Profil perusahaan

| RBC Ringkasan Ulasan | |

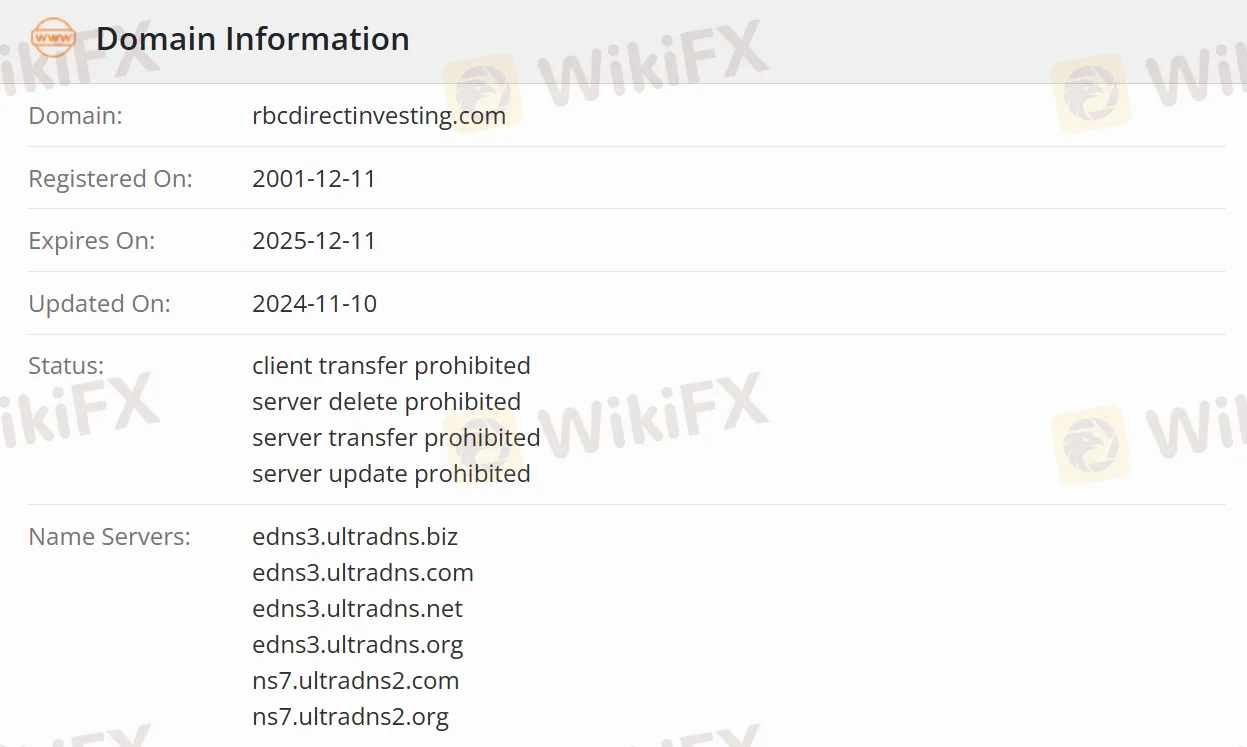

| Teregistrasi Pada | 2001-12-11 |

| Negara/Daerah Terdaftar | Kanada |

| Regulasi | Tergolong |

| Produk Investasi | Saham, Opsi, Emiten Baru/IPO, ETFS, Reksadana, GICs, Obligasi, Emas, dan Perak |

| Platform Perdagangan | Platform investasi online, Aplikasi Seluler RBC (Seluler) |

| Dukungan Pelanggan | Gratis: 1-800-769-2560 |

| Luar Negeri: 1-416-977-1255 | |

| Kantonis dan Mandarin: 1-800-667-8668 atau 416-313-8611 | |

| Fax: 1 (888) 722-2388 | |

Informasi RBC

RBC Direct Investing adalah platform investasi mandiri di bawah Royal Bank of Canada (RBC), yang diatur dengan ketat. Platform ini menawarkan berbagai layanan investasi, termasuk saham, opsi, ETF, reksadana, dan obligasi, mencakup 18 pasar global seperti Kanada dan Amerika Serikat. Mendukung tiga metode perdagangan—platform online, aplikasi seluler, dan dasbor perdagangan profesional—platform ini melayani semua jenis investor, dari pemula hingga trader berpengalaman.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Tergolong | Informasi akun yang tidak spesifik |

| Struktur komisi rendah (mulai dari $6.95 per transaksi) | Ambang batas biaya pemeliharaan |

| Informasi biaya yang jelas | Spread hingga 1.6% (USD-CAD) |

| Platform perdagangan fleksibel |

Apakah RBC Legal?

Organisasi Regulasi Investasi Kanada mengatur RBC, dengan nomor lisensinya tidak dirilis, dan RBC tunduk secara ketat pada regulasi sekuritas Kanada.

Apa yang Dapat Saya Perdagangkan di RBC?

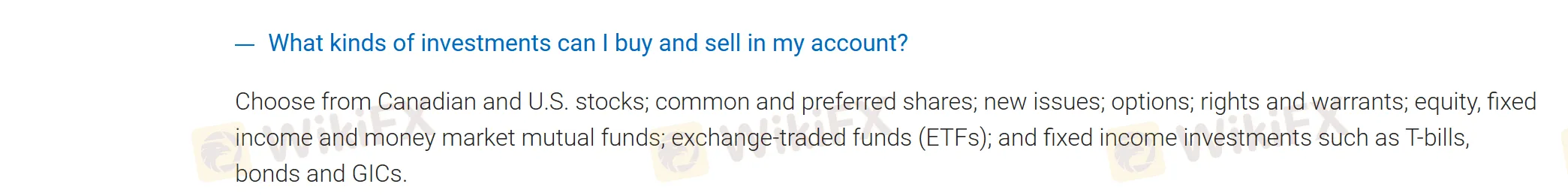

RBC menawarkan saham Kanada dan AS, termasuk saham biasa dan preferen, saham yang baru diterbitkan, opsi, hak dan waran, ekuitas, pendapatan tetap, dan dana investasi pasar uang, dana yang diperdagangkan di bursa (ETF), dan investasi pendapatan tetap seperti surat berharga pemerintah, obligasi, dan sertifikat investasi yang dijamin (GIC).

| Produk | Instrumen yang Dapat Diperdagangkan | Didukung |

| Investasi Ekuitas | Saham | ✔ |

| Opsi | ✔ | |

| Penawaran baru/IPO | ✔ | |

| Diversifikasi Terintegrasi | ETF | ✔ |

| Dana Investasi | ✔ | |

| Investasi Pendapatan Tetap | GIC | ✔ |

| Obligasi | ✔ | |

| Logam Mulia | Emas dan Perak | ✔ |

Jenis Akun

RBC menawarkan akun terdaftar dengan manfaat pajak dan akun tidak terdaftar.

Akun Terdaftar

TFSA (Rekening Tabungan Bebas Pajak)

RRSP (Rencana Menyimpan untuk Hari Tua Terdaftar)

FHSA (Rekening Tabungan Rumah Pertama)

RESP (Rencana Menyimpan untuk Pendidikan Terdaftar)

RRIF (Dana Pendapatan Pensiun Terdaftar)

Akun Tidak Terdaftar

Akun tunai, akun margin, dan akun korporat/kepercayaan untuk investor institusional (mendukung struktur korporat/mitra).

Biaya RBC

komisi

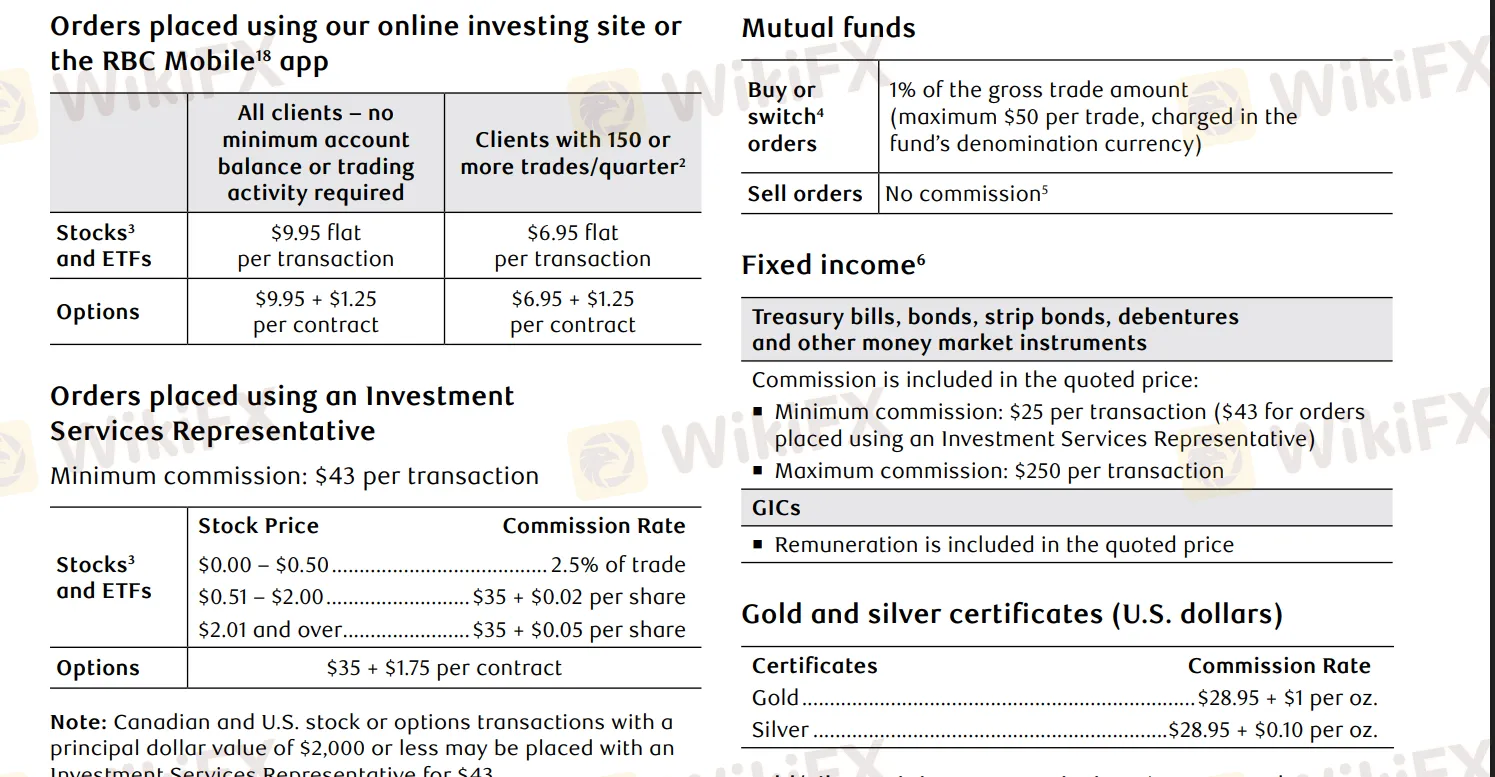

| Aset | Detail Komisi |

| Perdagangan Saham/ETF | Daring: $9.95 per transaksi (kurang dari 150 transaksi per kuartal), $6.95 per transaksi (150+ transaksi per kuartal) |

| Perdagangan Opsi | Daring: $9.95 per transaksi + $1.25 per kontrak (frekuensi rendah), $6.95 per transaksi + $1.25 per kontrak (frekuensi tinggi) |

| Pembelian Dana Investasi | Komisi 1% ($50 maksimum) |

| Emas | $28.95 + $1 per ons |

| Perak | $28.95 + $0.10 per ons |

| Pendapatan Tetap | Mulai dari $25 per transaksi |

Foreign Exchange Spread Rates

| Jumlah Transaksi (USD) | Spread (bps) | Spread (%) |

| $0 hingga $24,999 | 230 | 1.6% |

| $25,000 hingga $99,999 | 145 | 1.0% |

| $100,000 hingga $499,999 | 85 | 0.6% |

| $500,000 hingga $999,999 | 50 | 0.4% |

| $1,000,000 hingga $1,999,999 | 25 | 0.2% |

| $2,000,000.01 ke atas | Tidak lebih dari 10 bps | 0.1% |

Jika aset kurang dari $15,000, diperlukan biaya pemeliharaan triwulanan sebesar $25 (dispensasi tersedia). Selain itu, transfer kawat dalam Kanada atau AS biayanya $45 per transaksi.

Platform Perdagangan

RBC menawarkan platform investasi online yang cocok untuk analisis komprehensif, menyediakan akun demo. Selain itu, Aplikasi Seluler RBC memungkinkan perdagangan seluler yang nyaman, sementara alat Dasbor Perdagangan berkelas profesional disesuaikan untuk pedagang frekuensi tinggi dan investor institusi.

Bonus

Pedagang yang mentransfer aset ≥ $15,000 akan mendapatkan penggantian hingga $200 untuk biaya transfer akun dari pialang asal mereka.