Company Summary

| Barclays Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Bulgaria |

| Regulation | No regulation |

| Financial Services | Capital markets solutions, investment banking, foreign exchange, derivatives trading, fund management |

| Customer Support | Barclays Securities Co., Ltd.31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1100 |

| Barclays Bank, Tokyo Branch, 31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131Tel: 03-4530-5100 | |

| Barclays Investment Management Co., Ltd.31st floor,Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-2400 | |

| Barclays Services Japan Limited31st floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131 Tel: 03-4530-1190 | |

Barclays Information

Barclays operates in Japan as a key part of its global network, offering financial services through Barclays Securities Co., Ltd., Barclays Bank Tokyo Branch, and Barclays Investment Management Co., Ltd to clients in Japan, including business companies, financial institutions, institutional investors and public institutions.

Following its global expansion, especially after acquiring Lehman Brothers‘ North American operations in 2008, Barclays has established itself as one of Japan’s leading investment banks.

However, Barclays is not being regulated by any official authorities in Japan, which should raise your attention due to possible less credibility and trustworthiness.

Pros and Cons

| Pros | Cons |

| Global presence | No regulation in Japan |

| Reputable mother company | |

| Vraious financial services offered |

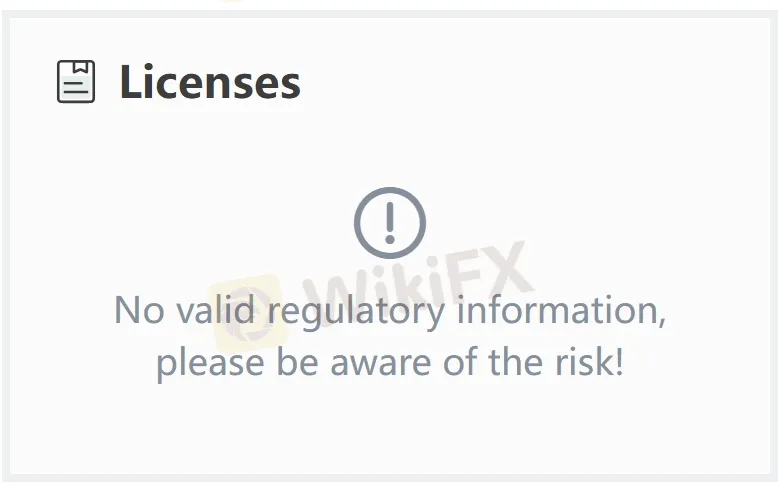

Is Barclays Legit?

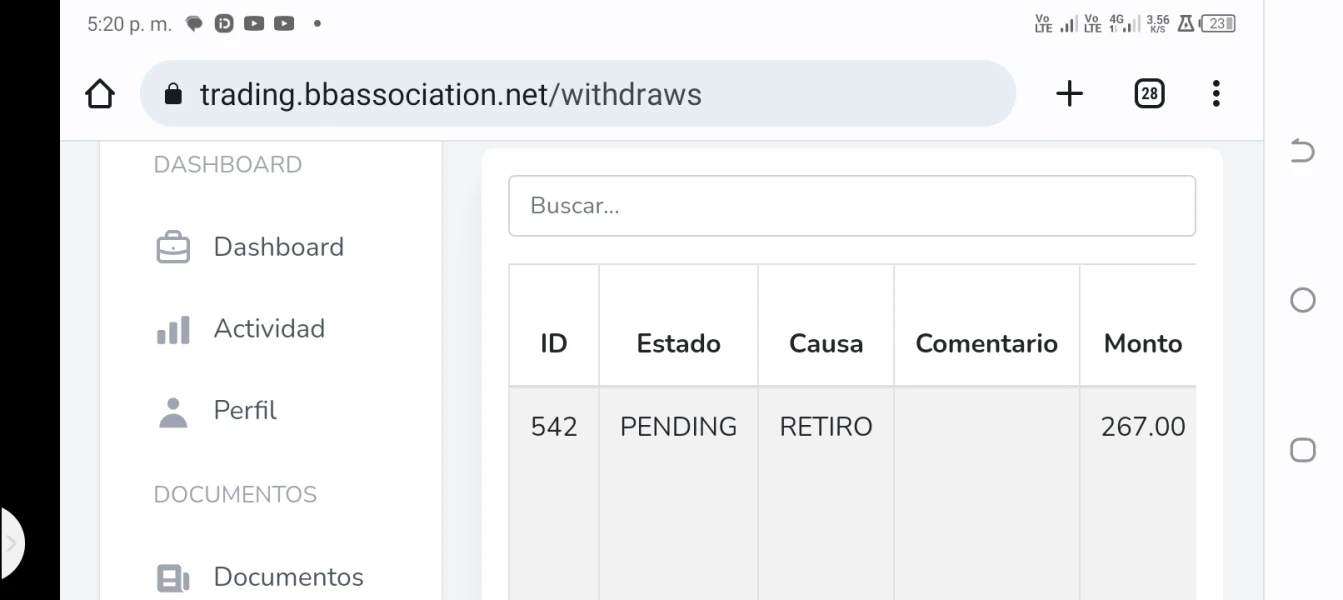

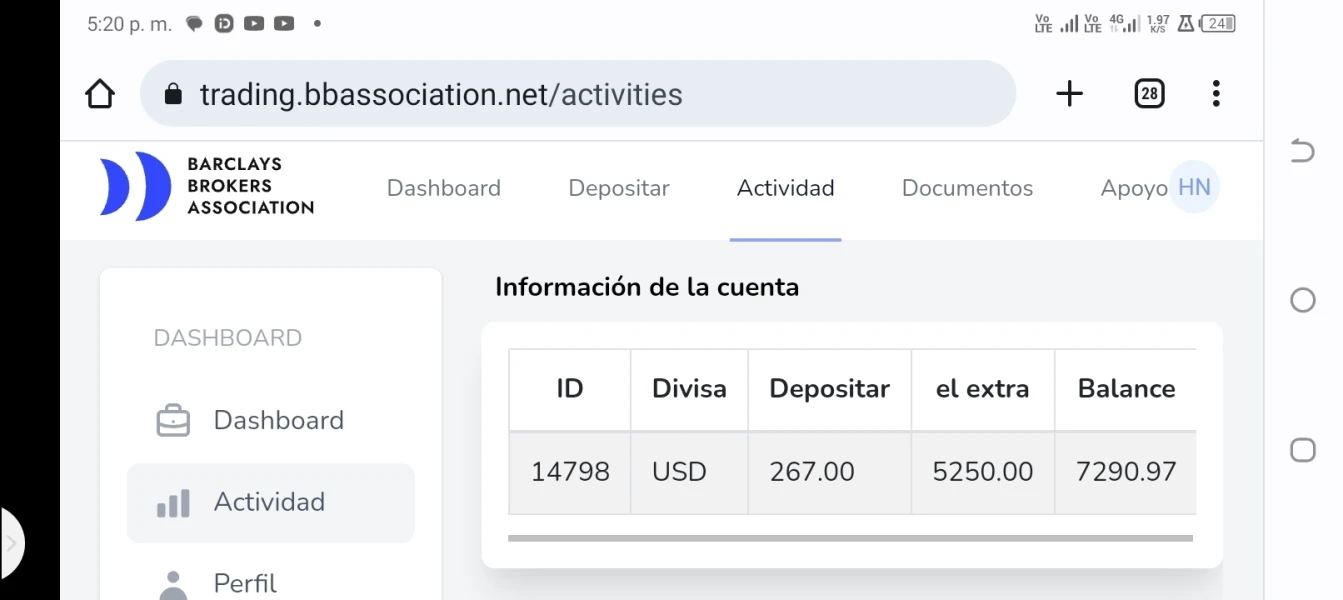

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. Barclays is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose Barclays with caution.

Barclays Services

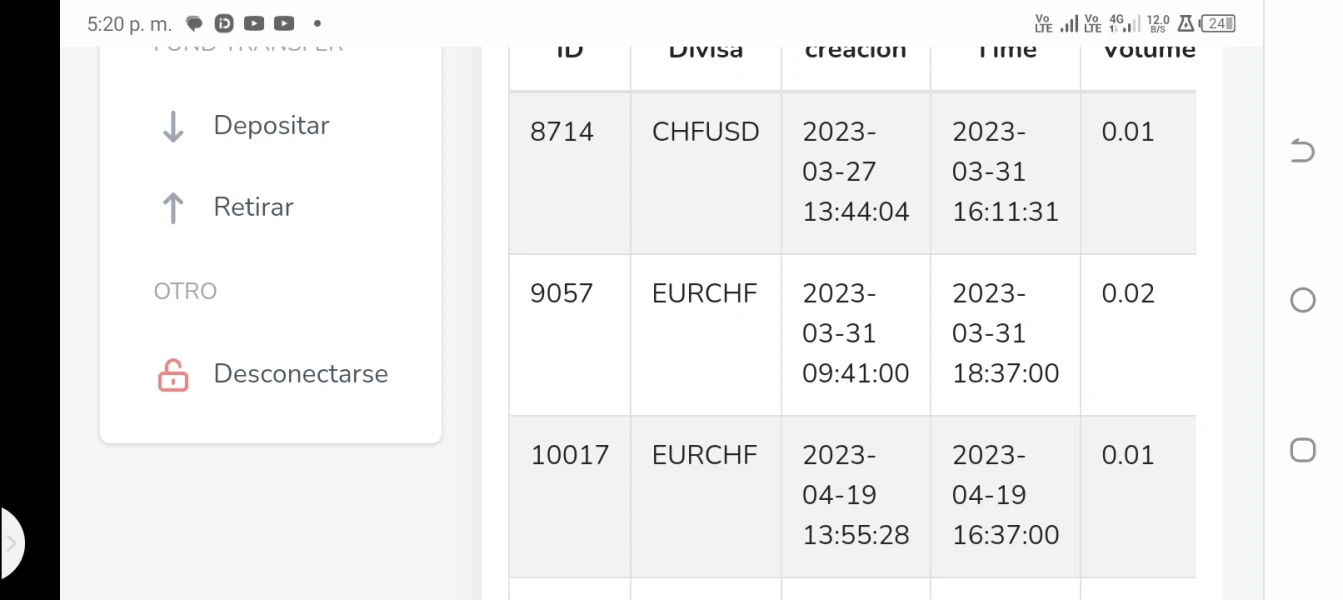

Barclays Japan provides a comprehensive suite of financial services including capital markets solutions, investment banking, foreign exchange, derivatives trading, and fund management.

Barclays Securities focuses on financing, asset management, and advisory services;

The Tokyo Branch facilitates wholesale market access, particularly in FX and derivatives;

While Barclays Investment Management manages mutual funds across diverse asset classes to meet institutional investor needs.