Company Summary

Note:InvestQHub's official website: https://investqhub.co/ is currently inaccessible normally.

| InvestQHub Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No Regulation |

| Market Instruments | Forex, Cryptocurrencies, Energy Commodities, Soft Commodities, and Precious Metals |

| Demo Account | ❌ |

| Leverage | Up to 1:400 |

| EUR/USD Spread | From 0.3 pips |

| Trading Platform | Web-based |

| Minimum Deposit | $500 |

| Customer Support | Service time: 24/7 |

| Phone: +44 74 6236 3672 | |

| Email: cs@investQhub.co | |

Founded in 2023, InvestQHub is an unregulated online trading broker based in the UK. It offers trading on forex, cryptocurrencies, energy and soft commodities, and precious metals with leverage up to 1:400 and EUR/USD spread from 0.3 pips via a web-based trading platform. Demo accounts are not available and the minimum deposit requirement to open a live account is as high as $500.

Pros and Cons

| Pros | Cons |

| Various tradable asset classes | Non-functional website |

| Tight EUR/USD spread | No regulation |

| No demo accounts | |

| No MT4/5 | |

| High minimum deposit |

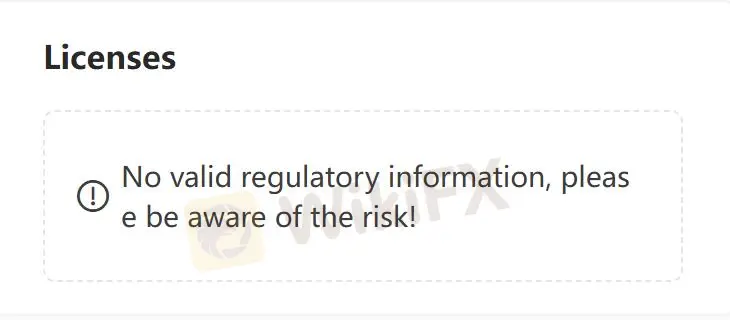

Is InvestQHub Legit?

At present, InvestQHub lacks valid regulation. We advise you to look for a regulated one.

What Can I Trade on InvestQHub?

InvestQHub claims to offer Forex, Cryptocurrencies, Energy Commodities, Soft Commodities, and Precious Metals.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Energy Commodities | ✔ |

| Soft Commodities | ✔ |

| Precious metals | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

InvestQHub offers tiered accounts from Starter to Master.

Starter ($500): for beginners, with basic features.

Advanced ($5,000): has advanced tools and automation.

Premier ($25,000): adds resources, swap discounts, gold spreads access.

Elite ($100,000): for high net worth/experienced, with perks.

Master ($150,000): offers VIP events, dedicated line, custom spreads.

It accepts USDT for deposits.

Leverage

The maximum leverage is up to 1:400. However, high leverage can amplify both profits and losses.

| Account Type | Starter | Advanced | Premier | Elite | Master |

| Max Leverage | 1:100 | 1:200 | 1:400 | ||

Spread

| Currency Pair | Spread |

| EUR/USD | 0.3 pips |

| GBP/USD | 0.7 pips |

| USD/JPY | 0.5 pips |

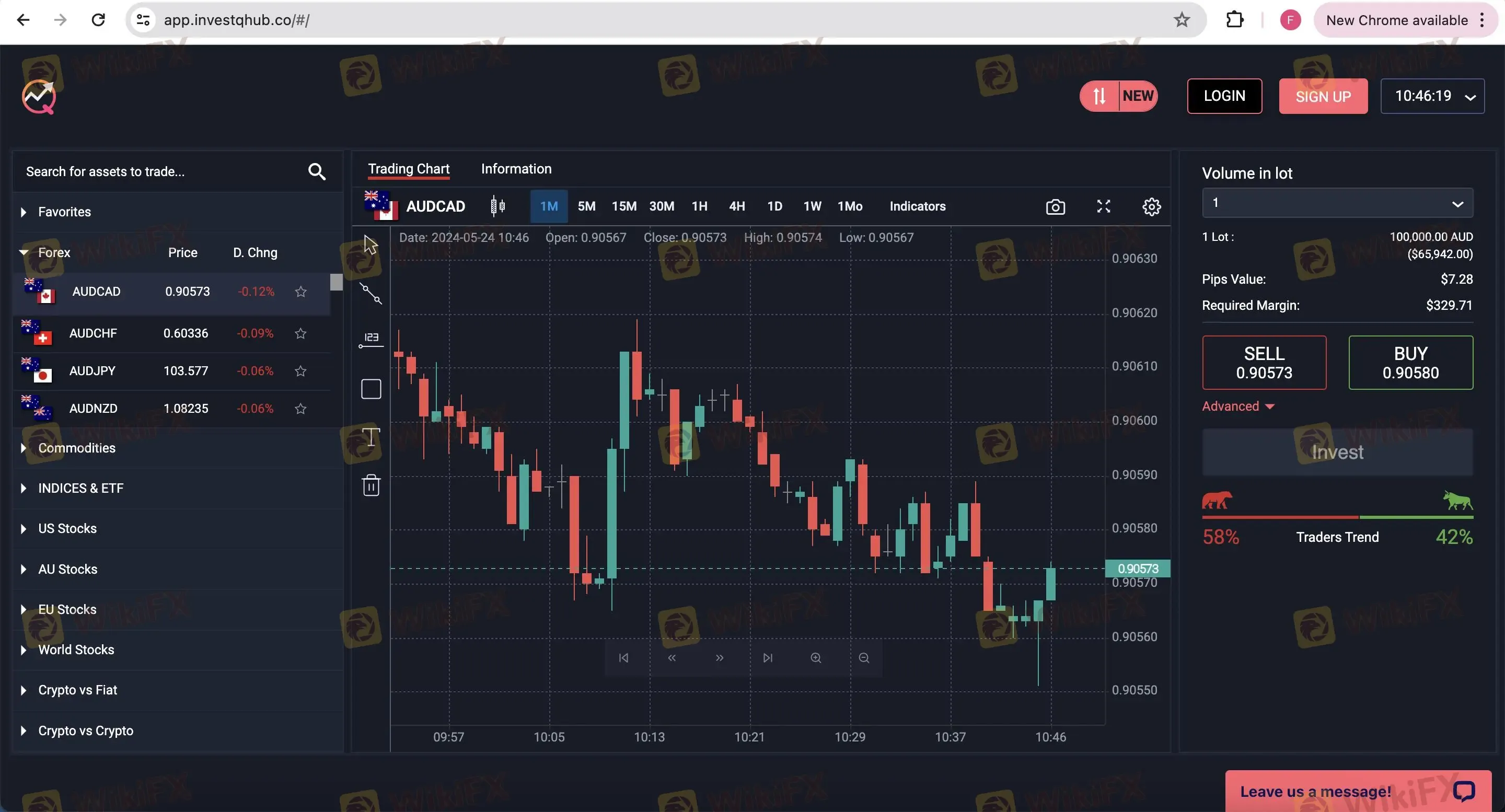

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Web-based | ✔ | Android, iPhone, Web, Tablet | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

InvestQHub limits its payment options to cryptocurrency transactions, specifically Bitcoin.

| Payment Method | Fee | Deposit Time | Withdrawal Time |

| Cryptos | Fee depends on crypto | 24 hours | 24 hours |