Overview of Rox Capitals

Rox Capitals is an online brokerage firm headquartered in the United Kingdom. Rox Capitals provides five classes of tradable instruments, including Forex, stocks, commodities, and cryptocurrencies. They offer multiple account types to accommodate traders at different experience levels, along with competitive spreads and advanced trading tools. The user-friendly MetaTrader 5 platform enhances convenience and analysis capabilities.

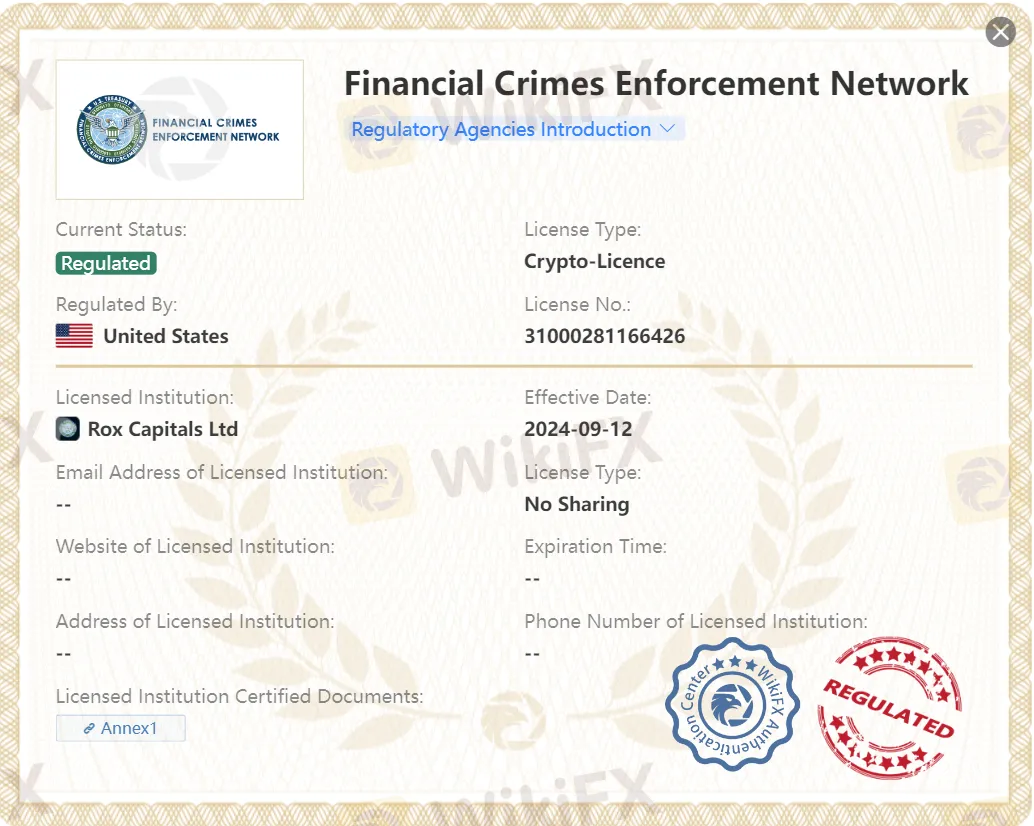

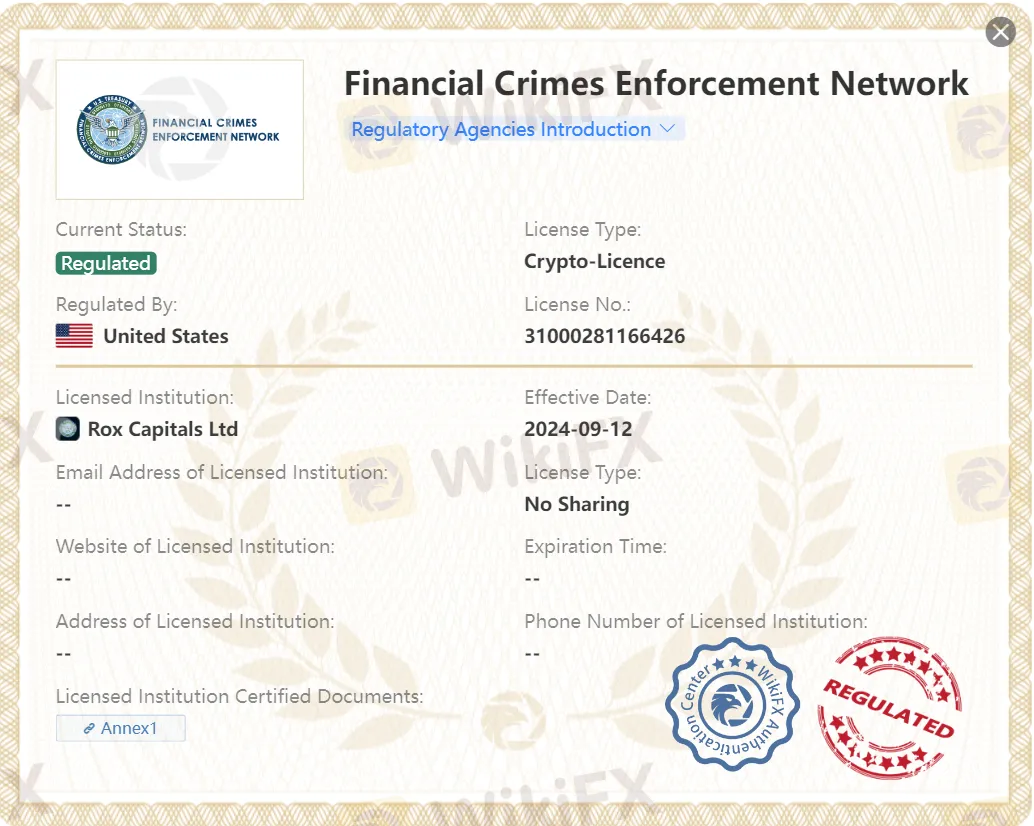

Is Rox Capitals Legit or Scam?

Rox Capitals is regulated under the Financial Crimes Enforcement Network (FinCEN) in the United States. It holds a crypto-license (License No. 31000281166426).

Pros & Cons

On the plus side, Rox Capitals offers access to popular markets and assets, including Forex, stocks, commodities, and cryptocurrencies and more. They provide competitive spreads to reduce costs and maximize returns. With multiple account types, traders can choose options that suit their preferences. Rox Capitals also offers educational resources for knowledge enhancement.

The broker has regional restrictions, limiting accessibility for traders from certain countries. Customer support is available in limited hours, potentially inconveniencing traders in different time zones.

Market Instruments

Rox Capitals offers a wide range of market instruments, providing traders with diverse options to explore and invest in. The platform offers a comprehensive selection of market instruments as follows:

- Forex: Forex trading involves the buying and selling of currencies. With Rox Capitals, traders can access the global currency market and trade in over 40 major, minor, and exotic currency pairs.

- CFDs (Contract for Difference): CFDs are financial derivatives that allow traders to speculate on the price movements of various assets without owning the underlying asset. Rox Capitals offers CFD trading on a variety of instruments, including global indices, stocks, and cryptocurrencies.

- Metals: Rox Capitals allows traders to engage in metal trading, specifically in precious metals like gold and silver. Trading in metals has been popular for centuries, and with Rox Capitals, traders can participate in this market and benefit from potential price movements in gold and silver prices.

- Cryptocurrencies: Rox Capitals allows trading cryptocurrencies in the form of CFDs. Traders can speculate on the price movements of popular cryptocurrencies such as Bitcoin, Ethereum, Dashcoin, Ripple, and more.

- Stocks: Rox Capitals give access to over 40 major stocks.

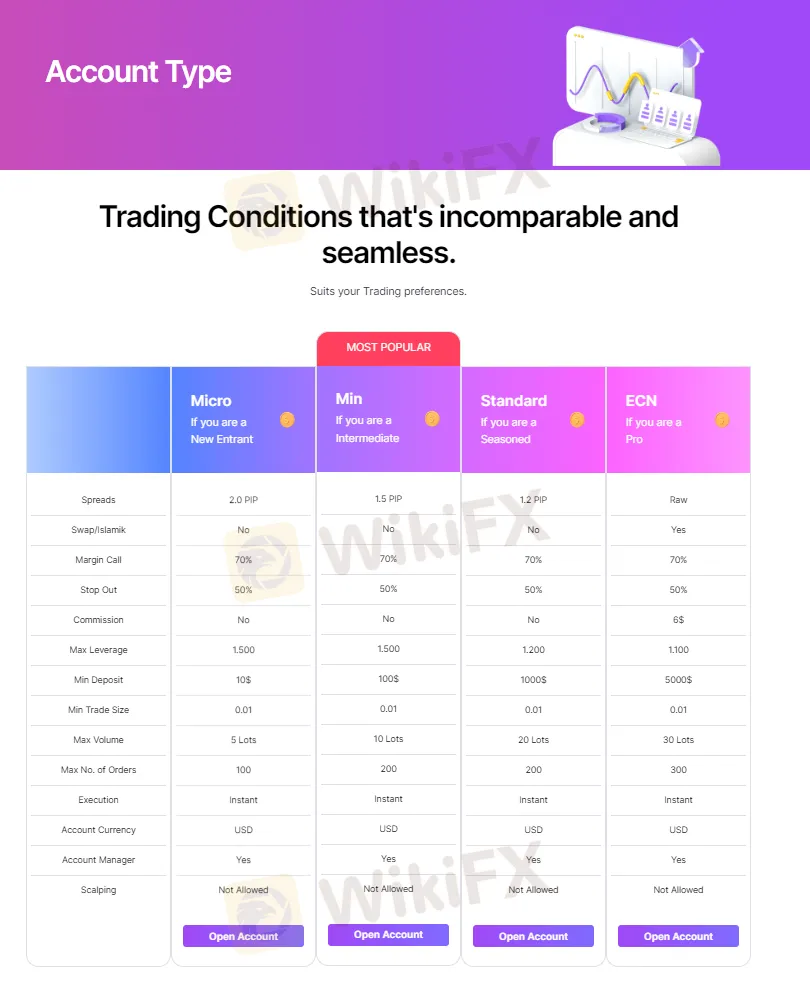

Account Types

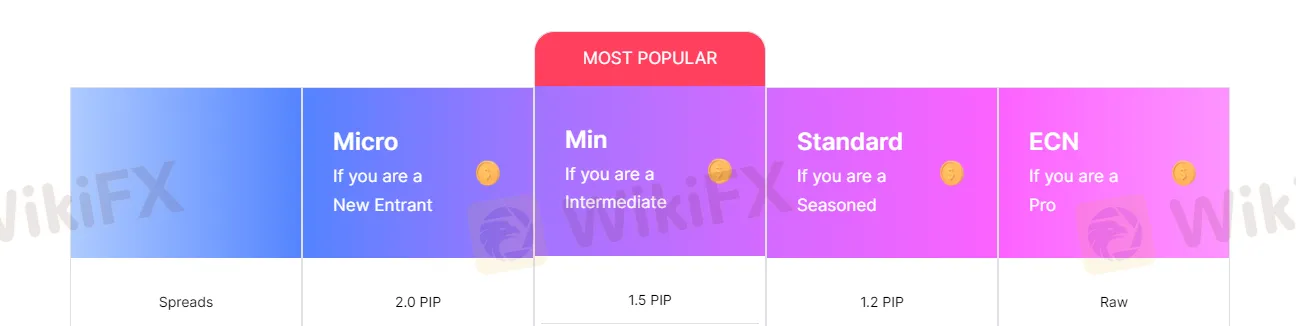

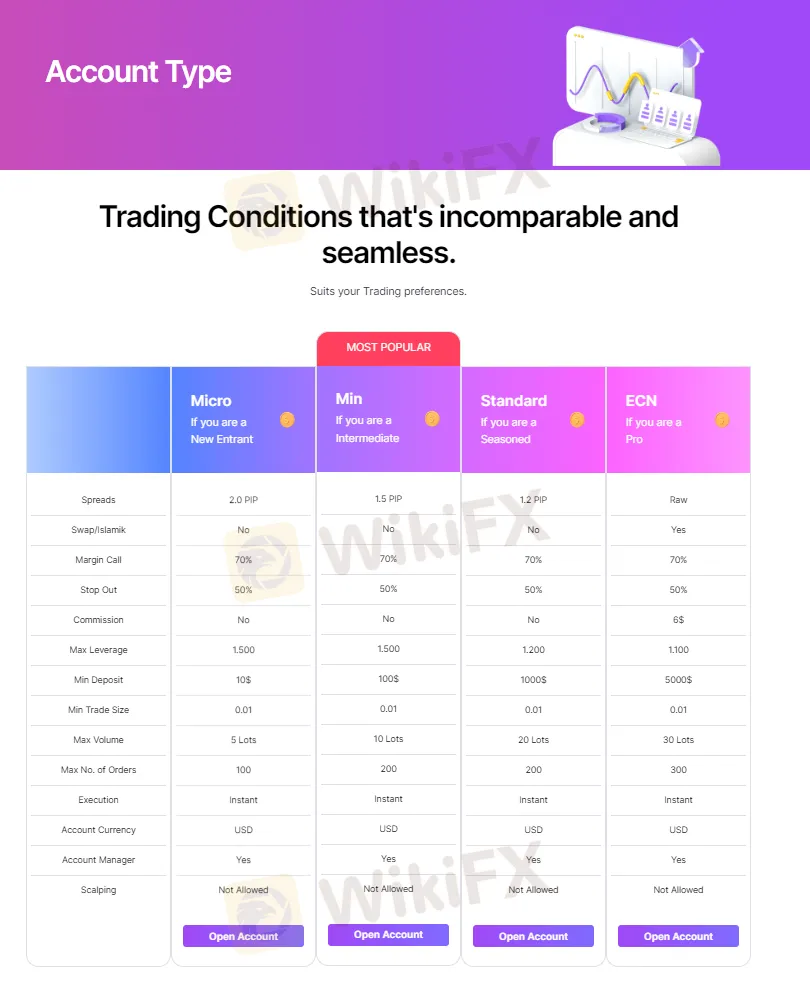

Rox Capitals offers four distinct account types tailored for different traders: Micro, Mini, Standard, and ECN.

The Micro account stands out as the most accessible, requiring a minimum deposit of just $10, ideal for beginners or those looking to test the waters with minimal risk. The Mini account, with a $100 minimum deposit, offers slightly higher trading limits and is suitable for traders who are ready to step up their game.

For more serious traders, the Standard account requires a $1,000 minimum deposit and provides increased maximum volume and number of orders. The ECN account, geared towards professional traders, demands a $5,000 minimum deposit but offers the highest maximum volume and number of orders, along with the tightest spreads.

All account types share some common features, such as a 70% margin call level, 50% stop out level, and a minimum trade size of 0.01 lots. Notably, only the ECN account offers swap-free (Islamic) options. The broker maintains a no-scalping policy across all accounts, which may disappoint short-term traders. However, the provision of an account manager for all tiers is a valuable addition, offering personalized support to traders at every level.

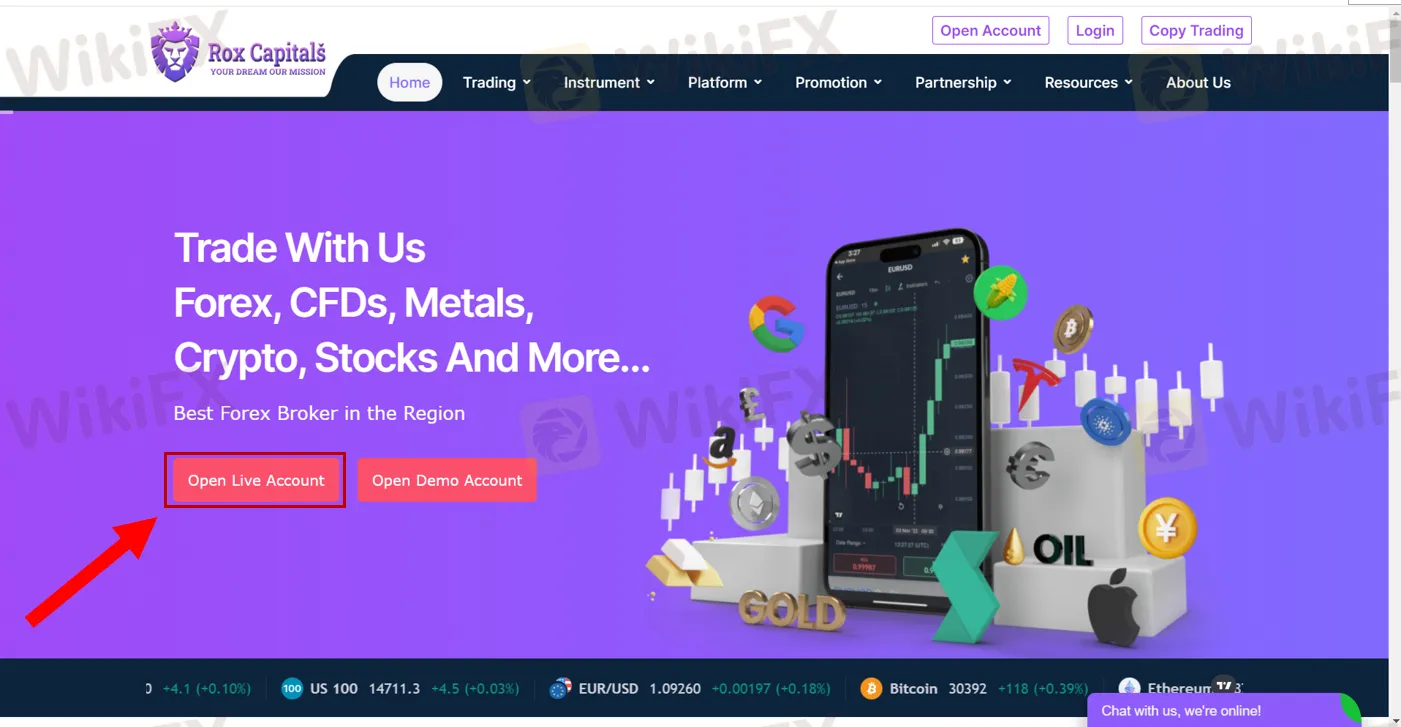

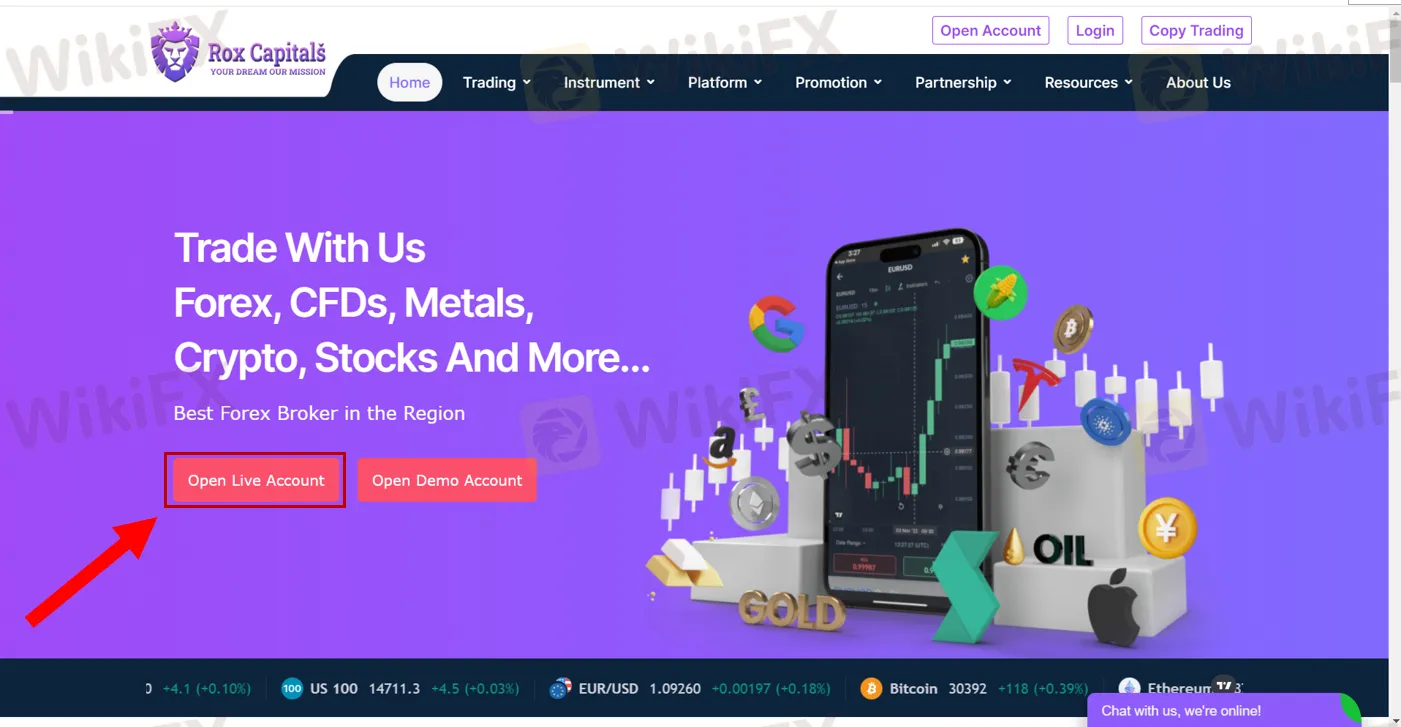

How to Open an Account?

Each trader should open an account to get into their trading journey. You are just a few steps away to open your Rox Capitals account by following these steps:

- Registration: Visit the Rox Capitals website and click on the “Open Live Account” button. Fill in the required information in the provided form to create your account.

2. Verification: After registering, you will need to go through a verification process. This involves filling out a questionnaire about your trading experience and providing proof of identification and residence.

3. KYC Verification: Once you have submitted the required documents, our team will review and verify them to ensure compliance with Know Your Customer (KYC) regulations.

4. Account Funding: Once your account has been verified, you can proceed to fund it. Rox Capitals offers various payment options to deposit funds into your account, making it convenient and accessible for you.

5. Start Trading: With your account funded, you are ready to start trading. Log in to your account, explore the range of available markets and instruments, and execute your trades according to your trading strategy.

Leverage

Rox Capitals provides leveraged trading, allowing traders to amplify their exposure to the financial markets. Leverage is a mechanism that enables traders to control larger positions with a smaller amount of capital. It works by borrowing funds from the broker to open positions that exceed the trader's account balance.

The maximum leverage offered by Rox Capitals varies based on the account type and the financial instrument being traded. For Micro and Min accounts, the maximum leverage is 1:500. Standard account holders have a maximum leverage of 1:200, while ECN account members enjoy a maximum leverage of 1:100. The ECN account, specifically designed for advanced professionals, provides direct market access and offers the lowest possible spreads. Traders utilizing the ECN account should be aware of the higher capital requirements and the potential risks associated with leverage. It is crucial to carefully assess and manage risk when trading with leverage to ensure a responsible and informed approach.

Spreads & Commissions

In Rox Capitals, the minimum spread is an essential consideration when trading financial instruments. It represents the smallest difference between the bid and ask prices, reflecting the cost of executing a trade. The minimum spread varies across different account types: 2.0 PIP for the Micro Account, 1.5 PIP for the Min Account, 1.2 PIP for the Standard Account, and raw spread for the ECN Account. By factoring in the minimum spread, traders can choose the account type that best suits their trading needs.

Additionally, for certain account types like ECN accounts, Rox Capitals employs a transparent commission structure. The Standard account may have a commission fee structure. For example, it could charge a fixed commission fee of $6 per lot traded. Meanwhile, The ECN account is designed for direct market access and offers the lowest spreads. It has a fixed commission fee of $6 per lot traded.

Promotions

Rox Capital offers an engaging monthly demo contest on the MT5 platform, providing traders an opportunity to showcase their skills in a risk-free environment. The contest runs for one month, with attractive cash prizes for the top five performers, ranging from $500 for first place to $50 for fourth and fifth places.

Participation is straightforward: traders need to sign up or log in to Rox Capitals, open a dedicated Champion contest account, download MT5, and start trading. This promotion serves as an excellent way for traders to test strategies, gain experience, and potentially earn rewards without risking real capital, while also familiarizing themselves with the broker's trading conditions.

Trading Platform

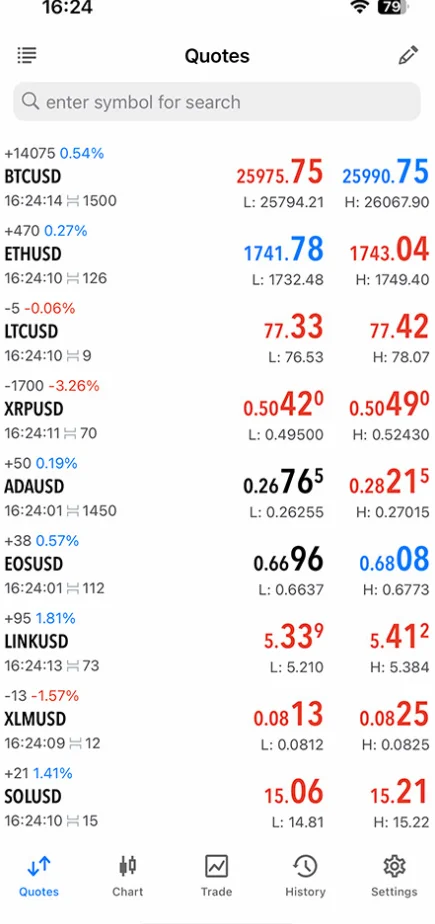

Rox Capitals connects clients with the trade market through its trading platform. Rox Capitals utilizes the MetaTrader 5 (MT5) trading platform, which is a powerful and comprehensive platform that offers a wide range of features and tools to enhance the trading experience. It provides traders with the ability to trade various financial instruments, including Forex, stocks, and futures, all from a single platform. With MT5, traders can access real-time market data, perform technical analysis, execute trades, and manage their positions efficiently.

The platform is available for desktop, web, and mobile devices, ensuring traders can stay connected and trade anytime, anywhere. With its user-friendly interface, advanced charting capabilities, and customizable features, MT5 is a preferred choice for both beginner and experienced traders.

Copy Trading

Rox Capitals enhances its trading platform with the inclusion of a copy trading feature. This popular social trading tool allows less experienced investors to replicate the strategies of successful traders automatically. By offering this functionality, Rox Capitals enables its clients to potentially benefit from the expertise of top-performing traders on the platform, diversifying their trading approach without needing extensive market knowledge. This feature can be particularly attractive for novice traders looking to learn from more experienced counterparts while still maintaining control over their investment decisions.

Deposit and Withdrawal Methods

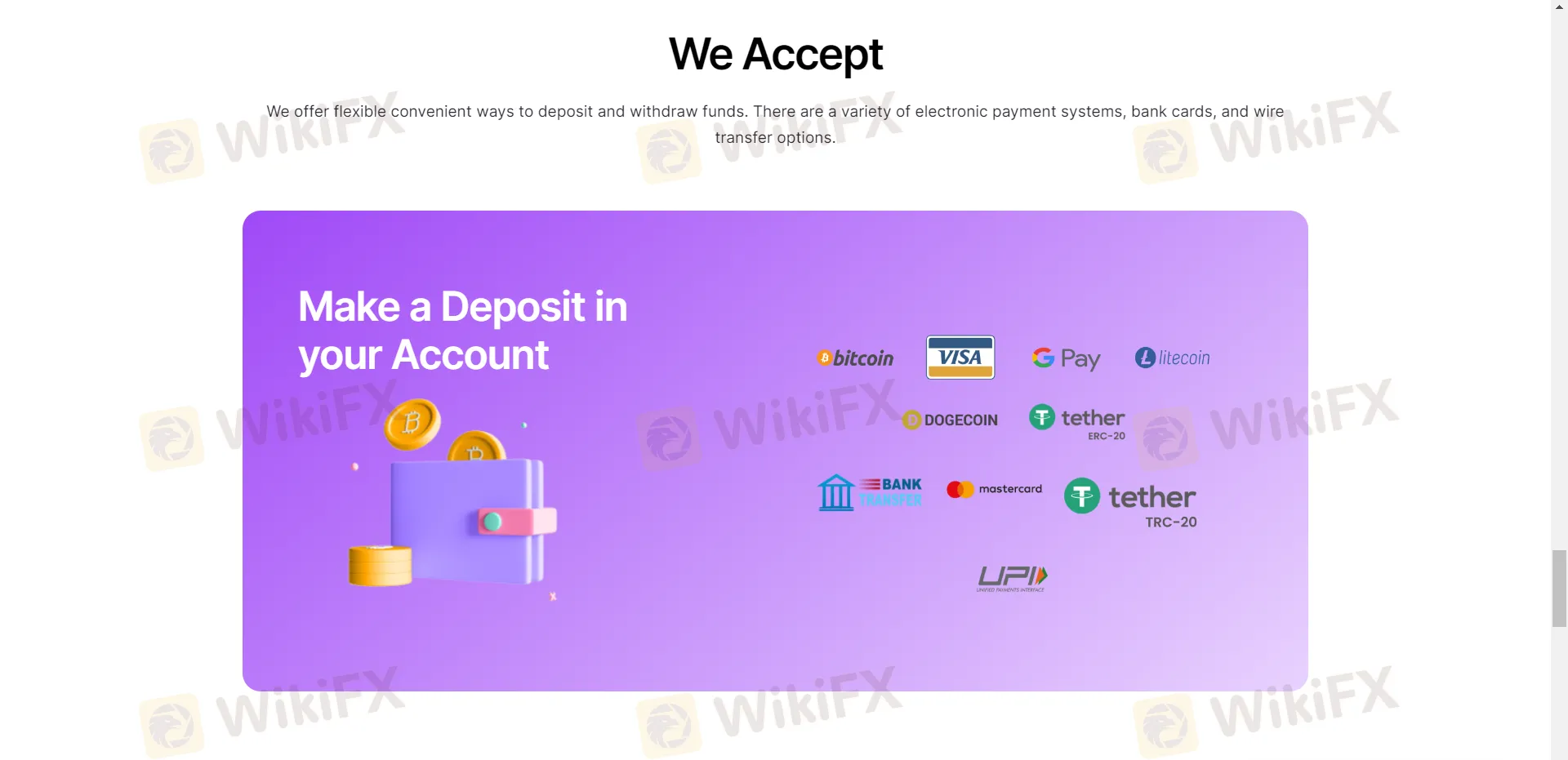

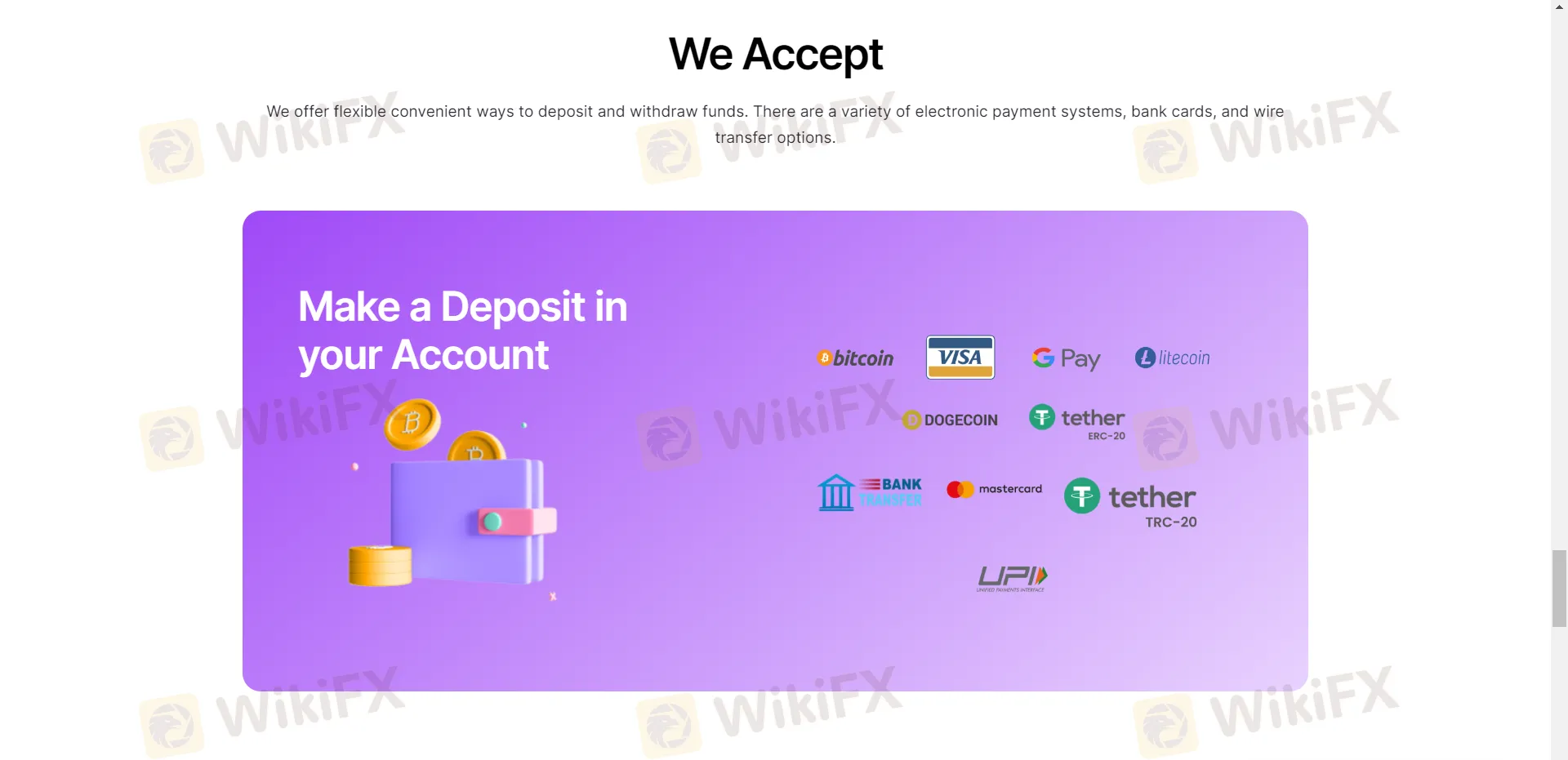

Clients of Rox Capitals have various options available to deposit and withdraw funds. Deposits can be made through several methods, including India Local Banks, PayU money, Local Cash, UPI, Mastercard, VISA, PhonePe, Paytm, Tether TRC-20, Tether ERC-20, Bitcoin, Binance Coin, and Ethereum. These payment options provide flexibility and convenience for clients to fund their accounts in multiple currencies. Traders can start with a minimum deposit of $10 and withdraw as little as $0.1. The maximum deposit and withdrawal amounts are both $20,000.

Similarly, when it comes to withdrawals, clients can utilize the same payment methods to withdraw their funds. This ensures a seamless and efficient process for clients to access their profits or manage their account balances. Deposits are instant, while withdrawals take 1 minute to 1 day to process. There is no deposit fee, but a 0.5% withdrawal fee applies.

Customer Support

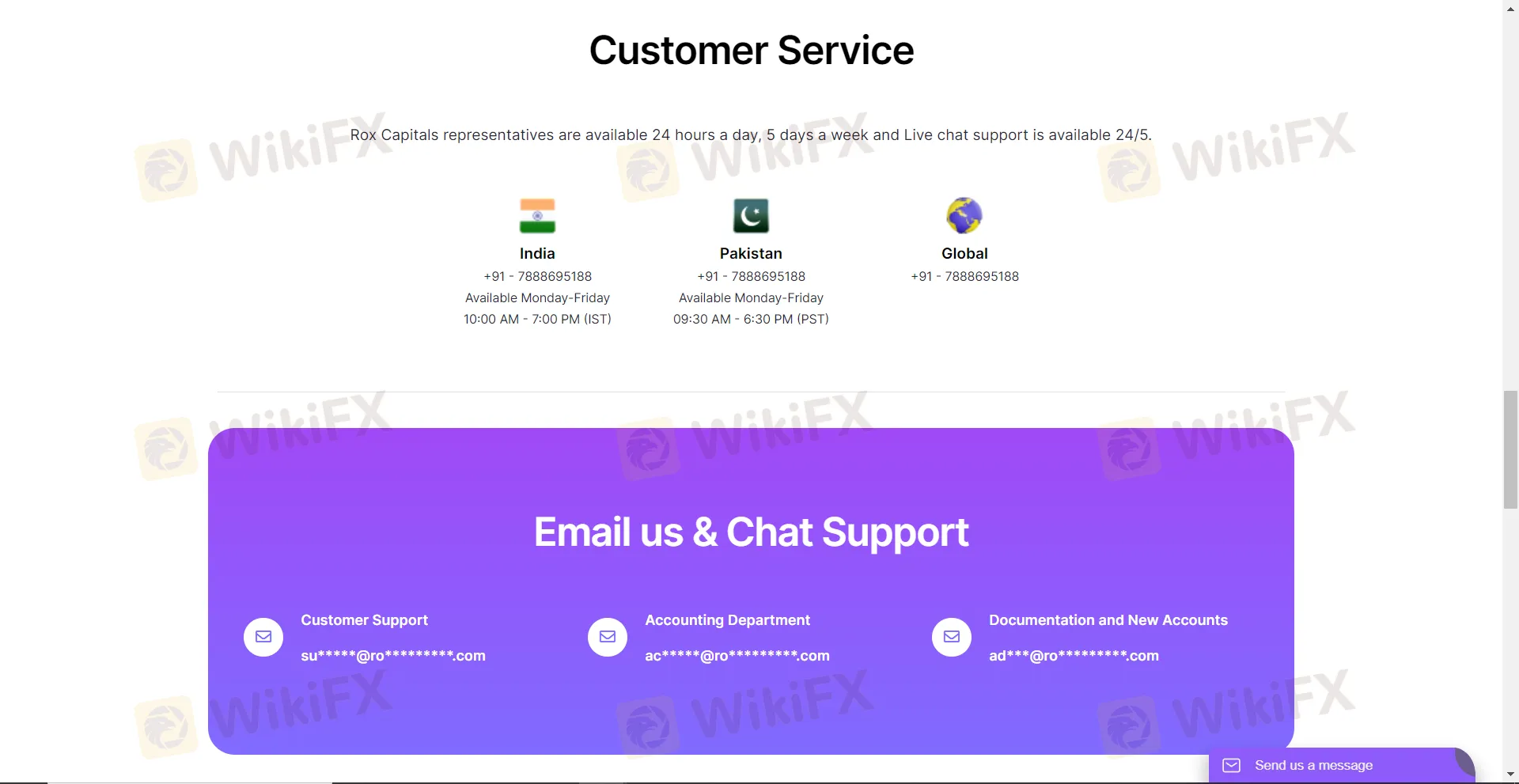

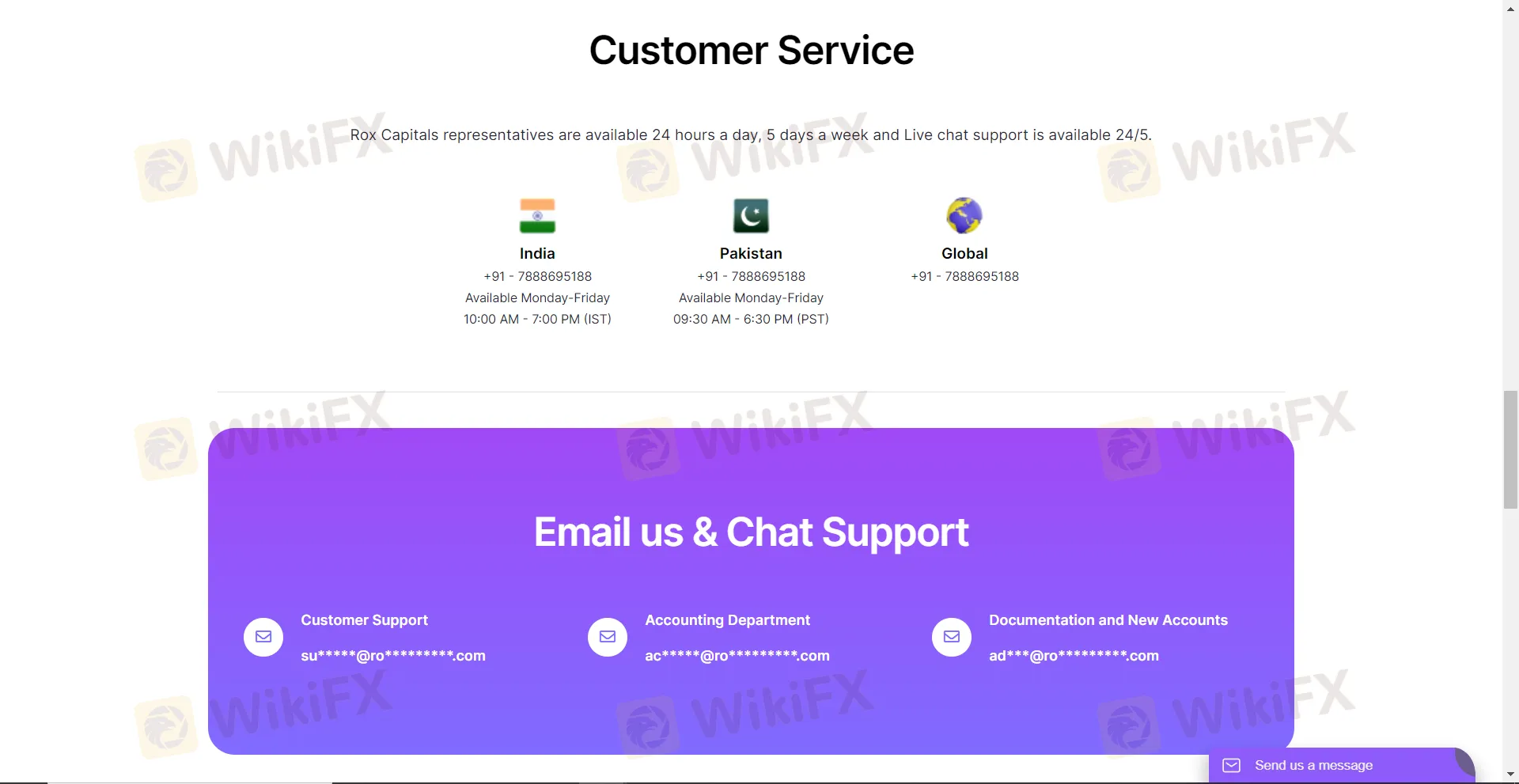

Rox Capitals prioritizes customer support, offering a range of channels for clients to seek assistance. Their dedicated team is available 24/5, providing round-the-clock support through live chat and phone calls. Clients in India and Pakistan have specific contact numbers, while a global contact number is provided for clients worldwide. Additionally, email and chat support are available to address various inquiries, including customer support, accounting, and documentation for new accounts.

To ensure transparency, Rox Capitals shares their registered and office addresses, with the company being registered in London, United Kingdom. They are also associated with the National Futures Association, upholding regulatory standards. However, it's important to note that Rox Capitals has regional restrictions and does not offer services to residents of certain countries.

Clients can also connect with Rox Capitals through popular social media platforms like Facebook, Twitter, LinkedIn, Instagram, YouTube, and Telegram, enabling them to stay updated and engage with the company's updates and announcements.

Educational Resources

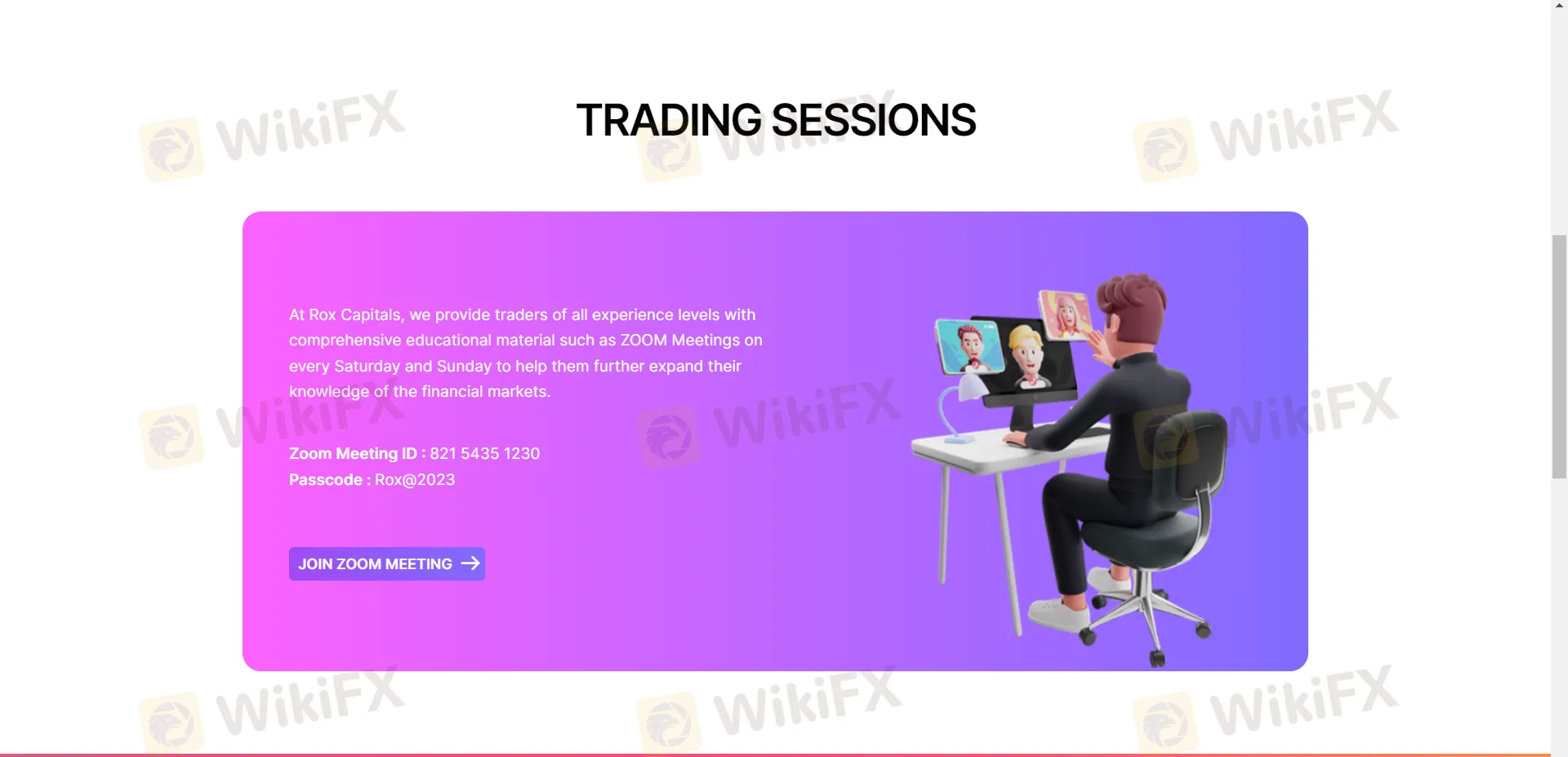

Rox Capitals is committed to empowering its clients through comprehensive educational resources. They offer a range of learning programs, including interactive ZOOM Meetings held every Saturday and Sunday. These sessions give traders of all levels valuable insights into the financial markets.

Clients can join the ZOOM Meetings using the provided Meeting ID and Passcode. In addition to live sessions, Rox Capitals offers educational resources on their official website. Traders can access an Economic Calendar, PIP Calculator, and other educational materials to enhance their trading knowledge.

By providing these resources, Rox Capitals aims to equip clients with the necessary tools and information to make informed trading decisions. They understand the importance of continuous learning and strive to support their clients in expanding their understanding of the markets.

Conclusion

In conclusion, Rox Capitals is a comprehensive trading platform offering diverse markets, multiple account types, and educational resources. With access to various asset classes, traders can explore a wide range of investment opportunities. The platform accommodates traders of different budget levels, provides leverage options, and offers customer support.

FAQs

What financial instruments can I trade with Rox Capitals?

Rox Capitals offers some poplar market instruments, including Forex, CFDs, Stocks, Metals, and Cryptocurrencies.

IsRox Capitals a good broker for beginners?

Yes, beginners can trade through the brokerage because its regulated status.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

FX3290678695

India

As an Indian investor, I must expose the disgusting activities of Rox Capitals. When the non-farm payroll data was released in July, I traded in EUR/USD. The platform had promised a maximum slippage of 0.3 pips per day, but I actually faced a slippage of 5 pips, resulting in a direct loss of $230. This does not match the advertised average slippage of 10.7 milliseconds at all. This platform is full of fee traps. The platform had advertised a spread of 1.2 pips on EUR/USD, but in actual trading, it increased to 8 pips, resulting in an additional cost of $68 per lot. I am also charged an unnecessary "account management fee" and a hefty "currency conversion fee" every month. Based on my monthly trading volume of 10 lots, this amounts to over $700 in additional costs. Indian investors are advised to stay away from this! A reminder to all: choose a regulated, legitimate platform and avoid being deceived by Rox Capitals' false advertisements, otherwise you may lose all your mo...

Exposure

FX4158985884

Pakistan

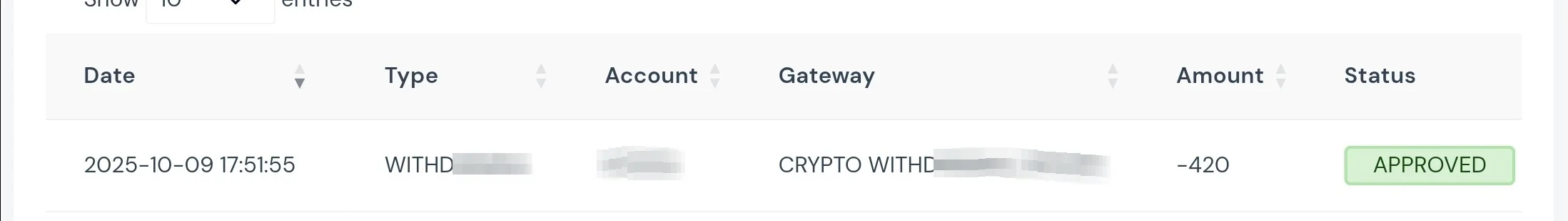

Strongly dissatisfied with Rox capitals.I applied for the withdraw on 09/10/2025, my request is approved on 15/10/2025 and amount is deducted from my MT5 account but still not received in wallet. I got 2,3 different excuses on my helpdesk ticket. At first they say there are some usdt exchange issue then support team reply that they are facing problem with the partners and they trying to resolve it but didn't. After all these statements i got a reply that the amout is successfully credited to my wallet but i didn't received.

Exposure

jantrading

Switzerland

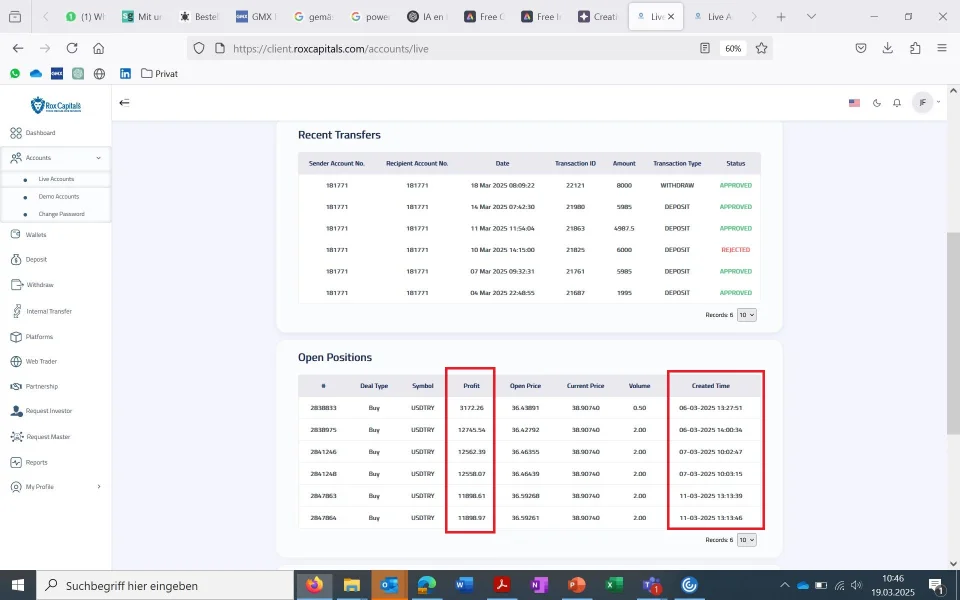

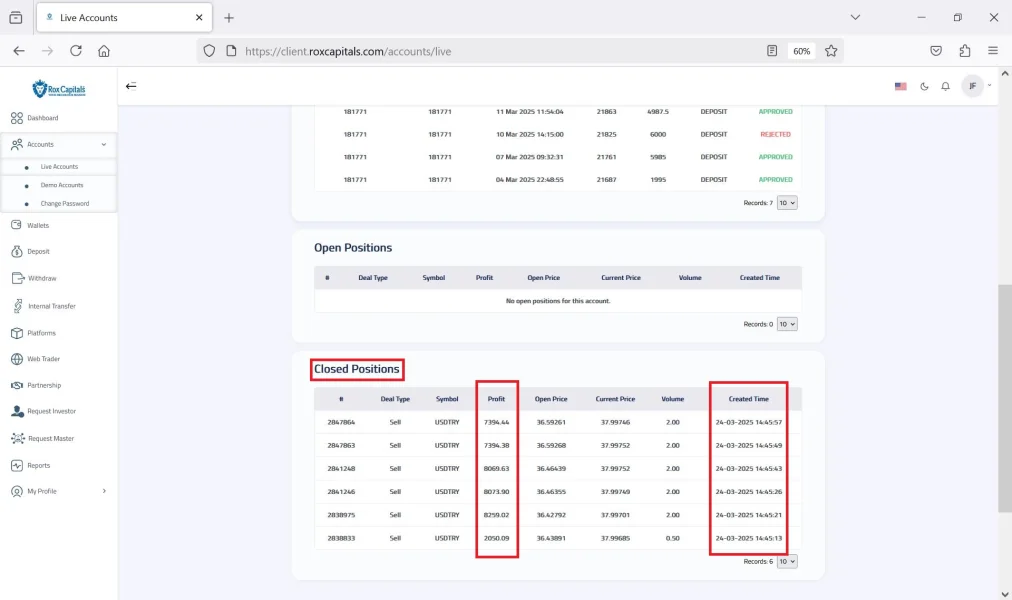

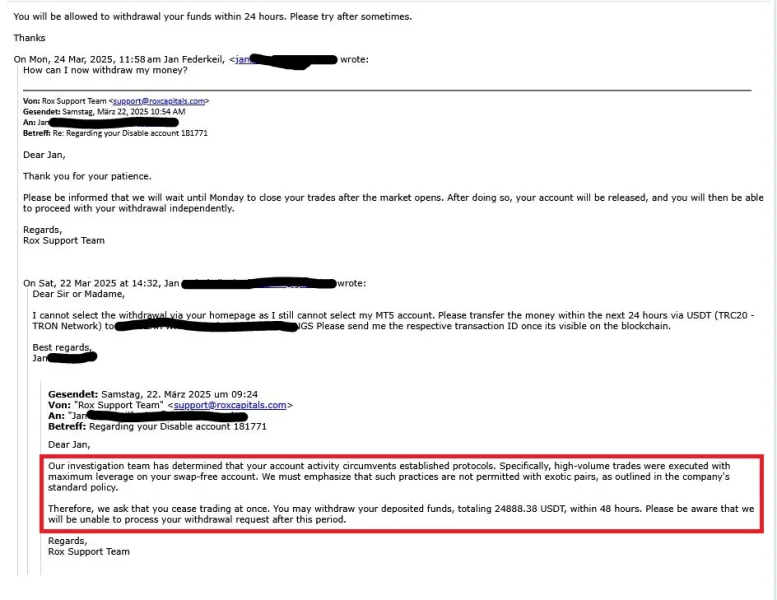

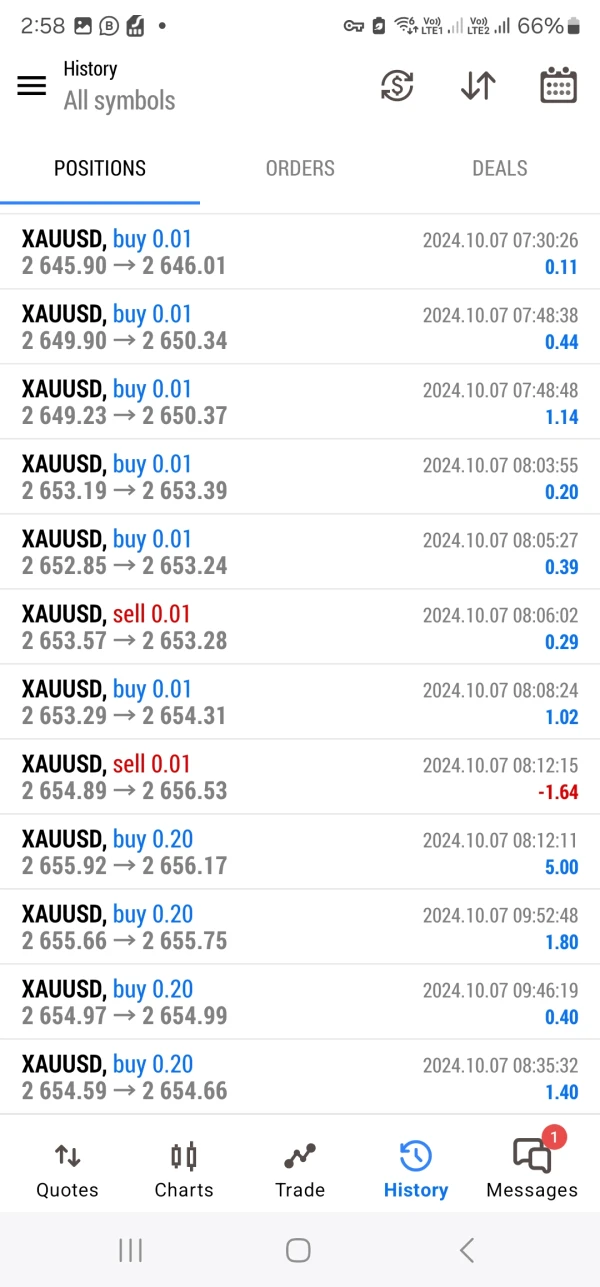

Between March 6–11, 2025, I opened several USDTRY long positions. When the Turkish Lira dropped sharply on March 19, my trades reached over USD 64,000 in profit. Just then, Rox Capitals blocked my MT5 account. They ignored my messages and eventually closed all positions without my consent on March 24, locking in USD 41,000 in profit—but refused to let me withdraw any of it. They falsely claimed I used a swap-free account and violated rules by trading exotic pairs with high leverage. In reality, I used 50:1 leverage with USD 21,000 margin—completely standard. They said I could only withdraw my deposit and threatened to freeze even that if I reported them. I stayed silent out of fear, but no longer.

Exposure

jantrading

Switzerland

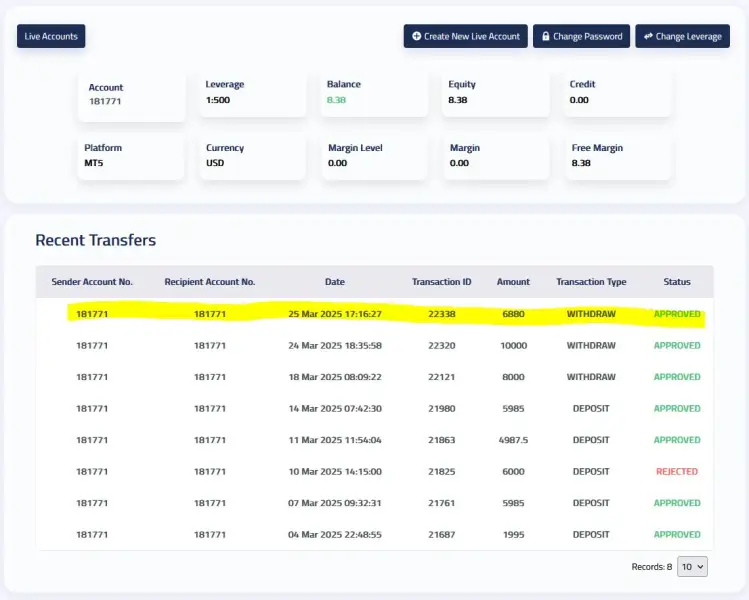

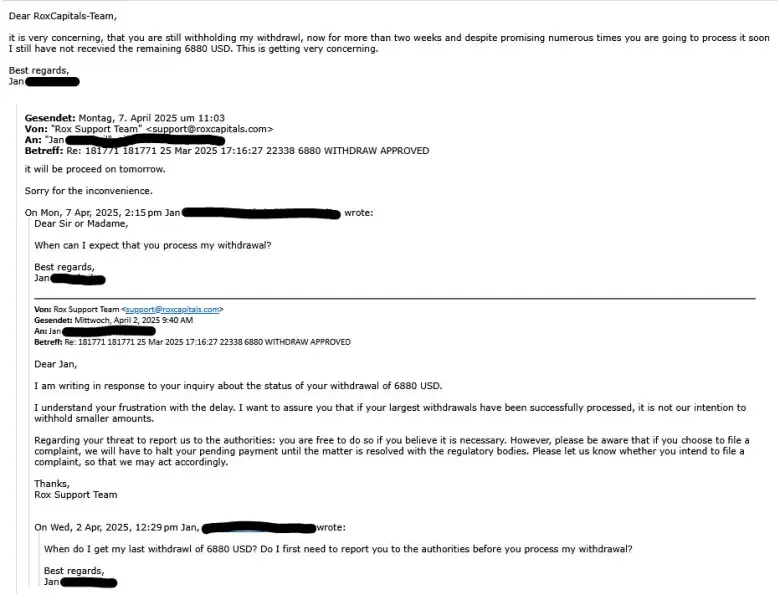

I have been waiting for my withdrawal of $6880 since March 25, 2025. Despite multiple promises from Rox Capitals that the money would be processed "tomorrow," I still haven't received anything as of April 15, 2025. The transaction is marked as "APPROVED" in my account, but that clearly doesn't mean much, because the funds were never transferred. I reached out several times via email and was repeatedly given empty reassurances. Eventually, I even received a message stating that if I file a complaint with authorities, my pending payment will be put on hold until the matter is resolved. That is unacceptable and, in my opinion, highly unprofessional. Here are the details of the missing transaction: Date: March 25, 2025 Amount: $6880 Status: APPROVED I strongly advise everyone to avoid Rox Capitals. If a broker only pays out when pressured - or not at all- it's a massive red flag. Do not trust this broker.

Exposure

FX2079975048

France

Hi This Uzma and i Highly recommended this broker because my experience with Rox Capitals is quite amazing. They provide quality of services to their investors who want to work with them as business partners. Their skilled staff and classified Mentors are appreciate able because this is my first experience and they guide me very well.I recommend Rox Capitals Regards.

Positive

FX2656989900

Pakistan

Brokers staff exhibit professionalism and integrity in their interactions with clients, demonstrating strong communication and problem-solving skills to navigate the complexities of the forex market effectively.

Positive

FX2288943890

Pakistan

I've been trading with Rox Capitals for over a year now, and I'm very happy to work with them. Their platform is user-friendly and offers a wide range of tools for analysis. The customer support is top-notch—always quick to respond and very helpful. I appreciate the low spreads and fast execution times. Highly recommend for both beginners and experienced traders.

Positive

FX1620550043

Pakistan

"I've been trading with RoxCapital for 4 years and I'm thoroughly impressed with their exceptional service. Their platform is user-friendly, reliable, and offers competitive spreads. The customer support team is responsive, knowledgeable, and always willing to help.

Positive

FX6627549702

United Arab Emirates

Rox Capital is a broker that aims to provide a robust trading environment for both novice and experienced traders. Their trading platform stands out with a range of features designed to enhance the trading experience.🌹🌹🌹🌴 Overall, Rox Capital’s trading platform is a strong choice for traders seeking a reliable and feature-rich environment. Its user-friendly design, combined with advanced tools and responsive customer support, makes it a competitive option in the brokerage space.🌲🌹

Positive

Phylis

United States

Rox Capitals impresses with its withdrawal options and trading platforms! Swift, secure withdrawals and a user-friendly interface make trading a seamless experience.

Positive

water8331

United Kingdom

Been with Rox Capitals for a couple of years now. Impressed by the quick deposit and withdrawal process, and the trade execution is lightning fast. No issues with slippage or latency either.

Positive

Hugher

Egypt

I gotta keep it real about Rox Capitals. Yeah, they offer different account types and a range of assets, but there's a big problem – they ain't regulated. That's a major turn-off. I mean, they claim to be supervised by the UK NFA, but turns out it's unauthorized. That's sketchy. And what's up with their office in India? Seems fishy. Also, their website talks about transparency, but they don't even disclose deposit and withdrawal methods. I wouldn't trust my money with them – too many uncertainties and potential risks.

Neutral

Theophilusiya

Argentina

They're big on education, providing market analysis and webinars. Customer support is there, and you can reach them through different channels. But here's the catch – they've been around for 2 to 5 years, and they're not regulated. That's a red flag for me.

Neutral

fxtrade7070

India

ROX CAPITALS IS BEST . QUICK DEPOSIT AND WITHDRAWAL.SUPPORTIVE STAFF.

Positive

FX3268669507

India

Rox capitals is very good and trustworthy Broker. over all is good broker quick deposit and withdrawal and all services.

Positive

永能

Singapore

This is a very good & trustworthy broker. They provide a lot of trading instruments than any other broker. Also, the spread is reasonable. On top of that, customer care is good. The account manager helps & responds properly. yet, their platform is OK.

Positive

FX1067477397

India

I don’t like this broker’s account setting, with the micro and Mini accounts asking for $100, $500, unfriendly to most beginners. So, I strongly recommend that anyone who wants to seek for a reliable brokers trade with some influential players, FXTM, eightcap, for example.

Neutral