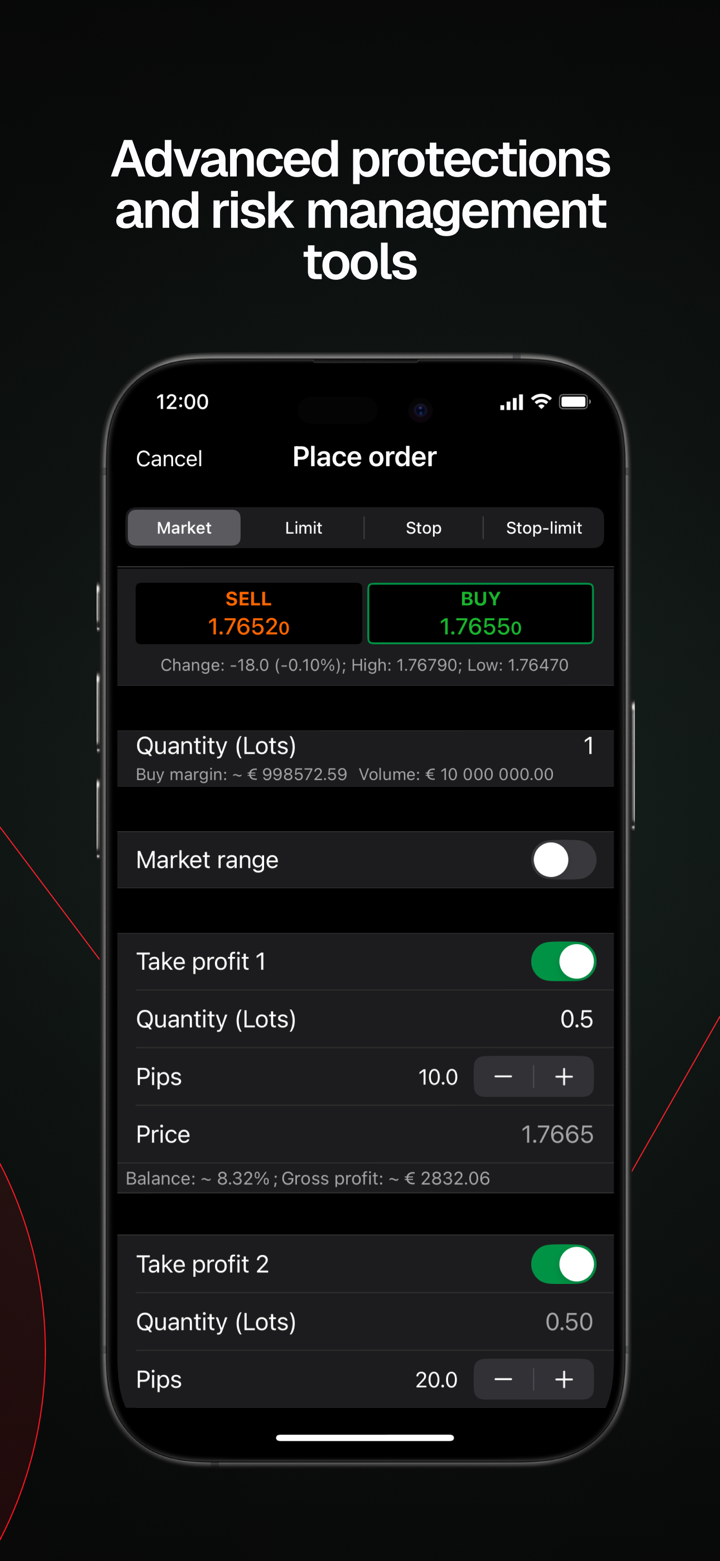

| Naa Purple Trading nag-aalok ng iba't ibang antas ng leverage depende sa instrumento na pinagkakatiwalaan at sa klasipikasyon ng kliyente: - Para sa mga retail na kliyente, ang pinakamataas na leverage sa trading ay hanggang 1:30 sa lahat ng instrumento, kasama ang Forex, Indices, Commodities, Stocks, at Futures.

- Para sa mga kliyenteng sumusunod sa mga kinakailangang klasipikasyon bilang propesyonal na kliyente, ang pinakamataas na leverage ay hanggang 1:500 para sa ilang instrumento.

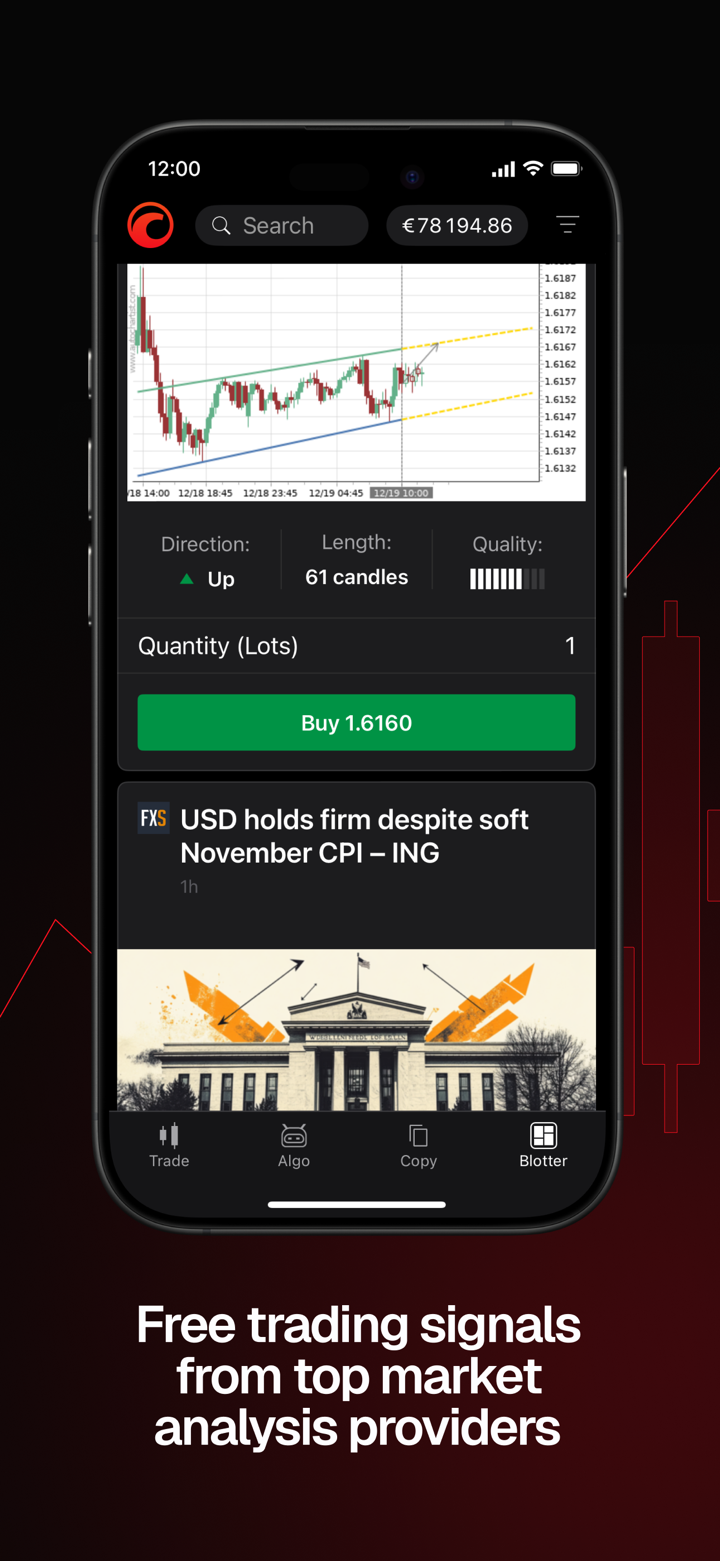

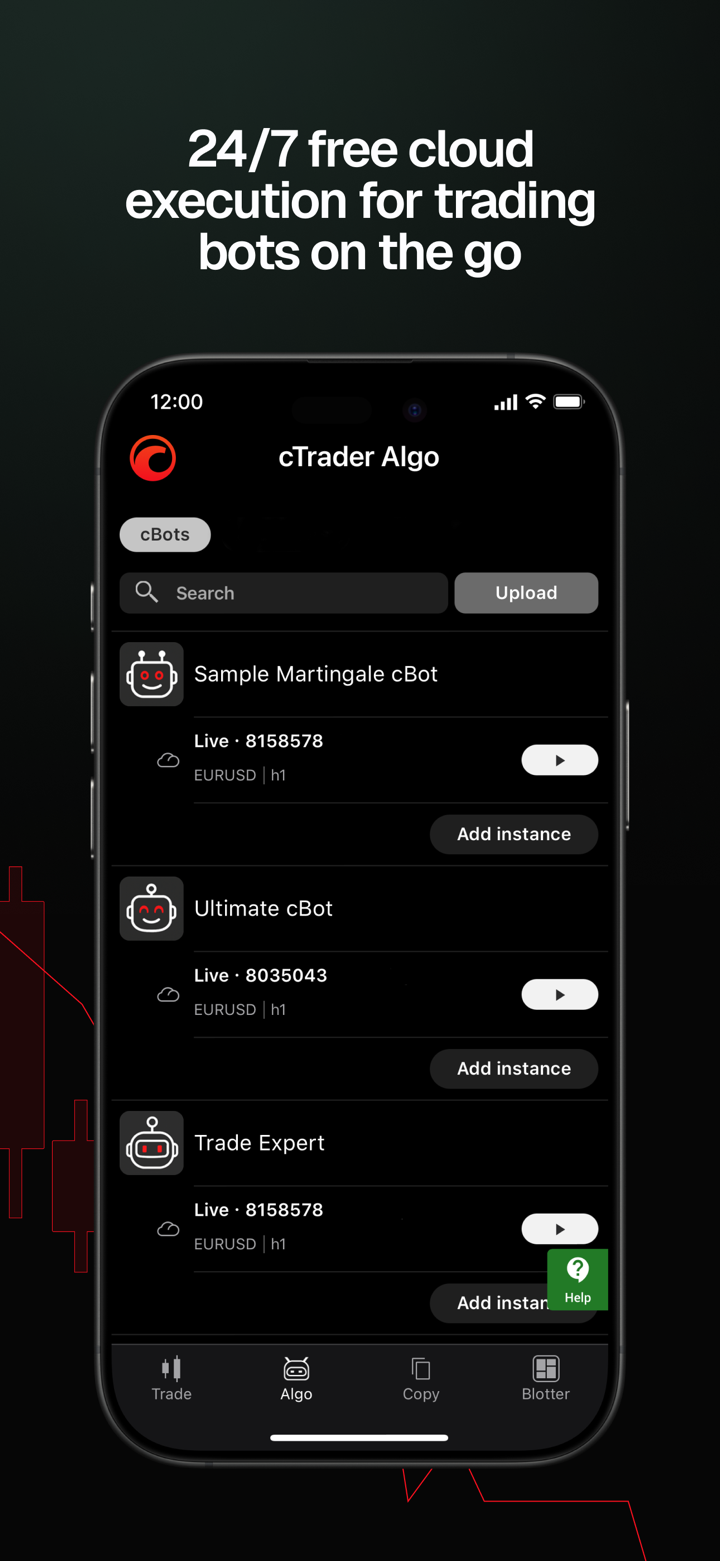

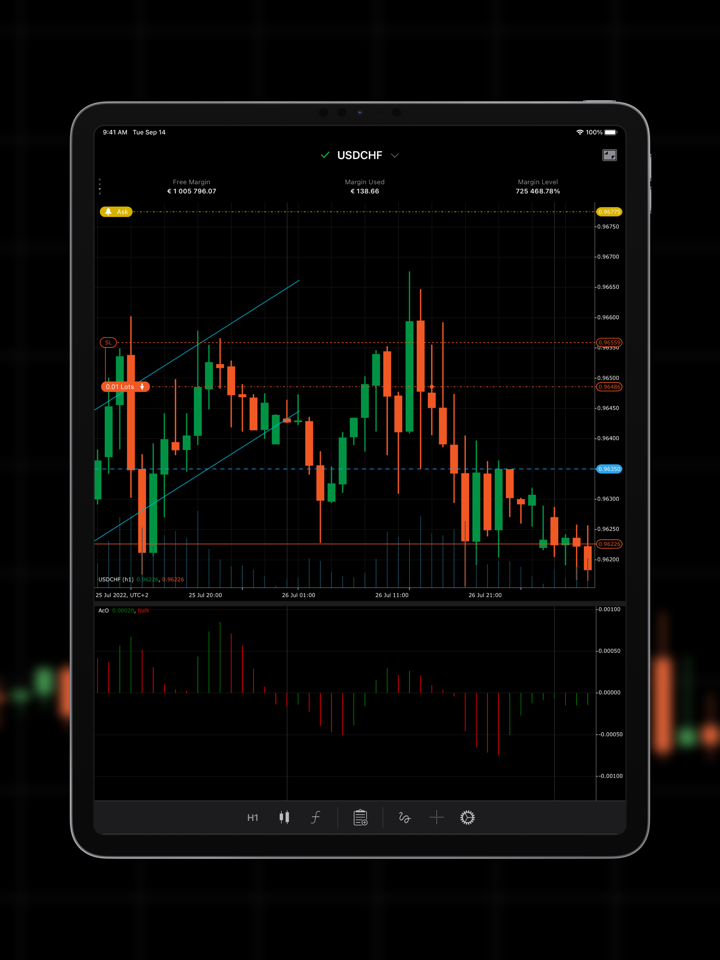

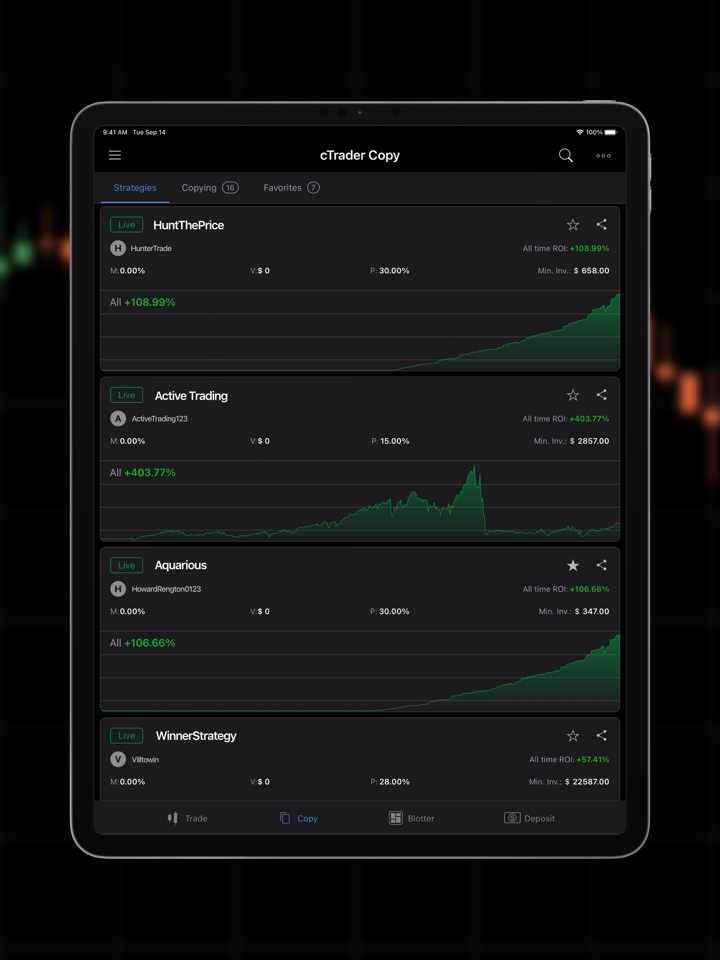

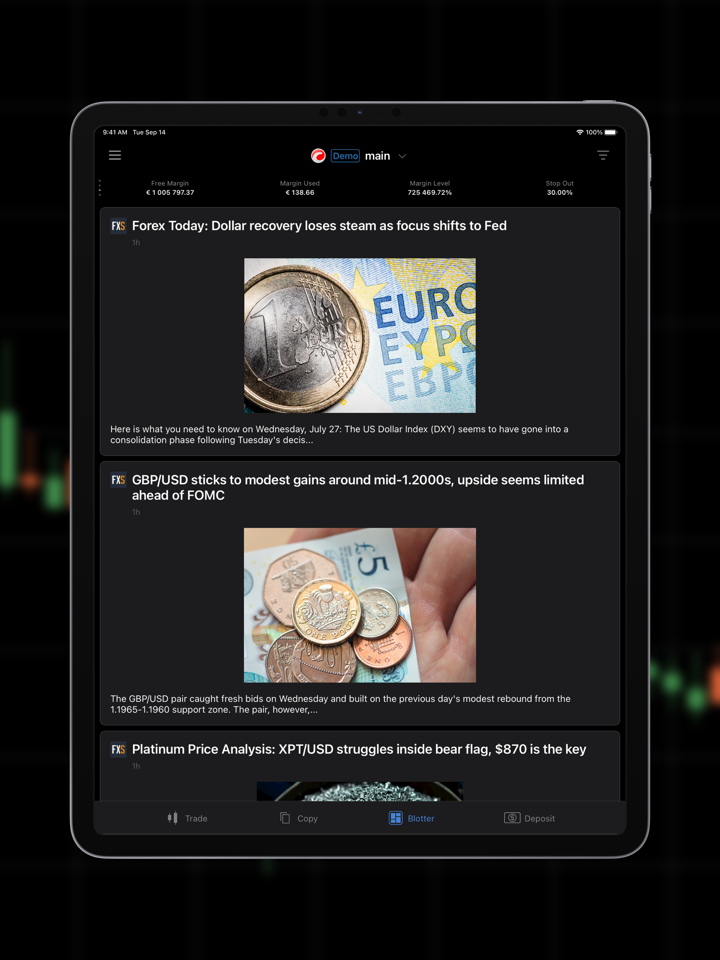

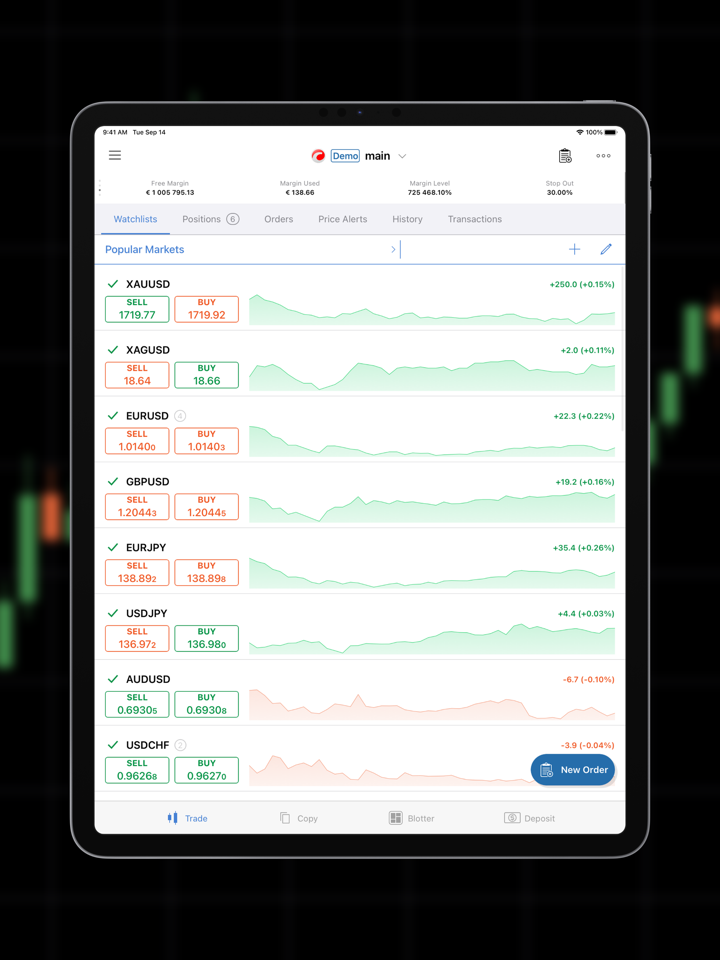

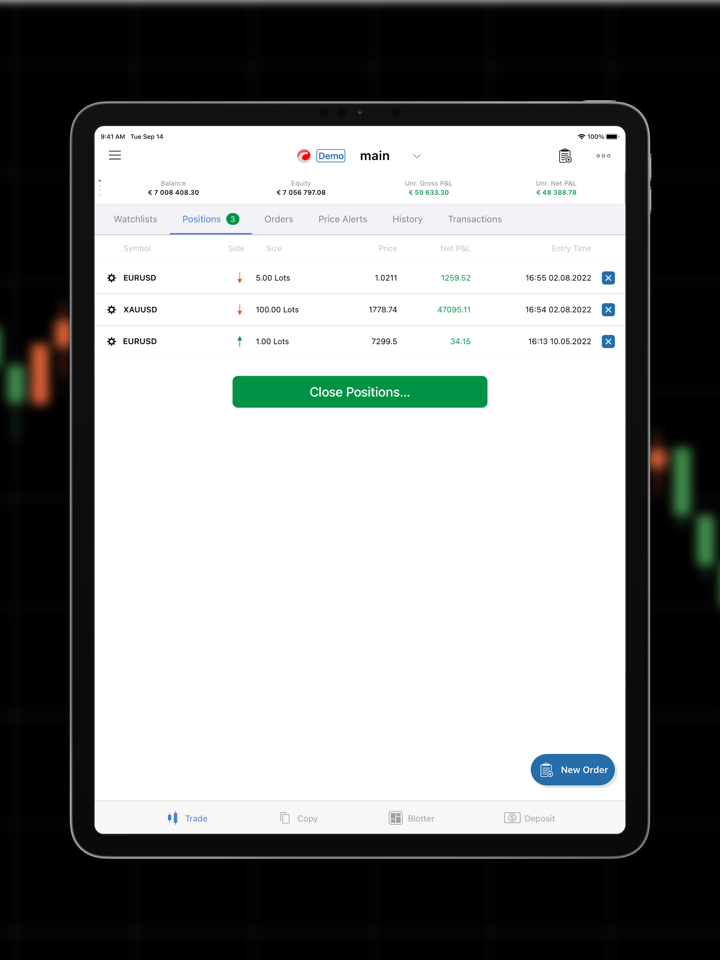

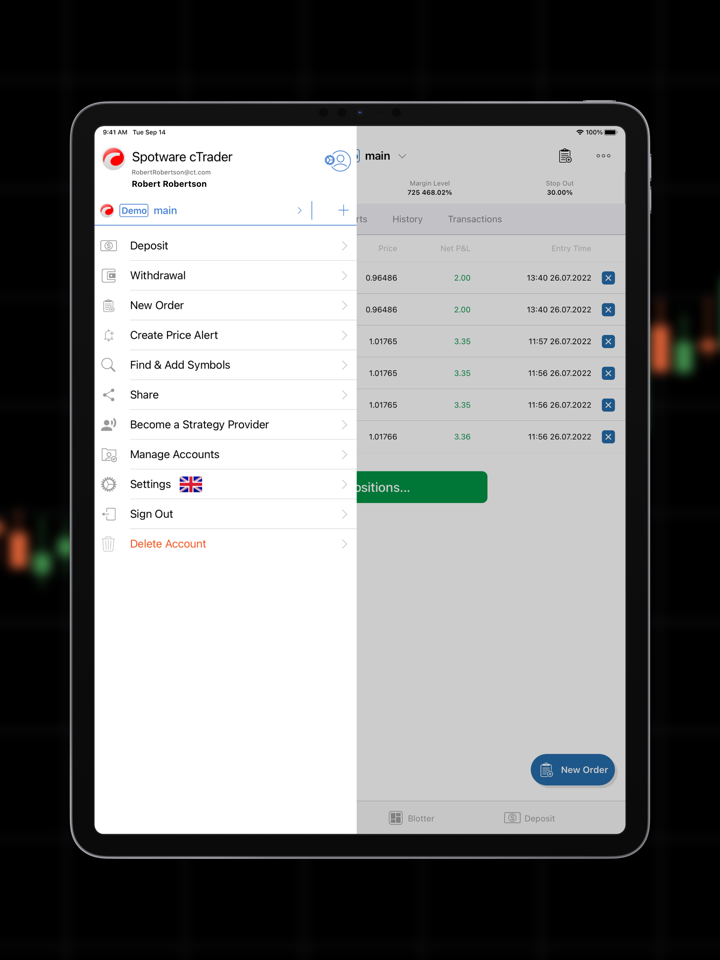

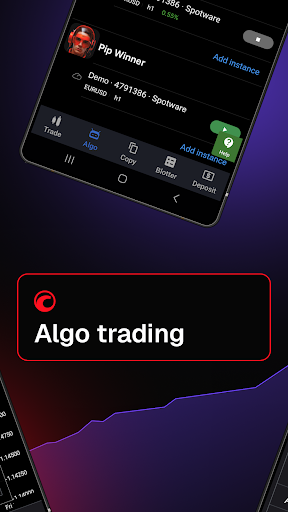

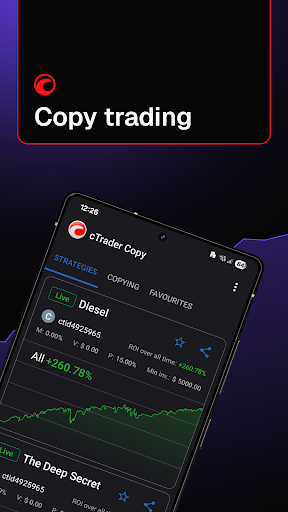

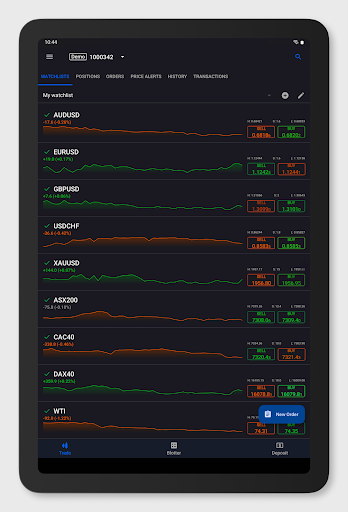

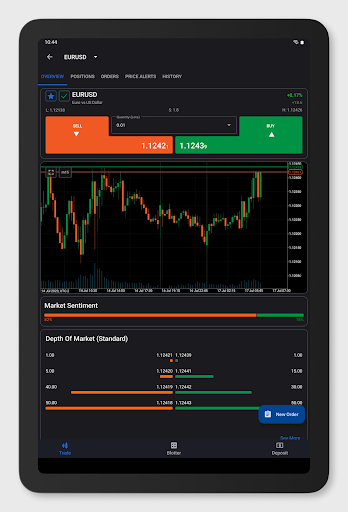

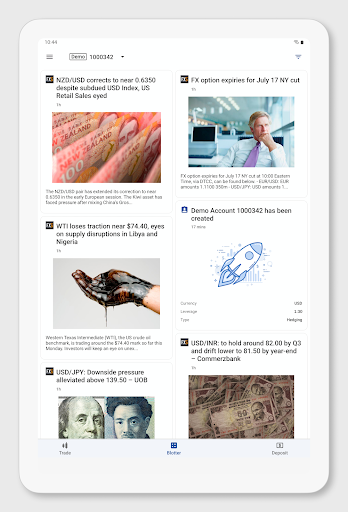

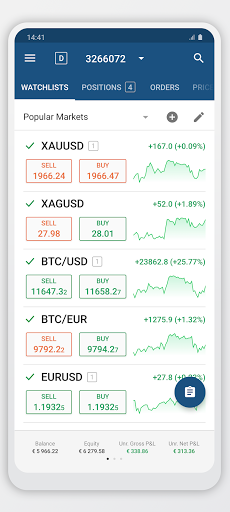

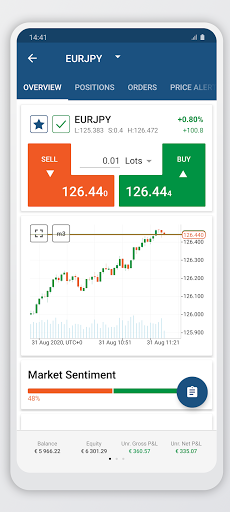

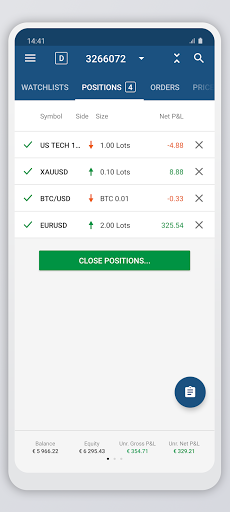

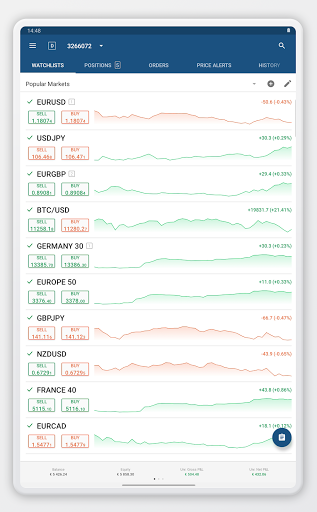

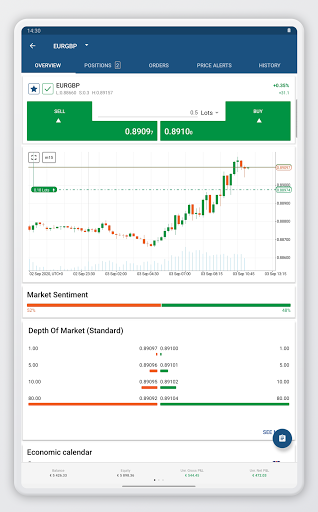

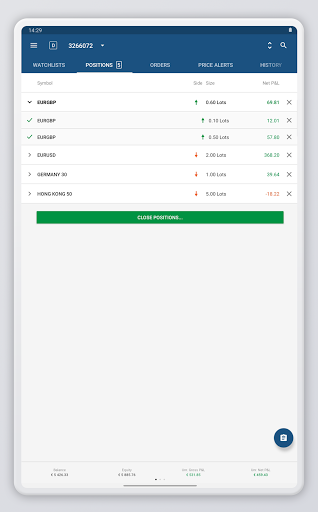

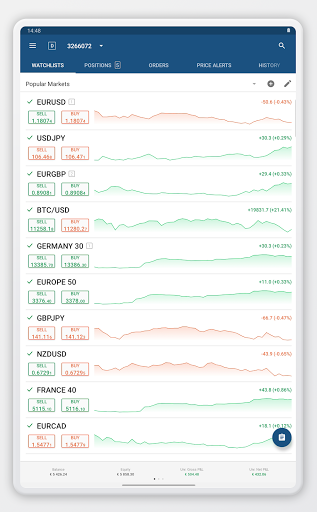

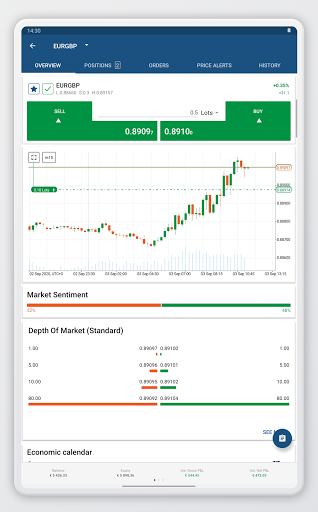

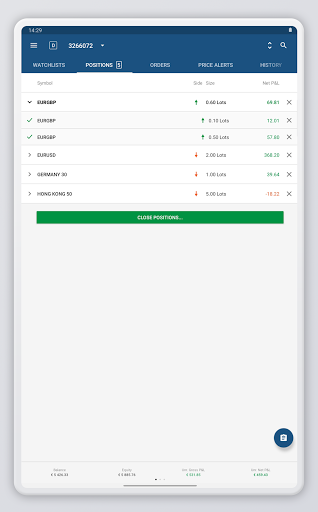

Mga Platform sa Pag-tradePurple Trading nagbibigay ng access sa tatlong pangunahing mga platform sa pag-trade, MetaTrader 4/5 (MT4/5) at cTrader, na nag-aalok sa mga kliyente ng kumpletong set ng mga tool at tampok para sa epektibong pag-trade. Ang MetaTrader 4/5, isang malawakang kinikilalang platform sa industriya, ay nag-aalok ng advanced na kakayahan sa pag-chart, customizable na mga indicator, at automated trading sa pamamagitan ng Expert Advisors (EAs), na nagbibigay ng malakas na mga tool para sa teknikal na pagsusuri ng mga trader. Sa kabilang banda, ang cTrader ay kakaiba sa kanyang intuitive na interface, mabilis na pagpapatupad, at Level II pricing transparency, na naglilingkod sa mga trader na nagbibigay-prioridad sa bilis, kahusayan, at lalim ng mga insights sa merkado. Pagdedeposito at PagwiwithdrawTandaan na ang mga deposito at pagwiwithdraw na ginawa sa isang ibang currency kaysa sa currency ng iyong account ay awtomatikong iko-convert at maaaring mag-iba ang huling halaga na naikredit dahil sa mga exchange at conversion rates.

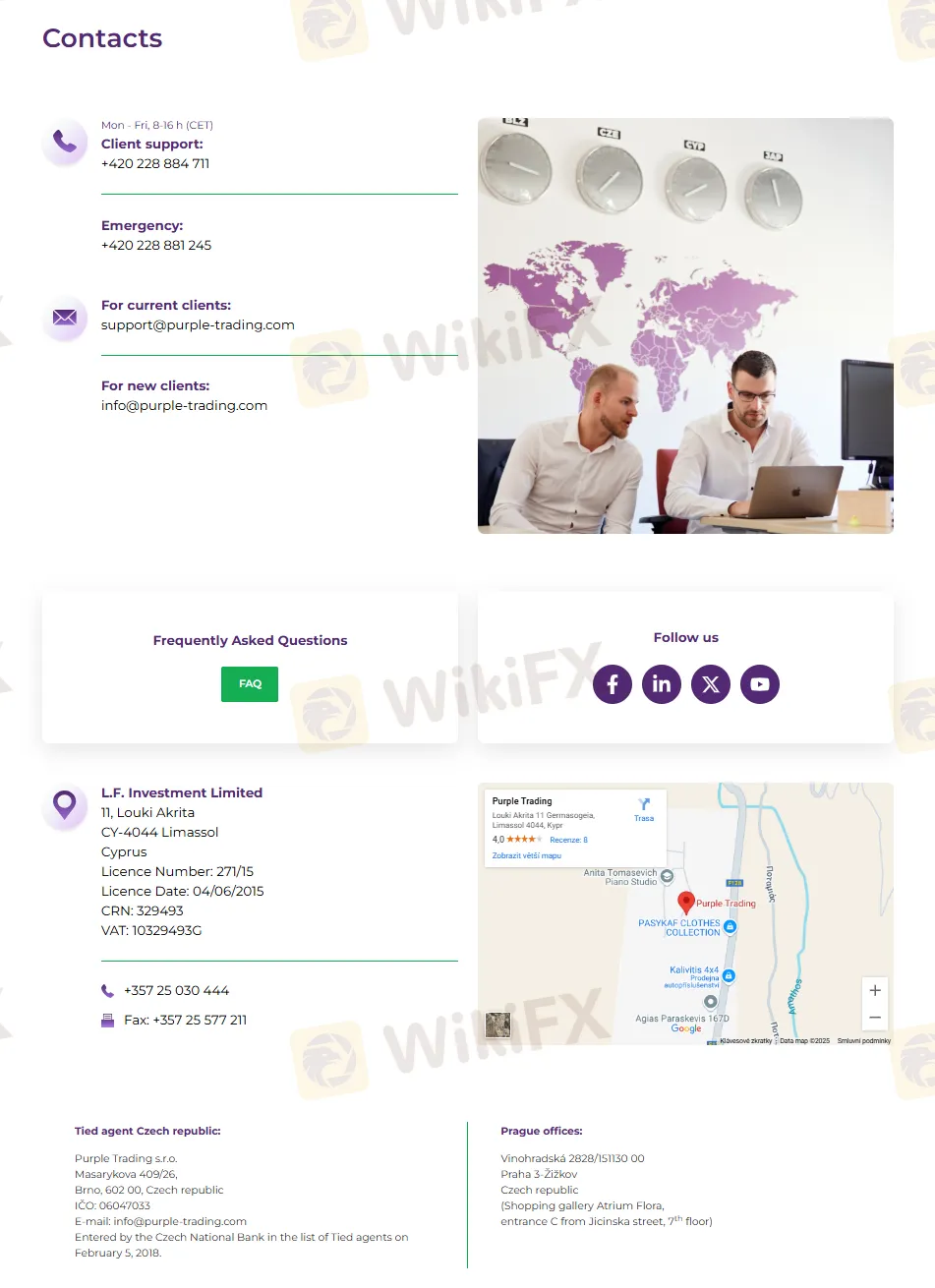

Suporta sa KustomerPurple Trading nag-aalok ng kumpletong suporta sa kustomer sa pamamagitan ng iba't ibang mga channel: - Suporta sa Telepono:

- Sa mga kaso ng mga emergency, maaaring makipag-ugnayan ang mga kliyente sa Purple Trading sa +420 228 881 245.

- Ang pangkalahatang suporta sa kliyente ay available Lunes hanggang Biyernes mula 8:00 hanggang 16:00 (CET) sa telepono sa +44 14 46 506 711.

- Suporta sa Email:

- Maaaring makipag-ugnayan ang mga bagong kliyente sa info@purple-trading.com para sa mga katanungan.

- Maaaring kontakin ng mga umiiral na kliyente ang support@purple-trading.com para sa tulong.

- Online na mga Mapagkukunan:

- Maaaring bisitahin ng mga kliyente ang Frequently Asked Questions (FAQs) na seksyon sa website ng Purple Trading para sa mabilis na mga sagot sa mga karaniwang katanungan.

- Physical na Address:

- Maaaring makipag-ugnayan ang mga kliyente sa kumpanya sa pamamagitan ng telepono sa +357 25 030 444 o via fax sa +357 25 577 211.

- Ang punong tanggapan ng Purple Trading ay matatagpuan sa 11, Louki Akrita, CY-4044 Limassol, Cyprus.

Mga keyword- 10-15 taon

- Kinokontrol sa Cyprus

- Pagpapatupad ng Forex (STP)

- Pangunahing label na MT4

- Ang buong lisensya ng MT5

- cTrader

- Mga Broker ng Panrehiyon

- Mataas na potensyal na peligro

Pagbubunyag ng regulasyon※ Pinanggalingan ng Datos  WikiFX Datamagbigay

Sumang-ayon at Magpatuloy Wiki Q&AVladimir 1-2 taon Is Purple Trading regulated? Yes, Purple Trading is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license number 271/15. As a trader, I believe the CYSEC regulation is important because it ensures the broker follows stringent legal standards and offers protection for clients. In my experience, brokers regulated by authorities like CYSEC tend to operate with higher levels of transparency and integrity. For me, this brings a sense of security, knowing that the broker is legally bound to comply with financial regulations, safeguarding client funds. CYSEC's regulations require brokers to keep clients' funds in segregated accounts, which adds an additional layer of protection in case the broker faces financial difficulties. However, one thing I’d point out is that CYSEC-regulated brokers like Purple Trading are only available to clients within the European Economic Area (EEA), which means clients outside the EEA cannot access the platform. For me, as someone based in the EEA, this is not an issue, but for international traders, it’s something to consider. While CYSEC's regulations are strong, I do wonder how they compare to other top-tier regulatory bodies like the UK’s FCA or the US SEC. Nonetheless, overall, I do consider Purple Trading a safe and reliable broker, especially for European clients. J Forex Trader 1-2 taon What is the maximum amount I can deposit or withdraw with Purple Trading? The maximum deposit or withdrawal amount via Visa and MasterCard is EUR 60,000, which is more than sufficient for most traders, including me. I appreciate that Purple Trading offers such a high limit, as it allows for larger transactions when needed. For international payments, the same conversion fee applies, but overall, I find the flexibility of high deposit and withdrawal limits to be an advantage. This high limit provides me with more options and control over my trading capital, making it easier for me to manage larger sums when necessary. Broker Issues Withdrawal Deposit Arnold Joseph 1-2 taon What is the maximum leverage available with Purple Trading? Purple Trading offers a maximum leverage of 1:30 for retail clients, which is standard for brokers regulated under CYSEC. As a retail trader, I find this leverage to be sufficient for my needs, as it helps to manage risk effectively. However, for professional clients, Purple Trading offers a higher leverage of up to 1:500, which can be appealing for more experienced traders looking to take on larger positions. Personally, I prefer to trade with lower leverage, as it helps to reduce risk and avoid overleveraging. But I can see how higher leverage would be useful for professional traders, especially those who engage in short-term trading or scalping. Broker Issues Account Leverage Platform Instruments kennis2244 1-2 taon Are there any fees for deposit or withdrawal in Purple Trading? Purple Trading does not charge any deposit or withdrawal fees for transactions made in EUR or CZK, which is fantastic for me as a European trader. It helps keep my trading costs down, especially when making frequent deposits or withdrawals. However, for international payments made in currencies other than EUR, there is a 0.5% fee, with a minimum of 5 EUR and a maximum of 100 EUR. This can add up if you are making large withdrawals or deposits in currencies outside the Eurozone, which is something I keep in mind when transferring funds. For someone like me, who mostly transacts in EUR, the lack of fees is a significant advantage. I also appreciate the transparency in purple trading review, where I can easily see all the applicable fees before making a transaction. Broker Issues Fees and Spreads  Paglalahad  Neutral  Positibo Nilalaman na nais mong i-komento   TOP TOP Chrome Extension ng Chrome Pandaigdigang Forex Broker Regulatory Inquiry I-browse ang mga website ng forex broker at tumpak na tukuyin ang mga legit at pandaraya na broker  I-install Ngayon

|