RED LION CAPITAL

Seychelles

Seychelles

Time Machine

Check whenever you want

Download App for complete information

Exposure

No Data

RED LION CAPITAL · Company Summary

| RED LION CAPITAL | Basic Information |

| Company Name | RED LION CAPITAL |

| Founded | 2020 |

| Headquarters | Seychelles |

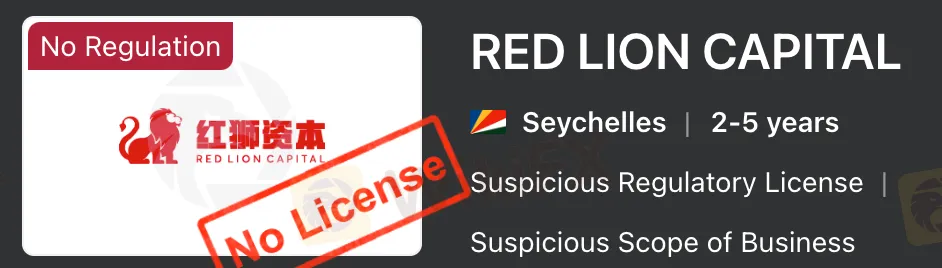

| Regulations | Not regulated |

| Tradable Assets | Forex, Cryptocurrencies, Indices, Stocks, Commodities |

| Account Types | Standard, VIP, Islamic, Corporate (Types may vary) |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 (Varies by asset and account type) |

| Spreads | From 0.1 pips |

| Commission | Applicable (Varies by account type) |

| Deposit Methods | Visa, Bitcoin |

| Trading Platforms | MetaTrader 4 (MT4) |

| Customer Support | Email (cs@rlcbroker.com) |

| Education Resources | Limited Education Resources |

| Bonus Offerings | None |

Overview of RED LION CAPITAL

RED LION CAPITAL, established in 2020 and headquartered in Seychelles, presents itself as a trading platform offering access to various financial markets. The broker provides a diverse range of tradable assets, including Forex, Cryptocurrencies, Indices, Stocks, and Commodities. With a minimum deposit requirement of $100, RED LION CAPITAL caters to traders with different experience levels through various account types, such as Standard, VIP, Islamic, and Corporate.

However, it's crucial to note that RED LION CAPITAL operates without regulatory oversight, raising concerns about the safety and transparency of its services. The absence of regulation means that the broker is not subject to supervision by recognized financial authorities, potentially exposing traders to increased risks. Traders considering RED LION CAPITAL should carefully weigh the advantages of its asset variety and accessible entry against the potential drawbacks associated with an unregulated trading environment. As with any investment, thorough research and consideration of risk factors are essential for making informed decisions in the financial markets.

Is RED LION CAPITAL Legit?

RED LION CAPITAL is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like RED LION CAPITAL, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

RED LION CAPITAL offers a mix of advantages and drawbacks that traders should consider. On the positive side, the broker provides a diverse range of trading instruments, including Forex, Cryptocurrencies, Indices, Stocks, and Commodities. The availability of various account types, such as Standard, VIP, Islamic, and Corporate, caters to the different needs of traders. Additionally, the MetaTrader 4 (MT4) platform, a widely recognized and user-friendly tool, is supported, ensuring a familiar trading experience. On the downside, the absence of regulation is a significant concern, as it poses potential risks related to fund security and dispute resolution. The limited educational resources may also be a drawback for traders seeking comprehensive learning materials.

| Pros | Cons |

|

|

|

|

|

Trading Instruments

Red Lion Capital, a brokerage based in Seychelles, offers a comprehensive range of trading instruments across various asset classes, providing traders with diverse options to build and manage their investment portfolios. The platform caters to the following key trading instruments:

1. Forex (Foreign Exchange):

Red Lion Capital facilitates forex trading, allowing users to engage in the global currency markets. Traders can access major, minor, and exotic currency pairs, providing opportunities to capitalize on exchange rate fluctuations.

2. Cryptocurrencies:

In response to the growing popularity of digital assets, Red Lion Capital includes cryptocurrencies in its trading instruments. Traders can participate in the dynamic and volatile cryptocurrency market, with options to trade popular digital currencies like Bitcoin, Ethereum, and others.

3. Indices:

The platform covers a variety of stock market indices, enabling traders to speculate on the overall performance of major financial markets. This includes indices such as the S&P 500, Dow Jones, and NASDAQ, providing opportunities for investors to capitalize on broader market trends.

4. Stocks:

Red Lion Capital extends its services to individual stocks, allowing traders to invest in and trade shares of companies listed on major global stock exchanges. This feature provides diversification opportunities and the ability to capitalize on specific companies' performances.

5. Commodities:

Traders interested in the commodities market can access a range of assets, including precious metals like gold and silver, as well as energy commodities such as oil and natural gas. Red Lion Capital's inclusion of commodities allows users to diversify their portfolios and take advantage of global economic trends.

Account Types

Red Lion Capital offers a variety of account types to cater to the diverse needs and preferences of traders. While specific details may vary, brokers commonly structure account types to accommodate traders with varying experience levels and trading volumes. Here is a general overview of the possible account types at Red Lion Capital:

1. Standard Account:

The Standard Account is often designed for traders with moderate experience. It provides access to a range of trading instruments and features, offering a balanced set of conditions suitable for those who are not beginners but may not require the advanced features of premium accounts.

2. VIP Account:

The VIP Account is typically tailored for more experienced traders or those with a higher trading volume. Traders holding a VIP Account often enjoy additional benefits such as lower spreads, personalized customer support, and sometimes exclusive market insights. This type of account is designed to cater to the needs of traders who require a more tailored and premium trading experience.

3. Islamic Account:

Recognizing the diversity of its client base, Red Lion Capital may offer an Islamic Account that adheres to Sharia law principles. This account type is typically swap-free, accommodating traders who follow Islamic finance principles that prohibit earning or paying interest.

4. Corporate Account:

Tailored for corporate entities and institutional traders, the Corporate Account is designed to meet the specific needs of businesses engaged in financial markets. It may offer features such as dedicated account management and specialized solutions for institutional requirements.

Leverage

Red Lion Capital provides traders with the option of utilizing leverage, allowing them to control larger positions with a relatively smaller amount of capital. Leverage can magnify both potential profits and risks, and its availability varies across different asset classes and account types on the platform.

In the forex market, Red Lion Capital offers leverage to traders, with ratios that may go up to 1:500 for major currency pairs. However, it's important to note that the specific leverage ratios can differ based on the chosen currency pair and the trader's selected account type. While leverage can enhance trading opportunities, it comes with increased exposure to market fluctuations, and traders should approach it with caution.

Similarly, Red Lion Capital extends leverage options to other asset classes such as stocks, commodities, cryptocurrencies, and indices. The maximum leverage ratios may vary depending on the asset, and traders are encouraged to review the platform's leverage policies and consider their risk tolerance before utilizing leverage in their trades.

It's crucial for traders to have a thorough understanding of how leverage works, the associated risks, and how it aligns with their trading strategies. Responsible use of leverage is essential for managing risk and making informed trading decisions on the Red Lion Capital platform.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Red Lion Capital | eToro | XM | RoboForex |

| Maximum Leverage | 1:500 | 1:400 | 1:888 | 1:2000 |

Spreads and Commissions

Red Lion Capital imposes a fee structure that encompasses spreads and commissions, significantly impacting the financial burden on traders. In the realm of forex trading, the spreads, representing the disparity between buy and sell prices, can be as minimal as 0.1 pips for major currency pairs. It is imperative to acknowledge the volatile nature of spreads, subject to fluctuations based on market conditions, volatility levels, and the type of account chosen by the trader.

Commissions constitute an additional layer of expense, with Red Lion Capital potentially enforcing charges on specific account types. The rates of these commissions are contingent on the account type and the financial instruments involved in trading. Traders are strongly urged to meticulously scrutinize the commission rates affiliated with their chosen account type to grasp the full scope of their trading costs.

Furthermore, Red Lion Capital's introduction of various account types implies divergent fee structures. For instance, a Standard Account may feature a distinct fee arrangement compared to a VIP Account. Traders are well-advised to comprehensively comprehend the fee framework associated with their chosen account type, enabling them to make judicious decisions concerning their trading endeavors on the Red Lion Capital platform.

Traders navigating Red Lion Capital should exercise due diligence in considering both spreads and commissions, in conjunction with any other potential fees that might be applicable. This discernment is fundamental for astute risk management and optimizing the profitability of trades in an environment characterized by financial constraints.

Deposit & Withdraw Methods

Red Lion Capital provides users with a straightforward and limited selection of deposit methods, aiming to offer convenience and accessibility. Clients can fund their accounts using Visa cards, allowing for instant deposits with the widely used and globally accepted payment method. This option suits those who prefer the familiarity and security of credit card transactions. Additionally, Red Lion Capital accommodates cryptocurrency enthusiasts by accepting Bitcoin deposits, offering a fast and secure alternative for users engaged in the digital asset space.

On the withdrawal side, specific methods are not explicitly outlined in the provided information. However, it's reasonable to infer that clients can likely use the same methods available for deposits—Visa and Bitcoin—for withdrawals. This alignment simplifies the transaction process and ensures consistency in the channels through which clients can manage their funds.

For prospective clients considering Red Lion Capital, the minimum deposit requirement is set at $100. This relatively modest minimum deposit may attract traders who wish to start with a smaller initial investment. However, it's essential for users to review the terms and conditions associated with deposits and withdrawals, including any potential fees or processing times, to make well-informed decisions aligned with their financial preferences and objectives.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | Red Lion Capital | Quadcode Markets | Tickmill | GO Markets |

| Minimum Deposit | $100 | $50 | $100 | $200 |

Trading Platforms

Red Lion Capital provides its traders with a simplified and limited choice of trading platforms, aiming to cater to different preferences and levels of experience. The broker supports the MetaTrader 4 (MT4) platform, a well-established and widely used trading software known for its user-friendly interface and comprehensive features. MT4 offers real-time price quotes, advanced charting tools, and supports automated trading through Expert Advisors (EAs). While MT4 remains a popular choice, it's important to note that it is an older version of the MetaTrader series.

The availability of MT4 ensures that traders can access a stable and familiar platform, especially beneficial for those who have experience with or are accustomed to using MetaTrader software. However, it's worth mentioning that the information provided does not indicate support for the latest MetaTrader 5 (MT5) platform, which offers additional features and capabilities compared to its predecessor.

Traders using Red Lion Capital can access the MT4 platform across various devices, including desktop computers, web browsers, and mobile devices (iOS and Android). The inclusion of a widely recognized platform like MT4 suggests that the broker prioritizes simplicity and accessibility, providing a reliable tool for traders to execute their strategies and navigate financial markets with ease.

Customer Support

Red Lion Capital offers customer support through email, with the designated email address being cs@rlcbroker.com. This communication channel allows traders to reach out to the broker for inquiries, assistance, or issue resolution. While email support can provide a written record of communication, it might not offer the immediacy or real-time interaction that some traders prefer, especially in urgent situations.

The absence of additional customer support channels, such as phone support or live chat, may be a limitation for traders seeking more direct and immediate assistance. Email communication, while a structured means of conveying queries, might result in longer response times compared to other channels that offer real-time engagement.

Traders considering Red Lion Capital should be mindful of the available support options and assess them based on their individual preferences and requirements for timely and effective assistance. It's essential to consider the responsiveness of the support team and the convenience of the chosen communication method in addressing the diverse needs of traders.

Educational Resources

Red Lion Capital provides limited information regarding its educational resources. The available details suggest that the broker offers educational materials to assist traders in enhancing their knowledge and skills in the financial markets. However, specific details about the content, format, and depth of these educational resources are not explicitly outlined.

Educational resources typically play a crucial role in empowering traders, especially those new to the financial markets, to make informed decisions and navigate various trading strategies. These resources may include articles, tutorials, guides, or webinars covering fundamental concepts, technical analysis, and trading strategies.

Traders interested in educational support should explore the platform's educational section for insights into market dynamics and trading practices. While the specifics of Red Lion Capital's educational resources are not detailed, the presence of such materials reflects an effort to contribute to traders' learning experiences. It's recommended for traders to assess the comprehensiveness and relevance of the educational content based on their individual learning needs and trading objectives.

Conclusion

In conclusion, RED LION CAPITAL offers a diverse range of trading instruments and account types, providing flexibility for traders. However, the absence of regulatory oversight, limited customer support options, and unclear details on educational resources raise concerns. Traders considering RED LION CAPITAL should weigh the advantages of asset variety and accessible entry against the potential risks associated with an unregulated platform.

FAQs

Q: Is RED LION CAPITAL regulated?

A: No, RED LION CAPITAL is not regulated, and traders should exercise caution due to the associated risks.

Q: What is the minimum deposit at RED LION CAPITAL?

A: The minimum deposit at RED LION CAPITAL is $100.

Q: What is the maximum leverage at RED LION CAPITAL?

A: The maximum leverage at RED LION CAPITAL is up to 1:500, with variations based on assets and account types.

Q: What trading platforms are supported by RED LION CAPITAL?

A: RED LION CAPITAL supports the MetaTrader 4 (MT4) platform.

Q: How can I contact customer support at RED LION CAPITAL?

A: Customer support at RED LION CAPITAL is available through email at cs@rlcbroker.com.

News

No Data