Profil perusahaan

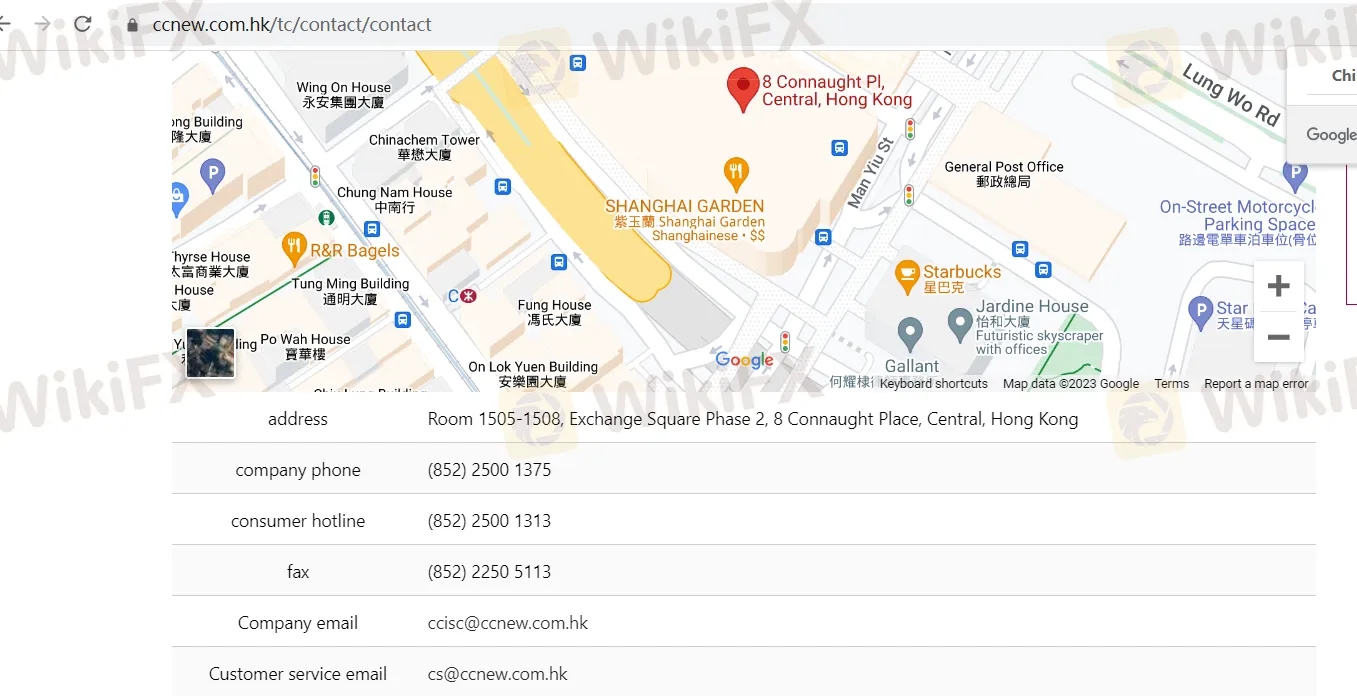

| informasi perusahaan | Detail |

| Nama perusahaan | CENTRALco sekuritas internasional cina., terbatas |

| Lokasi | 1505-1508, fase ke-2, alun-alun pertukaran, 8 tempat penghubung, CENTRAL , Hongkong |

| Garis utama | (852) 2500 1375 |

| Telepon Layanan Pelanggan | (852) 2500 1313 |

| Fax | (852) 2250 5113 |

| Email Perusahaan | ccisc@ccnew.com.hk |

| Email Layanan Pelanggan | cs@ccnew.com.hk |

| Otoritas Pengatur | Komisi Sekuritas dan Berjangka Hong Kong (SFC) |

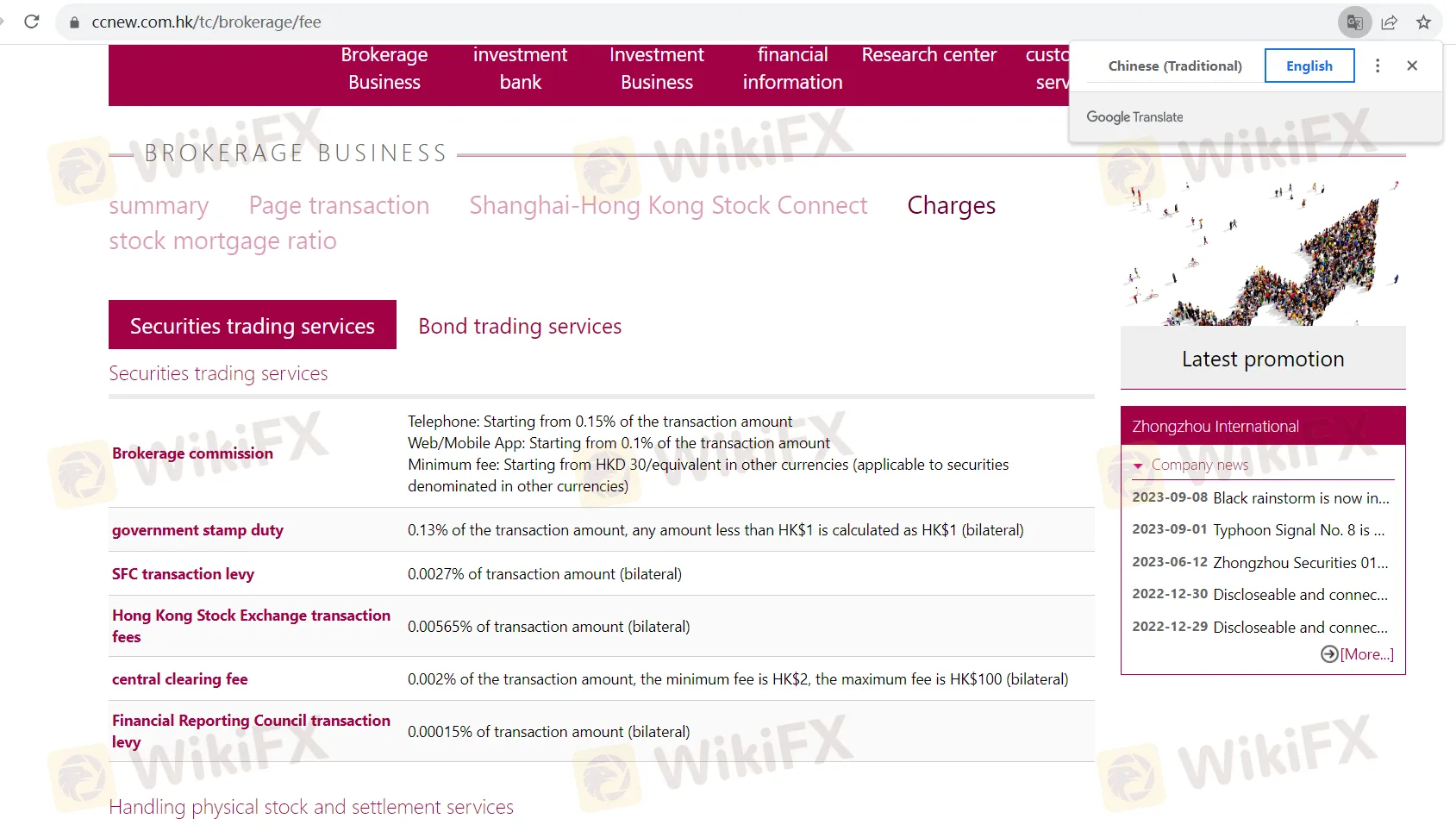

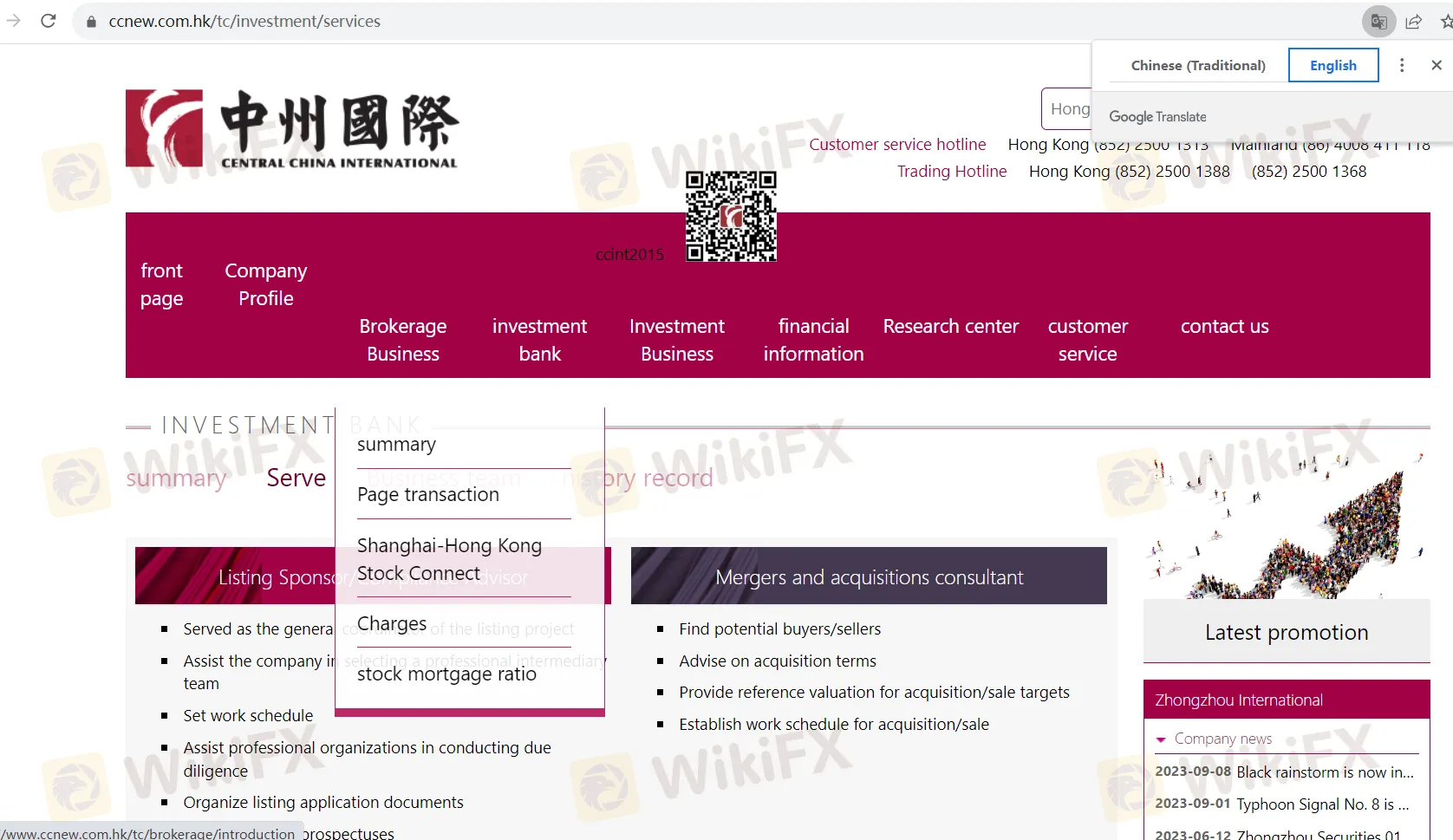

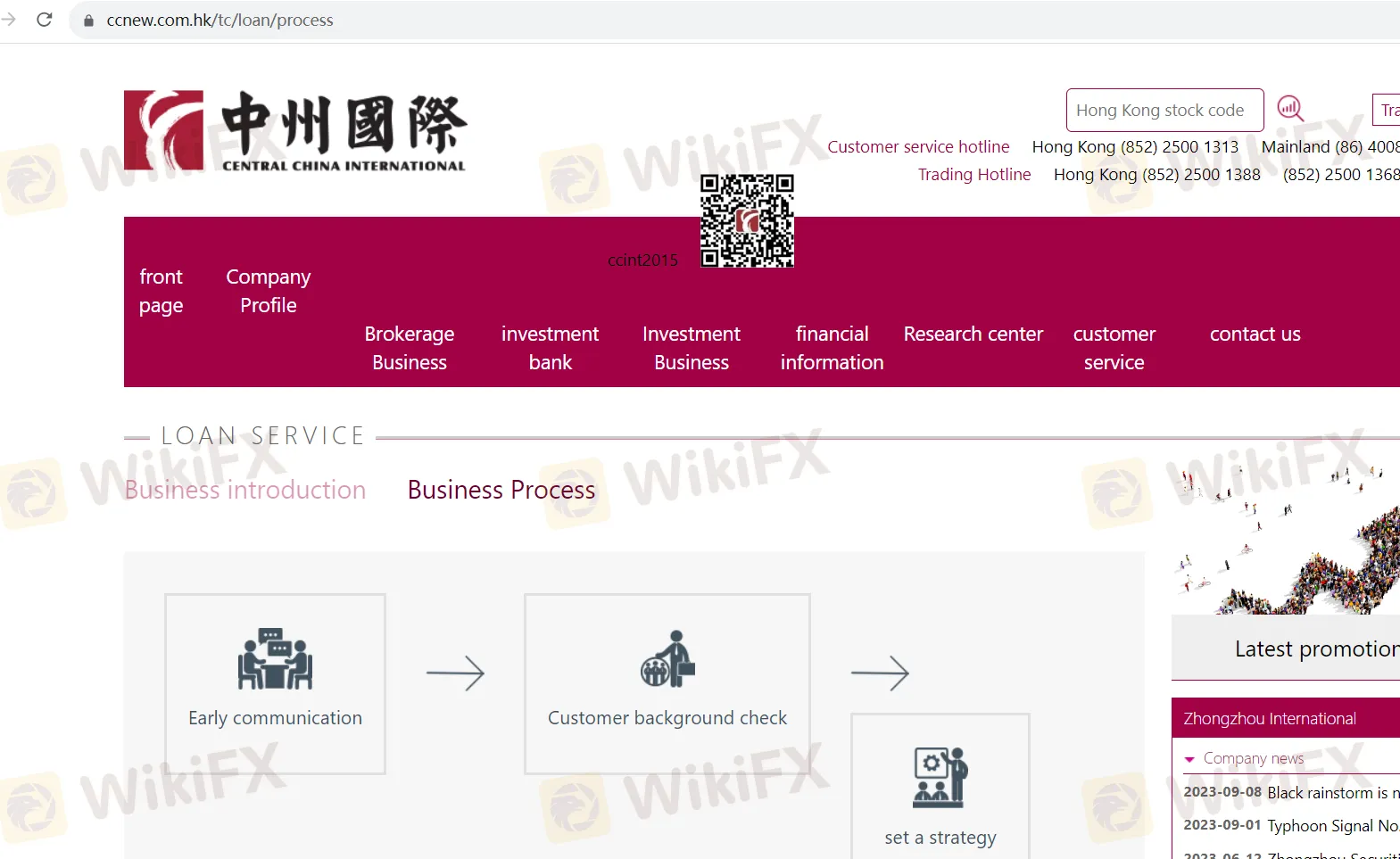

| Jasa | Perdagangan Sekuritas, Perbankan Investasi, Layanan Investasi, Penitipan Saham, Pemindahan Saham, Layanan Agen, Aksi Korporasi |

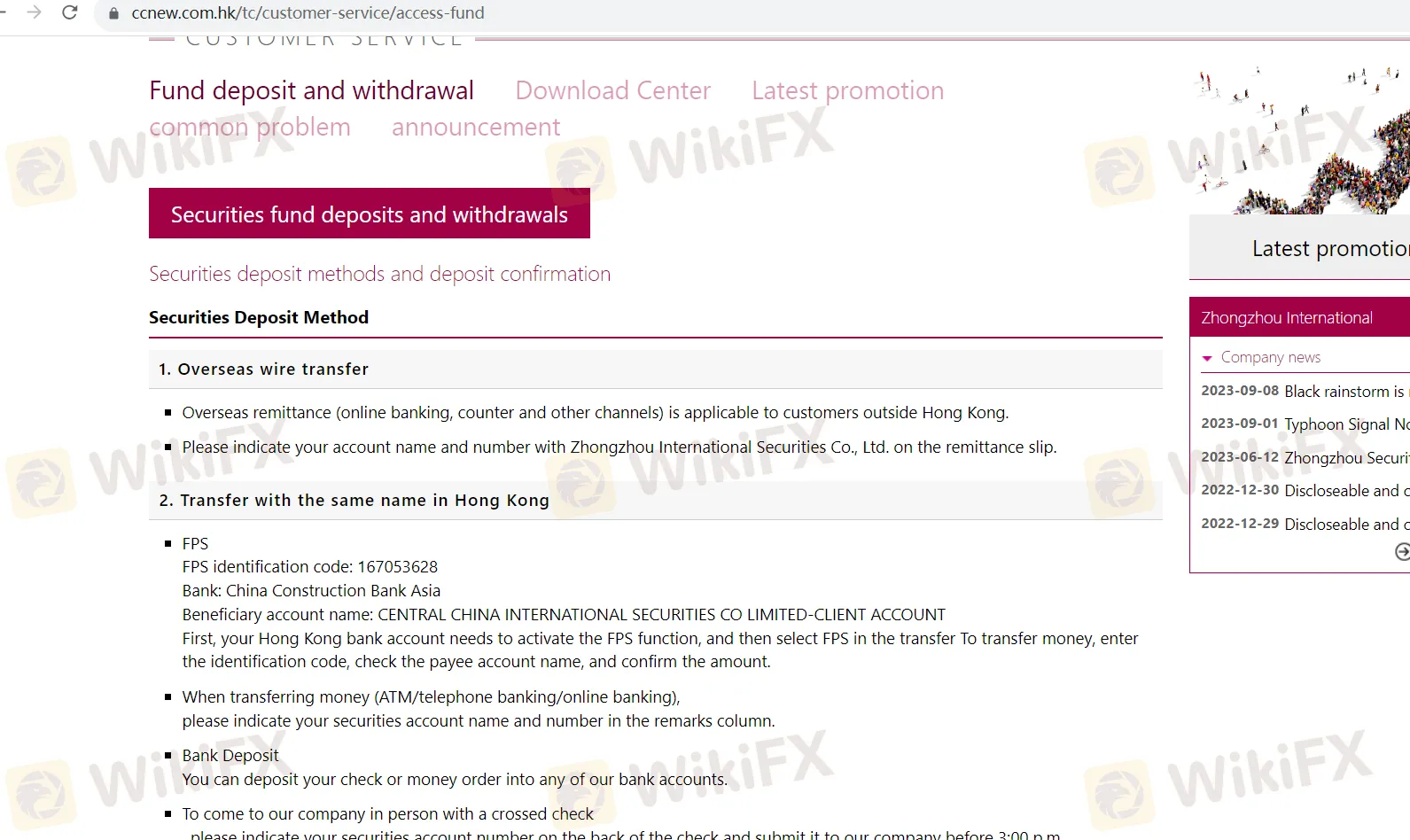

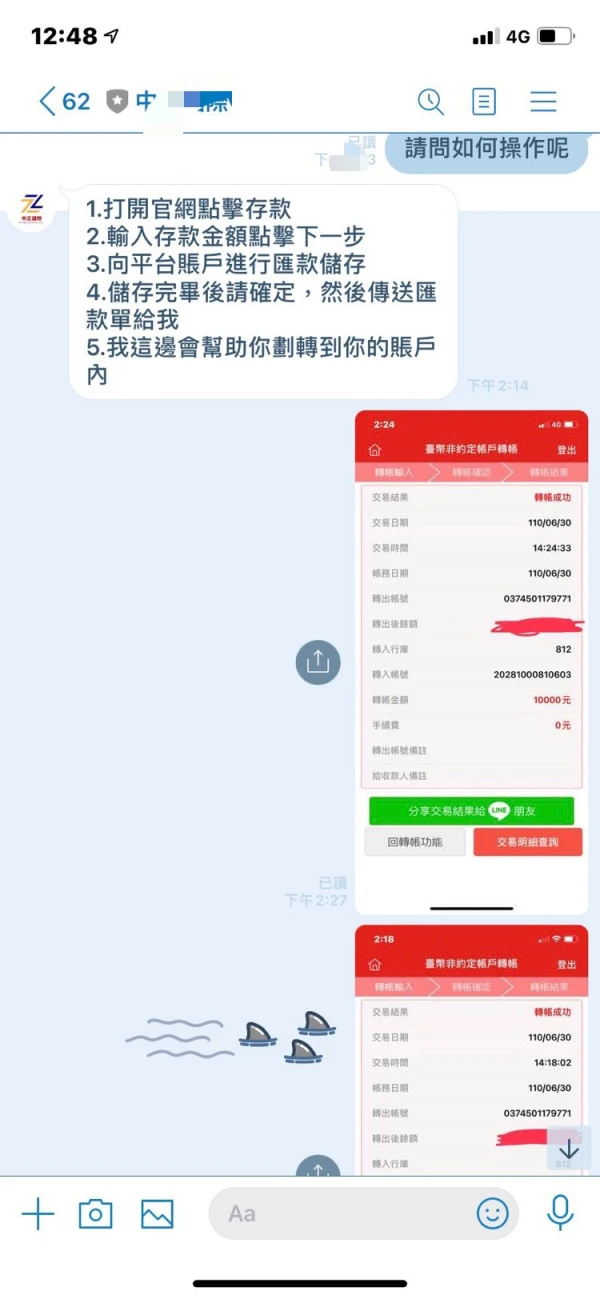

| Metode Setoran | Transfer Bank Luar Negeri, Transfer Nama Sama Hong Kong (FPS), Transfer (ATM / Phone Banking / Online Banking), Setoran Bank |

| Metode Penarikan | Hubungi Manajer Akun atau Isi Formulir Penarikan |

| Kelebihan | - Berbagai layanan keuangan yang komprehensif - Opsi penyetoran dan penarikan dana yang mudah - Kehadiran yang mapan di industri keuangan - Berbagai saluran dukungan pelanggan |

| Kontra | - Status peraturan untuk transaksi kontrak berjangka dicabut - Informasi biaya terbatas untuk layanan tertentu - Status “Melebihi” untuk izin sekuritas tidak jelas - Struktur biaya dapat berubah |