Présentation de l'entreprise

| Résumé de l'examen de la Banque Access | |

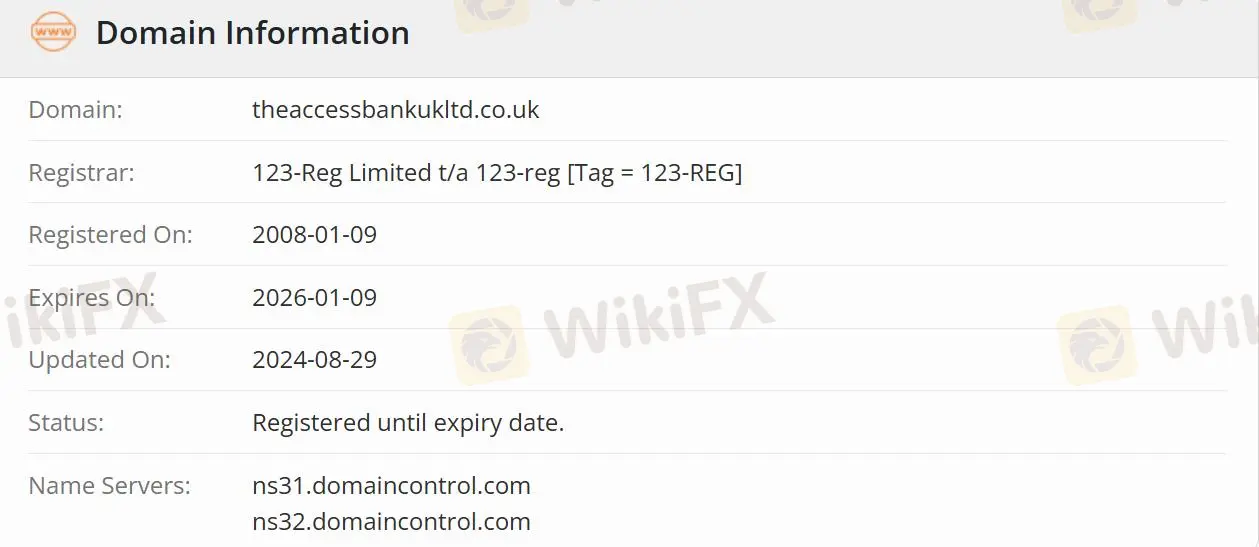

| Fondée | 2008-01-19 |

| Pays/Région d'enregistrement | Royaume-Uni |

| Réglementation | Réglementée |

| Services | Financement du commerce/Banque commerciale/Gestion d'actifs/Investissement |

| Assistance clientèle | Email: ccontactaaccessprivatebank.com |

| Téléphone: 0333 222 4516 (Royaume-Uni)/+44 1606 813020 | |

Informations sur la Banque Access

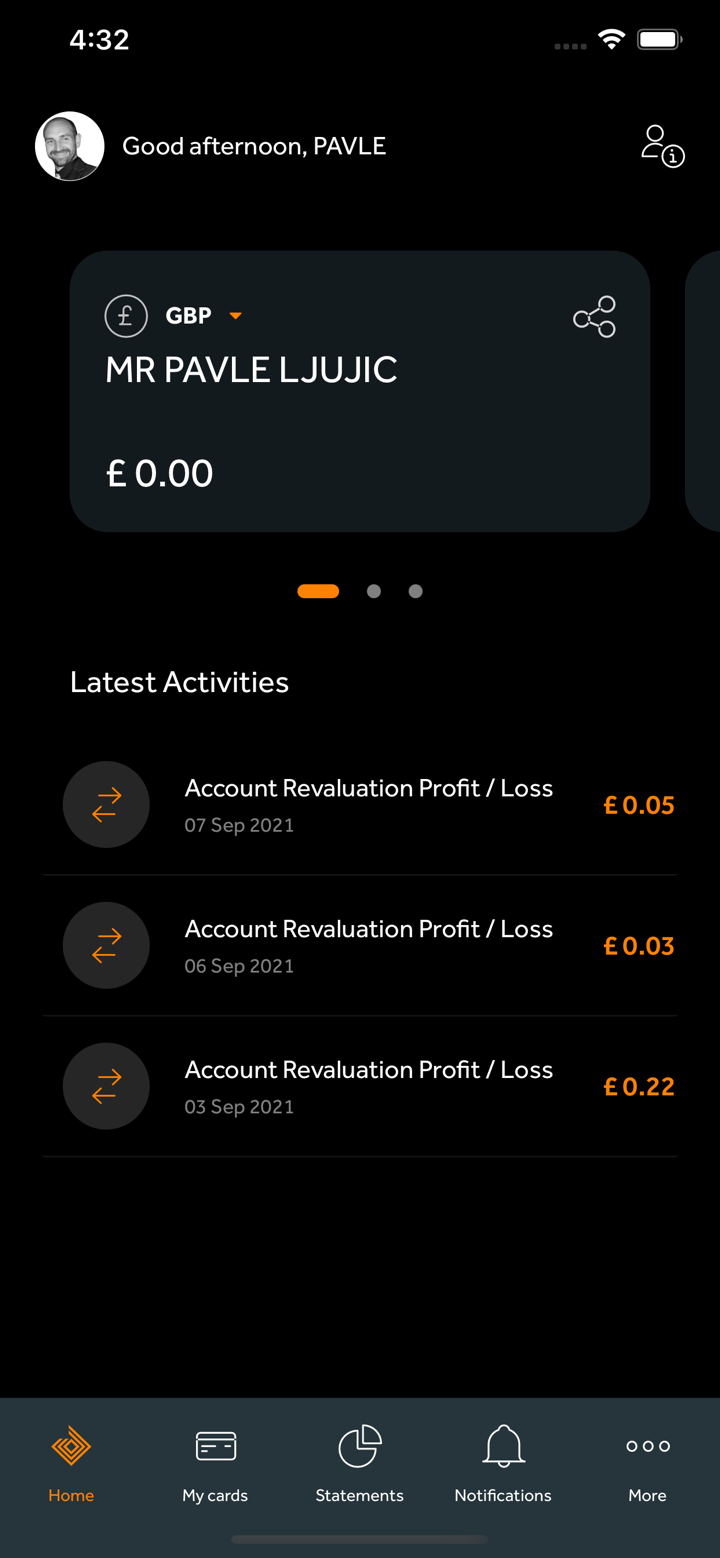

La Banque Access, enregistrée au Royaume-Uni, propose une large gamme de produits et services innovants, notamment le financement du commerce, la banque commerciale et la gestion d'actifs, ainsi que soutient le flux d'investissements sur les marchés du Nigeria, de l'Afrique et de la région MENA. L'objectif de la banque est de développer l'activité internationale du groupe Access Bank grâce au service client et à des solutions innovantes dans le financement du commerce, la banque commerciale et la gestion d'actifs.

La Banque Access est-elle légitime ?

La Banque Access est autorisée et réglementée par l'Autorité de conduite financière (FCA) avec le numéro de licence 478415. Une entreprise réglementée est plus sûre qu'une entreprise non réglementée.

Quels services propose la Banque Access ?

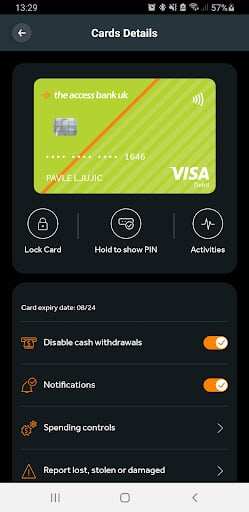

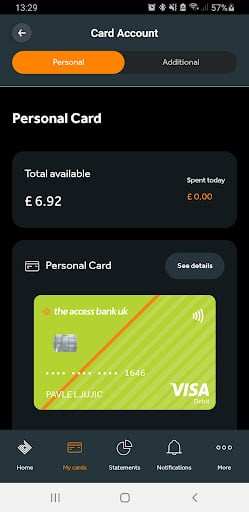

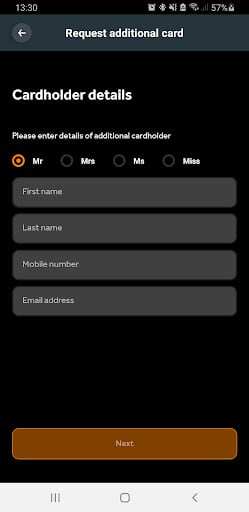

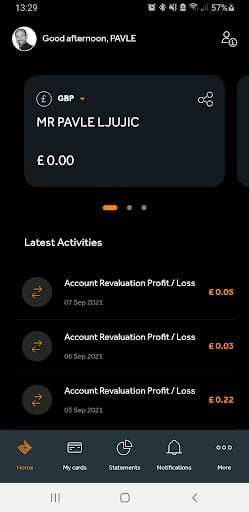

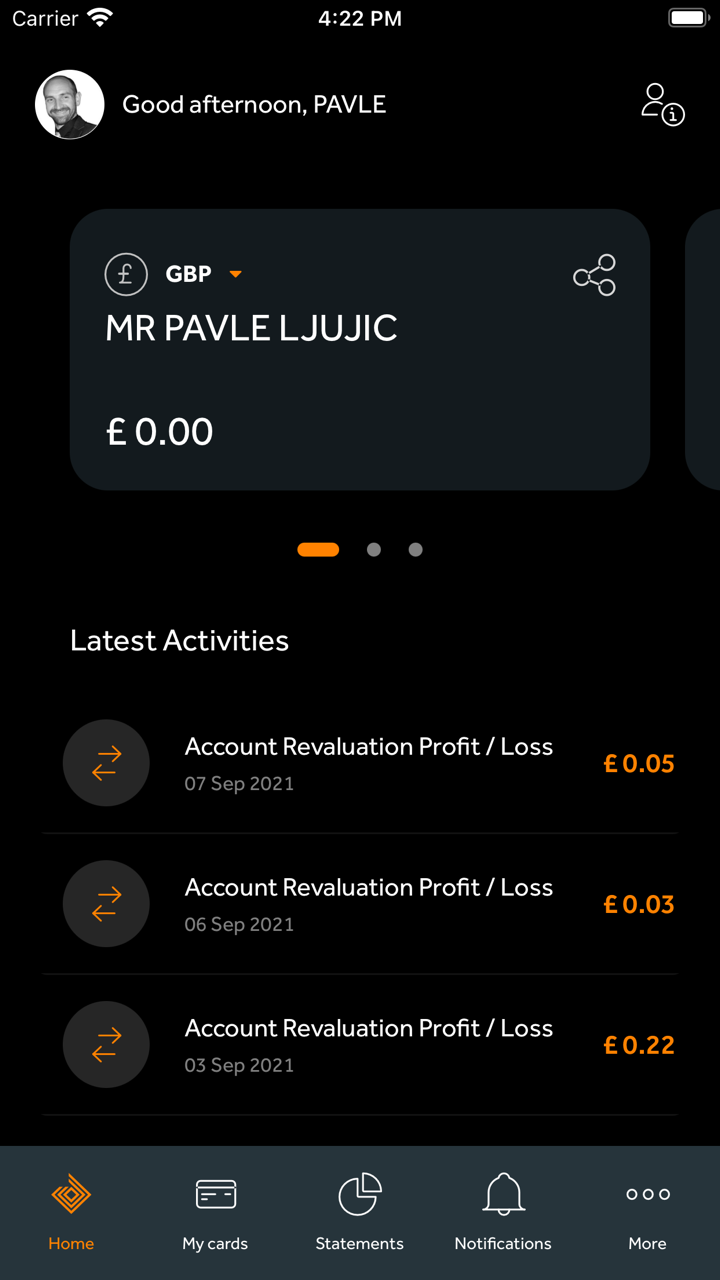

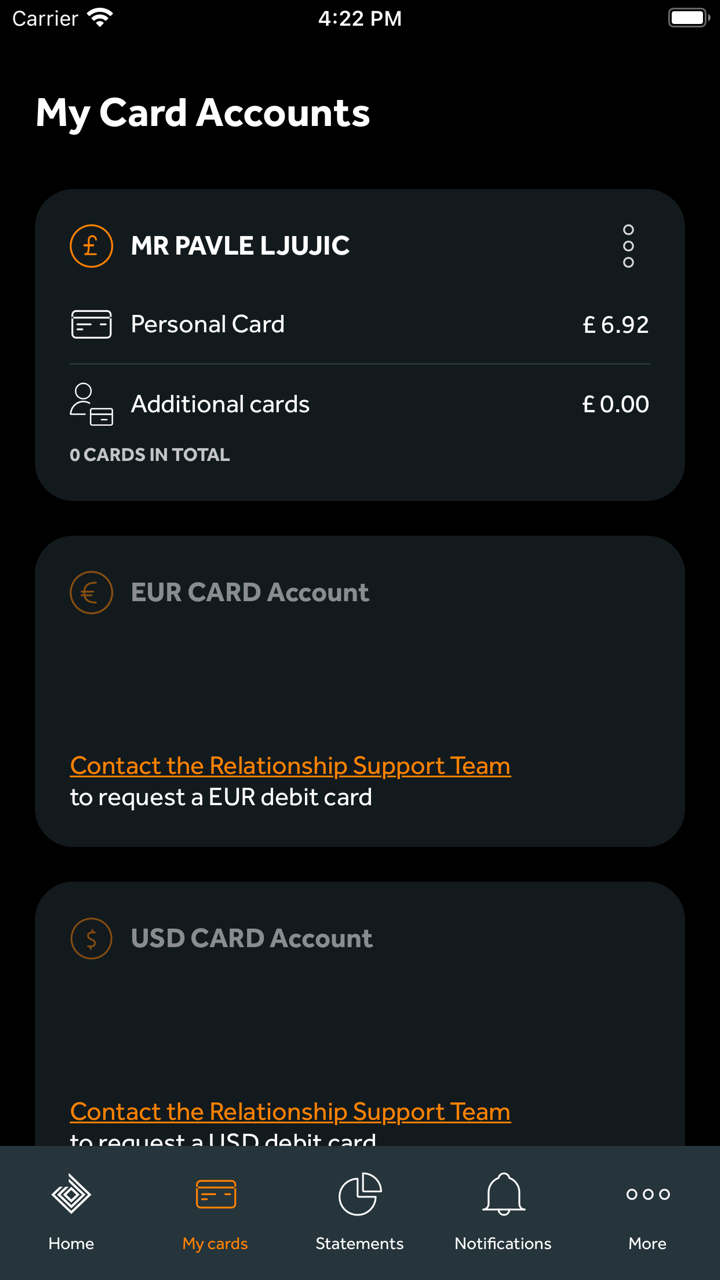

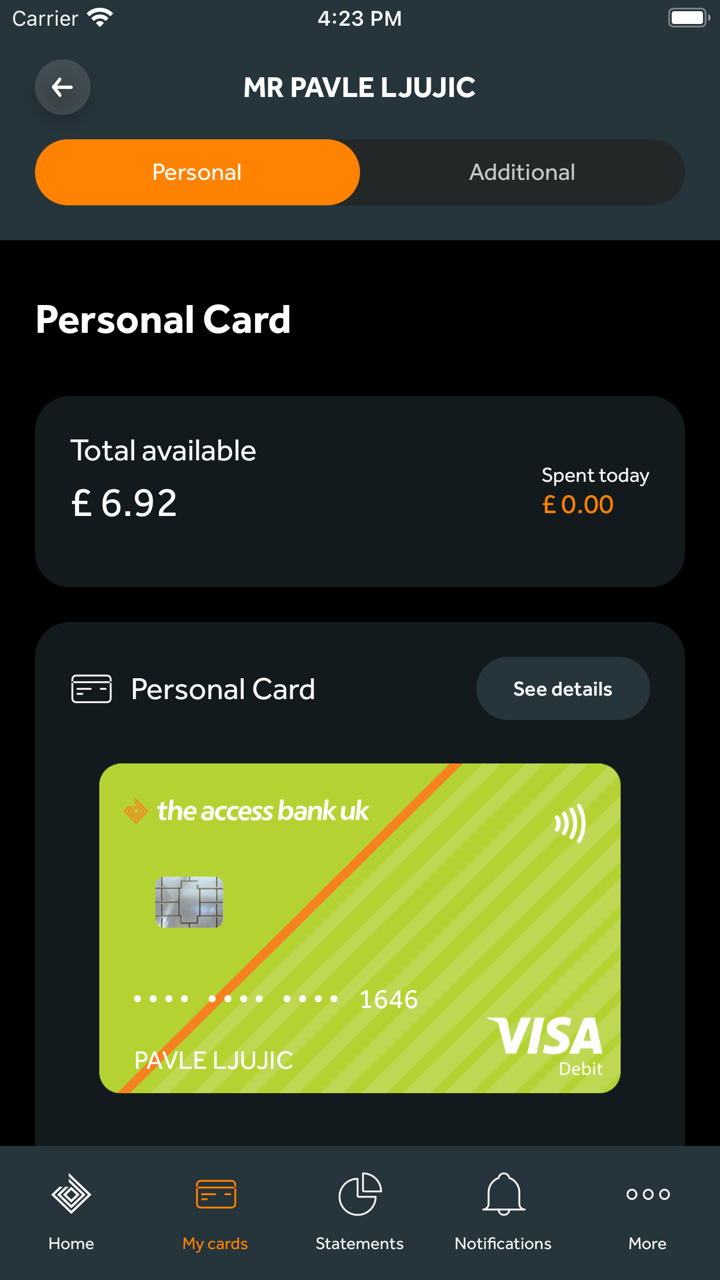

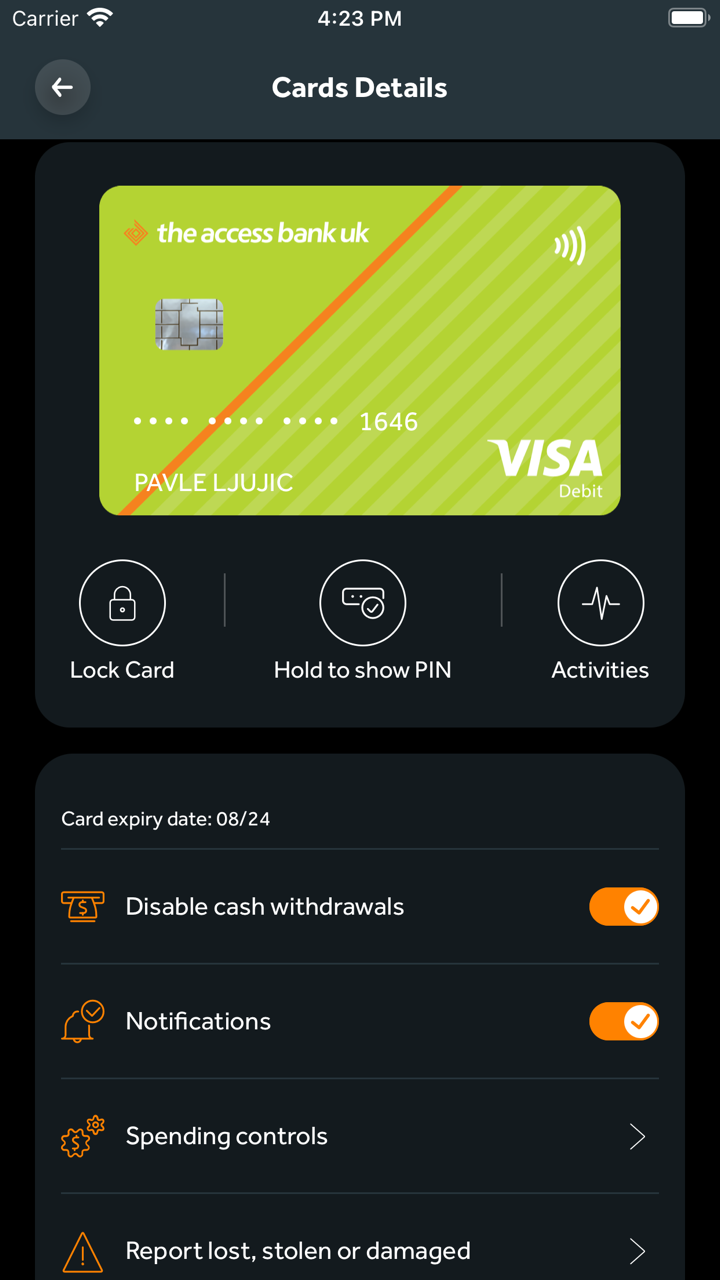

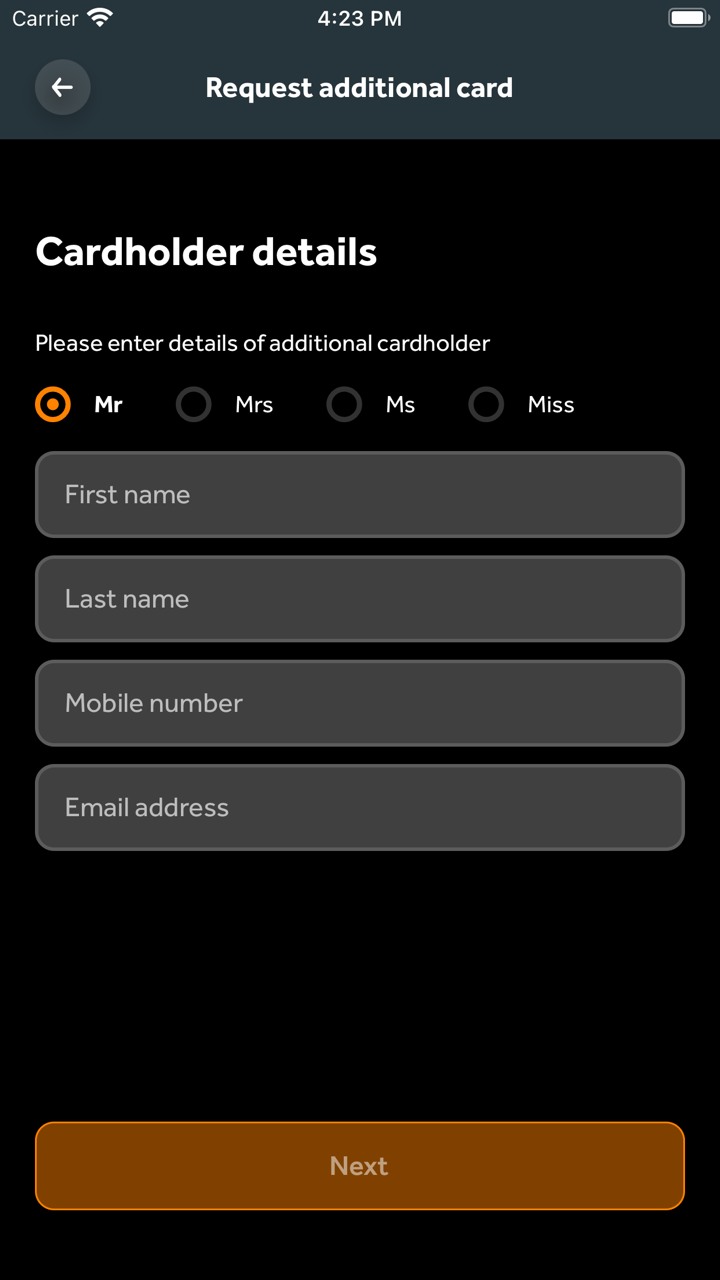

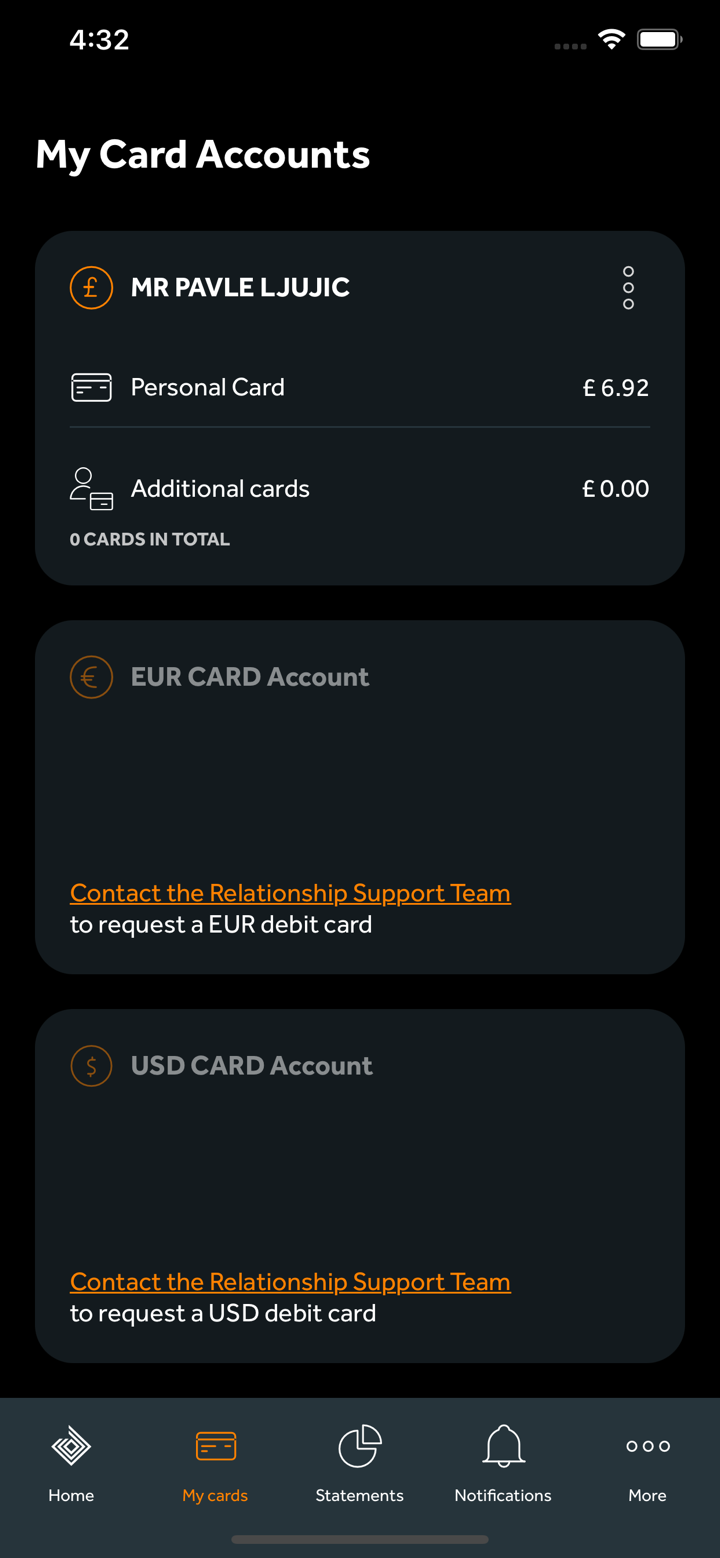

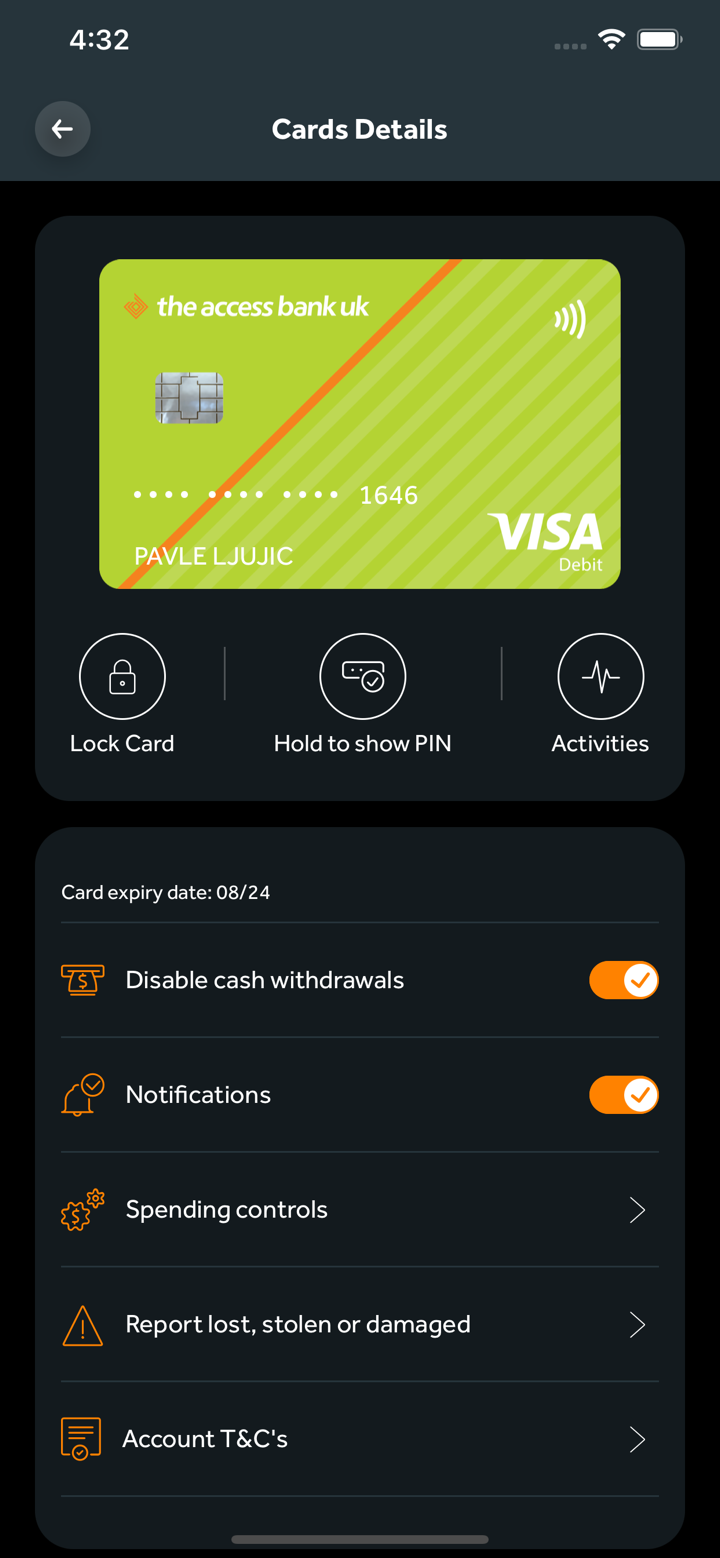

La Banque Access propose divers services financiers aux particuliers, aux entreprises et aux particuliers privés au Royaume-Uni. Les utilisateurs internationaux peuvent également bénéficier de services tels que la banque commerciale et le financement du commerce.

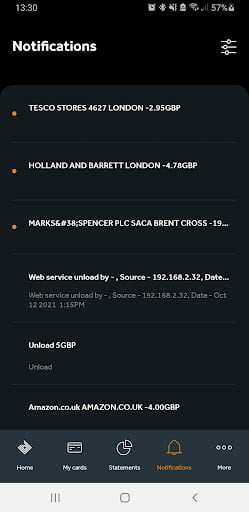

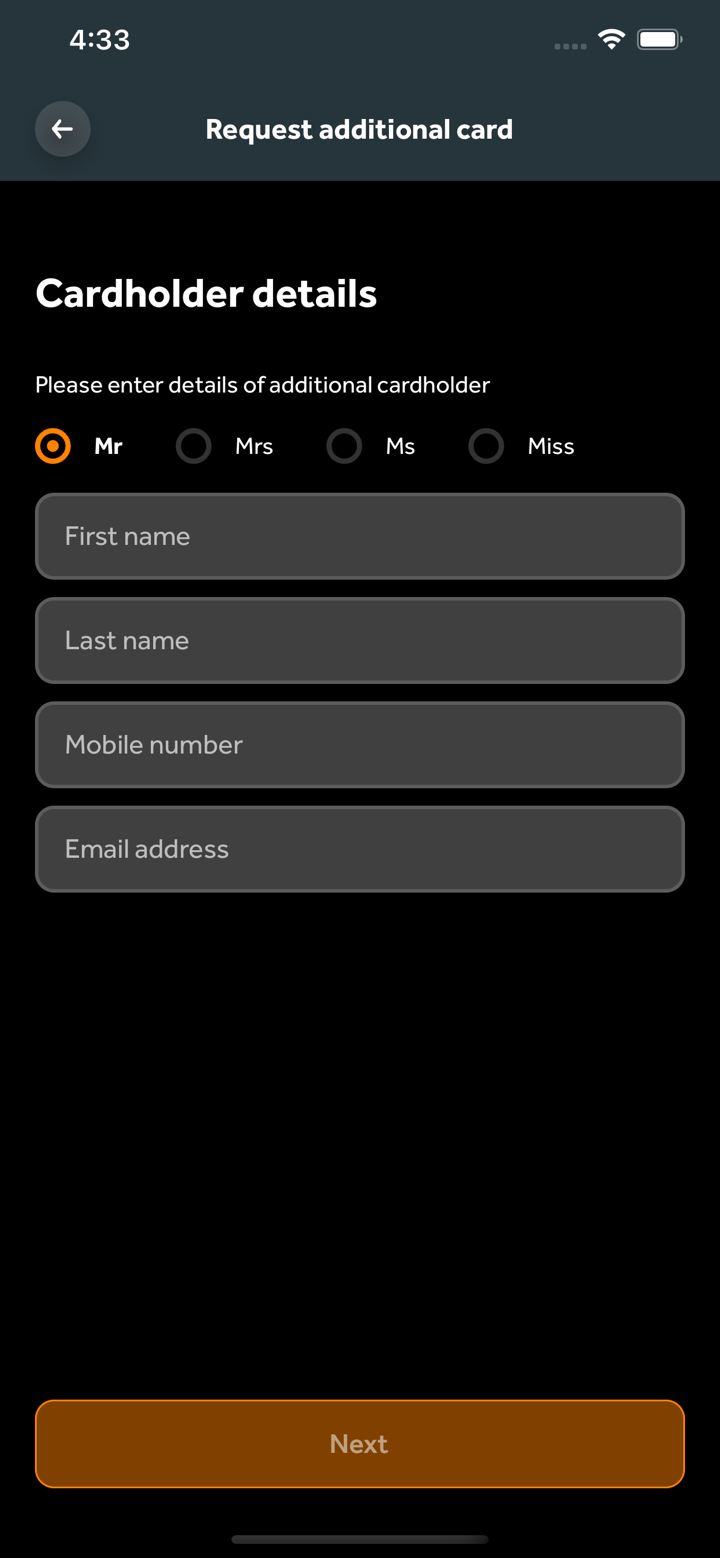

Les clients personnels du Royaume-Uni peuvent choisir la banque personnelle, les comptes courants, les prêts immobiliers, les services de change, les paiements plus rapides, les questions fréquemment posées et les comptes de dépôt à préavis.

La banque propose aux clients professionnels du Royaume-Uni la banque d'entreprise, les comptes professionnels, le financement du commerce, les prêts immobiliers, les comptes de dépôt à préavis, les prêts directs, les paiements plus rapides et les questions fréquemment posées.

Les clients privés du Royaume-Uni bénéficient d'une banque privée exclusive, de portefeuilles discrétionnaires, de portefeuilles en exécution seule, de prêts immobiliers, de comptes de dépôt à préavis, de paiements plus rapides et de prêts garantis par le portefeuille.

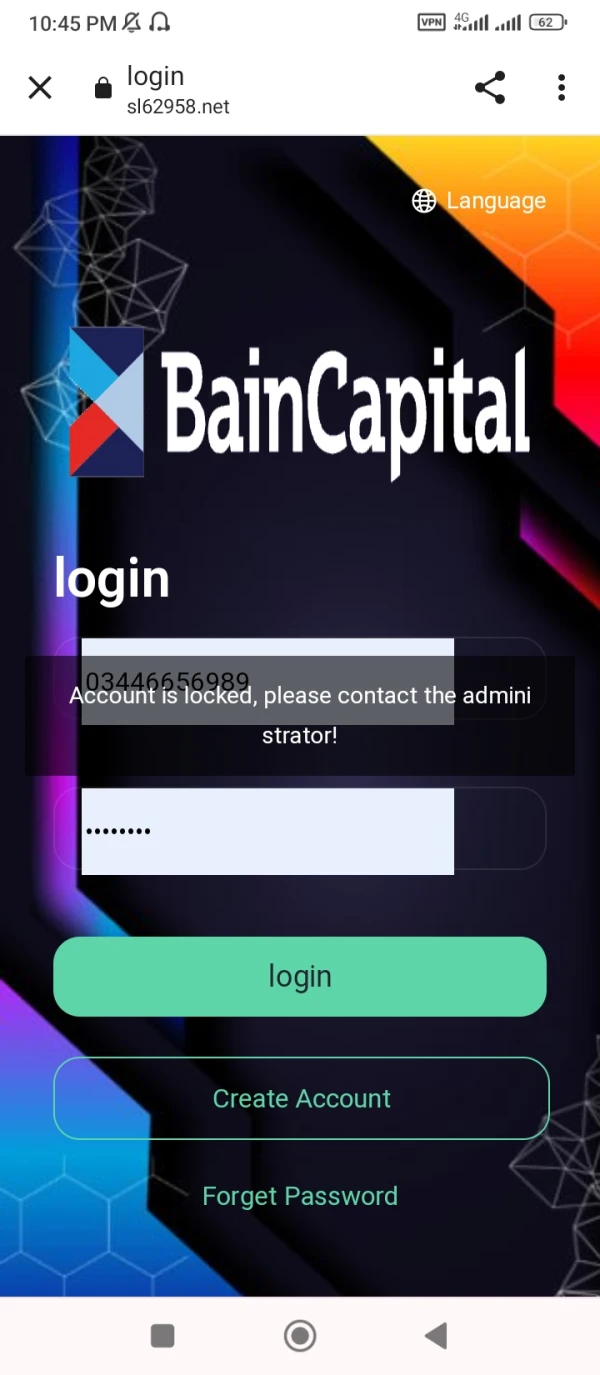

Ghazi6612

Le pakistan

Maintenant, mon compte est également verrouillé.

Divulgation

sunny91

La turquie

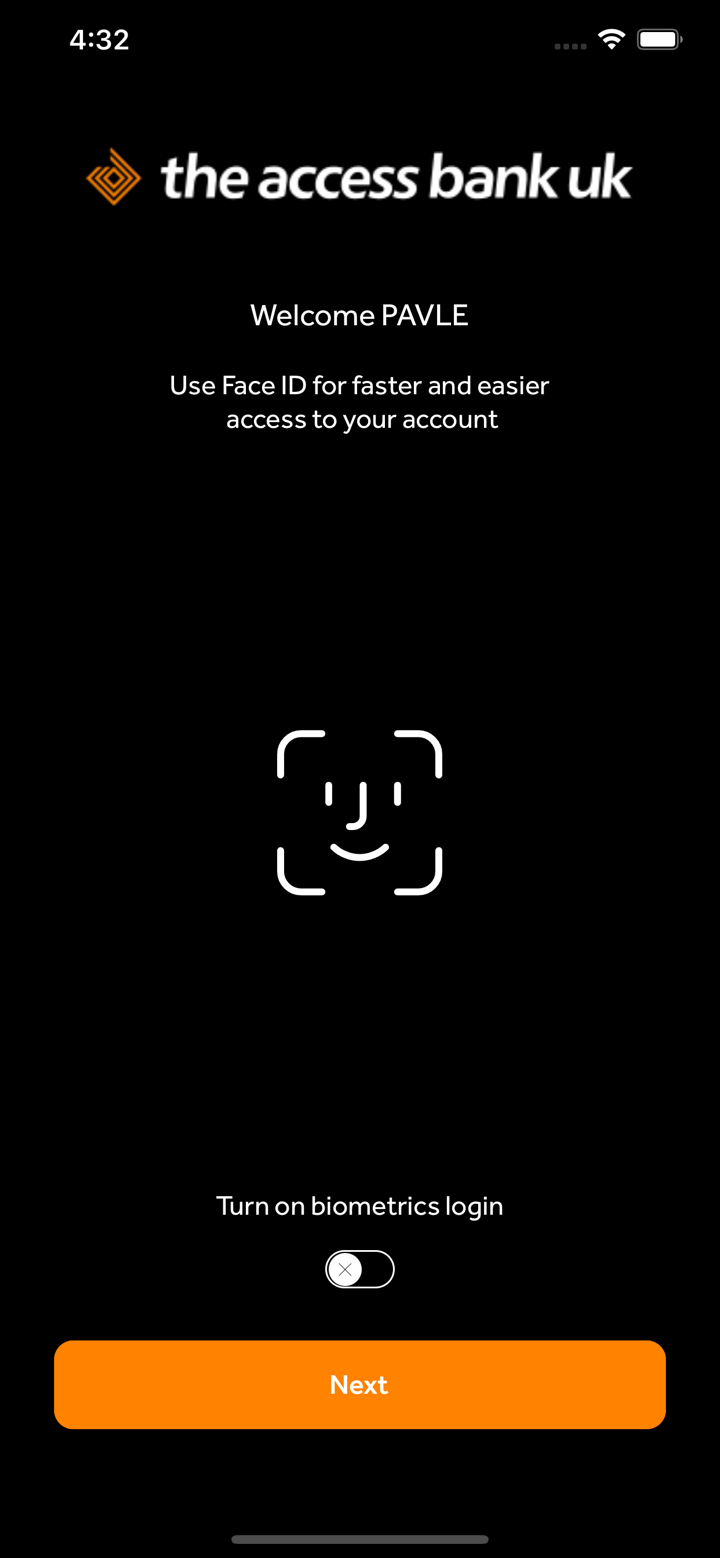

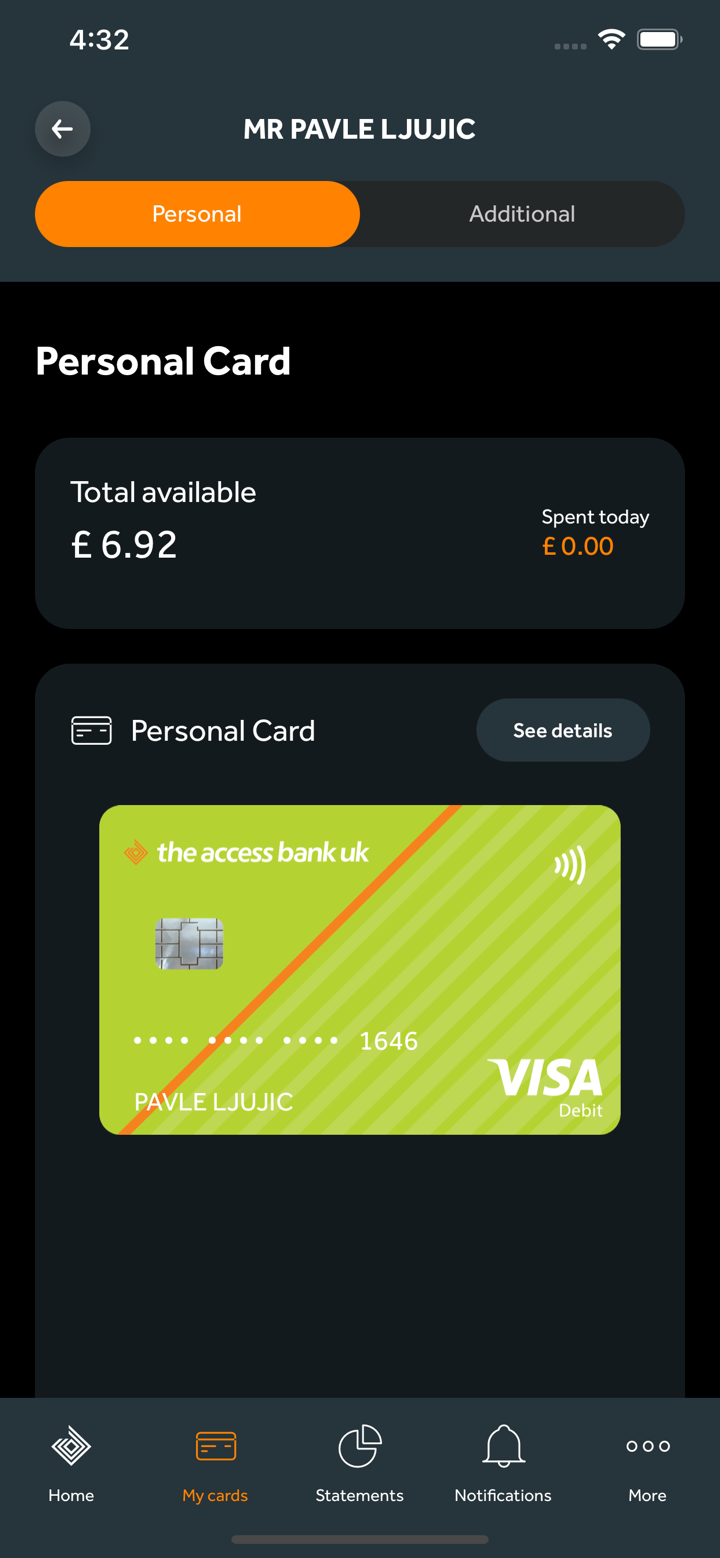

La banque avec Access Bank UK est vraiment personnelle. Ils accordent une réelle priorité à la compréhension et à la satisfaction de mes besoins. Leur banque en ligne est simple et efficace.

Positifs

拳

Singapour

Digne de confiance et fiable ! Service bancaire de premier ordre !

Positifs

KASLAS

Le Nigeria

le principal problème des courtiers est un mauvais réseau mais le courtier Access Bank est très bon en réseau est simple pour le commerce et le processus de retrait des bénéfices a réussi

Positifs

程安 -陶

L'Argentine

Le service client de cette entreprise est très bon. J'ai reçu une réponse dans l'heure qui a suivi l'envoi de l'e-mail et le service client m'a patiemment et méticuleusement aidé à résoudre le problème.

Positifs

Rith Rith

Hong Kong

J'ai essayé beaucoup de choses de ce genre, dans un sens, je veux essayer, mais dans mon subconscient je pense, oui, oui, je veux essayer !! Quelqu'un peut-il me dire que cela fonctionne.

Positifs