Company Summary

| Feature | Information |

| Company Name | Thunder Markets |

| Registered Country/Area | Seychelles |

| Founded Year | 2022 |

| Regulation | Seychelles Financial Services Authority (FSA) |

| Minimum Deposit | $500 |

| Maximum Leverage | Up to 400:1 |

| Spreads | From 0.0 pips (Classic and Thunder Accounts) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Over 400 CFDs on forex, indices, stocks, precious metals, commodities, bonds, and futures |

| Account Types | Classic Account, Thunder Account, Demo Account |

| Demo Account | Yes |

| Customer Support | 24/5 multilingual support via live chat, email, and phone |

| Deposit & Withdrawal | Credit/debit cards, e-wallets (Skrill, Neteller, Sofort, PerfectMoney), bank transfers |

| Educational Resources | Webinars, trading courses, articles and videos, demo account, one-on-one coaching |

Overview of Thunder Markets

Thunder Markets is a Seychelles-based forex and CFD broker that was founded in 2022. The company is regulated by the Seychelles Financial Services Authority (FSA). Thunder Markets offers a variety of trading accounts, including a Classic Account, a Thunder Account, and a Demo Account. The minimum deposit for the Classic Account is $500, and the minimum deposit for the Thunder Account is $1,000. The Demo Account is a risk-free way to practice trading with virtual funds.

Pros and Cons

| Pros | Cons |

| Well-regulated forex and CFD broker | Relatively new broker with limited experience |

| Good selection of trading accounts and tools | Limited selection of trading platforms |

| Competitive spreads | Limited selection of tradable assets compared to some other brokers |

| Free demo account | High leverage can be risky for inexperienced traders |

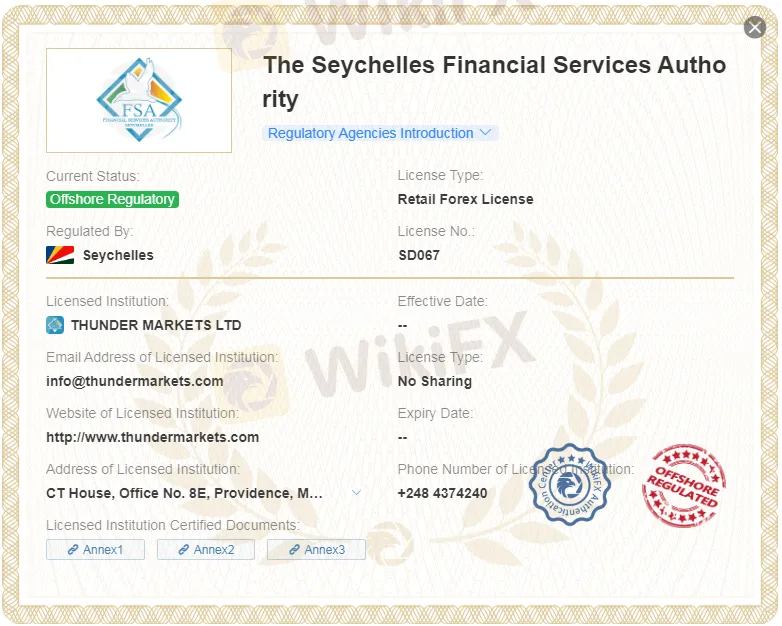

Regulatory Status

Thunder Markets is regulated as a Securities Dealer by theFinancial Services Authority of Seychelles (FSA) with license number SD067. The FSA is the primary financial services regulator in Seychelles, responsible for overseeing the activities of financial institutions such as banks, brokers, and investment funds.

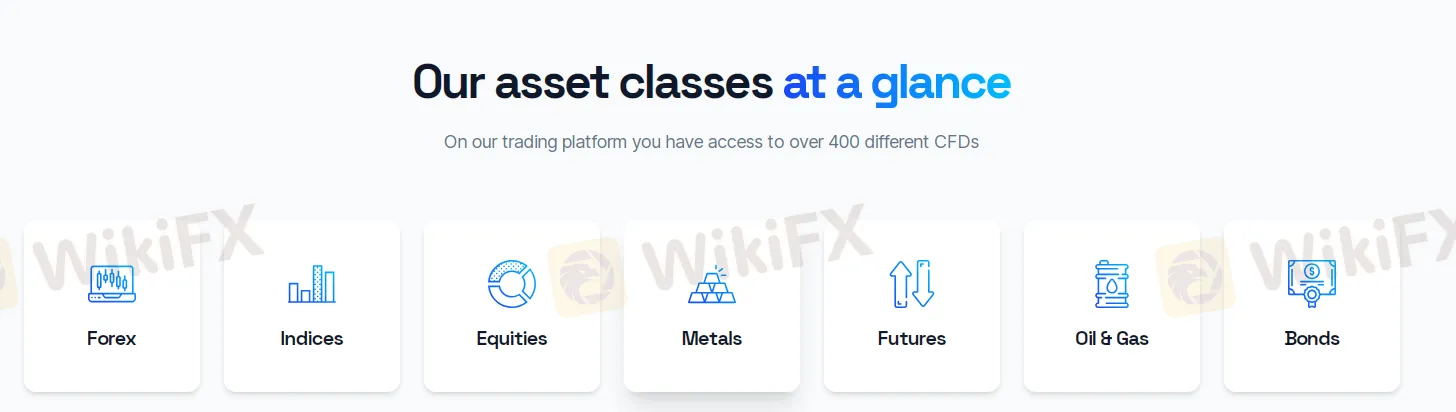

Market Instruments

| Product | Features | |

|---|---|---|

| Trade Forex Online | Trade currency pairs in the largest financial market. | ✅ |

| Cash and Future Indices Trading | Trade stock indices with lower individual risk. | ✅ |

| Trade Equities Online | Access to major stocks from the USA, Europe, and Asia. | ✅ |

| Precious Metals | Trade gold, silver, palladium, platinum, and copper. | ✅ |

| CFD Futures Trading | Speculate on future prices without asset delivery. | ✅ |

| Trade Oil & Gas Online | Trade oil and gas contracts, including WTI and Brent. | ✅ |

| CFD Bond Trading | Trade European and US government bonds with various maturities. | ✅ |

Account Types

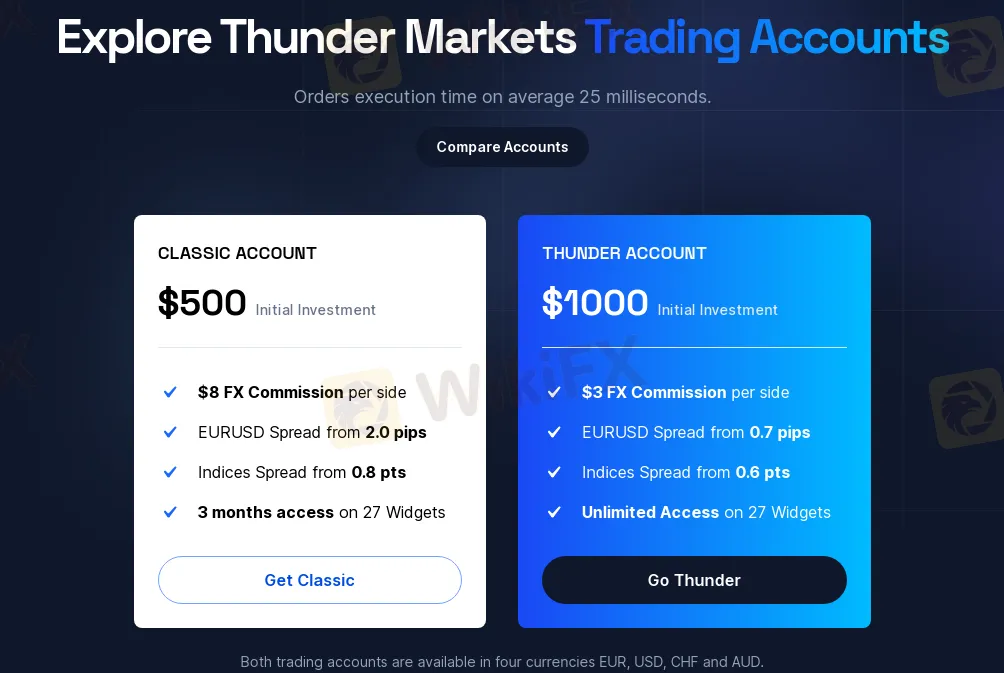

Thunder Markets offers two account types for retail traders: the Classic Account and the Thunder Account. Both accounts are available in four currencies: EUR, USD, CHF, and AUD.

Classic Account

The Classic Account is a great option for beginners and experienced traders alike. It has a minimum initial investment of $500 and an FX commission of $8 per side. The EURUSD spread starts from 2.0 pips and the indices spread starts from 0.8 pts. Traders also have access to 27 widgets for 3 months.

Thunder Account

The Thunder Account is designed for experienced traders who demand the best possible trading conditions. It has a minimum initial investment of $1000 and an FX commission of $3 per side. The EURUSD spread starts from 0.7 pips and the indices spread starts from 0.6 pts. Traders also have unlimited access to 27 widgets.

| Feature | Classic Account | Thunder Account |

| 24/7 Live video chat support | Yes | Yes |

| Withdrawals | Fee-free | Fee-free |

| Demo Account | 3 months access | Unlimited access |

| Copy Trading tool | Yes | Yes |

| Bonus | No | No |

| Other features | Orders execution time on average 25 milliseconds | Orders execution time on average 25 milliseconds |

| Initial Investment | $500 | $1,000 |

| FX Commission per side | $8 | $3 |

| EURUSD Spread from | 2.0 pips | 0.7 pips |

| Indices Spread from | 0.8 pts | 0.6 pts |

| Available currencies | EUR, USD, CHF, AUD | EUR, USD, CHF, AUD |

How to Open an Account?

Here are the steps on how to open a Thunder Markets account:

- Visit the Thunder Markets website and click on the 'Live Account' button.

- Enter your personal information, such as your name, email address, and phone number.

- Choose your account type, either Classic or Thunder.

- Verify your email address and phone number.

- Deposit funds into your account using one of the supported methods.

- Once your funds have been deposited, you can start trading.

Spreads & Commissions

Spreads

Thunder Markets offers tight, reliable, and transparent spreads on a wide range of instruments. The spreads start from 0.0 pips for forex and 0.8 pts for indices. The spreads for other instruments vary depending on the instrument and the market conditions.

Here is a table that summarizes the spreads for the Classic and Thunder Accounts:

| Instrument | Classic Account | Thunder Account |

| Forex | From 0.0 pips | From 0.0 pips |

| Indices | From 0.8 pts | From 0.6 pts |

| Commodities | From 1.5 pts | From 1.0 pts |

| Metals | From 0.5 pts | From 0.3 pts |

Commissions

Thunder Markets charges commissions on forex trades. The commission for forex is $8 per side for the Classic Account and $3 per side for the Thunder Account.

Here is a table that summarizes the commissions for the Classic and Thunder Accounts:

| Account Type | Commission |

| Classic Account | $8 per side |

| Thunder Account | $3 per side |

Leverage

The maximum leverage for Thunder Markets accounts is 400:1. This means that traders can control up to $400 worth of assets for every $1 they deposit in their account. Leverage can be a powerful tool for traders, but it also comes with increased risk. Traders should only use leverage that they are comfortable with and should understand the potential risks involved.

Trading Platform

Thunder Markets offers the MetaTrader 4 (MT4) trading platform, a popular and versatile platform that is used by millions of traders around the world. MT4 is known for its user-friendly interface, powerful charting tools, and wide range of features.

Features of Thunder Markets' MT4 Trading Platform

- Access to over 400 CFDs: Traders can access over 400 CFDs on forex, indices, stocks, precious metals, commodities, bonds, and futures.

- One-click trading: Traders can place trades with a single click of the mouse.

- History of trades: Traders can view a history of their trades, including the time, price, and volume of each trade.

- Algorithmic trading allowed: Traders can use automated trading strategies, also known as algorithmic trading or robots, to execute trades.

- Four types of pending orders: Traders can place four types of pending orders: buy limit, sell limit, buy stop, and sell stop.

- Three order execution options: Traders can choose from three order execution options: instant execution, market execution, and pending orders.

- Web, desktop, and mobile trading: Traders can access the MT4 platform on their web browser, desktop computer, or mobile device.

Deposit & Withdrawal

Deposit Methods

There are a variety of deposit methods available for Thunder Markets accounts. These methods include credit/debit cards, e-wallets, and bank transfers.

- Credit/debit cards: The following credit/debit cards are accepted for deposits: Visa, Mastercard, Maestro, and UnionPay. There are no fees for depositing funds with a credit/debit card.

- E-wallets: The following e-wallets are accepted for deposits: Skrill, Neteller, Sofort, and PerfectMoney. There are fees for depositing funds with an e-wallet. The fees are as follows: Skrill: 1%, Neteller: 1%, Sofort: 2.5%, and PerfectMoney: 2.5%.

- Bank transfers: Bank transfers are also accepted for deposits. The following types of bank transfers are accepted: wire transfers and local bank transfers. There are fees for depositing funds with a wire transfer. The fees are as follows: wire transfers: inward: 0.5%, outward: 20 USD. There are no fees for depositing funds with a local bank transfer.

Withdrawal Methods

The same methods that are available for depositing funds can also be used to withdraw funds. These methods include credit/debit cards, e-wallets, and bank transfers.

- Credit/debit cards: The following credit/debit cards are accepted for withdrawals: Visa, Mastercard, Maestro, and UnionPay. There are no fees for withdrawing funds with a credit/debit card.

- E-wallets: The following e-wallets are accepted for withdrawals: Skrill and Neteller. There are fees for withdrawing funds with an e-wallet. The fees are as follows: Skrill: 1% and Neteller: 1%.

- Bank transfers: Bank transfers are also accepted for withdrawals. The following types of bank transfers are accepted: wire transfers and local bank transfers. There are fees for withdrawing funds with a wire transfer. The fees are as follows: wire transfers: inward: free, outward: 20 USD. There are no fees for withdrawing funds from a local bank transfer.

Minimum Deposit and Withdrawal Amounts

The minimum deposit and withdrawal amounts for Thunder Markets are as follows:

- Credit/debit cards: $50

- E-wallets: $50

- Bank transfers: Wire transfers: $500, local bank transfers: $50

Processing Times

The processing times for deposits and withdrawals for Thunder Markets are as follows:

- Credit/debit cards: Instant

- E-wallets: Instant

- Bank transfers: Wire transfers: 2-5 business days, local bank transfers: 1-2 business days

| Feature | Credit/debit cards | e-Wallets | Bank transfers |

| Deposit methods | Visa, Mastercard, Maestro, UnionPay | Skrill, Neteller, Sofort, PerfectMoney | Wire transfers, local bank transfers |

| Deposit fees | No fees | Skrill: 1%, Neteller: 1%, Sofort: 2.5%, PerfectMoney: 2.5% | Wire transfers: Inward: 0.5%, Outward: 20 USD, Local bank transfers: Free |

| Withdrawal methods | Visa, Mastercard, Maestro, UnionPay | Skrill, Neteller | Wire transfers, local bank transfers |

| Withdrawal fees | No fees | Skrill: 1%, Neteller: 1% | Wire transfers: Inward: Free, Outward: 20 USD, Local bank transfers: Free |

| Minimum deposit and withdrawal amounts | $50 | $50 | Wire transfers: $500, Local bank transfers: $50 |

| Processing times | Instant | Instant | Wire transfers: 2-5 business days, Local bank transfers: 1-2 business days |

Customer Support

Thunder Markets excels in customer support, providing services to clients around the world. They offer multi-lingual assistance ensuring a wide range of customers can seamlessly access their services. Their support team is available 24 hours a day, 5 days a week from 06:00 to 18:00 GMT+4. This comprehensive time coverage ensures that customers can resolve their issues or queries in a timely manner. You can reach them by calling their support line at +44 2032393135.

Additionally, customers can also contact them via email at support@thundermarkets.com for non-urgent queries or consultation.

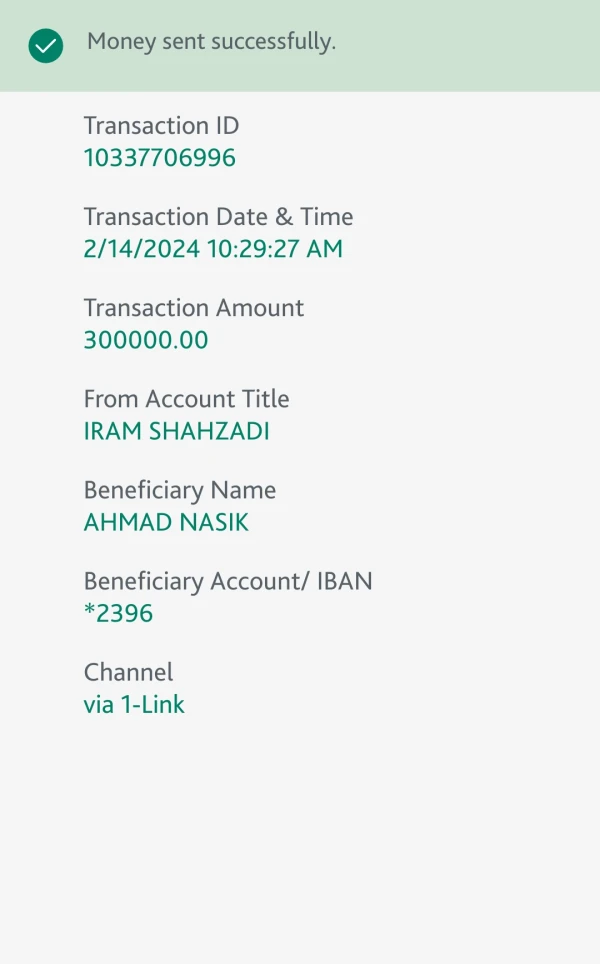

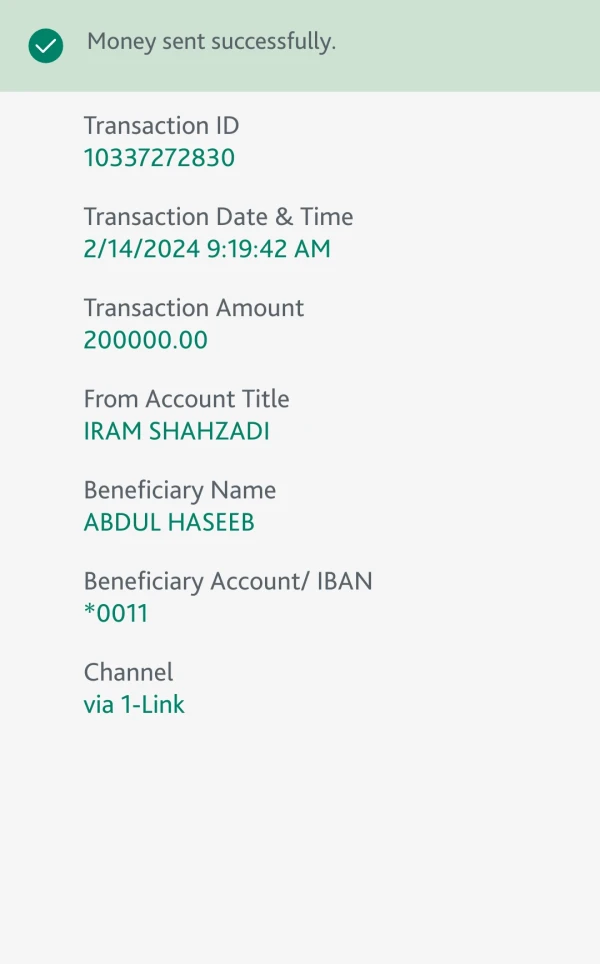

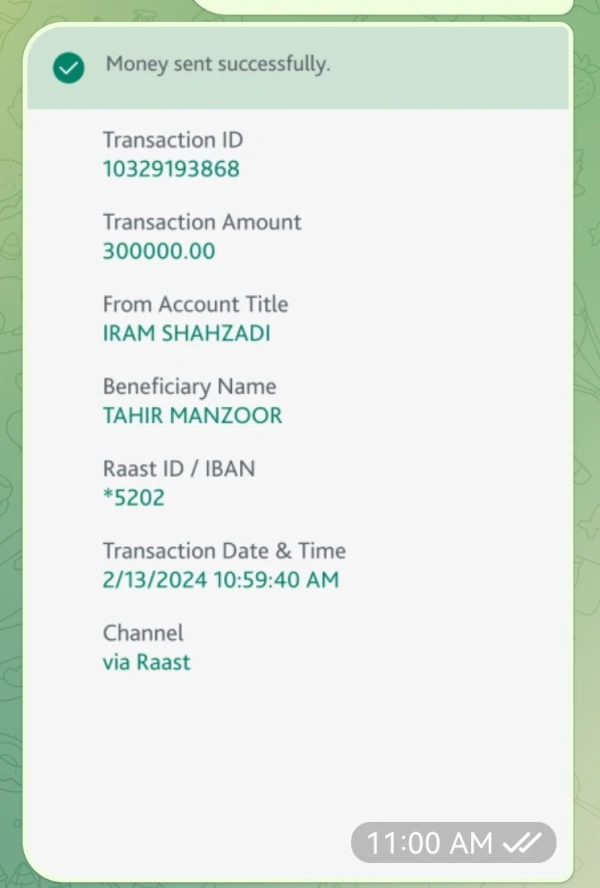

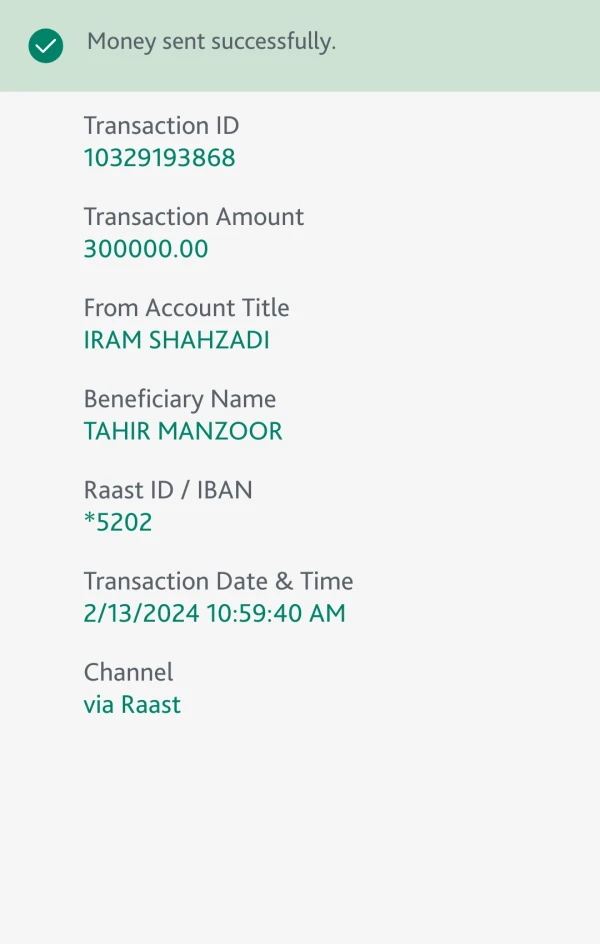

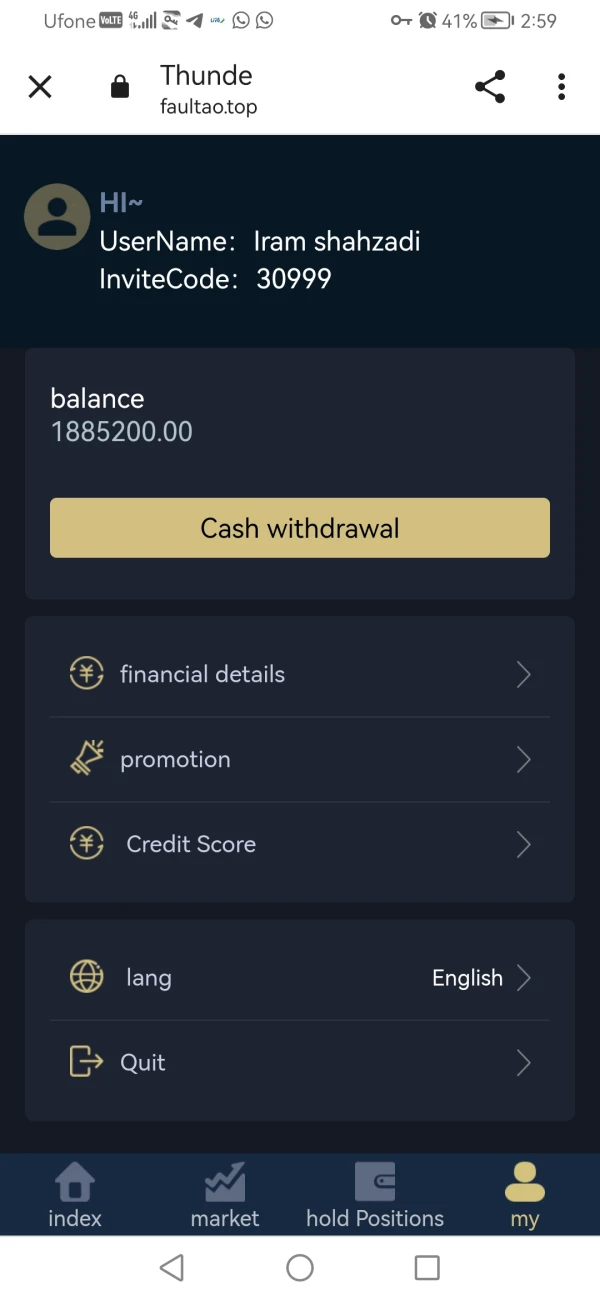

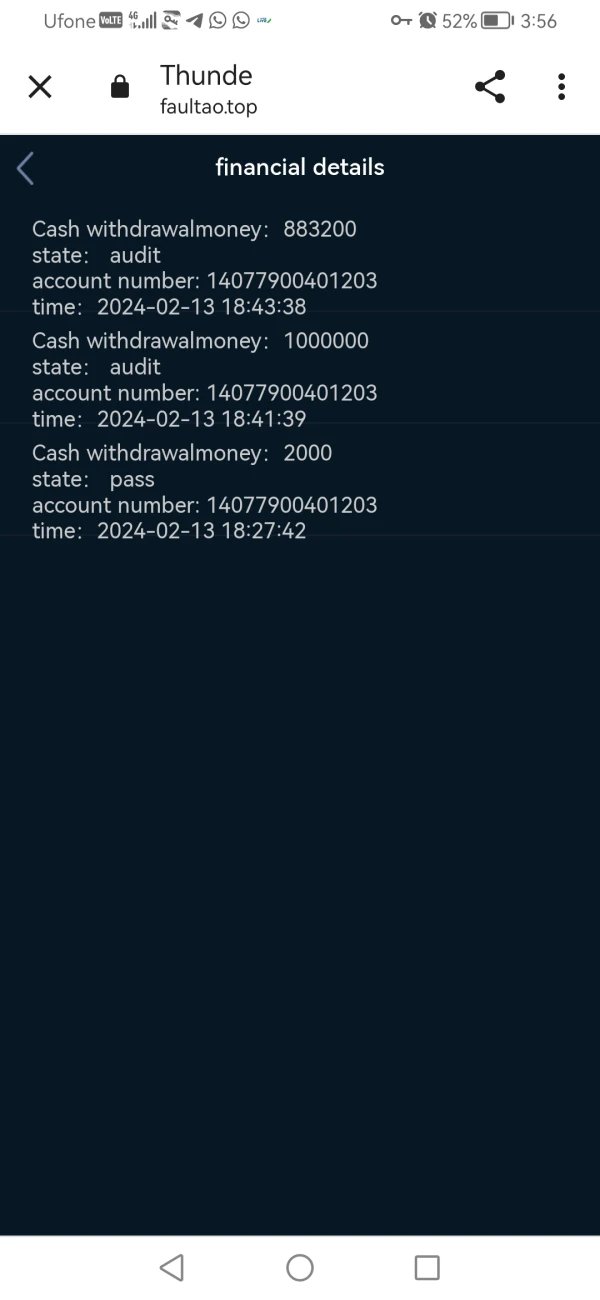

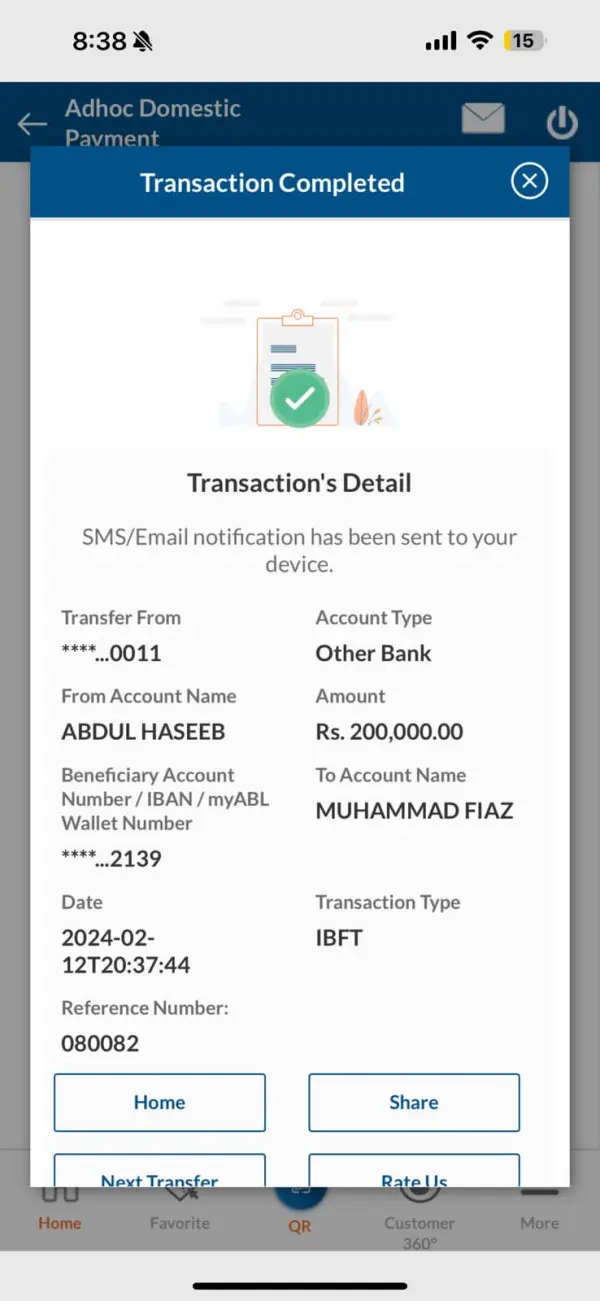

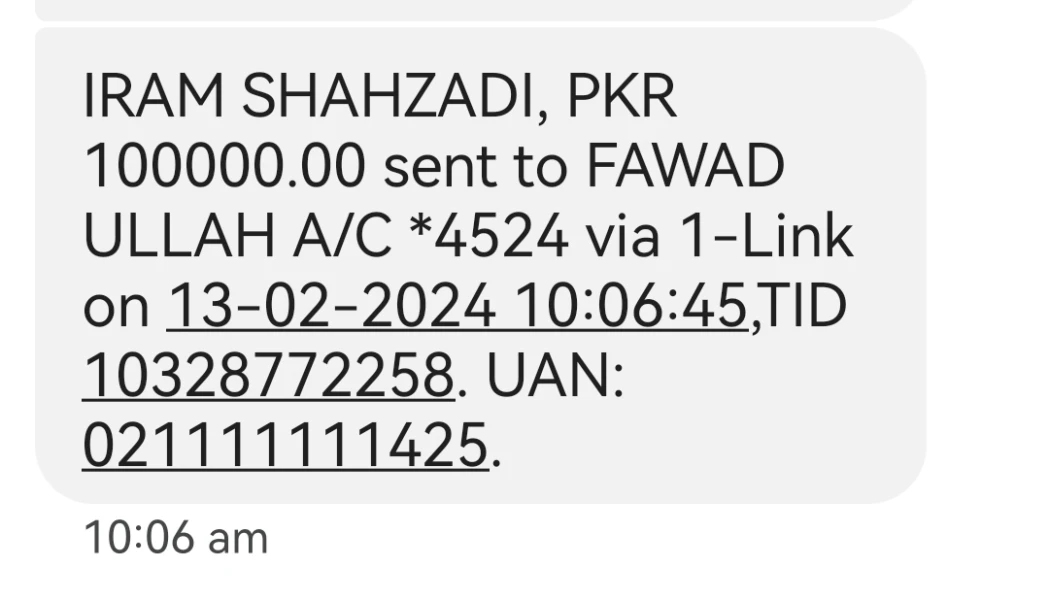

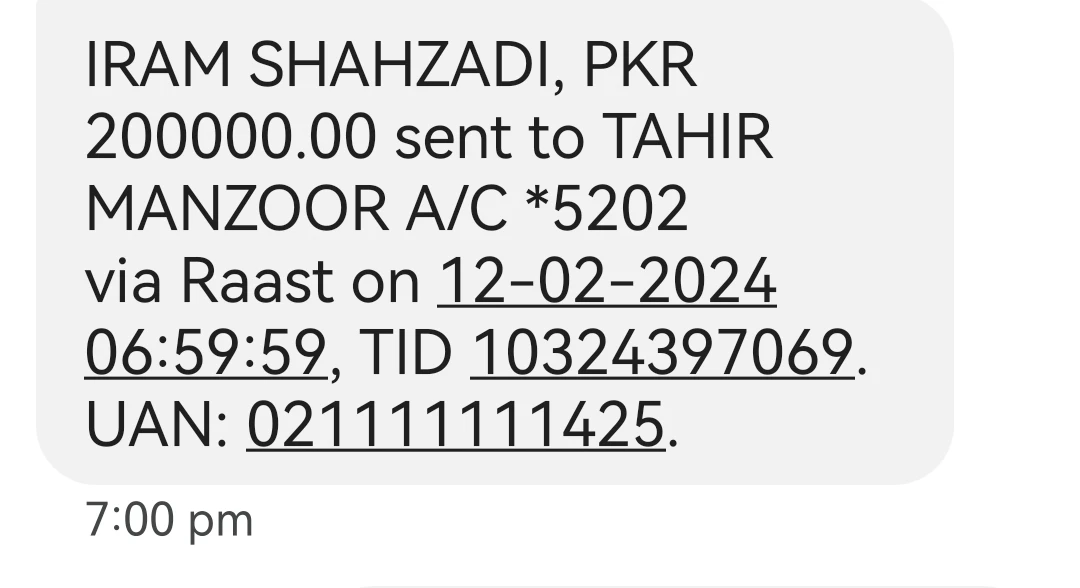

imi790

Pakistan

I invested 1500000 in this someone text me on WhatsApp that its a freelanceing wrk from home and they start from small investment on 1st investment they send me 1800 commission and then they share their plans i buy 200000 pkr plan and they said i commit a mistake and i have to snd more money to resolve my mistake i snd 1500000 in 7-8 transection but at the time of withdrawal they only snd me 2000 rps into my accout and said the system is freeze and you have to submit more amoint to unfreeze your account and then you can withdraw your amount i have attached all screenshot kindly help me to withdraw my all amount

Exposure

Stockye

Vietnam

Hey, even though they've got a legit regulator, I'm a bit skeptical about their team's expertise since they only set up shop in 2022, like, just two years ago. It's still a pretty new kid on the block.

Neutral

Crush

Netherlands

All queries answered and issues resolved within 10 minutes. Great service.

Neutral

香雨

South Africa

Thunder Markets is a good broker. I can give its four stars. I love its stable trading platforms, and my trades were always executed quickly, so I can get the best price. Thank you, Thunder Markets team. The only problem with this broker is that they don’t provide 7/24 customer service. I am a day trader and I often trading during weekends, and lack of the customer service is really a torture for me.

Neutral

李国豪

Australia

Thunder Markets' various trading conditions looked so reliable that I was ready to open a demo account and try it out. After all, it's not like a demo account is going to cost me money.

Neutral