Présentation de l'entreprise

| au Kabucom SecuritiesRésumé de l'examen | |

| Fondé | 1997 |

| Pays/Région enregistré(e) | Japon |

| Régulation | FSA |

| Produits et services | Actions, Marge, Transaction (Système/Général), Offre publique initiale (IPO)/Vente publique (PO), ETF/ETN/REIT, ETF gratuit (Fonds négocié en bourse sans commission), Petites actions (Actions de moins d'une unité), Offre publique d'achat (TOB), Fonds d'investissement, FX (Trading sur marge Forex), Trading de contrats à terme/options, Obligations (Obligations étrangères), Fonds du marché monétaire libellés en devises étrangères, CFD (partage 365) |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | Application Au Kabucom FX |

| Dépôt minimum | / |

| Assistance clientèle | Chat en direct |

| Tél: 0120 390 390, 05003-6688-8888 | |

| Email: cs@kabu.com | |

| Réseaux sociaux: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities est une société de courtage en ligne et est la société principale du groupe Mitsubishi UFJ Financial Group (groupe MUFG) dans les services financiers en ligne. L'entreprise est impliquée dans le négoce, le courtage, l'offre et la vente de titres. En plus d'autres services financiers, elle propose des services de banque et de trading sur marge de change.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la FSA | Informations limitées sur les conditions de trading |

| Société établie avec une maison mère réputée | |

| Divers produits et services de trading | |

| Assistance par chat en direct |

au Kabucom Securities est-il légitime ?

Oui, Au Kabucom est actuellement réglementé par l'Agence des services financiers (FSA), détenant une licence de change au détail (No.61).

| Pays réglementé | Autorité réglementée | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| Agence des services financiers (FSA) | Réglementé | au Kabucom Securities株式会社 | Licence de change au détail | 関東財務局長(金商)第61号 |

Produits et services

| Produits et services | Disponible |

| Actions | ✔ |

| Transaction sur marge (Système/Général) | ✔ |

| Offre publique initiale (IPO)/Vente publique (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| ETF gratuit (Fonds négocié en bourse sans commission) | ✔ |

| Petites actions (Actions de moins d'une unité) | ✔ |

| Offre publique d'achat (TOB) | ✔ |

| Fonds d'investissement | ✔ |

| FX (Trading sur marge de change) | ✔ |

| Contrats à terme/Options | ✔ |

| Obligations (Obligations étrangères) | ✔ |

| Fonds du marché monétaire libellés en devises étrangères | ✔ |

| CFD (Share 365) | ✔ |

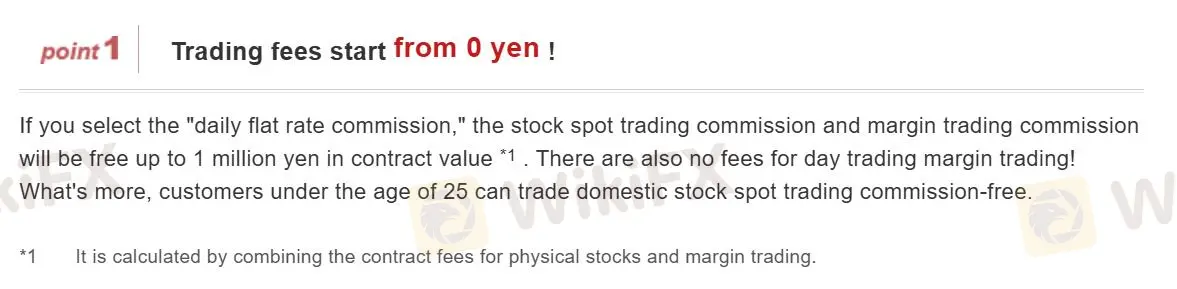

Frais

au Kabucom Securities propose des opérations de change sans commission, où le coût des opérations est intégré dans les spreads.

Au Kabucom facture cependant des frais pour les transactions impliquant d'autres produits. Voici par exemple les frais de négociation d'actions.

Frais de négociation d'actions (à l'exclusion de Petit (Kabu®) et de l'accumulation Premium (Petit (Kabu® )))

| Prix du contrat (JPY) | Frais physiques (taxes incluses) | Plan préférentiel pour les gros volumes |

| 0 yen à 50 000 yen ou moins | 55 yen | ❌ |

| Plus de 50 000 yen à moins de 100 000 yen | 99 yen | |

| Plus de 100 000 yen à moins de 200 000 yen | 115 yen | |

| Plus de 200 000 yen à moins de 500 000 yen | 275 yen | |

| Plus de 500 000 yen à moins de 1 000 000 yen | 535 yen | |

| Plus de 1 million yen | Montant du contrat × 0,099% (taxes incluses) + 99 yen [Maximum : 4 059 yen] |

Note:

- Les frais ci-dessus seront appliqués indépendamment des conditions d'exécution (ordre au marché, ordre limite, trading automatisé, etc.).

- Si un calcul (calcul des frais ou calcul de la taxe de consommation) donne une partie fractionnaire, elle sera arrondie à la baisse.

- Pour les transactions par téléphone, des frais d'opérateur de 2 200 yens (taxes incluses) seront ajoutés séparément.

- Les frais d'achat et de vente de droits d'acquisition d'actions sont les mêmes que les frais d'achat et de vente d'actions physiques mentionnés ci-dessus.

- Il n'y a pas de frais pour les transactions dans un compte NISA (investissement à petite échelle exempté d'impôt).

- Si la limite supérieure de la fourchette de prix (stop high) change en raison d'un ordre spécifié par période et que le montant disponible est insuffisant, l'ordre sera annulé de force.

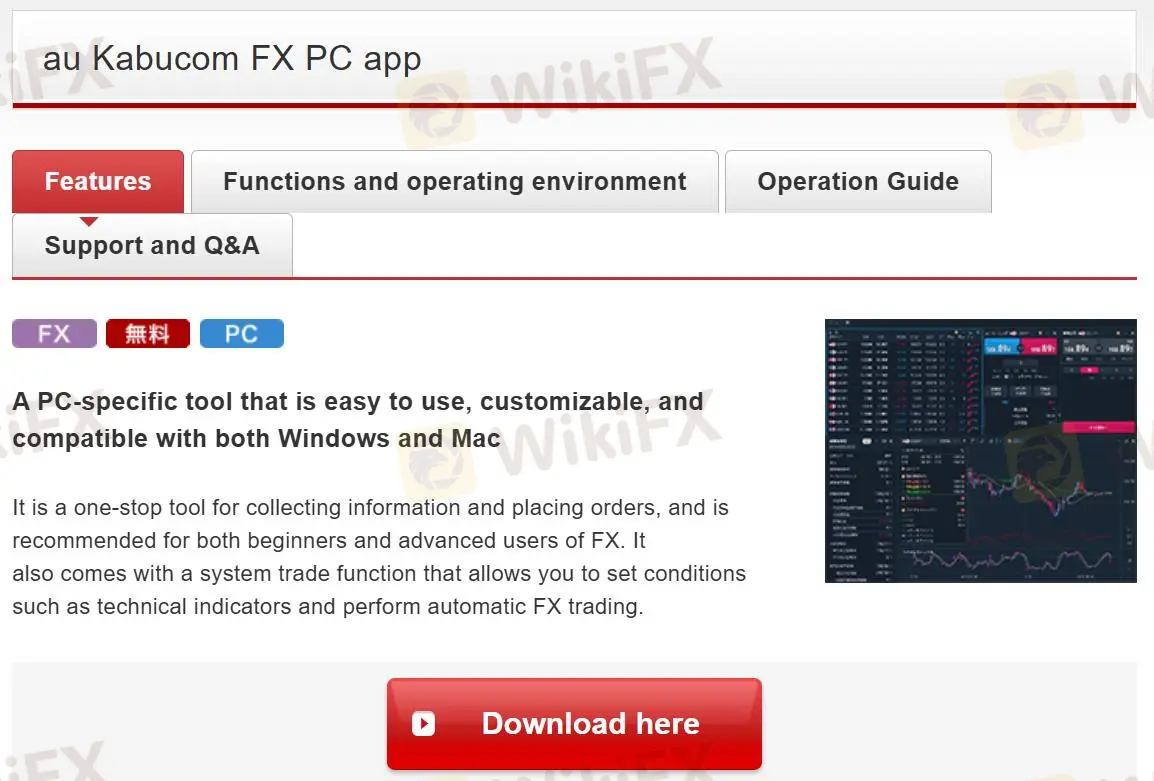

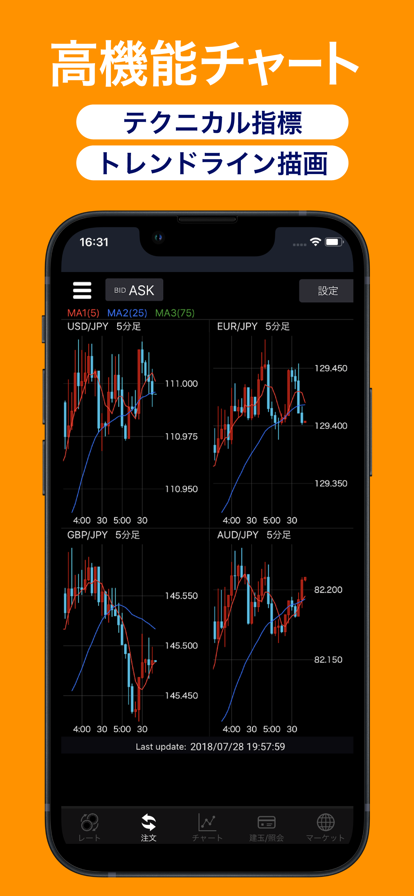

Plateforme de trading

Au Kabucom Securities propose une application au Kabucom disponible à la fois sur PC et sur plateforme mobile.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Application Au Kabucom FX | ✔ | Ordinateur de bureau, Mobile | / |

| MT5 | ❌ | / | Traders expérimentés |

| MT4 | ❌ | / | Débutants |