Company Summary

| Westpac | Basic Information |

| Company Name | Westpac |

| Founded | 1982 |

| Headquarters | Australia |

| Regulations | ASIC |

| Products and Services | Home loans, bank accounts, credit cards, personal loans, business services, share trading, insurance |

| Trading Platforms | Westpac Online, Westpac Share Trading, BT Online for Investors, PayWay, WinTrade |

| Customer Support | Support available via phone, email, and online with specific numbers for different services |

| Education Resources | Investor Centre offering information on shareholding management, dividends, and investments |

Overview of Westpac

Westpac, established in 1982 and headquartered in Australia, is one of the country's leading financial institutions. It is regulated by the Australian Securities & Investment Commission (ASIC) and offers a broad range of financial products and services, including personal banking, business solutions, and investment services. Known for its strong focus on innovation and customer service, Westpac provides state-of-the-art digital trading platforms and comprehensive support, catering to the diverse needs of its customers within Australia and beyond.

Is Westpac Legit?

Westpac is a regulated entity under the oversight of the Australian Securities & Investment Commission (ASIC), adhering to stringent regulatory standards set by Australian authorities. It holds a Market Making (MM) license with the license number 233714, confirming its compliance with the financial regulations necessary for operating within Australia.

Pros and Cons

Westpac, established in 1982 and headquartered in Australia, is one of the country's leading financial institutions. It is regulated by the Australian Securities & Investment Commission (ASIC) and offers a broad range of financial products and services, including personal banking, business solutions, and investment services. Known for its strong focus on innovation and customer service, Westpac provides state-of-the-art digital trading platforms and comprehensive support, catering to the diverse needs of its customers within Australia and beyond.

| Pros | Cons |

|

|

|

|

|

Products and Services

Westpac offers a comprehensive range of financial products and services, including:

Home Loans: Options for buying, refinancing, and calculating mortgages.

Bank Accounts: Transaction accounts, savings accounts, and term deposits.

Credit Cards: Rewards, low rate, and low fee credit cards.

Personal Loans: Debt consolidation, car loans, and loan repayment calculators.

Business Services: Business bank accounts, loans, and payment processing solutions like EFTPOS and eCommerce.

Additional Services: Share trading, various insurance products, and international travel services.

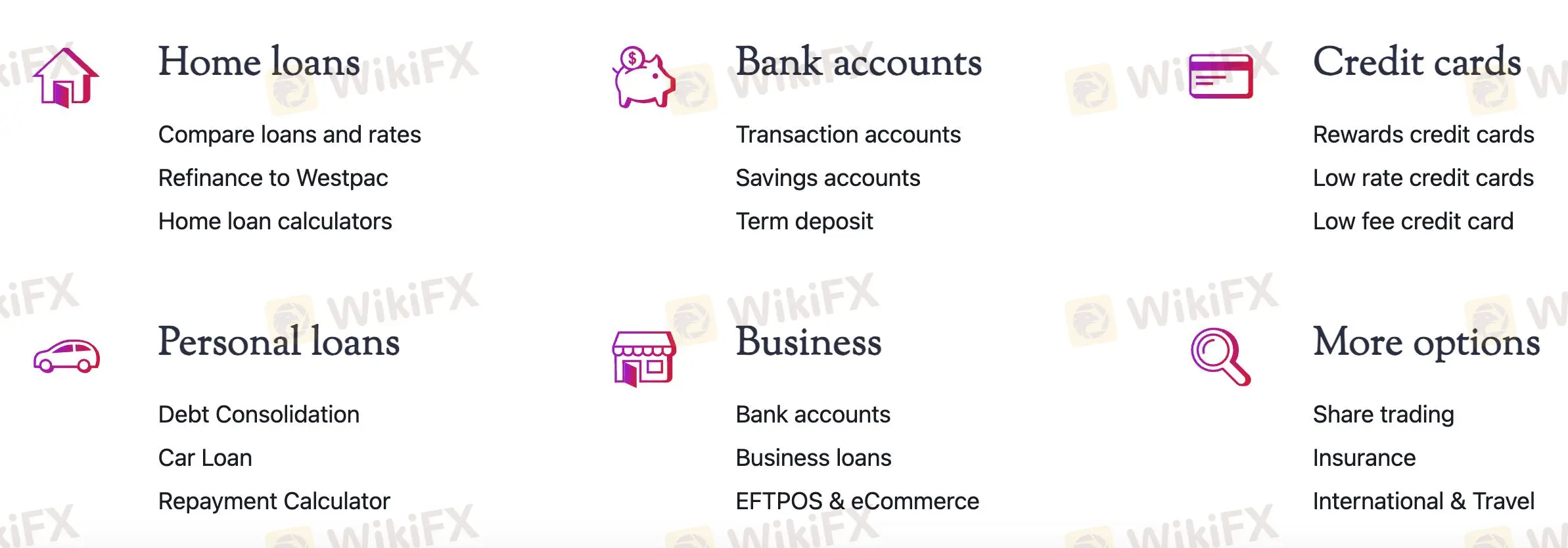

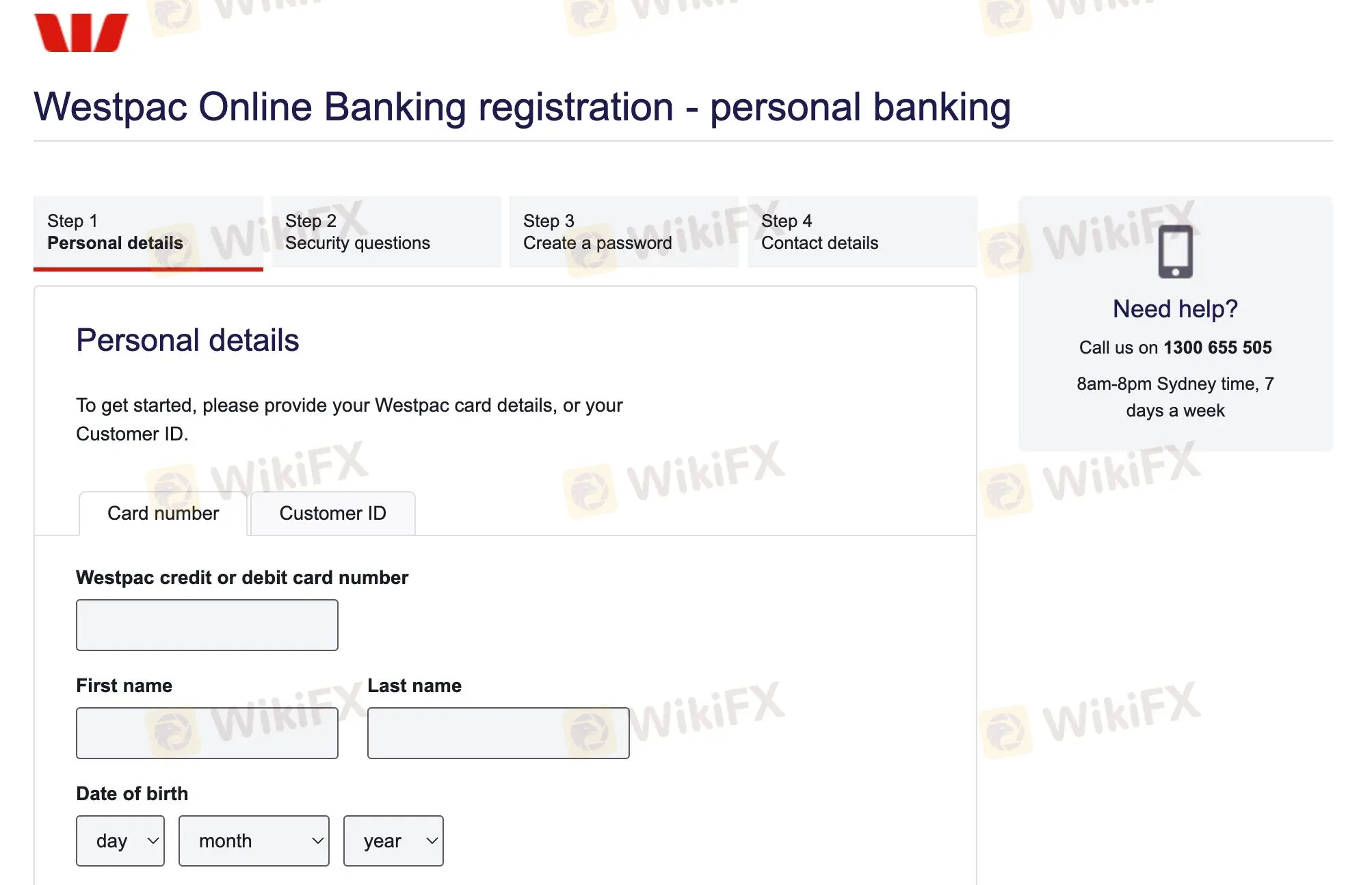

How to Open an Account

To open an account with Westpac, follow these steps.

Visit the Westpac website. Look for the “Register” button on the homepage, choose an category and click on it.

Taking Personal Account as an example: Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Download the platform and start trading

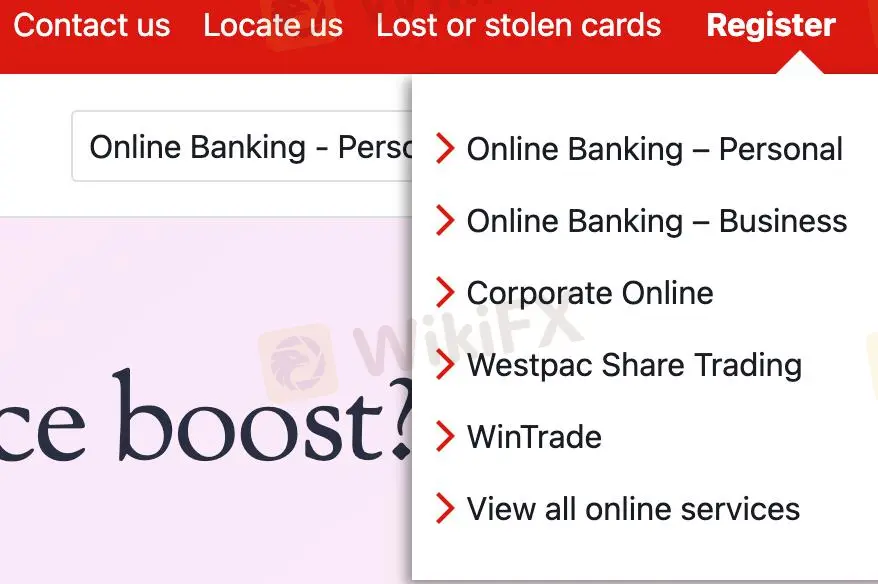

Trading Platforms

Westpac provides a variety of trading platforms tailored to meet the needs of personal, business, and corporate clients:

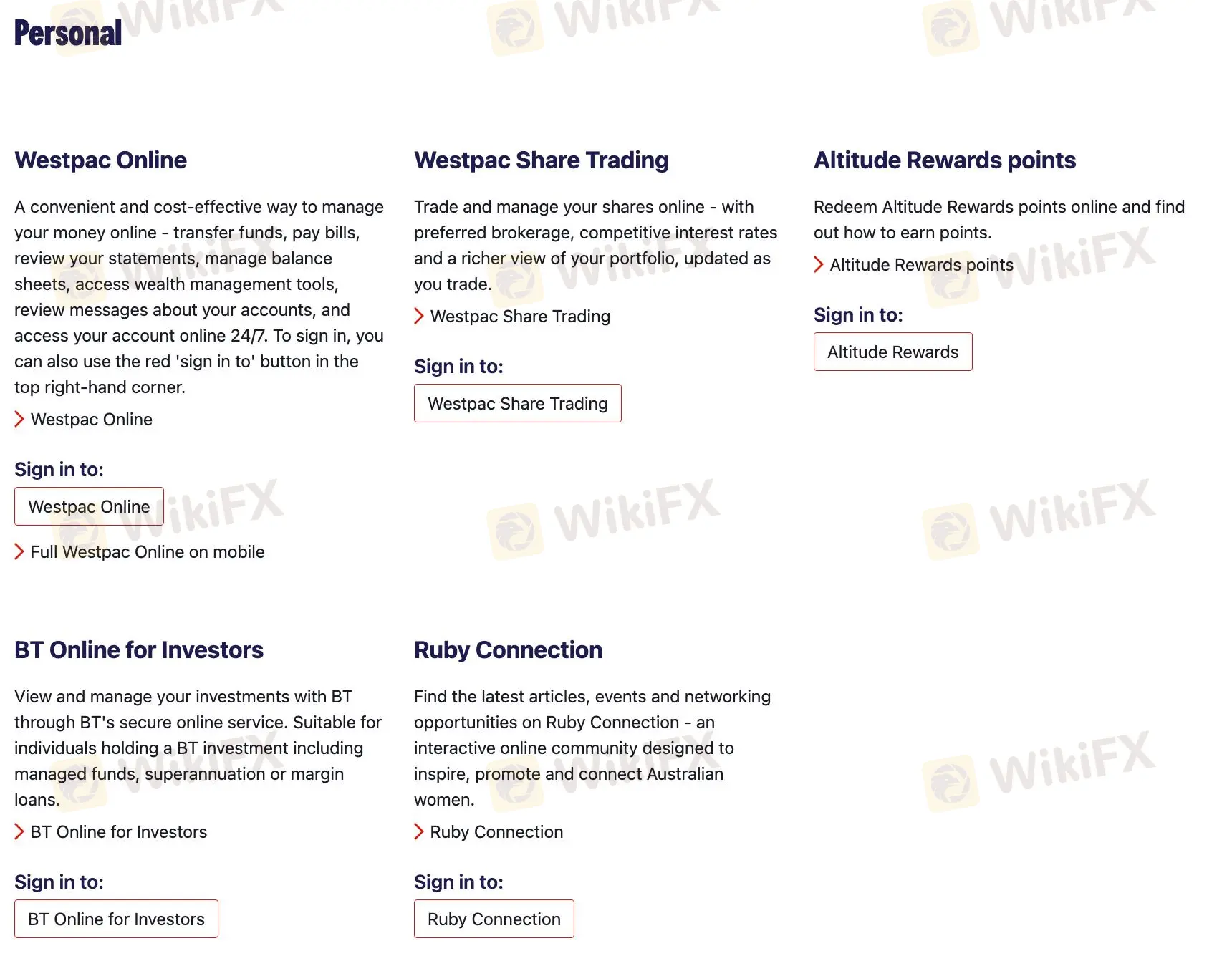

Personal:

Westpac Online: Offers 24/7 online access to manage money, transfer funds, pay bills, and access wealth management tools.

Westpac Share Trading: Allows trading and management of shares online with real-time portfolio updates.

Altitude Rewards: Online platform for redeeming and earning reward points.

BT Online for Investors: Secure online service for managing investments in managed funds, superannuation, or margin loans.

Ruby Connection: Online community for Australian women featuring articles, events, and networking opportunities.

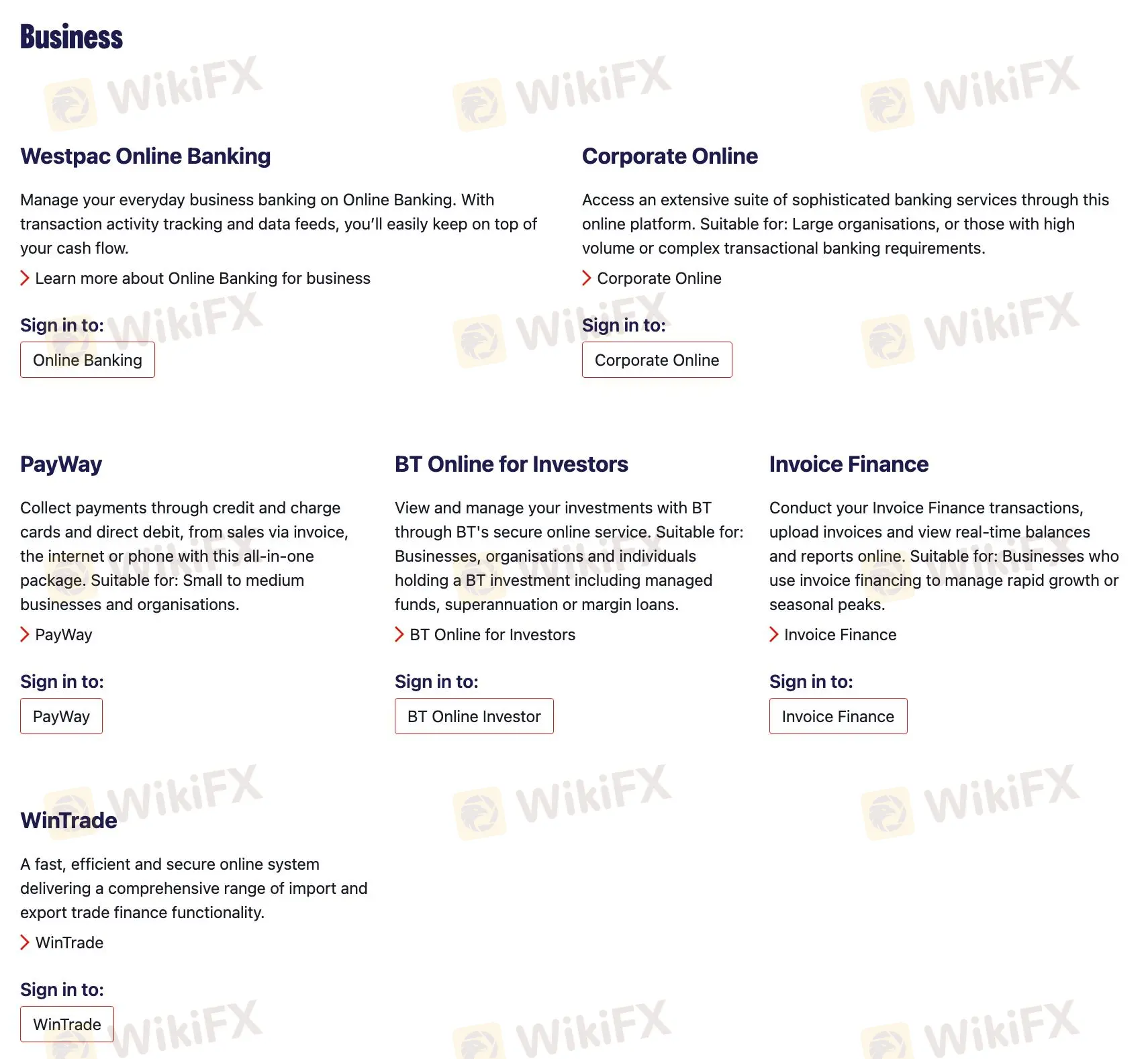

Business:

Westpac Online Banking: Online platform for managing everyday business banking and tracking transactions.

Corporate Online: Sophisticated online banking services for large organizations or those with complex needs.

PayWay: Integrated solution for collecting payments via cards and direct debit.

Invoice Finance: Online service for managing invoice financing, including uploading invoices and viewing balances.

WinTrade: Online system for comprehensive import and export trade finance functionality.

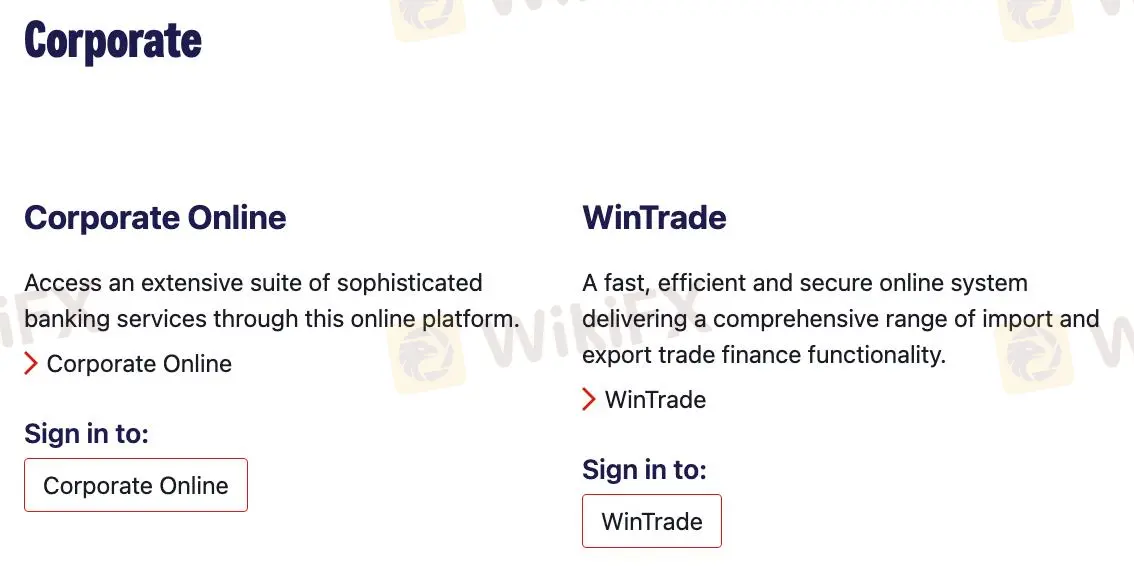

Corporate:

Corporate Online: Advanced online banking platform offering a wide range of services.

WinTrade: Secure system for managing a wide range of import and export trade finance services online.

Customer Support

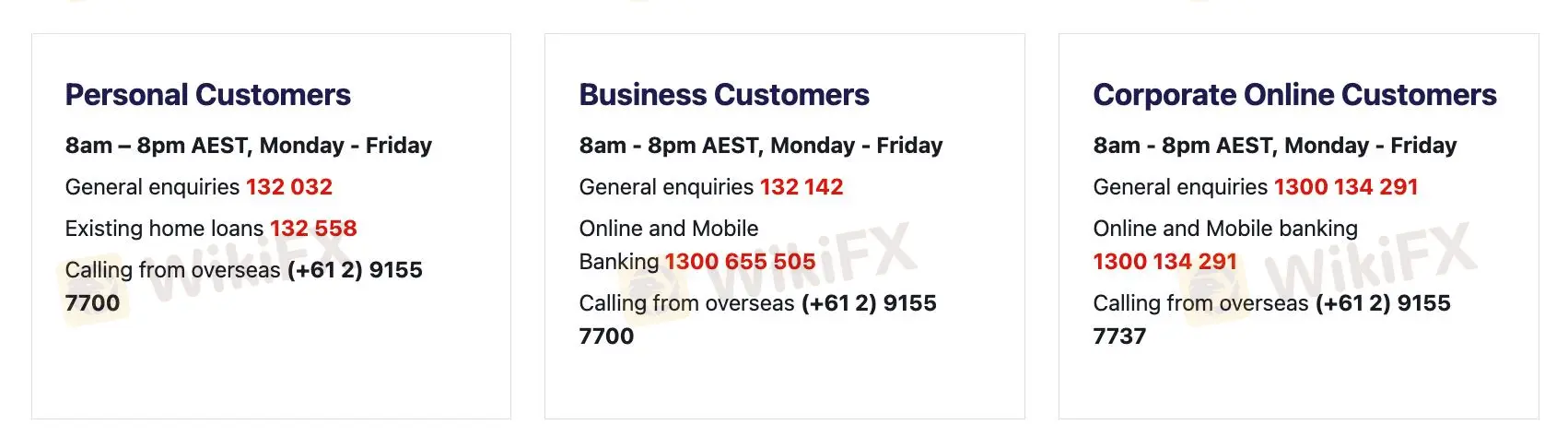

Westpac provides dedicated customer support services for personal, business, and corporate customers:

Personal Customers:

Hours: 8am – 8pm AEST, Monday Friday

General Enquiries: 132 032

Existing Home Loans: 132 558

Overseas: (+61 2) 9155 7700

Business Customers:

Hours: 8am 8pm AEST, Monday Friday

General Enquiries: 132 142

Online and Mobile Banking: 1300 655 505

Overseas: (+61 2) 9155 7700

Corporate Online Customers:

Hours: 8am 8pm AEST, Monday Friday

General Enquiries and Online/Mobile Banking: 1300 134 291

Overseas: (+61 2) 9155 7737

These support services are accessible during business hours on weekdays, offering both local and international assistance.

Educational Resources

Westpac's Investor Centre provides educational resources for investors, including management of shareholdings, dividend information, details on Westpac shares and other securities, financial reports, and investor events. It also offers direct access to investor relations and resources for fixed income investors, ensuring comprehensive support for financial decision-making.

Conclusion

Westpac stands as a robust financial institution with a strong regulatory framework, offering a wide range of services and advanced trading platforms. While it provides significant advantages like comprehensive customer support and diverse financial products, it faces limitations such as a primarily Australian focus and potentially higher fees. Overall, Westpac remains a solid choice for customers seeking reliable banking and financial services in Australia.

FAQs

Q: What regulatory body oversees Westpac?

A: Westpac is regulated by the Australian Securities & Investment Commission (ASIC) under license number 233714.

Q: What types of accounts can I open with Westpac?

A: Westpac offers various account types including transaction accounts, savings accounts, term deposits, and business accounts.

Q: How can I manage my investments with Westpac?

A: You can manage your investments through Westpac's Investor Centre and BT Online for Investors platform.

Q: Are there online trading options available at Westpac?

A: Yes, Westpac provides online trading options through platforms like Westpac Online, Westpac Share Trading, and WinTrade.

Q: What kind of customer support does Westpac offer?

A: Westpac offers customer support through dedicated phone lines, online banking support, and overseas contact options for personal, business, and corporate clients.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.