회사 소개

| China-Derivatives Futures리뷰 요약 | |

| 설립 연도 | 1996 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFEX |

| 제품 및 서비스 | 선물, 중개, 투자, 컨설팅, 자산 관리, 펀드 |

| 데모 계정 | ✅ |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, 그리고 TradeBlazer |

| 최소 입금액 | / |

| 고객 지원 | 실시간 채팅 |

| 이메일: office@cdfco.com.cn | |

| 전화: 400-688-1117 | |

| 주소: 중양 성, 동사 사거리 82번지 진창안 빌딩 B동 7층, 베이징 | |

China-Derivatives Futures 정보

1996년에 설립된 China-Derivatives Futures Co., Ltd.는 중국 금융선물거래소 (CFFEX) 감독하에 규제된 기관입니다. 그러나 중국 내 클라이언트만을 대상으로 하며 국내 파생상품 시장에서 주요 역할을 합니다. 중국 증권 감독위원회 (CSRC) 승인을 받은 종합 금융 회사로 국내 상품 선물 중개, 금융 선물 중개, 선물 거래 컨설팅, 자산 관리, 그리고 증권 투자 펀드 공모에 특화되어 있습니다.

장단점

| 장점 | 단점 |

| CFFEX 규제 | 투명성 부족 |

| 선물 거래 전문화 | |

| 데모 거래 지원 | |

| 다양한 거래 플랫폼 | |

| 긴 운영 역사 |

China-Derivatives Futures 합법적인가요?

China-Derivatives Futures 은 CFFEX에 의해 라이선스 번호 0197로 규제되고 있습니다.

| 규제 국가 | 규제 기관 | 규제 상태 | 규제 기관 | 라이선스 유형 | 라이선스 번호 |

| 중국 | 중국 금융선물거래소 (CFFEX) | 규제됨 | 중국 상품 선물 주식회사 | 선물 라이선스 | 0197 |

제품 및 서비스

China-Derivatives Futures 은(는) 주로 선물 거래에 중점을 두고 있으며 중개, 투자, 컨설팅, 자산 관리 및 펀드와 같은 포괄적인 투자 서비스 범위도 제공합니다.

| 제품 및 서비스 | 지원 |

| 선물 | ✔ |

| 펀드 | ✔ |

| 중개 | ✔ |

| 투자 | ✔ |

| 컨설팅 | ✔ |

| 자산 관리 | ✔ |

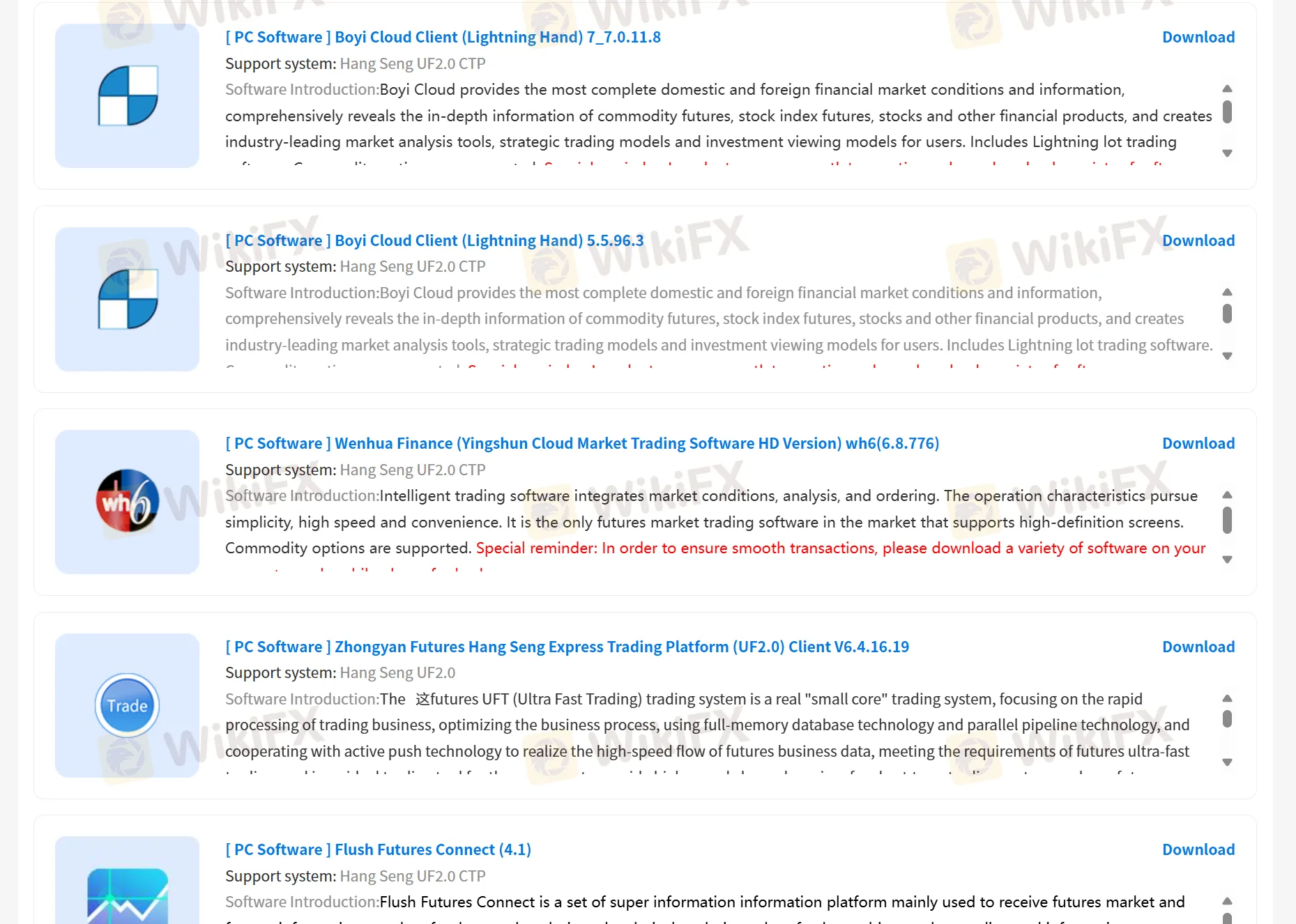

거래 플랫폼

중국 파생상품 선물은 자체 플랫폼, China-Derivatives Futures App, 보이 클라이언트 클라우드, 웬화 파이낸스, 이생 폴라 스타 및 트레이드 블레이저를 통해 거래를 지원합니다. 또한 고객에게 거래 시뮬레이션 기회도 제공합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

| China-Derivatives Futures App | ✔ | PC, 모바일 | / |

| 보이 클라이언트 클라우드 | ✔ | PC | / |

| 웬화 파이낸스 | ✔ | PC | / |

| 이생 폴라 스타 | ✔ | PC | / |

| 트레이드 블레이저 | ✔ | PC | / |

扶众法援

홍콩

이번 3 월에 친구 요청을 받았는데, 이것이 친구라고 생각했습니다. 그런 다음 멤버들이 이익 스크린 샷을 보여준 준비 그룹으로 끌려갔습니다. 나는 움직이고 잠시 동안 관찰되었다. 나중에 등록을해서 선생님의 지시를 따랐습니다. 선생님은 저에게 보증금을 5 만 명까지 책정하여 전문 교사가 저를 위해 일할 수 있다고 주장했습니다. 손익이 발생했습니다. 남은 시간이 10 만 명이었을 때, 출금을 신청하려고했습니다. 그러나 자금 조달 채널은 위험이 존재하기 때문에 이용할 수 없었습니다. 담임 선생님은 계속 수비를하고 입금 / 인출이 연기 될 수 있음을 알게되었습니다. 인출은 일주일 동안 이용할 수 없습니다.

신고

Cris Men

에콰도르

출금이나 그와 관련된 문제는 한 번도 경험한 적이 없어요

좋은 평가

Maximilian 111

나이지리아

나는 항상 여기에서 상품을 거래합니다. 투명한 수수료와 훌륭한 고객 서비스를 제공하며, 이는 항상 내 견고한 선택입니다.

좋은 평가

Vegas

콜롬비아

China-Derivatives Futures co,.LTD. 다양한 거래 앱을 제공하며, 거래 실수의 경우 매우 친절합니다. 그리고 회사는 공식 규제 기관을 갖추고 있으며, 거래 정보는 공개되고 투명하게 제공되어 안심할 수 있습니다.

좋은 평가