Company Summary

| Exnova Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Saint Kitts and Nevis |

| Regulation | No regulation |

| Market Instruments | Currencies and commodities |

| Demo Account | ✅($10,000 demo money) |

| Leverage | / |

| Spread | / |

| Trading Platform | Exnova |

| Minimum Deposit | $10 |

| Customer Support | 24/7 support, live chat |

| Email: support@exnova.com | |

| Address: Lighthouse Trust Nevis Ltd, Suite 1, A.L. Evelyn Ltd Building, Main Street, Charlestown, Nevis | |

| Facebook, X, Instagram | |

Exnova Information

Exnova is an unregulated service provider, offering trading in currencies and commodities. The minimum deposit requirement is only $10.

Pros and Cons

| Pros | Cons |

| Negative balance protection | No regulation |

| Demo accounts | Single account type |

| Low minimum deposit of $10 | |

| No deposit fees | |

| Live chat support |

Is Exnova Legit?

Exnova claims to offer negative balance protection, however, it currently has no valid regulations. Please be aware of the risk!

What Can I Trade on Exnova?

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Exnova offers a single standard account, and the standard account's minimum deposit is $10. Besides, Exnova also offers demo accounts.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Exnova | ✔ | / | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Exnova accepts payments options such as BOLETO RAPIDO, MasterCard, PicPay, Perfect Money, TED, advcash, pix, BOLEO, etc, with zero fees for all deposits.

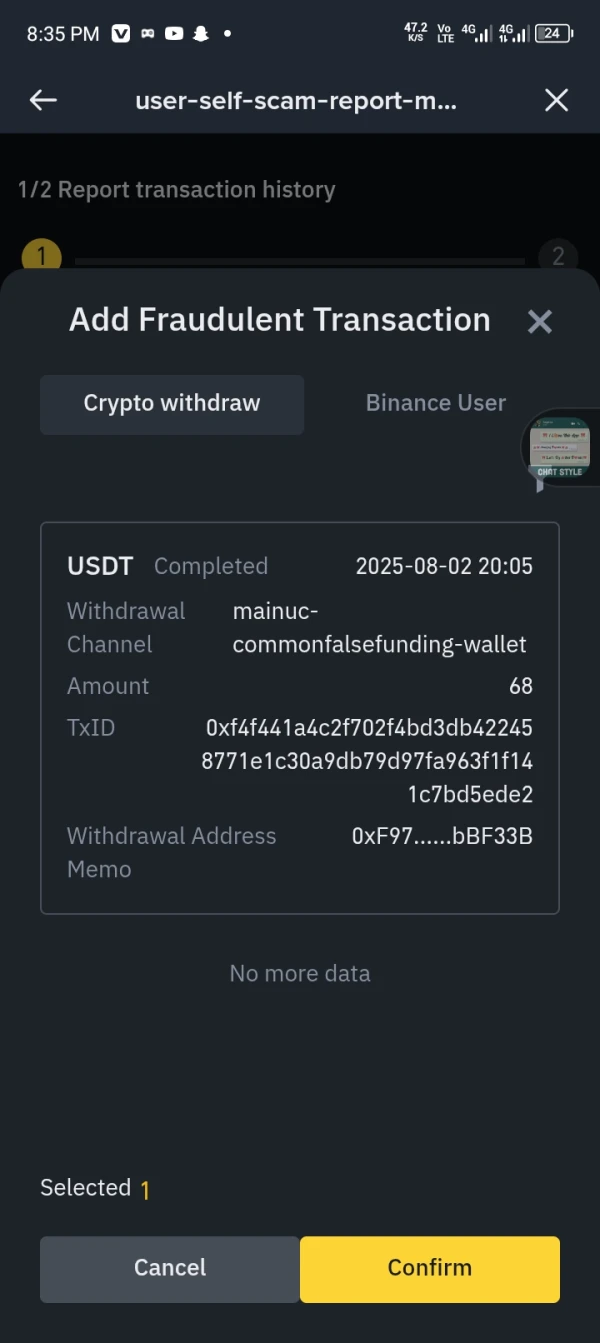

Eduardo albarran

Colombia

It won't let me withdraw to another platform, and that's supposed to be from crypto to cryptocurrency.

Exposure

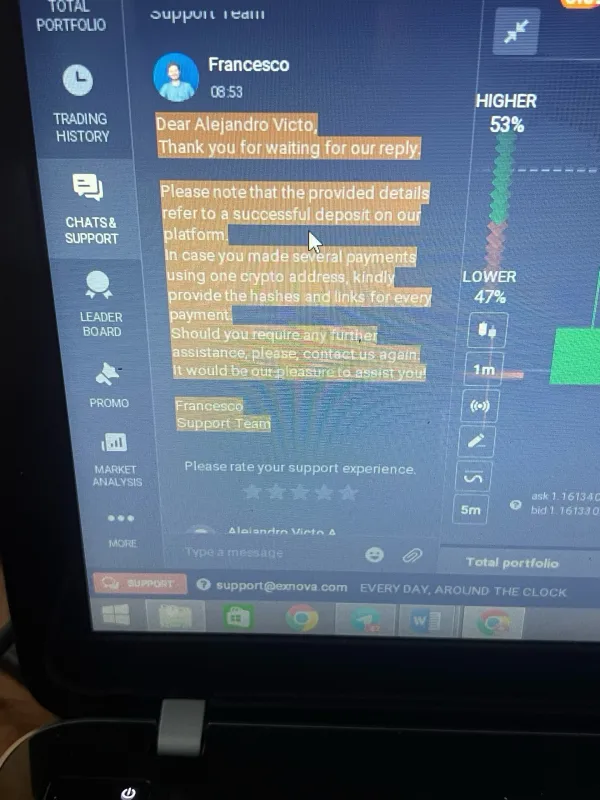

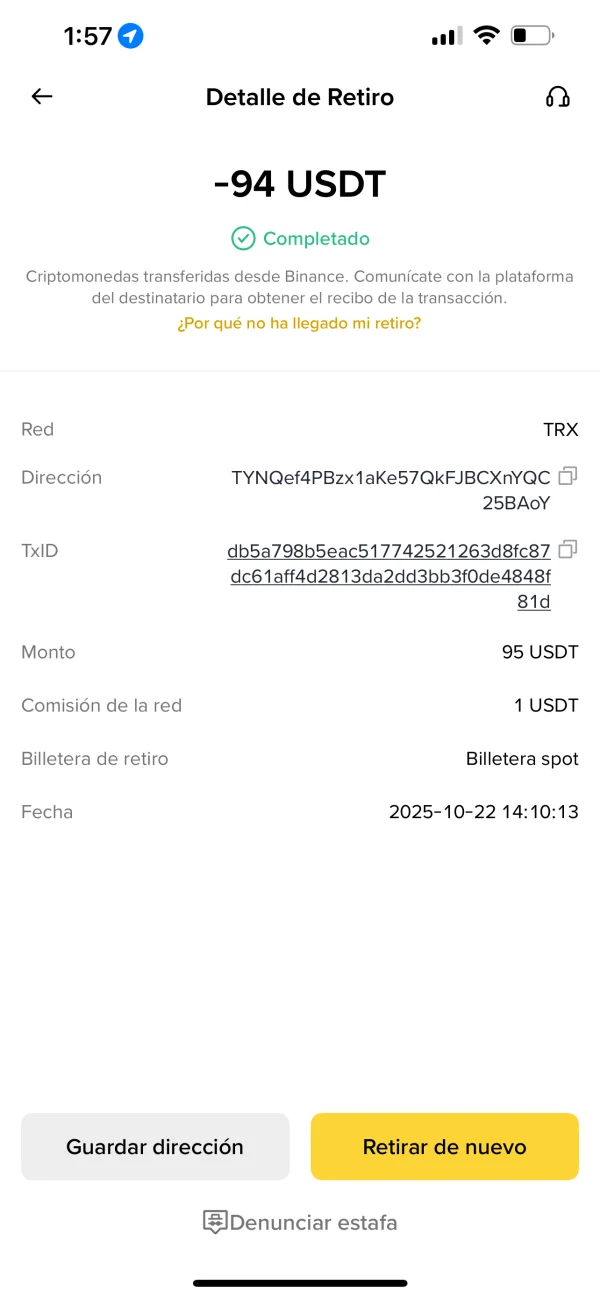

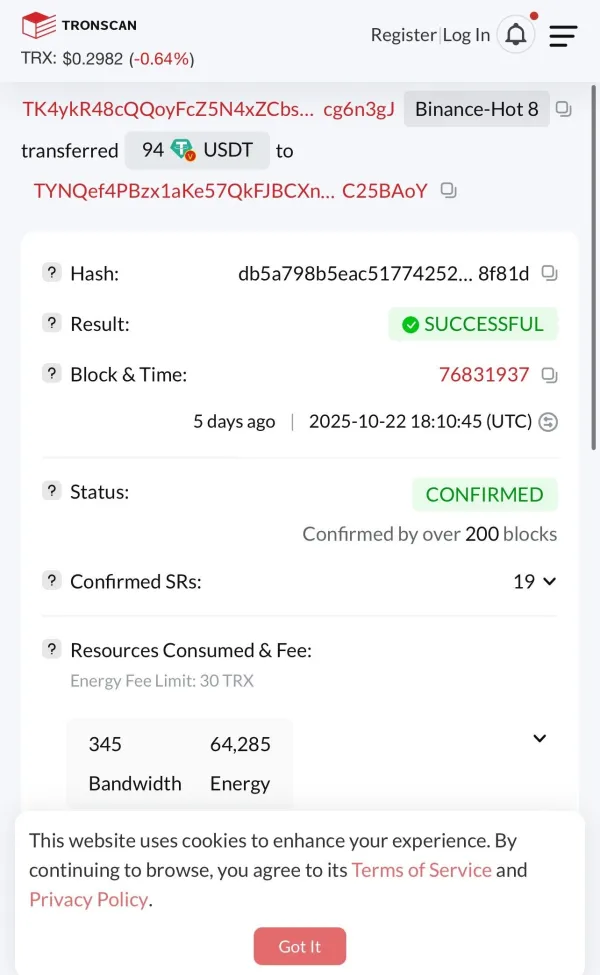

Alejandro Andia velasco

Bolivia

I made a deposit of 94 USDT (TRC20) on October 22, 2025, from my Binance wallet to the address generated by Exnova. The transaction was successful and confirmed on the TRON blockchain. Several days have passed since the confirmation and the funds are still not reflected in my Exnova account. I have contacted official support, providing all the data and Tronscan screenshot, but I have not received a solution or balance credit. I request that the lack of deposit credit be investigated and that the company publicly clarify the transaction status.

Exposure

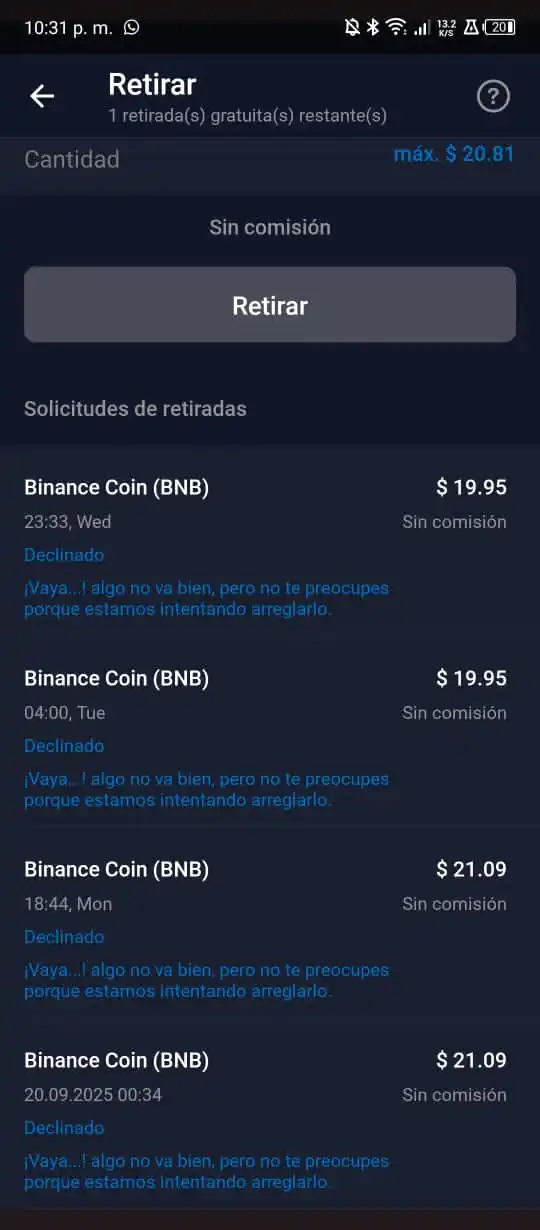

Felix Botello

Venezuela

The people who profit are those who work with affiliates, but it's a scam. At first, you get your withdrawals, but then they cancel them. You write to support, and they don't respond.

Exposure

Umer Farooq

Pakistan

not show my deposit it is scammer Unable to withdraw funds

Exposure

FX1260185180

Ecuador

I only deposited $100 attracted by the 100% bonus. After a month of trading and with a balance of $327.85, they canceled the bonus and emptied the account. Thieves!!!!

Exposure

FX1160605283

Uruguay

Perhaps in the past it wasn't so good. But today, it's excellent. Deposits are simple and withdrawals are processed in just over 1 business day!

Positive

saad_khalid

Kuwait

I am currently working on it and waiting for withdrawal operations. The platform is excellent, but I need to review it a little and look into its value and reliability. I am on the way to achieve big profits and many withdrawals. I will see what they are doing.

Neutral

FX1314862760

Thailand

Whether it is withdrawal or anything else, although the platform speed is slow, it can help solve it.

Neutral

FX1314862760

Thailand

I've attempted multiple times, but still can't withdraw. It's a scam platform. They just tell me to wait when I contact them and insist that even inability to withdraw is not their responsibility, as they claim it was notified at the time of registration.

Exposure

FX2640171915

Brazil

I couldn't withdraw my money.

Exposure

FX3115012106

Philippines

This broker is a scam, wont let you withdraw, they suddenly blocked my account and became unresponsive with my emails after trying to withdraw just $10 from my $3000 account. Imagine what they could do to peoples hard earned money. To all the victims of this company, kindly reachout and stop this company from ruining other peoples finances

Exposure

FX3398290949

Algeria

I deposited $233 into the platform when I made a profit of $50. I requested to withdraw the money and profit. The money did not reach me. 3 days have passed and I have not received the money. Beware of this platform. It is a scam and fraud. There is no response.

Exposure

FX3052724347

Bolivia

I withdrew what I had deposited more than 5 days ago and I still haven't received anything in my bank account, but on the ex nova platform it appears as already withdrawn but I haven't received anything.

Exposure

Ravi Kayal

India

not only does exnova broker provide a stable trading platform for honing skills and earning profits, but also it has quite an advanced mobile application. i tested it recently and it turned out to be a cool way to trade if you are far from home. the only thing is that the connection has to be seamless, otherwise there might be lags. but it's not a big deal, today wifi can be found anywhere. all in all, I had no troubles trading on the feet at all. thanks, exnova, keep it up!!

Positive

Tello4531

Mexico

Don't be fooled, you will never win anything, they only give you bonuses so that you fall for their lies and then they will leave you without a penny.

Exposure

Tello4531

Mexico

Hello, I would like to know if there is some way to recover what I lost with this scamming and manipulative company, please.

Exposure

Alberto1255

Mexico

It kinda fels good to know that we're following da same logical thinking with this brokers. They have the assets i want, they gots the design i want see, and it is the same thing with features. They don't have enough assets yet, and maybe the platform could be improved, but it's all good so far.

Positive

Emiliano

Mexico

I love the variety of trading instruments available on Exnova's platform. They offer forex, stocks, commodities, and options trading, making it easy for me to diversify my portfolio.

Positive

Enrique C.

Mexico

A simple website does not give a complete picture of the trading conditions provided by this company. But the trading conditions themselves are excellent. You can't argue with that. So if you skip the step with the site study and go straight to the platform, you get an excellent tool for making profits. I'm sure of it. So you shouldn't always judge a broker by his website. And sometimes you have to spend time to study it in more detail.

Positive

Vicente Saez

Colombia

This is a preferable investing platform for all traders despite the market experience. The company offers everything to blend smoothly into the world of finances and investing with its handy features.

Positive

FX1097897873

Mexico

Although this company allows me to test it with a demo account before I start trading, I don't want to waste my time trading with it, because I saw that it does not have any regulatory license and is registered in Saint Vincent and the Grenadines, a country known to harbor too many scammers. of Forex.

Neutral