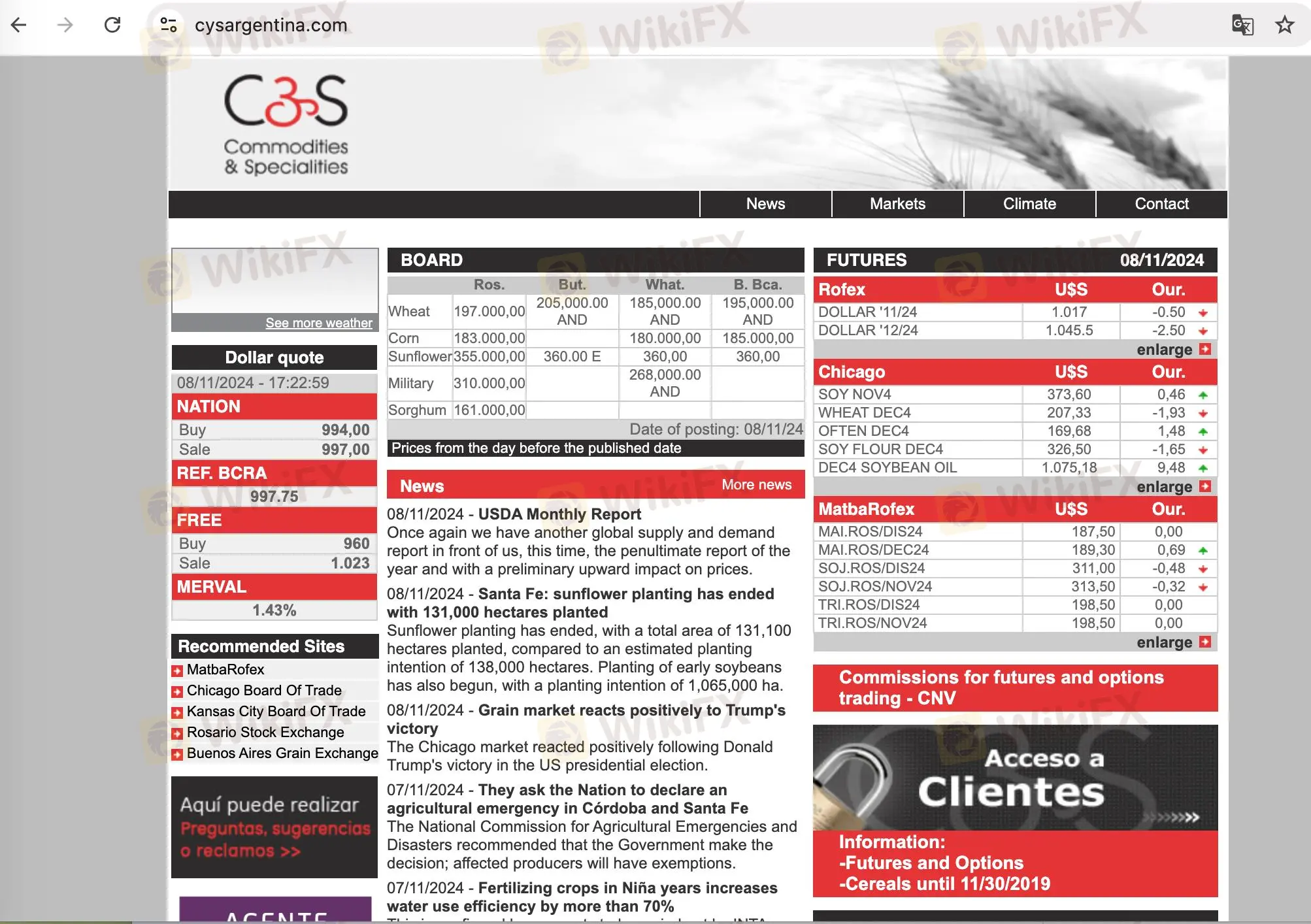

Présentation de l'entreprise

| C&S Résumé de l'examen | |

| Fondé | 2008 |

| Pays/Région enregistré | Argentine |

| Réglementation | Aucune réglementation |

| Instruments de marché | Matières premières |

| Compte de démonstration | ❌ |

| Plateforme de trading | / |

| Dépôt minimum | / |

| Assistance clientèle | Téléphone : (+54.341) 426-0226 / 426-7201 |

| Email : contacto@cysargentina.com | |

| Adresse : Entre Rios 729 - P.11 - Rosario, Santa Fe, Argentine | |

| Twitter : https://twitter.com/cysargentina | |

| Facebook : https://www.facebook.com/home.php?#!/profile.php?id=100001769530055 | |

Informations C&S

Fondé en 2008, C&S est un fournisseur de services financiers non réglementé enregistré en Argentine, proposant des opérations sur les matières premières.

Avantages et inconvénients

| Avantages | Inconvénients |

| Multiples canaux de contact | Aucune réglementation |

| Pas de compte de démonstration | |

| Produits de trading limités |

C&S est-il légitime ?

Non. C&S est enregistré en Argentine. Il n'a actuellement aucune réglementation valide.

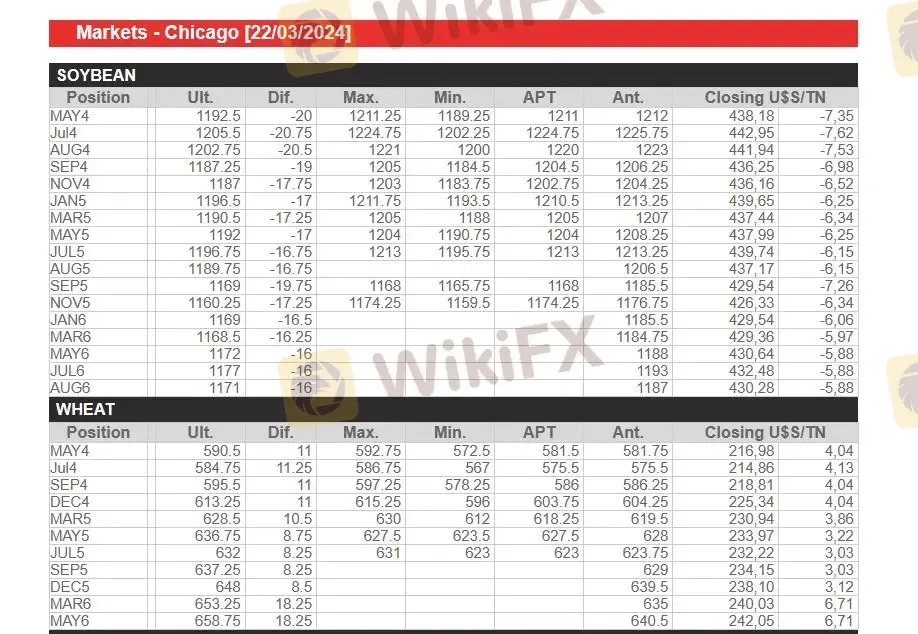

Que puis-je trader sur C&S ?

| Instruments négociables | Pris en charge |

| Matières premières | ✔ |

| Forex | ❌ |

| Actions | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |