회사 소개

| CITIC Futures 리뷰 요약 | |

| 설립 연도 | 2007 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFEX |

| 서비스 | 중개 서비스, 투자 자문, 기술 지원, 자산 관리 |

| 데모 계정 | ✅ |

| 거래 플랫폼 | Fast Issue (V2), Fast Issue (V3), Mandarin WH6 등 |

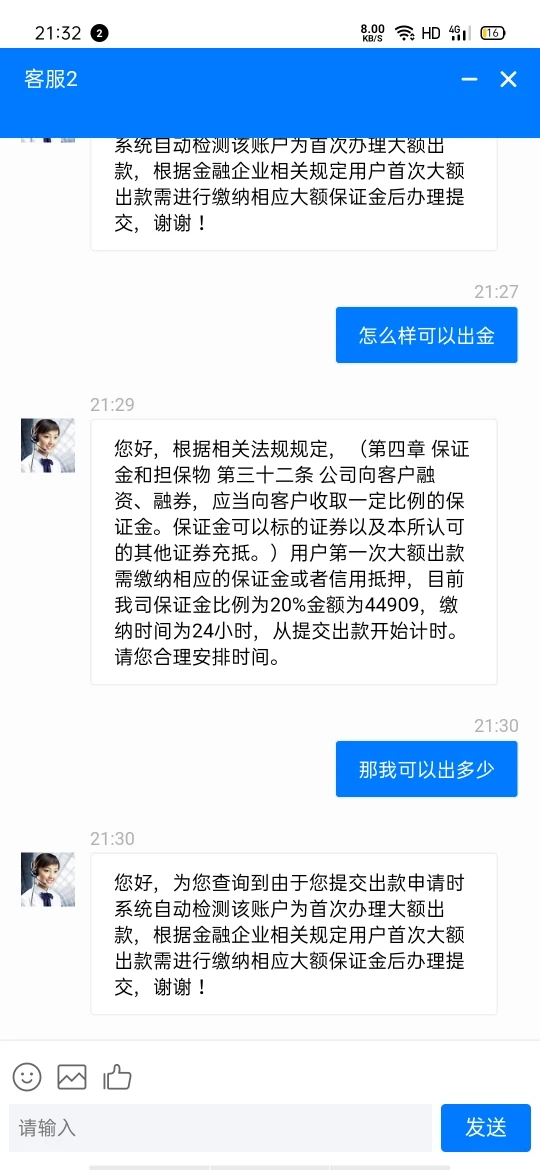

| 고객 지원 | 24/7 라이브 챗 |

| 전화: 400-9908-826 | |

| 팩스: 0755-83217421 | |

| 우편번호: 518048 | |

| 주소: 중국 심천시 후티안 지구 중신 3로 8번 타임스 스퀘어 엑셀런스 (2단계) 북쪽 블록 13층 및 14층 1301-1305호, 518048 | |

| Facebook, X, Instagram, LinkedIn | |

CITIC Futures 정보

CITIC Futures는 중국에서 2007년에 설립된 프리미어 중개 및 금융 서비스의 규제된 서비스 제공업체입니다. 중개 서비스, 투자 자문, 기술 지원 및 자산 관리 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 데모 계정 | 한정된 거래 제품 |

| 운영 시간이 길다 | 다양한 수수료 부과 |

| 다양한 연락 채널 | |

| 잘 규제됨 |

CITIC Futures 합법적인가요?

네. CITIC Futures은 CFFEX의 라이센스를 받았습니다. 라이센스 번호는 0018입니다. 중국 인민 공화국 국무원과 중국 증권 감독 위원회 (CSRC)의 승인을 받아 설립된 CFFEX는 금융 선물, 옵션 및 기타 파생상품에 대한 거래 및 청산 서비스를 제공하는 특수 거래소입니다.

| 규제 국가 | 규제기관 | 현재 상태 | 규제 대상 | 라이센스 유형 | 라이센스 번호 |

| 중국 금융 선물 거래소 (CFFEX) | 규제됨 | 中信期货有限公司 | 선물 라이센스 | 0018 |

CITIC Futures 서비스

| 서비스 | 지원됨 |

| 중개 서비스 | ✔ |

| 투자 자문 | ✔ |

| 기술 지원 | ✔ |

| 자산 관리 | ✔ |

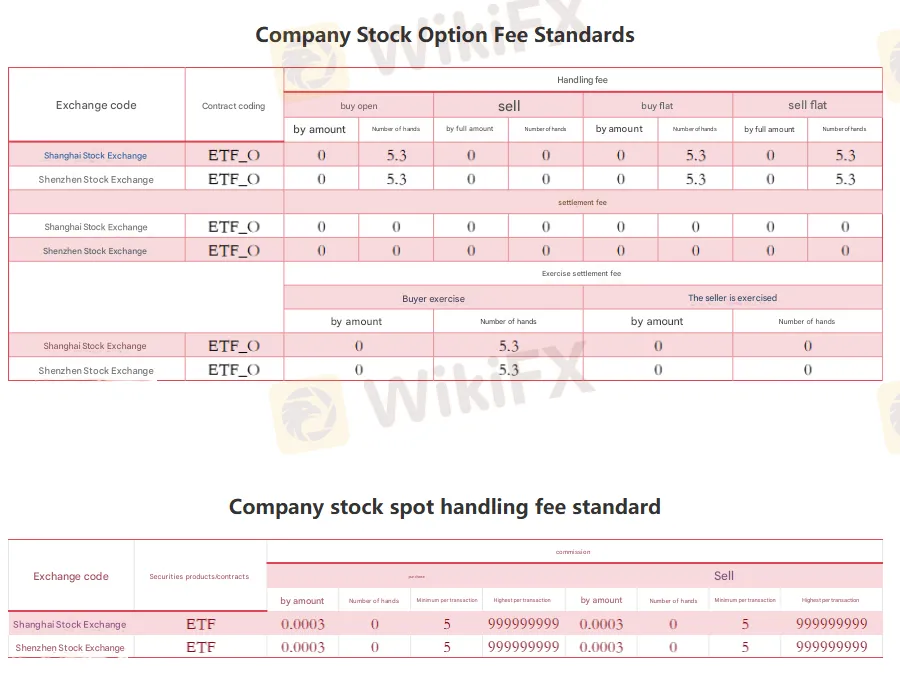

CITIC Futures 수수료

다른 거래소의 다른 제품에 대해 다른 수수료가 부과되며 자세한 내용은 공식 웹 사이트를 방문하십시오 (사진은 Google 번역으로 번역되어 매우 명확하지 않으므로 자세한 내용은 공식 웹 사이트를 방문하십시오).

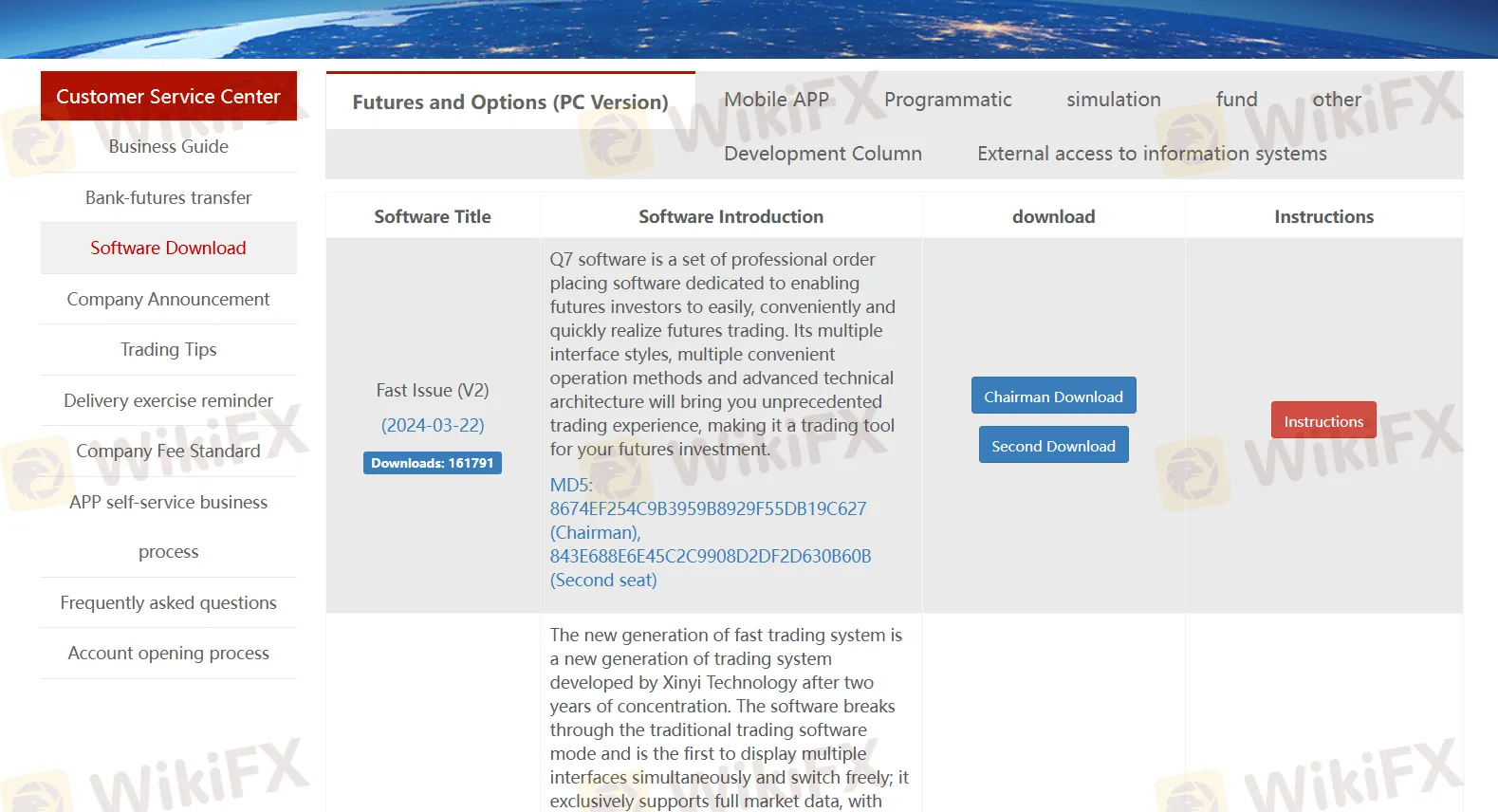

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Fast Issue (V2) | ✔ | PC, 노트북, 태블릿 |

| Fast Issue (V3) | ✔ | PC, 노트북, 태블릿 |

| Mandarin WH6 | ✔ | PC, 노트북, 태블릿 |

| Boyi Master 7 | ✔ | PC, 노트북, 태블릿 |

| Boyi Master 5 | ✔ | PC, 노트북, 태블릿 |

| CITIC Futures Tonghuashun Futures | ✔ | PC, 노트북, 태블릿 |

| CITIC Futures Infinite Easy | ✔ | PC, 노트북, 태블릿 |

| Polestar 9.5 | ✔ | PC, 노트북, 태블릿 |

| CITIC Polestar 9.3 | ✔ | PC, 노트북, 태블릿 |

| Qianlong Option | ✔ | PC, 노트북, 태블릿 |

| Huidian Stock Options Professional Investment System | ✔ | PC, 노트북, 태블릿 |

| CITIC Futures-Xin eLu | ✔ | 모바일 |

| CITIC Futures-Trading Edition | ✔ | 모바일 |