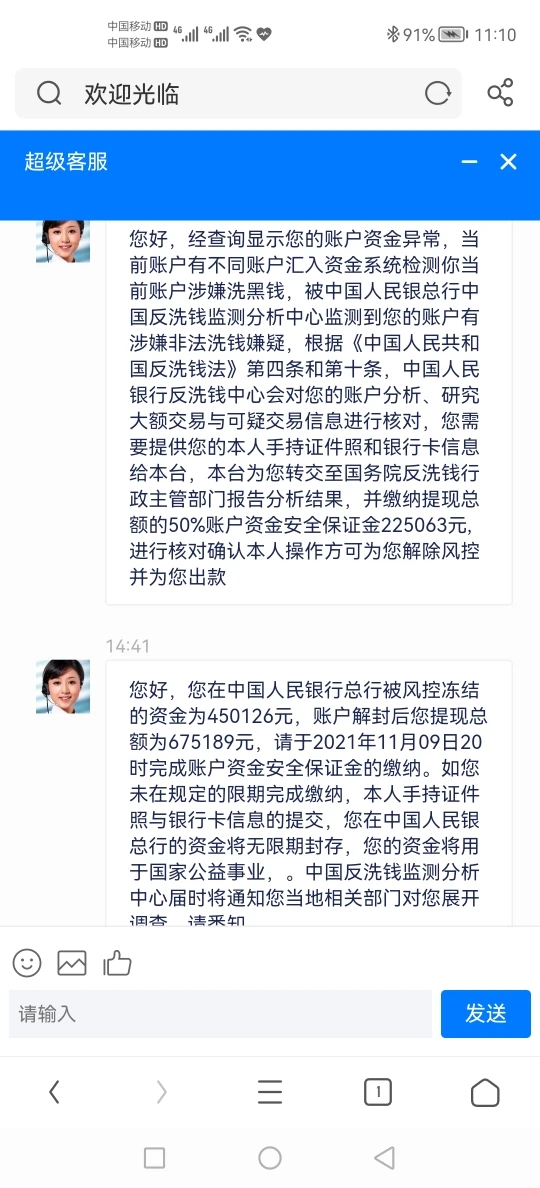

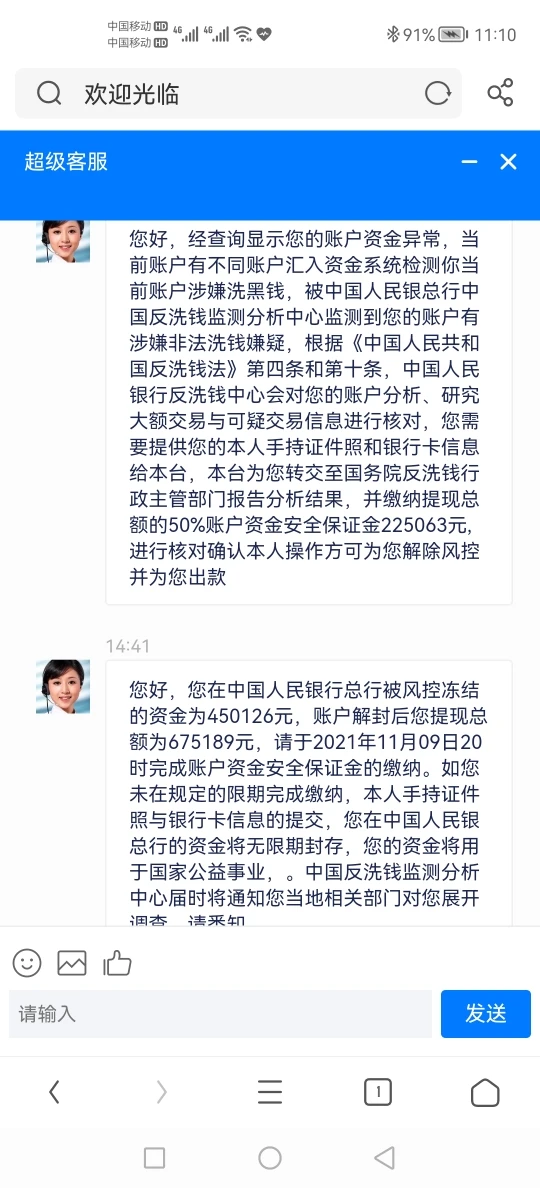

회사 소개

| Morgan Stanley리뷰 요약 | |

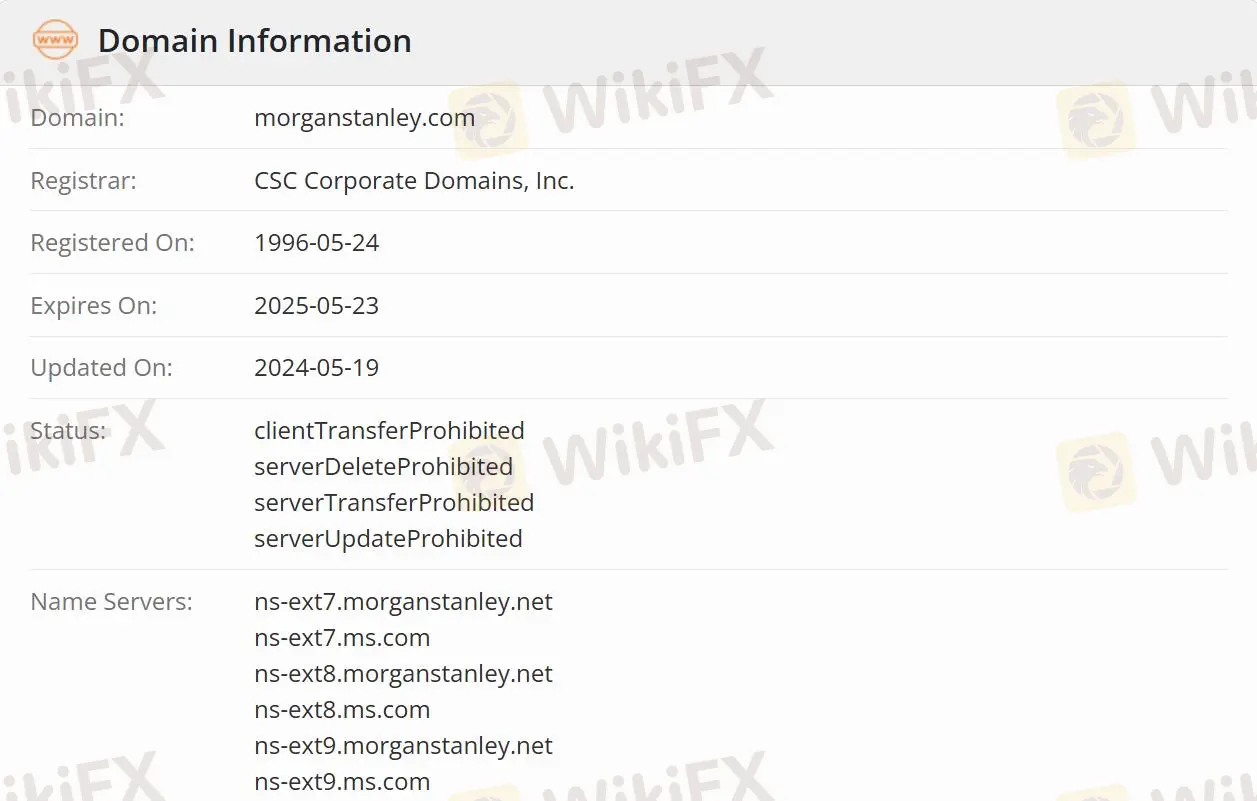

| 설립일 | 1996-05-24 |

| 등록 국가/지역 | 미국 |

| 규제 | 규제됨 |

| 서비스 | 재무 관리, 투자은행 및 자본시장, 판매 및 거래, 연구, 투자 관리, Morgan Stanley at Work, 지속 가능한 투자 및 포용적 벤처 그룹 |

| 고객 지원 | 소셜 미디어: LinkedIn, Instagram, Twitter, Facebook, YouTube |

Morgan Stanley 정보

Morgan Stanley는 개인, 가족, 기관 및 정부가 자본을 조달, 관리 및 분배하는 데 도움을 주는 브로커입니다.

Morgan Stanley이 신뢰할 만한가요?

Morgan Stanley은 캐나다 투자 규제 기구(CIRO)에 의해 승인 및규제되어 있으므로 규제된 브로커보다 안전합니다. 그러나 완전히 위험을 피할 수는 없습니다.

Morgan Stanley은 무엇을 하는가요?

회사의 업무는 재무 관리, 투자은행 및 자본시장, 판매 및 거래, 연구, 투자 관리, Morgan Stanley at Work, 지속 가능한 투자 및 포용적 벤처 그룹을 포함한 8가지 주요 측면을 다룹니다.

재무 관리: 사람들, 기업 및 기관이 재산을 구축, 보존 및 관리하는 데 도움을 줍니다.

투자은행 및 자본시장: 기업, 기관 및 정부를 위한 시장 분석, 자문 및 자본 조달 서비스에 대한 전문 지식을 제공합니다.

판매 및 거래: 판매, 거래 및 시장 메이킹 서비스를 위한 Morgan Stanley.

연구: 기업, 부문, 시장 및 경제에 대한 분석을 제공하여 고객의 결정을 돕습니다.

투자 관리: 공개 및 비공개 시장에서 다양한 자산 클래스에 걸친 투자 전략을 제공합니다.

Morgan Stanley at Work: 조직 및 그들의 직원을 위한 직장 금융 솔루션을 제공하며 조언을 결합합니다.

지속 가능한 투자: 지속 가능한 투자 제품을 제공하고 혁신적인 솔루션을 육성하며 지속 가능성 문제에 대한 실질적인 통찰력을 제공합니다.

고객 지원 옵션

트레이더들은 LinkedIn, Instagram, Twitter, Facebook 및 YouTube를 포함한 다양한 소셜 미디어에서 Morgan Stanley를 팔로우할 수 있습니다.

| 연락 옵션 | 세부 정보 |

| 소셜 미디어 | LinkedIn, Instagram, Twitter, Facebook, YouTube |

| 지원되는 언어 | 영어 |

| 웹사이트 언어 | 영어 |

| 실제 주소 | Morgan Stanley 1585 Broadway New York, NY 10036 |