Présentation de l'entreprise

| YAMAGATARésumé de l'examen | |

| Fondé | 2006 |

| Pays/Région enregistré | Japon |

| Régulation | FSA |

| Produits de trading | Actions, ETF (Fonds négociés en bourse), REIT (Fonds d'investissement immobilier), Obligations, Contrats à terme, Options |

| Compte de démonstration | ✅ |

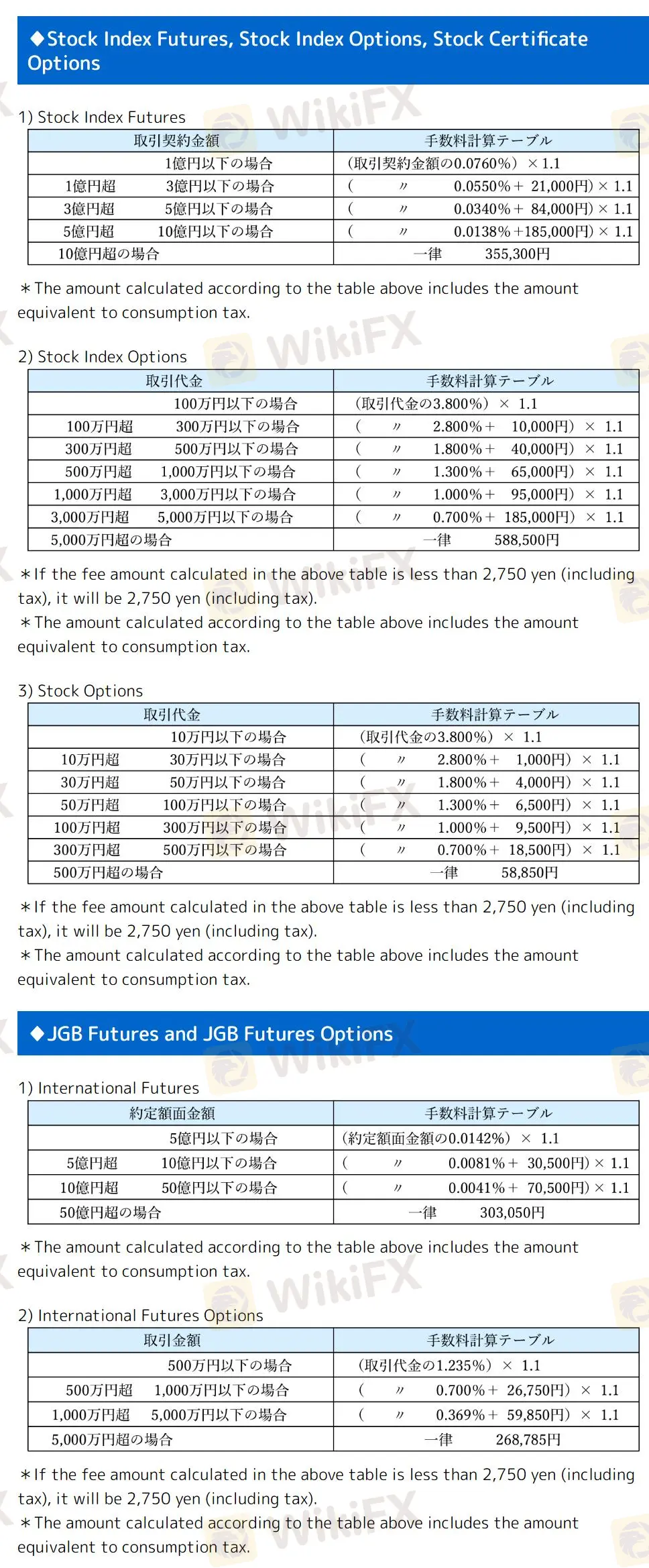

| Commission | Selon les produits, de 2 750 yens à 588 500 yens |

| Assistance clientèle | Tél : 023-631-7720 |

| Email : soumu@yamagatashoken.co.jp | |

| Adresse de l'entreprise : 990-0042 yamagata city nanika-machi 2-1-41 (〒990-0042 山形市七日町2-1-41) | |

Fondé en 2006, YAMAGATA est un courtier en valeurs mobilières réglementé par la FSA et enregistré au Japon, offrant des services de trading sur les actions américaines (courtage en actions américaines), les actions (négociation au comptant des actions nationales, actions étrangères, etc.), les obligations, les contrats à terme (contrats à terme JGB), les fonds d'investissement et les assurances vie.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la FSA | Seuil de lecture japonais |

| Variété de produits de trading | |

| Comptes de démonstration | |

| Structure de frais claire |

Est-ce que YAMAGATA est légitime ?

Oui. YAMAGATA est actuellement réglementé par l'Autorité des services financiers (FSA).

| Pays réglementé | Régulateur | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| Autorité des services financiers (FSA) | Réglementé | YAMAGATA株式会社 | Licence de Forex de détail | 東北財務局長(金商)第3号 |

Que puis-je trader sur YAMAGATA?

| Instruments négociables | Pris en charge |

| Actions | ✔ |

| ETF (Fonds négociés en bourse) | ✔ |

| REIT (Société d'investissement immobilier) | ✔ |

| Obligations | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

YAMAGATA Frais

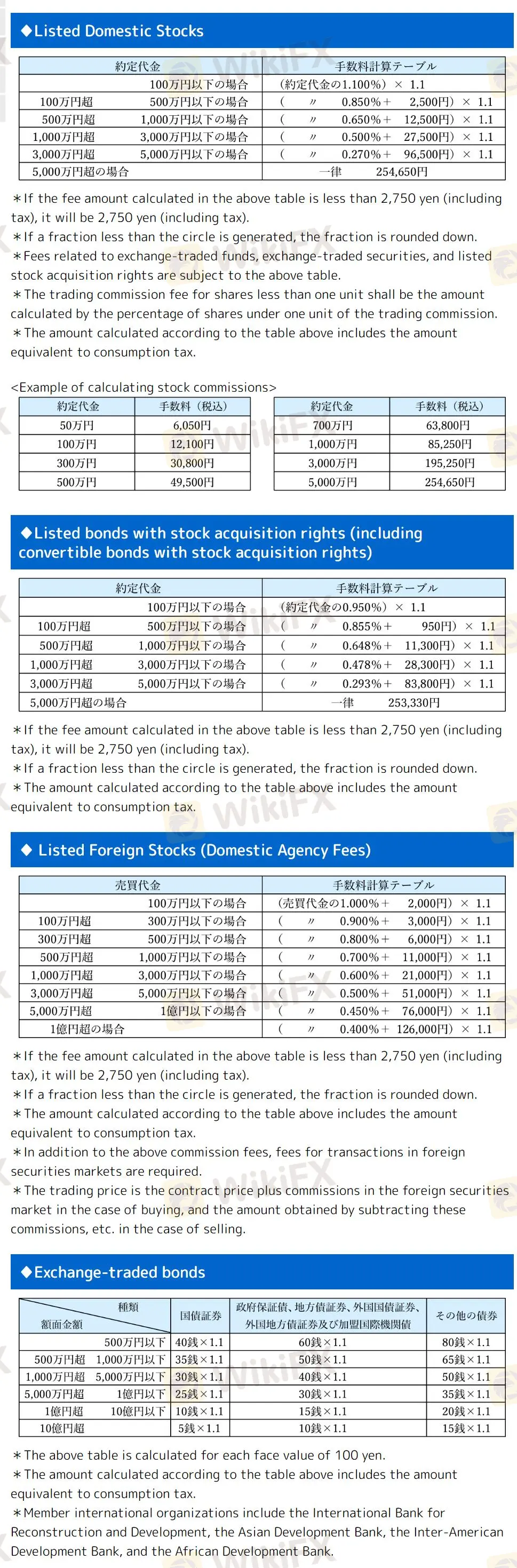

Frais pour les actions:

- Actions nationales et obligations: Des frais minimums de 2 750 yens (taxes incluses) s'appliquent si les frais calculés sont inférieurs à ce montant. Les fractions de yen sont arrondies à la baisse.

- Actions étrangères: Les mêmes frais minimums que les actions nationales, plus des frais supplémentaires pour les transactions sur les marchés étrangers.

- ETF et titres avec droits d'acquisition d'actions: Suivent la même structure de frais que les actions nationales.

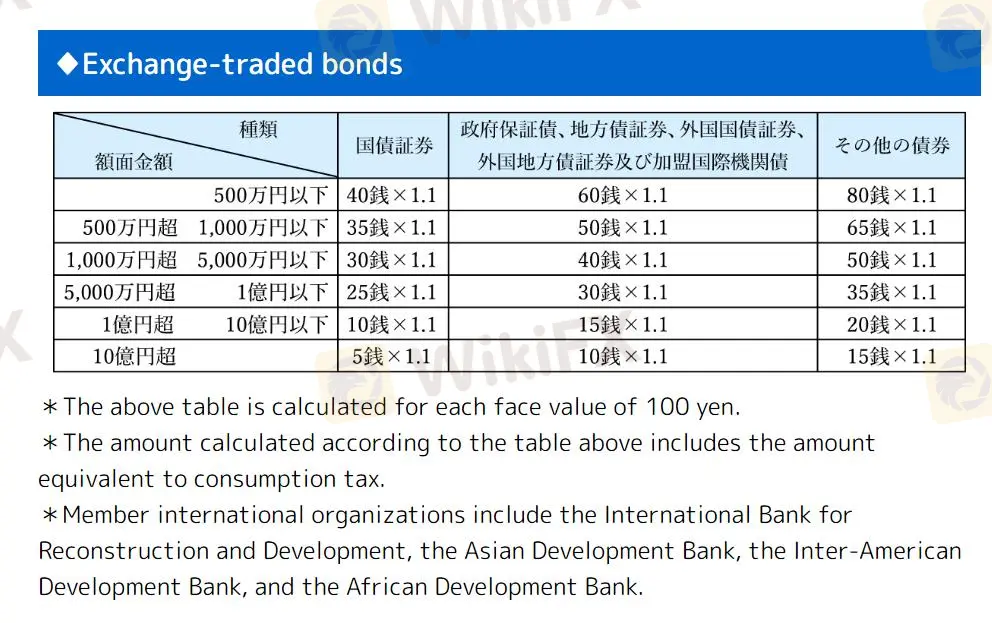

Frais pour les obligations:

- Obligations négociées en bourse: Frais calculés par tranche de 100 yens de valeur nominale, taxes de consommation incluses.

Frais pour les futures et les options:

- Futures sur indices boursiers: Les frais incluent la taxe de consommation.

- Options sur indices boursiers et options sur actions: Frais minimum de 2 750 yens (taxes incluses) si les frais calculés sont inférieurs à ce montant.

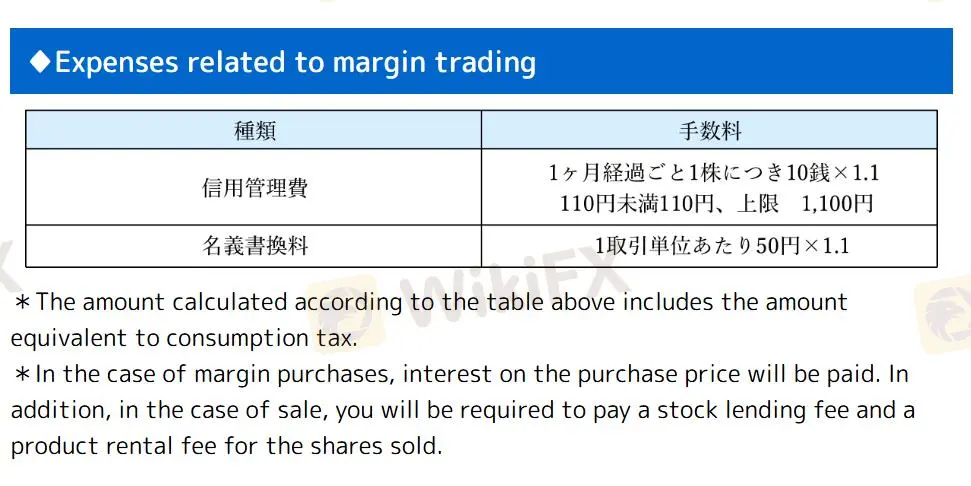

Frais de négociation sur marge:

- Incluent les intérêts sur les prix d'achat pour les achats et les frais de prêt d'actions pour les ventes, plus la taxe de consommation.

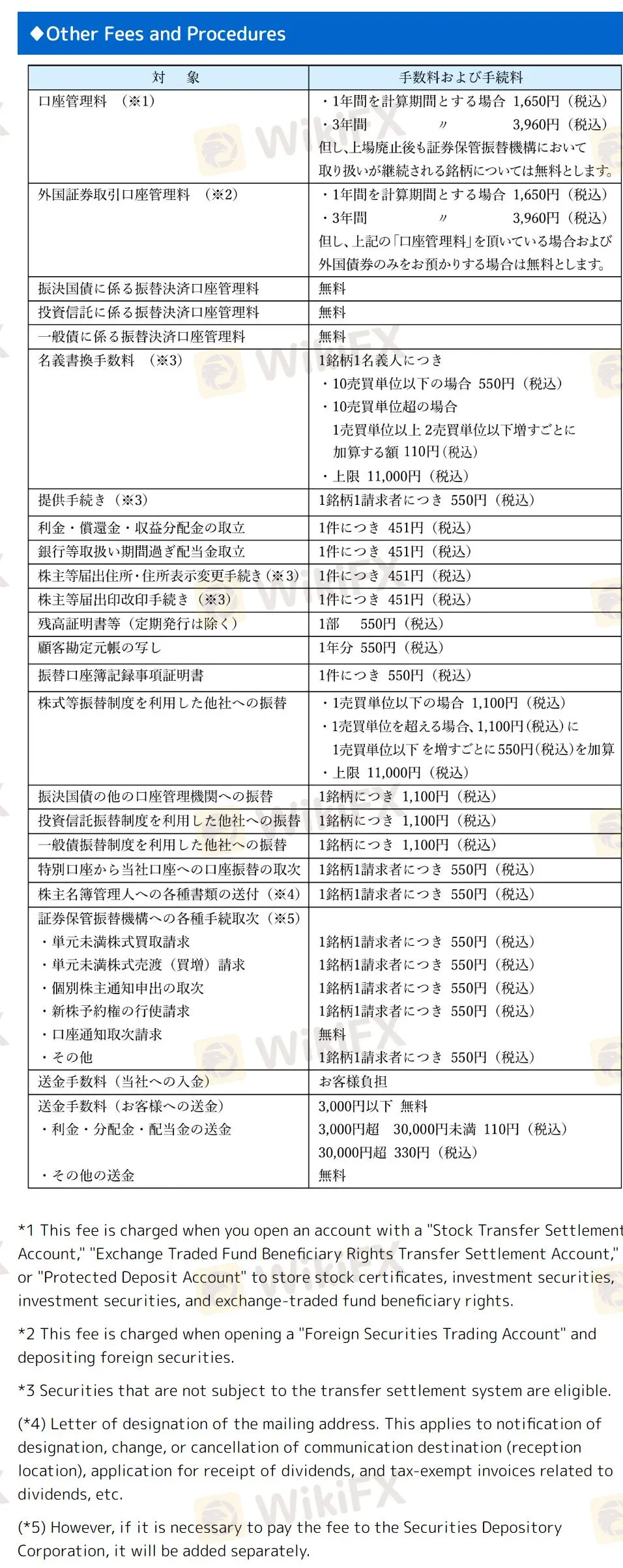

Frais supplémentaires:

- S'appliquent à l'ouverture de comptes spécifiques tels que les transferts d'actions ou les comptes de titres étrangers.

- S'appliquent aux titres non transférables.

- Incluent les frais de désignation d'adresse de correspondance et les documents liés aux dividendes.

- Peuvent inclure des frais supplémentaires pour les services fournis par la Société de dépôt des titres.