Présentation de l'entreprise

| I-Access Résumé de l'examen | |

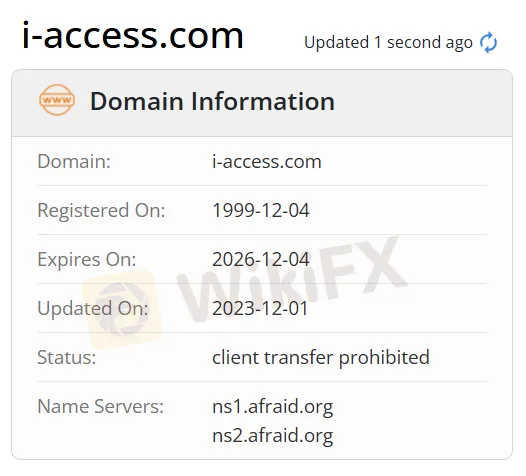

| Fondé | 1999 |

| Pays/Région Enregistré | Hong Kong |

| Régulation | Pas de régulation |

| Instruments de Marché | Titres, Actions, Contrats à terme, Options |

| Compte de Démo | ✅ |

| Plateforme de Trading | ISSNet |

| Support Client | |

| Tél : 2890 8019 | |

| Fax : 2850 5786 | |

| Email : info@i-access.com | |

| Adresse : Tsim Sha Tsui Suite 801-3, 8th Floor, Ocean Centre, Harbour City | |

Informations sur I-Access

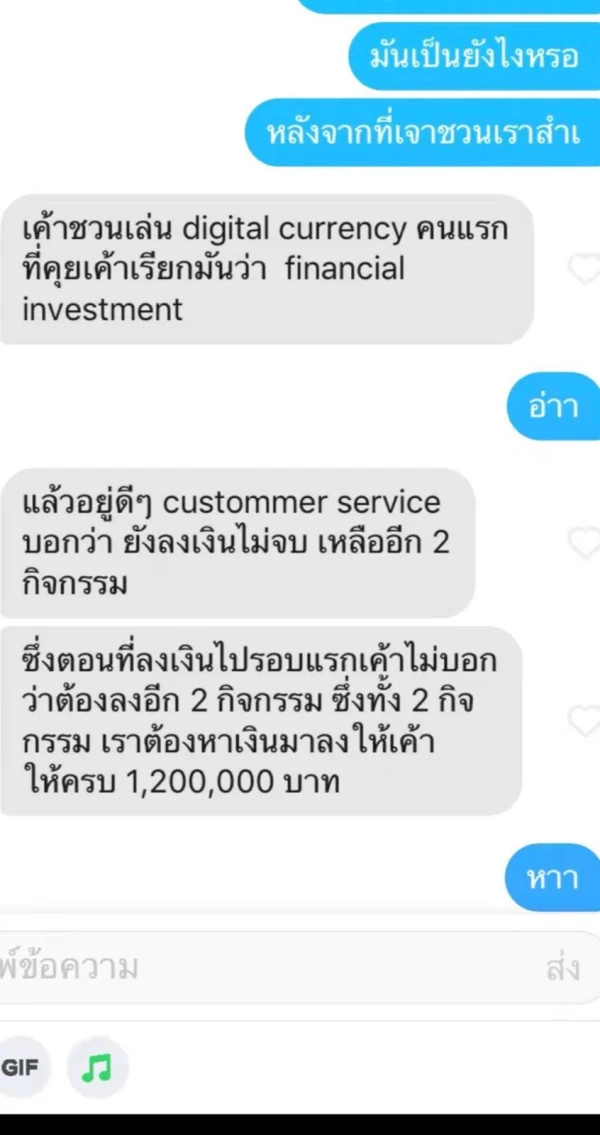

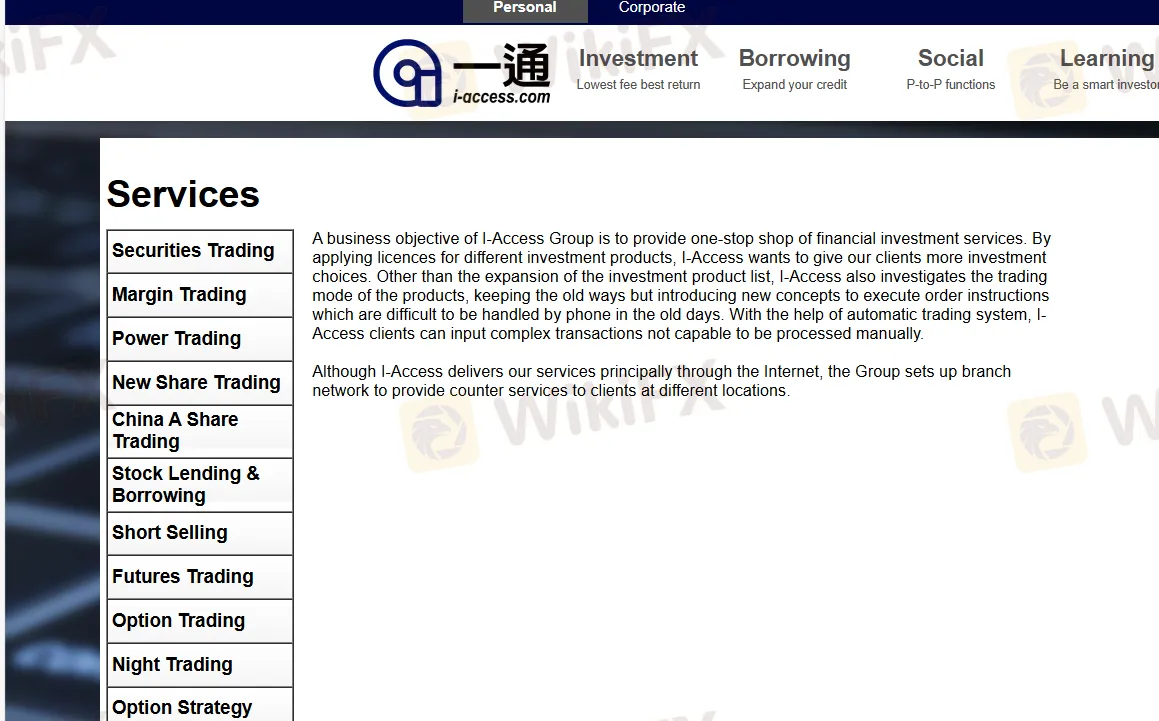

I-Access est un fournisseur de services non réglementé de courtage et de services financiers de premier plan, fondé à Hong Kong en 1999. Il propose des produits et services pour le Trading de Titres, le Trading de Marge, le Trading de Puissance, le Trading de Nouvelles Actions, le Trading d'Actions Chinoises A, le Prêt et Emprunt d'Actions, la Vente à Découvert, le Trading de Contrats à Terme, le Trading d'Options, le Trading de Nuit, la Stratégie d'Options, le Haut Rendement, le Report, le Bullion, le Trading de Lots Impairs, le Plan Mensuel, l'eIPO, la Souscription en Ligne d'Obligations, la Cotation en Temps Réel, les Services de Guichet, les Fonds Entrants/Sortants et les Emprunts.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Temps d'opération prolongé | Manque de régulation |

| Divers produits de trading | Frais de commission facturés |

| Comptes de démonstration disponibles |

I-Access est-il légitime ?

Non. I-Access n'a actuellement aucune réglementation valide. Veuillez être conscient du risque ! De plus, son statut de domaine montre que le transfert de clients est interdit.

Que puis-je trader sur I-Access ?

| Instruments de Trading | Pris en Charge |

| Titres | ✔ |

| Actions | ✔ |

| Contrats à terme | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Matières Premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| ETFs | ❌ |

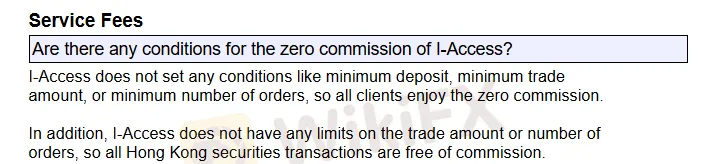

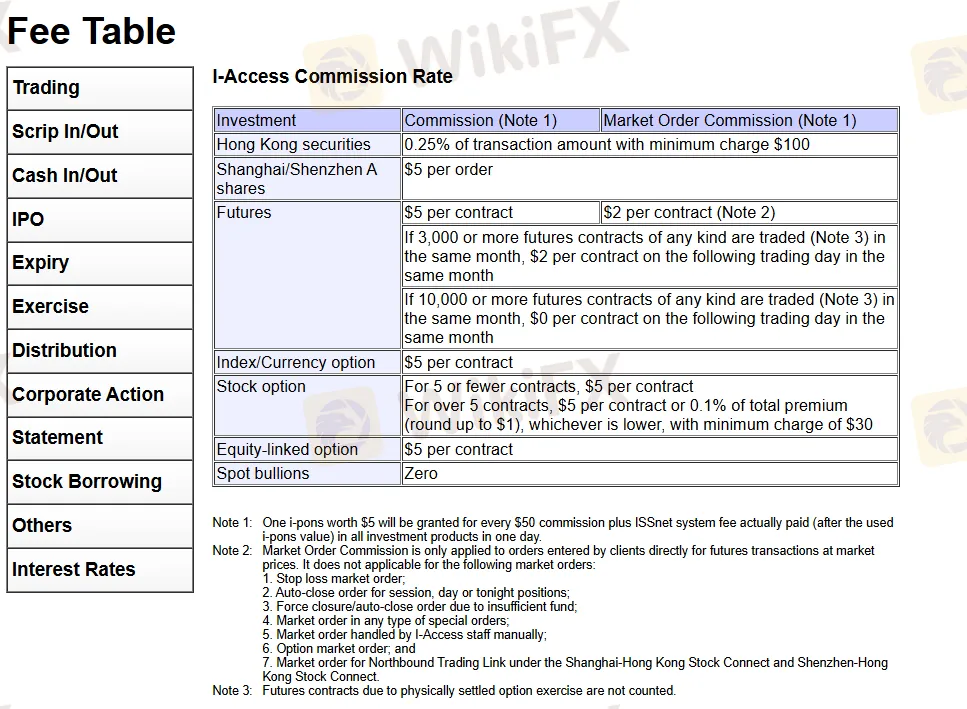

I-Access Frais

| Investissement | Commission | Commission d'ordre de marché |

| Valeurs de Hong Kong | 0,25 % du montant de la transaction avec un minimum de 100 $ | |

| Actions A de Shanghai/Shenzhen | 5 $ par ordre | |

| Contrats à terme | 5 $ par contrat | 2 $ par contrat |

| Si 3 000 contrats à terme ou plus de tout type sont échangés le même mois, 2 $ par contrat le jour de négociation suivant le même mois | ||

| Si 10 000 contrats à terme ou plus de tout type sont échangés le même mois, 0 $ par contrat le jour de négociation suivant le même mois | ||

| Option sur indice/de change | 5 $ par contrat | |

| Option sur actions | Pour 5 contrats ou moins, 5 $ par contrat. Pour plus de 5 contrats, 5 $ par contrat ou 0,1 % de la prime totale (arrondi à 1 $), selon le montant le plus bas, avec un minimum de 30 $ | |

| Option sur actions liées aux actions | 5 $ par contrat | |

| Lingots d'or au comptant | ❌ | |

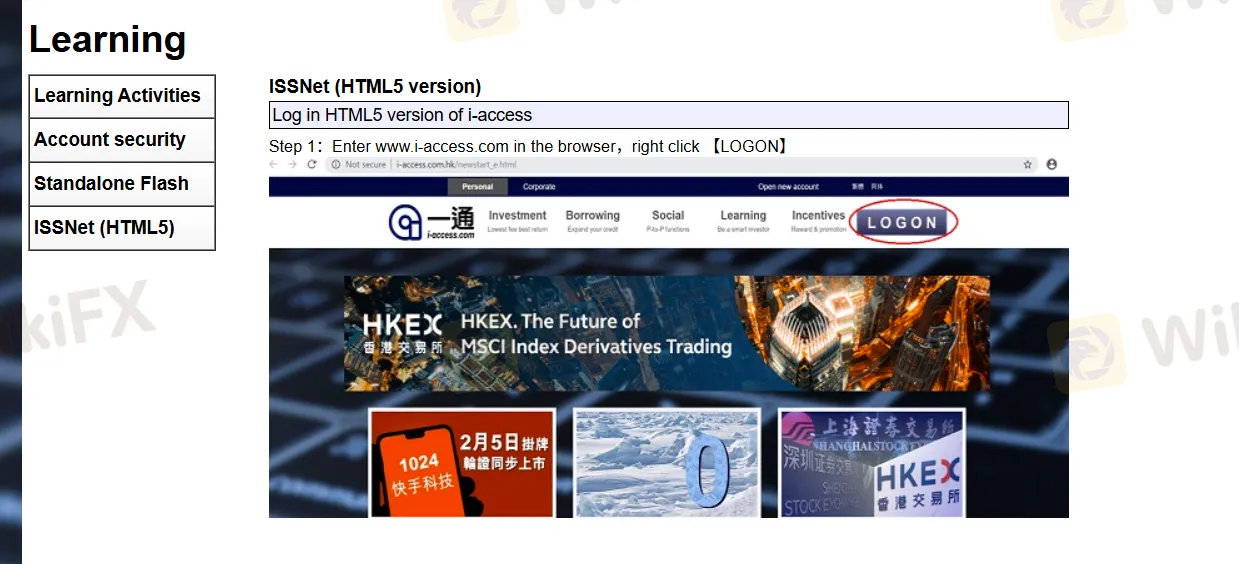

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles |

| ISSNet APP | ✔ | Mobile |

| ISSNet web | ✔ | PC, ordinateur portable, tablette |

Dépôt et retrait

En ce qui concerne le dépôt minimum, I-Access ne fixe aucune condition. En dehors de cela, d'autres détails tels que le délai de traitement, les options de paiement et les devises acceptées, ne sont pas clairs.