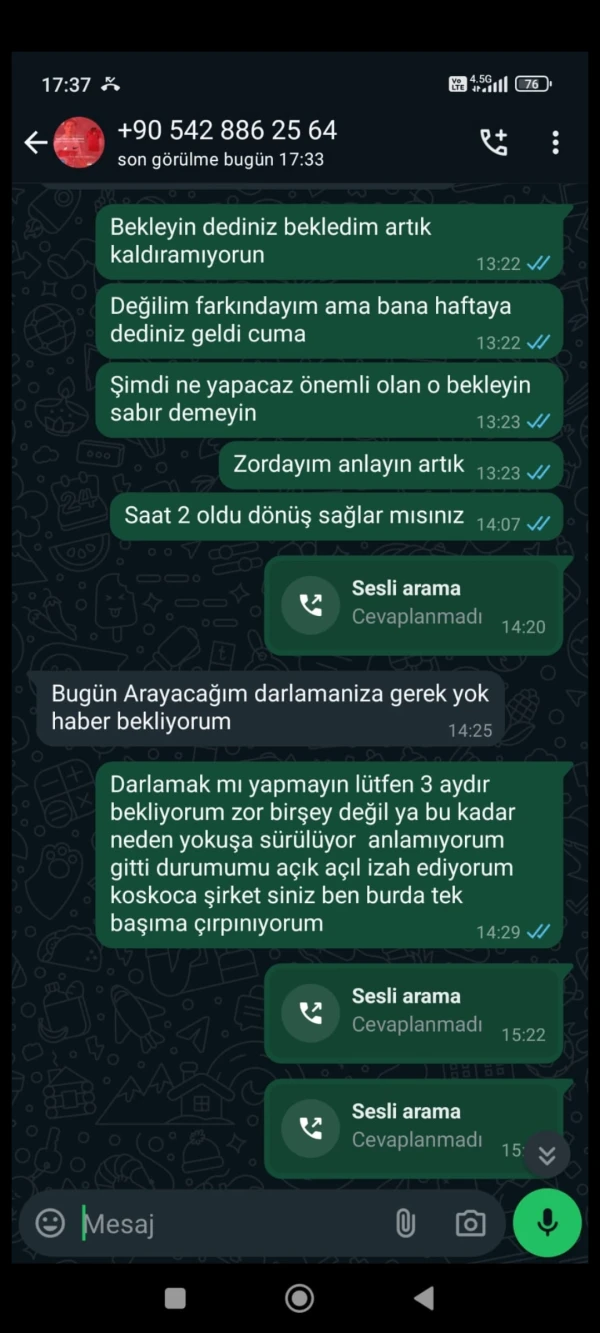

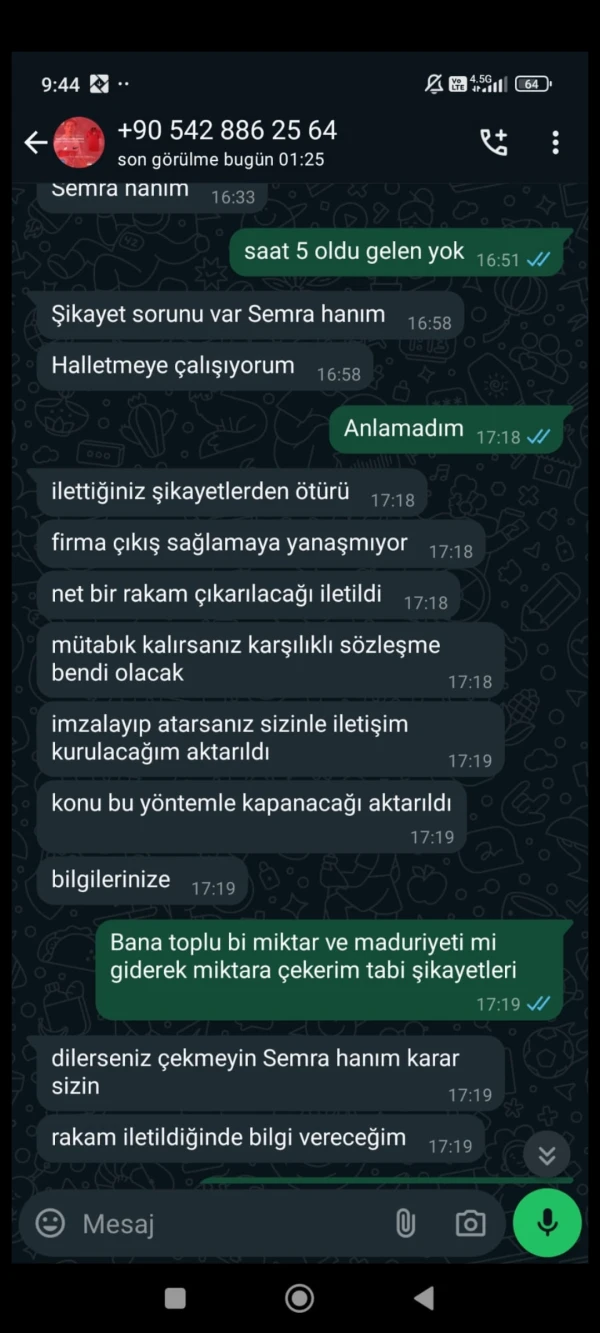

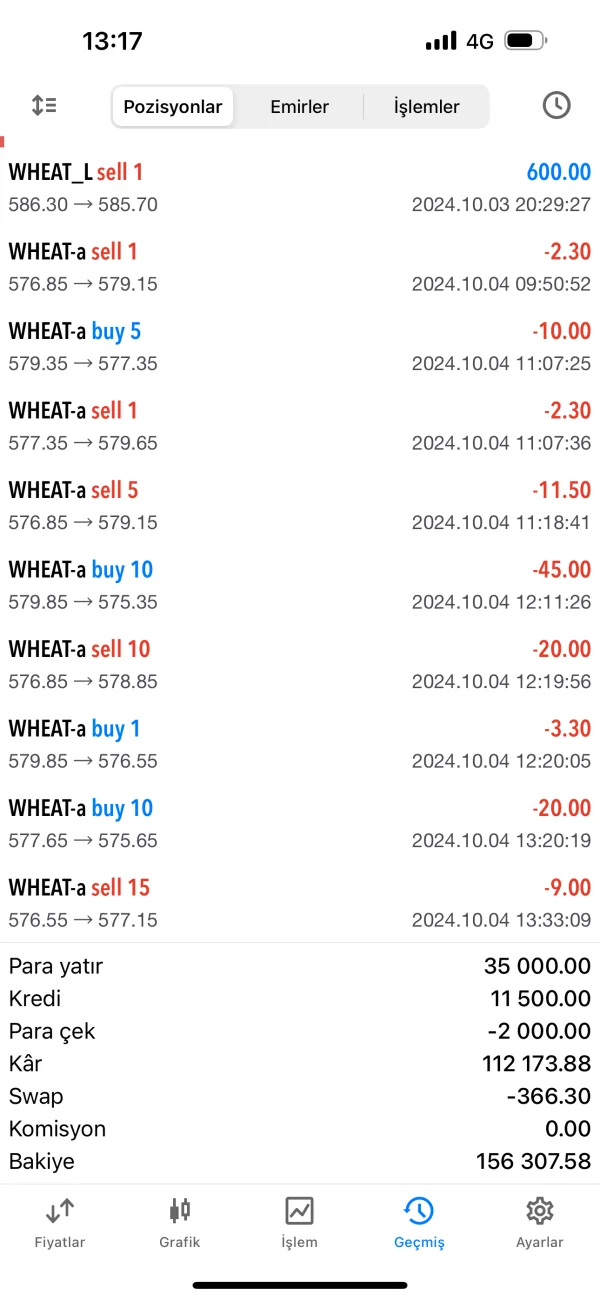

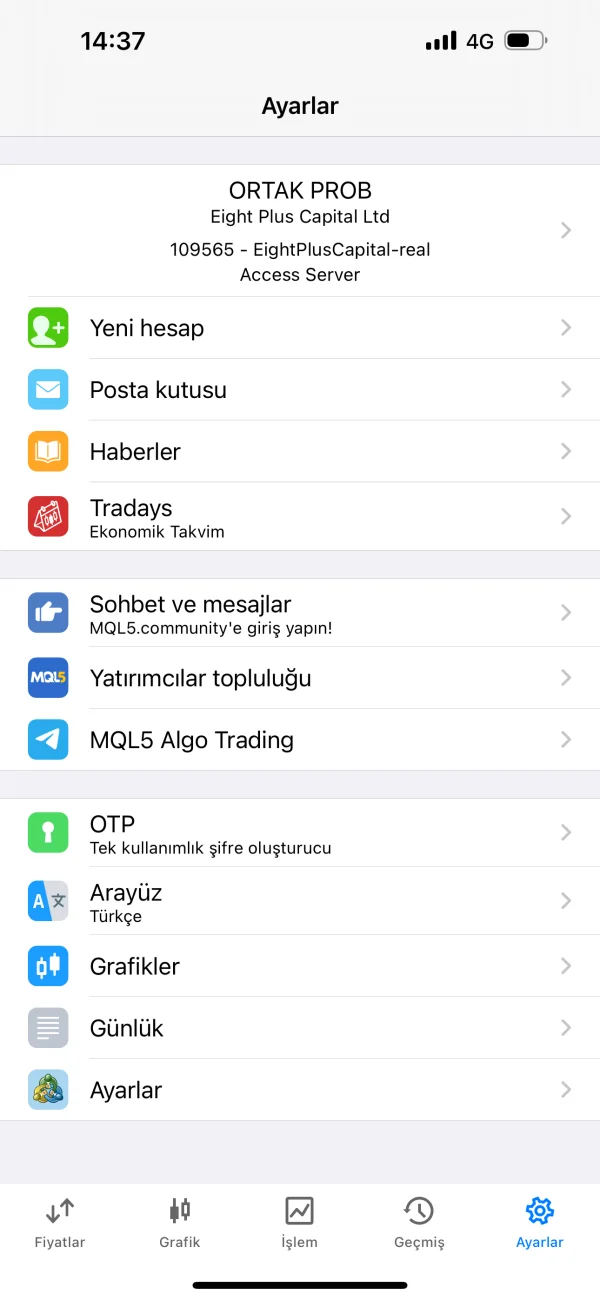

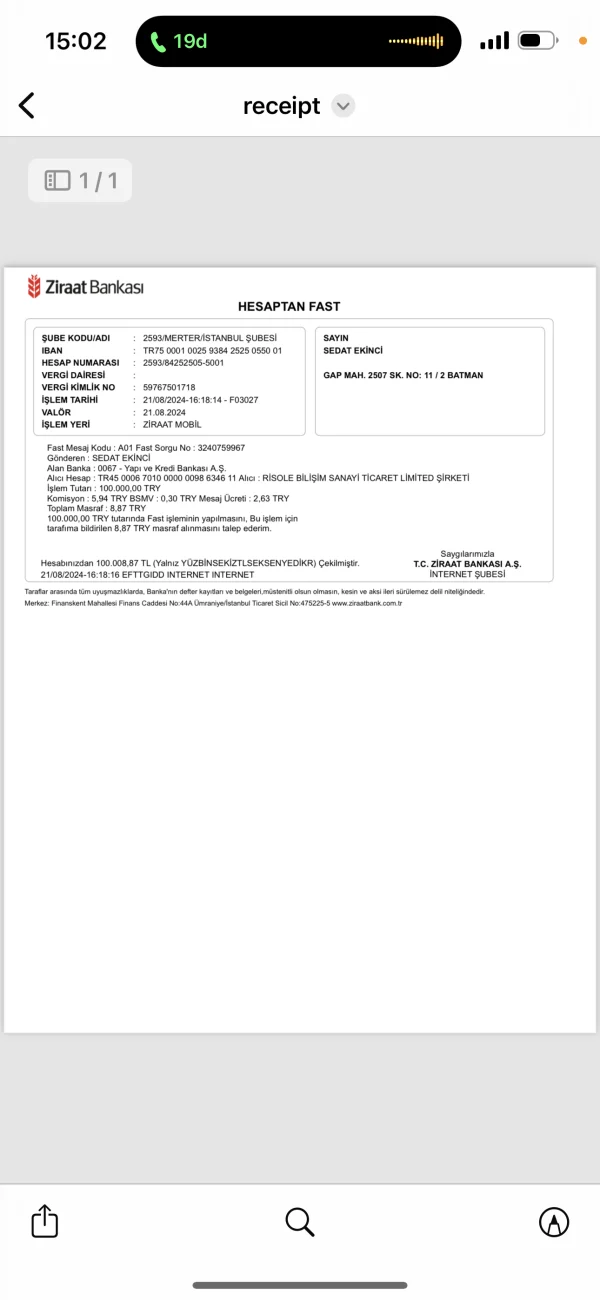

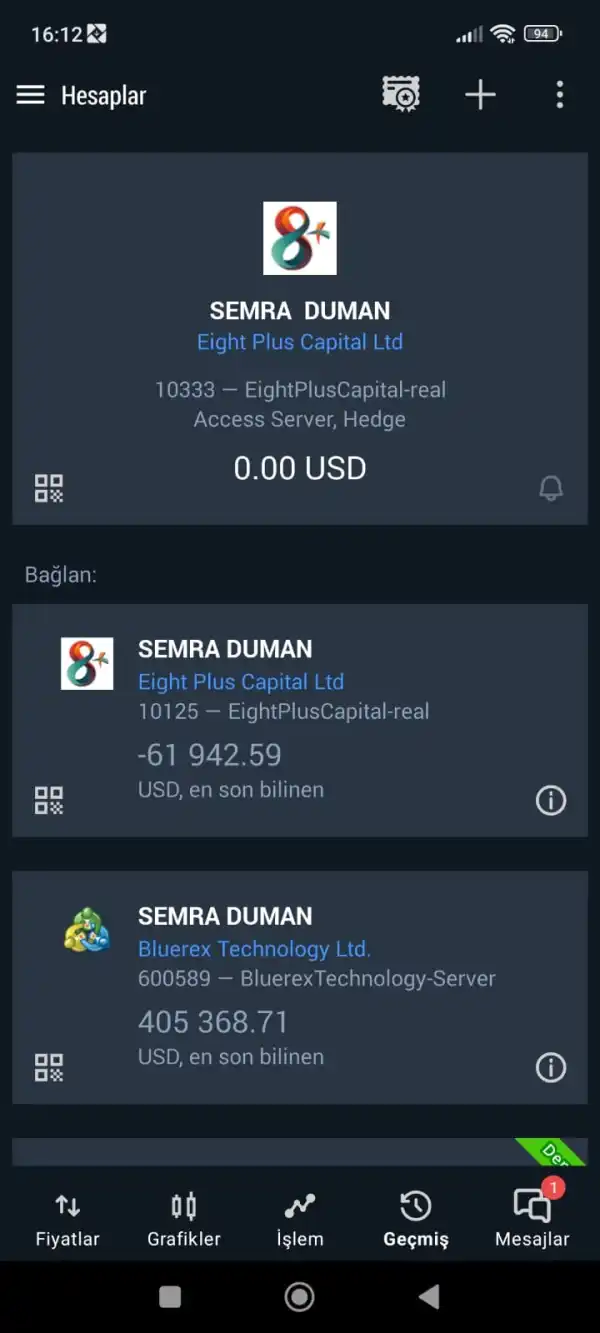

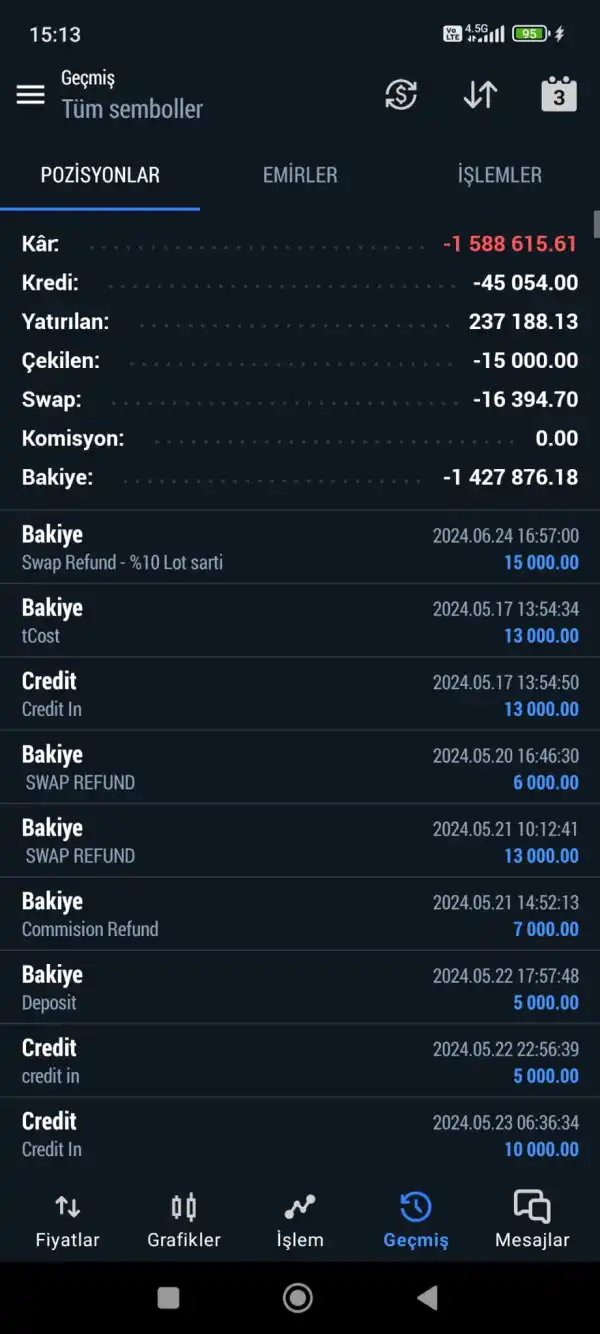

Semra

Turkey

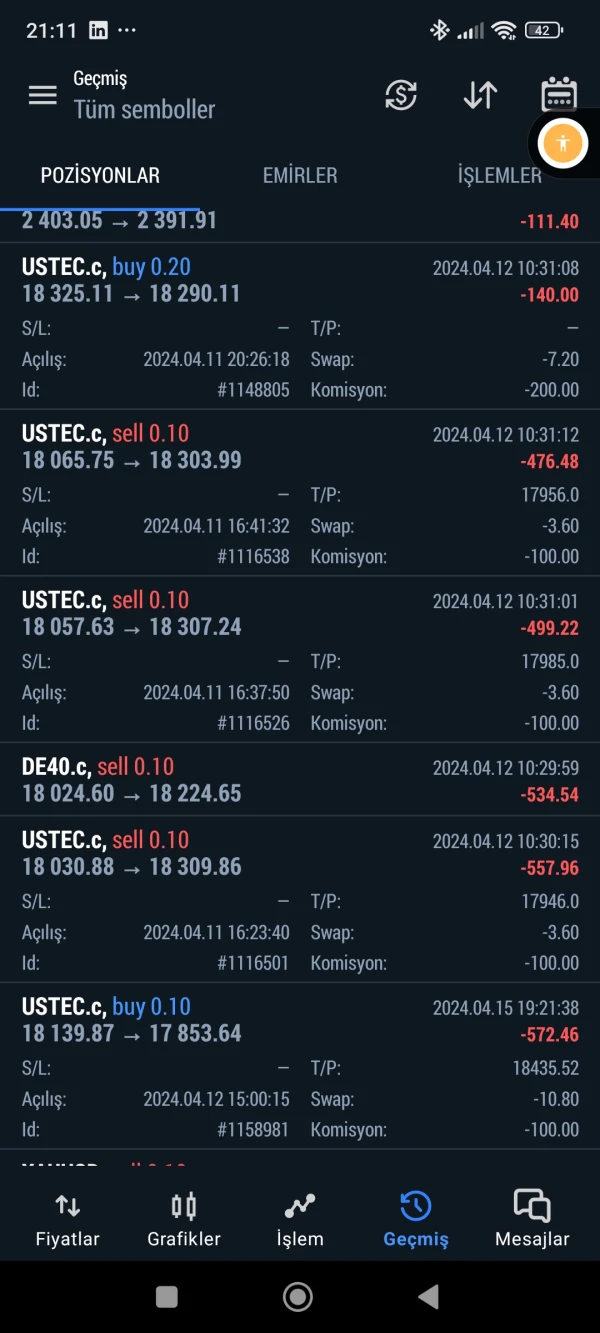

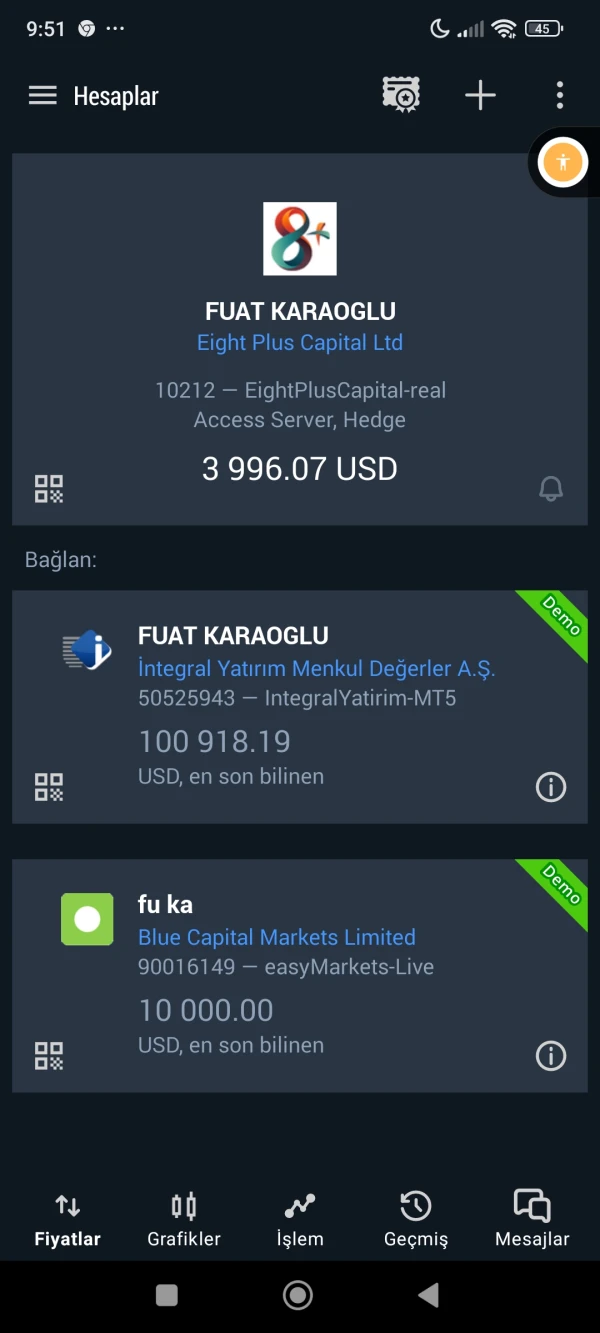

I was scammed by the company Eigtht Plus and Rexen. My principal is 55,000 dollars and my account is 190,000 dollars with my wife. The day I wanted to withdraw money, it was stopped. I was asked for 120,000 dollars to open the account. When I did not deposit it, my account was completely closed.. WHEN I STARTED THE LEGAL PROCESS, I RECEIVED CALLS FROM PEOPLE I DON'T KNOW, TELLING ME THAT I WON'T GET MONEY AND THAT I SHOULD GIVE UP THIS ISSUE. I HAVE SENT YOU VARIOUS SCREENSHOT AND RECEIPTS. I AM SENDING THE NUMBERS OF THE MT5 SERVER OWNERS. AS A WOMAN, IT IS NOT POSSIBLE FOR ME TO DELETE THIS MONEY AND AS A WOMAN, I DO NOT THINK THAT YOU WILL TOLERATE ME TO BE THREATENED. I EXPECT YOUR SUPPORT IN A SHORT TIME, THANK YOU IN ADVANCE.REXEN - BLUEREX TECHNOLOGY LTD SERVER MT5 ACCOUNT REXEN 600589 ASPLUS 10125

Exposure

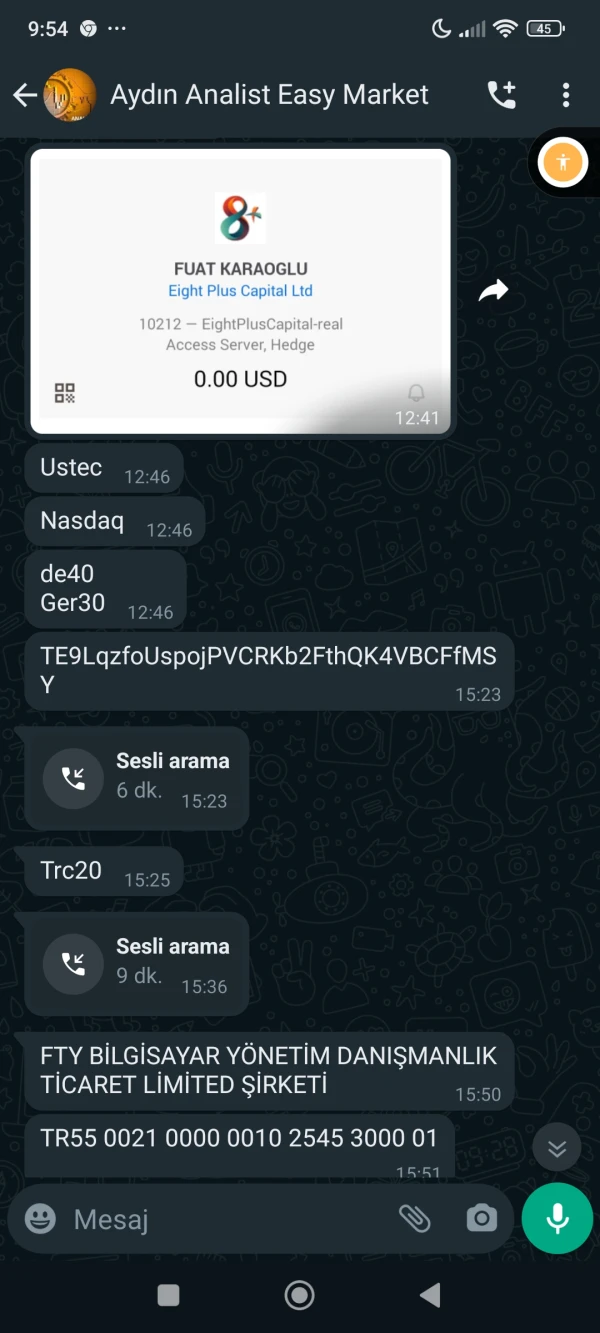

FX8451835862

Turkey

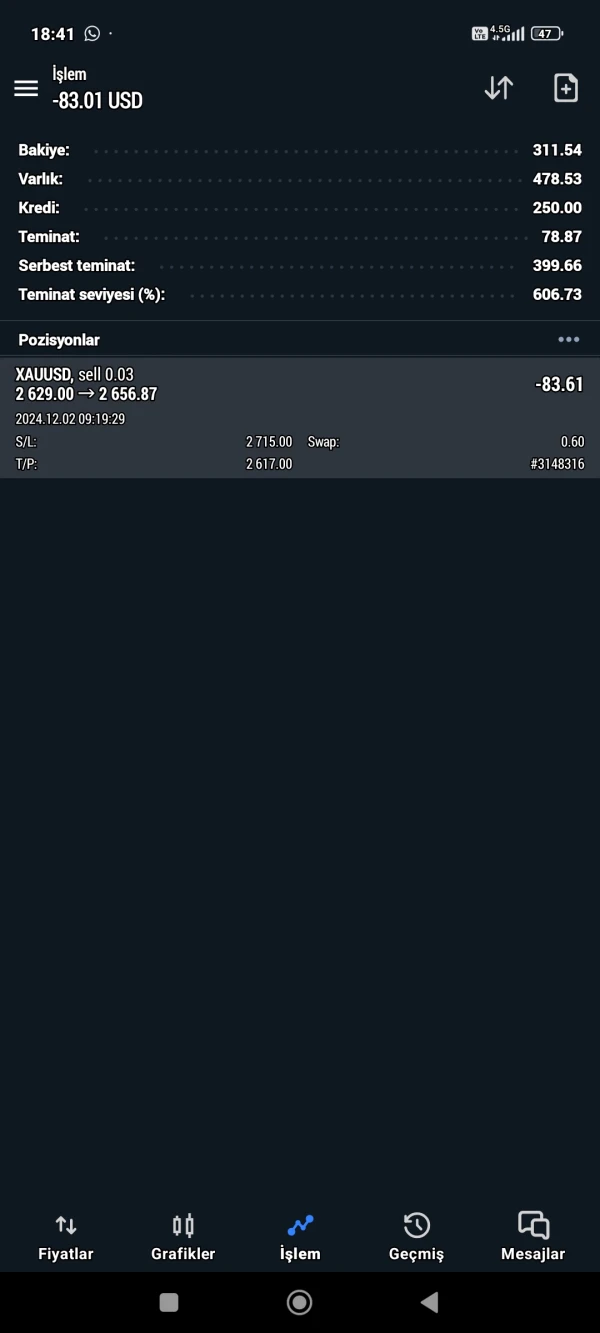

Hello I used to trade in a different platform and during my trades, I was repeatedly contacted by eight plus capital and on 08/07/24, I was somehow convinced. I started with $310 initially. Later, they talked about a great advantage and convinced us to buy wheat. We invested $9,000 and then our account blew up. They asked for another $5,000 to reopen the account and imposed a condition of 50 lots. Our account was opened and we were trading to meet the lot requirement. At that time, a person named BEKİR MERT YILMAZ said he would make my lot trades faster and asked for my Meta password. He logged in and at that time, my account was $170,000. Suddenly, BEKİR opened a 20-lot trade and caused the account to go negative and blow up. Then they said they would reopen it and asked for $30,000. Later, a person named NAZLI ŞAHİN reduced it to $5,000 and convinced us to send $4,000. Then, when we had 16 lots left, suddenly the wheat trade disappeared.

Exposure

FX2862672224

Turkey

I have invested half, and it has grown from $12,000 to $22,000. When you want to make a withdrawal, they demand 45% of the money under the name of tax. They say that if you don't pay, you cannot withdraw the money, but as you pay, they come up with new excuses to request fees. I want my money to be deposited. If it is not deposited, I will file a criminal complaint through my lawyer.

Exposure

FX1126306962

Turkey

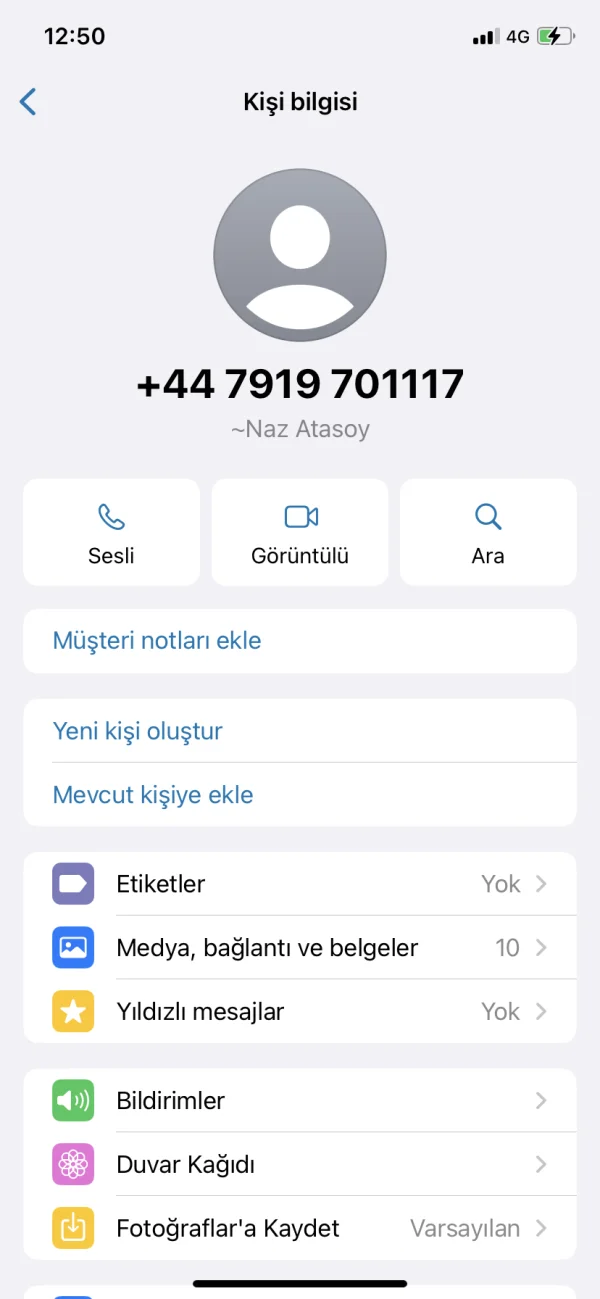

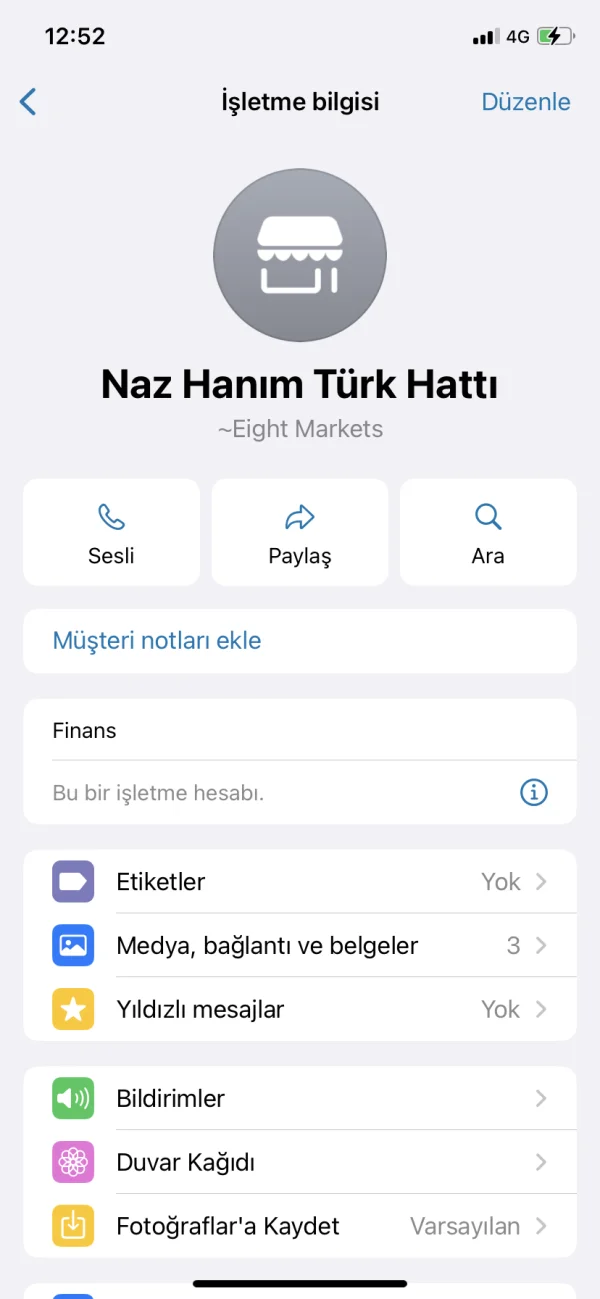

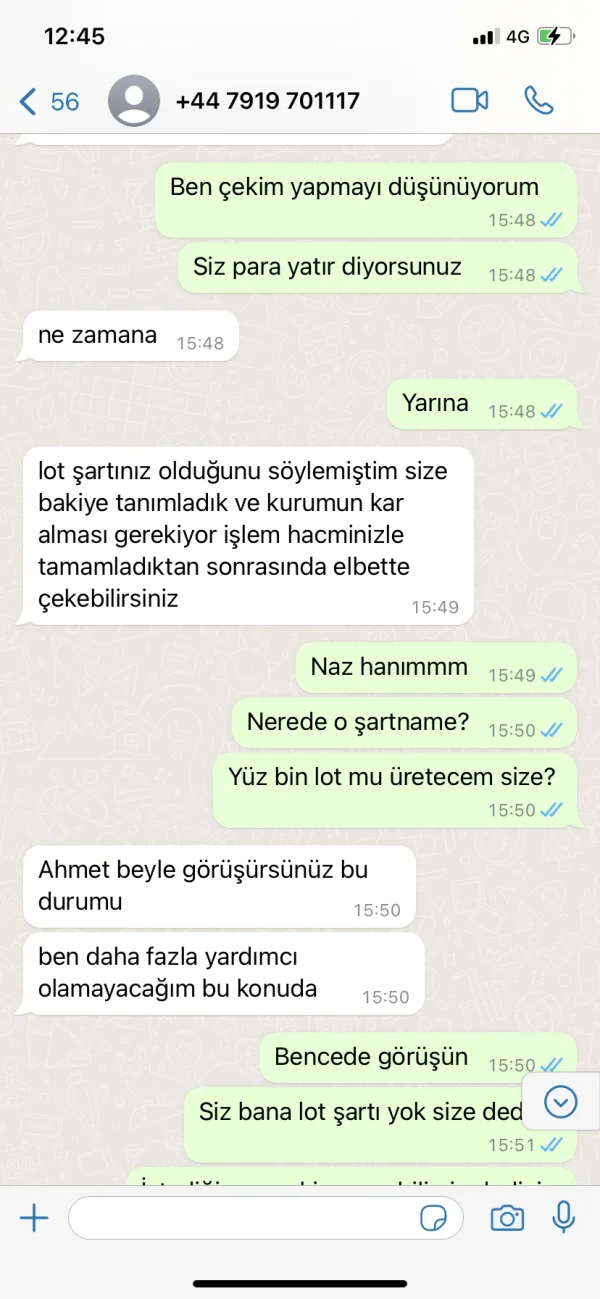

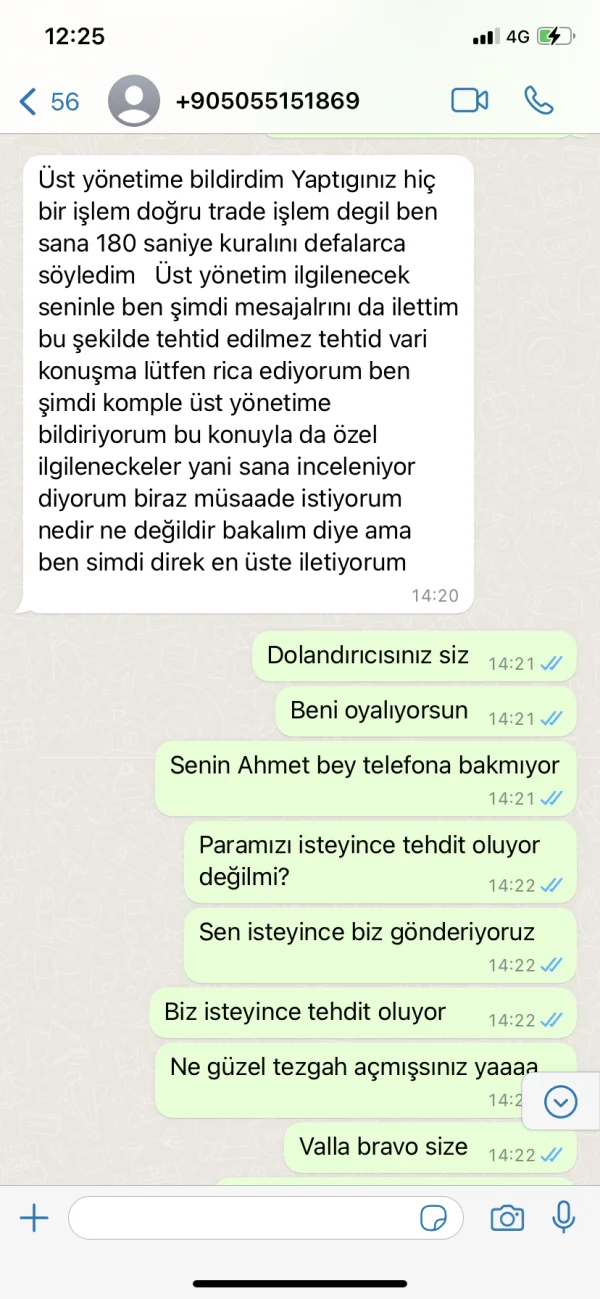

The biggest scam company in the Forex market is EİĞHT PLUS. The sole purpose of this company is to take your money. Even if you have $100,000 in your account, they still ask for 3-5 thousand from you. Because there is no real money in your account..! They don't forward your orders to the service provider, they just take your money and wait for you to lose in your trades. And if you manage to make money, you can never withdraw that money..! Then they block you and close your account. These are professional scammers. I reported them to the Prosecutor's Office. My advice to you is not to lose your money to these scammers. It is not possible to make money from this company..!!! The so-called investment advisor Orçun SEZGİN, the so-called investment advisor for big accounts Naz Atasoy, and their so-called manager Ahmet bey.. these three people spin you around like a top and then never answer your calls. They closed my account when I had $40,000 and I can't log in and they don't answer my calls. SCAMMERS

Exposure

Harkerri

Peru

My last experience is deemed great because the support was able to provide the detailed information of what am looking for. More so I am thrilled by the fact they are willing to go extra in making sure that am able to navigate all the trading services of Eight Plus correctly.

Positive

Semra

Turkey

My account at Rexen brokerage was stopped due to high lot sizes opened by the managers and advisors. When the account faced issues, Tayfun Bey ensured funding was done each time, and later claimed partnership in the account. Tayfun Bey, whom I knew as the manager, later transferred my account to Eight Plus company for personal management. Continuing with the same risk and high lots, my account eventually stopped out. When I wanted to withdraw from the account, it was left in a negative state and stopped out. Currently, Eight Plus company is not opening my account and is asking for funding ($120,000). I am in significant loss and request your assistance. Currently, I cannot communicate with anyone from either Rexen or Eight Plus company. Rexen 600589 Eight Plus 10333 and 10125 These are the accounts; please I have been wronged and request an investigation into my accounts and a refund of my principal amount.

Exposure

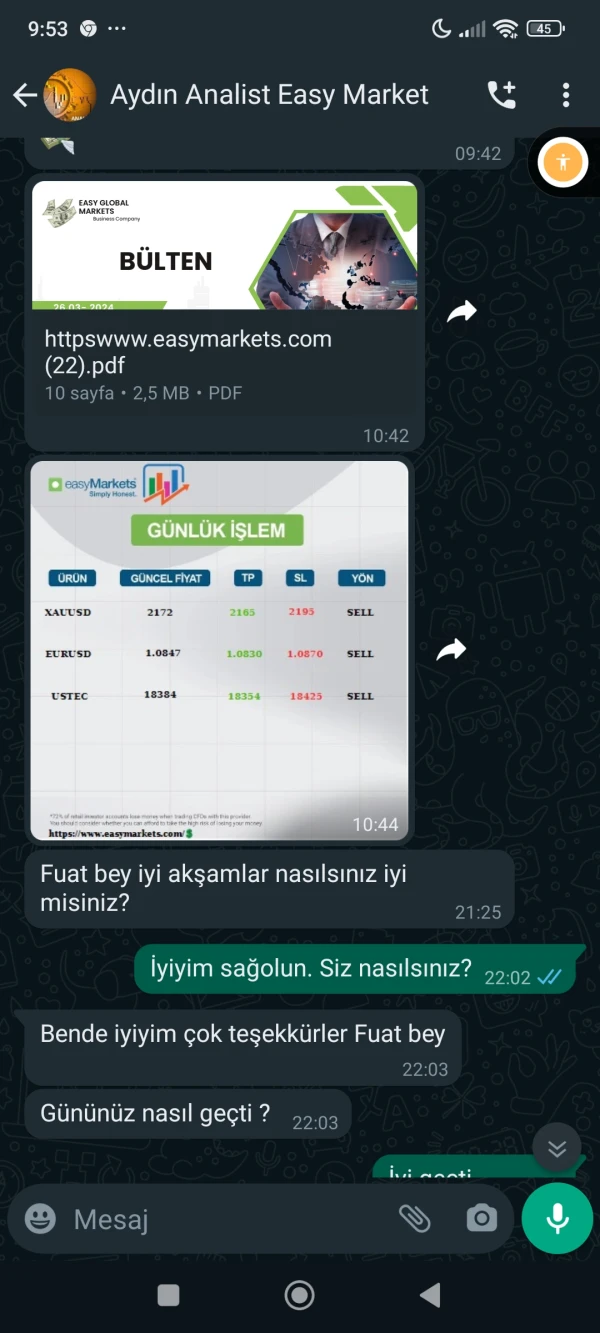

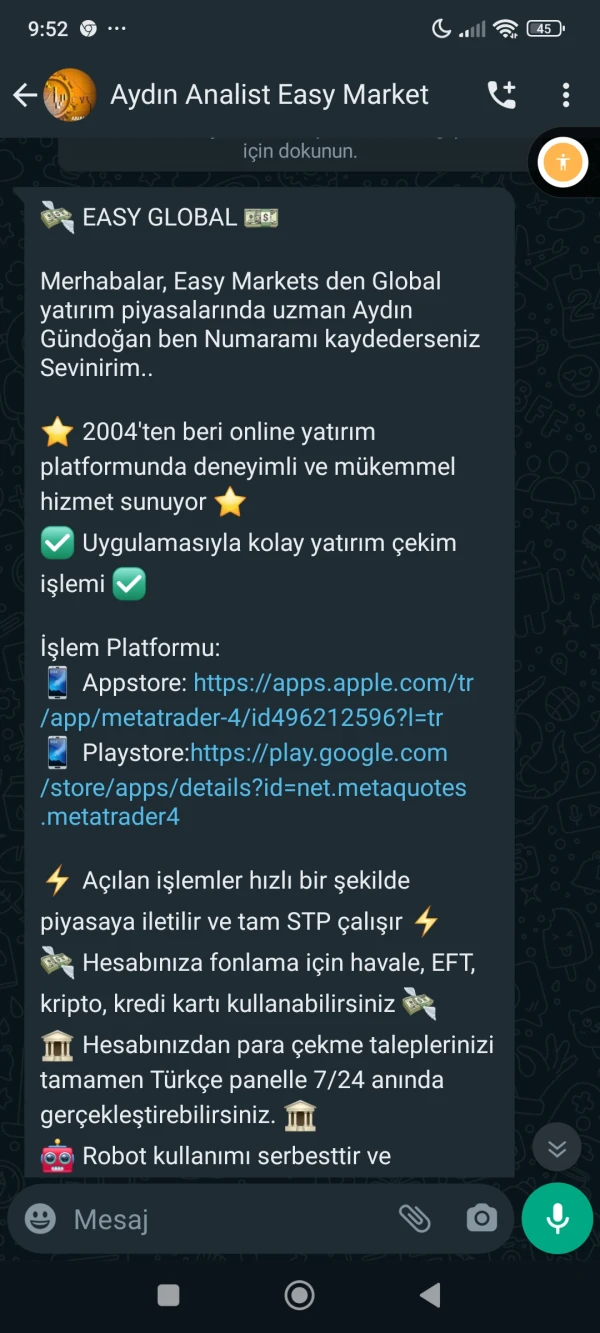

fuatmonu

Turkey

A fraudulent and imitative company. First of all, they manipulate our psychology very well and persuade us. However, when they start trading and making money, they first widen the spreads excessively. Even if you open a trade, you cannot earn much. Your earnings go to transactions. When you request a withdrawal, they deduct a commission of $100 or $200 for each transaction closed from the money in your account. Unfortunately, there is no money left to withdraw. The amount you deposit does not appear on the withdrawal platform.

Exposure

Betül

Turkey

I work with this company, but I cannot reach the consultant. When I want to withdraw money, there is no one to contact me. Nobody from the company cares. I sent an e-mail, but I can't reach them, and there is no response.

Exposure