Company Summary

| Aspect | Information |

| Company Name | Tradoverse |

| Registered Country/Area | United Sates |

| Founded Year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | $50 |

| Market Instruments | stocks, currencies, futures, and ETFs |

| Account Types | Individual account,joint account |

| Commissions | 0 commissions |

| Trading Platforms | Tradoverse app |

| Demo Account | Available |

| Customer Support | Email:soporte@tradoverse.com |

| Deposit & Withdrawal | Bank transfer,credit/debit card |

Overview of Tradoverse

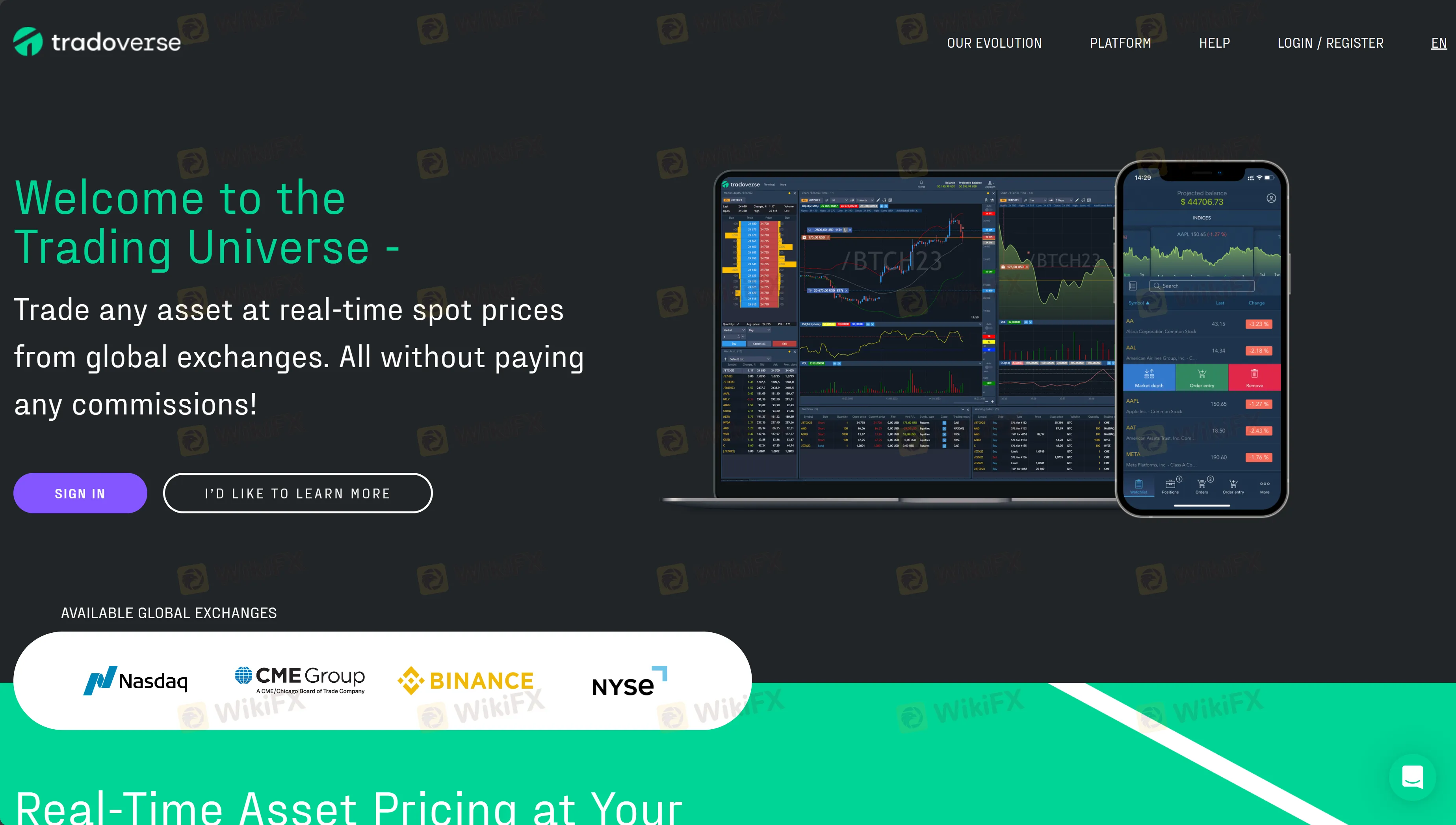

Tradoverse, established in 2022 in the United States, is an unregulated trading company offering a variety of market instruments such as stocks, currencies, futures, and ETFs. Catering to diverse trading preferences, it provides options for individual and joint accounts, both with a minimum deposit requirement of $50.

Notably, Tradoverse operates on a commission-free model and its trading activities are centered around its proprietary app. Additionally, the company supports a demo account for practice trading. For customer assistance, Tradoverse can be reached via email at soporte@tradoverse.com.

Regarding financial transactions, it accepts deposits and withdrawals through bank transfers and credit/debit cards.

Is Tradoverse Legit or a Scam?

Tradoverse is currently an unregulated trading entity. Being unregulated means that it operates without the oversight of financial regulatory authorities.

This lack of regulation can imply a higher risk for traders and investors, as regulatory bodies typically enforce standards and practices to protect consumer interests, ensure fair trading environments, and prevent fraud.

Potential clients of Tradoverse should be aware of these aspects when considering their investment options, as the absence of regulatory supervision might affect the recourse available in the event of disputes or financial discrepancies.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated |

| Low Minimum Deposit | New Company |

| No Commissions | Limited Customer Support Options |

| Trading Platform | Limited Deposit & Withdrawal Methods |

| Demo Account | Potential Risks for Investors |

Pros of Tradoverse:

Diverse Market Instruments: Offers a wide range of trading options including stocks, currencies, futures, and ETFs, catering to various investment preferences.

Low Minimum Deposit: With a minimum deposit of just $50, it's accessible to a broad range of investors, especially those starting with smaller capital.

No Commissions: The platform operates on a commission-free model, which can reduce trading costs for users.

Trading Platform: The availability of a dedicated Tradoverse app provides a convenient and potentially user-friendly trading experience.

Demo Account: Offers a demo account option, allowing new users to practice trading and get acquainted with the platform without financial risk.

Cons of Tradoverse:

Unregulated: As an unregulated entity, it lacks oversight by financial authorities, which could increase the risk of unfair practices and limit user protection.

New Company: Being founded in 2022, it has a limited track record, which may make it difficult to assess its long-term reliability and performance.

Limited Customer Support Options: Customer support is primarily via email, which may not be as immediate or comprehensive as other support channels like phone or live chat.

Limited Deposit & Withdrawal Methods: The platform accepts only bank transfers and credit/debit card transactions, which may not be convenient for all users.

Potential Risks for Investors: The combination of being unregulated and relatively new might pose higher risks for investors compared to established, regulated platforms.

Market Instruments

Tradoverse offers a diverse array of market instruments, enabling traders to expand their investment portfolios across various asset classes:

Stocks:

Tradoverse provides opportunities for trading in a broad spectrum of stocks. This allows traders to invest in shares of various companies, potentially capitalizing on the growth and performance of these businesses across different sectors and regions.

Currencies:

The platform enables trading in currency pairs, encompassing major, minor, and possibly exotic pairs. This feature is particularly appealing for those looking to trade in the forex market, leveraging the fluctuations in global currency values.

Futures:

Tradoverse offers futures trading, which involves contracts that obligate traders to buy or sell an asset at a predetermined future date and price. This can be an effective way for traders to speculate on or hedge against the future price movements of various assets.

ETFs (Exchange-Traded Funds):

The platform provides access to ETFs, which are investment funds traded on stock exchanges, much like stocks. ETFs often track an index, commodity, bonds, or a basket of assets, offering a diversified investment option for traders.

By providing a variety of market instruments, Tradoverse caters to different trading strategies and preferences, allowing investors to diversify their portfolios from traditional stock trading to the more specialized areas of futures and ETFs.

Account Types

Tradoverse offers two main types of accounts, catering to different needs and preferences of traders:

Individual Account:

This account type is designed for single users. It's ideal for individual traders who want to manage their investments personally. An individual account gives the user complete control over their trading decisions and financial management, making it suitable for solo traders with specific investment strategies and goals.

Joint Account:

The joint account option is tailored for two or more individuals who wish to manage a trading account together. This type of account is typically used by partners, family members, or close associates who want to pool their resources for trading purposes. It allows for shared decision-making and investment, which can be beneficial for those looking to combine their expertise or financial resources.

Both account types require a minimum deposit of $50 to start trading, making them accessible to a wide range of investors, from beginners to more experienced traders. The choice between an individual and a joint account depends on the users preference for independent trading or collaborative investment strategies.

How to Open an Account?

Opening an account with Tradoverse can be a straightforward process, typically involving the following steps:

Visit the Tradoverse Website or App:

Start by navigating to the Tradoverse website or downloading their trading app. This is your entry point to accessing their services and beginning the account creation process.

Choose the Account Type:

Select the type of account you wish to open, either an individual or a joint account. Make sure you understand the features and requirements of each account type to choose the one that best suits your trading needs and circumstances.

Fill Out the Registration Form:

Complete the registration form with your personal details. This will likely include your name, contact information, and possibly financial details or trading experience. Ensure that all information provided is accurate and up-to-date to comply with any verification processes.

Deposit Funds:

Once your account is set up, youll need to deposit funds to start trading. The minimum deposit for Tradoverse accounts is $50. You can choose your preferred method of deposit, such as bank transfer or credit/debit card, as per the options provided by Tradoverse.

After completing these steps, your account should be ready for use. It's recommended to familiarize yourself with the trading platform and consider starting with a demo account if you're new to trading.

Commissions

Tradoverse operates on a 0 commission model, which means that traders using their platform are not charged any commission fees on their trades. This approach can be particularly appealing to both novice and experienced traders as it allows for cost-effective trading, enhancing the potential for better net returns on investments.

The absence of commission fees is advantageous for those who engage in frequent trading or those who are starting with a smaller capital, as it reduces the overall cost of trading activities.

However, it's important for users to be aware of any other possible fees or charges that might apply, such as spreads, overnight fees, or withdrawal fees, to fully understand the cost structure of trading with Tradoverse.

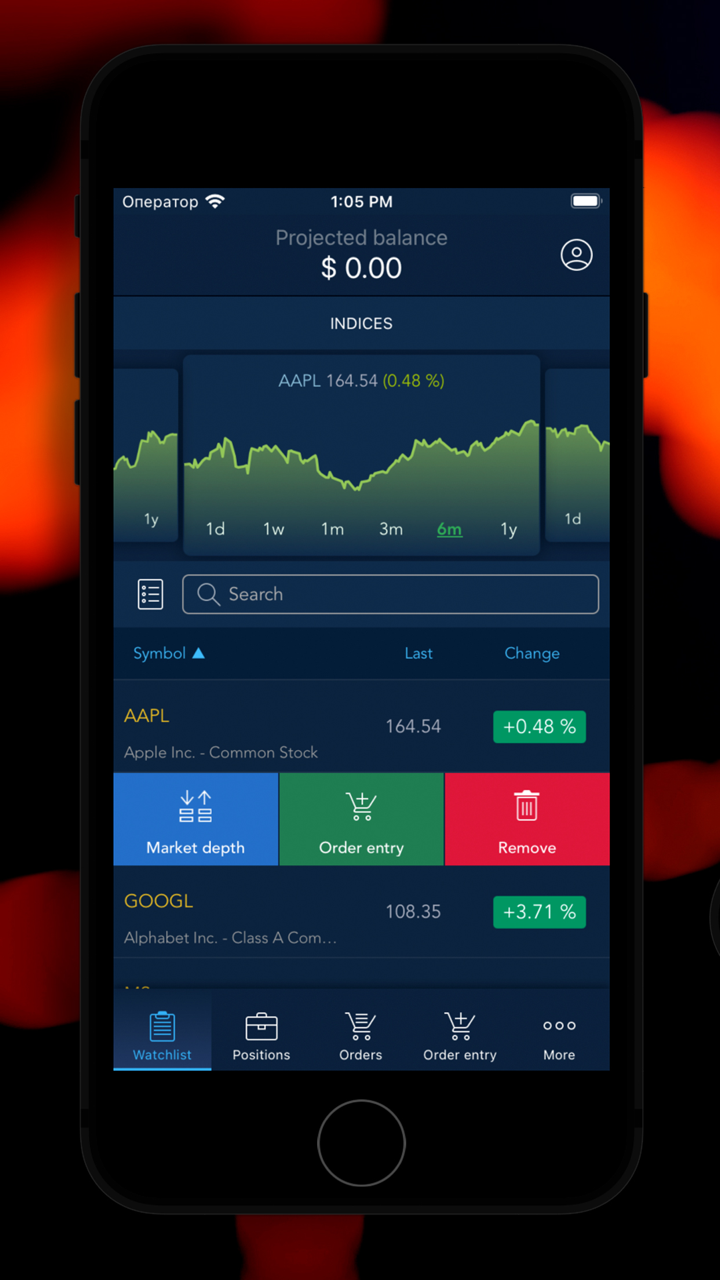

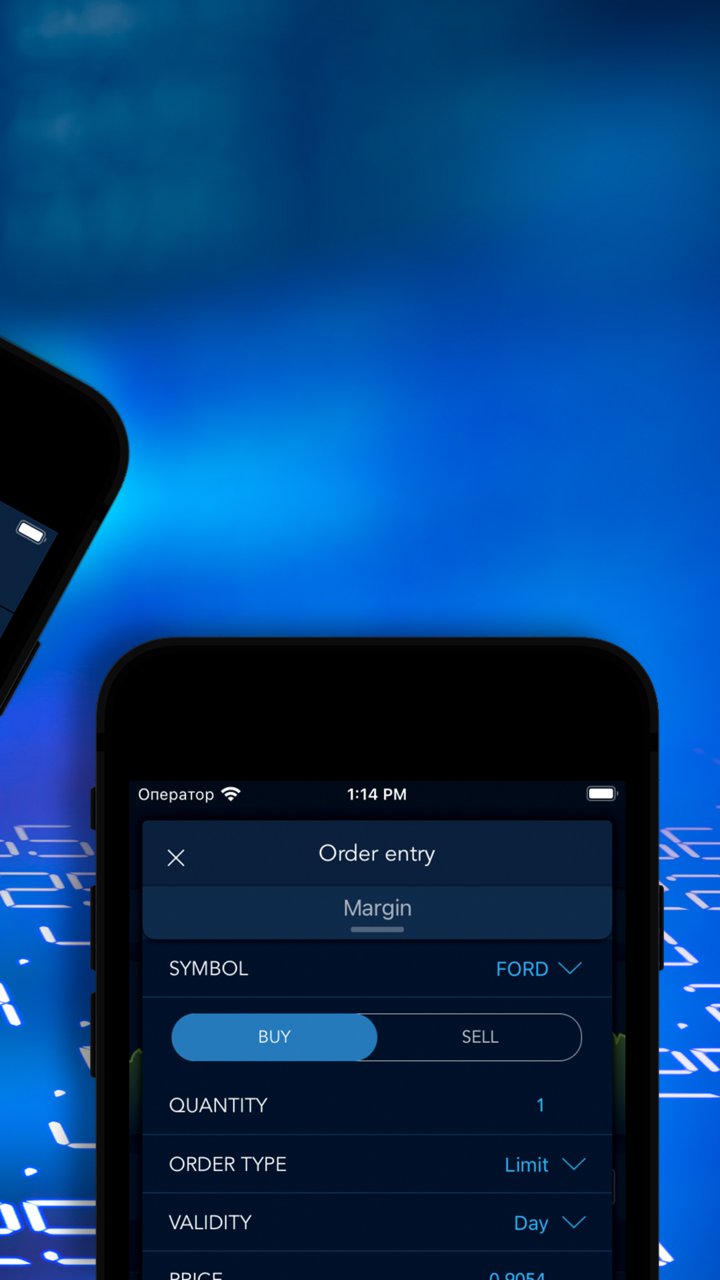

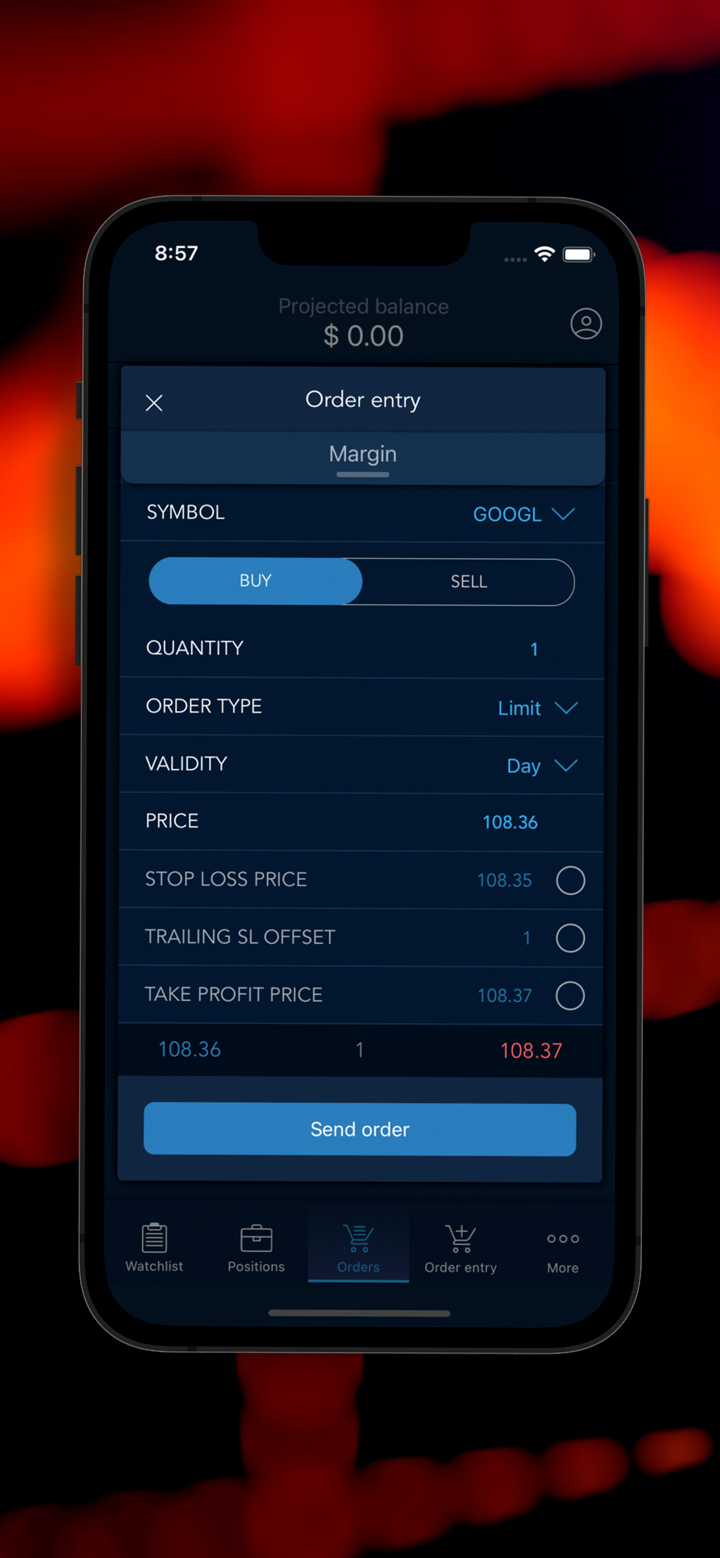

Trading Platform

Tradoverse recognizes the importance of flexibility and mobility in modern trading, and therefore, offers a comprehensive mobile app designed to cater to these needs. This app allows traders to engage in trading activities from any location, providing a seamless trading experience on-the-go.

Available for both iOS and Android devices, and also accessible via a web platform, the app ensures that traders can access all of Tradoverse's trading tools and features right from their smartphones.

This level of accessibility is ideal for those who are constantly moving, be it commuting or traveling, as it offers the convenience to trade anytime and anywhere, ensuring that users never miss out on potential trading opportunities.

Deposit & Withdrawal

For deposit and withdrawal transactions, Tradoverse offers a streamlined and user-friendly process to ensure ease of financial management for its traders:

Payment Methods:

Tradoverse accepts deposits and processes withdrawals through two primary payment methods: bank transfers and credit/debit cards. These widely-used methods provide a level of convenience and accessibility for most traders.

Minimum Deposit:

The platform requires a minimum deposit of $50. This relatively low threshold makes it accessible for a wide range of traders, from beginners to those who prefer starting with a smaller investment.

When it comes to withdrawals, it's important for users to be aware of any processing times or potential fees that might be associated with their chosen method.

Customer Support

Tradoverse offers customer support primarily through 24/7 email, with their support address being soporte@tradoverse.com. This email-based support system allows users to reach out with any inquiries, concerns, or issues they may encounter while using the platform.

Conclusion

In conclusion, Tradoverse presents itself as a versatile trading platform, catering to modern traders with its mobile app for on-the-go trading, and offering a range of market instruments including stocks, currencies, futures, and ETFs.

It's accessible to a wide audience with a low minimum deposit of $50 and the appeal of a commission-free model. However, potential clients should carefully consider the implications of it being an unregulated entity, especially regarding the security and protection of their investments.

The platform provides two types of accounts - individual and joint - and supports basic payment methods for deposits and withdrawals. Customer support is primarily via email, which might require consideration of response times.

FAQs

Q:How can I open an account with Tradoverse?

A:To open an account, visit the Tradoverse website or download their app, select the type of account (individual or joint), fill out the registration form, and deposit a minimum of $50.

Q:What are the account types available on Tradoverse?

A:Tradoverse offers two types of accounts: individual accounts for single users and Joint accounts for two or more individuals.

Q:Is there a minimum deposit required to start trading on Tradoverse?

A:Yes, Tradoverse requires a minimum deposit of $50 to start trading.

Q:What trading platform does Tradoverse use?

A:Tradoverse provides a mobile trading app available for iOS and Android devices, as well as a web platform, enabling trading flexibility and mobility.

Q:How does Tradoverse handle deposits and withdrawals?

A:Deposits and withdrawals can be made via bank transfers and credit/debit cards. Users should be aware of any potential processing times or fees.

Q:How can I contact Tradoverse customer support?

A:Customer support can be reached through their email address soporte@tradoverse.com.