مقدمة عن الشركة

| CHIEFملخص المراجعة | |

| تأسست | 1979 |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | منظم |

| أدوات السوق | الأوراق المالية والعقود الآجلة |

| حساب تجريبي | ❌ |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | Chief Deal |

| الحد الأدنى للإيداع | / |

| دعم العملاء | البريد الإلكتروني: cs@chiefgroup.com.hk |

| وسائل التواصل الاجتماعي: فيسبوك، لينكد إن، يوتيوب، واتساب، ويشات | |

معلومات CHIEF

CHIEF، تأسست في هونغ كونغ عام 1979. تخضع حاليًا للتنظيم من قبل هيئة الأوراق المالية وتقدم بشكل رئيسي تداول الأوراق المالية والعقود الآجلة ولديها منصة تداول خاصة بها.

المزايا والعيوب

| المزايا | العيوب |

| تخضع للتنظيم من قبل هيئة الأوراق المالية | لا يتم دعم MT4/5 |

| لا تتوفر حسابات تجريبية |

هل CHIEF شرعي؟

| البلد/المنطقة المنظمة |  |

| السلطة المنظمة | هيئة الأوراق المالية |

| الكيان المنظم | شركة Chief Commodities Limited |

| نوع الترخيص | التعامل في عقود الآجلة |

| رقم الترخيص | AAZ607 |

| الحالة الحالية | منظم |

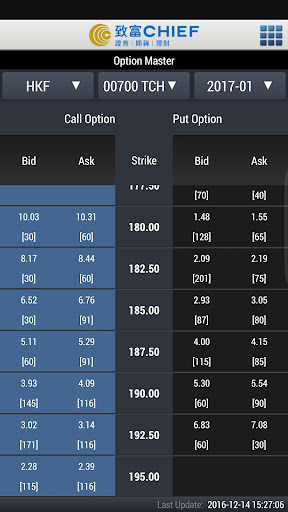

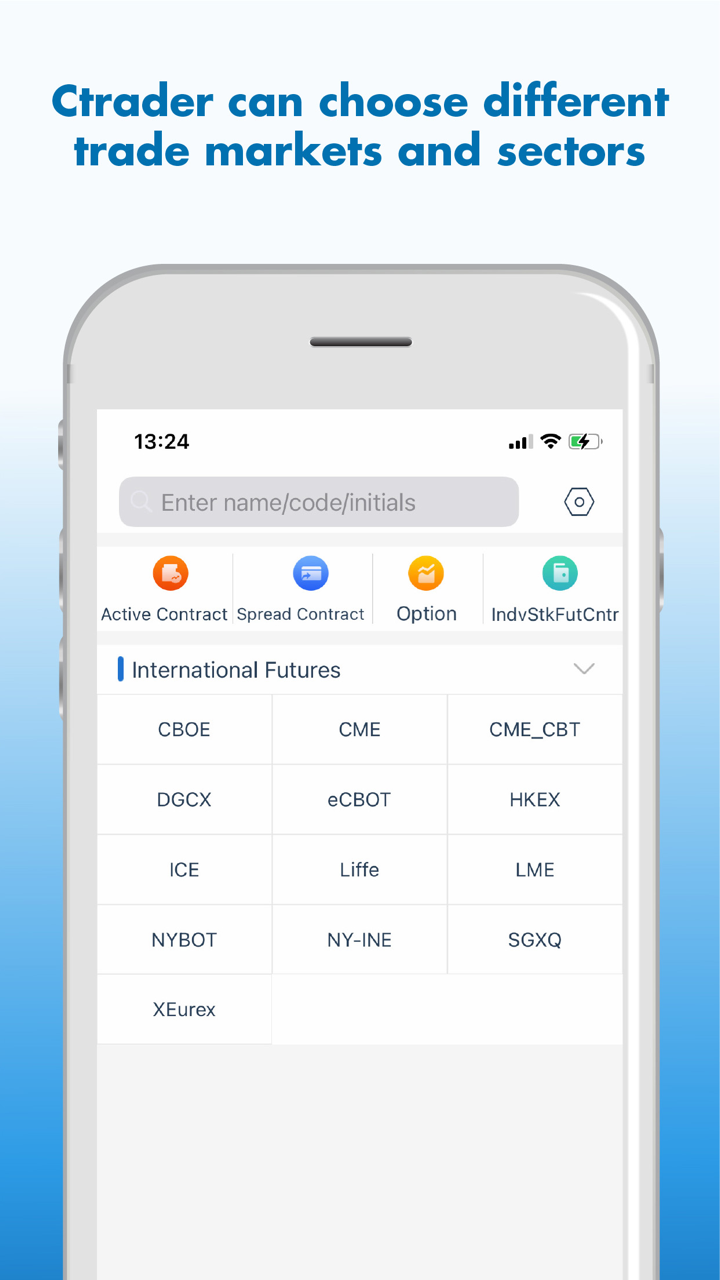

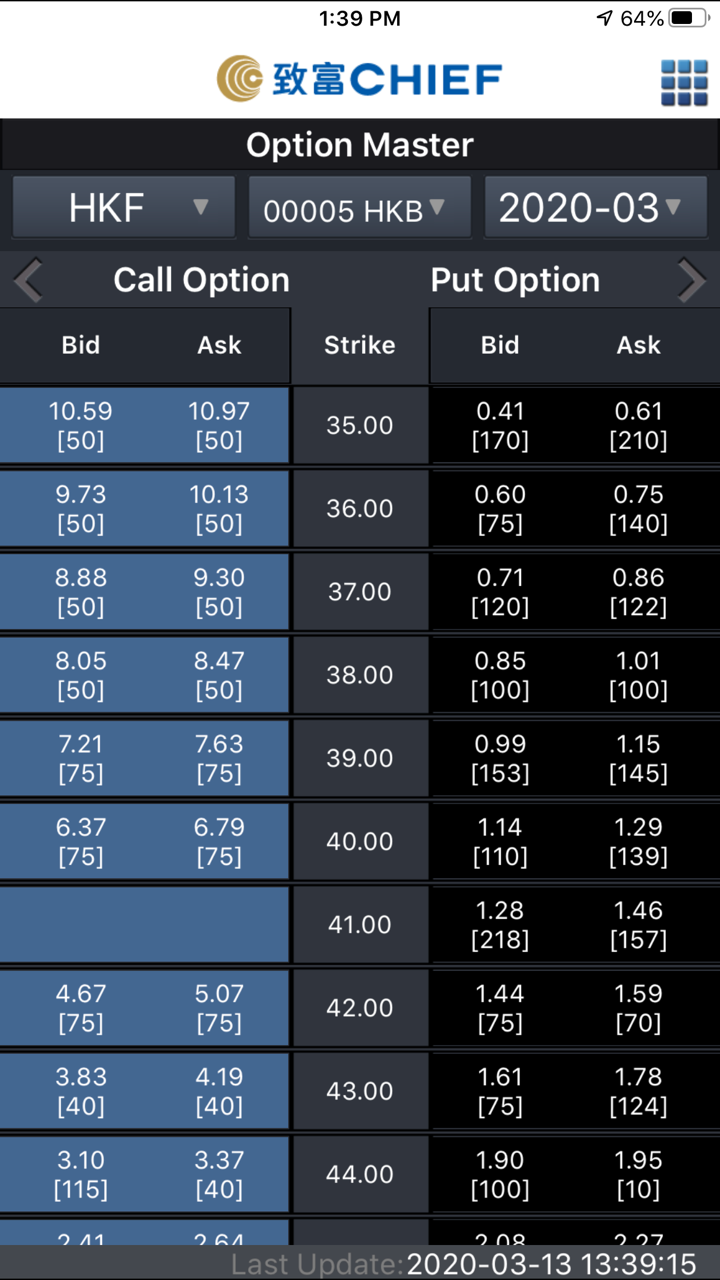

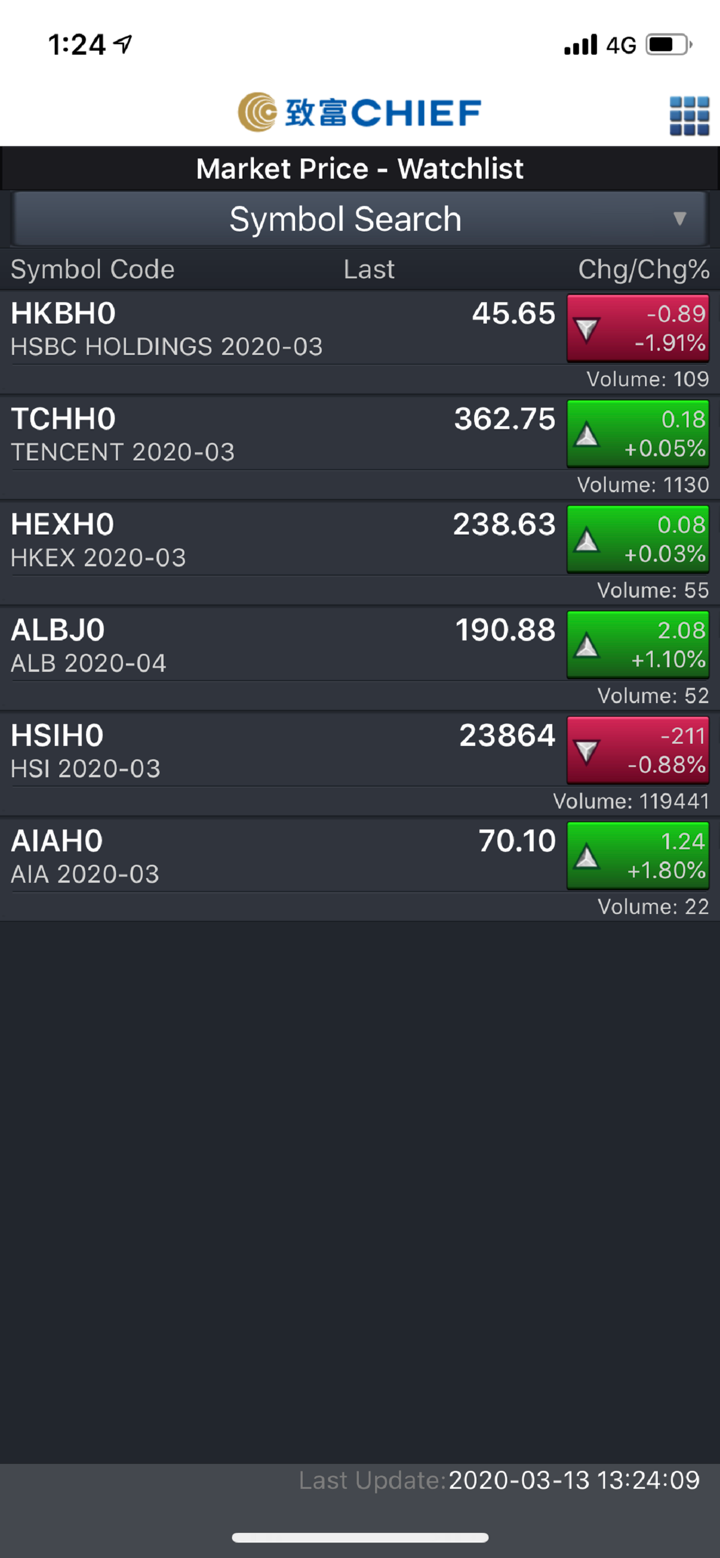

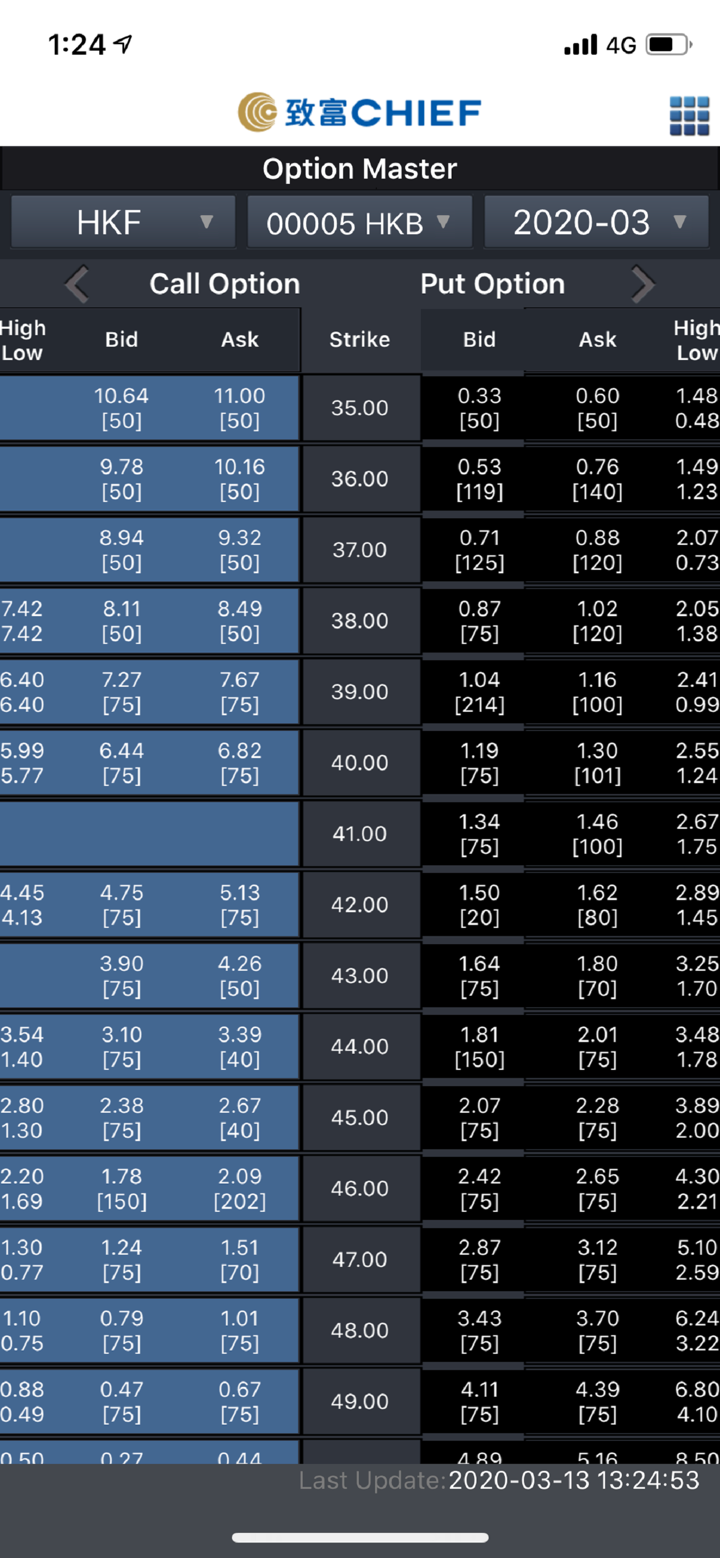

ما يمكنني التداول به على CHIEF؟

CHIEF يدعمك في التداول في الأوراق المالية والعقود الآجلة.

| أدوات التداول | مدعوم |

| الأوراق المالية | ✔ |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| المعادن الثمينة والسلع | ❌ |

| المؤشرات | ❌ |

| السندات | ❌ |

| صناديق المؤشرات المتداولة | ❌ |

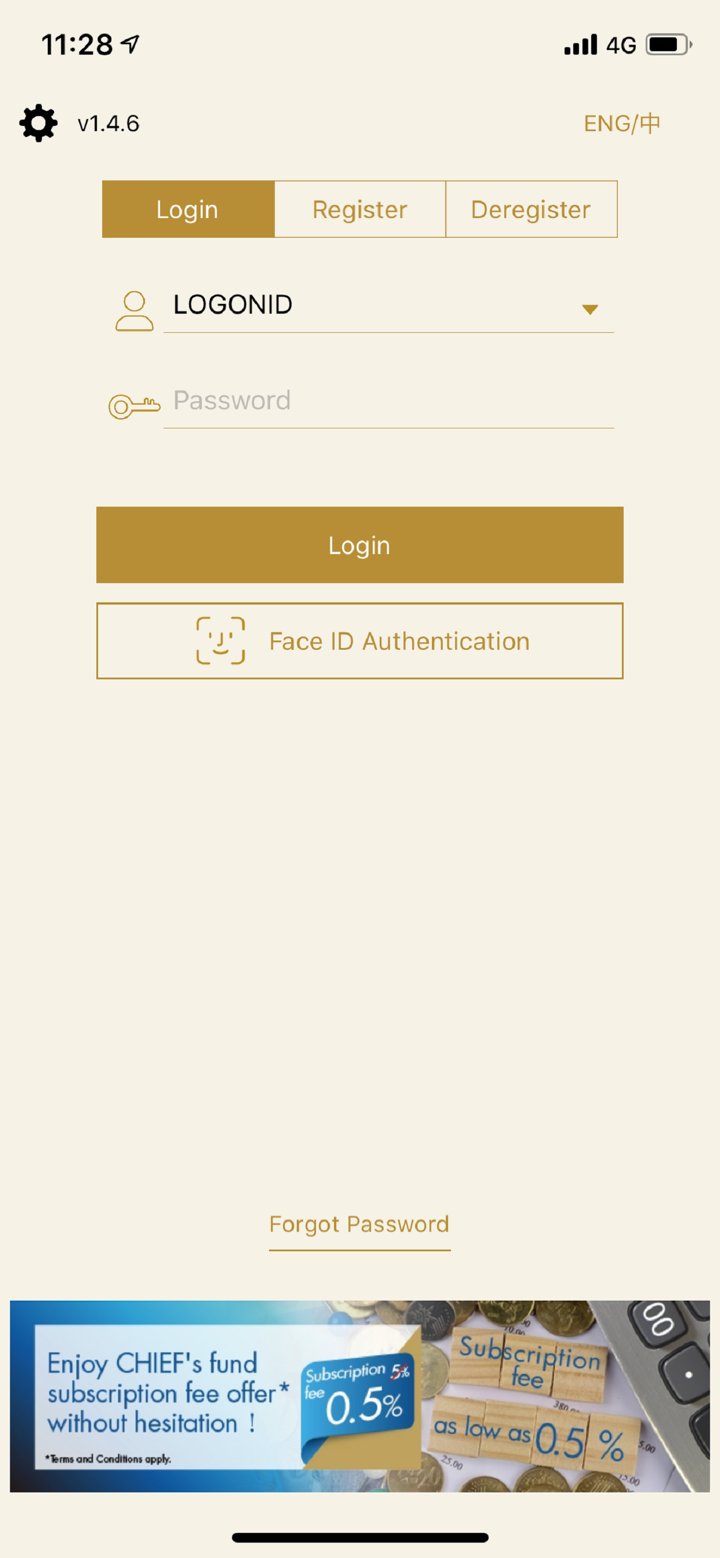

أنواع الحسابات

CHIEF لم يقدم معلومات الحساب. ومع ذلك، تتوفر طرق فتح الحساب المدعومة هي "تعيين فتح الحساب عن بعد"، وفتح الحساب شخصيًا وفتح الحساب عن طريق البريد. يمكنك الرجوع إلى: https://www.chiefgroup.com.hk/hk/account?apply=e-account

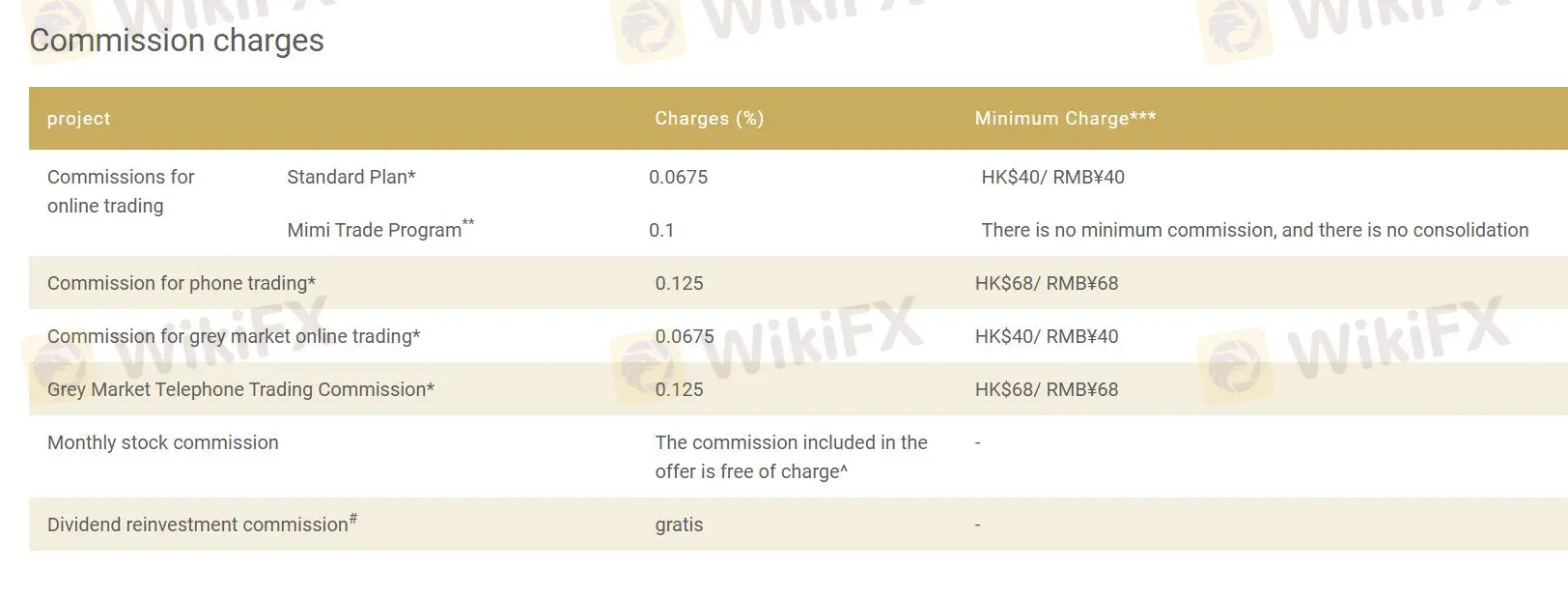

CHIEF الرسوم

CHIEF يدعم بعض المشاريع بدون عمولة، ومعدل العمولة للمشروع لا يتجاوز 0.2%. الرسوم الدنيا تتراوح من HK $40 إلى HK $68 و RMB ¥40 إلى RMB ¥68.

| المشروع | الرسوم (%) | الحد الأدنى للرسوم**** |

| عمولات التداول عبر الإنترنت | ||

| الخطة القياسية* | 0.0675 | HK$40 / RMB¥40 |

| برنامج التداول الصغير** | 0.1 | لا يوجد حد أدنى للعمولة، لا يوجد تجميع |

| عمولة التداول عبر الهاتف* | 0.125 | HK$68 / RMB¥68 |

| عمولة التداول عبر الإنترنت في السوق الرمادي* | 0.0675 | HK$40 / RMB¥40 |

| عمولة التداول عبر الهاتف في السوق الرمادي* | 0.125 | HK$68 / RMB¥68 |

| عمولة الأسهم الشهرية | العمولة المدرجة في العرض مجانية* | - |

| عمولة إعادة استثمار الأرباح# | مجانًا | - |

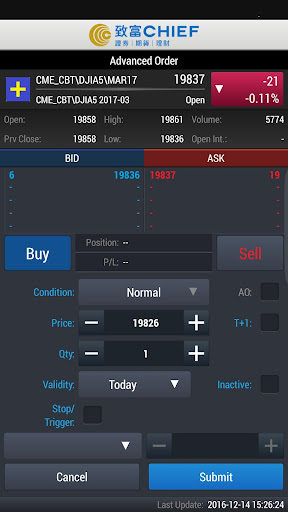

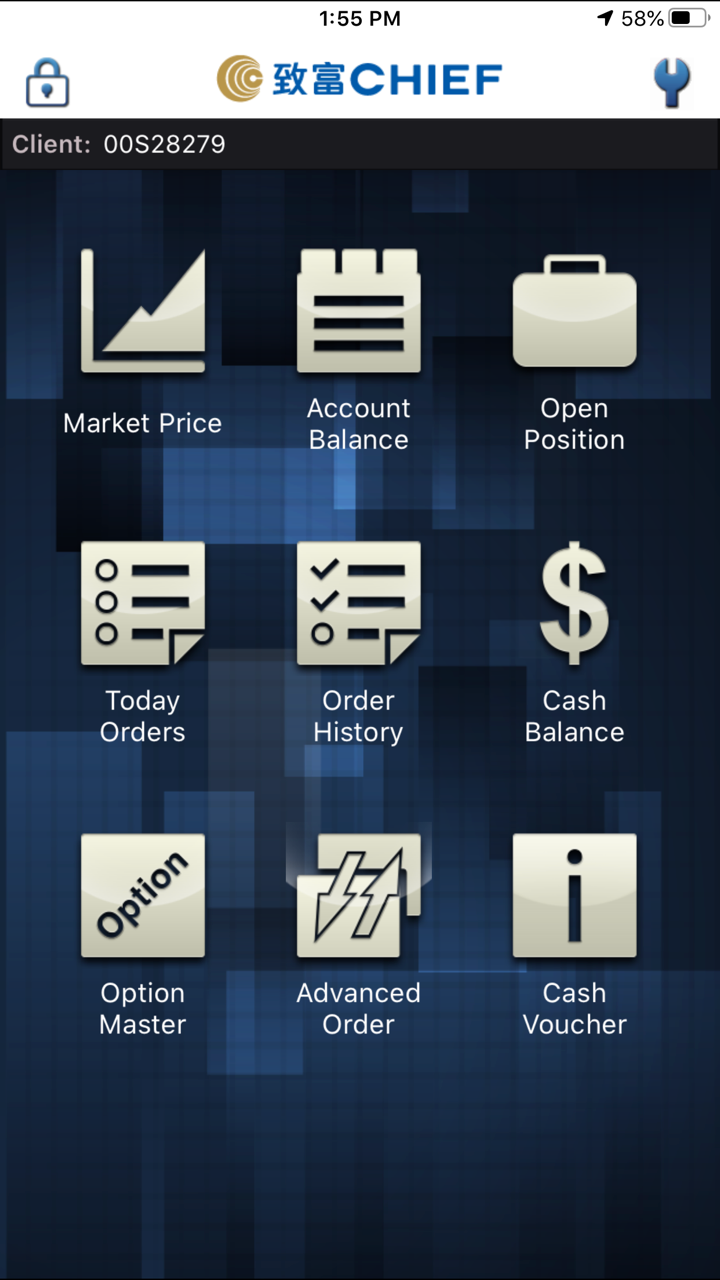

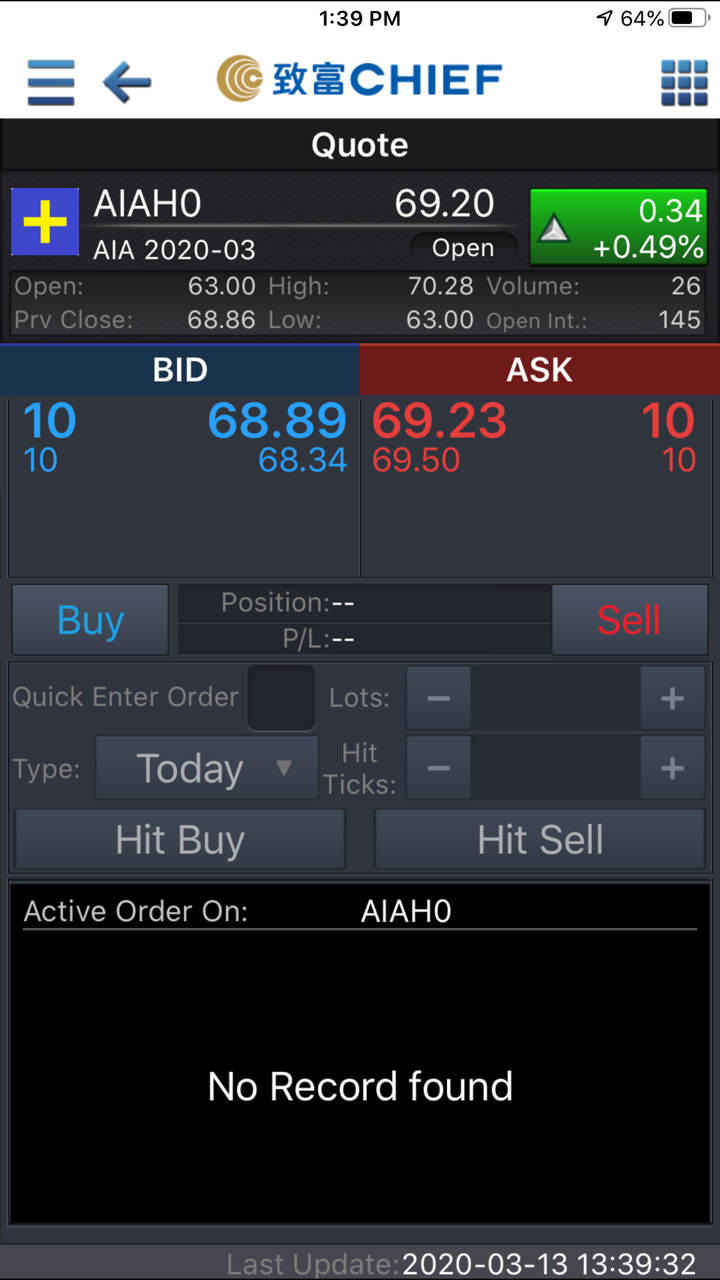

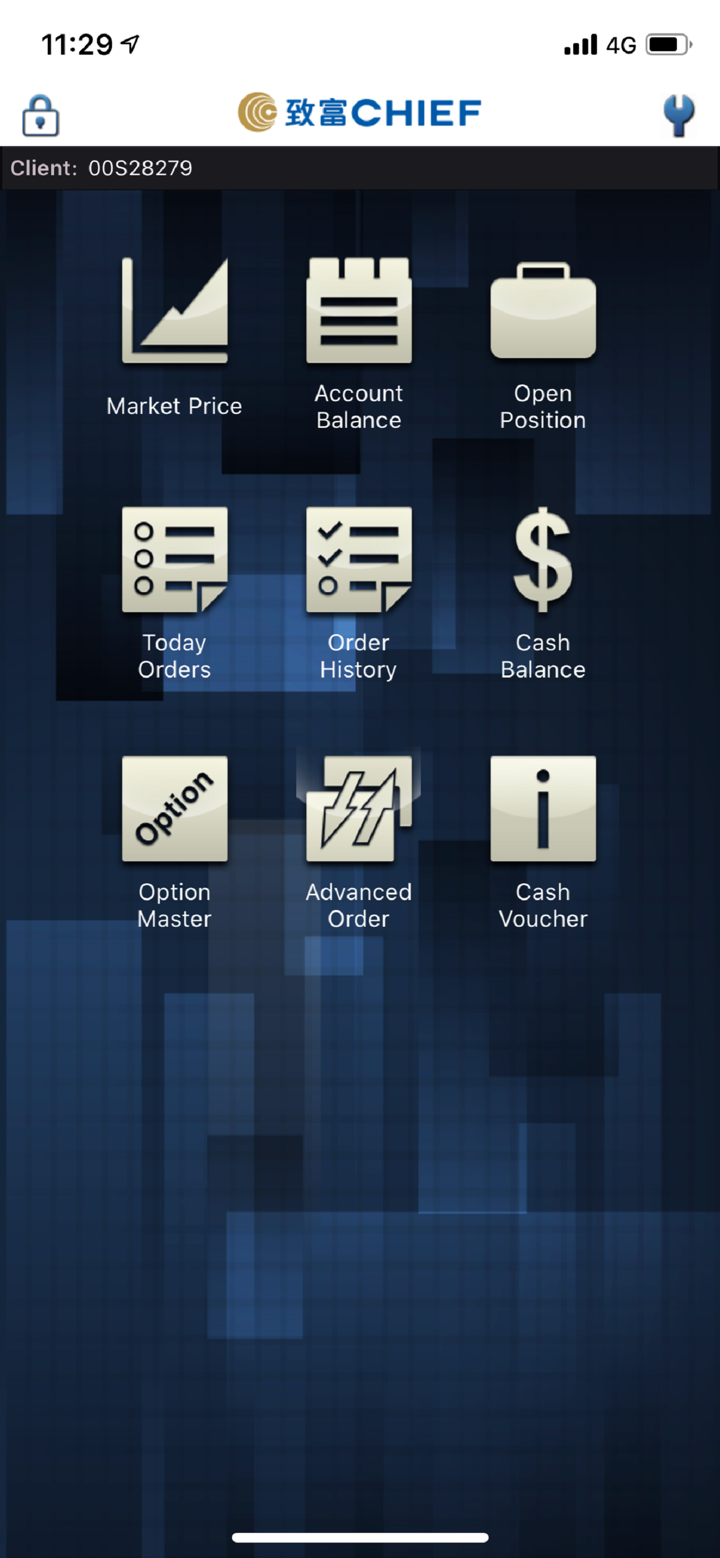

منصة التداول

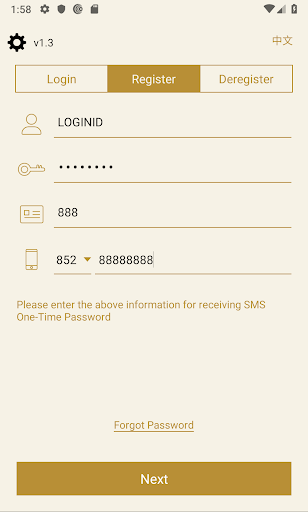

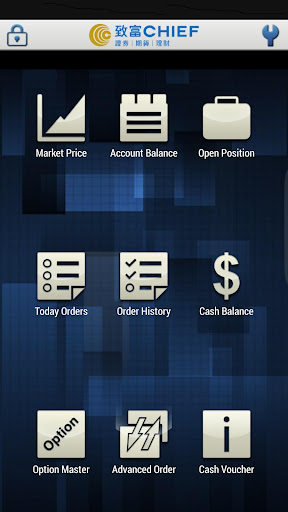

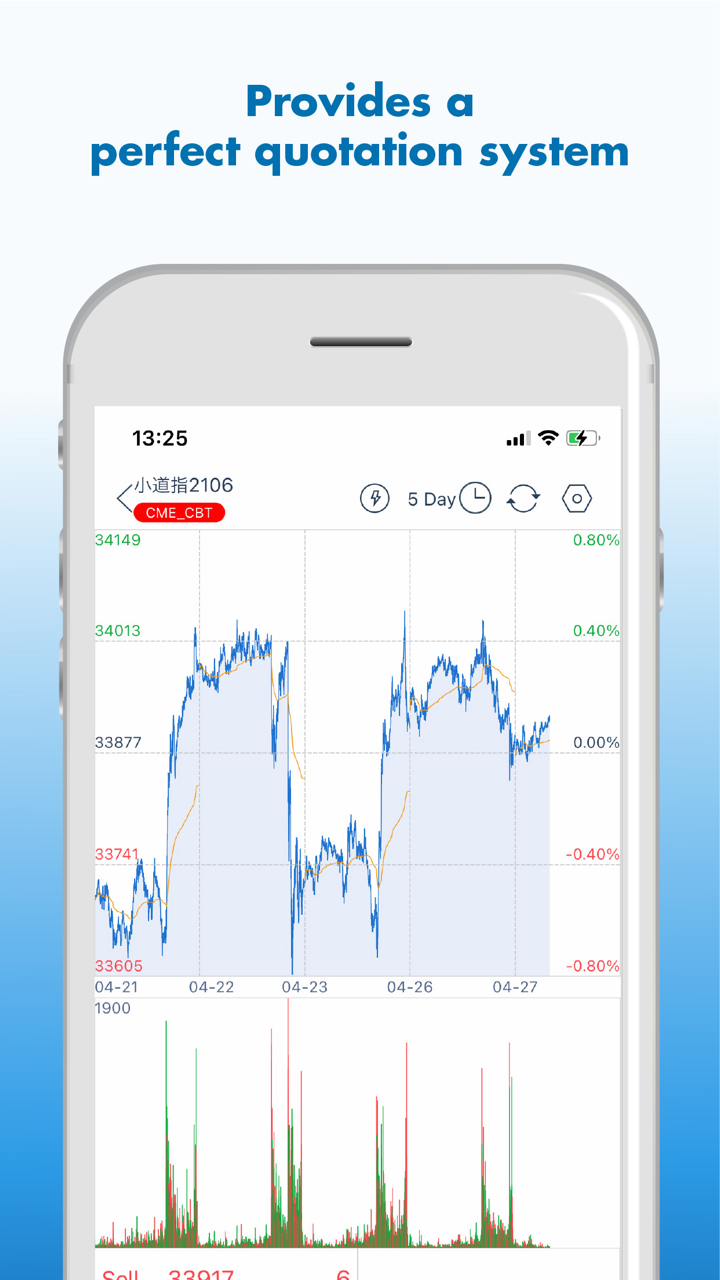

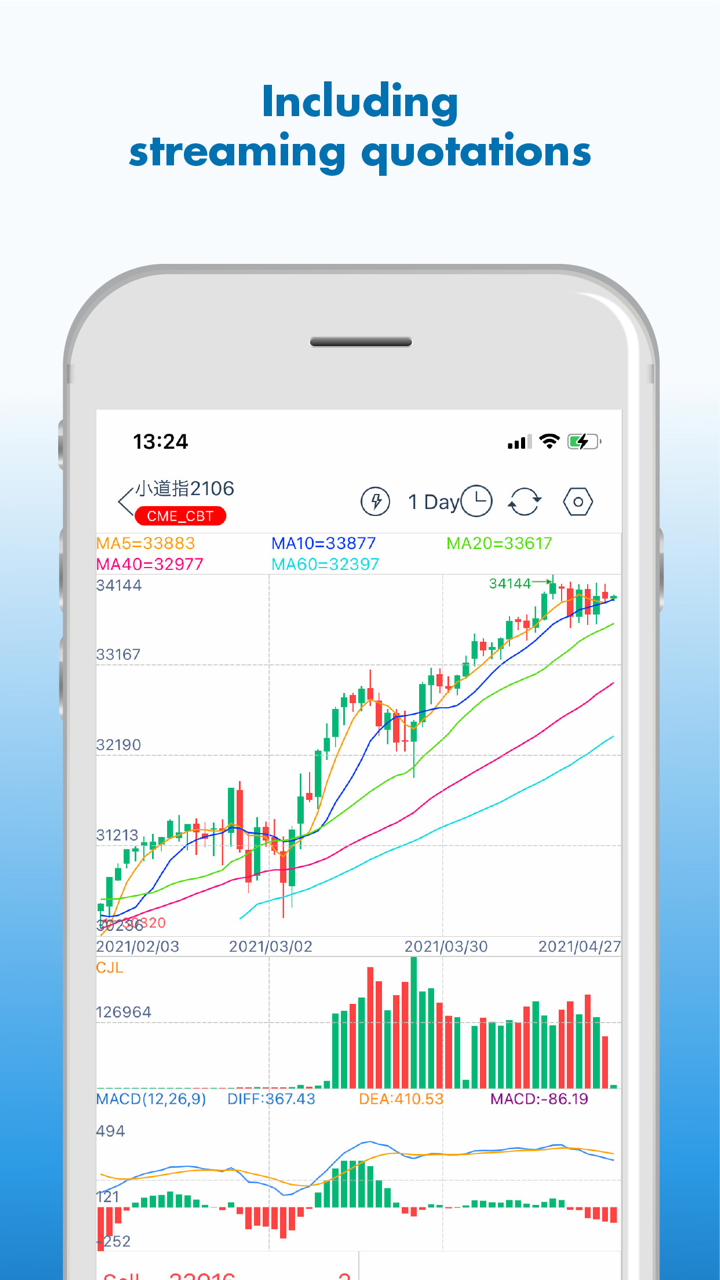

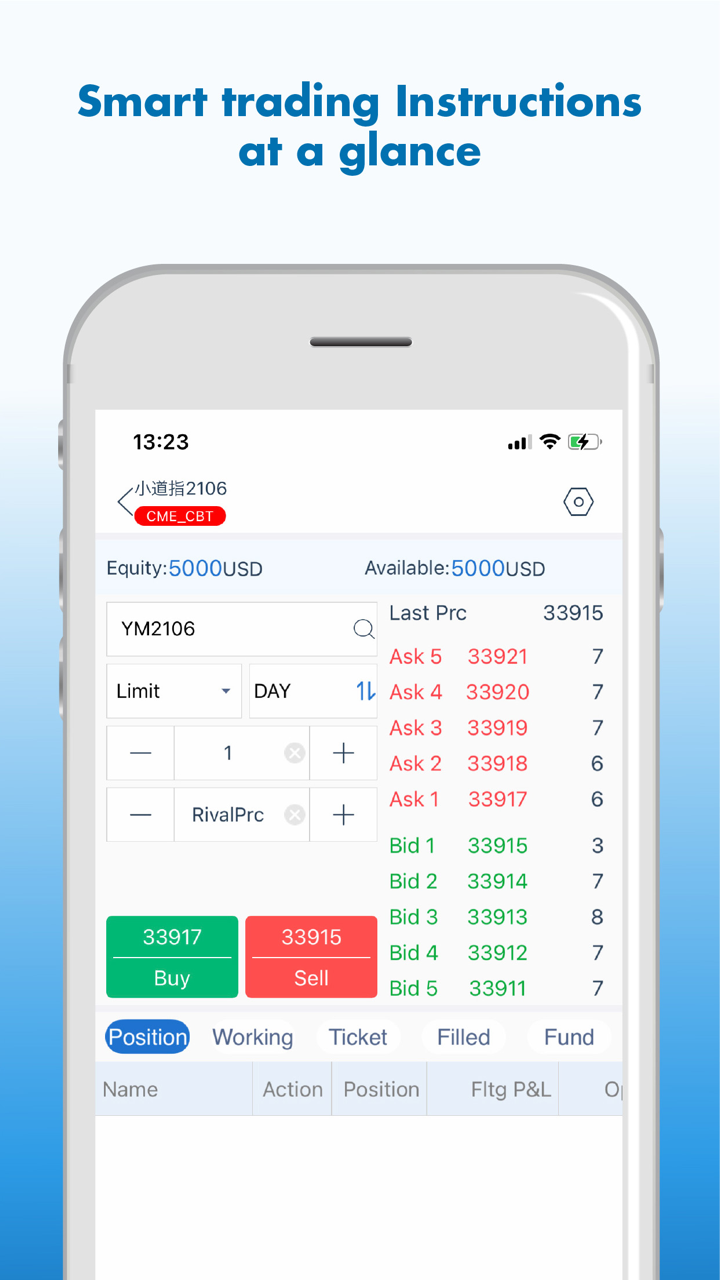

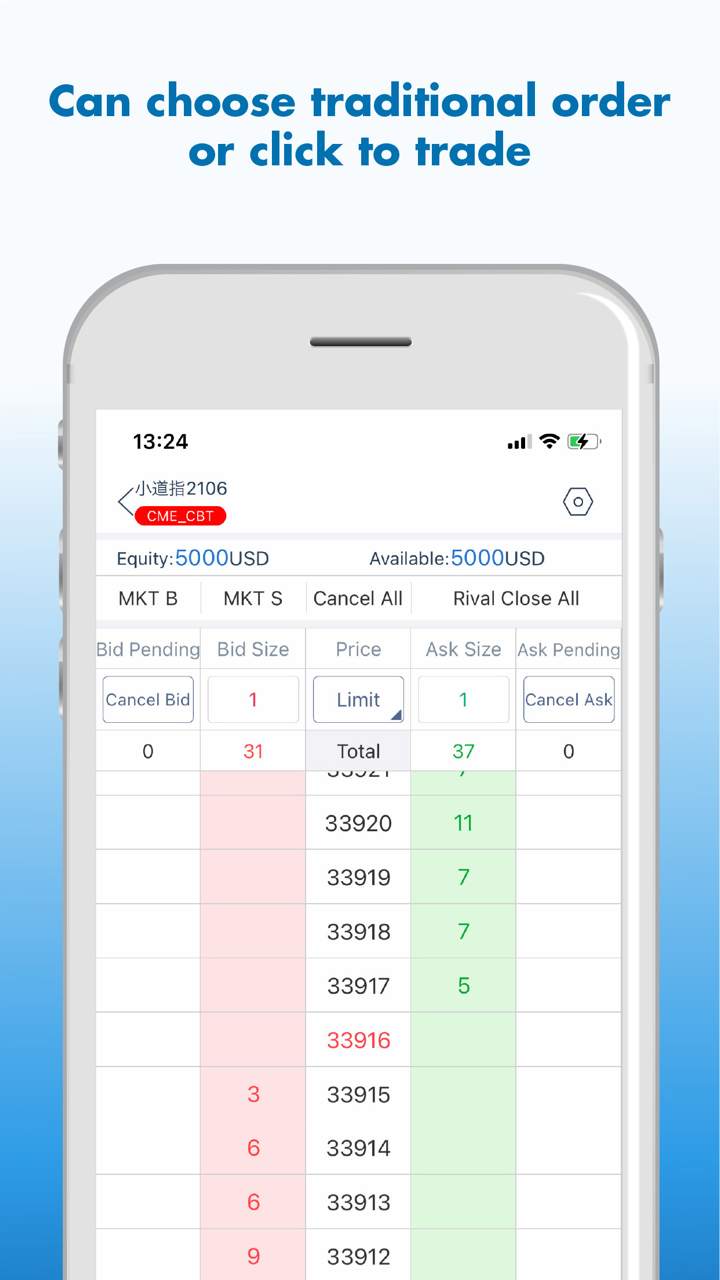

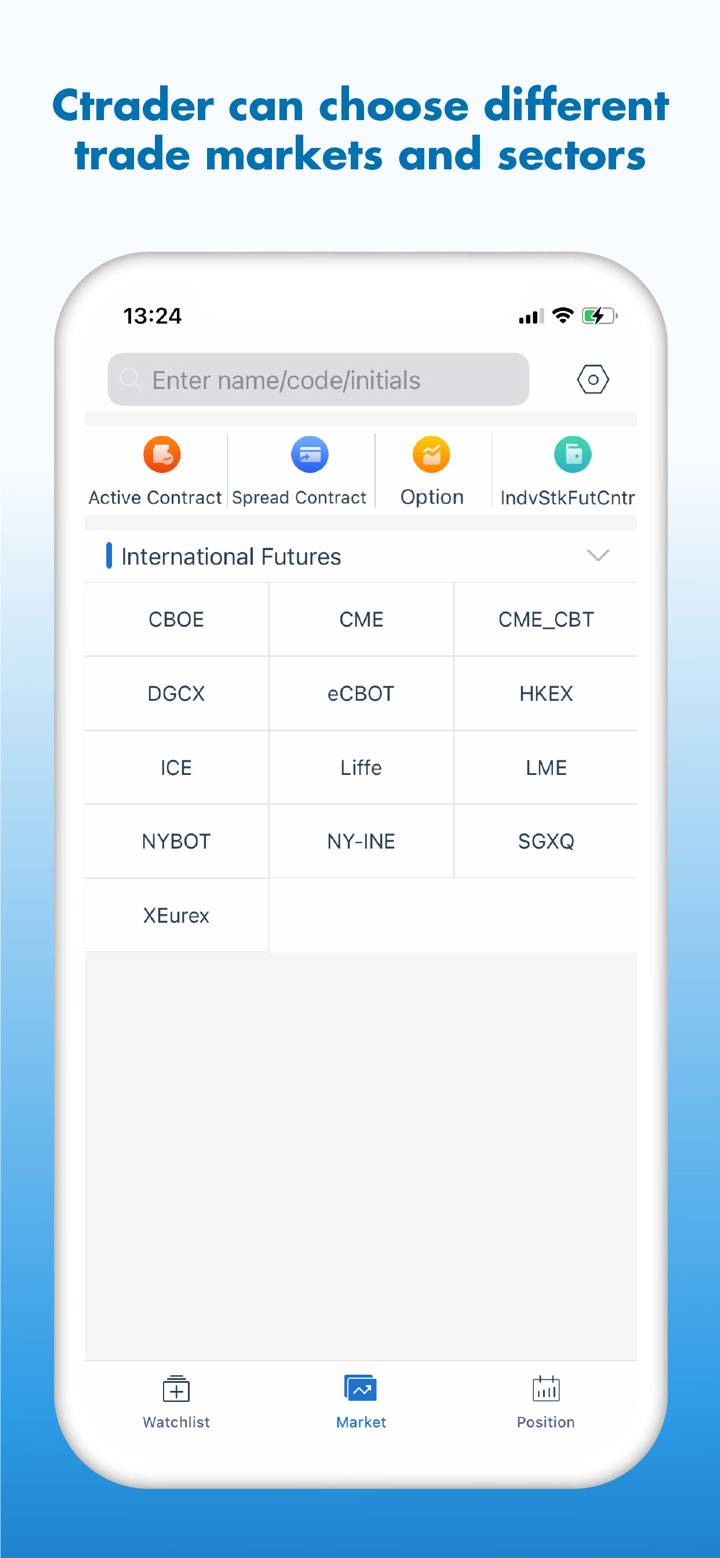

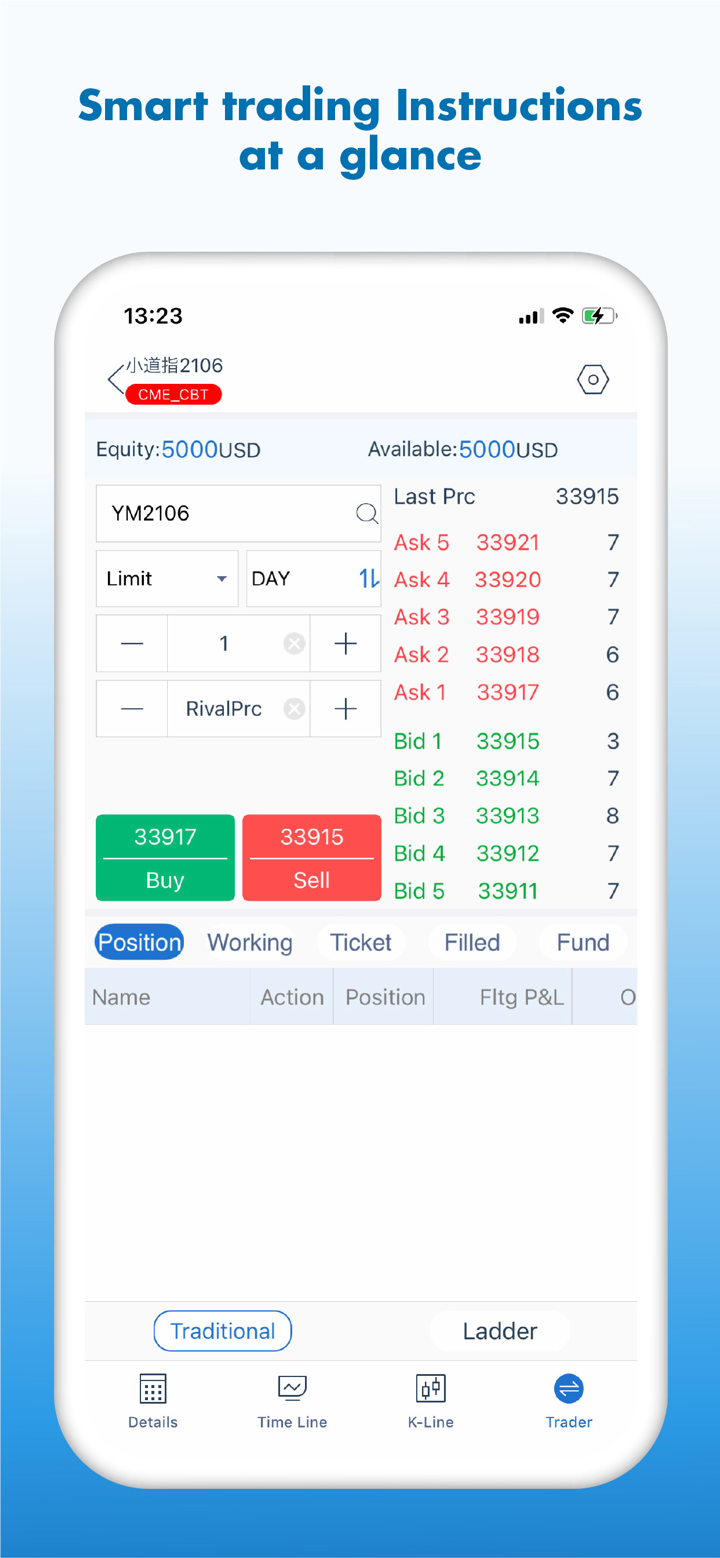

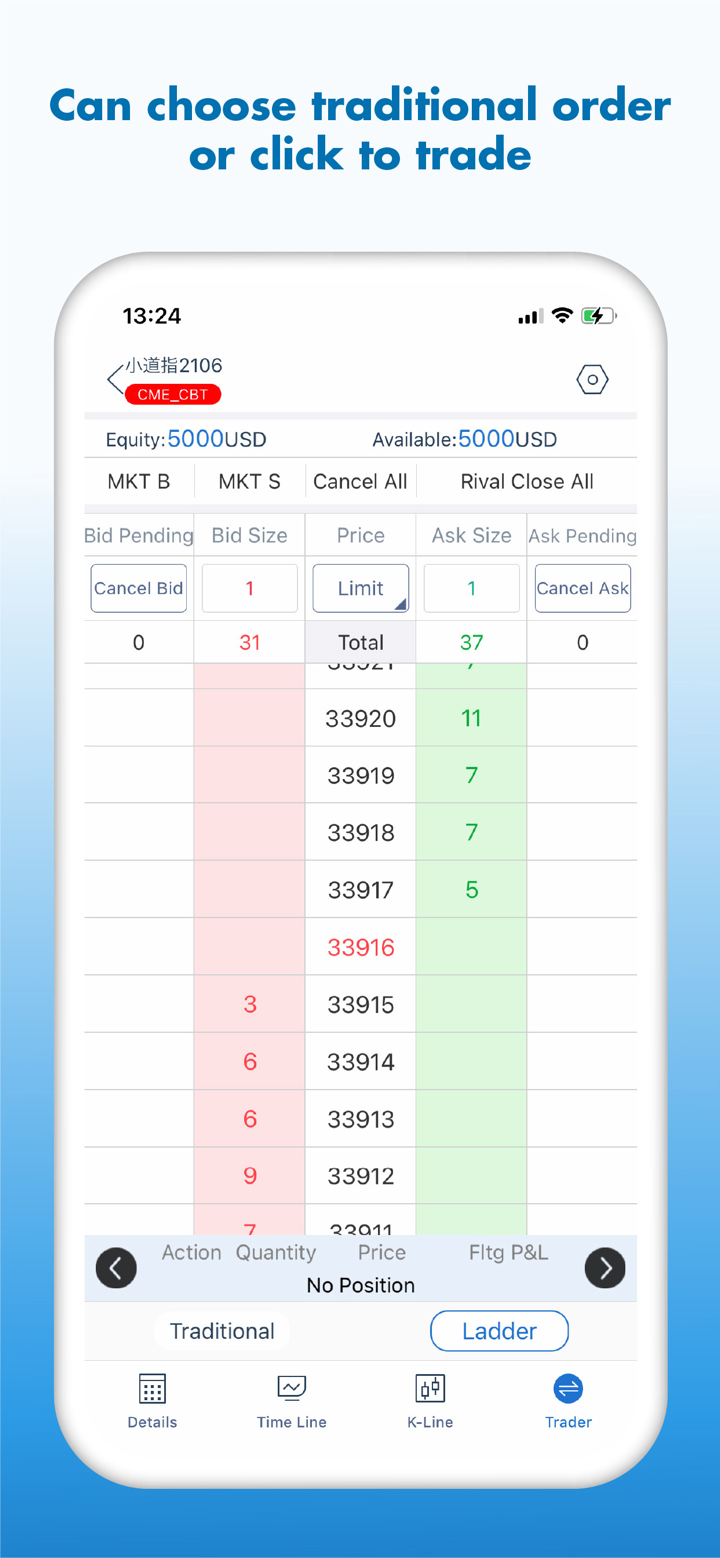

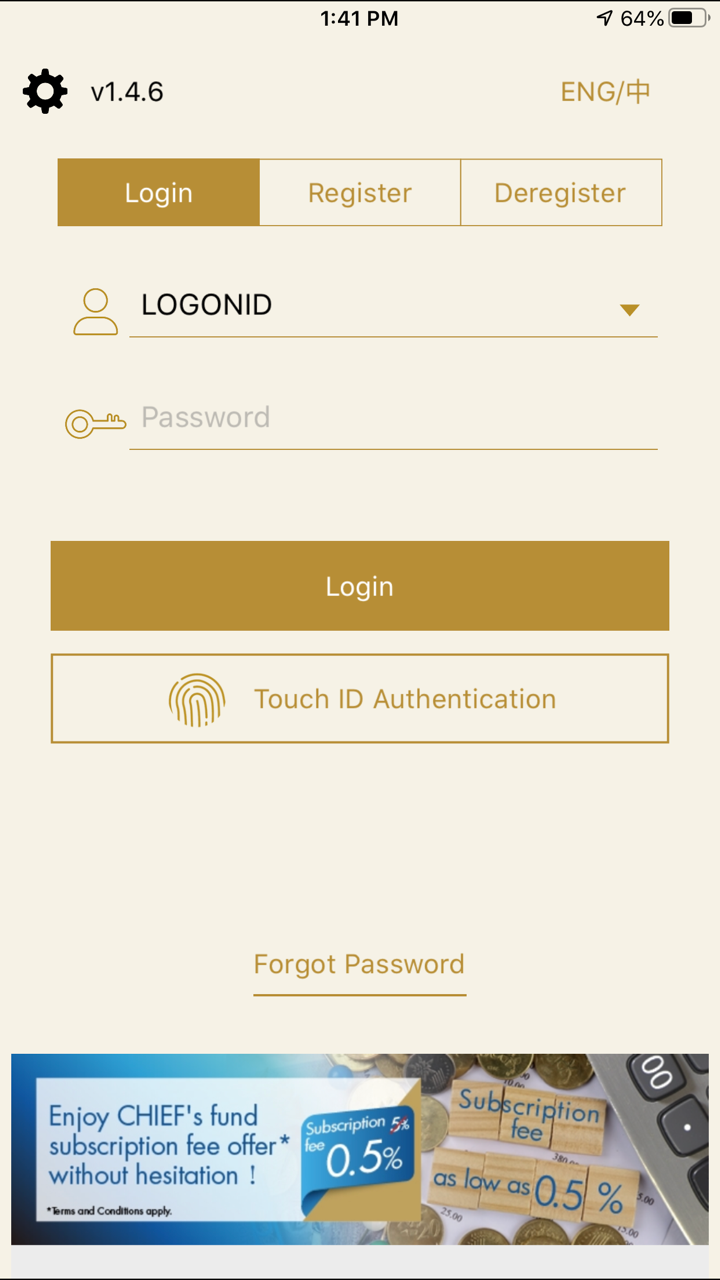

CHIEF يقدم منصته الخاصة Chief Deal، والتي يمكن استخدامها على الهواتف المحمولة.

| منصة التداول | مدعومة | الأجهزة المتاحة | مناسبة لـ |

| Chief Deal | ✔ | الهواتف المحمولة | جميع المتداولين |

| MT4 | ❌ | ||

| MT5 | ❌ |

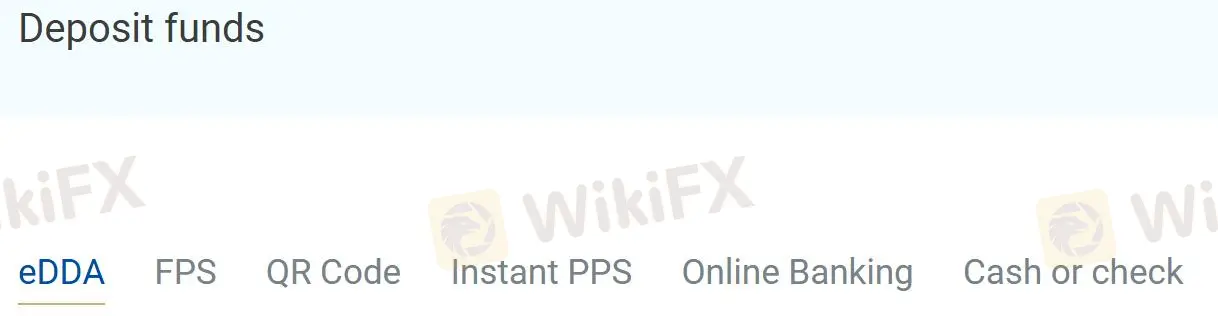

الإيداع والسحب

CHIEF يقدم 6 طرق للإيداع: eDDA، FPS، رمز الاستجابة السريعة، PPS الفوري، الخدمات المصرفية عبر الإنترنت، نقدًا أو شيك.

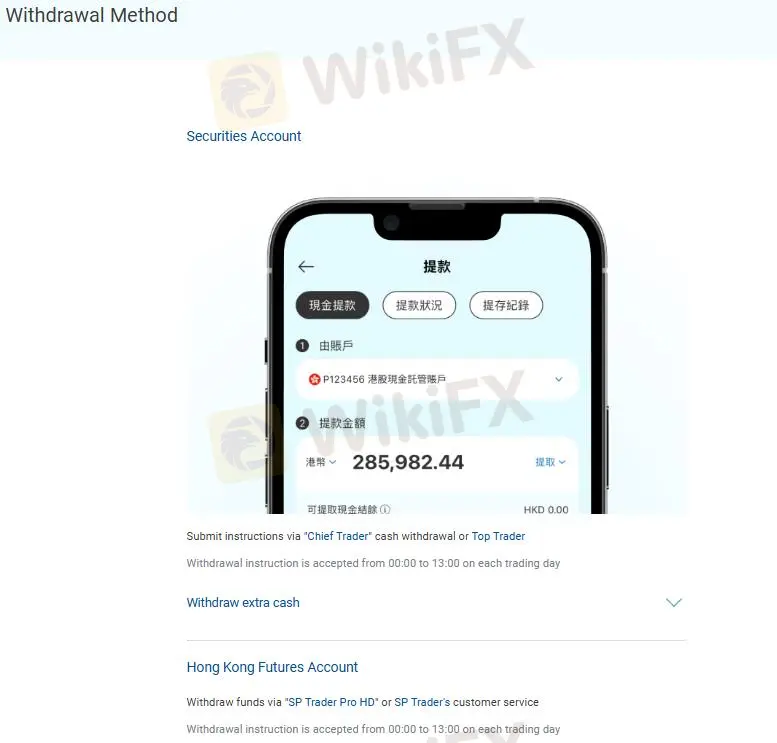

يحتاج السحب إلى تقديم تعليمات عبر "Chief Trader" لسحب النقد أو Top Trader، أو سحب الأموال عبر "SP Trader Pro HD" أو خدمة عملاء SP Trader.