Company Summary

| BOCI Review Summary | |

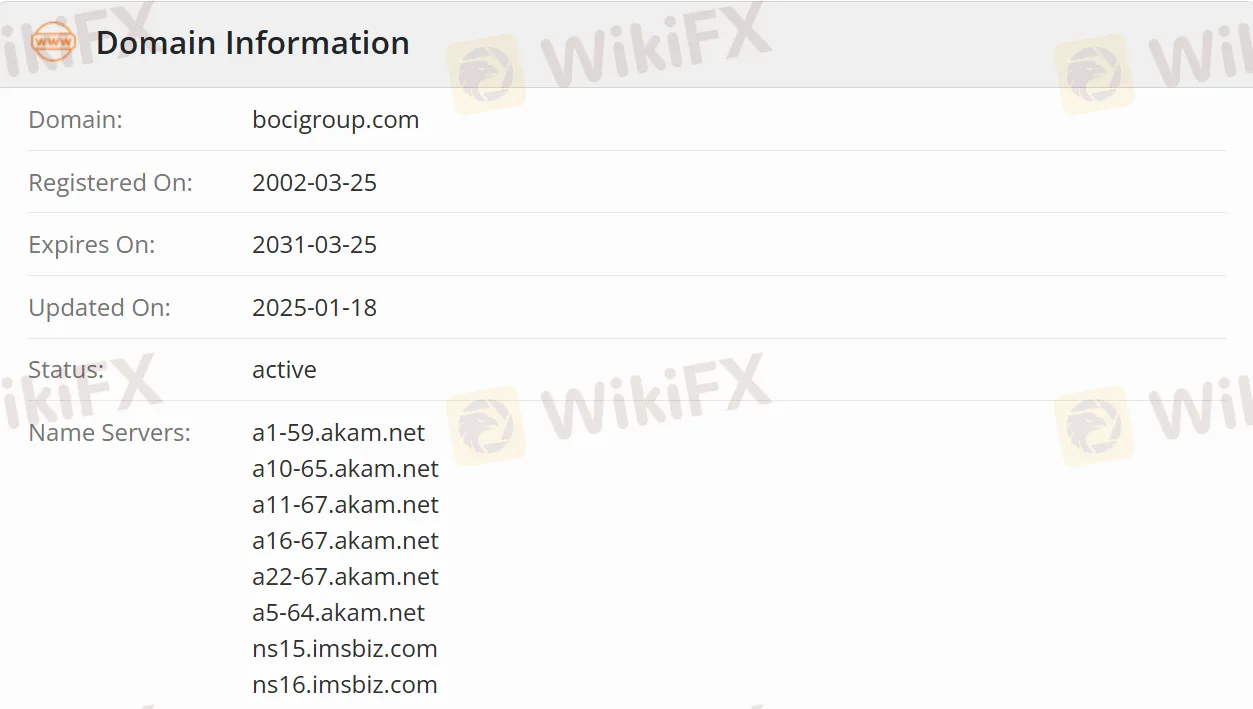

| Founded | 2002-03-25 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Finance Servies | Commodities, Insurance, Stocks, Funds, Bonds, Stock Issuance, Bond Issuance, Mergers, Acquisitions, Restructuring, etc. |

| Customer Support (24/7) | Telephone: (852) 3988 6000 |

| Fax: (852) 2147 9065 | |

| E-mail: info@bocigroup.com | |

BOCI Information

Bank of China International Holdings Limited (referred to as “BOCI”) has its headquarters in Hong Kong. It has 45 subsidiaries worldwide and has business institutions in major international financial centers such as London, Hong Kong, Singapore, as well as in central cities like Beijing, Shanghai, and Shenzhen. It provides clients with full-fledged and global investment banking products and services, including stock issuance, mergers and acquisitions, bond issuance, fixed income, private banking, direct investment, global commodities, asset management, equity derivative products, leveraged and structured financing, etc.

Pros and Cons

| Pros | Cons |

| Regulated | The high threshold for some services (high-end services and products) |

| Relying on the Bank of China | Complex fees |

| Various financial services | |

| Cross-border financial services |

Is BOCI Legit?

BOCI is a legitimate and compliant financial institution. As an important member of the Bank of China, its establishment and operation are subject to strict financial supervision. The Hong Kong Regulatory Authority regulates BOCI Commodities & Futures Limited, and the license number is AAJ737.

What Services Does BOCI Provide?

At Bank of China International, there is a wide variety of trading products. In the field of corporate finance, clients can participate in businesses such as stock issuance, bond issuance, mergers, acquisitions, and restructuring. In terms of personal finance, it is possible to conduct various asset allocations related to investment services for high-end clients, such as investments in products like stocks, funds, bonds, and insurance. In addition, it also involves global commodity trading, including commodities such as energy, base metals, precious metals, and agricultural products, as well as trading of stock derivative products etc.

| Finance Servies | Supported |

| Commodities | ✔ |

| Insurance | ✔ |

| Stocks | ✔ |

| Funds | ✔ |

| Bonds | ✔ |

| Stock Issuance | ✔ |

| Bond Issuance | ✔ |

| Mergers | ✔ |

| Acquisitions | ✔ |

| Restructuring | ✔ |

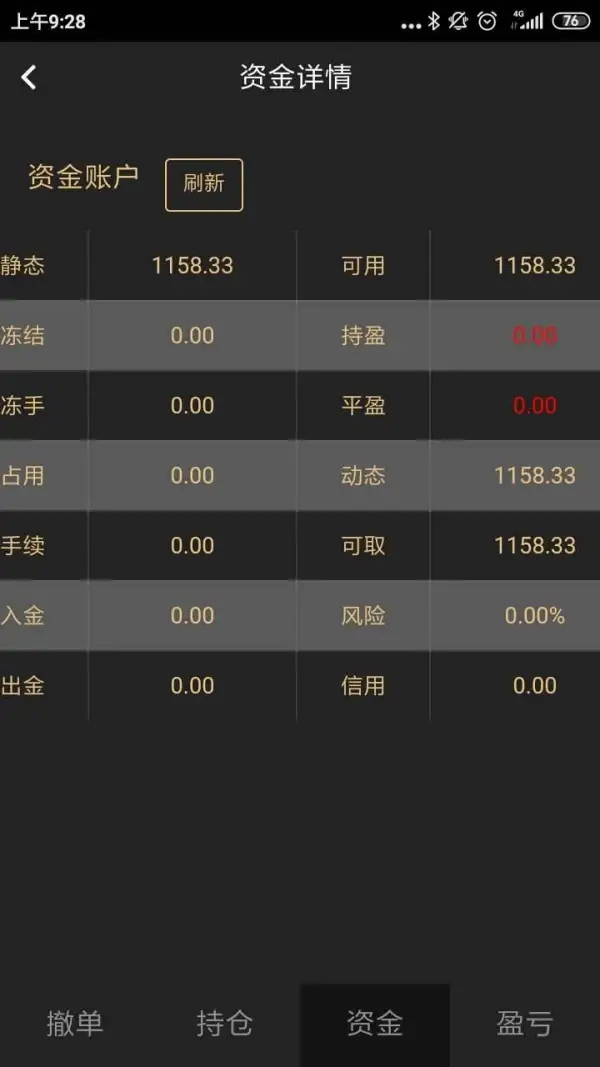

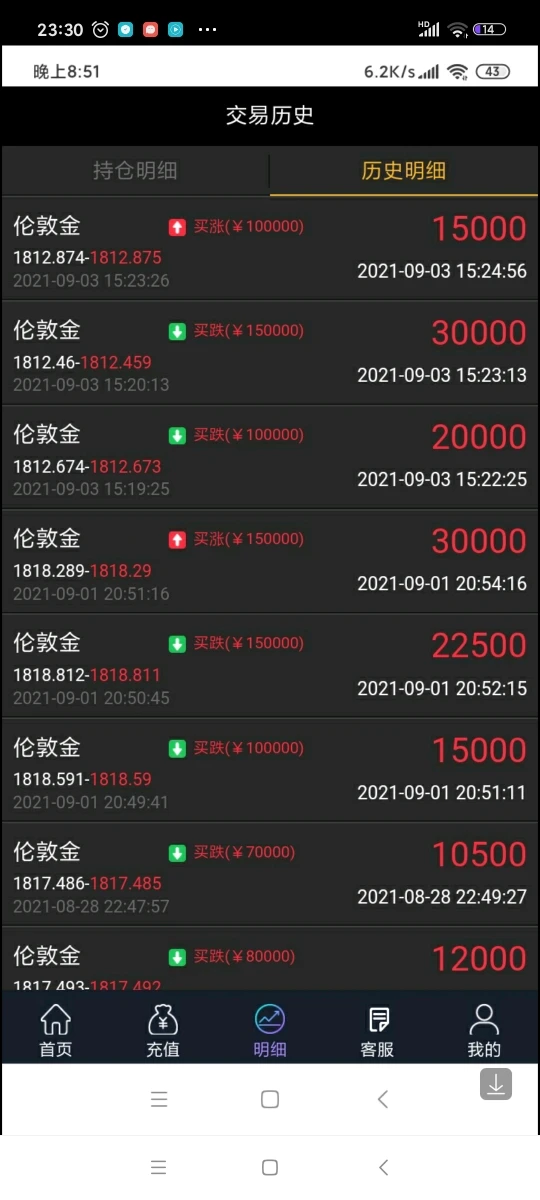

Deposit and Withdrawal

In terms of fund custody and withdrawal, clients can make deposit operations through various methods such as bank transfer and electronic payment. The withdrawal process is standardized. After clients submit a withdrawal application, and upon review, the funds will be promptly returned to the customers' designated accounts. It also meets the capital needs of customers for international investments.

Copy Trading

BOCI provides clients with Copy Trading services. Clients can choose to follow experienced and high-performing investment experts on the platform to conduct transactions.

错落年间〃我许你一生

Hong Kong

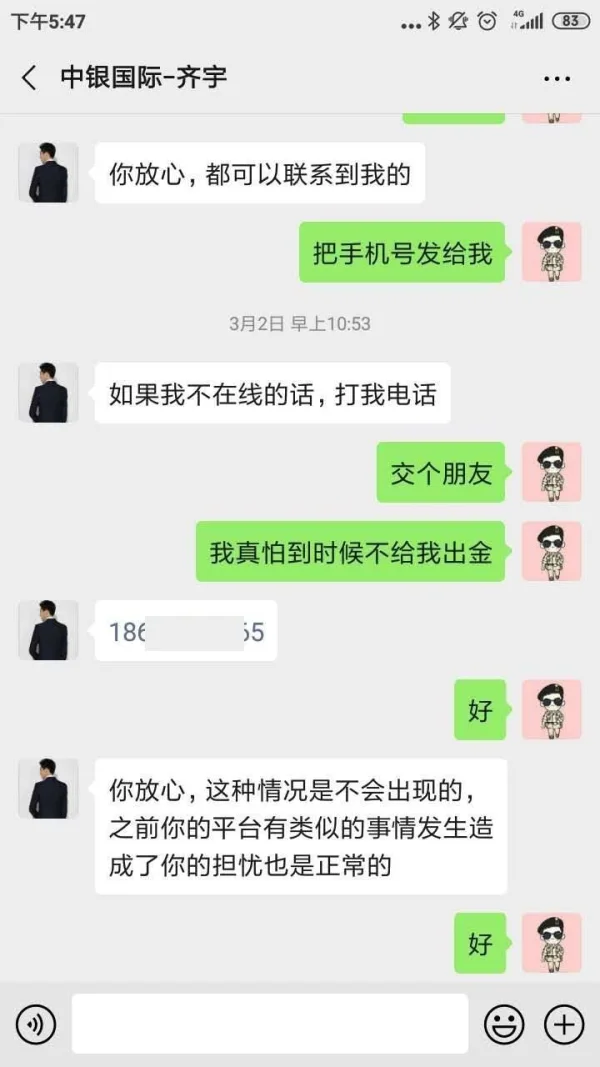

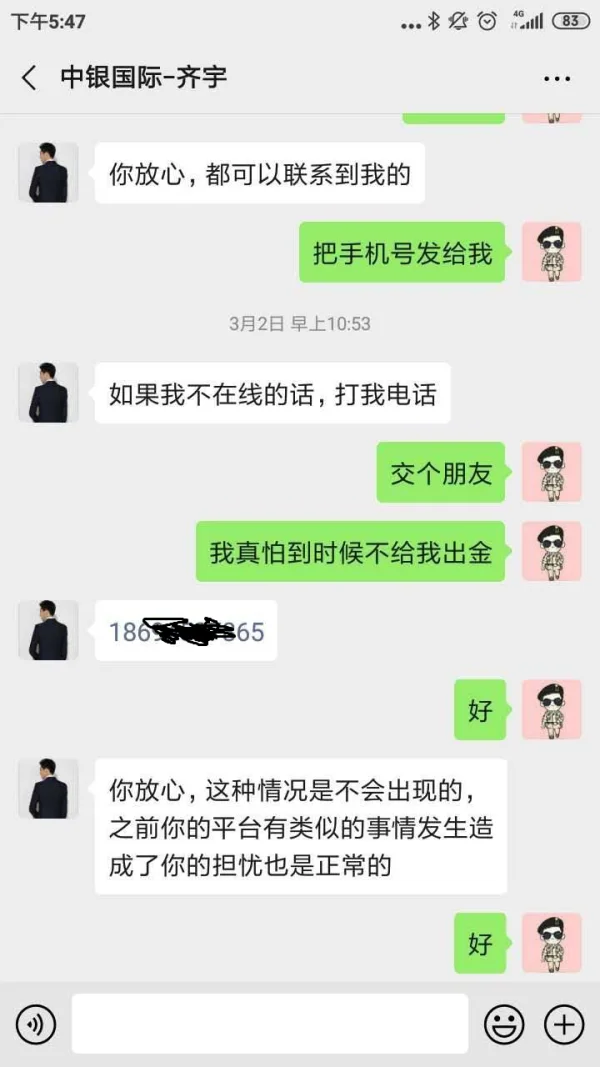

I can’t withdraw my money and the salesman blacklisted me.

Exposure

错落年间〃我许你一生

Hong Kong

The withdrawal is unavailable. The customer service also disappeared. Stay away form this fraud platform!

Exposure

错落年间〃我许你一生

Hong Kong

Stay away from this scam platform which gives no access to withdrawals.

Exposure

Little Rain

Belarus

Been with these guys a while, good steady broker. Could do with more choice but overall no problems.

Neutral

健乐

Tunisia

BOCI is a reliable and trustworthy bank company with years of industry experience. Investing here is of high safety security. However, sometimes I have also encountered some minor issues such as slow deposit and withdrawal processing time. All in all, I am very satisfied with their services and would recommend them to others.

Positive

夏至未末

Hong Kong

The illusion of guaranteed profits is all a deceptive facade, luring people into the trap.

Exposure

夏至未末

Hong Kong

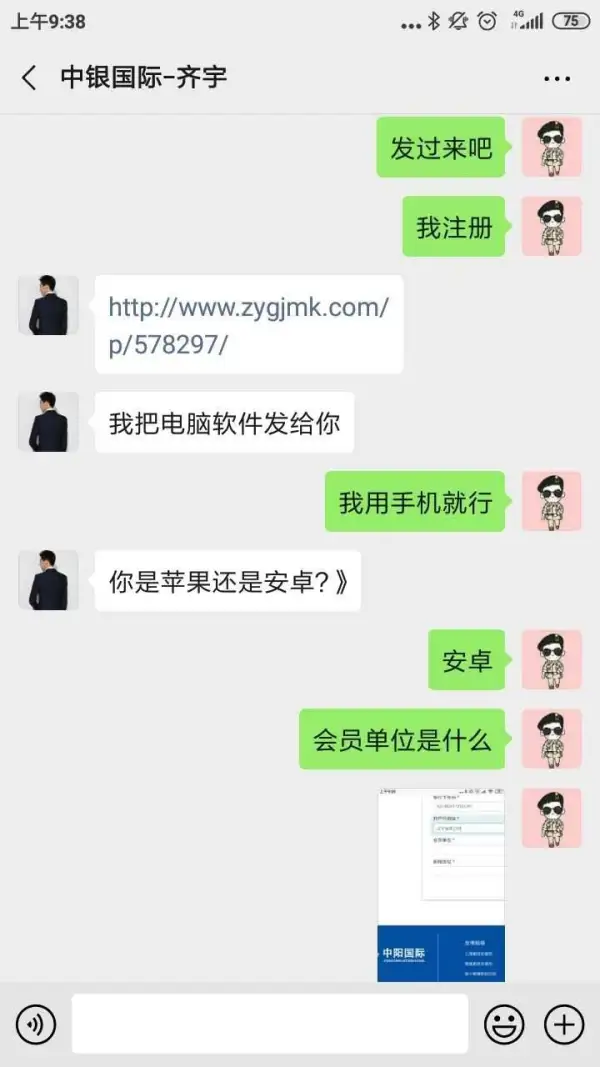

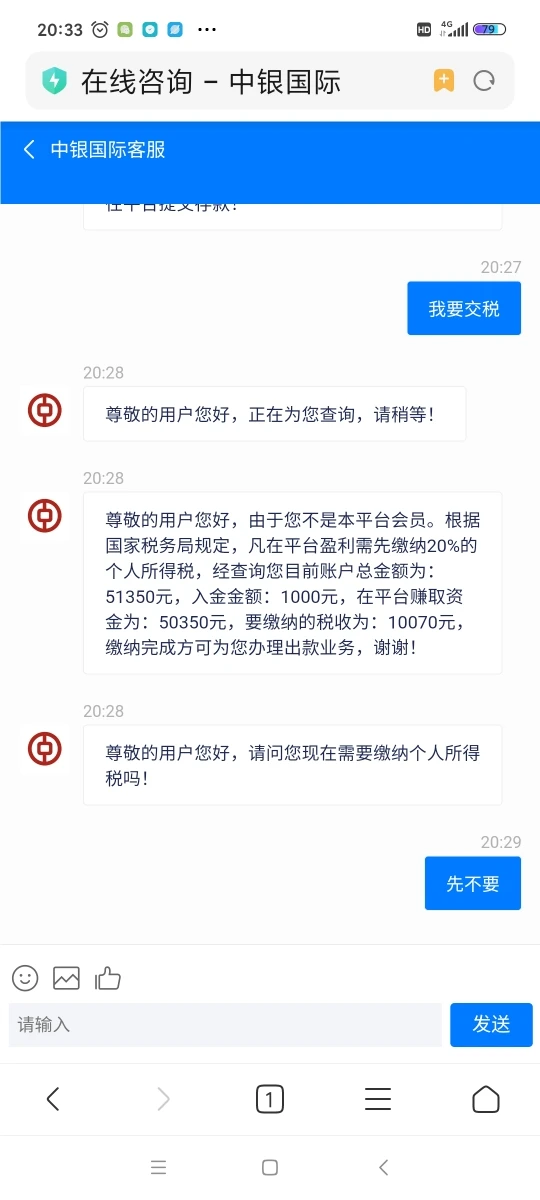

Lure into the game, cheat after securing a sure win: pay taxes, now the customer service cannot be contacted

Exposure

FX1305625852

Malaysia

Fraud platform. It rejected my withdrawal due to wrong bank information and asked me to pay margins. Then it blocked me from the website.

Exposure

目标170

Hong Kong

Actually, your software is manipulated by other people. Your software can be invalid at any time

Exposure

目标170

Hong Kong

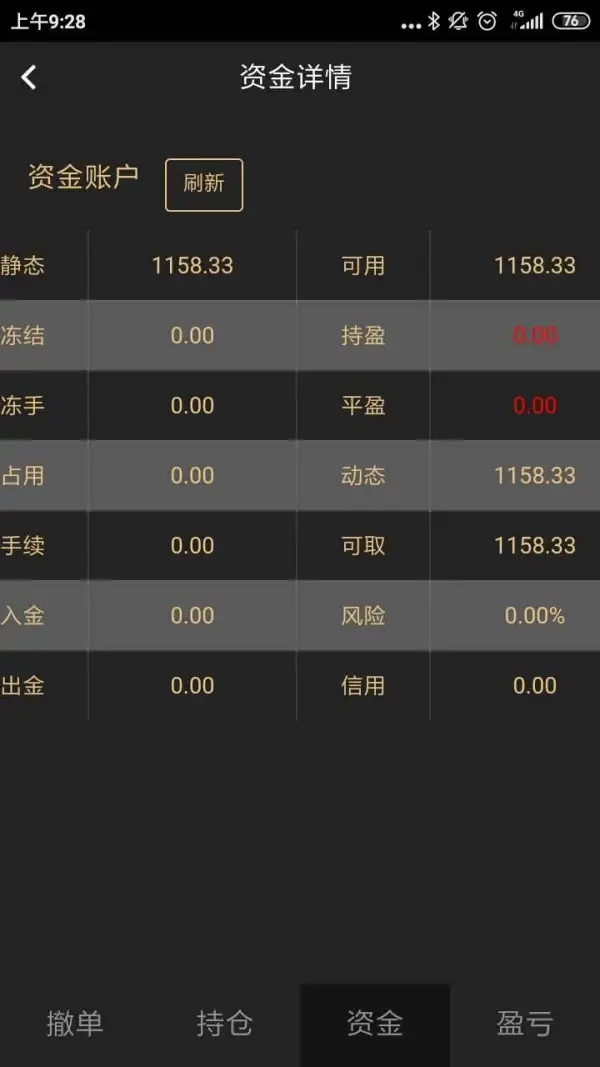

Click withdrawal button at over 2,000. At first, I can’t contact the customer service and I left my contact details. Then the app was disabled. I have to contact the customer service every time I deposit and withdraw funds. It’s a 100% scam

Exposure

丁丁81794

Hong Kong

The money was successfully withdrawn but it didn’t reach the bank card, but I was asked to get my ID card, and then I could withdraw the money after recharging

Exposure

FX2892665095

Hong Kong

Don’t have enough money so I borrowed some from them. And they said we could withdraw funds after repayment! So my friend paid back money. But they said the account didn’t belong to him, so he was suspected of money laundering! Freeze the money returned. Ask for repayment again or freeze my account forever. I don’t know whether I can withdraw funds or not after the repayment. I can just accept the loss.

Exposure

FX3743866098

Malaysia

[d83d][de20][d83d][de20][d83d][de20] I asked the customer service what else do I have to pay. But the ill-mannered customer service just push me to deposit insurance money and individual income tax.

Exposure

FX2389103371

Hong Kong

My account was frozen because I offered the wrong info. And I was asked to pay the same amount money as my withdrawal and upload my ID card photo and bank card photo. I don’t listen to him cuz I don’t know whether it is true. What should I do?

Exposure

FX7028616482

Hong Kong

I was cheated by BOC. Everyone should be careful.

Exposure

允诺而不朽

Hong Kong

I can’t contact the platform directly. This woman contacted me and said the platform was upgrading. This thing happened last October and I can’t contact the woman later. Luckily, I didn’t deposit much money or I don’t know what to do.

Exposure

Hong Kong

An individual tax was asked for before a withdrawal.

Exposure

凌子

Hong Kong

BOC gave no access to withdrawal and even canceled my account. After several times of trial, the trading became unavailable.

Exposure

燃คิดถึง

Hong Kong

I was asked to pay margin before a withdrawal. As long as you deposited fund, there would be varied stipulations that hinder your withdrawal request and ask for fee.

Exposure

ぺ爲了,遇見伱゜

Hong Kong

The activity required me to deposit fund constantly. But the withdrawal is unavailable.

Exposure

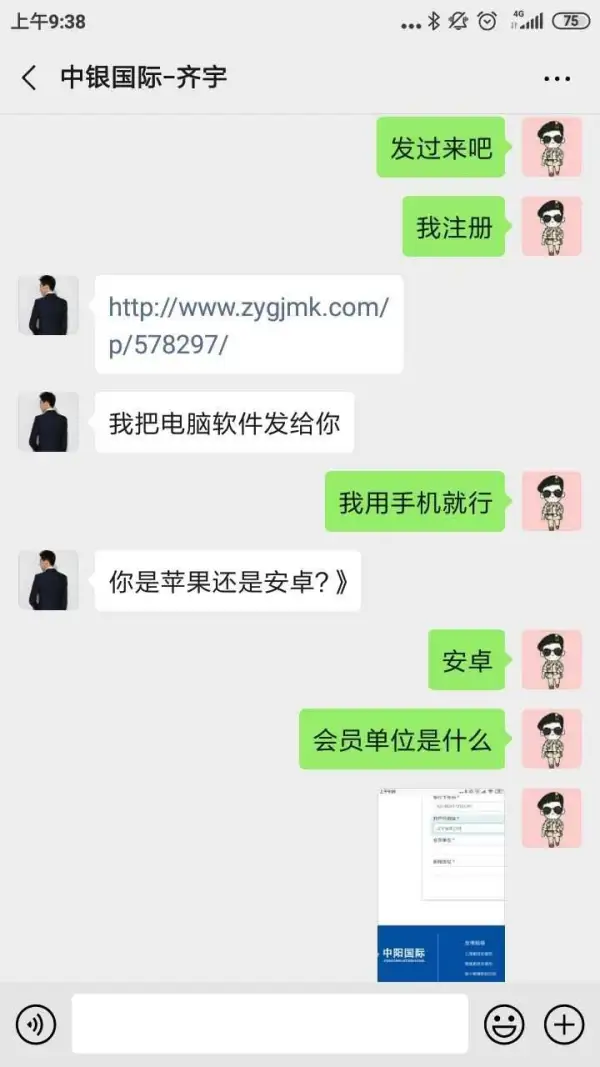

FX1277117374

Hong Kong

A friend which I haven’t met ever before recommended me BOC . Without hesitation, I downloaded. The beginning trading was smooth. On the 21st, my friend helped me to gather 100 thousand yuan. The customer service recommended a deposit set, i.e., deposit 500 thousand get 58888 yuan. After doing so, I was refused to withdraw fund. The service claimed that I hadn’t met the standard of 500 thousand deposit within 5 days, thus, a daily 25 thousand was required. I am afraid of a fraud platform. Please clear the fake platforms in case of exerting a bad influence on the official platform.

Exposure

星月

Hong Kong

The platform, with the excuse of insufficient credit score and individual tax, induced me to add fund, giving no access to withdrawal.

Exposure