Puan

Tiger Markets(test)

Amerika Birleşik Devletleri | 5-10 yıl |

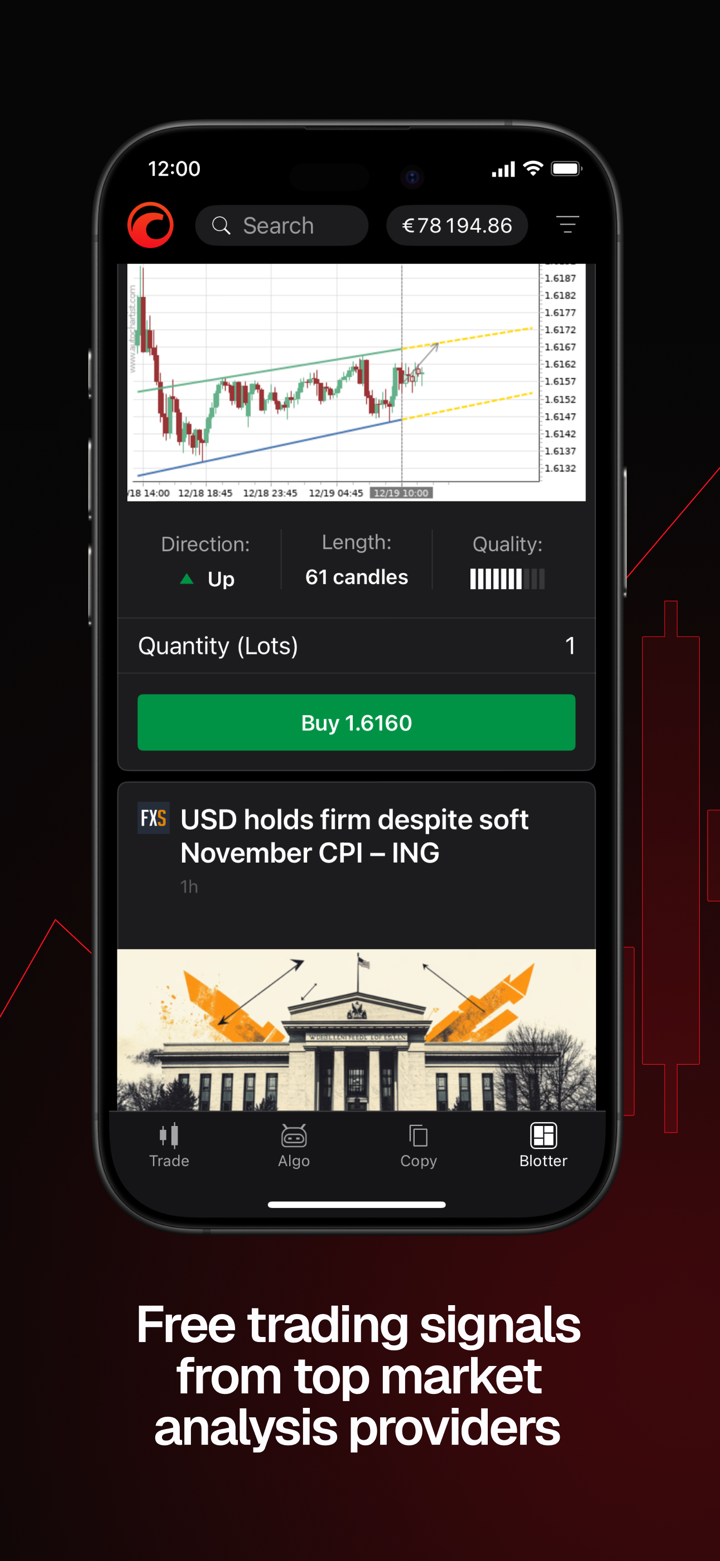

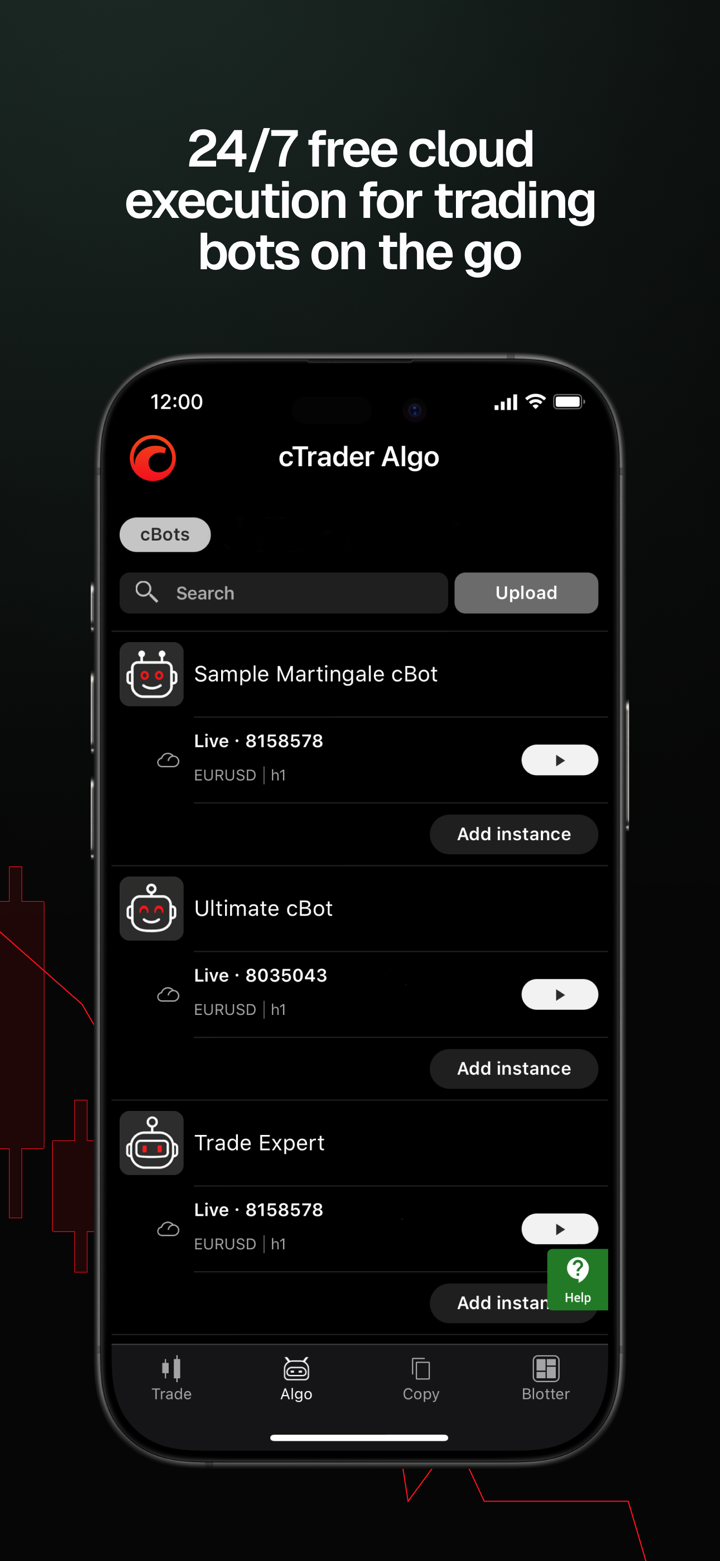

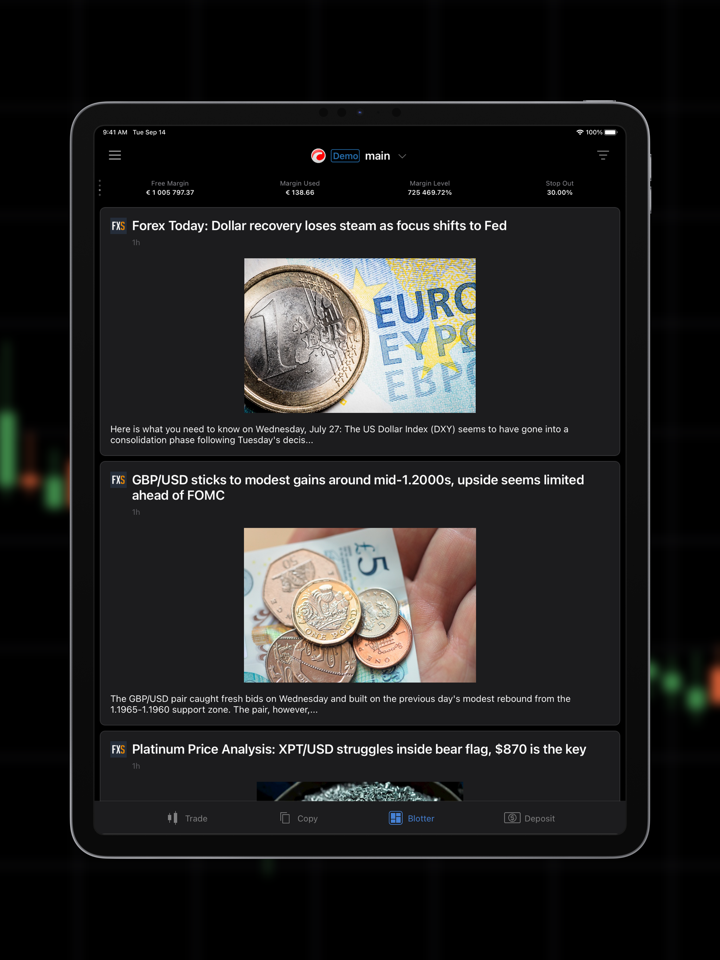

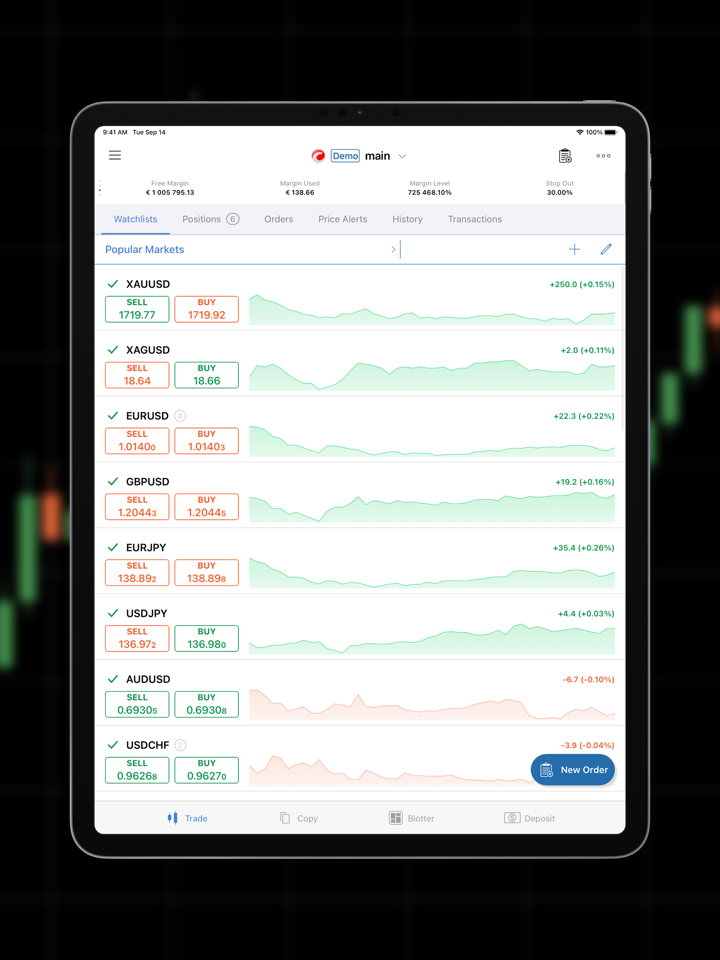

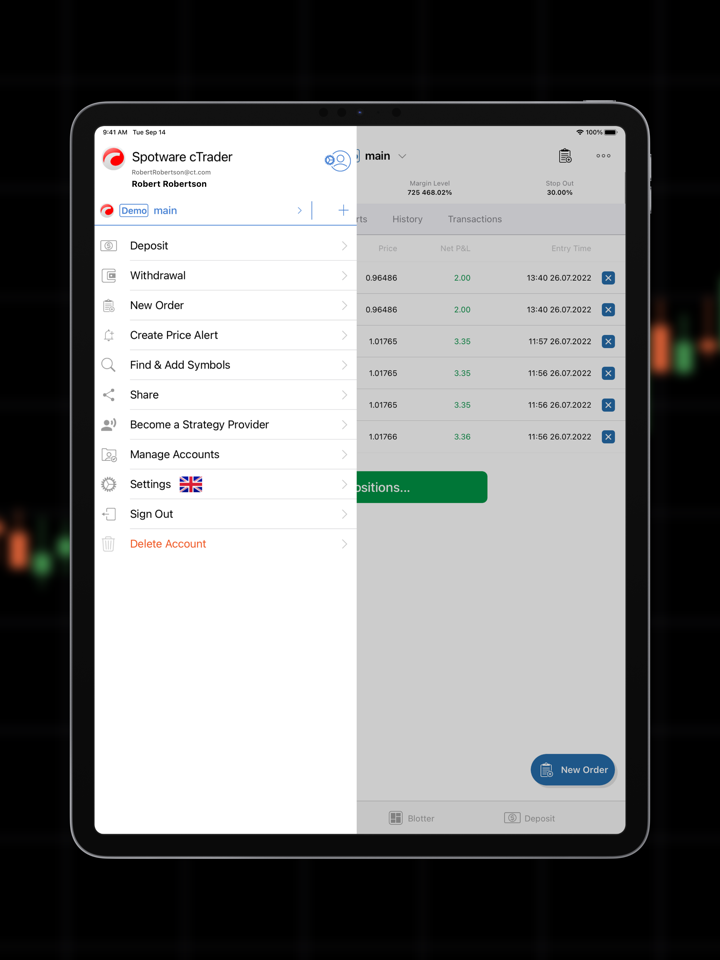

Amerika Birleşik Devletleri | 5-10 yıl | WikiLicense Düzenleyici Ülke/Bölge: Avustralya | Pazar Yapıcılık (MM) | cTrader | Şüpheli İş Kapsamı | Birleşik Krallık Forex İcra (STP) İptal Edilmiş | Orta düzeyde potansiyel risk | Offshore Düzenleyici

WikiLicense Düzenleyici Ülke/Bölge: Avustralya | Pazar Yapıcılık (MM) | cTrader | Şüpheli İş Kapsamı | Birleşik Krallık Forex İcra (STP) İptal Edilmiş | Orta düzeyde potansiyel risk | Offshore Düzenleyici http://www.tigermarketsld.com

Web Sitesi

Derecelendirme Endeksi

Etkilemek

Etkilemek

C

Etki endeksi NO.1

Kıbrıs 2.99

Kıbrıs 2.99 İletişim

Temel Bilgiler

Amerika Birleşik Devletleri

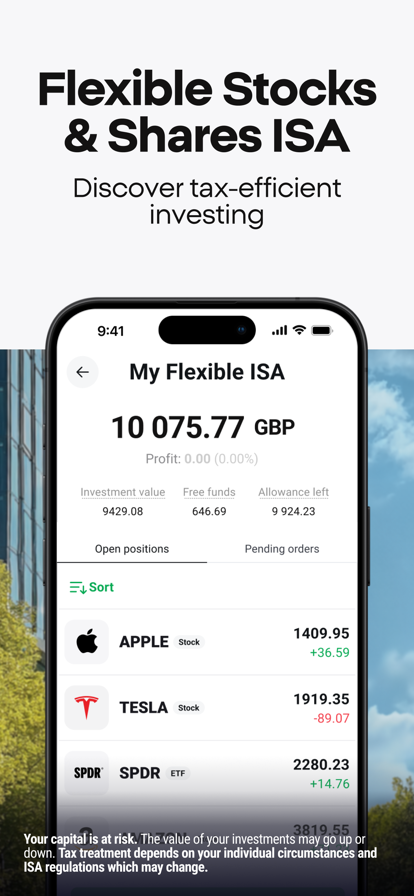

Amerika Birleşik Devletleri Hesap

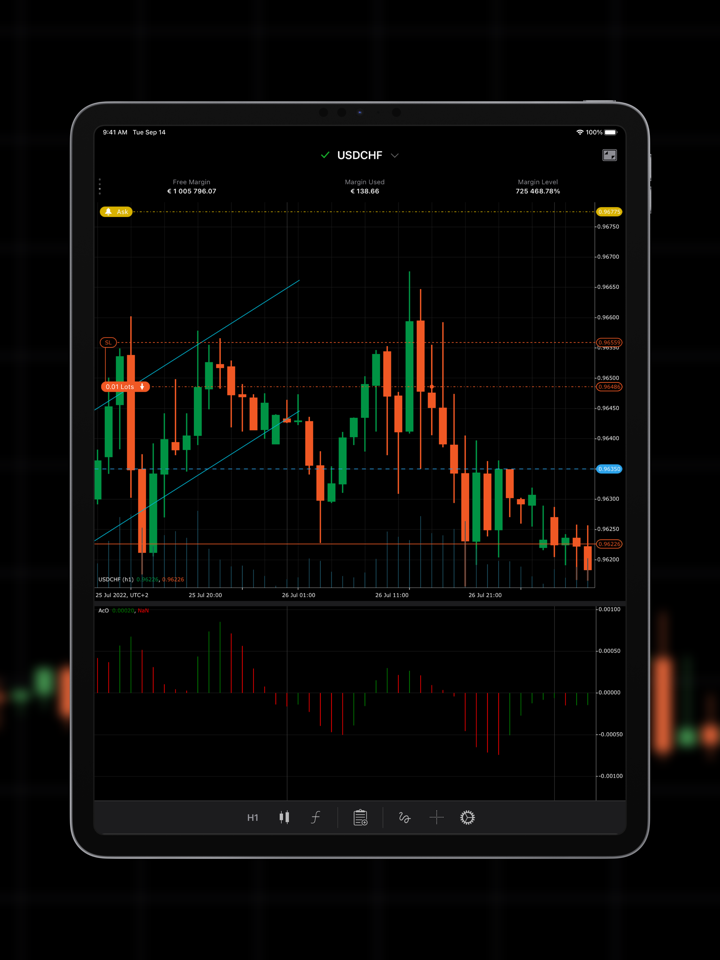

- Ticaret Ortamı--

- Para birimi--

- Maksimum Kaldıraç--

- DestekleniyorEA

- Minimum Para Yatırma--

- Minimum Spread--

- Para Yatırma Yöntemi(4+) VISA Neteller MASTER Bank transfer

- Para Çekme Yöntemi--

- Minimum Pozisyon--

- Komisyon--

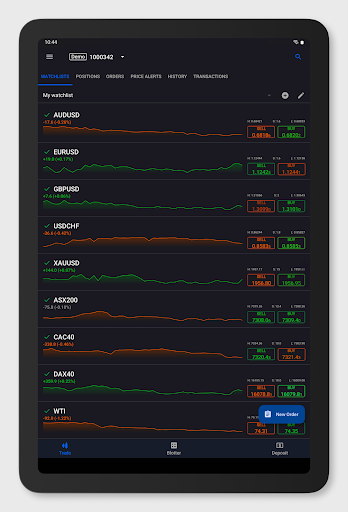

- Ürünler123123

Tiger Markets(test) ürününü görüntüleyen kullanıcılar bunları da görüntüledi..

XM

VT Markets

Vantage

Mitrade

Web sitesi

tigermarketsld.com

3.33.130.190Sunucu KonumuAmerika Birleşik Devletleri

ICP kaydı--En çok ziyaret edilen ülkeler/alanlar--Etki Alanı Yürürlük Tarihi--Web Sitesi--Şirket--

Şecere

İlgili Şirketler

Wiki Soru & Cevap

In what ways does Tiger Markets(test)'s regulatory standing help safeguard my funds?

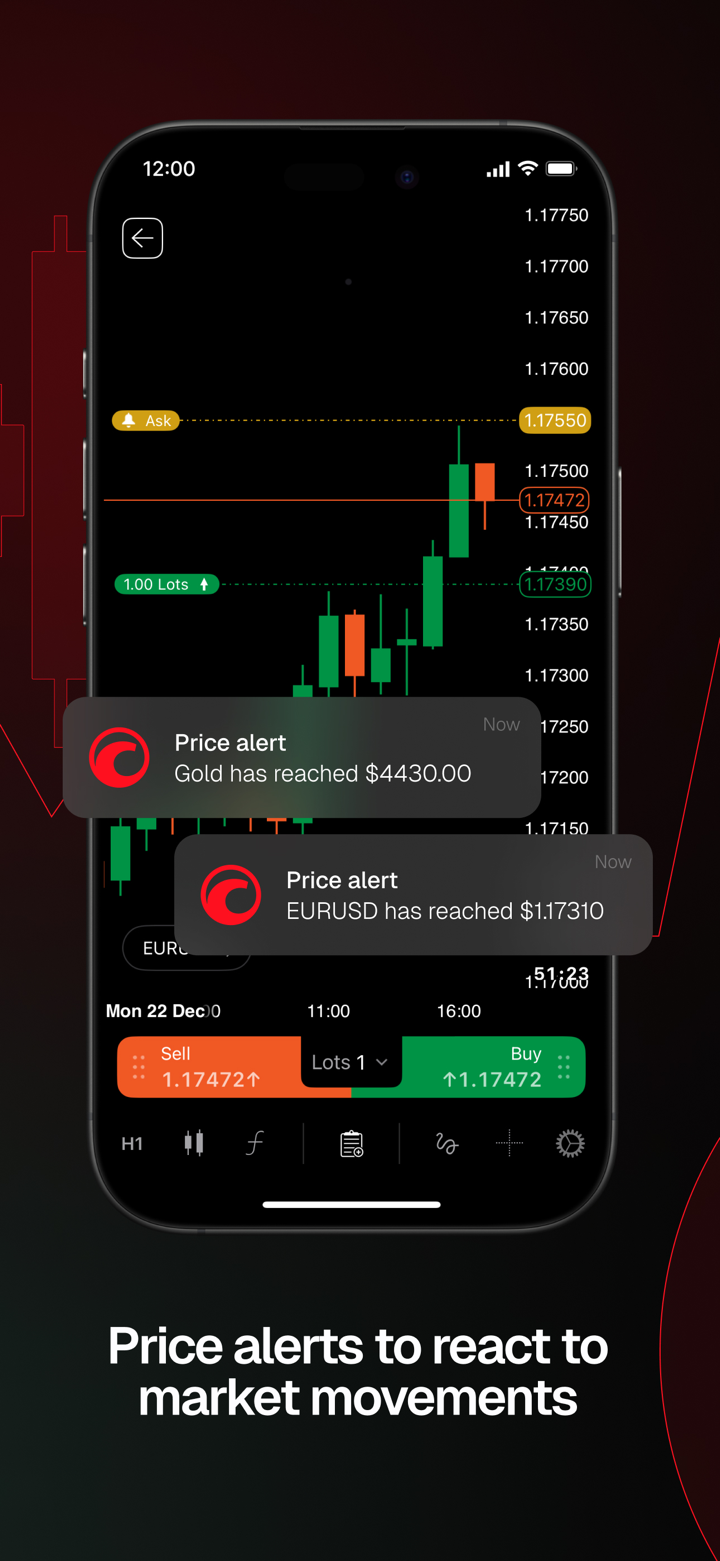

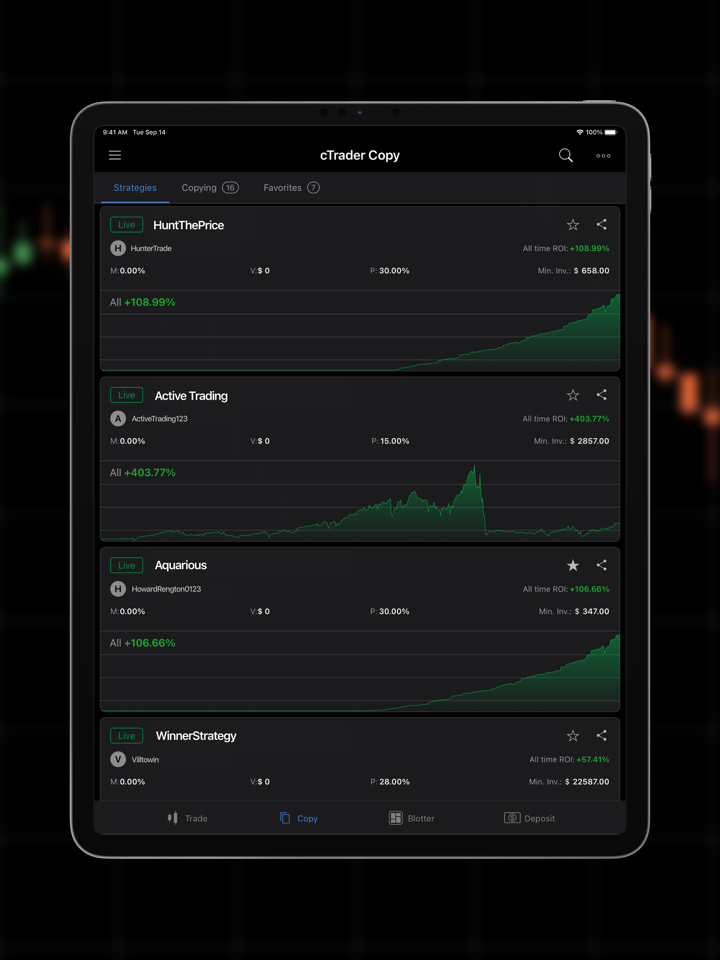

Based on my experience as a forex trader, I've learned that regulatory oversight is one crucial factor when evaluating a broker's reliability, especially regarding the safety of client funds. Tiger Markets (test) claims to be regulated in Cyprus under a CYSEC license and appears to employ a Straight Through Processing (STP) model. Regulation in Cyprus theoretically means the broker must follow certain financial and procedural standards, such as maintaining segregated accounts and reporting regularly to authorities, which can reduce some risks of misconduct or insolvency. However, what stood out to me is the medium potential risk rating and exposures posted by users, particularly frequent complaints about withdrawal issues and trade execution problems. This pattern gives me pause, because robust regulation should, in principle, help protect traders from these exact scenarios by providing avenues for recourse and ensuring accountability. In my view, while CYSEC regulation might offer some framework for client protection, it's not a guarantee of safety or reliable operations. I've seen that regulation can help, but it's not a substitute for careful due diligence on a broker’s business practices, responsiveness, and transparency. For me, Tiger Markets (test)'s regulatory status could offer some safeguards in theory, but the user complaints indicate gaps that merit caution before considering any substantial deposit.

What's the smallest amount I’m allowed to withdraw at once from my Tiger Markets (test) account?

As an experienced trader who evaluates brokers with care, I have to say that with Tiger Markets (test), I was unable to determine a clear minimum withdrawal amount from the information presented. I always prioritize transparent withdrawal terms because the ability to access funds efficiently is a key trust factor for me. In my own trading, I have encountered situations where lack of clarity around withdrawal policies created unnecessary delays and concerns, so I scrutinize this aspect closely. For Tiger Markets (test), despite their mention of accepted funding methods such as VISA, Neteller, Master, and bank transfers, I did not find specific figures or conditions relating to the smallest withdrawal allowed. This is essential information; without it, I have to exercise heightened caution. Additionally, I noticed several user reports highlighting withdrawal difficulties on this platform, which, combined with a medium risk and some regulatory ambiguities, raises concerns about reliability and fund accessibility. Given the lack of publicly listed minimums and the experiences shared by other users, I recommend proceeding very carefully and making sure you verify withdrawal terms directly with their support before depositing. When real money is at stake, especially in forex, I cannot overstate the importance of clear, upfront policies and responsive customer service. For me, this lack of transparency is a significant red flag.

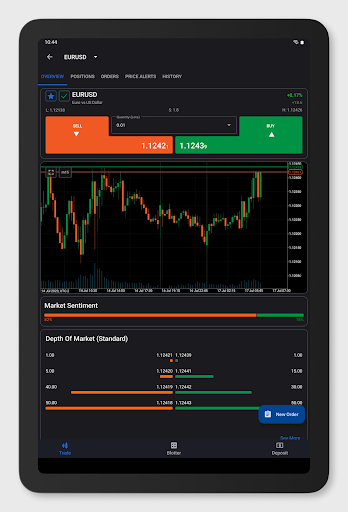

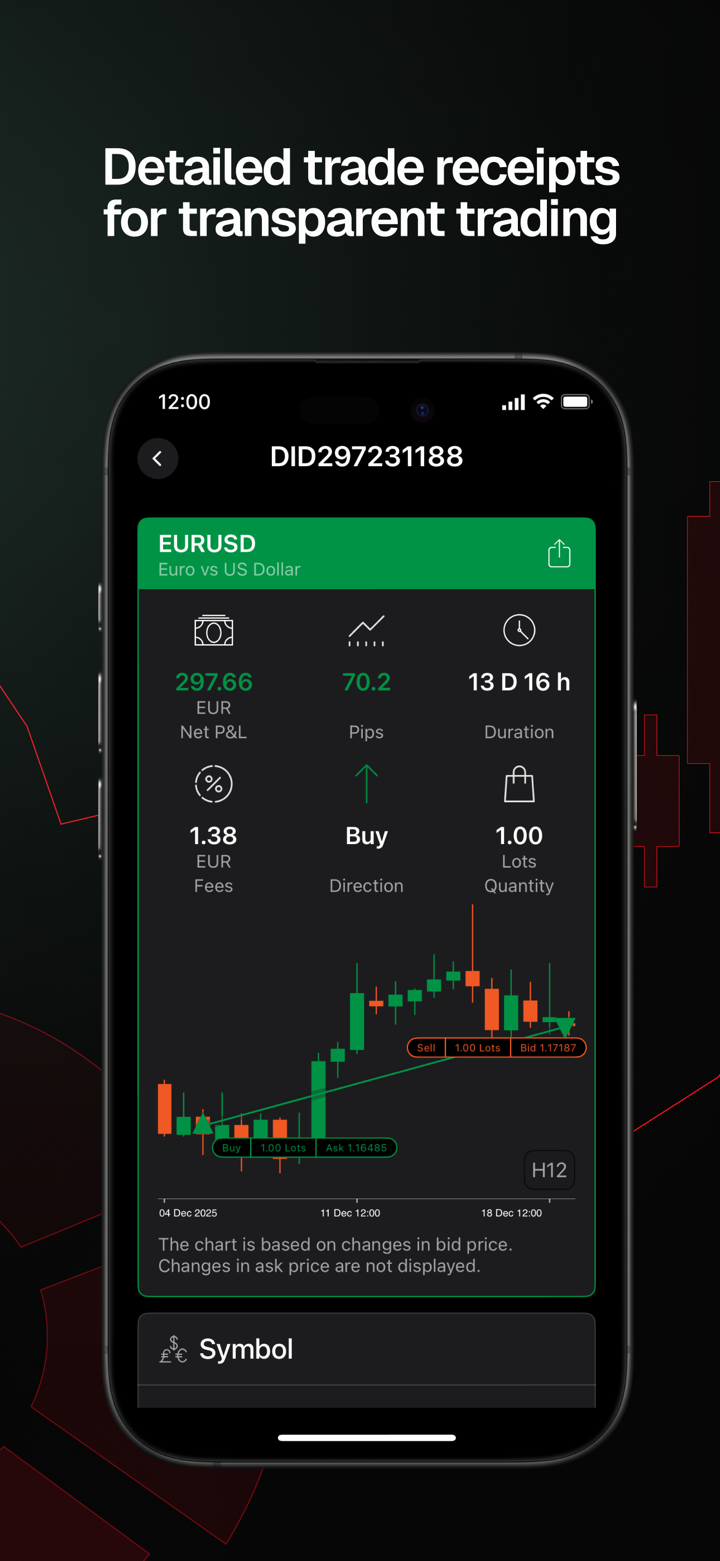

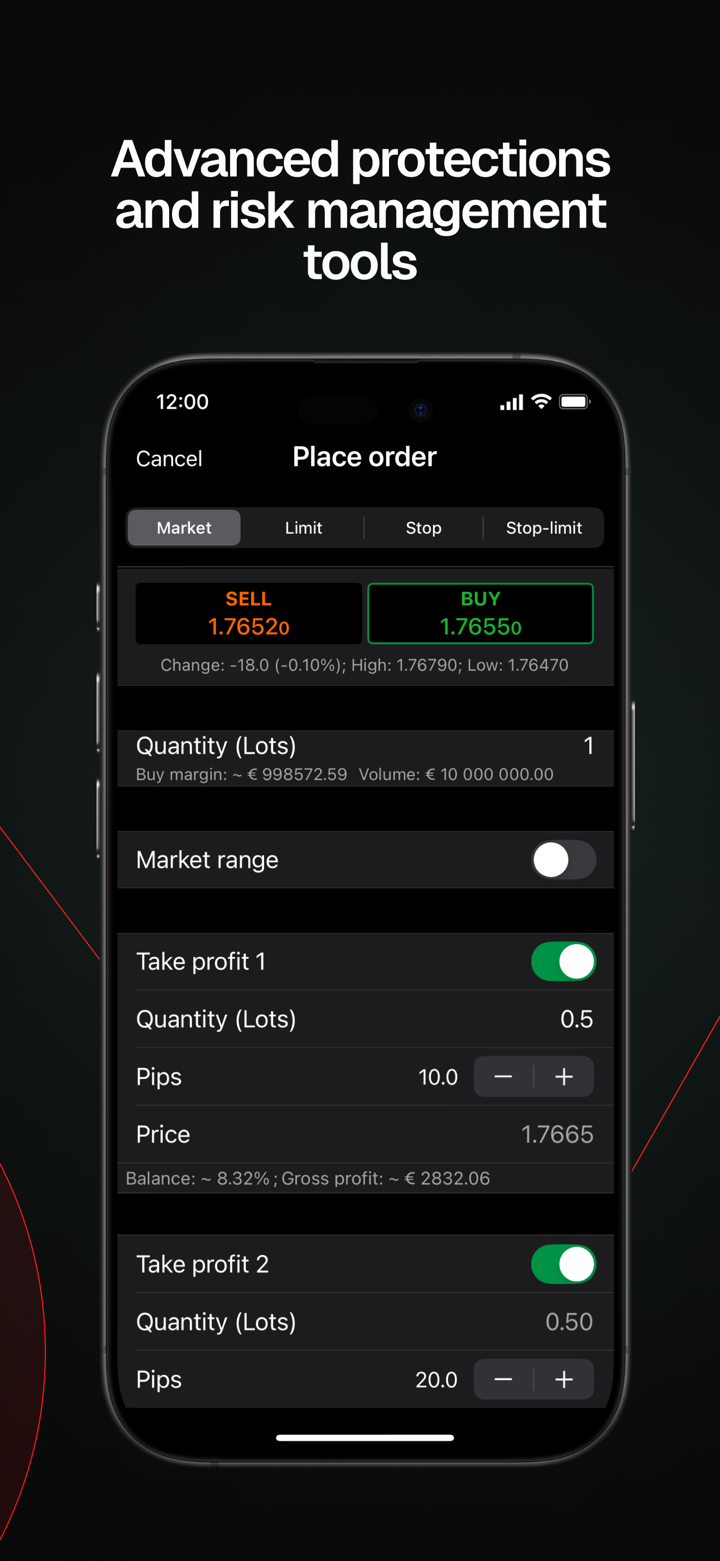

Could you give an in-depth overview of the fee structure for Tiger Markets (test), covering both commission charges and spreads?

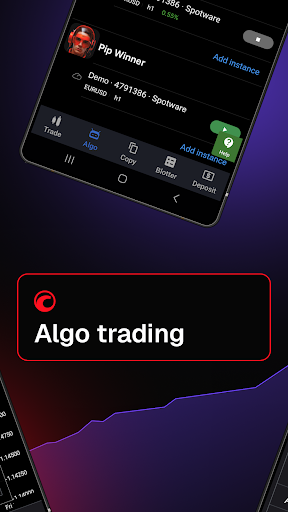

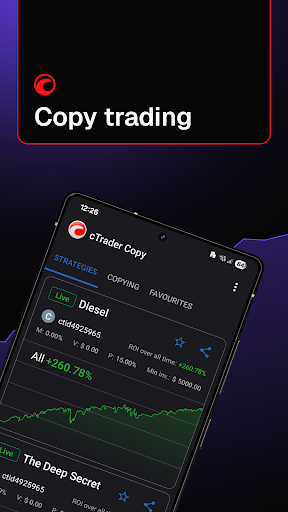

As an experienced trader, my assessment of Tiger Markets (test) makes it clear that understanding their fee structure is challenging due to a significant lack of transparency. From my research, I couldn’t find detailed or reliable information about the specific spreads, commission charges, or even the minimum deposit required. Though some data fields reference numbers for “minimum deposit” and “commission,” it’s unclear whether these are placeholders or valid figures, making it impossible for me to confidently factor them into any trading cost calculations. What gives me pause is the absence of clear data on spreads—which is critical information for everyday cost management as a trader. Reliable brokers generally publish detailed tables for both commission and spread structures on major currency pairs, but here, there’s none of that clarity. Furthermore, while the platform claims to offer “Straight Through Processing (STP)” and cTrader, that alone doesn’t guarantee tight spreads or competitive commissions. The fee structure’s opacity is further complicated by user complaints regarding withdrawal issues and platform function, raising concerns about overall trustworthiness. As a rule, I need to see clear, independently verifiable cost disclosures before committing funds to any broker. For me, the lack of transparency around the actual fee structure at Tiger Markets (test) is a cautionary red flag and something that should not be overlooked.

Does Tiger Markets offer a swap-free (Islamic) account option for traders?

From my careful review of the available data, I could not find any explicit indication that Tiger Markets offers a swap-free (Islamic) account option. In my own trading, especially when considering brokers for religious compliance or for a specific trading strategy, the clear availability and documented terms of swap-free accounts are crucial, as these accounts are designed to comply with Sharia law by removing interest charges on overnight positions. When I look for this feature, I expect to see detailed information regarding eligibility, application process, and any potential administrative fees. Unfortunately, Tiger Markets’ information does not specify this kind of account, and several core aspects like the minimum deposit structure and account features are either unclear or missing. Additionally, the presence of unresolved user complaints—particularly about withdrawal difficulties and position closure issues—gives me further pause when evaluating the trustworthiness of their offerings. If swap-free trading is a vital requirement, I would personally be hesitant to proceed with Tiger Markets until they provide more transparent and comprehensive disclosures about their account types and operational policies. For now, in my assessment, traders seeking an Islamic account should be extremely cautious and look for more straightforward confirmations from the broker before considering them.

kullanıcı incelemesi6

Değerlendirmek istedikleriniz

Lütfen giriş yapın...

Yorum 6

TOP

TOP

Chrome

Chrome uzantısı

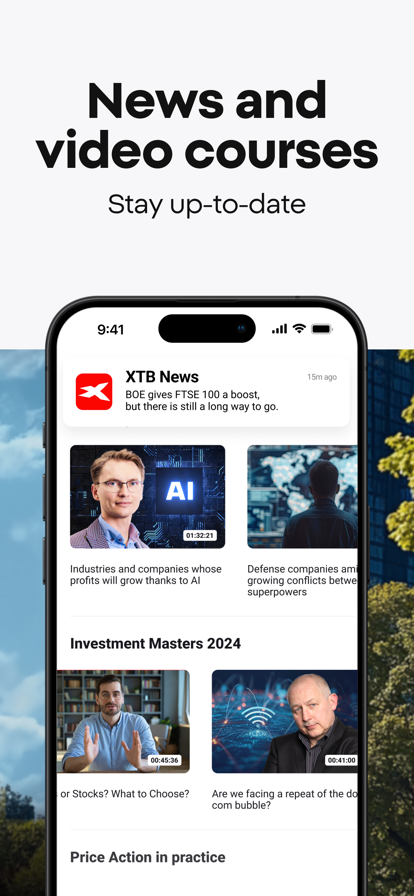

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle

Bu tüccar örnek bir tüccardır

Verilerin tümü test verileridir

Biliyorum

下一次看海约在哪

İrlanda

Neden her zaman para çekme işlemi yapamayan platformlarla karşılaşıyorum? Bu çok sinir bozucu.

Teşhir

Serendipity88888

Amerika Birleşik Devletleri

Son zamanlarda fonları çekememe durumu, birden fazla iletişim etkisiz oldu. Bu platformun kötü davranışlarını burada ortaya çıkararak, ilgili departmanların dikkatini çekmesini ve fonları geri almasını umuyoruz. Çok teşekkür ederim.

Teşhir

77788891

Hong Kong

İyi bir platform, iyi bir platform

Pozitif

77788891

Hong Kong

iyi bir işlemci

Doğal

Serendipity88888

Japonya

好

Pozitif

Serendipity88888

Japonya

中

Doğal