Company Summary

| One Asia Securities Review Summary | |

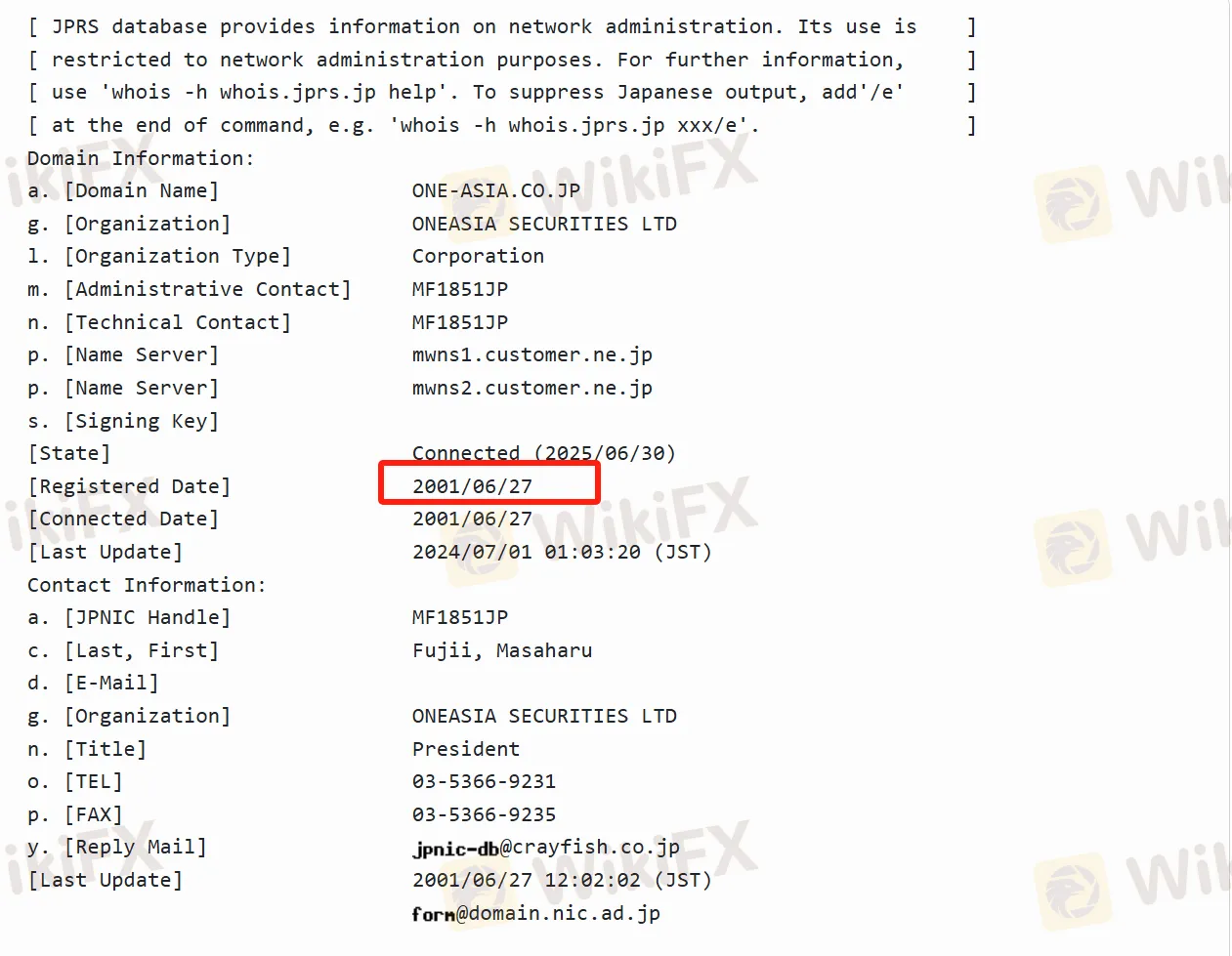

| Founded | 2001 |

| Registered Country/Region | Japan |

| Regulation | FSA (Regulated) |

| Market Instruments | Stocks, Index Futures, Options |

| Trading Platform | / |

| Customer Support | Tel: 03-6273-4201 |

| Address: One Asia Securities Co., Ltd. 3F Nissin Building, 1-6-4 Kudankita, Chiyoda-ku, Tokyo 102-0073 | |

One Asia Securities Information

One Asia Securities is a legitimate financial institution regulated by the Financial Services Agency and holds a Retail Forex License. Its formal operation number is No. 201 issued by the Commissioner of the Kanto Local Finance Bureau (in the case of gold trading businesses). This platform offers a rich variety of trading products, covering domestic stocks (including spot and margin trading, but margin trading is limited to institutional credit-listed stocks), foreign stocks in the Hong Kong market, index futures, options, etc. In addition, the platform regularly holds free study sessions and seminars to help investors enhance their market insights.

Pros and Cons

| Pros | Cons |

| Regulated | Limited information on some services |

| Rich financial products | Restricted credit trading |

| Free educational activities | |

| Long operation time |

Is One Asia Securities Legit?

Yes, One Asia Securities is regulated and has obtained a Retail Forex License. It is regulated by the Financial Services Agency, and its formal operation number is “関東財務局長(金商)第201号.”

What Can I Trade on One Asia Securities?

One Asia Securities offers domestic listed stocks restricted to institutional credit categories. For foreign stocks, it is limited to those listed on the Hong Kong market. Investors can also choose index futures and options.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Index Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |